0 ratings0% found this document useful (0 votes)

38 viewsChapter-1 Establishing of Exportfirm

Chapter-1 Establishing of Exportfirm

Uploaded by

mohammedThe document outlines the key steps and registrations required to establish an export business in India. This includes:

1. Registering the business as a sole proprietorship, partnership, or private/public company.

2. Obtaining an Importer-Exporter Code (IEC) number from the Directorate General of Foreign Trade which is required for all export and import activities.

3. Registering with relevant export promotion councils, the Export Credit Guarantee Corporation, central excise and sales tax authorities, and other regulatory bodies.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Chapter-1 Establishing of Exportfirm

Chapter-1 Establishing of Exportfirm

Uploaded by

mohammed0 ratings0% found this document useful (0 votes)

38 views10 pagesThe document outlines the key steps and registrations required to establish an export business in India. This includes:

1. Registering the business as a sole proprietorship, partnership, or private/public company.

2. Obtaining an Importer-Exporter Code (IEC) number from the Directorate General of Foreign Trade which is required for all export and import activities.

3. Registering with relevant export promotion councils, the Export Credit Guarantee Corporation, central excise and sales tax authorities, and other regulatory bodies.

Original Description:

establishing of export firm

Original Title

Chapter-1 establishing of exportfirm

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

The document outlines the key steps and registrations required to establish an export business in India. This includes:

1. Registering the business as a sole proprietorship, partnership, or private/public company.

2. Obtaining an Importer-Exporter Code (IEC) number from the Directorate General of Foreign Trade which is required for all export and import activities.

3. Registering with relevant export promotion councils, the Export Credit Guarantee Corporation, central excise and sales tax authorities, and other regulatory bodies.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

38 views10 pagesChapter-1 Establishing of Exportfirm

Chapter-1 Establishing of Exportfirm

Uploaded by

mohammedThe document outlines the key steps and registrations required to establish an export business in India. This includes:

1. Registering the business as a sole proprietorship, partnership, or private/public company.

2. Obtaining an Importer-Exporter Code (IEC) number from the Directorate General of Foreign Trade which is required for all export and import activities.

3. Registering with relevant export promotion councils, the Export Credit Guarantee Corporation, central excise and sales tax authorities, and other regulatory bodies.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 10

Export Preliminaries

• The setting up of an export firm is completed

in two stages:

1.Establishing a business firm

2.Obtaining the Importer-Exporter Code

number for the business firm and completing

other registrations

Establishing a business firm

• Various formalities and registrations to be made with different

authorities:

• Selection of Name of Firm:

• Any name

• Desirable to indicate that the business relates to exports

• Export, Import, Overseas, International, global

• Approval of Name of firm:

• Regional Licensing Authority of DGFT

• If the firm is exporting ready made garments-approval from Apparel

Export Promotion Council (AEPC)

• Once name is approved then company has to register within 3

months

• After registration –registered exporter- quota allocation of ready

made garments to export quota countries

• E.g.: USA, Canada and countries of European Union-Garment Quota

System.

• Registration of Organization:

• Sole proprietorship, partnership under Indian Partnership Act 1932 or

Joint stock company under Companies Act, 1956

• Joint Stock-Private and Public limited company

• Partnership firm or joint stock company-registration under

appropriate act is required

• Sole proprietor requires permission from local authorities

• Opening of bank Account :

• With any commercial bank, authorized by RBI to deal in foreign

exchange

• Firms need pre-shipment and post-shipment assistance from bank

• Deciding bank and branch-company’s credit requirements and

cooperative attitude to bank to assist , timely credit-as exports need

to be highly competitive

• Obtaining Permanent Account Number:

• Export income is subjected to number of exemptions and deductions

under IT Act.

• PAN is required for applying for Export Import Code Number.

• Registration with Sales Tax Authorities:

• Exporter need not pay sales tax while making

purchases, meant for exports

• Export firm has to register with sales tax authorities

and secure sales tax number

• Exporter/Purchaser has to give Form-H to

seller/manufacturer

• Export firm has to make an application along with

copy of LC or export order to sales Tax office for

issuance of Form –H

• 3 copies of form H is received-2 copies to seller and

1 with exporter

• Importer-Exporter Code Number:

• It is necessary to get registered with the (Territorial Jurisdiction) DGFT (Director

General of Foreign Trade), Ministry of Commerce, Government of India.

• DGFT provide exporter a unique IEC Number.

• IEC Number is a ten digits code required for the purpose of export as well as import

• IEC entitles to import or export any item of non-prohibited goods.

i. Profile of exporter/importer

ii. DD-Rs. 1000/-

iii. Certificate from banker of the applicant

iv. 2 passport size photographs of applicant

v. Non-resident investment and if such investment is with full repatriation benefit, full

particulars of such investment are to be approved by RBI

vi. Declaration on applicant’s letterhead that there is no association of applicant’s firm

with caution listed firms

• No expiry date for IEC Number-Valid till revoked

• IEC Number is to be quoted on all documents.

• However, if the goods are exported to Nepal, or to Myanmar through Indo-Myanmar

boarder or to China through Gunji, Namgaya, Shipkila or Nathula ports then it is not

necessary to obtain IEC number provided the CIF value of a single consignment does

not exceed Indian amount of Rs. 25, 000 /-.

• Registration Cum Membership Certificate:

• Register with respective and appropriate Export

Promotion Council (EPC) and obtain RCMC

• Benefits provided in the current Exim Policy are

available only to those having valid RCMC

Literatures and guidance given by EPC

MDA and MAI

• E.g.: Engineering Export Promotion Council, Textile

Export Promotion Council, Apparel Export Promotion

Council

• 2 types of RCMC’s:

Registered Exporter

Merchant Exporter

• Registration with ECGC:

• Export Credit and Guarantee Corporation of India

• To Secure export payments against political and commercial risk

• Also helps to get financial assistance from commercial banks and other financial

organizations

• Registration under Central Excise Law:

• Central Excise levy is applicable if:

1. The duty is on the goods

2. The goods must be excisable

3. The goods must be manufactured or produced

4. The goods must be manufactured produced in India

• When Central Excise Registration is to be made:

• Application to be made to jurisdictional Range Officer of the Central Excise for

registration if total value of goods cleared for home consumption, known as

Domestic Turnover exceed exemption limit

• SSI-Exemption Limit: Rs. 100 Lakhs

• Non-SSI-Exemption Limit: Rs. 50 lakhs

• However the unit is exempt from registration if the products manufactured by it are

not excisable like salt

• This duty is levied when goods are moved out of the factory/warehouse of the

manufacturer.

• Allotment of Central Excise Registration Number:

• Firm on register ting with Central Excise Authorities gets

ECC Number (Excise Control Code) from Central Excise

Authority

• Has 15 digits-first 10 are same as PAN number

• Applicability of Excise duty to Exporter:

• For exports, goods enjoy exemption from duty on the

final product, meant for export.

• Where exemption is not availed, refund of excise duty is

made after actual exports.

• Refund of excise duty in made on inputs used in

manufacture of goods, meant for exports

• Exporter submitted ARE-1, in six tuplicate, to relevant

excise authority for clearance of the goods.

• Registration with other Authorities:

• Desirable for exporters to become members of local

Chamber of Commerce, Productivity Council or any

other trade promotion organization recognized by the

Ministry of Commerce or Industry

• Local membership helps in getting many facilities like

Certificate of Origin, vital for exports to certain

countries.

• Registration for Business Identification Number:

• Exporters have to obtain PAN based Business

Identification Number (BIN) from DGFT prior to filing for

Customs Clearance of Exports goods

• Common identification number to all persons dealing in

various regulatory agency such as Central Excise,

Customs Department, IT Dept, DGFT Office

• Export Licensing:

• Many items of goods are free for exports without

obtaining any license, if they do not fall in Negative List.

• Negative List:

1. Prohibited Items-These items cannot be exported or

imported. E.g.: Wild life, exotic birds, wood and wood

products in form of logs, timber, pulp and charcoal

2. Restricted Items: Items-These are items, export or

import of which is restricted through license. They can

be imported or exported only in accordance with

regulation of government

3. Canalized Items: These items can be imported/exported

through Canalizing agency. DGFT issues license to any

other person to import or export those items

Hence it is must for exporter to check the nature of the

item before he enters into contract as should not be

banned list.

You might also like

- Import and Export ProceduresDocument27 pagesImport and Export Proceduressubbu2raj3372100% (1)

- Monday Debra PYW216S EEDocument2 pagesMonday Debra PYW216S EEDeb LewisNo ratings yet

- Employee Salary AdvanceDocument2 pagesEmployee Salary AdvanceDipika100% (7)

- Formalities of Registration and Export DocumentationDocument10 pagesFormalities of Registration and Export DocumentationAyush GargNo ratings yet

- Export Import ProcedureDocument193 pagesExport Import Procedureprasantkumar8783% (6)

- Actividad 10 Evidencia 8Document30 pagesActividad 10 Evidencia 8Sergio Fabian Bayona ReyNo ratings yet

- Export Procedures: By: Shruti BhattDocument24 pagesExport Procedures: By: Shruti BhattSrikar ChandraNo ratings yet

- Lms Module On Export - Import of JewelleryDocument45 pagesLms Module On Export - Import of JewelleryRaghu.GNo ratings yet

- Export Procedure of Agricultural Products: Registration As A Business EntityDocument5 pagesExport Procedure of Agricultural Products: Registration As A Business Entityvinnie10No ratings yet

- Central Excise ActDocument47 pagesCentral Excise ActPurushottam BaviskarNo ratings yet

- How To Start An International Business ???: BY Arpit Sharma Roll No. 01416603909Document9 pagesHow To Start An International Business ???: BY Arpit Sharma Roll No. 01416603909Arpit9999943148No ratings yet

- Import Procedures : Categories of ImportersDocument15 pagesImport Procedures : Categories of Importers98937No ratings yet

- How To ImportDocument30 pagesHow To ImportRiyaz ShaikhNo ratings yet

- SIMS Exim ManagementDocument56 pagesSIMS Exim ManagementRounaq DharNo ratings yet

- 1.3 Registration Export Licensing IEC RCMC (Audio)Document20 pages1.3 Registration Export Licensing IEC RCMC (Audio)Abhishek kumarNo ratings yet

- Individual - Sole Proprietorship - Corporation/PartnershipDocument3 pagesIndividual - Sole Proprietorship - Corporation/PartnershipAliyaaaahNo ratings yet

- Export DocumentationDocument148 pagesExport DocumentationNitesh AgarwalNo ratings yet

- Import LicenseDocument3 pagesImport LicensejagdishNo ratings yet

- Unit 4Document12 pagesUnit 4Abhinav RanjanNo ratings yet

- Import Purchase ProcedureDocument20 pagesImport Purchase ProcedureAbdul KhaderNo ratings yet

- Export ProcedureDocument41 pagesExport ProcedureSuman BhandariNo ratings yet

- Central Excise LawDocument14 pagesCentral Excise Lawabhi2260102No ratings yet

- FTP ReportDocument73 pagesFTP ReportrashiNo ratings yet

- Stage 1: Preliminary StageDocument8 pagesStage 1: Preliminary StageIshaan JaveriNo ratings yet

- Vat Presentation: RevisionDocument30 pagesVat Presentation: RevisionKartik VermaNo ratings yet

- Session 6 Chapter 3 Mode of EntryDocument61 pagesSession 6 Chapter 3 Mode of EntryApurva RamtekeNo ratings yet

- UnitDocument11 pagesUnitRohanNo ratings yet

- FEM-Section Eight Foreign Trade P and F(1)Document18 pagesFEM-Section Eight Foreign Trade P and F(1)uchihaitachi60.uhNo ratings yet

- Export ImportDocument128 pagesExport ImportPrateek SinghNo ratings yet

- Import Export of IndiaDocument10 pagesImport Export of IndiaTanya KholiNo ratings yet

- Export Import DocumentationDocument21 pagesExport Import DocumentationSabir ShaikhNo ratings yet

- Export Procedure and DocumentationDocument22 pagesExport Procedure and DocumentationnandiniNo ratings yet

- Unit V: Export IncentivesDocument37 pagesUnit V: Export IncentivesthensureshNo ratings yet

- Value Added Tax (Vat) .PPT FinalDocument57 pagesValue Added Tax (Vat) .PPT FinalNick254No ratings yet

- Tax RegulationsDocument9 pagesTax RegulationsAjeshDevasiaNo ratings yet

- IEC CODE DetailsDocument4 pagesIEC CODE DetailsAmandeep Singh BediNo ratings yet

- How To ImportDocument28 pagesHow To ImportHarinder SinghNo ratings yet

- The IECDocument3 pagesThe IECmufaddalb.cs24No ratings yet

- Export ProcessDocument18 pagesExport ProcessemmabrowneinfoNo ratings yet

- Customs Trader Leaflet ENG March 2021Document4 pagesCustoms Trader Leaflet ENG March 2021fenilkumar001No ratings yet

- Export ManagementDocument36 pagesExport ManagementprasadtharwalNo ratings yet

- Iec & RCMCDocument10 pagesIec & RCMCNanee DNo ratings yet

- Income Tax Act - 1961Document37 pagesIncome Tax Act - 1961Aniket KottalagiNo ratings yet

- Evidencia 6 Video Steps To Export.Document3 pagesEvidencia 6 Video Steps To Export.Andrea ArdilaNo ratings yet

- Export Import Procedures and DocumentationDocument23 pagesExport Import Procedures and DocumentationClarinda Fernandes100% (1)

- Actividad de Aprendizaje 10 Evidencia 6 InglesDocument11 pagesActividad de Aprendizaje 10 Evidencia 6 InglesMaria Emilcen Sanchez UribeNo ratings yet

- 1) Establishing An Organisation: Click HereDocument6 pages1) Establishing An Organisation: Click HerePraWin KharateNo ratings yet

- CCFFM CH4Document33 pagesCCFFM CH4ibrahimosman0308No ratings yet

- Q.1Application For Grant of IEC Number and Process of Online and Application Getting IEC NoDocument12 pagesQ.1Application For Grant of IEC Number and Process of Online and Application Getting IEC NoSabhaya ChiragNo ratings yet

- Import ProcedureDocument33 pagesImport Procedureshreyans singhNo ratings yet

- Legal Aspects of StartupsDocument100 pagesLegal Aspects of StartupsManogna Sai NandiveluguNo ratings yet

- Workshop On Finance For Non-Finance Executives: Mining & BeneficiationDocument36 pagesWorkshop On Finance For Non-Finance Executives: Mining & BeneficiationSaikumar SelaNo ratings yet

- Custom Clerarance: Area of Operations and AuthorityDocument4 pagesCustom Clerarance: Area of Operations and AuthorityRajeev VyasNo ratings yet

- Unit 4Document28 pagesUnit 4Nivedita SinghNo ratings yet

- Tax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesFrom EverandTax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesNo ratings yet

- Import Business: A Guide on Starting Up Your Own Import BusinessFrom EverandImport Business: A Guide on Starting Up Your Own Import BusinessRating: 4 out of 5 stars4/5 (1)

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- Business Taxation - Syllabus - BS Commerce - IUBDocument2 pagesBusiness Taxation - Syllabus - BS Commerce - IUBLabib ShahNo ratings yet

- Prorata Pension DetailsDocument6 pagesProrata Pension Detailsshaunak_srNo ratings yet

- Question 1 Answer:A: Partnership OperationsDocument7 pagesQuestion 1 Answer:A: Partnership OperationsSharmaineMirandaNo ratings yet

- HDFC - Saving AccountsDocument11 pagesHDFC - Saving Accountsপ্রিয়াঙ্কুর ধরNo ratings yet

- Документ 2022 02 27 132713Document2 pagesДокумент 2022 02 27 132713Sergey MenshovNo ratings yet

- MumbaiDocument2 pagesMumbaiJayshreeNo ratings yet

- Tutorial Letter 501/3/2022: General Financial ReportingDocument277 pagesTutorial Letter 501/3/2022: General Financial ReportingMelissaNo ratings yet

- Amgen Financial AnalysisDocument2 pagesAmgen Financial AnalysisNiNo ratings yet

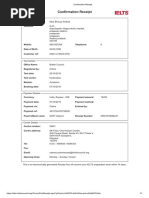

- Confirmation ReceiptDocument1 pageConfirmation ReceiptShafi SkNo ratings yet

- 40 Netflix AccountDocument3 pages40 Netflix AccountJosé Milton GonçalvesNo ratings yet

- C.T.A. Case No. 6188Document21 pagesC.T.A. Case No. 6188doraemoanNo ratings yet

- Exempt SalesDocument4 pagesExempt SalesMary Joy DenostaNo ratings yet

- Chapter 1. Overview of Service Tax: Constitutional Validity and ConceptsDocument38 pagesChapter 1. Overview of Service Tax: Constitutional Validity and ConceptsPrateek UpadhyayNo ratings yet

- Account Statement 5555XXXXXX1883Document7 pagesAccount Statement 5555XXXXXX1883amitsinghhhh000078666No ratings yet

- CA Inter Tax QP May 2024Document14 pagesCA Inter Tax QP May 2024mishrag7722No ratings yet

- 2018 91 Taxmann Com 401 ArticleDocument3 pages2018 91 Taxmann Com 401 ArticleAmandeep MalikNo ratings yet

- E-WAY BILL DetailsDocument1 pageE-WAY BILL DetailsrohanNo ratings yet

- Paytm ProjectDocument9 pagesPaytm ProjectSmit MungraNo ratings yet

- InvoiceDocument1 pageInvoiceSUNIL PATELNo ratings yet

- Psac/Sait Well Testing Training ProgramDocument1 pagePsac/Sait Well Testing Training Programtidjani73No ratings yet

- PGBP Section ListDocument1 pagePGBP Section Listpavan30195No ratings yet

- Dinesh RMPRDocument72 pagesDinesh RMPRdineshsagar1906No ratings yet

- Bookkeeping UMDocument28 pagesBookkeeping UMArlyn IndogNo ratings yet

- ENach Brochure - Veri5Digital (Khosla Labs)Document1 pageENach Brochure - Veri5Digital (Khosla Labs)veri5digitaNo ratings yet

- Philhealth EPRS ProcedureDocument1 pagePhilhealth EPRS ProcedureKatherineNo ratings yet

- First PageDocument2 pagesFirst Pagehritikagarwal995No ratings yet

- TRLJEADJKT982120A Inv 2 PDFDocument1 pageTRLJEADJKT982120A Inv 2 PDFHeru WicaksonoNo ratings yet

- Mund Manufacturing Inc Started Operations at The Beginning of TheDocument1 pageMund Manufacturing Inc Started Operations at The Beginning of TheLet's Talk With HassanNo ratings yet