Residential Status True or False

Uploaded by

Sarvar PathanCopyright:

Available Formats

Residential Status True or False

Uploaded by

Sarvar PathanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Residential Status True or False

Uploaded by

Sarvar PathanCopyright:

Available Formats

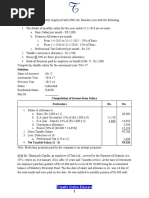

TRUE OR FALSE

1. Once a person is a resident in a previous year he shall be deemed to be resident for

subsequent previous years.

2. Once a person is a resident for a source of income in a particular year he shall be deemed

to be resident for all other sources of income in the same previous year.

3. A resident in India cannot become resident in any other country for the same assessment

year.

4. Residential status is to be determined on the basis of stay in India during assessment year.

5. Incomes which accrue or arise outside India but are received directly into India are

taxable only in case of resident.

6. Income deemed to accrue or arise in India is taxable in case of all the assessees.

7. Income which accrues or arise outside India from a business controlled from India is

taxable case of only not ordinarily resident.

8. Income which accrues or arises outside India and also received outside India is taxable in

case of both ordinarily resident and not ordinarily resident.

9. Total income of a person is determined on the basis of his citizenship in India.

10. Residential status of a person may change from year to year.

11. An Indian citizen may be a non-resident in India.

12. Residential status is important in deciding whether indian income of a person is taxable

or not.

13. A person is deemed to be of "Indian origin", if his father was born in Pakistan in 1927.

14. A person is deemed to be of "Indian origin", if his mother was born in Nepal.

15. A person is deemed to be of "Indian origin", if his grandmother was born in Bangladesh

Tripathi Online Educare

1

in 1945.

16. A person is deemed to be of "Indian origin", if his grandfather was born in Sri Lanka in

1957.

17. While counting the number of days for determining residential status, a stay in a cruise

boat anchored in the Mumbai Port is treated as stay in India.

18. Indian income is taxable in all cases, whether of an ordinary resident, or a not-ordinary

resident, or a non-resident.

19. Foreign income of an ordinary resident is wholly taxable.

20. Foreign income of non-resident is not taxable at all.

21. Income accruing outside India will be deemed to be received in India if it is included in a

balance sheet prepared in India.

22. If an income is included in the total income of a person on the basis of accrual, it may be

included again on the basis of its receipt in subsequent period.

Answer

True - 2,6,10,11,13,15,17,18,19,20

False - 1,3,4,5,7,8,9,12,14,16,21,22.

4. False; During Previous Year

5. False; all the assesses

7. False; both ordinarily resident and not ordinarily resident

8. False; resident only

9. False; residential status in India

12.False; residential status is important in deciding whether foreign income of a person is taxable

or not.

21. False; Income accruing outside India will not be deemed to be received in India merely

because cannot be included again on the basis of its receipt in subsequent period (Explanation 2

to S.5)

Tripathi Online Educare

2

You might also like

- Resdential Status Questionsby Garun Kumar GDCM Srikakulam100% (1)Resdential Status Questionsby Garun Kumar GDCM Srikakulam9 pages

- Scope of Total Income U/S. 5: Presented To:-Prof. SeemaNo ratings yetScope of Total Income U/S. 5: Presented To:-Prof. Seema17 pages

- Residential Status and Incidence of Tax On Income Under Income Tax ActNo ratings yetResidential Status and Incidence of Tax On Income Under Income Tax Act6 pages

- Residential Status and Scope of Total IncomeNo ratings yetResidential Status and Scope of Total Income19 pages

- L15 MCQs Residential Status No Anno (1) (1) (Recovered)No ratings yetL15 MCQs Residential Status No Anno (1) (1) (Recovered)8 pages

- Income Tax Law & Practice Residential StatusNo ratings yetIncome Tax Law & Practice Residential Status11 pages

- What Are The Different Types of Residential Status Under Income Tax Act and What Is Their RelevanceNo ratings yetWhat Are The Different Types of Residential Status Under Income Tax Act and What Is Their Relevance5 pages

- You Can Be A Resident Indian and An NRI at The Same TimeNo ratings yetYou Can Be A Resident Indian and An NRI at The Same Time4 pages

- Elective Income Tax Law Practice 1 - 021917No ratings yetElective Income Tax Law Practice 1 - 02191733 pages

- Residential Status Under Income-Tax Act, 1961100% (1)Residential Status Under Income-Tax Act, 19616 pages

- Residential Status and Incidence of Tax - Study MaterialNo ratings yetResidential Status and Incidence of Tax - Study Material6 pages

- Whoisannri?: Person Resident Outside India Means A Person Who Is Not Resident in IndiaNo ratings yetWhoisannri?: Person Resident Outside India Means A Person Who Is Not Resident in India3 pages

- Unit 1 Residential Status Under Section 6 of Income Tax ActNo ratings yetUnit 1 Residential Status Under Section 6 of Income Tax Act3 pages

- Tax Treatment of Foreign Income of Persons Resident in IndiaNo ratings yetTax Treatment of Foreign Income of Persons Resident in India4 pages

- Section 5 Which Defines The "Scope of Income" Section 6 Which Defines The "The Residential Status" of The PersonNo ratings yetSection 5 Which Defines The "Scope of Income" Section 6 Which Defines The "The Residential Status" of The Person8 pages

- Residential Status and Scope of Total Income - AY 2023 - 24No ratings yetResidential Status and Scope of Total Income - AY 2023 - 2412 pages

- Assignment On Principles of Taxation Law: Topic-Residential StatusNo ratings yetAssignment On Principles of Taxation Law: Topic-Residential Status19 pages

- International Banking & Financing: Nri'S & Pio'S Under FemaNo ratings yetInternational Banking & Financing: Nri'S & Pio'S Under Fema15 pages

- What Are The Different Types of Residential Status Under Income Tax Act and What Is Their RelevanceNo ratings yetWhat Are The Different Types of Residential Status Under Income Tax Act and What Is Their Relevance4 pages

- How an NRI Income Will Be Taxed in IndiaNo ratings yetHow an NRI Income Will Be Taxed in India14 pages

- My Space: Indian Citizenship at A CrossroadNo ratings yetMy Space: Indian Citizenship at A Crossroad2 pages

- Present Indian: Indian Citizenship, Indian Passport and Visa free travelFrom EverandPresent Indian: Indian Citizenship, Indian Passport and Visa free travel5/5 (1)

- Mi 4A PRO 80 CM 32 HD Ready LED Smart Android TV With Google Data SaverNo ratings yetMi 4A PRO 80 CM 32 HD Ready LED Smart Android TV With Google Data Saver2 pages

- Individual Account Opening Form: (Demat + Trading)No ratings yetIndividual Account Opening Form: (Demat + Trading)27 pages

- Acknowledgement of Online Application For Services On Existing DLNo ratings yetAcknowledgement of Online Application For Services On Existing DL1 page

- Acknowledgement of Online Application For Services On Existing DLNo ratings yetAcknowledgement of Online Application For Services On Existing DL1 page

- Important Theory Questions: Tripathi Online EducareNo ratings yetImportant Theory Questions: Tripathi Online Educare1 page

- ch07 - Intermediate Acc IFRS (Cash and Receivable)No ratings yetch07 - Intermediate Acc IFRS (Cash and Receivable)104 pages

- Fundamental Aspects of Bharti Airtel: Presented By:-Irshad Naushad Sheikh0% (1)Fundamental Aspects of Bharti Airtel: Presented By:-Irshad Naushad Sheikh10 pages

- Agamata Relevant Costing Chap 9 Short Term Decision PDFNo ratings yetAgamata Relevant Costing Chap 9 Short Term Decision PDF2 pages

- Financial Management (D. Risk & Leverage) : OverallNo ratings yetFinancial Management (D. Risk & Leverage) : Overall7 pages

- Financial Statements: Analysis and Reporting Felix I. Lessambo All Chapters Instant Download100% (3)Financial Statements: Analysis and Reporting Felix I. Lessambo All Chapters Instant Download55 pages

- Reformulated Comprehensive Income StatementNo ratings yetReformulated Comprehensive Income Statement5 pages

- SFEDI Level 2 Certificate in Preparing To Start Your Own BusinessNo ratings yetSFEDI Level 2 Certificate in Preparing To Start Your Own Business2 pages

- Week 6 (Non-Assurance & Related Services, Code of Ethics)100% (1)Week 6 (Non-Assurance & Related Services, Code of Ethics)33 pages

- Chapter 4: Income Statement and Related Information: Intermediate Accounting, 11th Ed. Kieso, Weygandt, and WarfieldNo ratings yetChapter 4: Income Statement and Related Information: Intermediate Accounting, 11th Ed. Kieso, Weygandt, and Warfield22 pages

- Accounting (IAS) Level 3: LCCI International QualificationsNo ratings yetAccounting (IAS) Level 3: LCCI International Qualifications16 pages