01 Tan Vs CA

01 Tan Vs CA

Uploaded by

Jimenez LorenzCopyright:

Available Formats

01 Tan Vs CA

01 Tan Vs CA

Uploaded by

Jimenez LorenzOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

01 Tan Vs CA

01 Tan Vs CA

Uploaded by

Jimenez LorenzCopyright:

Available Formats

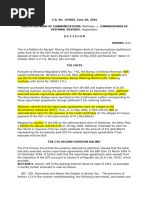

G.R. No.

108555 December 20, 1994

RAMON TAN, petitioner,

vs.

THE HONORABLE COURT OF APPEALS and RIZAL COMMERCIAL BANKING CORPORATION

FACTS:

Petitioner Ramon Tan had maintained Current Account with respondent bank. To avoid carrying cash while

enroute to Manila, he secured a Cashier's Check payable to his order. He deposited the check in his account with

RCBC Binondo. RCBC erroneously sent the same cashier's check for clearing to the Central Bank which was

returned for having been "missent" or "misrouted." RCBC debited the amount covered by the same cashier's check

from the account of the petitioner. Respondent bank at this time had not informed the petitioner of its action.

Petitioner issued two (2) personal checks. Check in the name of MS Development Trading Corporation was

returned twice for insufficiency of funds.

Petitioner, alleging to have suffered humiliation and loss of face in the business sector due to the bounced checks,

filed a complaint against RCBC for damages.

Petitioner sought to prove that it was RCBC's responsibility to call his attention there and then that he had

erroneously filled the wrong deposit slip and it was negligence on RCBC's part not to have done

RCBC disowning any negligence, put the blame for the "misrouting" on the petitioner for using the wrong check

deposit slip.

The trial court rendered in petitioner's favor. The CA reversed the decision of the trial court.

ISSUE: Whether THE HONORABLE COURT OF APPEALS COMMITTED GROSS AND MANIFEST ERROR IN

CONCLUDING THAT THE NEGLIGENCE WAS ASCRIBABLE TO HEREIN PETITIONER.

HELD:

YES. The Court do not subscribe to RCBC's assertion that petitioner's use of the wrong deposit slip was the

proximate cause of the clearing fiasco and so, petitioner must bear the consequence. The conclusion is inevitable

that respondent RCBC had been remiss in the performance of its duty and obligation to its client, as well as to

itself.

An ordinary check is not a mere undertaking to pay an amount of money. There is an element of certainty or

assurance that it will be paid upon presentation that is why it is perceived as a convenient substitute for currency

in commercial and financial transactions.

What was presented for deposit in the instant cases was not just an ordinary check but a cashier's check payable to

the account of the depositor himself. A cashier's check by its peculiar character and general use in the commercial

world is regarded substantially to be as good as the money which it represents. In this case, therefore, PCIB by

issuing the check created an unconditional credit in favor of any collecting bank.

All these considered, petitioner's reliance on the layman's perception that a cashier's check is as good as cash is

not entirely misplaced, as it is rooted in practice, tradition, and principle.

You might also like

- CrimPro G.R. No. 134307 Conjuangco Jr. Vs Sandiganbayan100% (1)CrimPro G.R. No. 134307 Conjuangco Jr. Vs Sandiganbayan4 pages

- Lao vs. Court of Appeals 275 SCRA 237, July 08, 1997 FactsNo ratings yetLao vs. Court of Appeals 275 SCRA 237, July 08, 1997 Facts1 page

- Allied Banking Corporation VS Bank of The Philippine Islands100% (1)Allied Banking Corporation VS Bank of The Philippine Islands3 pages

- Part 1 - Total of 33Pts: San Beda University College of Law Taxation2 Final ExaminationNo ratings yetPart 1 - Total of 33Pts: San Beda University College of Law Taxation2 Final Examination4 pages

- Philippine Accident Insurance Co. Vs Hon. Flores and NavaltaNo ratings yetPhilippine Accident Insurance Co. Vs Hon. Flores and Navalta2 pages

- Lloyd - S Enterprises and Credit Corp. vs. Sps. Dolleton (Case Digest)No ratings yetLloyd - S Enterprises and Credit Corp. vs. Sps. Dolleton (Case Digest)1 page

- Sps. Oliveros vs. Hon. Presiding Judge, Regional Trial Court, Br. 24, G.R. No. 165963, 23 September 2007No ratings yetSps. Oliveros vs. Hon. Presiding Judge, Regional Trial Court, Br. 24, G.R. No. 165963, 23 September 20072 pages

- Madrigal v. Department of Justice G.R. No. 168903, June 18,2014No ratings yetMadrigal v. Department of Justice G.R. No. 168903, June 18,201429 pages

- Personal Status Legal Personality and Capacity Report100% (1)Personal Status Legal Personality and Capacity Report34 pages

- 2 - United Coconut Planters Bank V Iac - GR No. 72664-65 - Cayabyab100% (1)2 - United Coconut Planters Bank V Iac - GR No. 72664-65 - Cayabyab2 pages

- Velayo V Shell Co of The Phils Saudi Arabian Airlines V Ca (Morada)No ratings yetVelayo V Shell Co of The Phils Saudi Arabian Airlines V Ca (Morada)10 pages

- Digest BANK OF AMERICA NT & SA vs. PHILIPPINE RACING CLUB INCORPORATEDNo ratings yetDigest BANK OF AMERICA NT & SA vs. PHILIPPINE RACING CLUB INCORPORATED2 pages

- Affidavit of Loss: Republic of The Philippines) City of Muntinlupa) S.SNo ratings yetAffidavit of Loss: Republic of The Philippines) City of Muntinlupa) S.S1 page

- Article 2176. Whoever by Act or Omission Causes Damage To Another, There Being Fault orNo ratings yetArticle 2176. Whoever by Act or Omission Causes Damage To Another, There Being Fault or3 pages

- THE WELLEX GROUP INC. Vs U LAND ARILINESCO. CivilLawRevNo ratings yetTHE WELLEX GROUP INC. Vs U LAND ARILINESCO. CivilLawRev2 pages

- Sveriges Assurance v. Qua Chee Gan 21 SCRA 12 1967No ratings yetSveriges Assurance v. Qua Chee Gan 21 SCRA 12 19672 pages

- Gumudiano vs. Naess - Elements of Contract - Potestative ConditionNo ratings yetGumudiano vs. Naess - Elements of Contract - Potestative Condition4 pages

- CrimPro G.R. No. 168641 People Vs BautistaNo ratings yetCrimPro G.R. No. 168641 People Vs Bautista2 pages

- CrimPro G.R. No. 158763 Miranda Vs TuliaoNo ratings yetCrimPro G.R. No. 158763 Miranda Vs Tuliao5 pages

- PEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, vs. BERNABE PAREJA y CRUZ, Accused-Appellant. G.R. No. 202122 January 15, 2014No ratings yetPEOPLE OF THE PHILIPPINES, Plaintiff-Appellee, vs. BERNABE PAREJA y CRUZ, Accused-Appellant. G.R. No. 202122 January 15, 20145 pages

- Antiporda Vs Hon. Garchitorena G.R. No. 1332890% (1)Antiporda Vs Hon. Garchitorena G.R. No. 1332893 pages

- CreditTrans People Vs Montemayor GR No. L 17449100% (1)CreditTrans People Vs Montemayor GR No. L 174492 pages

- CreditTrans Roxas Vs Cayetano GR No. 92245No ratings yetCreditTrans Roxas Vs Cayetano GR No. 922453 pages

- CreditTrans Calibo Vs Abella GR No. 120528No ratings yetCreditTrans Calibo Vs Abella GR No. 1205283 pages

- 23 CREDTRANS Durban Apartments Corp Vs Pioneer InsuranceNo ratings yet23 CREDTRANS Durban Apartments Corp Vs Pioneer Insurance2 pages

- PF Provident Fund TRANSFER FORMAT IX A IX-A Pry Final WithdrawalNo ratings yetPF Provident Fund TRANSFER FORMAT IX A IX-A Pry Final Withdrawal1 page

- Saudi Aramco Supplier Registration & Qualification SeminarNo ratings yetSaudi Aramco Supplier Registration & Qualification Seminar15 pages

- Listen Platform Bridging Perception Gap EbookNo ratings yetListen Platform Bridging Perception Gap Ebook16 pages

- Biopad - Biobased Fabric Powered by Nano-Vpci: Metals Protected (Multimetal)No ratings yetBiopad - Biobased Fabric Powered by Nano-Vpci: Metals Protected (Multimetal)2 pages

- Iso 18692 Export Pipeline Equal BV Offshore Standard 4706.5.432ni - 2007-11No ratings yetIso 18692 Export Pipeline Equal BV Offshore Standard 4706.5.432ni - 2007-1153 pages

- 10.1 American Wire Daily Rated Employees Union Vs American WireNo ratings yet10.1 American Wire Daily Rated Employees Union Vs American Wire1 page

- Whole Brain Learning System Outcome-Based Education: Senior High SchoolNo ratings yetWhole Brain Learning System Outcome-Based Education: Senior High School16 pages

- Assessment On The Implementation of The Business Permit and Licensing System (BPLS) Stream Lining Program: The Case of Baggao, CagayanNo ratings yetAssessment On The Implementation of The Business Permit and Licensing System (BPLS) Stream Lining Program: The Case of Baggao, Cagayan29 pages