Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answer

Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answer

Uploaded by

cdCopyright:

Available Formats

Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answer

Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answer

Uploaded by

cdOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answer

Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answer

Uploaded by

cdCopyright:

Available Formats

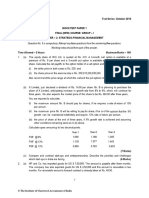

Test Series: April 2021

MOCK TEST PAPER 2

FINAL (NEW) COURSE: GROUP – I

PAPER – 2: STRATEGIC FINANCIAL MANAGEMENT

Question No. 1 is compulsory. Attempt any four questions from the remaining five questions.

Working notes should form part of the answer.

Time Allowed – 3 Hours Maximum Marks – 100

1. (a) In March 2020, XYZ Bank sold some 7% Interest Rate Futures underlying Notional 7.50%

Coupon Bonds. The exchange provides following details of eligible securities that can be

delivered:

Security Quoted Price of Bonds Conversion Factor

7.96 GOI 2023 1037.40 1.0370

6.55 GOI 2025 926.40 0.9060

6.80 GOI 2029 877.50 0.9195

6.85 GOI 2026 972.30 0.9643

8.44 GOI 2027 1146.30 1.1734

8.85 GOI 2028 1201.70 1.2428

Recommend the Security that should be delivered by the XYZ Bank if Future Settlement Price is

1000. (8 Marks)

(b) Following is the data regarding six securities:

A B C D E F

Return (%) 8 8 12 4 9 8

Risk (Standard deviation) 4 5 12 4 5 6

(i) Assuming three will have to be selected, advise which ones will be picked.

(ii) Assuming perfect correlation, evaluate whether it will be preferable to invest 75% in A and

25% in C or to invest 100% in E. (8 Marks)

(c) The idea of Quant Fund is stock-picking free from human intervention. Discuss. (4 Marks)

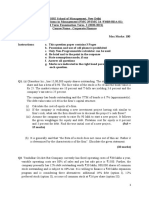

2. (a) On 1 October 2019 Mr. X an exporter enters into a forward contract with a BNP Bank to sell

US$ 1,00,000 on 31 December 2019 at Rs. 70.40/$ and bank simultaneously entered into a cover

deal at Rs. 70.60/$. However, due to the request of the importer, Mr. X received amount on 28

November 2019. Mr. X requested the bank the take delivery of the remittance on 30 November

2019 i.e. before due date. The inter-banking rates on 28 November 2019 were as follows:

Spot Rs. 70.22/70.27

One Month Swap Points 15/10

If bank agrees to take early delivery, then determine the net inflow to Mr. X assuming that the

prevailing prime lending rate is 10% and deposit rate is 5%.

Note: (i) While exchange rates to be considered upto two decimal points the amount to be

rounded off to Rupees i.e. no paisa shall be involved in computation of any amount.

(ii) Assume 365 days a year. (8 Marks)

© The Institute of Chartered Accountants of India

(b) ABC Ltd. wants to issue 9% Bonds redeemable in 5 years at its face value of Rs. 1,000 each.

The annual spot yield curve for similar risk class of Bond is as follows:

Year Interest Rate

1 12%

2 11.62%

3 11.33%

4 11.06%

5 10.80%

(i) Evaluate the expected market price of the Bond if it has a Beta value of 1.10 due to its

popularity because of lesser risk.

(ii) Interpret the nature of the above yield curve and reasons for the same.

Note: Use PV Factors upto 4 decimal points and value in Rs. upto 2 decimal points. (8 Marks)

(c) Explain key decisions falling within the scope of Financial Strategy . (4 Marks)

3. (a) C Ltd. and P Ltd. both companies operating in the same industry decided to merge and form a

new entity S Ltd. The relevant financial details of the two companies prior to merger

announcement are as follows:

C Ltd. P Ltd.

Annual Earnings after Tax (Rs. lakh) 10000 5800

No. Shares Outstanding (lakh) 4000 1000

PE Ratio (No. of Times) 8 10

The merger will be affected by means of stock swap (exchange) of 3 shares of C Ltd. for 1 share

of P Ltd.

After the merger it is expected that due to synergy effects, Annual Earnings (Post Tax) are

expected to be 8% higher than sum of the earnings of the two companies individually. Further, it

is expected that P/E Ratio of S Ltd. shall be average of P/E Ratios of two companies before the

merger.

Evaluate the extent to which shareholders of P Ltd. will be benefitted per share from the

proposed merger. (8 Marks)

(b) Cinderella Mutual Fund has the following assets in Scheme Rudolf at the close of business on

31st March, 2019.

Company No. of Shares Market Price Per Share

Nairobi Ltd. 25000 Rs. 20

Dakar Ltd. 35000 Rs. 300

Senegal Ltd. 29000 Rs. 380

Cairo Ltd. 40000 Rs. 500

The total number of units of Scheme Rudol fare 10 lacs. The Scheme Rudolf has accrued

expenses of Rs. 2,50,000 and other liabilities of Rs. 2,00,000. Calculate the NAV per unit of the

Scheme Rudolf. (8 Marks)

(c) Explain the strategy of Portfolio rebalancing under which the value of a portfolio shall not below a

specified value in normal market conditions. (4 Marks)

© The Institute of Chartered Accountants of India

4. (a) Mr. Dayal is interested in purchasing equity shares of ABC Ltd. which are currently selling at

Rs. 600 each. He expects that price of share may go upto Rs. 780 or may go down to Rs. 480 in

three months. The chances of occurring such variations are 60% and 40% respectively. A call

option on the shares of ABC Ltd. can be exercised at the end of three months with a strike price

of Rs. 630.

(i) Advise what combination of share and option should Mr. Dayal select if he wants a perfect

hedge?

(ii) Evaluate the value of option today (the risk free rate is 10% p.a.)?

(iii) Interpret the expected rate of return on the option? (8 Marks)

(b) The following information is given for 3 companies that are identical except for their capital

structure:

Orange Grape Apple

Total invested capital 1,00,000 1,00,000 1,00,000

Debt/assets ratio 0.8 0.5 0.2

Shares outstanding 6,100 8,300 10,000

Pre tax cost of debt 16% 13% 15%

Cost of equity 26% 22% 20%

Operating Income (EBIT) 26,600 25,500 26,000

Net Income 8,970 12,350 14,950

The tax rate is uniform 35% in all cases.

(i) Compute the Weighted average cost of capital for each company.

(ii) Compute the Economic Valued Added (EVA) for each company.

(iii) Based on the EVA, which company would be considered for best investment? Give reasons.

(iv) If the industry PE ratio is 11x, estimate the price for the share of each company. Also give

your observation on using same PE Ratio to estimate the price for the share of all

companies.

(v) Calculate the estimated market capitalisation for each of the Companies. (8 Marks)

(c) Distinguish between Pass Through Certificates (PTCs) and Pay Through Securities (PTSs).

(4 Marks)

5. (a) The closing value of Sensex for the month of October, 2007 is given below:

Date Closing Sensex Value

1.10.07 2800

3.10.07 2780

4.10.07 2795

5.10.07 2830

8.10.07 2760

9.10.07 2790

10.10.07 2880

11.10.07 2960

12.10.07 2990

15.10.07 3200

3

© The Institute of Chartered Accountants of India

16.10.07 3300

17.10.07 3450

19.10.07 3360

22.10.07 3290

23.10.07 3360

24.10.07 3340

25.10.07 3290

29.10.07 3240

30.10.07 3140

31.10.07 3260

With the help of above data evaluate the weak form of efficient market hypothesis by applying the

run test at 5% and 10% level of significance.

Following value can be used:

Value of t at 5% is 2.101 at 18 degrees of freedom

Value of t at 10% is 1.734 at 18 degrees of freedom (12 Marks)

(b) ABC Ltd. is considering a project X, which is normally distributed and has mean return of Rs. 2

crore with Standard Deviation of Rs. 1.60 crore.

In case ABC Ltd. loses on any project more than Rs. 1.00 crore there will be financial difficulties.

Determine the probability the company will be in financial difficulty.

Given: Standard Normal Distribution Table (Z-Score) providing area between Mean and Z score

Z Score Area

1.85 0.4678

1.86 0.4686

1.87 0.4693

1.88 0.4699

1.89 0.4706

(4 Marks)

(c) Modified Duration is a proxy not an accurate measure of change in price of a Bond due to change

interest rate. Discuss.

OR

Explain the term Business Model with help of an example. (4 Marks)

6. (a) On 1st February 2020, XYZ Ltd. a laptop manufacturer imported a particular type of Memory

Chips from SKH Semiconductor of South Korea. The payment is due in one month from the date

of Invoice, amounting to 1190 Million South Korean Won (SKW). Following Spot Exchange Rates

(1st February) are quoted in two different markets:

USD/ INR 75.00/ 75.50 in Mumbai

USD/ SKW 1190.00/ 1190.75 in New York

Since hedging of Foreign Exchange Risk was part of company’s strategic policy and no contract

for hedging in SKW was available at any in-shore market, it approached an off-shore Non-

Deliverable Forward (NDF) Market for hedging the same risk.

© The Institute of Chartered Accountants of India

In NDF Market a dealer quoted one-month USD/ SKW at 1190.00/1190.50 for notional amount of

USD 100,000 to be settled at reference rate declared by Bank of Korea.

After 1 month (1st March 2020) the dealer agreed for SKW 1185/ USD as rate for settlement and

on the same day the Spot Rates in the above markets were as follows:

USD/ INR 75.50/ 75.75 in Mumbai

USD/ SKW 1188.00/ 1188.50 in New York

Analyze the position of company under each of the following cases, comparing with Spot Position

of 1st February:

(i) Do Nothing.

(ii) Opting for NDF Contract.

Note: Both Rs./ SKW Rate and final payment (to be computed in Rs. Lakh) to be rounded off

upto 4 decimal points. (10 Marks)

(b) Odessa Limited has proposed to expand its operations for which it requires funds of $ 15 million,

net of issue expenses which amount to 2% of the issue size. It proposed to raise the funds

though a GDR issue. It considers the following factors in pricing the issue:

(i) The expected domestic market price of the share is Rs. 300.

(ii) 3 shares (having face value of Rs. 10 each) underly each GDR.

(iii) Underlying shares are priced at 10% discount to the market price.

(iv) Expected exchange rate is Rs. 60/$.

You are required to compute the number of GDR's to be issued and cost of GDR to Odessa

Limited, if 20% dividend is expected to be paid with a growth rate of 20%. (4 Marks)

(c) Explain the methods in which a Startup firm can bootstrap. (6 Marks)

© The Institute of Chartered Accountants of India

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2024 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2024 Edition)Rating: 4.5 out of 5 stars4.5/5 (6)

- Moodys Default Rate PDFDocument60 pagesMoodys Default Rate PDFSaad OlathNo ratings yet

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDocument6 pagesCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayNo ratings yet

- 7 Cost of Capital CTDI October 2013Document85 pages7 Cost of Capital CTDI October 2013Diane SerranoNo ratings yet

- Metro Manila College: College of Business and AccountancyDocument8 pagesMetro Manila College: College of Business and AccountancyJeric TorionNo ratings yet

- MTP 1 May 18 QDocument4 pagesMTP 1 May 18 QSampath KumarNo ratings yet

- 44956mtpbosicai Final QP p2Document7 pages44956mtpbosicai Final QP p2Shubham SurekaNo ratings yet

- SFM QuesDocument5 pagesSFM QuesAstha GoplaniNo ratings yet

- SFM Q 2Document5 pagesSFM Q 2riyaNo ratings yet

- MTP 1 May 21 QDocument4 pagesMTP 1 May 21 QSampath KumarNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument15 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answerritz meshNo ratings yet

- SFM MTP - May 2018 QuestionDocument6 pagesSFM MTP - May 2018 QuestionMajidNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerCA Dipesh Jain100% (1)

- Afm RTP 2021Document42 pagesAfm RTP 2021rpj.group2018No ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument17 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerMajidNo ratings yet

- Maf5102 Accounting and Finance Virt MainDocument4 pagesMaf5102 Accounting and Finance Virt Mainshobasabria187No ratings yet

- SFM Old MTP Dec 21Document6 pagesSFM Old MTP Dec 21Kanchana SubbaramNo ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument8 pagesThis Paper Is Not To Be Removed From The Examination HallsPaul DavisNo ratings yet

- Model Paper Financial ManagementDocument6 pagesModel Paper Financial ManagementSandumin JayasingheNo ratings yet

- Corporate Financial ManagementDocument3 pagesCorporate Financial ManagementRamu KhandaleNo ratings yet

- TEST Paper 2Document10 pagesTEST Paper 2Pools KingNo ratings yet

- MTP 1 Nov 18 QDocument6 pagesMTP 1 Nov 18 QSampath KumarNo ratings yet

- SFM N RTP, MTP, EXAMDocument204 pagesSFM N RTP, MTP, EXAMKuperajahNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerKuperajahNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological Universitysiddharth devnaniNo ratings yet

- Paper 14Document7 pagesPaper 14amalappuexorcistNo ratings yet

- Derivatives (Q) .Document3 pagesDerivatives (Q) .chandrakantchainani606No ratings yet

- Mock Test Q1 PDFDocument4 pagesMock Test Q1 PDFManasa SureshNo ratings yet

- Oct19 Ques-1Document5 pagesOct19 Ques-1absankey770No ratings yet

- Ba ZG521 Ec-3r First Sem 2022-2023Document20 pagesBa ZG521 Ec-3r First Sem 2022-2023sethvijay075No ratings yet

- Paper - 2: Strategic Financial Management: (5 Marks) Security A K S PDocument24 pagesPaper - 2: Strategic Financial Management: (5 Marks) Security A K S PSaurabh GholapNo ratings yet

- 7 Corporate Finance - Prof. Gagan SharmaDocument4 pages7 Corporate Finance - Prof. Gagan SharmaVampireNo ratings yet

- Test Series: August, 2016 Mock Test Paper - 1 Final Course: Group - I Paper - 2: Strategic Financial ManagementDocument40 pagesTest Series: August, 2016 Mock Test Paper - 1 Final Course: Group - I Paper - 2: Strategic Financial ManagementMuhamed Muhsin PNo ratings yet

- BFI 300 Corporate Finance Cat II 10.11.2023Document2 pagesBFI 300 Corporate Finance Cat II 10.11.2023mahmoudfatahabukarNo ratings yet

- Sep23 Ques-1Document5 pagesSep23 Ques-1absankey770No ratings yet

- Strategic Financial ManagementDocument9 pagesStrategic Financial Managementcmadheerajnambiar707No ratings yet

- SFMDocument29 pagesSFMShrinivas PrabhuneNo ratings yet

- Super 60 Questions CA Final AFM For MAy 24 ExamsDocument42 pagesSuper 60 Questions CA Final AFM For MAy 24 ExamsHenry HundersonNo ratings yet

- BBC 422Document3 pagesBBC 422Saheel RazzNo ratings yet

- Mock Test Q2 PDFDocument5 pagesMock Test Q2 PDFManasa SureshNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument5 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerItikaa TiwariNo ratings yet

- TEST Paper 1 Full TestDocument9 pagesTEST Paper 1 Full Testjohny SahaNo ratings yet

- Mba Summer 2019Document4 pagesMba Summer 2019Dhruvi PatelNo ratings yet

- GTU PaperscjsgjsvjbvksnkbsggjvsvbbsibDocument23 pagesGTU Paperscjsgjsvjbvksnkbsggjvsvbbsibizhseabt2fNo ratings yet

- Commerce Bcom Banking and Insurance Semester 6 2023 April Security Analysis Portfolio Management CbcgsDocument3 pagesCommerce Bcom Banking and Insurance Semester 6 2023 April Security Analysis Portfolio Management CbcgsSiddhi mahadikNo ratings yet

- Afm Past Papers (2002 - 2019)Document137 pagesAfm Past Papers (2002 - 2019)peterNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2020Document3 pagesBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNo ratings yet

- BSF 1102 - Principles of Finance - November 2022Document6 pagesBSF 1102 - Principles of Finance - November 2022JulianNo ratings yet

- SFM Mixed Compilation QTSDocument25 pagesSFM Mixed Compilation QTSBijay AgrawalNo ratings yet

- FM-July Aug 2022 QPDocument3 pagesFM-July Aug 2022 QPJasmine Placy DaisNo ratings yet

- Test Paper: Chapter-1: Cost of CapitalDocument13 pagesTest Paper: Chapter-1: Cost of Capitalcofinab795No ratings yet

- CF Paper Summer 2015Document4 pagesCF Paper Summer 2015Vicky ThakkarNo ratings yet

- Question PaperDocument3 pagesQuestion PaperAmbrishNo ratings yet

- QP CA Inter New Syllabus 2 FMSM Ns CA Int Feb 24 7726Document3 pagesQP CA Inter New Syllabus 2 FMSM Ns CA Int Feb 24 7726ayushkumar3766999No ratings yet

- Maf5102 Financial Management Virt SuppDocument3 pagesMaf5102 Financial Management Virt Suppshobasabria187No ratings yet

- SFM Q MTP 2 Final May22Document6 pagesSFM Q MTP 2 Final May22Divya AggarwalNo ratings yet

- ICAI - Question BankDocument6 pagesICAI - Question Bankkunal mittalNo ratings yet

- BAF 313 EXAMDocument5 pagesBAF 313 EXAMkennedymustafa11No ratings yet

- BBC 422Document3 pagesBBC 422Saheel RazzNo ratings yet

- SFM New Sums AddedDocument78 pagesSFM New Sums AddedRohit KhatriNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityAmul PatelNo ratings yet

- MBA 5109 - Financial Management (MBA 2020-2022)Document6 pagesMBA 5109 - Financial Management (MBA 2020-2022)sreekavi19970120No ratings yet

- QP CA Inter New Syllabus 5 FMSM Ns CA Int Feb 24 8563Document7 pagesQP CA Inter New Syllabus 5 FMSM Ns CA Int Feb 24 8563ayushkumar3766999No ratings yet

- Sample Questions 2Document14 pagesSample Questions 2조서현No ratings yet

- ME Engg Economy FORMULAS AND REVIEW MANUALDocument10 pagesME Engg Economy FORMULAS AND REVIEW MANUALMashuNo ratings yet

- Marginal AnalysisDocument10 pagesMarginal AnalysiscompheenaNo ratings yet

- Chapter 6 Valuation of Bonds FM1Document25 pagesChapter 6 Valuation of Bonds FM1Alona Jane ObilloNo ratings yet

- Mathematics-of-Investment-midterm LessonsDocument50 pagesMathematics-of-Investment-midterm LessonsJohn Luis Masangkay BantolinoNo ratings yet

- Handout Appendix DCF Valuation 2023Document21 pagesHandout Appendix DCF Valuation 2023Akshay SharmaNo ratings yet

- Reading 5 VaR Mapping - AnswersDocument7 pagesReading 5 VaR Mapping - AnswersKyawLinNo ratings yet

- 7 (PREPA - Lisa Donahue - Testimony (CGSH Draft of October 3, 2016) )Document27 pages7 (PREPA - Lisa Donahue - Testimony (CGSH Draft of October 3, 2016) )Debtwire MunicipalsNo ratings yet

- Smo Module-IDocument58 pagesSmo Module-INafs100% (1)

- Quiz - Quiz 3 - Asset Pricing, Corporate Investments, Insurance and FuturesDocument5 pagesQuiz - Quiz 3 - Asset Pricing, Corporate Investments, Insurance and FuturesJuhi ShahNo ratings yet

- Accounting Textbook Solutions - 48Document19 pagesAccounting Textbook Solutions - 48acc-expertNo ratings yet

- Summary On An Intelligent Investor by Benjamin GrahamDocument30 pagesSummary On An Intelligent Investor by Benjamin GrahamvssrjNo ratings yet

- Coursefm 1105Document26 pagesCoursefm 1105api-3723125100% (1)

- Prosper Chapter6v2 PDFDocument28 pagesProsper Chapter6v2 PDFAdam Taggart100% (2)

- PACER LearningSystemDocument18 pagesPACER LearningSystemshamashmNo ratings yet

- FINANCIAL LEVERAGE Gentry Motors Inc. A Producer of Turbine Generators Is in This Situation - EBIT...Document2 pagesFINANCIAL LEVERAGE Gentry Motors Inc. A Producer of Turbine Generators Is in This Situation - EBIT...amrin jannatNo ratings yet

- Conwor ReviewerDocument4 pagesConwor ReviewerlominoquestephenieNo ratings yet

- COMMISSION STRUCTURE - 01 April, 2021 To 30 June, 2021: OrangeDocument2 pagesCOMMISSION STRUCTURE - 01 April, 2021 To 30 June, 2021: Orangekapoor_mukesh4uNo ratings yet

- Annual Report 2019 GreenfreshDocument143 pagesAnnual Report 2019 GreenfreshTaufik HidayatNo ratings yet

- Module 3 Construction Project Procurement and Contract ManagementDocument13 pagesModule 3 Construction Project Procurement and Contract ManagementKej YrastorzaNo ratings yet

- CRT-Prospectus EN Digital Mit Nachtrag Mrz2020Document111 pagesCRT-Prospectus EN Digital Mit Nachtrag Mrz2020Rapulu UdohNo ratings yet

- Uts Akuntansi Keuangan Menengah 2Document5 pagesUts Akuntansi Keuangan Menengah 2Herzian FatihaNo ratings yet

- An Introduction To Financial Markets and InstitutionsDocument18 pagesAn Introduction To Financial Markets and InstitutionsWindyee TanNo ratings yet

- Arens Auditing16e SM 22Document20 pagesArens Auditing16e SM 22김현중No ratings yet

- Credit Suisse Brochure SP Flexible enDocument23 pagesCredit Suisse Brochure SP Flexible ensh2k2kNo ratings yet

- Computational Finance 2Document71 pagesComputational Finance 2Hemant Chaudhari100% (1)