Still On The Influence of Interest Rate On Nigerian Economy (1986 - 2018)

Still On The Influence of Interest Rate On Nigerian Economy (1986 - 2018)

Copyright:

Available Formats

Still On The Influence of Interest Rate On Nigerian Economy (1986 - 2018)

Still On The Influence of Interest Rate On Nigerian Economy (1986 - 2018)

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Still On The Influence of Interest Rate On Nigerian Economy (1986 - 2018)

Still On The Influence of Interest Rate On Nigerian Economy (1986 - 2018)

Copyright:

Available Formats

Volume 6, Issue 4, April – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Still on the Influence of Interest Rate on Nigerian

Economy (1986 – 2018)

Sulaiman, Luqman Adedamola1, Idris, Babatunde Kazeem2

Department of Finance, Faculty of Management Sciences, Integrated Data Service Limited

Ekiti State University, EKSU : Benin, Nigeria

Ado-Ekiti, Nigeria.

Badru, Taiwo Bolanle3

Department of Accounting, Faculty of Management Sciences

Ekiti State University, EKSU

Ado-Ekiti, Nigeria.

Abstract:- Interest rate has been at the center of every I. INTRODUCTION

monetary policies around the world, as it is vital in

stimulating and changing the state of the economy. This For centuries now, the main target of every country

study examines the effect of interest rate on the growth of around the world has been growth and development which

Nigerian economy for the period 1986 to 2018. It utilizes should be a reflection of the state of the economy (Abebiyi,

the ARDL bound testing method to find the connection 2002 as cited in Maiga, 2017). However, the problem is not

between economic growth measured by GDP and with the target but with the means through which the target

independent variables (lending interest rate (INT), can be achieved without creating further imbalances. Several

savings rate (SVR), inflation rate (INF), broad money theories have been propounded to provide countries with

supply (M2), financial deepening (FD) and exchange rate models on how sustainable growth and development can be

(EXR). The findings establish a long run relationship attained while also explaining the causes and effects of certain

between rate of interest and the growth of the economy. phenomenon. There is a general consensus that capital

The short run analysis shows that one lagged value of formation is key to unlocking the desire for growth and

GDP is negatively related with current GDP. While two development potentials in any economy (Adeleye, 2018). Also

lagged value of GDP has positive effect on the current the availability of financial resources is an important

GDP. The current value and one lagged value of M2 have requirement of economic growth as it either allows or hinders

negative effect on GDP. While two lagged value of M2 has the critical sectors of the economy to pursue their growth-

positive effect on GDP. INF, FD and the current one oriented activities. The financial system exists to provide the

lagged and two lagged value of EXR have negative effect platform for capital formation as it attracts financial resources

on GDP. On the other hand, the current, one lagged and from where it is temporarily not needed and channels it to

two lagged value of SVR have positive effect on the GDP. where it is needed. Hence, the financial system performs the

The granger causality test revealed a unidirectional role of a catalyst for capital formation. It is noteworthy that the

causality from GDP to M2, weak unidirectional causation performance of this role has both cost, benefits and other

running from GDP to INT, SVR to GDP, and weak implications to the deficit and the surplus units respectively.

bidirectional causation between EXR and GDP. Also a The cost and benefit depending on the perspective from where

unidirectional causation running from GDP to FD, INF to it is viewed, is often referred to as interest rate.

INT, SVR to INT, and a bidirectional causation between

SVR and INF. There is no causation between INT and There are divergent views on the meaning of interest

FD. The findings of this study reveals that rate of interest rate. Modern economists explain interest rate in terms of

has a positive effect on the growth of the economy. Based “money”, “saving”, “productivity”, and “liquidity preference”.

on the findings, the study recommends that monetary It is simultaneously the reward for the supply of money, of

authority need to be more proactive rather than being saving, the pure yield of capital, and for forgoing of liquidity

proactive most times. (Jhingan, 1999). From this definition, interest rate can be

viewed as an important determinant of demand and supply of

Keywords:- Interest Rate, Economic Growth, Gross money as it plays the role of an equilibrating force between

Domestic Product, ARDL, Nigeria. the demand and supply of loanable funds (Anthony, 2017).

Interest rate has been at the center of every monetary policies

around the world, as it is vital in stimulating and changing the

state of the economy (Mushtaq & Siddiqui, 2016; Lee &

Werner, 2018). Every investment and savings decision of all

economic agents relies heavily on the state of the interest rate

(Anaripour, 2011). Therefore, interest rate should be a major

economic growth determinant through its effects on

IJISRT21APR358 www.ijisrt.com 953

Volume 6, Issue 4, April – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

investments and savings which are prerequisites in achieving Empirical studies exist on the effect of interest rate on

economic growth (Stawska & Miszcynska, 2017). economic growth both in developed and developing countries.

However, a general consensus remains elusive till date as

The McKinnon (1973) and Shaw (1973) framework existing studies have documented varying results from

provides theoretical support for a market determined interest different economies (Twinoburyo & Odhiambo, 2018). For

rate, and strongly rejects financial repression, which according example, using Johansen Cointegration, Akinwale (2018)

to the framework, fails to show the true competitive state of found a negative connection between rate of interest and the

the interest rate. According to the hypothesis, interest rate growth of the economy, while Okoye, Nwakoby and Modebe

determined by the “invisible hand” attracts and allocates (2015) using VECM obtained a positive relationship between

financial resources more efficiently in the economy, as the interest rate and output growth in Nigeria. Lee and Werner

competitive interest rate is likely to increase the level of (2018) also found that interest rate positively follows GDP

savings which is crucial for capital formation needed for growth in industrialized countries. Contrary to the result of

growth-inducing investments in the economy. Succinctly, Lee and Werner (2018), Barry (2014) reported a weak

liberalized interest rates positively affect economic growth as relationship between rate of interest and the growth of the

against artificial ceilings of interest rate (Odhiambo, 2009). economy. It is therefore obvious that there is need for further

Critics of the hypothesis suggest that financial liberalization empirical investigations on this topic as earlier suggested by

leads to higher level of interest rate, which consequently Aspinall, Jones, McNeill, Werner and Zalk (2015), among

attracts more savings but it adversely affect the borrowing others in their various studies.

capacity of some sectors that are yet to be developed, and

therefore weakens investment in some crucial sectors of the In addition, through financial deepening, it has been

economy. posited that financial system can enhance it contributions and

put the economy on the path of sustainable growth and

Financial theory suggests that a lower lending / interest development. One of the key variables to financial deepening

rate attracts more investment, which then boosts economic as suggested by Odhiambo (2009) is interest rate which can be

growth (Woodford, 2003; Baum, 2009). While a higher used to attract the unbanked populace in the economy. He

lending / interest rate discourages investment, which is argued that interest rate does not affect the economy directly

harmful to output growth. Similarly, a high lending / interest but rather through its transmissions on financial deepening.

rate encourages the surplus units to supply more funds, while a Hence, this study intends to examine the relationship between

lower one discourages them. Monetary authority faces a interest rate and financial deepening, interest rate and

dilemma in setting the appropriate interest rate which would economic growth and the causality between lending rate,

not only encourage savings but attracts more investments as savings rate and economic growth in Nigeria as such studies

well. Therefore, every monetary authority from both are relatively scarce in developing countries especially in

developed and developing economies are being confronted Nigeria. This study is also justified on the premise that if

with how to find an optimum interest rate policy, which is not monetary authority can identify the variable that causes the

only capable of attracting investments both locally and behavior of other variables, formulating an effective and

internationally but as well sustain output growth. efficient monetary policy for a sustainable growth would be

relatively easy. The remaining part of the paper is divided as

Developing economies like Nigeria has taken on several follows: sections two and three are for review of literature and

reforms over the years in order to find an optimum mechanism methods of analysis, section four is results and discussion and

through which an optimum interest rate can be achieved, as section five concludes the paper and make some

the country still lacks the optimal level of savings and recommendations.

investments needed for sustainable growth and development

(Eze, 2010 as cited in Jelilov, 2016). Despite the fact that the II. LITERATURE REVIEW

country remains one of the largest economy in Africa, the

level of infrastructures does not reflect this status as Using a panel data set of 22 countries, Anaripour (2011)

infrastructures continue to linger in deplorable state. One of carried out an empirical study on the causality between

the major reforms in the country has been the Structural economic growth and rate of interest by employing Granger

Adjustment Programme (SAP) introduced in 1986 which causality test. Result indicated that a negative and unilateral

ushered in financial liberalization which opened the door for a relationship exist between economic growth and interest rate

market-determined interest rate and credit allocation which running from economic growth to interest rate. In the same

was intended to enhance efficiency in the financial system and vein, Bhunia (2016) study on the relationship between

contribute to the rapid economic development. Since the inflation, economic growth and interest rates found a long run

introduction of SAP, the economy has witnessed several negative and unilateral causal relationship from economic

swings in the interest rate as the CBN continues to struggle to growth to interest rate in India.

find an optimum level of interest rate. While the small and

medium scale enterprises remains undernourished due to the Utile, Okwori and Ikpambese (2018) proxy economic

paucity of funds which is a result of an inefficient financial growth by GDP and reported a negative but insignificant

system. effect of interest rate on economic growth. Similar result was

also documented in the study of Etale and Ayunku (2016),

who employed ECM to analyze the association between

interest rate and the growth of the economy over the period

IJISRT21APR358 www.ijisrt.com 954

Volume 6, Issue 4, April – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

1980-2016. However, a study by Heba (2017) using 15 through savings and investments in South African

countries provided a support for the McKinnon and Shaw Development Community (SADC) countries.

hypothesis. The findings of the study showed that real interest

rate is positively associated with economic growth. That is, It is obvious from the above review that there is no

improvement in interest rate leads to more efficiency in capital consensus among the researchers as to the relationship

formation, which then encourages investments. between interest rate, financial deepening and economic

growth. Therefore, a further study of this nature is required to

Ajayi, Oladipo, Ajayi and Nwanji (2017) also found out fill this gap.

that a unilateral causal relationship running from savings

interest rate to GDP exists. And suggest that insecurity, III. RESEARCH METHODS

regional socio-political unrest and political instability in

general apart from interest rate are some of the factors Time series yearly data between 1986 and 2018 were

restricting economic growth. In line with the results of Ajayi collected using both Federal bureau of statistics and CBN

et al (2017) is Obamuyi (2009) who found out a positive statistical bulletin in other to achieve the primary aim of

relationship between deposit interest rate and GDP growth. In investigating the influence of interest rate on the growth

addition, the result indicated that financial deepening has an economy.

adverse relationship with economic growth due to the

weaknesses in the financial system. This is contrary to the IV. MODEL SPECIFICATION

study of Odhiambo (2009), who found out that financial

deepening granger causes economic growth in Zambia. The model adopted for this study is in line with the

McKinnon and Shaw hypothesis, which argued that interest

In a study on Asian countries, Harswari and Hamza rate liberalization positively affect economic growth. The

(2017) used a panel data of 20 countries within the period adopted model is expressed as follows:

2006 – 2015. The correlation and regression analysis

employed revealed that interest rate negatively and 𝐺𝐷𝑃𝑡 = 𝛽0 + 𝛽1 𝐼𝑁𝑇𝑡 + 𝛽2 𝑆𝑉𝑅𝑡 + 𝛽3 𝐹𝐷𝑡 +

significantly influence economic growth. However, Saymeh 𝛽4 𝑀2𝑡 + 𝛽5 𝐼𝑁𝐹𝑡 + 𝛽6 𝐸𝑋𝑅𝑡 + µ𝑡

and Orabi (2013) in a study in Jordan on the relationship

………………………………………. (1)

between economic growth, inflation rate and interest rate

showed that interest rate has positive effect on economic

Where;

growth. Similarly, a study in Zambia by Odhiambo (2009) on

β0 = intercept

interest rate liberalization and economic growth using

β1 – β6 = parameters

cointegration-based error correction model found out that

µt = error term

interest rate liberalization indirectly affect economic growth

GDP = gross domestic product

positively through financial deepening.

INT = lending interest rate

SVR = savings/deposit interest rate

Udoka and Anyingang (2012) employed the multiple

FD = financial deepening measured by CPS/GDP

regression analysis to identify the impact of interest rate

M2 = Money supply

movement on economic growth for the periods 1970 to 2010

INF = Inflation rate

in Nigeria. The findings pointed to an inverse relationship

EXR = Exchange rate

between interest rate and economic growth. Contrarily,

Osadume (2018) reported a positive and significant effect of

V. ESTIMATION TECHNIQUES

interest rate on economic development. The study however

proxy economic development by human development index.

Unit Root Tests

Alhassan (2017), covering the period 1981 to 2014 and using

The study test for the stationarity of the variables using

ARDL to analyze the impact of interest rate liberalization on

the Augmented Dickey Fuller (ADF) unit root test to check

economic growth found that interest rate had a negative effect

the order of integration of variables and to avoid spurious

on the growth of the Nigerian economy. The result suggests

results after performing diagnostic test such as serial

that the liberalization of interest rate has led to high lending

correlation, heteroscedasticity and normality.

rate which has inflated the cost of capital. Thereby, hindering

productive investments and encouraging capital flight.

ARDL Cointegration Approach

Perhaps, developing economies are not yet ripe for

The study employed the Autoregressive Distributed Lag

liberalization of interest rate as empirical evidences from

(ARDL) cointegration approach because of its superiority over

developing economies have suggested. This can be traced to

other methods of estimation. It could be used on variables with

the “structural weaknesses” and “underdeveloped financial

different order of integration that is, I(0) or I(0).

markets” which are yet to be effectively integrated into the

global markets. This is echoed in the study of Lee and Werner

(2018) who found out a positive relationship between interest

rate and economic growth in industrialized countries as

monetary policies tend to be effective in such countries.

However, Moyo and Le Roux (2018) documented a positive

relationship between interest rate and economic growth

IJISRT21APR358 www.ijisrt.com 955

Volume 6, Issue 4, April – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

The ARDL bound testing procedure employs the following equation;

n n n n n n

𝐿𝐺𝐷𝑃𝑡 = 𝛽0 + ∑ 𝛽1 ∆ L GDPt−1 + ∑ 𝛽2 ∆ L INTt−1 + ∑ 𝛽3 ∆ L SVR t−1 + ∑ 𝛽4 ∆ L 𝐹𝐷t−1 + ∑ 𝛽5 ∆ 𝐿𝑀𝑆𝑡−1 + ∑ 𝛽6 ∆ 𝐿𝐼𝑁𝐹𝑡−1

i=0 i=0 i=0 i=0 i=0 i=0

n

+ ∑ 𝛽7 ∆ 𝐿𝐸𝑋𝑅𝑡−1 + α1 LGDPt−1 + α2 LINTt−1 + α3 LSVR t−1 + α4 LFDt−1 + α5 LMSt−1 + α6 LINFt−1

i=0

+ α7 LEXR t−1 + µ𝑡 (2)

Where: Β = the short run coefficients; µ = the white-noise error term; α = the long run coefficients; ∆ = the first difference operator;

t = denoted time period; Akaike Info criterion (AIC) is the basis of chosen the highest number of lags in the model.

VI. RESULTS AND DISCUSSION

Descriptive Statistics

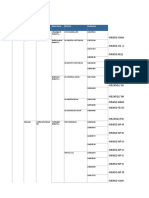

Table 1. Descriptive Statistics for Variables

Variables Mean Std. Dev. Min. Max. Kurtosis

RGDP 33725.22 19578.10 13779.26 69810.02 1.996529

M2 5153.530 7536.395 14.47117 25079.72 3.431348

INF 20.10105 18.22136 0.220000 76.76000 4.716528

INT 17.57661 4.628233 7.750000 29.80000 3.668152

SVR 7.350403 5.050325 1.410541 18.80000 2.273558

EXR 90.13014 90.31565 0.610000 306.1875 3.133873

FD 11.05262 5.377672 5.917270 20.77330 1.962942

Source: Author’s Computation (2021) via EVIEW 9 Package

In order to give a brief overview of the time series data, level of instability in the economy, while FD has the lowest

the descriptive statistics for the dependent and independent mean of 11%. The value of Kurtosis is use to determine the

variables were presented in table 1. The explained variable is peakedness of the series and usually considered at a value

economic growth (RGDP) measured by the value of real gross below or above three, when it is below three, it said to be

domestic product, while the explanatory variables are: money flat/platykurtic and when above three it is considered

supply (M2), inflation rate (INF), interest rate (INT), savings leptokurtic to the normal distribution. From table 4.1 below

rate (SVR), exchange rate (EXR) and financial deepening RGDP, SVR and FD are less than three and as such are flat or

measured by credit to private sector as a measure of GDP platykurtic while M2, INF, INT and EXR are more than three

(FD). The descriptive statistics presents the mean, standard therefore is peaked or leptokurtic.

deviation, minimum, maximum and kurtosis value. The

statistics show that GDP has the highest mean value of 33,725 Unit Root Test Result

in billions of naira and the highest volatility which shows the

Table 2: Augmented-Dickey-Fuller (ADF) Test

Null Hypothesis: Variable has a Unit root

Variables Augmented Dickey-Fuller test statistic Order of Integration

Level First Difference

RGDP -0.704467 -3.114373** 1(1)

M2 -2.365216 -3.139574** 1(1)

INF -2.706619* -4.907288*** 1(1)

INT -4.605514*** 1(0)

SVR -0.952982 -6.395918** 1(1)

EXR 0.688990 -4.707789*** 1(1)

FD -0.856241 -4.876972*** 1(1)

Asymptotic critical values*:

1% level -3.661661

5% level -2.960411

10% level -2.619160

Source: Author’s Compilation (2021) via EVIEW 9

Note: *, **, *** indicates significant at 10%, 5% and 1% levels respectively

IJISRT21APR358 www.ijisrt.com 956

Volume 6, Issue 4, April – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

The Augmented Dickey Fuller (ADF) test as presented in table 2 showed that only INT is stationary at level while others

variables are at first difference. The ADF test confirmed that ARDL approach is suitable for the study because the variables are of

different order. Hence the ARDL method was used in the study.

ARDL Bound Test

Table 3: Results of ARDL Bounds Test

Null Hypothesis: No long-run relationships exist

Estimated equation 𝐺𝐷𝑃 = 𝑓(𝑀2, 𝑆𝑉𝑅, 𝐼𝑁𝐹, 𝐼𝑁𝑇, 𝐸𝑋𝑅, 𝐹𝐷)

F-statistics 5.76***

Optimal lag length (3, 3, 3, 2, 3, 3, 0)

Critical values

Significance level

Lower bound I0 Upper bound I1

1% 2.12 3.23

5% 2.45 3.61

10% 3.15 4.43

Note: *** denotes significance at 1%

The Null hypothesis of no cointegration among the variables was rejected because the F statistic value of 5.76 is greater than

upper bound critical value as shown in table 3. The optimal lag length selected using the Akaike Info criterion (AIC) is ARDL (3, 3,

3, 2, 3, 3, 0). The results of the model selected are presented in Table 4 and 5 for long and short run respectively.

Table 4 Long Run Coefficients of ARDL (3, 3, 3, 2, 3, 3, 0)

Dependent variable: ∆GDP

Regressor Coefficient Standard error t-Statistic Probability

𝒍𝒏𝑴𝟐 0.395791 0.044823 8.829996 0.0000

𝑰𝑵𝑭 -0.006835 0.001495 -4.571465 0.0013

𝑰𝑵𝑻 0.038384 0.015893 2.415093 0.0389

𝑺𝑽𝑹 -0.016403 0.020150 -0.814022 0.4366

𝒍𝒏𝑬𝑿𝑹 -0.316801 0.078361 -4.042831 0.0029

𝑭𝑫 -0.014435 0.006018 -2.398617 0.0400

𝑪 8.756599 0.210702 41.559161 0.0000

Source: Author’s Compilation (2021) via EVIEW 9

Note: *, **, *** indicates significant at 10%, 5% and 1% levels respectively

From the result presented in Table 4, the long run coefficients showed that the major determinants of economic growth from

the selected independent variables are interest rate, broad money supply, exchange rate, inflation rate and financial deepening in the

long run. Increase in broad money supply (M2) causes an upward trend in GDP. The result also shows that the coefficient of interest

rate (INT) is positively and significantly related to the economy (GDP). This implies that increase in the lending interest rate

seemingly causes an upward movement in the GDP in the long run. On the other hand, the savings interest rate (SVR) coefficient is

negatively signed, which implies that SVR causes a downward swing in the economy in the long run. This is contrary to economic

theory. However, this could be due to some factors such as weak banking system, economic instability and political instability in

terms of relative frequent changes in government policies among others (Ajayi et al, 2017). This is more evident from the

coefficient of both inflation rate (INF) and exchange rate (EXR) which have negative effects on the economy. Surprisingly,

financial deepening (FD) has significant negative effect on the economy in the long run. This could also be traced to the

underdeveloped financial system in the country as significant numbers of people remain unbanked.

IJISRT21APR358 www.ijisrt.com 957

Volume 6, Issue 4, April – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Table 5: Short Run Coefficients of ARDL (3, 3, 3, 2, 3, 3, 0)

Dependent variable: ∆GDP

Regressor Coefficient Standard error t-Statistic Probability

∆𝒍𝒏𝑮𝑫𝑷(−𝟏) -0.497732** 0.169667 -2.933587 0.0167

∆𝒍𝒏𝑮𝑫𝑷(−𝟐) 0.261924** 0.093435 2.803266 0.0206

∆𝒍𝒏𝑴𝟐 -0.018600 0.027315 -0.680958 0.5130

∆𝒍𝒏𝑴𝟐(−𝟏) -0.099937* 0.050678 -1.971983 0.0801

∆𝒍𝒏𝑴𝟐(−𝟐) 0.100326** 0.038335 2.617073 0.0279

∆𝑰𝑵𝑭 -0.000522** 0.000207 -2.523235 0.0326

∆𝑰𝑵𝑻 0.003014* 0.001430 2.107459 0.0643

∆𝑰𝑵𝑻(−𝟏) -0.001325 0.001002 -1.322562 0.2186

∆𝑺𝑽𝑹 0.004325 0.003232 1.338124 0.2137

∆𝑺𝑽𝑹(−𝟏) 0.004581* 0.002471 1.853832 0.0968

∆𝑺𝑽𝑹(−𝟐) 0.011249*** 0.002559 4.395183 0.0017

∆𝒍𝒏𝑬𝑿𝑹 -0.099677*** 0.009895 -10.073602 0.0000

∆𝒍𝒏𝑬𝑿𝑹(−𝟏) -0.034880** 0.012200 -2.859137 0.0188

∆𝒍𝒏𝑬𝑿𝑹(−𝟐) -0.014507 0.010573 -1.372094 0.2033

∆𝑭𝑫 -0.004668** 0.001760 -2.652054 0.0264

𝑬𝑪𝑴 -0.323377*** 0.095505 -3.385965 0.0081

Source: Compiled by Authors (2021) via EVIEW 9

Note: *, **, *** indicates significant at 10%, 5% and 1% levels respectively

The short run coefficients showed the major contributing GDP. Expectedly, INF has an adverse effect on the GDP. In

factors to economic growth in the short run are lagged value of the same vein, the current, one lagged and two lagged value of

GDP, lagged value of M2, current value of INF, lagged value EXR have negative effect on GDP. On the other hand, the

of SVR, current and lagged EXR and current FD as showed in current, one lagged and two lagged value of SVR have

Table 5. positive effect on the GDP. While FD exhibits a negative

effect on GDP.

One lagged value of GDP is surprisingly negatively

related with current GDP. While the two lagged value of GDP Furthermore, the Error Correction term coefficient is

has positive effect on the current GDP. The current value and significant and shows that the variable adjust by 3.2338 per

one lagged value of M2 have negative effect on GDP. On the cent towards the equilibrium level in the long run whenever it

other hand, two lagged value of M2 has positive effect on drifted from it in the short run.

Table 6 Result of Diagnostic Tests

Test Statistics P-value

Serial Correlation: CHSQ(2) 0.160667 0.6885

Heteroscedasticity 28.83524 0.1858

F-statisitics 6318 0.0000

Normality test (Jarque-Bera) 1.729990 0.4211

R-squared 0.9999

Adjusted R-squared 0.9997

Source: Author’s Compilation via EVIEW 9

Generally, the ARDL regression model fits well as it passed the entire estimation test conducted and reported in Table 6.

IJISRT21APR358 www.ijisrt.com 958

Volume 6, Issue 4, April – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Granger Causality Test

Table 7: Granger Causality

Null HYPOTHESIS F-Statistics Prob.

M2 does not Granger Cause GDP 0.79771 0.4611

GDP does not Granger Cause M2 5.70433 0.0088***

INT does not Granger Cause GDP 1.26490 0.2991

GDP does not Granger Cause INT 2.97119 0.0688*

SVR does not Granger Cause GDP 3.24060 0.0554*

GDP does not Granger Cause SVR 0.30661 0.7386

EXR does not Granger Cause GDP 2.54715 0.0977*

GDP does not Granger Cause EXR 2.55612 0.0969*

FD does not Granger Cause GDP 1.67142 0.2076

GDP does not Granger Cause FD 6.12271 0.0066***

SVR does not Granger Cause INF 10.4622 0.0005***

INF does not Granger Cause SVR 6.54689 0.0005***

INT does not Granger Cause INF 1.39668 0.2654

INF does not Granger Cause INT 4.31438 0.0241**

SVR does not Granger Cause INT 3.99878 0.0306**

INT does not Granger Cause SVR 2.37473 0.1129

FD does not Granger Cause INT 1.04117 0.3673

INT does not Granger Cause FD 0.44113 0.6480

Source: Compiled by Authors (2021)

Note: *, **, *** indicates significant at 10%, 5% and 1% levels respectively

The result of the granger causality test from table 4.6 significant in the long run as businesses and consumers adjust

reveal unidirectional causality from GDP to M2, weak to the implemented changes in interest rate. The result also

unidirectional causation running from GDP to INT, SVR to suggests that the liberalization of the interest rate in 1986 has

GDP, and weak bidirectional causation between EXR and not only reflect the true competitive state of the interest rate

GDP. Also a unidirectional causation running from GDP to but has also contributed to the growth of the economy

FD, INF to INT, SVR to INT, and a bidirectional causation positively. The findings is in line with the McKinnon and

between SVR and INF. However, there is no causation Shaw hypothesis and the studies of Obamuyi (2009) Ajayi et

between INT and FD. al (2017), and Heba (2017). However, it contradicts Chris and

Anyingang (2012), Bhunia (2016), and Harswari and Hamza

VII. DISCUSSION AND CONCLUSION (2017).

This paper investigates the influence of interest rate on The broad money supply (M2) exhibits an adverse effect

Nigerian economy for the period 1986 to 2018. utilizing the on the economy in the short run and a positive effect in the

ARDL approach, both short and long run relationships long run. Increase in money supply has been associated with

between economic growth and the selected explanatory inflationary trend as too much money will be chasing few

variables which are broad money supply (M2), inflation rate goods. This causes imbalance in the economy in the short run.

(INF), interest rate (INT), savings rate (SVR), exchange rate However, the effect turns out positive in the long run as firms

(EXR) and financial deepening (FD) were analyzed. increase their productive capacity to accommodate the

increase in demand, as the result suggests.

The findings of the study suggest that lending interest

rate and savings rate generally have positive effect on Inflation rate (INF) has adverse effect on the economy

economic growth both in the short and long run which both in the short and long run. This only supports the level of

conforms to economic theory. Although, the effect of lending instability in the economy, and the inability of the monetary

interest rate on the economy is insignificant in the short run. authorities to provide balance in the economy. This is

This may be due to the response lag effect, which may cause supported by the effect of the exchange rate (EXR) on the

delay in bringing the desired changes in the economy economy which is negative also both in the short and long run.

(Stawska & Miszcynska, 2017). However, the effect is

IJISRT21APR358 www.ijisrt.com 959

Volume 6, Issue 4, April – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

This is a reflection of the weakness in the productive capacity, [5]. Anaripour, J. T. (2011). Study on relationship between

insecurity and unstable economic policy of the country. interest rate and economic growth by E-View (2004-

2010, Iran). Journal of Basic and Applied Scientific

Contrary to the study of Odhiambo (2009) and in line Research, 1(11), 46-52.

with the study of Obamuyi (2009), financial deepening has [6]. Aspinall, N. G., Jones, S. R., McNeill, E. H., Werner, R.

had a negative effect on the economy. This may be traced to A., & Zalk, T. (2015). Sustainability and the financial

the weak financial system, which is yet to contribute system, review of literature. Institute and Faculty of

effectively and efficiently to the economy, despite the various Actuaries, London.

reforms that have taken place in the banking sector. The result [7]. Baum, S. D. (2009). Description, prescription and the

only shows that more still need to be done in order to position choice of discount rates. Ecological Economics, 69(1),

the Nigerian banking sector in the global financial market. 197–205.

[8]. Bhunia, A. (2016). How inflation and interest rates are

The Granger causality employed showed that savings related to economic growth? A case of India. Journal of

rate weakly granger causes economic growth, which is in line Finance and Accounting, 4(1), 20-26.

with the Mckinnon and Shaw hypothesis. Increase in the [9]. Etale, L. M., & Ayunku, P. E. (2016). The relationship

savings rate encourages more funds from the surplus units between interest rate and economic growth in Nigeria:

which can then be channeled to productive uses by the deficit AN error correction model (ECM) approach.

unit. As capital formation is key to economic growth. On the International Journal of Economics and Financial

other hand, GDP granger causes both lending interest rate and Research, 2(6), 127-131.

financial deepening index, which shows that the monetary [10]. Harswari, M. H., & Hamza, S. M. (2017). The impact of

policy has been more reactive than proactive so far, which interest rate on economic development: A study on

could account for the instability in the economy. In addition, Asian countries. International journal of Accounting and

inflation rate also granger causes lending interest rate, while Business Management, 5(1), 180-188.

saving rates and inflation rate both granger cause each other. [11]. Heba, E. M. S. A. (2017). The relationship between

The result suggests that the monetary authority need to pay interest rate and economic growth: An international

more attention to the savings/deposit rates more than before in comparative study with reflection on the Egyptian

order to boost the economic activities in the country. economy (Thesis), Faculty of Commercce, Zagazig

University.

In conclusion, the findings of this study has shown that [12]. Jelilov, G. (2016). The impact of interest rate on

interest rate has positive effect on the growth of the economy. economic growth example of Nigeria. African Journal of

However, the savings rate needs to be given more attention Social Sciences, 6(2), 51-64.

than before. The liberalization of the interest rate has been [13]. Jhingan, M. L. (1999). Microeconomic theory (4th ed.).

more beneficial to the economy, which supports the Mckinnon Delhi, Vrinda Publications.

and Shaw hypothesis. The study also suggests that monetary [14]. Lee, K. S., & Werner, R. A. (2018). Reconsidering

authority need to be more proactive rather than being monetary policy: An empirical examination of the

proactive most times. More creative reforms are needed in the relationship between interest rates and nominal GDP

financial system so as to not only provide more financial growth in the U.S., U.K., Germany and Japan.

services but also make the Nigerian banking system more Ecological Economics, 146(1), 26-34.

competitive globally. [15]. Maiga, F. K. (2017). Impact of interest rate on economic

growth in Nigeria. Journal of Business and Finance

REFERENCES Management Research, 3(3), 98-111.

[16]. McKinnon, R. I. (1973). Money, Capital and Banking in

[1]. Adeleye, S. T. (2018). Capital formation in the Nigerian Economic Development. Brooklyn Institution,

capital market and its effect on economic growth. Washington D.C.

International Journal of Economics and Business [17]. Moyo, C., & Le Roux, P. (2018). Interest rate reforms

Management, 4(2), 16-23. and economic growth: the savings and investment

[2]. Ajayi, S. A., Oladipo, O. A., Ajayi, L. B., & Nwanji, T. channel. MPRA Paper, No. 85297.

I. (2017). Interest rate and economic growth. [18]. Mushtaq, S., & Siddiqui, D. A. (2016). Effect of interest

International Review of Business Research Papers, rate on economic performance: Evidence from Islamic

13(1), 141-150. and non-Islamic economies. Financial Innovation, 2(9),

[3]. Akinwale, S. O. (2018). Bank lending rate and economic 1-14.

growth: Evidence from Nigeria. International Journal of [19]. Nwosu, E. O. & Anthony, O. (2017). Addressing

Academic Research in Economics and Management poverty and gender inequality through access to formal

Sciences, 7(3), 111-122. credit and enhanced enterprise performance in Nigeria:

[4]. Alhassan, A. (2017). The Impact of interest rate An empirical investigation. African Development

deregulation on Gross Domestic product of Nigeria. Review, 29(51), 56-72

Journal of Economics and Sustainable Development, [20]. Obamuyi, T. M. (2009). An investigation of the

8(18), 67-73. relationship between interest rates and economic growth

in Nigeria, 1976 -2006. Journal of Economic and

International Finance, 1(4), 93-98.

IJISRT21APR358 www.ijisrt.com 960

Volume 6, Issue 4, April – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

[21]. Odhiambo, N. M. (2009). Interest rate liberalization and

economic growth in Zambia: A dynamic linkage.

African Development Review, 21(3), 541-557.

[22]. Okoye, L. U., Nwakoby, C. I. N., & Modebe, N. J.

(2015). Interest rate reform and real sector performance:

Evidence from Nigeria. African Banking and Finance

Review, 2(1), 97-114.

[23]. Osadume, R. (2018). Effect of interest rate mechanisms

on the economic development of Nigeria, 1986-2016.

International Journal of Economics and Business

Management, 4(4), 91-115.

[24]. Saymeh, A. A. F., & Orabi, M. M. A. (2013). The effect

of interest rate, inflation rate, GDP, on real economic

growth rate in Jordan. Asian Economic and Financial

Review, 3(3), 341-354.

[25]. Shaw, E. (1973). Financial Deepening in Economic

Development, Oxford University Press, New York.

[26]. Stawska, J. & Mizcynska, K. (2017). The impact of

European central banks interest rates on investment in

Euro area. The Polish Journal of Economic, 5, 51-72

[27]. Twinoburyo, E. N., & Odhiambo, N. M. (2018).

Monetary policy and economic growth: A review of

international literature. Journal of Central Banking

Theory and Practice, 2(2), 123-137.

[28]. Udoka, C. A., & Anyingang, A. R. (2012). The effect of

interest rate fluctuation on the economic growth of

Nigeria 1970-2010. International Journal of Business

and Social Science, 3(20), 295-302.

[29]. Utile, B. J., Okwori, A. O., & Ikpambese, M. D. (2018).

Effect of interest rate on economic growth in Nigeria.

International Journal of Advanced Academic Research,

Social and Management Sciences, 4(1), 66-76.

[30]. Woodford, M. (2003). Interest and prices: foundations of

a theory of monetary policy. Princeton University Press,

Princeton.

IJISRT21APR358 www.ijisrt.com 961

You might also like

- War and Interest Rates by Zoltan PozsarDocument10 pagesWar and Interest Rates by Zoltan PozsarDavid PinsenNo ratings yet

- IMFI 2020 02 AdaramolaDocument14 pagesIMFI 2020 02 AdaramolaeranyigiNo ratings yet

- The Effect of Financial Institutions On Economic Growth in NigeriaDocument10 pagesThe Effect of Financial Institutions On Economic Growth in NigeriaNwigwe Promise ChukwuebukaNo ratings yet

- Interest Rate and Its Effect on Economic Growth an Issue for Nigeria Industrial SectorsDocument4 pagesInterest Rate and Its Effect on Economic Growth an Issue for Nigeria Industrial SectorsjamesNo ratings yet

- 6Document15 pages6Abdulkadir IsaNo ratings yet

- OhiomuDocument19 pagesOhiomuixora indah tinovaNo ratings yet

- ajol-file-journals_540_articles_188383_submission_proof_188383-6361-478559-1-10-20190725Document18 pagesajol-file-journals_540_articles_188383_submission_proof_188383-6361-478559-1-10-20190725enockezekiel45No ratings yet

- The Effect of Interest Rate On Kenya's EconomicDocument7 pagesThe Effect of Interest Rate On Kenya's Economickayder017No ratings yet

- Article 11 An Analytical Study of The Impact of InflationDocument11 pagesArticle 11 An Analytical Study of The Impact of InflationShanza KhalidNo ratings yet

- Financial Deepening and Per Capita Income in NigeriaDocument23 pagesFinancial Deepening and Per Capita Income in Nigeriakahal29No ratings yet

- Effect of Government Policies On Price Stability in NigeriaDocument14 pagesEffect of Government Policies On Price Stability in NigeriaResearch ParkNo ratings yet

- Abiodunstandalone2Document12 pagesAbiodunstandalone2vitucho170314No ratings yet

- Commercial Bank Credit To Micro, Small & Medium Enterpries (MSMEs) and Economic Growth in NigeriaDocument11 pagesCommercial Bank Credit To Micro, Small & Medium Enterpries (MSMEs) and Economic Growth in NigeriaAlok TiwariNo ratings yet

- Analyzing The Effect of Government Expenditure On Inflation Rate in Nigeria 1981 2019Document12 pagesAnalyzing The Effect of Government Expenditure On Inflation Rate in Nigeria 1981 2019Editor IJTSRDNo ratings yet

- Effect of Monetary Policies On The Growth of The Insurance Sector in NigeriaDocument10 pagesEffect of Monetary Policies On The Growth of The Insurance Sector in NigeriaEverpeeNo ratings yet

- Inflation Rate, Foreign Direct Investment, Interest Rate, and Economic Growth in Sub Sahara Africa Evidence From Emerging NationsDocument8 pagesInflation Rate, Foreign Direct Investment, Interest Rate, and Economic Growth in Sub Sahara Africa Evidence From Emerging NationsEditor IJTSRDNo ratings yet

- Interest Rate Deregulation and Savings Mobilization in Nigeria: An Impact AnalysisDocument8 pagesInterest Rate Deregulation and Savings Mobilization in Nigeria: An Impact AnalysisDr. Ezeanyeji ClementNo ratings yet

- Financial Development and SavingsDocument14 pagesFinancial Development and Savingskahal29No ratings yet

- 1106-Article Text-2162-1-10-20200719Document13 pages1106-Article Text-2162-1-10-20200719Ezekiel BaiyeNo ratings yet

- Autoregressive Distributed Lag Modeling of The EffDocument24 pagesAutoregressive Distributed Lag Modeling of The EffsamueljlNo ratings yet

- Economy Assignment 2Document8 pagesEconomy Assignment 2xyz007No ratings yet

- Inflation and Small and Medium Enterprises Growth in Ogbomoso Area, Oyo State, NigeriaDocument5 pagesInflation and Small and Medium Enterprises Growth in Ogbomoso Area, Oyo State, NigeriaAnonymous ed8Y8fCxkSNo ratings yet

- Inflation and Small and Medium Enterprises Growth in Ogbomoso Area, Oyo State, NigeriaDocument5 pagesInflation and Small and Medium Enterprises Growth in Ogbomoso Area, Oyo State, Nigeriacabdijibaar barreNo ratings yet

- Academia EdiDocument14 pagesAcademia EdiRia LestariNo ratings yet

- Impact of Monetary Policy On EconomicDocument10 pagesImpact of Monetary Policy On EconomicbiaremaNo ratings yet

- Does Financial Sector Development Promote Industrialisation in Nigeria?Document9 pagesDoes Financial Sector Development Promote Industrialisation in Nigeria?Praise IgweonuNo ratings yet

- Financial Deepening and Economic Growth in Nigeria: Evidence From 1982 - 2019Document6 pagesFinancial Deepening and Economic Growth in Nigeria: Evidence From 1982 - 2019kehinde joshuaNo ratings yet

- The Effect of Tax Structure On Financial Inclusion in Nigeria OsinugaDocument13 pagesThe Effect of Tax Structure On Financial Inclusion in Nigeria Osinugabideen872002No ratings yet

- Effect of Financial Intermediation On Capital Market in NigeriaDocument11 pagesEffect of Financial Intermediation On Capital Market in NigeriaMiftahu IdrisNo ratings yet

- Public Debt and Inflation in Nigeria: An Econometric AnalysisDocument6 pagesPublic Debt and Inflation in Nigeria: An Econometric AnalysisDr. Ezeanyeji ClementNo ratings yet

- Economic Growth Modelling in Africa: An Application of Bayesian Model AveragingDocument13 pagesEconomic Growth Modelling in Africa: An Application of Bayesian Model AveragingInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Effect of Monetary Policy On Economic Growth in NigeriaDocument8 pagesEffect of Monetary Policy On Economic Growth in NigeriaEditor IJTSRDNo ratings yet

- International Monetary PolicyDocument6 pagesInternational Monetary PolicyPXQ DIGITALSNo ratings yet

- An Empirical Study On The Effect of Gross Domestic Product On Inflation 1528 2635 22 6 305Document12 pagesAn Empirical Study On The Effect of Gross Domestic Product On Inflation 1528 2635 22 6 305Wahyu Logan Syahputra d'LovêhÜnteržNo ratings yet

- The Determinants and Impacts of Foreign Direct Investment in NigeriaDocument11 pagesThe Determinants and Impacts of Foreign Direct Investment in NigeriaKushagra KumarNo ratings yet

- MODERATING EFFECT OF INFLATION ON FOREIGN DIRECT INVESTMENT AND ECONOMIC GROWTH RELATIONSHIP IN NIGERIADocument13 pagesMODERATING EFFECT OF INFLATION ON FOREIGN DIRECT INVESTMENT AND ECONOMIC GROWTH RELATIONSHIP IN NIGERIAphuongb2008812No ratings yet

- 5 MacroiDocument11 pages5 MacroiJoan ValderramaNo ratings yet

- NATIONAL - SAVINGS - AND - ECONOMIC - Growth - Figs (3) (1) by GloryDocument33 pagesNATIONAL - SAVINGS - AND - ECONOMIC - Growth - Figs (3) (1) by GloryNene HappyNo ratings yet

- 57121-Article Text-177864-1-10-20221011Document10 pages57121-Article Text-177864-1-10-20221011EstefaniaNo ratings yet

- 188-Article Text-420-1-10-20140818Document15 pages188-Article Text-420-1-10-20140818Ývåň LoïcNo ratings yet

- Doradiana,+a8 The+Effect 125+-+140Document16 pagesDoradiana,+a8 The+Effect 125+-+140CheeweiLeeNo ratings yet

- 86-Article Text-433-5-10-20220806Document10 pages86-Article Text-433-5-10-20220806Ramadhan AdityaNo ratings yet

- Financial SectorDocument12 pagesFinancial Sectorayanfeoluwa odeyemiNo ratings yet

- BUA 817 COmparative MGTDocument12 pagesBUA 817 COmparative MGTemmanueladoroughNo ratings yet

- Macroeconomic Instability Index and Threshold for the Nigerian EcDocument35 pagesMacroeconomic Instability Index and Threshold for the Nigerian EcniharikaNo ratings yet

- Impact of Inflation On GDP Growth in Malaysian EconomyDocument4 pagesImpact of Inflation On GDP Growth in Malaysian EconomyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Effectof Monetary Policy Instrumentsoneconomicgrowth 1985 To 2016Document19 pagesEffectof Monetary Policy Instrumentsoneconomicgrowth 1985 To 2016SIR MIMISCONo ratings yet

- Impact of Macro Economic Variables On Gross Domestic Product (GDP) of PakistanDocument31 pagesImpact of Macro Economic Variables On Gross Domestic Product (GDP) of Pakistanaftab20No ratings yet

- The Effect of Investment Financing, Non Investment and Consumer Price Index On Economic Growth in Indonesia - A Simulation Model ApproachDocument6 pagesThe Effect of Investment Financing, Non Investment and Consumer Price Index On Economic Growth in Indonesia - A Simulation Model ApproachAldi PermanaNo ratings yet

- SSRN Id4117860Document12 pagesSSRN Id4117860Oloche UdenyiNo ratings yet

- 2079-Article Text-6221-1-10-20220814Document15 pages2079-Article Text-6221-1-10-20220814Fatima KhalidNo ratings yet

- Adeola 2017Document16 pagesAdeola 2017QUADRI YUSUFNo ratings yet

- Economic Freedom, FDI, Inflation, and Economic GrowthDocument10 pagesEconomic Freedom, FDI, Inflation, and Economic GrowthPutu SulasniNo ratings yet

- A Sectoral Analysis of Fiscal and Monetary Actions in NigeriaDocument22 pagesA Sectoral Analysis of Fiscal and Monetary Actions in NigeriaNiyi SeiduNo ratings yet

- Financial Development and Economic Growth Nexus in Nigeria: Imoagwu, Chika Priscilla, Dr. C.I. EzeanyejiDocument14 pagesFinancial Development and Economic Growth Nexus in Nigeria: Imoagwu, Chika Priscilla, Dr. C.I. EzeanyejiDr. Ezeanyeji ClementNo ratings yet

- Systematic Review: Determinants of Economic Growth in East AfricaDocument7 pagesSystematic Review: Determinants of Economic Growth in East AfricaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Ajbed 395Document19 pagesAjbed 395hyacinthegnanhuoi96No ratings yet

- Financial Deepening and Foreign Direct Investment in NigeriaDocument11 pagesFinancial Deepening and Foreign Direct Investment in NigeriaAJHSSR JournalNo ratings yet

- Analysis of Inflation and Its Effect On Economic Growth inDocument10 pagesAnalysis of Inflation and Its Effect On Economic Growth inGav InvestmentsNo ratings yet

- Impact of Monetary Policy On Indonesia's Economic GrowthDocument32 pagesImpact of Monetary Policy On Indonesia's Economic GrowthTechnical Officer LegalNo ratings yet

- EIB Working Papers 2019/09 - The impact of international financial institutions on SMEs: The case of EIB lending in Central and Eastern EuropeFrom EverandEIB Working Papers 2019/09 - The impact of international financial institutions on SMEs: The case of EIB lending in Central and Eastern EuropeNo ratings yet

- The Evolution in Design & Analysis of Prestressed Box Girder Bridge - A ReviewDocument17 pagesThe Evolution in Design & Analysis of Prestressed Box Girder Bridge - A ReviewInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Managing Anaesthesia Complexities in Ascending Aorta Surgeries in patients with Marfan SyndromeDocument5 pagesManaging Anaesthesia Complexities in Ascending Aorta Surgeries in patients with Marfan SyndromeInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Effectiveness of Maitland’s Mobilization Versus Sleepers Stretch and Posterior Capsule Stretch on Pain, Rom and Shoulder Functions in Patients with Adhesive Capsulitis: A Randomized Control TrialDocument12 pagesEffectiveness of Maitland’s Mobilization Versus Sleepers Stretch and Posterior Capsule Stretch on Pain, Rom and Shoulder Functions in Patients with Adhesive Capsulitis: A Randomized Control TrialInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Implementation and Appreciation of the Social Services Programs of the Provincal Social Welfare and Development Office of AlbayDocument6 pagesThe Implementation and Appreciation of the Social Services Programs of the Provincal Social Welfare and Development Office of AlbayInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Mineral and Heavy Metal Content of African Catfish (Clarias Gariepinus) Fed with Combination of Black Soldier Fly Larvae (Hermetia Illucens L.) and Commercial Feed in Port Harcourt, NigeriaDocument8 pagesMineral and Heavy Metal Content of African Catfish (Clarias Gariepinus) Fed with Combination of Black Soldier Fly Larvae (Hermetia Illucens L.) and Commercial Feed in Port Harcourt, NigeriaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Heart Attack Risk Detection Using Eye Retinal ImagesDocument6 pagesHeart Attack Risk Detection Using Eye Retinal ImagesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Optimizing Blood Bank Operations: A Centralized System for Enhanced Transfusion Services in Rwanda’s HealthcareDocument7 pagesOptimizing Blood Bank Operations: A Centralized System for Enhanced Transfusion Services in Rwanda’s HealthcareInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Managing Complexities in Ascending Aorta Surgeries in Patients with Marfan Syndrome – A Case SeriesDocument5 pagesManaging Complexities in Ascending Aorta Surgeries in Patients with Marfan Syndrome – A Case SeriesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Integration of Neurofeedback and Short-Term Memory Games: Enhancing Cognitive Therapy OutcomesDocument2 pagesThe Integration of Neurofeedback and Short-Term Memory Games: Enhancing Cognitive Therapy OutcomesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Identification of Constraining Factors Impacting Design Bid Build Project Delivery in Tanzania Construction IndustryDocument15 pagesThe Identification of Constraining Factors Impacting Design Bid Build Project Delivery in Tanzania Construction IndustryInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Evaluating the Classification of Employees as Company AssetsDocument2 pagesEvaluating the Classification of Employees as Company AssetsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Digital Transformation in Fintech through Cloud TechnologyDocument6 pagesDigital Transformation in Fintech through Cloud TechnologyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Bempedoic Acid in Hypercholesterolemia Management: A New ApproachDocument2 pagesBempedoic Acid in Hypercholesterolemia Management: A New ApproachInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Level of Patient Satisfaction with Dental and Oral Health Services in the Technical Implementation Unit of Nene Mallomo Regional General Hospital Sidenreng Rappang RegencyDocument5 pagesLevel of Patient Satisfaction with Dental and Oral Health Services in the Technical Implementation Unit of Nene Mallomo Regional General Hospital Sidenreng Rappang RegencyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Midwifery Students’ Knowledge on Pregnancy Induced Hypertension at Two Selected Nursing College in Dhaka CityDocument13 pagesMidwifery Students’ Knowledge on Pregnancy Induced Hypertension at Two Selected Nursing College in Dhaka CityInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Dielectric Performance of PVA/PPy Incorporating Copper Oxide NanocompositeDocument11 pagesDielectric Performance of PVA/PPy Incorporating Copper Oxide NanocompositeInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Review of Psidium guajava Leaves as a Natural Resource in Cosmetic ScienceDocument7 pagesReview of Psidium guajava Leaves as a Natural Resource in Cosmetic ScienceInternational Journal of Innovative Science and Research Technology100% (1)

- Social and Cultural Impact of TourismDocument7 pagesSocial and Cultural Impact of TourismInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Understanding the Role of Hindi Cinema in Popularizing Sufi Music and Its Rising Appeal among Youth in West BengalDocument4 pagesUnderstanding the Role of Hindi Cinema in Popularizing Sufi Music and Its Rising Appeal among Youth in West BengalInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Exploring Microbial Diversity in Air and Water and their Role in Enhancing Agricultural Resilience and Urban Ecosystem HealthDocument17 pagesExploring Microbial Diversity in Air and Water and their Role in Enhancing Agricultural Resilience and Urban Ecosystem HealthInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Effect of Snake and Ladder Playing Method Counseling on Knowledge and Teeth Brushing Skills in SDN 7 Baranti StudentsDocument5 pagesThe Effect of Snake and Ladder Playing Method Counseling on Knowledge and Teeth Brushing Skills in SDN 7 Baranti StudentsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Hybrid Deep Learning Approach for Video Object DetectionDocument9 pagesA Hybrid Deep Learning Approach for Video Object DetectionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Building the Backbone of the Digital Economy and Financial Innovation through Strategic Investments in Data CentersDocument17 pagesBuilding the Backbone of the Digital Economy and Financial Innovation through Strategic Investments in Data CentersInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Fabrication of Prosthetic Robot FingerDocument15 pagesFabrication of Prosthetic Robot FingerInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Caregivers Perception and Socio-Economic Challenges of Nocturnal Enuresis on Child and Family in Ibadan, NigeriaDocument7 pagesCaregivers Perception and Socio-Economic Challenges of Nocturnal Enuresis on Child and Family in Ibadan, NigeriaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Cancer-Related Fatigue: Evidence-Based Nursing StrategiesDocument2 pagesCancer-Related Fatigue: Evidence-Based Nursing StrategiesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Identification of Kerosene Compounds from Used Lubricating Oil Pyrolysis Using GC-MSDocument4 pagesIdentification of Kerosene Compounds from Used Lubricating Oil Pyrolysis Using GC-MSInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Calculation of Eigenvalues of a PT Symmetric Complex Cubic Oscillator through Morse-Feshbach Non-Linear Perturbation SeriesDocument4 pagesCalculation of Eigenvalues of a PT Symmetric Complex Cubic Oscillator through Morse-Feshbach Non-Linear Perturbation SeriesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Effect of Liquidity, Leverage, Activity and Institutional Ownership on Financial Distress with Company Size as a Moderating Variable in the Hotel IndustryDocument11 pagesThe Effect of Liquidity, Leverage, Activity and Institutional Ownership on Financial Distress with Company Size as a Moderating Variable in the Hotel IndustryInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Performance Evaluation of Underwater Wireless SAC-OCDMA SystemDocument9 pagesPerformance Evaluation of Underwater Wireless SAC-OCDMA SystemInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 6 Shelf Leaflet Display StandDocument7 pages6 Shelf Leaflet Display StandJason FitchNo ratings yet

- OrderAck - CV AnboDocument2 pagesOrderAck - CV AnboAndi ApriadiNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Rupam guptaNo ratings yet

- RESUMEDocument5 pagesRESUMEglenn dandyne montanoNo ratings yet

- 2e2 BG02 ZCFC-40063566-0Document1 page2e2 BG02 ZCFC-40063566-0Mohammed OmerNo ratings yet

- PLANO - ACOPLE - 3'' Boreline FittingDocument1 pagePLANO - ACOPLE - 3'' Boreline FittingGiancarlo CervantesNo ratings yet

- Economics Placement Preparation MaterialDocument17 pagesEconomics Placement Preparation MaterialTopsy KreateNo ratings yet

- Google XRay LinkedIn 2020 748893069Document100 pagesGoogle XRay LinkedIn 2020 748893069vinaykaamble100% (1)

- PPM Cooling Tower BangiDocument2 pagesPPM Cooling Tower Bangituan syarifNo ratings yet

- ch03 PPT RankinDocument25 pagesch03 PPT Rankinbolaemil20No ratings yet

- Type (1) Portland CementDocument3 pagesType (1) Portland CementCardo CaballesNo ratings yet

- Smash It Badminton HubDocument12 pagesSmash It Badminton HubGlenn Mark Del CampoNo ratings yet

- Kebijakan Publik Dan Tantangan Implementasi Di Indonesia: Indra KristianDocument11 pagesKebijakan Publik Dan Tantangan Implementasi Di Indonesia: Indra KristianTri okta anggreaniNo ratings yet

- Applied Economics ReviewerDocument6 pagesApplied Economics ReviewerAevan Joseph100% (1)

- My Industrial Training 2Document42 pagesMy Industrial Training 2Olawumi Timothy OluwatosinNo ratings yet

- A. The Former Is A Shift of The Curve and The Latter Is A Movement Along The CurveDocument9 pagesA. The Former Is A Shift of The Curve and The Latter Is A Movement Along The CurveABDULLAH ALSHEHRINo ratings yet

- Critical Trading Free Algo StrategyDocument1 pageCritical Trading Free Algo StrategyVaibhav OjhaNo ratings yet

- Maf CVP Multiple Products Exercise 3 - Topic 3Document3 pagesMaf CVP Multiple Products Exercise 3 - Topic 3Anis ZamriNo ratings yet

- Inspected Customers 2Document24 pagesInspected Customers 2Neha MadanNo ratings yet

- Micro HalDocument17 pagesMicro HalNikita NimbalkarNo ratings yet

- Monthly Family BudgetDocument3 pagesMonthly Family BudgetRoselyn TabundaNo ratings yet

- Brand Identity For: Lanka Premier LeagueDocument15 pagesBrand Identity For: Lanka Premier LeagueVinod KannanNo ratings yet

- RDO No. 99 - Malaybalay City, BukidnonDocument1,228 pagesRDO No. 99 - Malaybalay City, BukidnonAlnur MapandiNo ratings yet

- Estimating The Impact of Rural Feeder Roads in RwandaDocument2 pagesEstimating The Impact of Rural Feeder Roads in RwandaJNo ratings yet

- Practical Manual On Farm Management Production and Resource EconomicsDocument60 pagesPractical Manual On Farm Management Production and Resource Economicssaurabh r33% (3)

- Spot Detail 1 Elevation Detail Section of RampDocument1 pageSpot Detail 1 Elevation Detail Section of RampMalson GutierrezNo ratings yet

- Sample Practice Test Hast PDocument4 pagesSample Practice Test Hast PDo Ngan0% (1)

- Managerial EconomicsDocument3 pagesManagerial EconomicsCALIXTRO MYRA F. (CALIXTRO, MYRA F.)No ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Priyanka PawarNo ratings yet