Gajah Tunggal TBK.: Company Report: January 2019 As of 31 January 2019

Gajah Tunggal TBK.: Company Report: January 2019 As of 31 January 2019

Uploaded by

Paras FebriayuniCopyright:

Available Formats

Gajah Tunggal TBK.: Company Report: January 2019 As of 31 January 2019

Gajah Tunggal TBK.: Company Report: January 2019 As of 31 January 2019

Uploaded by

Paras FebriayuniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Gajah Tunggal TBK.: Company Report: January 2019 As of 31 January 2019

Gajah Tunggal TBK.: Company Report: January 2019 As of 31 January 2019

Uploaded by

Paras FebriayuniCopyright:

Available Formats

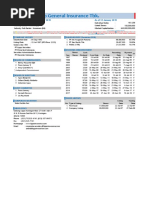

GJTL Gajah Tunggal Tbk.

COMPANY REPORT : JANUARY 2019 As of 31 January 2019

Main Board Individual Index : 157.060

Industry Sector : Miscellaneous Industry (4) Listed Shares : 3,484,800,000

Industry Sub Sector : Automotive And Components (42) Market Capitalization : 2,787,840,000,000

252 | 2.79T | 0.04% | 95.69%

146 | 1.54T | 0.07% | 93.39%

COMPANY HISTORY SHAREHOLDERS (December 2018)

Established Date : 24-Aug-1951 1. Denham Pte. Ltd. 1,724,972,443 : 49.50%

Listing Date : 08-May-1990 (IPO Price: 5,500) 2. Compagnie Financiere Michelin SCMA 348,480,000 : 10.00%

Underwriter IPO : 3. Public (<5%) 1,411,347,557 : 40.50%

PT Danareksa Sekuritas

Securities Administration Bureau : DIVIDEND ANNOUNCEMENT

PT Datindo Entrycom Bonus Cash Recording Payment

F/I

Year Shares Dividend Cum Date Ex Date Date Date

BOARD OF COMMISSIONERS 1990 10 : 1 27-Jun-91 28-Jun-91 5-Jul-91 22-Jul-91 F

1. Sutanto *) 1991 200.00 17-Jun-92 18-Jun-92 25-Jun-92 27-Jul-92 F

2. Benny Gozali 1992 5:4 21-Dec-92 22-Dec-92 30-Dec-92 1-Feb-93 BS

3. Christopher Chan Siew Choong 1992 150.00 10-Aug-93 11-Aug-93 19-Aug-93 17-Sep-93 F

4. Gautama Hartarto 1993 100.00 22-Jul-94 25-Jul-94 1-Aug-94 1-Sep-94 F

5. Herve Richert 1994 1:1 100.00 31-Jul-95 1-Aug-95 10-Aug-95 8-Sep-95 F

6. Lei Huai Chin 1995 100.00 15-Aug-96 16-Aug-96 26-Aug-96 24-Sep-96 F

7. Lim Kee Hong *) 1996 60.00 11-Jul-97 14-Jul-97 23-Jul-97 21-Aug-97 F

8. Sang Nyoman Suwisma 2005 5.00 21-Jul-06 24-Jul-06 26-Jul-06 9-Aug-06 F

9. Sunaria Tadjuddin *) 2006 5.00 20-Jul-07 23-Jul-07 25-Jul-07 8-Aug-07 F

10. Tan Enk Ee 2007 5.00 15-Jul-08 16-Jul-08 18-Jul-08 4-Aug-08 F

*) Independent Commissioners 2009 15.00 18-Jun-10 21-Jun-10 23-Jun-10 7-Jul-10 F

2010 12.00 10-Jun-11 13-Jun-11 15-Jun-11 30-Jun-11 F

BOARD OF DIRECTORS 2011 10.00 19-Jun-12 20-Jun-12 22-Jun-12 6-Jul-12 F

1. Sugeng Raharjo 2012 27.00 5-Jul-13 8-Jul-13 10-Jul-13 24-Jul-13 F

2. Budhi Santoso Tanasaleh 2013 10.00 30-Jun-14 1-Jul-14 3-Jul-14 17-Jul-14 F

3. Catharina Widjaja 2014 10.00 6-Jul-15 7-Jul-15 9-Jul-15 31-Jul-15 F

4. Ferry Lawrentius Hollen 2016 5.00 5-Jul-17 6-Jul-17 10-Jul-17 21-Jul-17 F

5. Hendra Soerijadi

6. Hui Chee Teck ISSUED HISTORY

7. Johny Tjoa Listing Trading

8. Juliani Gozali No. Type of Listing Shares Date Date

9. Kisyuwono 1. First Issue 20,000,000 8-May-90 8-May-90

10. Phang Wai Yeen 2. Partial Listing 5,000,000 25-May-90 25-May-91

3. Company Listing 75,000,000 27-Nov-90 27-Nov-91

AUDIT COMMITTEE 4. Bonus Shares 10,000,000 29-Jul-91 29-Jul-91

1. Toh David Ka Hock 5. Bonus Shares 88,000,000 2-Feb-93 2-Feb-93

2. Lim Kee Hong 6. Right Issue 100,000,000 11-Feb-94 18-Feb-94

3. Sugianto 7. Right Issue 21,087 11-Feb-94 22-Feb-94

8. Right Issue 37,612 11-Feb-94 23-Feb-94

CORPORATE SECRETARY 9. Right Issue 25,381 11-Feb-94 28-Feb-94

Catharina Widjaja 10. Right Issue 37,094 11-Feb-94 1-Mar-94

11. Right Issue 2,251 11-Feb-94 2-Mar-94

HEAD OFFICE 12. Right Issue 71,716 11-Feb-94 3-Mar-94

Wisma Hayam Wuruk 10th Floor 13. Right Issue 59,642 11-Feb-94 9-Mar-94

Jl. Hayam Wuruk No. 8 14. Right Issue 39,897 11-Feb-94 18-Mar-94

Jakarta 10120 15. Right Issue 94,790 11-Feb-94 21-Mar-94

Phone : (021) 380-5916 16. Right Issue 21,792 11-Feb-94 23-Mar-94

Fax : (021) 380-4908 17. Right Issue 73,424 11-Feb-94 25-Mar-94

Homepage : www.gt-tires.com 18. Right Issue 1,105,968 11-Feb-94 29-Mar-94

Email : gajahjak@gt-tires.com 19. Right Issue 96,409,346 11-Feb-94 13-Apr-94

20. Bonus Shares 396,000,000 11-Sep-95 11-Sep-95

21. Right Issue 792,000,000 14-Oct-96 14-Oct-96

22. Stock Split 1,584,000,000 20-Oct-97 20-Oct-97

23. Right Issue 316,800,000 2-Jan-08 2-Jan-08

GJTL Gajah Tunggal Tbk.

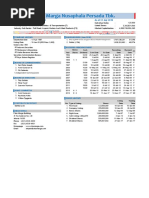

TRADING ACTIVITIES

Closing Price* and Trading Volume

Gajah Tunggal Tbk. Closing Price Freq. Volume Value

Day

Closing Volume

Price* January 2015 - January 2019 (Mill. Sh) Month High Low Close (X) (Thou. Sh.) (Million Rp)

1,800 240 Jan-15 1,520 1,225 1,460 18,558 139,173 190,739 21

Feb-15 1,570 1,245 1,400 20,870 171,873 243,294 19

1,575 210 Mar-15 1,405 1,235 1,325 18,733 180,173 234,612 22

Apr-15 1,320 1,055 1,100 11,375 107,682 131,548 21

May-15 1,140 1,000 1,010 11,580 79,740 84,827 19

1,350 180

Jun-15 1,070 845 855 10,683 50,271 48,100 21

Jul-15 890 730 750 7,781 49,210 41,372 19

1,125 150

Aug-15 760 418 500 9,012 62,356 35,939 20

Sep-15 715 453 525 16,750 112,497 68,217 21

900 120

Oct-15 690 515 590 11,288 78,690 48,208 21

Nov-15 630 535 535 6,953 36,939 22,012 21

675 90 Dec-15 570 470 530 10,589 43,154 22,486 19

450 60 Jan-16 540 489 505 3,329 21,991 11,171 20

Feb-16 525 480 483 4,536 28,482 13,956 20

225 30 Mar-16 760 483 735 15,745 134,645 85,823 21

Apr-16 825 660 795 18,848 243,582 183,662 21

May-16 805 665 710 21,969 352,658 257,530 20

Jun-16 1,030 700 975 29,553 404,782 364,640 22

Jan-15 Jan-16 Jan-17 Jan-18 Jan-19

Jul-16 1,645 975 1,615 32,870 373,779 493,617 16

Aug-16 1,755 1,310 1,510 45,840 383,328 596,131 22

Sep-16 1,590 1,355 1,500 41,560 212,670 315,757 21

Closing Price*, Jakarta Composite Index (IHSG) and Oct-16 1,520 1,235 1,250 40,392 215,777 284,999 21

Miscellaneous Industry Index Nov-16 1,280 1,000 1,005 25,374 105,455 120,159 22

January 2015 - January 2019 Dec-16 1,260 950 1,070 54,179 510,031 568,492 20

45%

Jan-17 1,200 1,040 1,150 23,328 206,456 234,401 21

30% Feb-17 1,295 1,005 1,265 32,370 275,571 323,950 19

24.6% Mar-17 1,280 1,095 1,130 30,903 237,834 281,167 22

15% Apr-17 1,160 1,020 1,035 19,990 116,480 127,529 17

11.2% May-17 1,095 950 995 23,368 141,820 145,102 20

- Jun-17 1,215 995 1,130 37,138 318,228 355,735 15

Jul-17 1,100 950 960 25,037 215,850 215,663 21

Aug-17 1,015 770 805 44,519 412,504 382,993 22

-15%

Sep-17 820 680 685 34,506 257,356 190,872 19

Oct-17 735 680 695 39,096 255,488 180,575 22

-30%

Nov-17 780 665 715 42,598 286,011 204,873 22

Dec-17 750 670 680 44,442 182,189 129,048 18

-45% -42.9%

Jan-18 935 680 850 65,112 573,811 474,147 22

-60% Feb-18 890 735 830 24,307 283,500 227,091 19

Mar-18 870 715 810 28,315 417,202 334,191 21

-75% Apr-18 960 770 815 29,230 355,668 313,583 21

Jan 15 Jan 16 Jan 17 Jan 18 Jan 19 May-18 890 790 815 18,328 142,725 120,335 20

Jun-18 855 665 690 9,491 63,921 48,579 13

Jul-18 720 575 665 12,661 74,133 48,466 22

SHARES TRADED 2015 2016 2017 2018 Jan-19 Aug-18 715 625 635 8,570 48,914 32,553 21

Volume (Million Sh.) 1,112 2,987 2,906 2,249 324 Sep-18 650 580 630 5,774 26,058 15,987 19

Value (Billion Rp) 1,171 3,296 2,772 1,784 235 Oct-18 735 595 620 17,946 119,745 78,619 23

Frequency (Thou. X) 154 334 397 242 38 Nov-18 690 590 640 13,786 85,791 54,223 21

Days 244 246 238 240 22 Dec-18 690 610 650 8,965 57,154 36,342 18

Price (Rupiah) Jan-19 810 605 800 38,346 324,231 235,027 22

High 1,570 1,755 1,295 960 810

Low 418 480 665 575 605

Close 530 1,070 680 650 800

Close* 530 1,070 680 650 800

PER (X) -5.89 4.80 -12.63 -7.43 -9.14

PER Industry (X) 0.95 13.86 4.78 16.15 17.64

PBV (X) 0.34 0.65 0.43 0.41 0.50

* Adjusted price after corporate action

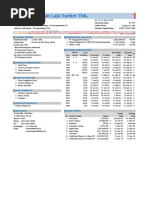

GJTL Gajah Tunggal Tbk.

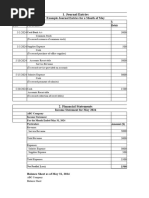

Financial Data and Ratios Book End : December

Public Accountant : Satrio Bing Eny & Partners

BALANCE SHEET Dec-14 Dec-15 Dec-16 Dec-17 Sep-18 TOTAL ASSETS AND LIABILITIES (Bill. Rp)

(in Million Rp, except Par Value) Assets Liabilities

Cash & Cash Equivalents 957,144 641,916 755,545 696,485 837,274 20,000

Receivables 2,338,576 2,881,929 3,774,753 3,554,607 2,377,268

2,247,074 2,112,616 2,280,868 2,526,513 3,225,255 16,000

Inventories

Current Assets 6,283,252 6,602,281 7,517,152 7,168,378 8,555,614

12,000

Fixed Assets 7,611,453 8,733,925 9,130,997 8,900,168 9,374,264

Other Assets - 90,925 101,756 96,351 97,437

8,000

Total Assets 16,042,897 17,509,505 18,697,779 18,191,176 19,711,819

Growth (%) 9.14% 6.79% -2.71% 8.36% 4,000

Current Liabilities 3,116,223 3,713,148 4,343,805 4,397,957 5,701,729 -

Long Term Liabilities 6,943,382 8,402,215 8,505,797 8,103,753 8,429,423 2014 2015 2016 2017 Sep-18

Total Liabilities 10,059,605 12,115,363 12,849,602 12,501,710 14,131,152

Growth (%) 20.44% 6.06% -2.71% 13.03%

TOTAL EQUITY (Bill. Rp)

Authorized Capital 6,000,000 6,000,000 6,000,000 6,000,000 6,000,000 5,983 5,848 5,689

Paid up Capital 1,742,400 1,742,400 1,742,400 1,742,400 1,742,400 5,983

5,394 5,581

Paid up Capital (Shares) 3,485 3,485 3,485 3,485 3,485

Par Value 500 500 500 500 500

4,763

Retained Earnings 4,031,623 3,593,604 4,220,165 4,247,771 4,018,976

5,983,292 5,394,142 5,848,177 5,689,466 5,580,667

3,542

Total Equity

Growth (%) -9.85% 8.42% -2.71% -1.91% 2,322

INCOME STATEMENTS Dec-14 Dec-15 Dec-16 Dec-17 Sep-18 1,101

Total Revenues 13,070,734 12,970,237 13,633,556 14,146,918 11,239,534

Growth (%) -0.77% 5.11% 3.77%

-120

2014 2015 2016 2017 Sep-18

Cost of Revenues 10,625,591 10,346,094 10,438,263 11,682,799 9,402,453

Gross Profit 2,445,143 2,624,143 3,195,293 2,464,119 1,837,081

TOTAL REVENUES (Bill. Rp)

Expenses (Income) 2,051,084 2,956,012 2,369,346 2,357,295 2,111,370

Operating Profit - - 825,947 106,824 -274,289 14,147

13,634

13,071 12,970

Growth (%) -87.07%

14,147

11,240

11,261

Other Income (Expenses) - - - - -

Income before Tax 394,059 -331,869 825,947 106,824 -274,289 8,375

Tax 124,191 -18,543 199,386 61,796 45,494

Profit for the period 269,868 -313,326 626,561 45,028 -228,795 5,489

Growth (%) N/A N/A -92.81%

2,603

Period Attributable 269,868 -313,326 626,561 45,028 -228,795 -283

Comprehensive Income 293,797 -207,955 454,035 -141,289 -109,017 2014 2015 2016 2017 Sep-18

Comprehensive Attributable 293,797 -207,955 454,035 -141,289 -109,017

RATIOS Dec-14 Dec-15 Dec-16 Dec-17 Sep-18 PROFIT FOR THE PERIOD (Bill. Rp)

Current Ratio (%) 201.63 177.81 173.05 162.99 150.05

627

Dividend (Rp) 10.00 - 5.00 - - 627

EPS (Rp) 77.44 -89.91 179.80 12.92 -65.66

BV (Rp) 1,716.97 1,547.91 1,678.20 1,632.65 1,601.43 439

270

DAR (X) 0.63 0.69 0.69 0.69 0.72

DER(X) 1.68 2.25 2.20 2.20 2.53

251

1.68 -1.79 3.35 0.25 -1.16 45

ROA (%) 63 2015 Sep-18

ROE (%) 4.51 -5.81 10.71 0.79 -4.10

GPM (%) 18.71 20.23 23.44 17.42 16.34 -125

2014 2016 2017

OPM (%) - - 6.06 0.76 -2.44

NPM (%) 2.06 -2.42 4.60 0.32 -2.04 -229

-313

-313

Payout Ratio (%) 12.91 - 2.78 - -

Yield (%) 0.70 - 0.47 - -

*US$ Rate (BI), Rp 12,436 13,794 13,436 13,548 14,929

You might also like

- Indocement Tunggal Prakarsa TBKDocument3 pagesIndocement Tunggal Prakarsa TBKRika SilvianaNo ratings yet

- Kalbe Farma TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesKalbe Farma TBK.: Company Report: January 2019 As of 31 January 2019safiraNo ratings yet

- Pakuwon Jati TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesPakuwon Jati TBK.: Company Report: January 2019 As of 31 January 2019Paras FebriayuniNo ratings yet

- Indofood Sukses Makmur TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesIndofood Sukses Makmur TBK.: Company Report: January 2019 As of 31 January 2019Aryanto ArNo ratings yet

- BfinDocument3 pagesBfinjonisugandaNo ratings yet

- Lap Keu SMCBDocument3 pagesLap Keu SMCBDavid Andriyono AchmadNo ratings yet

- Citra Marga Nusaphala Persada TBK.: Company Report: July 2018 As of 31 July 2018Document3 pagesCitra Marga Nusaphala Persada TBK.: Company Report: July 2018 As of 31 July 2018Melinda KusumaNo ratings yet

- DildDocument3 pagesDildPrasetyo Indra SuronoNo ratings yet

- EkadDocument3 pagesEkadErvin KhouwNo ratings yet

- Darya-Varia Laboratoria TBKDocument3 pagesDarya-Varia Laboratoria TBKArsyitaNo ratings yet

- TSPC PDFDocument3 pagesTSPC PDFFITRA PEBRI ANSHORNo ratings yet

- Resource Alam Indonesia TBKDocument3 pagesResource Alam Indonesia TBKsriyupiagustinaNo ratings yet

- Kabelindo Murni TBKDocument3 pagesKabelindo Murni TBKIstrinya TaehyungNo ratings yet

- ABDADocument3 pagesABDAerikNo ratings yet

- Metrodata Electronics TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesMetrodata Electronics TBK.: Company Report: January 2019 As of 31 January 2019Reza CahyaNo ratings yet

- Indosat TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesIndosat TBK.: Company Report: January 2019 As of 31 January 2019EndryNo ratings yet

- Kalbe Farma TBKDocument3 pagesKalbe Farma TBKK-AnggunYulianaNo ratings yet

- Semen Indonesia (Persero) TBKDocument3 pagesSemen Indonesia (Persero) TBKFarah DarmaNo ratings yet

- UnspDocument3 pagesUnspmercia.evangelista2015No ratings yet

- Fast Food Indonesia TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesFast Food Indonesia TBK.: Company Report: January 2019 As of 31 January 2019marrifa angelicaNo ratings yet

- LapasiDocument3 pagesLapasiWenny MellanoNo ratings yet

- Jaya Real Property TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesJaya Real Property TBK.: Company Report: January 2019 As of 31 January 2019Denny SiswajaNo ratings yet

- RigsDocument3 pagesRigssulaiman alfadliNo ratings yet

- SMCB PDFDocument3 pagesSMCB PDFCherry BlasoomNo ratings yet

- Holcim Indonesia TBKDocument3 pagesHolcim Indonesia TBKHENI OKTAVIANINo ratings yet

- Asahimas Flat Glass TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesAsahimas Flat Glass TBK.: Company Report: January 2019 As of 31 January 2019Abdur RohmanNo ratings yet

- Indf 1Document4 pagesIndf 1Asri ArdianaNo ratings yet

- 1 PDFDocument3 pages1 PDFRohmat TullohNo ratings yet

- 11 PDFDocument3 pages11 PDFRohmat TullohNo ratings yet

- Panca Global Securities TBKDocument3 pagesPanca Global Securities TBKreyNo ratings yet

- Bumi Resources TBKDocument3 pagesBumi Resources TBKadjipramNo ratings yet

- BBLD PDFDocument3 pagesBBLD PDFyohannestampubolonNo ratings yet

- CMNP SumDocument3 pagesCMNP SumadjipramNo ratings yet

- Indah Kiat Pulp & Paper TBKDocument3 pagesIndah Kiat Pulp & Paper TBKDenny SiswajaNo ratings yet

- Indofood Sukses Makmur Tbk. (S) : Company Report: January 2017 As of 31 January 2017Document3 pagesIndofood Sukses Makmur Tbk. (S) : Company Report: January 2017 As of 31 January 2017Solihul HadiNo ratings yet

- Mayora Indah TBK.: Company Report: January 2018 As of 31 January 2018Document3 pagesMayora Indah TBK.: Company Report: January 2018 As of 31 January 2018ulfaNo ratings yet

- Alk - Fika - Tugas Ke 1Document3 pagesAlk - Fika - Tugas Ke 1fika rizkiNo ratings yet

- Charoen Pokphand Indonesia TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesCharoen Pokphand Indonesia TBK.: Company Report: January 2019 As of 31 January 2019ayyib12No ratings yet

- Global Mediacom Tbk. (S) : Company Report: January 2017 As of 31 January 2017Document3 pagesGlobal Mediacom Tbk. (S) : Company Report: January 2017 As of 31 January 2017Dicky L RiantoNo ratings yet

- Asuransi Dayin Mitra TBK Asdm: Company History Dividend AnnouncementDocument3 pagesAsuransi Dayin Mitra TBK Asdm: Company History Dividend AnnouncementJandri Zhen TomasoaNo ratings yet

- PP London Sumatra Indonesia TBKDocument3 pagesPP London Sumatra Indonesia TBKRIZAL HARDIANSYAHNo ratings yet

- Bram PDFDocument3 pagesBram PDFElis priyantiNo ratings yet

- Blta PDFDocument3 pagesBlta PDFyohannestampubolonNo ratings yet

- Bank Pan Indonesia TBKDocument3 pagesBank Pan Indonesia TBKParas FebriayuniNo ratings yet

- Laporan Keuangan ASSIDocument3 pagesLaporan Keuangan ASSITiti MuntiartiNo ratings yet

- Bank CIMB Niaga TBKDocument3 pagesBank CIMB Niaga TBKEka FarahNo ratings yet

- Gudang Garam TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesGudang Garam TBK.: Company Report: January 2019 As of 31 January 2019LiuKsNo ratings yet

- Aali PDFDocument3 pagesAali PDFroy manchenNo ratings yet

- Amfg PDFDocument3 pagesAmfg PDFyohannestampubolonNo ratings yet

- Asgr PDFDocument3 pagesAsgr PDFyohannestampubolonNo ratings yet

- Asuransi Ramayana TBKDocument3 pagesAsuransi Ramayana TBKSanesNo ratings yet

- TinsDocument3 pagesTinsIman Nurakhmad FajarNo ratings yet

- Perusahaan Gas Negara TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesPerusahaan Gas Negara TBK.: Company Report: January 2019 As of 31 January 2019Muhammad Anfaza FirmanzaniNo ratings yet

- Voksel Electric TBKDocument3 pagesVoksel Electric TBKMemel KaliwugeNo ratings yet

- LpgiDocument3 pagesLpgiSyafira FirdausiNo ratings yet

- Ramayana Lestari Sentosa TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesRamayana Lestari Sentosa TBK.: Company Report: January 2019 As of 31 January 2019Paras FebriayuniNo ratings yet

- Bhit PDFDocument3 pagesBhit PDFyohannestampubolonNo ratings yet

- Chapter 5 Class ExercisesDocument13 pagesChapter 5 Class ExercisesSky GatdulaNo ratings yet

- Excel FSADocument20 pagesExcel FSAJeremy PascuaNo ratings yet

- IAS 32 39 IFRS 7 9 Long Term LiabilitiesDocument48 pagesIAS 32 39 IFRS 7 9 Long Term LiabilitiesSamer BrownNo ratings yet

- Accounting ExamDocument5 pagesAccounting ExamAccounting SerbizNo ratings yet

- Fam Session 3-4 Hand OutDocument70 pagesFam Session 3-4 Hand Outrabbi sodhiNo ratings yet

- CH 5 Answers 2014 PDFDocument6 pagesCH 5 Answers 2014 PDFDenise Villanueva100% (1)

- Accounting Work Sample in ExcelDocument3 pagesAccounting Work Sample in Exceljha333851No ratings yet

- Adjusting Accounts and Preparing Financial StatementsDocument58 pagesAdjusting Accounts and Preparing Financial StatementsHEM CHEA100% (4)

- Completing The Accounting Cycle: Learning ObjectivesDocument43 pagesCompleting The Accounting Cycle: Learning ObjectivesShadman Sakib FahimNo ratings yet

- Accounting Equation ch5Document19 pagesAccounting Equation ch5Ebony Ann delos SantosNo ratings yet

- Acca Fa Trial - Exam - 1 - QuestionsDocument18 pagesAcca Fa Trial - Exam - 1 - QuestionsElshan ShahverdiyevNo ratings yet

- Ôn Tập Trắc Nghiệm Chuẩn Mực (48 Trang)Document48 pagesÔn Tập Trắc Nghiệm Chuẩn Mực (48 Trang)Thương TrầnNo ratings yet

- ch08 Accounting For ReceivablesDocument75 pagesch08 Accounting For ReceivablesNisrina Ardyanti67% (3)

- CHP 3 Problems Student TemplateDocument28 pagesCHP 3 Problems Student TemplateDarkeningoftheLightNo ratings yet

- Ratio and Income and Balance SheetDocument12 pagesRatio and Income and Balance SheetJerry RodNo ratings yet

- UntitledDocument30 pagesUntitledMariola AlkuNo ratings yet

- Chapter 04Document60 pagesChapter 04peregrinum100% (2)

- Accounting TFDocument12 pagesAccounting TFLuna VeraNo ratings yet

- Financial Accounting ExerciseDocument14 pagesFinancial Accounting ExerciseMiraeNo ratings yet

- Bookkeeping MaterialDocument16 pagesBookkeeping MaterialPrincess Alyssa BarawidNo ratings yet

- Aud Ar AnswerDocument5 pagesAud Ar Answerlena cpaNo ratings yet

- A Compilation of All The Laboratory ExercisesDocument91 pagesA Compilation of All The Laboratory ExercisesClariceLacanlaleDarasinNo ratings yet

- Chap005-Consolidation of Less-Than-Wholly Owned SubsidiariesDocument71 pagesChap005-Consolidation of Less-Than-Wholly Owned Subsidiaries_casals100% (3)

- BCDocument73 pagesBCAbi Serrano Taguiam100% (2)

- Pocket Guide To IFRS 2016Document104 pagesPocket Guide To IFRS 2016memmemoNo ratings yet

- Financial StatementDocument14 pagesFinancial StatementMD. NEAMUL HASAN KHAN 2110027No ratings yet

- Thermax: Performance HighlightsDocument10 pagesThermax: Performance HighlightsAngel BrokingNo ratings yet

- FINC6021 - Financial StatementsDocument126 pagesFINC6021 - Financial Statements尹米勒No ratings yet

- FABM1Document16 pagesFABM1Dia JulianaNo ratings yet

- S FRA Session 1 2018Document37 pagesS FRA Session 1 2018Deepali GuptaNo ratings yet