Professional Documents

Culture Documents

The Discounted Cash Flow (DCF) Estimate of Snap Stock's Fair Market Value On Per Share Is 27.94

The Discounted Cash Flow (DCF) Estimate of Snap Stock's Fair Market Value On Per Share Is 27.94

Uploaded by

NarinderOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Discounted Cash Flow (DCF) Estimate of Snap Stock's Fair Market Value On Per Share Is 27.94

The Discounted Cash Flow (DCF) Estimate of Snap Stock's Fair Market Value On Per Share Is 27.94

Uploaded by

NarinderCopyright:

Available Formats

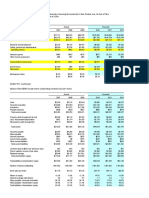

2016Act

Net Revenue $405

Growth 589.5%

Adj. EBITDA (Note 1) ($459)

Adj. EBITDA Margin (113.6%)

Cash Taxes $0

Incr (Decr) in Net WC $151

Capital Expenditures $67

Stock-based Comp. $32

Free Cash Flow ($709)

Terminal Value

Discount Factor

Enterprice Value 38728.46

Enterprice Value 38728.46

Debt 0

Cash 501.7

WACC 9.70%

Terminal Growth Rate 3.50%

The Discounted cash flow (DCF) Estimate of Snap Stock's Fair M

Financial Forecast ($ millions)

2017 2018 2019 2020 2021 2022

$944 $1,935 $3,254 $4,902 $6,907 $9,189

133.3% 105.0% 68.2% 50.6% 40.9% 33.0%

($772) ($610) ($195) $363 $1,474 $2,616

(81.8%) (31.5%) (6.0%) 7.4% 21.3% 28.5%

$0 $0 $0 $0 $0 $0

$257 $228 $231 $228 $209 $224

$83 $97 $109 $120 $130 $140

$75 $159 $203 $257 $317 $421

($1,186) ($1,093) ($737) ($243) $818 $1,831

0.911577028259 0.830972678449305 0.757496 0.690516 0.629458151621889

Equity Value EV-DEBT + CASH

39230.16

Total Shares 1404

Price/share 27.9417094017094

market price 22.74

ate of Snap Stock's Fair Market Value on per share is 27.94

2023 2024 2025 ear (2026)

$11,635 $14,131 $16,569 $17,149

26.6% 21.4% 17.3% 3.5%

$3,888 $5,223 $6,574 $6,804

33.4% 37.0% 39.7% 39.7%

$0 $823 $1,448

$248 $207 $151

$148 $155 $161

$533 $648 $759

$2,958 $3,390 $4,054 $4,196

0.5737995913 0.523063 0.476812

33,399.62

undervalued

You might also like

- Lady M DCF TemplateDocument4 pagesLady M DCF Templatednesudhudh100% (1)

- Intrinsic Value Calculator (Discounted Free Cash Flow Method 10 Years)Document41 pagesIntrinsic Value Calculator (Discounted Free Cash Flow Method 10 Years)Clarence Ryan100% (2)

- Smith Family Financial PDocument11 pagesSmith Family Financial PNarinder50% (2)

- DCF Template BofA - VFDocument1 pageDCF Template BofA - VFHunter Hearst LevesqueNo ratings yet

- Final Examination Case Study FIN 855 Spring 2021 Professor Jim SewardDocument1 pageFinal Examination Case Study FIN 855 Spring 2021 Professor Jim SewardNarinderNo ratings yet

- D'leon Financial Statements Analysis Exercise - SolvedDocument8 pagesD'leon Financial Statements Analysis Exercise - SolvedDIPESH KUNWARNo ratings yet

- Flash - Memory - Inc From Website 0515Document8 pagesFlash - Memory - Inc From Website 0515竹本口木子100% (1)

- Anandam Manufacturing Company: Analysis of Financial StatementsDocument5 pagesAnandam Manufacturing Company: Analysis of Financial StatementsNarinderNo ratings yet

- How To Cook Pork Tenderloin (Easy To Make) - Spend With PenniesDocument1 pageHow To Cook Pork Tenderloin (Easy To Make) - Spend With PenniesgibNo ratings yet

- AWS MidTest 2Document6 pagesAWS MidTest 2Tika TikaNo ratings yet

- CLW Analysis 6-1-21Document5 pagesCLW Analysis 6-1-21HunterNo ratings yet

- Project NPV Sensitivity AnalysisDocument54 pagesProject NPV Sensitivity AnalysisAsad Mehmood100% (3)

- Genzyme DCF PDFDocument5 pagesGenzyme DCF PDFAbinashNo ratings yet

- Historical ProjectionsDocument2 pagesHistorical ProjectionshekmatNo ratings yet

- UST Debt Policy Spreadsheet (Reduced)Document9 pagesUST Debt Policy Spreadsheet (Reduced)Björn Auðunn ÓlafssonNo ratings yet

- Joseph Carlson DCF SpreadsheetDocument3 pagesJoseph Carlson DCF Spreadsheetمحمد عبد التوابNo ratings yet

- ABNB ValuationDocument4 pagesABNB ValuationKasturi MazumdarNo ratings yet

- 2 Million / 40%) + $5 Million Post-Money Valuation $7 MillionDocument1 page2 Million / 40%) + $5 Million Post-Money Valuation $7 MillionShabnam ShahNo ratings yet

- Lesson 3Document29 pagesLesson 3Anh MinhNo ratings yet

- Bac DCFDocument7 pagesBac DCFVivek GuptaNo ratings yet

- Solucion Caso Lady MDocument13 pagesSolucion Caso Lady Mjohana irma ore pizarroNo ratings yet

- McD's Free Cash Flow AnalysisDocument2 pagesMcD's Free Cash Flow AnalysisRama Krishna ShikaramNo ratings yet

- Currency USD USD USD USD USD USD USD: Growth Over Prior Year NA 436.1% 179.3% 55.6% 24.7% 96.3% 36.4%Document29 pagesCurrency USD USD USD USD USD USD USD: Growth Over Prior Year NA 436.1% 179.3% 55.6% 24.7% 96.3% 36.4%raman nandhNo ratings yet

- Titan Company Limited: Company Name Eps Tim $14.72 Growth Rate 33% Discount Rate 12.00% $14.72 P/E Ratio 66.00 $1,931.91Document6 pagesTitan Company Limited: Company Name Eps Tim $14.72 Growth Rate 33% Discount Rate 12.00% $14.72 P/E Ratio 66.00 $1,931.91KS UnofficialNo ratings yet

- Apple TTMDocument25 pagesApple TTMQuofi SeliNo ratings yet

- Fin 600 - Radio One-Team 3 - Final SlidesDocument20 pagesFin 600 - Radio One-Team 3 - Final SlidesCarlosNo ratings yet

- Investment Banking, 3E: Valuation, Lbos, M&A, and IposDocument10 pagesInvestment Banking, 3E: Valuation, Lbos, M&A, and IposBook SittiwatNo ratings yet

- Sum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Document6 pagesSum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Laura Fonseca SarmientoNo ratings yet

- DCF Template: Start StepDocument11 pagesDCF Template: Start StepBrian DongNo ratings yet

- 08 ENMA302 InflationExamplesDocument8 pages08 ENMA302 InflationExamplesMotazNo ratings yet

- Tata Technologies FinancialsDocument22 pagesTata Technologies FinancialsRitvik DuttaNo ratings yet

- DCF Analysis CompletedDocument10 pagesDCF Analysis Completedrafael.nunezguillaumeNo ratings yet

- PZ Financial AnalysisDocument2 pagesPZ Financial Analysisdewanibipin100% (1)

- Valuation - PepsiDocument24 pagesValuation - PepsiLegends MomentsNo ratings yet

- Student Workbook Flash Amended Final PDFDocument21 pagesStudent Workbook Flash Amended Final PDFGaryNo ratings yet

- Rental Property Calculator: ResultDocument3 pagesRental Property Calculator: ResultHarsh AcharyaNo ratings yet

- Ejercicio Proyecto FinalDocument3 pagesEjercicio Proyecto FinalCortez Rodríguez Karen YanethNo ratings yet

- Outreach NetworksDocument3 pagesOutreach NetworksPaco Colín50% (2)

- Cmni Priormonth 1Document1 pageCmni Priormonth 1api-255333441No ratings yet

- Nestle India Financial Model 1690555420Document24 pagesNestle India Financial Model 1690555420Shrikant GuptaNo ratings yet

- Nestle Model Group 5Document129 pagesNestle Model Group 5Aayushi ChandwaniNo ratings yet

- Net Present Value and Other Investment RulesDocument38 pagesNet Present Value and Other Investment RulesBussines LearnNo ratings yet

- DCF Textbook Model ExampleDocument6 pagesDCF Textbook Model ExamplePeterNo ratings yet

- Intrinsic Valuation DCF Model TATA MOTORS LTD 1699087548Document13 pagesIntrinsic Valuation DCF Model TATA MOTORS LTD 1699087548WtransfastNo ratings yet

- FM and Dupont of GenpactDocument11 pagesFM and Dupont of GenpactKunal GarudNo ratings yet

- QR Shopper: To Perform A Financial Analysis For A Startup Tech Company in Rochester, New YorkDocument3 pagesQR Shopper: To Perform A Financial Analysis For A Startup Tech Company in Rochester, New YorkRajat SinghNo ratings yet

- Flash MemoryDocument14 pagesFlash MemoryPranav TatavarthiNo ratings yet

- Valuation - NVIDIADocument27 pagesValuation - NVIDIALegends MomentsNo ratings yet

- DCF Template: Exit MultipleDocument11 pagesDCF Template: Exit MultipleShane BrooksNo ratings yet

- Appendix Figure 1 Annual Lease Payments For AircraftDocument4 pagesAppendix Figure 1 Annual Lease Payments For AircraftbananahoverboardNo ratings yet

- Designer Lamp Project Blank SpreadsheetDocument4 pagesDesigner Lamp Project Blank SpreadsheetAnna BudaevaNo ratings yet

- Perhitungan LODDocument4 pagesPerhitungan LODFranciskus Febry AnggoroNo ratings yet

- Beron - FinancialForecastingDocument25 pagesBeron - FinancialForecastingKat BeronNo ratings yet

- CCME Financial Analysis ReportDocument5 pagesCCME Financial Analysis ReportOld School ValueNo ratings yet

- Income Statement (In Million) Current Year: NY at 6% NY at 10%Document4 pagesIncome Statement (In Million) Current Year: NY at 6% NY at 10%bittesh chakiNo ratings yet

- Netflix Financial StatementsDocument2 pagesNetflix Financial StatementsGoutham RaoNo ratings yet

- Ejercicio Matemática Digital - ResueltoDocument6 pagesEjercicio Matemática Digital - ResueltoDess DésiréeNo ratings yet

- Ejercicio Estados Financieros Vertical y Horizontal 22 SepDocument5 pagesEjercicio Estados Financieros Vertical y Horizontal 22 Sepgracy yamileth vasquez garayNo ratings yet

- Flash Memory IncDocument9 pagesFlash Memory Incxcmalsk100% (1)

- Kezi Juice Company FinancialsDocument3 pagesKezi Juice Company FinancialsTendai SixpenceNo ratings yet

- Data Year-End Common Stock Price: Ratios SolutionDocument2 pagesData Year-End Common Stock Price: Ratios SolutionTarun KatariaNo ratings yet

- September 2021 Casino Revenue DataDocument14 pagesSeptember 2021 Casino Revenue DataWJZNo ratings yet

- 2019-09-21T174353.577Document4 pages2019-09-21T174353.577Mikey MadRat100% (1)

- Understanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyFrom EverandUnderstanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyNo ratings yet

- OB Sunday FINAL EXAM (Subjective Paper)Document2 pagesOB Sunday FINAL EXAM (Subjective Paper)NarinderNo ratings yet

- Water & Power Development Authority Phase XIV (WAPDA-XIV) (469) Application Form For The Post of 02. Assistant Director (Computer Operations)Document4 pagesWater & Power Development Authority Phase XIV (WAPDA-XIV) (469) Application Form For The Post of 02. Assistant Director (Computer Operations)NarinderNo ratings yet

- FPSC@FPSC Gov PKDocument72 pagesFPSC@FPSC Gov PKNarinderNo ratings yet

- Running Head: QVC 1Document13 pagesRunning Head: QVC 1NarinderNo ratings yet

- The Walt Disney CompanyDocument11 pagesThe Walt Disney CompanyNarinderNo ratings yet

- Jetblue Airways: Deicing at Logan AirportDocument4 pagesJetblue Airways: Deicing at Logan AirportNarinderNo ratings yet

- Running Head: K.Peabody Firm: Creating Elusive Profits 1Document13 pagesRunning Head: K.Peabody Firm: Creating Elusive Profits 1NarinderNo ratings yet

- Jetblue Airways: Deicing at Logan AirportDocument5 pagesJetblue Airways: Deicing at Logan AirportNarinderNo ratings yet

- Bond Buyback at Deutsche Bank: Running Head: 1Document10 pagesBond Buyback at Deutsche Bank: Running Head: 1NarinderNo ratings yet

- Astral - XLS: Assumptions / InputsDocument6 pagesAstral - XLS: Assumptions / InputsNarinderNo ratings yet

- THE WALT DISNEY COMPANY - EditedDocument11 pagesTHE WALT DISNEY COMPANY - EditedNarinderNo ratings yet

- Indian Stock MarketDocument8 pagesIndian Stock MarketArpit JainNo ratings yet

- CamLogic Product RangeDocument10 pagesCamLogic Product RangeMa LhNo ratings yet

- Da10 Air Cooled Engine (Appn Code D3.2007 & D3Document26 pagesDa10 Air Cooled Engine (Appn Code D3.2007 & D3Sandeep NikhilNo ratings yet

- Application Engineering Bulletin: Electronic Engine Features - Engine Protection Automotive Industrial G-Drive MarineDocument60 pagesApplication Engineering Bulletin: Electronic Engine Features - Engine Protection Automotive Industrial G-Drive MarineMiguel Angel Cortes PrietoNo ratings yet

- Book Answer Summaries Chapter 2 3Document6 pagesBook Answer Summaries Chapter 2 3ghada alshabibNo ratings yet

- De Castro DigestsDocument24 pagesDe Castro DigestsCara HenaresNo ratings yet

- Post Doctoral Fellow - NotificationDocument3 pagesPost Doctoral Fellow - Notificationkumar.sujeet4No ratings yet

- Sample Job Description Administrative AssistantDocument2 pagesSample Job Description Administrative Assistant다네No ratings yet

- Establishment Process of Rep Office Contractor in IndonesiaDocument8 pagesEstablishment Process of Rep Office Contractor in IndonesiaZakaria KartohardjonoNo ratings yet

- Questionnaire On ShoesDocument6 pagesQuestionnaire On ShoesMayank GuptaNo ratings yet

- Function Opf MatpowerDocument44 pagesFunction Opf MatpowerMuhammad SulaimanNo ratings yet

- Interpretation-WPS Office PDFDocument42 pagesInterpretation-WPS Office PDFAnand maratheNo ratings yet

- Repair Part List - 8168451Document10 pagesRepair Part List - 8168451wshrockNo ratings yet

- Pas 33Document7 pagesPas 33AnneNo ratings yet

- General Service Solenoid Valves: NC NO UDocument4 pagesGeneral Service Solenoid Valves: NC NO UDevinNo ratings yet

- Undecorticated Cotton Seed Oil Cake - Akola Product Note Chapter 1 - Trading Parameters 3Document1 pageUndecorticated Cotton Seed Oil Cake - Akola Product Note Chapter 1 - Trading Parameters 3AjayNo ratings yet

- Eurocopter TigerDocument8 pagesEurocopter Tigerjb2ookwormNo ratings yet

- NTS 02-G: Quick Start GuideDocument1 pageNTS 02-G: Quick Start GuideTrung TrầnNo ratings yet

- Transmission Fluid Level Service ProcedureDocument2 pagesTransmission Fluid Level Service ProcedureBruceli CWBNo ratings yet

- Bluetooth TutorialDocument349 pagesBluetooth Tutorialjohn bougsNo ratings yet

- Project Proposal BU3102 Copy SP1 2017Document36 pagesProject Proposal BU3102 Copy SP1 2017Chen WenxuanNo ratings yet

- SAMPLE PROBLEMS Fluid Mechanics Pump DeNeversDocument2 pagesSAMPLE PROBLEMS Fluid Mechanics Pump DeNeversGeorge Isaac McQuilesNo ratings yet

- Nursery Plant Production GuideDocument300 pagesNursery Plant Production GuideMamatha Kamireddy100% (1)

- Validity of MarriageDocument17 pagesValidity of MarriageRicha RajpalNo ratings yet

- Project Management Lean & Six Sigma in Construction: WasteDocument3 pagesProject Management Lean & Six Sigma in Construction: WasteBLUE TOOTHNo ratings yet

- Chapter 2Document14 pagesChapter 2Abdullah OmerNo ratings yet

- Generator ManualDocument419 pagesGenerator ManualVinay Mishra100% (2)

- Chapter 3 - The Third Big Question - What Is The Best Way Forward For The OrganizationDocument7 pagesChapter 3 - The Third Big Question - What Is The Best Way Forward For The OrganizationSteffany RoqueNo ratings yet