Acp 101

Acp 101

Uploaded by

Lyca SorianoCopyright:

Available Formats

Acp 101

Acp 101

Uploaded by

Lyca SorianoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Acp 101

Acp 101

Uploaded by

Lyca SorianoCopyright:

Available Formats

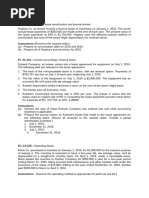

Pamantasan ng Cabuyao

Katapatan Subd., Banay Banay, City of Cabuyao

PRELIM EXAMINATION

Name: _________________________________ Score:___________

Accounting for Special Transactions (ACP101) W.E. Peralta

Solve the following problems and encircle the correct answer. Show all necessary computations.

1. Carson and Lamb establish a partnership to operate a used-furniture business under the name C&L Partnership. Carson

contributes furniture inventory that cost P600,000 and has fair value of P800,000. Lamb contributes P300,000 cash and delivery

equipment that cost P400,000 and has fair value of P300,000. The partners agree to share profits and losses 60% to Carson

and 40% to Lamb. What is the capital balances of Carson and Lamb respectively, immediately after the formation of the

partnership?

A. P800,000 and P700,000 C. P800,000 and P800,000

B. 800,000 and 600,000 D. 700,000 and 700,000

2. Arnold, Beverly and Carolyn are partners who share profit and losses 4:4:2, respectively, after Beverly, who manages the

partnership, receives a bonus of 10% of income net of the bonus. Partnership income for the year is P253,000. How much is

the share of Arnold in the partnership income?

A. P115,000 C. P 46,000

B. 92,000 D. 102,500

Use the following information for Questions 3 and 4:

Kathy and Eddie formed the K&E partnership many years ago. Capital account balances on January 1, 2017, were as follows:

Kathy P496,750

Eddie 268,250

The partnership agreement provides Kathy with an annual salary of P10,000 plus a bonus of 5% of partnership net income for

managing the business. Eddie is provided an annual salary of P15,000 with no bonus. The remainder, if any, is shared evenly

by the partners. Partnership net income for the year 2017 was P30,000. Eddie and Kathy each invested an additional P5,000

during the year to finance a special purchase. Year-end drawing account balances were P15,000 for Kathy and P10,000 for

Eddie.

3. What is the share of Kathy and Eddie, respectively, in the net income of the partnership?

A. P16,750 and P13,250 C. P15,000 and P15,000

B. 13,250 and 16,750 D. 14,250 and 17,250

4. What is the capital balance at year-end of Partner Kathy and Eddie respectively?

A. P280,000 and P500,000 C. P500,000 and P280,000

B. 310,000 and 480,000 D. 520,000 and 260,000

Use the following information Questions 5 through 7:

Timmy and Lassie have been operating an accounting firm as partners for a number of years, and at the beginning of 2012,

their capital balances were P60,000 and P75,000 respectively. During 2012, Timmy invested an additional P10,000 on April 1

and withdrew P6,000 on August 30. Lassie withdrew P12,000 on May 1 and withdrew another P6,000 on November 1. In

addition, Timmy and Lassie withdrew their salary allowances of P18,000 and P24,000, respectively. At the end of 2012, total

capital of the partnership was P182,000. Timmy and Lassie share income after salary allowances in a 60:40 ratio.

5. What is the average capital balance of Timmy and Lassie respectively for the year 2012?

A. P64,000 and P57,000 C. P60,000 and P75,000

B. 65,500 and 66,000 D. 70,000 and 63,000

6. What is the share of Timmy and Lassie in the partnership income, respectively, for the year 2012?

A. P29,400 and P31,600 C. P54,600 and P48,400

B. 60,600 and 42,400 D. None of the Above

7. What is the capital balance of Timmy and Lassie, respectively at the end of the year 2012?

A. P100,600 and P81,400 C. P 90,600 and P91,400

B. 95,600 and 86,400 D. 105,600 and 86,400

Use the following information for Questions 8 through10:

Harry, Iona, and Jerry formed a partnership on January 1, 2010, with each partner contributing P20,000 cash. Although the

partnership agreement provides that Jerry receive a salary of P1,000 per month for managing the partnership business, Jerry

has never withdrawn any money from the partnership. Harry withdrew P4,000 in each of the years 2010 and 2011, and Iona

invested an additional P8,000 in 2010 and withdrew P8,000 during 2011. Due to an oversight, the partnership has not maintained

formal accounting records, but the following information as of December 31, 2011, is available:

Cash on hand 28,500

Due from customers 20,000

Merchandise on hand 40,000

Delivery vehicle (net) 37,000

Prepaid expenses 4,000

Assets 129,500

Accounts payable 14,600

Wages payable 4,400

Note payable 10,000

Interest payable 500

Liabilities 29,500

The partners agreed that income for 2011 was about half of the total income for the first two years of operations. Although profits

were not divided in 2011, the partnership agreements provide that profits, after allowance for Jerry’s salary, are to be divided

each year on the basis of beginning-of-the-year capital balances.

8. How much is the net income for 2011?

A. P48,000 C. P96,000

B. 24,000 D. 16,000

9. How much is the share of Harry, Iona and Jerry respectively, in the 2011 net income?

A. P4,000, P4,000, P12,000 C. P8,000, P8,000 and P8,000

B. 5,000, 3,000 12,000 D. Some other amount for each partner

10. What is the capital balances at January 1, 2011 of Harry, Iona and Jerry, respectively?

A. P22,000; P36,000; P24,000 C. P36,000; P22,000; P24,000

B. 20,000; 32,000; 36,000 D. 32,000; 20,000; 36,000

11. The capital accounts of Faxon and Bell partnership on September 30, 2011, were:

Faxon capital (75% profit percentage) 140,000

Bell capital (25% profit percentage) 60,000

On October 1, 2011, Roberts was admitted to a 40% interest in the partnership when he purchased 40% of each existing

partner’s capital for P120,000, paid directly to Faxon and Bell. What is the capital balances of Faxon, Bell and Roberts

respectively, immediately after the admission?

A. P84,000; P36,000; P80,000 C. P140,000; P60,000; P120,000

B. 90,000; 40,000; 80,000 D. 100,000: 64,000: 90,000

12. Capital balances and profit sharing percentage for the partnership of Manda, Emeril, and Fotenot on January 1, 2011 are as

follows:

Manda (36%) 140,000

Emeril (24%) 100,000

Fotenot (40%) 160,000

On January 3, 2011, the partners agree to admit Bourdeaux for a 25% interest in capital and earnings for his investment in the

partnership of P120,000. What is the capital balance of Bourdeax immediately after the admission?

A. P120,000 C. P130,000

B. 110,000 D. 140,000

13. On December 31, 2012, Tina and Webb, who share profits and losses equally, have capital balances of P170,000 and P200,000

respectively. They agree to admit Zen for one-third interest in capital and profits for his investment of P200,000. Partnership

assets are fairly valued and so its liabilities. Immediately after the admission of Zen, what is the capital balance of Tina, Webb

and Zen, respectively?

A. P170,000, P200,000, and P200,000

B. P165,000, P195,000, and P200,000

C. P175,000, P205,000, and P190,000

D. P185,000, P215,000 and P200,000

14. The December 31, 2011, balance sheet of Bennet, Carter and Davis partnership is summarized as follows:

Cash 100,000 Carter loan 100,000

Other assets, net 500,000 Bennet, capital 100,000

Carter, capital 200,000

Davis, capital 200,000

600,000 P600,000

The partners share profits and losses as follows: Bennet 20%; Carter 30%; and Davis, 50%. Carter is retiring from the

partnership, and the partners have agreed that “other assets” should be adjusted to their fair value of P600,000 at December

31, 2011. They further agreed that Carter will receive P244,000 cash for his partnership interest exclusive of his loan, which is

to be paid in full. After Carter’s retirement, the capital balances of Bennet and Davis, respectively, will be:

A. 116,000 and 240,000 C. 100,000 and 200,000

B. 101,714 and 254,286 D. 73,143 and 182,857

15. Partners Allen, Baker, and Coe share profits and losses 50:30:20, respectively. The balance sheet at April 30, 2011, follows:

Cash 40,000 Accounts payable 100,000

Other assets 360,000 Allen, capital 74,000

Baker, capital 130,000

Coe, capital 96,000

400,000 P400,000

The partners assets and liabilities are recorded and presented at their respective fair values. Jones is to be admitted as a new

partner with a 20% capital interest and 20% share of profits and losses in exchange for a cash contribution. How much cash

should Jones contribute?

A. 60,000 C. 75,000

B. 72,000 D. 80,000

16. Williams desires to purchase a one-fourth capital and profit and loss interest in the partnership of Eli, George and Dick. The

three partners agree to sell Williams one-fourth of their respective capital and profit and loss interests in exchange for a total

payment of P40,000. Immediately before the sale of their interests to Williams, the capital balances of the partners were as

follows:

Eli (60%) 80,000

George (30%) 40,000

Dick (10%) 20,000

All assets, except for a depreciable asset, and liabilities of the partnership are fairly valued. It was agreed to adjust the book of

the partnership with respect to the undervalued before the acquisition of Williams of the interest in the partnership. Immediately

after William’s acquisition, what should be the capital balances of Eli, George and Dick respectively?

A. P60,000; P30,000 and P15,000

B. P69,000; P34,500 and P16,500

C. P77,000; P38,500 and P19,500

D. P92,000; P46,000 and P22,000

Use the following information for Questions17 through 20:

Kobe Snow and Brian White formed a partnership on July 1, 2010. Kobe invested P20,000 cash, inventory valued at P15,000,

and equipment valued at P65,000. Brian invested P50,000 cash and land valued at P120,000. The partnership assumed the

P40,000 mortgage on the land.

On June 30, 2011, the partnership reported a net loss of P24,000. The partnership contract specified that income and losses

were to be allocated by allowing 10% interest on the original capital investment, salaries of P15,000 to Kobe and P20,000 to

Brian, and the remainder to be divided in the ratio of 40:60.

On July 1, 2011, Sam Hansel was admitted into the partnership with a P70,000 cash investment. Alan was given a 30% interest

in the partnership because of his special skills. The partners elect to use the bonus method to record the admission.

On June 30, 2012, the partnership reported a net income of P150,000. The new partnership agreement stipulated that net

income and losses were to be divided in a fixed ratio of 20:50:30.

On July 1, 2012, Kobe withdrew from the partnership for personal reasons. Kobe was given P40,000 cash and P60,000 note for

his capital interest.

17. What is the capital credit of Kobe and Brian, respectively, immediately after the formation of partnership?

A. P100,000 and P120,000 C. P110,000 and P130,000

B. 100,000 and 130,000 D. 100,000 and 140,000

18. How much is the capital credit of Sam Hansel upon admission?

A. P82,800 C. P70,000

B. 78,400 D. 84,000

19. How much is the share of Kobe, Brian and Sam , respectively, in the net income of partnership for the year ending June 30,

2012?

A. P50,000; P50,000; P50,000 C. P30,000; P50,000; P70,000

B. 30,000; 75,000; 45,000 D. 45,000; 60,000; 45,000

20. How much is the bonus old partners upon the withdrawal of Kobe from the partnership?

A. P27,080 C. P40,000

B. 60,000 D. 17,080

--- END ---

w ep/A C P 101/prelim exam

You might also like

- Afar First Mock Cpa Board Exam Nov 20 2020 FOR POSTING PDFDocument11 pagesAfar First Mock Cpa Board Exam Nov 20 2020 FOR POSTING PDFJamaica David50% (2)

- 1 1 4-Partnership-LiquidationDocument7 pages1 1 4-Partnership-LiquidationCundangan, Denzel Erick S.67% (3)

- Ratios HW 1 Template-5 Version 1Document14 pagesRatios HW 1 Template-5 Version 1api-506813505No ratings yet

- ACC 110 - CFE - 21 22 With ANSWERSDocument25 pagesACC 110 - CFE - 21 22 With ANSWERSGiner Mabale Steven100% (3)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2019 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2019 Edition)Rating: 5 out of 5 stars5/5 (1)

- Ethics in Accounting A Decision Making Approach Test BankDocument6 pagesEthics in Accounting A Decision Making Approach Test BankLyca SorianoNo ratings yet

- Trust Bank ICAAP ReportDocument16 pagesTrust Bank ICAAP ReportG117100% (2)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- MQC PartnershipDocument4 pagesMQC PartnershipMark Edgar De Guzman0% (1)

- ACCTSPTRANS All About PartnershipDocument7 pagesACCTSPTRANS All About PartnershipShailene David0% (1)

- PB DifficultDocument20 pagesPB DifficultPaulo MiguelNo ratings yet

- Pamantasan NG Cabuyao: Katapatan Subd., Banay Banay, Cabuyao, LagunaDocument4 pagesPamantasan NG Cabuyao: Katapatan Subd., Banay Banay, Cabuyao, LagunaDan RyanNo ratings yet

- Prelim - PART 2Document6 pagesPrelim - PART 2Dan RyanNo ratings yet

- SVCC - QUIZ Part 2 Practical PrelimsDocument4 pagesSVCC - QUIZ Part 2 Practical PrelimsJessaNo ratings yet

- PartnershipDocument9 pagesPartnershipGrace A. ManaloNo ratings yet

- AFAR - FINAL EXAMINATION - 03.22.2019 Wo ANSWERSDocument5 pagesAFAR - FINAL EXAMINATION - 03.22.2019 Wo ANSWERSrain suansingNo ratings yet

- PartnershipDocument4 pagesPartnershipComan Nocat Eam83% (6)

- Parcor CaseletsDocument13 pagesParcor CaseletsErika delos Santos100% (2)

- Midterm Quiz 2 Partnership Dissolution Without Answer KeyDocument4 pagesMidterm Quiz 2 Partnership Dissolution Without Answer Keyaleksiyaah lexleyNo ratings yet

- Advacc Final Exam Answer KeyDocument7 pagesAdvacc Final Exam Answer KeyRIZLE SOGRADIELNo ratings yet

- Quiz-Acc 114Document4 pagesQuiz-Acc 114Rona Amor MundaNo ratings yet

- Advacc Preboard QuestionsDocument9 pagesAdvacc Preboard QuestionsJefferson ArayNo ratings yet

- Anas - Afar - Prelim Module - Ivisan - Bsa 4 - A B 2Document13 pagesAnas - Afar - Prelim Module - Ivisan - Bsa 4 - A B 2nisutrackerNo ratings yet

- AFAR Quick Notes 2018 Ivan Yannick S. BagayaoDocument10 pagesAFAR Quick Notes 2018 Ivan Yannick S. Bagayaotmica7260No ratings yet

- 15Qs-Partnership-Corporate Liquidation - 052406Document8 pages15Qs-Partnership-Corporate Liquidation - 052406Daniboy BalinawaNo ratings yet

- Accounting 111E Quiz 5Document3 pagesAccounting 111E Quiz 5Khim NaulNo ratings yet

- Peer Quiz No.1: Partnership Formation: TotalDocument13 pagesPeer Quiz No.1: Partnership Formation: Totaldianel villaricoNo ratings yet

- 7 PARCOR Testbank Answer KeyDocument12 pages7 PARCOR Testbank Answer Keygiodarine0814No ratings yet

- Wew PDFDocument9 pagesWew PDFLance L. OrlinoNo ratings yet

- AfarDocument14 pagesAfarPaulo MiguelNo ratings yet

- 1st Pre-Board - P2 October 2011 BatchDocument8 pages1st Pre-Board - P2 October 2011 BatchKim Cristian MaañoNo ratings yet

- Partnership Operation Practice Problems PDFDocument11 pagesPartnership Operation Practice Problems PDFMeleen TadenaNo ratings yet

- Acctng 7 Partnership Review ProblemsDocument5 pagesAcctng 7 Partnership Review ProblemssarahbeeNo ratings yet

- PartnershipDocument10 pagesPartnershipMark Joseph Urmeneta Fernando80% (5)

- UE Center For Review & Special Studies (UECRSS), Inc.: Multiple Choice QuestionsDocument17 pagesUE Center For Review & Special Studies (UECRSS), Inc.: Multiple Choice QuestionsIya DelacruzNo ratings yet

- OperationDocument4 pagesOperationRyan SanchezNo ratings yet

- 123Document13 pages123Nicole Andrea TuazonNo ratings yet

- Acp 101 MexamDocument5 pagesAcp 101 MexamLyca SorianoNo ratings yet

- Pamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG ValenzuelaDocument9 pagesPamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG Valenzuela Pamantasan NG Lungsod NG ValenzuelaLeslie Mae Vargas ZafeNo ratings yet

- AFAR 1.0 Partnership-Accounting ASSESSMENTDocument5 pagesAFAR 1.0 Partnership-Accounting ASSESSMENTMakisa YuNo ratings yet

- Partnership Prof. Jon D. Inocentes, Cpa: UM Tagum College Arellano Street, Tagum City, 8100 PhilippinesDocument2 pagesPartnership Prof. Jon D. Inocentes, Cpa: UM Tagum College Arellano Street, Tagum City, 8100 PhilippinesJohn BryanNo ratings yet

- Partnership MyDocument13 pagesPartnership MyHoneylyne PlazaNo ratings yet

- Advacc Quiz On PartnershipDocument10 pagesAdvacc Quiz On PartnershipCzaeshel Edades0% (2)

- Afar 01Document11 pagesAfar 01Raquel Villar DayaoNo ratings yet

- Bill Signs A Contract To Buy Furniture For Official Use in The PartnershipDocument4 pagesBill Signs A Contract To Buy Furniture For Official Use in The PartnershipVon Andrei MedinaNo ratings yet

- Advnce - fin.Acc.&Repprac 2Document17 pagesAdvnce - fin.Acc.&Repprac 2Jerry Licayan0% (1)

- Quiz in PartnershipDocument12 pagesQuiz in Partnershiplouise carino50% (2)

- Question 3 and 4 Are Based On The FollowingDocument5 pagesQuestion 3 and 4 Are Based On The Following03LJNo ratings yet

- Advacc Quiz On PartnershipDocument10 pagesAdvacc Quiz On PartnershipLenie Lyn Pasion TorresNo ratings yet

- AFAR, PART 1Document14 pagesAFAR, PART 1JOVENo ratings yet

- Advacc Final Exam Answer KeyDocument7 pagesAdvacc Final Exam Answer KeyRIZLE SOGRADIELNo ratings yet

- Acco 30103 Partnership Formation and Operations 04-2022Document3 pagesAcco 30103 Partnership Formation and Operations 04-2022Zyrille Corrine GironNo ratings yet

- Advanced Financial Accounting and Reporting Accounting For PartnershipDocument6 pagesAdvanced Financial Accounting and Reporting Accounting For PartnershipMaria BeatriceNo ratings yet

- Answer Key POD Cup Jr. Final RoundDocument6 pagesAnswer Key POD Cup Jr. Final RoundRitsNo ratings yet

- Partnersip TutorialsDocument4 pagesPartnersip Tutorialsjames VillanuevaNo ratings yet

- Midterm Exam - 2BSA1Document3 pagesMidterm Exam - 2BSA1joevitt delfinadoNo ratings yet

- ACCL02B - Partnership and Corporation Accounting Prelim Reviewer: ComputationsDocument9 pagesACCL02B - Partnership and Corporation Accounting Prelim Reviewer: ComputationsBaby BabeNo ratings yet

- HO2 Partnership Dissolution and Liquidation RevisedDocument5 pagesHO2 Partnership Dissolution and Liquidation RevisedChristianAquinoNo ratings yet

- Sa 1Document48 pagesSa 1MingNo ratings yet

- Partnership Formation ReviewerDocument24 pagesPartnership Formation ReviewerJyasmine Aura V. AgustinNo ratings yet

- Pamantasan NG Cabuyao: Katapatan Subd., Banay Banay, City of CabuyaoDocument5 pagesPamantasan NG Cabuyao: Katapatan Subd., Banay Banay, City of CabuyaoLyca SorianoNo ratings yet

- Kickstart Your Corporation: The Incorporated Professional's Financial Planning CoachFrom EverandKickstart Your Corporation: The Incorporated Professional's Financial Planning CoachNo ratings yet

- Wipro Limited and SubsidiariesDocument34 pagesWipro Limited and SubsidiariesLyca SorianoNo ratings yet

- Acp 102 FTDocument7 pagesAcp 102 FTLyca SorianoNo ratings yet

- Analysis: My Last Farewell by Jose RizalDocument3 pagesAnalysis: My Last Farewell by Jose RizalLyca Soriano100% (1)

- Meralco Co. Consolidated Financial Statement 2020Document155 pagesMeralco Co. Consolidated Financial Statement 2020Lyca SorianoNo ratings yet

- Cpar 85 1st Preboards MasDocument13 pagesCpar 85 1st Preboards MasLyca SorianoNo ratings yet

- Bobadilla Compilation AudtheoDocument561 pagesBobadilla Compilation AudtheoLyca SorianoNo ratings yet

- A Literary Analysis On "My Last Farewell"Document2 pagesA Literary Analysis On "My Last Farewell"Lyca Soriano100% (2)

- Decision Making With A Strategic Emphasis Teaching Notes For CasesDocument30 pagesDecision Making With A Strategic Emphasis Teaching Notes For CasesLyca SorianoNo ratings yet

- Ia Vol 1 2019 SolmanDocument231 pagesIa Vol 1 2019 SolmanLyca SorianoNo ratings yet

- Schedules & Income Statement of Buco KoDocument7 pagesSchedules & Income Statement of Buco KoLyca SorianoNo ratings yet

- Auditing Theory: A Guide in Understanding The Philippine Standards On Auditing 2018Document8 pagesAuditing Theory: A Guide in Understanding The Philippine Standards On Auditing 2018Lyca SorianoNo ratings yet

- BPI LetterDocument1 pageBPI Letterchiqui_soNo ratings yet

- Inflation in Pakistan Economics ReportDocument15 pagesInflation in Pakistan Economics ReportQanitaZakir75% (16)

- Module 1 Lesson 2 Estate Tax DeductionsDocument15 pagesModule 1 Lesson 2 Estate Tax DeductionsHya Althea DiamanteNo ratings yet

- HBL Internship ReportDocument52 pagesHBL Internship Reportmehboob.pk0874No ratings yet

- Quiz 3Document14 pagesQuiz 3K L YEONo ratings yet

- 2nd Grand Slam!Document4 pages2nd Grand Slam!deepagarcha2No ratings yet

- Assignment 1Document5 pagesAssignment 1Loveness MphandeNo ratings yet

- Countingup Statement 2023 07Document1 pageCountingup Statement 2023 07SophiaNo ratings yet

- Impairment LossDocument3 pagesImpairment LossDave Sarmiento ArroyoNo ratings yet

- july24-Salary SlipDocument34 pagesjuly24-Salary SlipMohemmedNo ratings yet

- ECOM3201 Problems and Solutions - IS LMDocument18 pagesECOM3201 Problems and Solutions - IS LMKume BuverlNo ratings yet

- Bamburi Cement Ltd Audited Group Financial Results for the Year Ended 31 Dec 2020Document1 pageBamburi Cement Ltd Audited Group Financial Results for the Year Ended 31 Dec 2020godarkmuneneNo ratings yet

- 11-03-02 Demise of The US Dollar... - Zero HedgeDocument3 pages11-03-02 Demise of The US Dollar... - Zero HedgeHuman Rights Alert - NGO (RA)No ratings yet

- Đinh Thị Diệu Quỳnh - 18071213 - INS3032.01Document14 pagesĐinh Thị Diệu Quỳnh - 18071213 - INS3032.01Diệu QuỳnhNo ratings yet

- MathDocument13 pagesMathKristia Stephanie BejeranoNo ratings yet

- Finmar ReviewerDocument6 pagesFinmar ReviewershielaKD05No ratings yet

- Plagiarism Scan Report: Plagiarised UniqueDocument2 pagesPlagiarism Scan Report: Plagiarised UniqueDeepak YadavNo ratings yet

- O'Donnell Et Al., 2024 The Impact of Monetary Policy Interventions On Banking Sector Stocks An Empirical Investigation of The COVID-19 Crisis.Document41 pagesO'Donnell Et Al., 2024 The Impact of Monetary Policy Interventions On Banking Sector Stocks An Empirical Investigation of The COVID-19 Crisis.vyhuynh.31221021378No ratings yet

- Question Hinge Basic GroupDocument1 pageQuestion Hinge Basic Groupjohn ashleyNo ratings yet

- CE WH Media Invoice #70540Document2 pagesCE WH Media Invoice #70540Amelia RadebeNo ratings yet

- KYC New ProjectDocument42 pagesKYC New ProjectNisha RathoreNo ratings yet

- Complete Home Buying ExperienceDocument6 pagesComplete Home Buying ExperiencedawnzoellnerNo ratings yet

- 21. Leasing-Intermediate-soalDocument3 pages21. Leasing-Intermediate-soalLenrik AbcNo ratings yet

- IVOVDocument4 pagesIVOVlior pNo ratings yet

- Risk Management Short NoteDocument166 pagesRisk Management Short NoteShivam GuptaNo ratings yet

- Assignment of banking management docx fileDocument6 pagesAssignment of banking management docx fileSourodeep NiyogiNo ratings yet

- Acct Statement - XX2168 - 14102023Document6 pagesAcct Statement - XX2168 - 14102023imad karariNo ratings yet

- 02.mechanics of Futures MarketDocument8 pages02.mechanics of Futures MarketNg Jian LongNo ratings yet