Igst TCS (Provisional) Rounding Off: Terms & Conditions

Igst TCS (Provisional) Rounding Off: Terms & Conditions

Uploaded by

BILLING GLCPLCopyright:

Available Formats

Igst TCS (Provisional) Rounding Off: Terms & Conditions

Igst TCS (Provisional) Rounding Off: Terms & Conditions

Uploaded by

BILLING GLCPLOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Igst TCS (Provisional) Rounding Off: Terms & Conditions

Igst TCS (Provisional) Rounding Off: Terms & Conditions

Uploaded by

BILLING GLCPLCopyright:

Available Formats

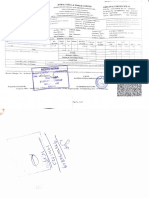

Tax Invoice (ORIGINAL FOR RECIPIENT)

M.R. Steels Invoice No. e-Way Bill No. Dated

Khasra No.78/189-190 TI/2020-21/870 891122271250 28-Oct-2020

Lal Dora, Village Bakoli Challan No Mode/Terms of Payment

North West Delhi

GSTIN/UIN: 07AAQFM3110P1ZY 1 Days

State Name : Delhi, Code : 07 Supplier's Ref. Other Reference

CIN: N/A

E-Mail : accounts@mrconsortium.com SO/2020-21/174 FE-550D JINDAL PANTHER TMT

Consignee Order No. Dated

Girdhari Lal Constraction Private Limited SO/2020-21/174 28-Oct-2020

DEL ADD-IIT , BHUBNESHWAR Despatch Doc No Dated

NEAR JATNI,

KHUDRA (ODISHA) -755020 Despatch Through Destination

GSTIN/UIN : 21AABCG9035B1Z8

PAN/IT No : AABCG9035B TRAILER KHUDRA, ODISHA-755020

Bill of Lading/LR-RR No. Motor Vehicle No.

State Name : Odisha, Code : 21

5166 dt. 28-Oct-2020 OD-02AE-5725

Buyer

Terms of Delivery

Girdhari Lal Constraction Private Limited THIS MATERIAL DISPATCH FROM

PHOENIX ISPAT (P) LTD

IRC Village Plot No-3/445, Nayapalli, ADD- PLOT NO-324/701, VILLAGE PAHAL

DIST. KHURDA , BHUBHNEASHWAR

Bhubaneshwar , Khordha, Odisha GST NO-21AAHCP3472H1ZK

AG BILL NO-PIPL/20-21/01745

GSTIN/UIN : 21AABCG9035B1Z8 DT-27.10.2020

EWAY BILLL NO-891122271250

PAN/IT No : AABCG9035B

State Name : Delhi, Code : 07

Place of Supply : Odisha

Sl Description of Goods HSN/SAC Quantity Rate per Amount

No.

1 08 MM TMT Rebars_Fe-550D_JSPL 72142090 15.110 mt 41,390.00 mt 6,25,402.90

2 12 MM TMT Rebars_Fe-550D_JSPL 72142090 16.560 mt 39,390.00 mt 6,52,298.40

12,77,701.30

IGST 2,29,986.23

TCS (Provisional) 0.075 % 1,130.77

Rounding Off 0.70

Total 31.670 mt ₹ 15,08,819.00

Amount Chargeable (in words) E. & O.E

INR Fifteen Lakh Eight Thousand Eight Hundred Nineteen Only

HSN/SAC Taxable Integrated Tax Total

Value Rate Amount Tax Amount

72142090 12,77,701.30 18% 2,29,986.23 2,29,986.23

Total 12,77,701.30 2,29,986.23 2,29,986.23

Tax Amount (in words) : INR Two Lakh Twenty Nine Thousand Nine Hundred Eighty Six and Twenty Three paise Only

Previous Balance 1,14,55,506.62

Invoice Amount 15,08,819.00

Total Due 1,29,64,325.62

Company's PAN : AAQFM3110P Company's Bank Details

Declaration Bank Name : State Bank Of India A/C No-36469392113

We declare that this invoice shows the actual price of the A/c No. : 36469392113

goods described and that all particulars are true and correct. Branch & IFS Code : Udyog Sadan, Patparganj, Delhi & SBIN0010553

Terms & Conditions

1. I certify that this claim is in all respects true, correct, supported by available documentations and in compliance with all terms/conditions, law and regulations governing its pay ment.

2. Interest will be charged @ 24% P.A. for delay payment

3. +/-0.5% Weightment tolerance is applicable as per industry norms.

4. We will accept the weightment done at proper weightment bridge. weightment done through sectional weight of steel & piece counting will not be accepted for claim of any sho rtage of material

5. Unloading charges at site will be in buyer’s a/c.

6. Charges incurred due to detention of vehicles at site will be in scope of buyer’s and the same will be charged at actual.

7. Payment are to be made only by way of cheque/RTGS/NEFT. Company neither accept cash as mode of payment nor have authorized any one to collect cash payment on it’s behalf

8. The value of goods indicated on this document represent the price actually charged and there is no any additional consideration directly or indirectly flowing from the buyer to t he company.

9. All disputes are subject to Delhi Jurisdiction.

10. E.&O.E.

for M.R. Steels

Authorised Signatory

This is a Computer Generated Invoice

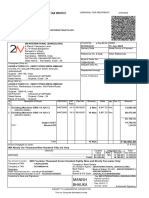

Tax Invoice (DUPLICATE FOR TRANSPORTER)

M.R. Steels Invoice No. e-Way Bill No. Dated

Khasra No.78/189-190 TI/2020-21/870 891122271250 28-Oct-2020

Lal Dora, Village Bakoli Challan No Mode/Terms of Payment

North West Delhi

GSTIN/UIN: 07AAQFM3110P1ZY 1 Days

State Name : Delhi, Code : 07 Supplier's Ref. Other Reference

CIN: N/A

E-Mail : accounts@mrconsortium.com SO/2020-21/174 FE-550D JINDAL PANTHER TMT

Consignee Order No. Dated

Girdhari Lal Constraction Private Limited SO/2020-21/174 28-Oct-2020

DEL ADD-IIT , BHUBNESHWAR Despatch Doc No Dated

NEAR JATNI,

KHUDRA (ODISHA) -755020 Despatch Through Destination

GSTIN/UIN : 21AABCG9035B1Z8

PAN/IT No : AABCG9035B TRAILER KHUDRA, ODISHA-755020

Bill of Lading/LR-RR No. Motor Vehicle No.

State Name : Odisha, Code : 21

5166 dt. 28-Oct-2020 OD-02AE-5725

Buyer

Terms of Delivery

Girdhari Lal Constraction Private Limited THIS MATERIAL DISPATCH FROM

PHOENIX ISPAT (P) LTD

IRC Village Plot No-3/445, Nayapalli, ADD- PLOT NO-324/701, VILLAGE PAHAL

DIST. KHURDA , BHUBHNEASHWAR

Bhubaneshwar , Khordha, Odisha GST NO-21AAHCP3472H1ZK

AG BILL NO-PIPL/20-21/01745

GSTIN/UIN : 21AABCG9035B1Z8 DT-27.10.2020

EWAY BILLL NO-891122271250

PAN/IT No : AABCG9035B

State Name : Delhi, Code : 07

Place of Supply : Odisha

Sl Description of Goods HSN/SAC Quantity Rate per Amount

No.

1 08 MM TMT Rebars_Fe-550D_JSPL 72142090 15.110 mt 41,390.00 mt 6,25,402.90

2 12 MM TMT Rebars_Fe-550D_JSPL 72142090 16.560 mt 39,390.00 mt 6,52,298.40

12,77,701.30

IGST 2,29,986.23

TCS (Provisional) 0.075 % 1,130.77

Rounding Off 0.70

Total 31.670 mt ₹ 15,08,819.00

Amount Chargeable (in words) E. & O.E

INR Fifteen Lakh Eight Thousand Eight Hundred Nineteen Only

HSN/SAC Taxable Integrated Tax Total

Value Rate Amount Tax Amount

72142090 12,77,701.30 18% 2,29,986.23 2,29,986.23

Total 12,77,701.30 2,29,986.23 2,29,986.23

Tax Amount (in words) : INR Two Lakh Twenty Nine Thousand Nine Hundred Eighty Six and Twenty Three paise Only

Previous Balance 1,14,55,506.62

Invoice Amount 15,08,819.00

Total Due 1,29,64,325.62

Company's PAN : AAQFM3110P Company's Bank Details

Declaration Bank Name : State Bank Of India A/C No-36469392113

We declare that this invoice shows the actual price of the A/c No. : 36469392113

goods described and that all particulars are true and correct. Branch & IFS Code : Udyog Sadan, Patparganj, Delhi & SBIN0010553

Terms & Conditions

1. I certify that this claim is in all respects true, correct, supported by available documentations and in compliance with all terms/conditions, law and regulations governing its pay ment.

2. Interest will be charged @ 24% P.A. for delay payment

3. +/-0.5% Weightment tolerance is applicable as per industry norms.

4. We will accept the weightment done at proper weightment bridge. weightment done through sectional weight of steel & piece counting will not be accepted for claim of any sho rtage of material

5. Unloading charges at site will be in buyer’s a/c.

6. Charges incurred due to detention of vehicles at site will be in scope of buyer’s and the same will be charged at actual.

7. Payment are to be made only by way of cheque/RTGS/NEFT. Company neither accept cash as mode of payment nor have authorized any one to collect cash payment on it’s behalf

8. The value of goods indicated on this document represent the price actually charged and there is no any additional consideration directly or indirectly flowing from the buyer to t he company.

9. All disputes are subject to Delhi Jurisdiction.

10. E.&O.E.

for M.R. Steels

Authorised Signatory

This is a Computer Generated Invoice

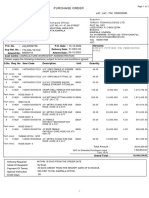

Tax Invoice (TRIPLICATE FOR SUPPLIER)

M.R. Steels Invoice No. e-Way Bill No. Dated

Khasra No.78/189-190 TI/2020-21/870 891122271250 28-Oct-2020

Lal Dora, Village Bakoli Challan No Mode/Terms of Payment

North West Delhi

GSTIN/UIN: 07AAQFM3110P1ZY 1 Days

State Name : Delhi, Code : 07 Supplier's Ref. Other Reference

CIN: N/A

E-Mail : accounts@mrconsortium.com SO/2020-21/174 FE-550D JINDAL PANTHER TMT

Consignee Order No. Dated

Girdhari Lal Constraction Private Limited SO/2020-21/174 28-Oct-2020

DEL ADD-IIT , BHUBNESHWAR Despatch Doc No Dated

NEAR JATNI,

KHUDRA (ODISHA) -755020 Despatch Through Destination

GSTIN/UIN : 21AABCG9035B1Z8

PAN/IT No : AABCG9035B TRAILER KHUDRA, ODISHA-755020

Bill of Lading/LR-RR No. Motor Vehicle No.

State Name : Odisha, Code : 21

5166 dt. 28-Oct-2020 OD-02AE-5725

Buyer

Terms of Delivery

Girdhari Lal Constraction Private Limited THIS MATERIAL DISPATCH FROM

PHOENIX ISPAT (P) LTD

IRC Village Plot No-3/445, Nayapalli, ADD- PLOT NO-324/701, VILLAGE PAHAL

DIST. KHURDA , BHUBHNEASHWAR

Bhubaneshwar , Khordha, Odisha GST NO-21AAHCP3472H1ZK

AG BILL NO-PIPL/20-21/01745

GSTIN/UIN : 21AABCG9035B1Z8 DT-27.10.2020

EWAY BILLL NO-891122271250

PAN/IT No : AABCG9035B

State Name : Delhi, Code : 07

Place of Supply : Odisha

Sl Description of Goods HSN/SAC Quantity Rate per Amount

No.

1 08 MM TMT Rebars_Fe-550D_JSPL 72142090 15.110 mt 41,390.00 mt 6,25,402.90

2 12 MM TMT Rebars_Fe-550D_JSPL 72142090 16.560 mt 39,390.00 mt 6,52,298.40

12,77,701.30

IGST 2,29,986.23

TCS (Provisional) 0.075 % 1,130.77

Rounding Off 0.70

Total 31.670 mt ₹ 15,08,819.00

Amount Chargeable (in words) E. & O.E

INR Fifteen Lakh Eight Thousand Eight Hundred Nineteen Only

HSN/SAC Taxable Integrated Tax Total

Value Rate Amount Tax Amount

72142090 12,77,701.30 18% 2,29,986.23 2,29,986.23

Total 12,77,701.30 2,29,986.23 2,29,986.23

Tax Amount (in words) : INR Two Lakh Twenty Nine Thousand Nine Hundred Eighty Six and Twenty Three paise Only

Previous Balance 1,14,55,506.62

Invoice Amount 15,08,819.00

Total Due 1,29,64,325.62

Company's PAN : AAQFM3110P Company's Bank Details

Declaration Bank Name : State Bank Of India A/C No-36469392113

We declare that this invoice shows the actual price of the A/c No. : 36469392113

goods described and that all particulars are true and correct. Branch & IFS Code : Udyog Sadan, Patparganj, Delhi & SBIN0010553

Terms & Conditions

1. I certify that this claim is in all respects true, correct, supported by available documentations and in compliance with all terms/conditions, law and regulations governing its pay ment.

2. Interest will be charged @ 24% P.A. for delay payment

3. +/-0.5% Weightment tolerance is applicable as per industry norms.

4. We will accept the weightment done at proper weightment bridge. weightment done through sectional weight of steel & piece counting will not be accepted for claim of any sho rtage of material

5. Unloading charges at site will be in buyer’s a/c.

6. Charges incurred due to detention of vehicles at site will be in scope of buyer’s and the same will be charged at actual.

7. Payment are to be made only by way of cheque/RTGS/NEFT. Company neither accept cash as mode of payment nor have authorized any one to collect cash payment on it’s behalf

8. The value of goods indicated on this document represent the price actually charged and there is no any additional consideration directly or indirectly flowing from the buyer to t he company.

9. All disputes are subject to Delhi Jurisdiction.

10. E.&O.E.

for M.R. Steels

Authorised Signatory

This is a Computer Generated Invoice

You might also like

- Sean Wilentz-The Rise of American Democracy - Jefferson To Lincoln-W. W. Norton & Company (2006) PDFDocument1,098 pagesSean Wilentz-The Rise of American Democracy - Jefferson To Lincoln-W. W. Norton & Company (2006) PDFOmar Sánchez Santiago100% (6)

- Hall Ticket IgnouDocument1 pageHall Ticket IgnouPranjalGoelNo ratings yet

- DLL 1 Intro To Personal DevelopmentDocument4 pagesDLL 1 Intro To Personal Developmentanon_298904132100% (17)

- Invoice 39000966-240122-020446-REVDocument3 pagesInvoice 39000966-240122-020446-REVlyquocduy1512No ratings yet

- Saeco Lirika SUP041 RI9840Document6 pagesSaeco Lirika SUP041 RI9840AlexNo ratings yet

- National IndustriesDocument10 pagesNational IndustriesKishan makvanaNo ratings yet

- Pankaj Final Industrial Training Report 1234Document36 pagesPankaj Final Industrial Training Report 1234pankaj madhheshiyaNo ratings yet

- Overview of Bhushan Power and SteelDocument18 pagesOverview of Bhushan Power and SteelAbhishek Dhawan0% (1)

- Advance To PayDocument1 pageAdvance To PayMayank RathodNo ratings yet

- Tata Steel Price ListDocument11 pagesTata Steel Price Listmdavies20No ratings yet

- Structural NPB UB JindalDocument5 pagesStructural NPB UB JindalKalpeshkumar PatelNo ratings yet

- RV1000079425,426,427Document7 pagesRV1000079425,426,427DSEWS DOLVINo ratings yet

- TataDocument102 pagesTataPawan Kr Mishra100% (2)

- Keyword Min Search Volume/Monthmax Search Volume/MonthDocument10 pagesKeyword Min Search Volume/Monthmax Search Volume/MonthShalabhSharmaNo ratings yet

- ARS-2023-24-38 With EwayDocument4 pagesARS-2023-24-38 With EwaypmmahobaNo ratings yet

- Vishal Construction 1Document1 pageVishal Construction 1Mayur PolNo ratings yet

- UP72AT2190Document4 pagesUP72AT2190Aashray JindalNo ratings yet

- BTI-434 Machine JamnagarDocument2 pagesBTI-434 Machine Jamnagareducationgarima9No ratings yet

- Bhushan Steel LTD - PresentationDocument34 pagesBhushan Steel LTD - PresentationHiren Shaw0% (1)

- Sales AJ 033 24-25Document1 pageSales AJ 033 24-25A J INDUSTRIESNo ratings yet

- Jindal-Panther-Tmt-Bar SeptDocument5 pagesJindal-Panther-Tmt-Bar SeptRitesh JhaNo ratings yet

- Bright Steel InvoiceDocument1 pageBright Steel InvoicePradeepta PatraNo ratings yet

- Tata Steel IdeationDocument12 pagesTata Steel IdeationReecha Sinha100% (1)

- Syllabus of OFS RevisedDocument8 pagesSyllabus of OFS Revisedalfred xNo ratings yet

- SAIL-Durgapur Steel PlantDocument13 pagesSAIL-Durgapur Steel PlantKisan kumar SahooNo ratings yet

- SME JSW SteelsDocument18 pagesSME JSW SteelsMeher KhanNo ratings yet

- Purchase Order - 4503555855 - Saint Gobain Abrasives.pDocument5 pagesPurchase Order - 4503555855 - Saint Gobain Abrasives.parahangdale156No ratings yet

- Adishwar Steel BangaloreDocument3 pagesAdishwar Steel BangalorefinanceadishwarsteelsNo ratings yet

- Preforma 12Document90 pagesPreforma 12Miko AbiNo ratings yet

- Pidilite Coimbatore EXZ NAD 41Document2 pagesPidilite Coimbatore EXZ NAD 41Swapnil CallaNo ratings yet

- Jindal Panther PDFDocument11 pagesJindal Panther PDFzilangamba_s4535No ratings yet

- WLBDocument13 pagesWLBSubhajit DeNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)abhinav5596No ratings yet

- Contact Details:: An ISO - 9001 2008 Certi Ed Exporter An ISO - 9001 2008 Certi Ed ExporterDocument3 pagesContact Details:: An ISO - 9001 2008 Certi Ed Exporter An ISO - 9001 2008 Certi Ed ExporterAmardeep Steel SalesNo ratings yet

- Cr-Product Manual - PDFDocument28 pagesCr-Product Manual - PDFThơ Thẫn ThờNo ratings yet

- SPA Research ReportDocument52 pagesSPA Research Reportashu9026No ratings yet

- Erw Pipe Catalogue (Full)Document36 pagesErw Pipe Catalogue (Full)Kaushik ChaudhuryNo ratings yet

- PO 4700071443 ECC SMS-2 SuppDocument33 pagesPO 4700071443 ECC SMS-2 SuppEngineering Construction CorporationNo ratings yet

- Iron & Steel FinalDocument67 pagesIron & Steel FinalKartik Ravichander0% (1)

- Bill 1391 PDFDocument1 pageBill 1391 PDFDeep GuptaNo ratings yet

- Reeny Steels Project ReportDocument56 pagesReeny Steels Project ReportMohit SinghNo ratings yet

- Tata Steel - MRVCDocument16 pagesTata Steel - MRVCRahul NirbaanNo ratings yet

- Cluster Profile Howrah Foundry Industries: West BengalDocument16 pagesCluster Profile Howrah Foundry Industries: West BengalSonal PatelNo ratings yet

- Techno-Commercial Offer For Air Compressor R0Document2 pagesTechno-Commercial Offer For Air Compressor R0Dipanshu SharmaNo ratings yet

- Manufacturer'S Test Certificate: Qatar Wire Products Co. LLCDocument1 pageManufacturer'S Test Certificate: Qatar Wire Products Co. LLCQc QatarNo ratings yet

- Chhattisgarh Steel Conclave-BrochureDocument2 pagesChhattisgarh Steel Conclave-BrochurebalaasenthilNo ratings yet

- Getjobid 1850678Document2 pagesGetjobid 1850678kaswade BrianNo ratings yet

- Utkarsh India Limited - Leading Steel Tube Manufacturer in IndiaDocument20 pagesUtkarsh India Limited - Leading Steel Tube Manufacturer in IndiaUtkarsh India LTD.No ratings yet

- Government of India Ministry of Railways East Central RailwayDocument95 pagesGovernment of India Ministry of Railways East Central RailwaySriram SubramanianNo ratings yet

- 14 Sep 2019 161222113SWJH9F4XPrefeasibilityReportASEPLDocument35 pages14 Sep 2019 161222113SWJH9F4XPrefeasibilityReportASEPLA V RANGA RAONo ratings yet

- PO 7300000152 Bajrang WireDocument6 pagesPO 7300000152 Bajrang WireSM AreaNo ratings yet

- IME 2023 BrochureDocument12 pagesIME 2023 BrochureAxk QueryNo ratings yet

- PO No. 7480000754 Dt. 10.11.2021Document6 pagesPO No. 7480000754 Dt. 10.11.2021Suyog GawandeNo ratings yet

- Jindal Panther: The Creation of A BrandDocument2 pagesJindal Panther: The Creation of A BrandnikiNo ratings yet

- Sale Company Project ReportDocument116 pagesSale Company Project ReportJyoti YadavNo ratings yet

- Swaraj HistoryDocument36 pagesSwaraj HistoryMohit PunaniNo ratings yet

- SteelsDocument66 pagesSteelsoceanicpollachiNo ratings yet

- MCI Metal Craft IndustriesDocument4 pagesMCI Metal Craft IndustriesSaurabh DangariaNo ratings yet

- Project KamleshDocument103 pagesProject Kamleshdeep1aroraNo ratings yet

- Greentech Engineers Company ProfileDocument7 pagesGreentech Engineers Company ProfileMuraliNo ratings yet

- Client Clarification Steel Hypermart TNDocument2 pagesClient Clarification Steel Hypermart TNSURANA1973No ratings yet

- Swan Steels, Inv-313, Amo-51684, Site-Amway DLF Square, Date-28-Jun-2024Document3 pagesSwan Steels, Inv-313, Amo-51684, Site-Amway DLF Square, Date-28-Jun-2024nitesh.kumarNo ratings yet

- Radhika Industrial Corporation (2024-25) : Output Sgst@9% Output Cgst@9% Round OffDocument5 pagesRadhika Industrial Corporation (2024-25) : Output Sgst@9% Output Cgst@9% Round OffdanishshababNo ratings yet

- Jam 596Document3 pagesJam 596danishshababNo ratings yet

- Dover Beach: by Matthew ArnoldDocument16 pagesDover Beach: by Matthew ArnoldShirin KamalNo ratings yet

- Eastman: Harvard Business ReviewDocument2 pagesEastman: Harvard Business ReviewMakuna NatsvlishviliNo ratings yet

- HSIE Marine LifeDocument3 pagesHSIE Marine LifeKirsten HarrisNo ratings yet

- B4A Co v. Yeung, GR 212705, 10 September 2014, First Division Resolution, Perlas-Bernabe (J) - MORA PDFDocument2 pagesB4A Co v. Yeung, GR 212705, 10 September 2014, First Division Resolution, Perlas-Bernabe (J) - MORA PDFloschudentNo ratings yet

- 4.3 Achieving Quality ProductionDocument2 pages4.3 Achieving Quality ProductionannabellNo ratings yet

- Data Comm Lab 4Document10 pagesData Comm Lab 4Sasi TharenNo ratings yet

- 2nd Parkview BrochureDocument14 pages2nd Parkview BrochureJeetendra KumarNo ratings yet

- Lakshmi Machine Works: Performance HighlightsDocument11 pagesLakshmi Machine Works: Performance HighlightsAngel BrokingNo ratings yet

- Project Management: Case Study Corona Virus (1) Project CharterDocument10 pagesProject Management: Case Study Corona Virus (1) Project CharterRanapriyabarua BaruaNo ratings yet

- Design 1 Project 2020 - 2Document2 pagesDesign 1 Project 2020 - 2Shahmi Mat NawiNo ratings yet

- Jhon Tribe Articulo Sobre TurismoDocument21 pagesJhon Tribe Articulo Sobre TurismoDanny Black MHNo ratings yet

- GIS Project Management GIS Project Management: Stakeholder Management Stakeholder ManagementDocument3 pagesGIS Project Management GIS Project Management: Stakeholder Management Stakeholder ManagementLeo DobreciNo ratings yet

- Guidelines for Term-Project and Presentation Macro 2024-25Document3 pagesGuidelines for Term-Project and Presentation Macro 2024-25gpt.mba26No ratings yet

- Learnings From DJ SirDocument94 pagesLearnings From DJ SirHare KrishnaNo ratings yet

- Partnership Is Primarily A Contractual RelationshipDocument8 pagesPartnership Is Primarily A Contractual Relationshipangelica100% (1)

- DLL G6 Q4 Week 4 All SubjectsDocument60 pagesDLL G6 Q4 Week 4 All SubjectsNota BelzNo ratings yet

- Final Research PaperDocument34 pagesFinal Research PaperDhianne Elezabeth MartinezNo ratings yet

- The Economy of GhanaDocument34 pagesThe Economy of GhanaWallaceAceyClarkNo ratings yet

- Module 2: Smart Task 02: Vce Summer Internship Program 2020 (PROJECT FINANCE-Modelling and Analysis)Document5 pagesModule 2: Smart Task 02: Vce Summer Internship Program 2020 (PROJECT FINANCE-Modelling and Analysis)vedant100% (1)

- In Re:) Chapter 11: Debtors.)Document28 pagesIn Re:) Chapter 11: Debtors.)Chapter 11 DocketsNo ratings yet

- PAT0147Document3 pagesPAT0147Hảo HtmNo ratings yet

- Reliance SIP InsureDocument7 pagesReliance SIP Insurebjitud100% (2)

- Legion of The Damned Fandex by BobKDocument10 pagesLegion of The Damned Fandex by BobKjackoftrumps8947No ratings yet

- Section A (20 Marks) Circle The Correct Answer.: Computer Is Made Up of The Things Below EXCEPTDocument11 pagesSection A (20 Marks) Circle The Correct Answer.: Computer Is Made Up of The Things Below EXCEPTNurul Azra QutubuddinNo ratings yet

- SBI Home Loan FinalDocument13 pagesSBI Home Loan FinalRonduck50% (2)

- 1.1. Problem-Solving TechniquesDocument6 pages1.1. Problem-Solving TechniquesPhát TrầnNo ratings yet