0 ratings0% found this document useful (0 votes)

79 views11 - Chapter 7

11 - Chapter 7

Uploaded by

Vinay Kumar Kumar1. The document discusses bank guarantees and injunctions related to letters of credit. It focuses on situations where injunctions may be granted to prevent payment under a letter of credit, specifically in cases of fraud.

2. The general rule is that a bank's obligation under a letter of credit is independent of any disputes between the buyer and seller. However, courts will make an exception and grant an injunction in cases where the seller is proven to be acting fraudulently, such as shipping worthless goods instead of what was agreed upon.

3. One case example discussed is Sztejn v. Henry Schroder Banking Corporation, where the plaintiff alleged the seller shipped cow hair and rubbish instead of the agreed upon

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

11 - Chapter 7

11 - Chapter 7

Uploaded by

Vinay Kumar Kumar0 ratings0% found this document useful (0 votes)

79 views50 pages1. The document discusses bank guarantees and injunctions related to letters of credit. It focuses on situations where injunctions may be granted to prevent payment under a letter of credit, specifically in cases of fraud.

2. The general rule is that a bank's obligation under a letter of credit is independent of any disputes between the buyer and seller. However, courts will make an exception and grant an injunction in cases where the seller is proven to be acting fraudulently, such as shipping worthless goods instead of what was agreed upon.

3. One case example discussed is Sztejn v. Henry Schroder Banking Corporation, where the plaintiff alleged the seller shipped cow hair and rubbish instead of the agreed upon

Original Title

11_chapter 7

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

1. The document discusses bank guarantees and injunctions related to letters of credit. It focuses on situations where injunctions may be granted to prevent payment under a letter of credit, specifically in cases of fraud.

2. The general rule is that a bank's obligation under a letter of credit is independent of any disputes between the buyer and seller. However, courts will make an exception and grant an injunction in cases where the seller is proven to be acting fraudulently, such as shipping worthless goods instead of what was agreed upon.

3. One case example discussed is Sztejn v. Henry Schroder Banking Corporation, where the plaintiff alleged the seller shipped cow hair and rubbish instead of the agreed upon

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

79 views50 pages11 - Chapter 7

11 - Chapter 7

Uploaded by

Vinay Kumar Kumar1. The document discusses bank guarantees and injunctions related to letters of credit. It focuses on situations where injunctions may be granted to prevent payment under a letter of credit, specifically in cases of fraud.

2. The general rule is that a bank's obligation under a letter of credit is independent of any disputes between the buyer and seller. However, courts will make an exception and grant an injunction in cases where the seller is proven to be acting fraudulently, such as shipping worthless goods instead of what was agreed upon.

3. One case example discussed is Sztejn v. Henry Schroder Banking Corporation, where the plaintiff alleged the seller shipped cow hair and rubbish instead of the agreed upon

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 50

293

CHAPTER - VII

BANK QUARAMTBES AMP INJUNCTIONS

The function of the Civil Law ia not only

to lay down or define the rights of the parties but

to provide for and grant relief when a person is

prevented from realizing or enjoying his rights or

when the right has been infringed or in other words,

when the corresponding duty is not being fulfilled

or has been violated. The highest form of protection

which may be expected from or should be aimed by the

state is to see that no one encroaches upon or inter-

cepts the rights of another. Palling that, the aim

of the Law should be to give a suitor the very thing

or nearly equivalent or similar to it as possible

which is being or has been deprived.

An injunction is a discretionary r^nedy, and

for the grant of an injunction we have to refer to the

provisions of the specific Belief Act and the Code of

Civil Procedxire, This means that the Courts in India

have to deal with Injunction not only as an equitable

relief but as a relief founded on the basis of law

which embodies the principles of injunction.

294

Lretters of credit are now coming Into wide

spread use as an effective commercial device. More

small manufactures and business are engaging in

international trade« necessitating their use.

Letters of credit are also becoming more common in

domestic trade. Most important* however* is the

dramatic development of performance guarantee/ bank

guarantee used in both domestic and international

transactions to guarantee the performance of such

contractual promises as construction of roads,

sewers* or buildings* malntainaDce of Sophisticated

communication* manufacturing* or other facilities

in foreign countries. The spread of credit into

nonsale areas* moreover* has just begun. The only

limits on their use are the creative abilities of

those who use them. In short* performance guarantees

are being used in more ways* in more business tran-

sactions* than ever before. The telling proof of

the broadenced Interest in letter of credit law is

dramatic Increase in the number of reported cases.

In the great bulk of these cases the critical Issue

has been under what circiunstances may an Injunction

issue restraining a bank from making payment on its

letter of credit. In other words two questions are

important in this regard. Firstly* is there any

29J

situation in which the bank is under a duty to

refuse payment when requested to do so by the

customer? Secondly, if so, when will an injunction

lie that orders the seller not to draw under the

credit or the issuing banker not to accept or pay?

Corresponding to cases in which buyers try

to take advantage of minor deviations known in

banking parlance as technicalities, beneficiaries

occassionally engage in fraudulent practices such

as falsification of bills of lading or other docu->

ments of title. When this comes to the attention

of the customer or the issuing bank, a thorney legal

problem is in the making.

The Courts will only interfere to grant an

injunction against the beneficiary of the credit pre-

venting him from receiving payment under the credit

Af a sufficiently grave reason could be shown, namely

forgery or fraud by the beneficiary or by some one

for whom he is responsible.

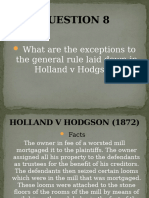

Fraud will be inferred In circumstances when

the goods shipped by the beneficiary are of a totally

different nature from thos contracted for and the

contract of sale ^s specified in the contract of

29J

credit, or the godds shipped contain rubbish. In

cases of fraud the court will not c^npel the

Issuing or confirming banH to honour the credit

because the beneficiary deliberately acts wrongfully

in seeking to avail himself of the credit when the

Icnows that he ( or a person for whOTi his respcMMliale)

has shipped goods which are not those called for by

the terms of the credit*

In accordance with customary law, the bank's

duty to verify and subsequently to accept or pay is

Independent of failure of consideration in the

underlying agreement. The issuing banker is, there-

fore, in an unconfortable position, he knows that

the acceptance or the payment he is going to make,

although warranted by the law because the documents

appear on their face to be genuine, will possibly

cause a loss to his custcxner, especially if the

transaction is an international one. If a seller is

willing to risk the consecjuences of a criminal action

on fraud, it is quite likely that his assets are

either virtually non exlstant or so well hidden that

an action in restitution by the distant purchasers

would result in nothing but an expensive academic

29;

victory for the pucchaser. The banker could became

'technical* himself and pick some deviation, however,

slight, in order to avoid payment, but, if there is

compliance on the face of the documents the bank

would be hard put to make such a claim, especially

if the drafts and documents were presented by an

intermediary negotiating bank.

Since the development of Modern letters of

credit law in the nineteenth century, courts have

uniformly held, as a general rule, the issu^ obli-

gation under the letter of credit is independent of

any defence the customer may have against payment on

the underlying contract. To this rule there is a

recognised exception. This exception provides that

the Courts will give relief if it is established that

the seller is acting fraudulently in the transaction.

In Edward Owen Engineering Ltd. v, Barclays Bank

International Ltd, Brown L,J, stated the exception

as follows I

"The exception is that where the

docviments under the credit are

presented by the beneficiary himself

and the bank knows when the documents

are presented that they are forged

or fraudulent, the bank is entitled

to refuse payment".

290

Under the Anglo-American Law, the customer

should be entitled to the Injunctive relief only

when he could show irreparable damage, for example,

if he had deposited cash with the issuing bank and

the bank was in danger of insolvency, but that.

where the credit was issued merely against the promise

of the buyer to indemnify the bank, the former can

in no way control the discretion of the bank in

paying out its funds under the credit. In sztejn v«

2

Henry Schsoder Banking Corporation, the plaintiff

in New York contracted to purchase a quantity of

bristles from a supplier in India* Payment under

the contract was to be effected by an irrevocable

letter of credit. The letter of credit provides

that the drafts by the beneficiary for a specified

portion of the siile price would be paid by the defendant

bank upon shipment of the merchandise and presenta-

tion of an invoice and bill of lading made out to

the order of the bank. The letter of credit was

delivered to the beneficiary by a correspondent of

the issuing bank in India. Both the bills of lading

and the invoices described the material shipped

exactly as required in the credit as bristles.

29^

The plaintiff alleged that the beneficiary

had filled the fifty crates with cow hair and other

worthless material and rubbish, with the intend of

simulating the merchandise and defrauding the plain-

tiff then alleged that the beneficiary had drawn a

draft under the letter of credit to the order of the

correspondent bank in olndia for collection. The

correspondent bank presented the draft and dociiments

to the issuing bank for payment. The plaintiff there-

upon brought an action seeldng that the letter of

credit be declared void, and asking for an injunction

to prevent of the drafts. Justice Shientag observed!

" I t would be a most unfortunate inter-

ference with business transactions

if a bank before honouring drafts

drawn upon it was obliged or even

allowed to go behind the doctiments,

at the request of the buyer, and

enter into controversies between

buyers and the seller regarding the

quality of the merchandise shipped.

If the buyer and the seller intended

the bank to do this they could have

so provided in the letter of credit

itself, and in the absence of such

a provision the court will not

demand or even pennit the bank to

delay drafts which are proper in

form". But he further said}

"this is not a controversy between

the buyer and seller concerning a

mere breach of warranty regarding

the quality of the merchandise.

OJ

On the present motion, it must

be assumed that the seller has

Intentionally failed to ship

any goods ordered by the buyer.

In such a situation,where the

seller*s £raud has been called

to the bank's attention before

the drafts and documents have

been presented for payments» the

principle of independence of the

banks' obligation under the letter

of credit should not be extended

to protect the unsczupulous seller

It is true that even though the

documents ojr forged or fraudulent,

if the issueing bank has already

paid the draft before receiving

notice of the seller's fraud, i£

will be piayteeded if it exercised

reasonable diligence before

making such payment.

The restraint which was granted, in

SJZTezn's case is subject to two impori:ant qualifi-

cations. First^ that the bank which was collecting

the draft was s^erely acting as the agent of the seller.

This point is significant because if the drafts had

been negotiated to a third party, the court would

have not restrained payrant. Secondly, the case

proceeded on the basis that fraud has been established.

The difficulty which most buyers face in practice

is establishing that fraud had taken place, Vfhen

the buyer is merely alleging that the seller has been

fraudulent* as opposed to actually establishing fraud.

30

the courts are normally cjulte reluctant to interfere.

Equally, if the drafts drawn under the credit had

been negotiated to the holder in due course, the

courts again will not interfere with the payment

Both these facts were taken into account by Megarry

3

J, in Discount Redards v» Barclays Bank, when he

dismissed the buyer's application to stop the issuing

and confirming bank from making payment under the

letter of credit. In this case, the plaintiff, an

English company, ordered from a French Canpany, 8,625

gramophone records and 825 oassetters. A confirmed

irrevocable letter of credit was opened by the buyers

through the defendant bank. When the goods were

delivered, the plaintiffs found that only 275 records

were as oi!"dered and that 75% of the cassetters

delivered vfere not as ordered. The Inspection of

the goods was done in the presence of a representative

of the bank. The plaintiffs instructed the Bank not

to pay on the ground that the seller had acted fraude-

lently. Counsel referred to Sztejn's case for the

proposition that where the seller's fraud has been

called to the bank's attention before the drafts and

documents have been presented for payment, the

3o:

principle of the Independence of the bank's obliga-

tion under the letter of credit aught not to be

extended to protect the unscrupulous seller* In

dismissing the application, Megarray J, distinguished

Szte^n's case on two grounds. First, that Satejn's

case was dealing with established fraud and secondly

in that there was an absence of any possible holder

4

in due course. He saidt

" In the present case, there is,

of course, no established fraud,

but merely an allegation of

fraud, I do not say that the

doctrine of that case is wrong

or that it is incapable of exten-

sion to cases in which fraud is

alleged but has not been established,

provided a sufficient cause is

made out".

Adding the usual caution against undue inter-

ference with the bank's payment obligations,

5

Megarry J, saidg

" 1 wouflid be slow to interfere

with bank*s irrevocable cre-

dits, and Hot least in the

spare of international banking,

unless a sufficiently grave

cause is shown, for intejrventions

by the Court that are too ready

or too frequent might gravely

impair the relliance which, quite

properly, is placed on such

credits".

30.

The difficulty of establishing actual fraud

has been one of the causes which has prevented the

plaintiff from getting an injunction. In United city

Merchants ( investments) Ltd, v* Boyal Bank of Canada,

the House of Lords further decided that a plea of

fraud will only apply If the person applying for

payment is a pazrty to the fraud. The plaintiff in

this case agreed to sell to peruvian buyers equipment

for a glass fibre making plant, Paj^ent was to be by

way of a letter of credit. The contract of sale

provided that shipment was to be made on or before

December 15, 1976, The goods were loaded on boardship

at Flen±4towe on Deceotiber 15, but the loading agents

issued a set of bills of lading on December 15, stating

that the goods were"received for payment". The defen-

dant bank objected to the bills of lading on the ground

that they were not on board bills of lading. The

carriers freight brokers then issued a fresh set of

bills of lading stating that the goods were loaded on

board ship at London on December 15, The bank again

refused to pay, this time on the ground that they had

information which suggests that shipment had not been

made on the date stated in the bills of lading. In an

action by the plaintiffs against the bank, the bank

304

conteiided they were under no obligation to pay i£

the documenta presented although conforming on

their face with the credit, nevertheless contain

seme statements of material facts which were not

accurate. This contention was rejected by the House

of Lords on the ground that to accede to it would

undermine the whole system of financing international

trade by means of documentary credits. Lord Diplock

saidt

•• The exception for fraud on the

part of the beneficiary seeking

to avail himself of the credit

is a clear application of the

maxim exturpi causa non orifxxr

actio or, if plain English is to

be preferred, fraud unravels all".

The Courts will not allow their

process to be used by a dishonest

person to carry out the fraud. The

instant case ,however, does npt

fall within the fraud exception".

In spite of the fact that the Courts have

expressly acknowledged the existence of the fraud

exception, they have, however, shown extreme reluc-

tance to apply the rule lest any damage be done to

the confidence in this system of payment. As in

the case of Bolivinter Oil S,A, V . Chase Manhattan

7

Bank, the court granted an injunction against the

30o

beneficiary of the credit of/performance bond but

left the bank free to honour their obligations if

they chose to do so* The plaintiff's in this case

were freight contractors who entered into an agre«nent

with Homs, an Iranian Company to carry 238 million

tons of Iranian cnide Oil to Syria, The plaintiffs'

gave Hone a performance bond for US fi million payable

at your first request without any other producers

whatever from your side". There was some delay in

the performance of this contract and Homes made a

claim on the plaintiff. The parties entered into

second freight agreement and it was agreed that the

performance guarantee would be released upon the

arrival ofthe cost vessel carrying oil to Syria, The

plaintiffs agreed to provide Homes with a letter of

credit for US^ 4,3 million to cover their disputes.

In spite of the argument Homes made a claim under

the performance guarantee. The plaintiffs obtained

injunctions against Homes# the issuing bank and the

confirming bank« the commercial bank of Syria from

paying out on the performance guarantee, Staughton j.

diacharged the injunctions against the issuing and

confirming bank in a subsequent hearing and the

30 J

plaintiff*a appealed againat this deciaion. The

plaintiffs contended that the injunction was sought

to prevent the beneficiary from profiting from his

own fraud. The court of Appeal decided that this

was not a case of established fraud*

It is clear from the above decisions that

courts maintain a great and fundamentally important

separation between the rights of the peurties under

the underlying contract and the rights of one of them

under the independent banking contract.

Whether fraud has been established in any

given case is a question of fact and closely related

to this is the question of the burden of proof that

lies on the plaintiff before a case of fraud is made

out. The issue was considered by the court of Appeal

g

in United Trading Corporation v. Allied Arab Bank.

The plaintiffs in this case contracted to supply

Agromark, a state enterprise in Iraq* with eggs,

chicken* lamb and beef, A total of 19 contracts*

worth some US ^ 950 million were involved. The plain-

tiffs provided the buyers with a performance guarantee

of 10% of the total value of the contract. The

3o;

guarantee payable unconditionally against any claim

for damages was given hy Rafidian BanX in Iraq on

behalf of the plaintiffs. The buyers made a claim

under the performance bond and the plaintiffs sought

an injunction against the issuing and the confirming

bank to restrain th«m from paying under the guarantee.

The plaintiffs contended that the buyers were acting

fraudulently in that the claims related to contracts

which had been satisfactorily perfoinmed many years

before. The court of Appeal was of the view that

the plaintiffs have established a seriously arguable

case that fraud Y^ad occiired but on the balance of

convenience, they would not grant the injunction,

9

Ackner L.J. said. The evidence of fraud must be

clear, both as to the fact of fraud and as to banlcs

knowledge. The mere assertion or allegation of fraud

would not be sufficient. The Courts require strong

corroborative evidence of the allegation, usually in

the form of contemporary documents, particularly

those emanating from the buyer. In general, for

evidence of fraud to be clear, courts would also expect

the buyer to have been given an apportunity to answer

the allegation and to have failed to provide any, or

30J

any adequate euiswer in circumstanoes where one could

properly be esqpected* where the Courts consider on

the material before it the only realistic inference

is that of a fraud* Then the seller would have made

out a sufficient case of fraud.

Commenting on the reluctance of the courts to

10

apply the exception in practice, AcJcner L,J« observed!

"Moreover we would find it an unsatis-

factory position if, having established

an important exception to what had

previously been thought an absolute

rule, the courts in practice were to

adopt so restrictive approach to the

evidence reguired as to prevent them-

selves fran intervening were this

to be the case, in pressive and high

sounding phrases such as fraud unravels

all".

It is well recognised that letter of credit lore

their economic viability if they are constantly subject

to delay or uncertainty. Letters of credit work well

only if payment under theOR . is pranpt and inevitable

when the beneficiary's documents are in order. C«nmer-

cial law has always recognised the high cost of fraud,

however, and some courts are justifeably concerned

that the credit not become a device for perpetrating

fraud. In cases of fraud, courts have been willing to

resort to their ecjuity powers to delay payment of the

30o

credit unfortunately, courts are not in a position

to know whether an account party's claim of fraud

is valid« and sometimes are properly reluctant to

entertain the fraud defence of an issuer or of an

account party seeking to enjoin honour of the credit.

The fraud inquiry entails considerable investigation

and time, if courts delay honour of credit until

the parties have litigated the fraud issue, the

credit will not survive as an efficient cannmercial

device and will not achieve some of its significant

commercial functions. Although there is a split of

authority on the scope of ffaud question, even those

courts that given the fraud defence broad scope

acknowledge that the costs of doing so are high.

Section 5-111(1) of the Uniform Commercial

Code imposes on the beneficiary of a letter of credit

a warranty obligation. The statute provides that

the beneficiary transfer or presentation of a docu-

mentary drafts or demand for payment warrants to all

interested parties that the necessary conditions of

the credit have been complied with.

First, the existence of warranty often gives

the complaining account party an adequate remedy at

310

law and should deprive him or her of the Equitable

relief so Often sought at great expense to the letter

of credit transaction. Second, the warranty gives

independent significance to the beneficiary's certi*

ficate common in perforraance guarantee transactions

and thereby over-comes the impliaation that the

purpose of the certificate is to give the account

party/beneficiary a fraud defence to a claim for

payment under the credit. Third, the warranty relieves

the account party from sometimes burden some proof

problems in his or her action for damages against

beneficiary that has obtained payment under the credit

with documents that contain latent defects.

In performance guarantees, the credit commonly

requires the beneficiary to certify - - ^i_ that

the account party has failed to perform his or her

executary permission. This is also known as a

certificate of inspection. A certificate of inspection

is a document which is issued by some one designated

euMl by both parties, or by a third party that is

asked to inspect the goods prior to shipment or at

the moment of shipment, or whatever is the nature

of credit. It may be a construction of something,it

may be, now-a-days drilling equipment or whatever, a

certificate of inspection is a documents then which

31

says, " I have inspected that which is to be

inspected under the credit. I hereby render an

opinion that this is in accordance with that was

12

stipulated to be the goods or service to be performed" ,

The requirement of other documents, and particularly

certificates of analysis, quality, weight and the like,

is a reasonable precaution for a prudent buyer to take,

since he may in this way obtain some measure of

assurance that the merchandise is as ordered. Courts

unaware of the beneficiary's warranty may be inclined

to see these certificates as a protection against the

beneficiary's fraud, under this view the account party

has insisted on the certificate in order to have a

fraud defence should the beneficiary present a false

certificate. This view beccmies all the more compelling

when the certificate referes to the underlying contract

by reciting for example, that a sum is due under a

contract or a lease. In these cases, the courts are

wont to say that the certificate incorporates the under-

lying contract and opens the letter of credit litiga-

tion to the resolution of underlying contract disputes,

that is, whether the sxun is in fact due. It is impor-

tant to recognise that the certificate plays an important

role in the transaction without serving as a vehicle for

312

entering the underlying dispute in the credit

transaction. It is true that the warranty forces

the court to look beneath the face of documents but

the warranty inquiry occures after the credit is paid

and does not interfere with the proper functioning

of the credit,

Cotirts can achieve two desirable results by

giving full rein to warranty provisions. First, they

can enhance the remedies for a defrauded account party.

Second, they can reduce the number of orders restraining

issuing bank from paying credits. This first result

puts fraud costs on beneficiaries withoat damaging

the credit. The second protects the credit device

from the impredictable costs and delays that equitable

interference inevitably imposes on credits in general

By reducing these costs and delays, courts will enhance

13

•to the benefit of all industries that use them,

A ccMiunercial letter of credit is independent

of the underlying sales contract between the customer

and the beneficiary. The issuers responsibility:K >to

honour a draft drawn under the credit is not affected

by the sellers* breach of warranty concerning the

quality or the conditions of goods involved. Thus in

the usual course the issuer must honour the draft for

313

payment that complies with the terms of the relevant

credit, regardless of whether the goods or dociiments

conform to the underlying contract. However, where

the documents or the underlying transaction are

tainted with the beneficiary's intentional fraud the

issuer need not honour the draft even though the

documents comply on their face, A proper definition

of fraud will necessarily encompass and be limited

by the recjuirement of scienter, that there be an affir-

mative, knowing misrepresentation of fact or that

the beneficiary state a fact not having any idea

about its truth or falsity, and in reckless disregard

of truth.

The stand-by letter of credit is useful in

such transactions precisely because it allows the

parties to shift the risk of unjustified demand from

the beneficiary to the custaner. This legitimate

purpose can best be served by a narrow definition of

fraud in the transaction. A strict definition of

fraud in the transaction would ultimately made the

standby letters of credit more valuable v/here it is

appropriate and thus preserve its usefulness in commer-

cial transactions.14

J14

Such a Btand«rd would not destroy the

coinmercial utility of letters of credit because it

serves no commercial purpose to provide certainty of

payment to one who has intentionally deceived other

parties to a transaction. Nor would such a standard

make injunctions readily available. Not merely

fraud be pleaded with particularity, but also the

four traditional factors Justifying a preliminary

injunction must be considered, First the probability

that the plaintiff will eventually succeed on the

merits; second, the presence of irreparable injury

to the plaintiff; third, the injury to the defendant

if the injxinction is granted; and, finally, the

interest of the public or third parties.

It is clear that the fraud exception is now

firmly recognised by the English Courts, in spite of

this recognition one seases an extreme reluctance by

the courts to apply it in practice for fear that irre-

porable damage would be done to the system of payment

that has grown up with the letter of credit. The

Courts have strived to maintain confidence in this

system of payment at the expense of a few individuals

who have entered into inexpedient contracts and this

is by no means a bad thing.

31J

The letter ot credit to-day Is an extremely

useful and viable financing device« both In the

sale of goods transaction

traditional/and In the more recent performance guarantee.

In the future the letter of credit will become

Increasingly Important In both International and

domestic earamercial and business transactions. As

the letter of credit grows in popularity the principles

of law applied to th«n- must be more fully elaborated

if their efficacy is to be maintained, in case of

letter of credit of international trade requires presen-

tation of documents prepared independently of the

beneficiary. In the case of performance guarantee

the documents called for is usually the beneficiary's

own certificate that the other party to the underlying

transaction is in default there under an open initiation

to abuse by the unscrupulous beneficiary. In any events

instances of fraud involving performance guarantee

appears ^ to be much ra«er than theoretical fears

could indicate. Loss of reputation in the interna-

tional community is a severe and immediate sanction

awaiting a dishonest beneficiary.

Indian poaltlon

Vfhether a bank guarantee has become enfor-

ceable or not wiil depend on its terms and the

language of the letter of demand. In other words.

In case of bank guarantee or a letter of credit

the enforceability of such an instrument against

the bank depends on the terms and conditions of the

same. In practice, the questions that most frequently

arise relate to the guarantor's liability. The

guaranteeing bank is liable for non-performance of

the underlying contract. This much is elementary

and flows from the very nature of the contract. But

in practice there arises questions of enforcement.

Is the guaranteeing bank entitled to defnahd proof

of non-performance, or is it bound to comply with

the guarantee as soon as it is called upon to do so 7

If the former is the case, then there can possibily

arise disputes as to non-performance. This is likely

to drag in the conflict between the Principal and

the beneficiary in the correspondence between the

guarantor and the beneficiary. On the other hand,

if the beneficiary and the bankioat to avAid such

three dimensional controversy, the guarantee can

either be made absolute and unconditional or at least

JIV

some acceptable mechanism for concrete proof of non-

performance may be laid down in the contract of

guarantee.

The same principles of Law which have been

adhered to and accepted by the courts in England and

the United States have been adopted and adhered to

by the courts in India as well. In Ten Maco Ltd, v,

16

State Bank of India and others^ it was held that the

bank must pay according to its guarantee, on demand, if

so stipulated, without proof or conditions. The only

exception is when there is a clear fraud of which

the *tbank has notice. The facts of the case wh«=»re that

at the request of the Pet|:tdkoner company the respondent

bank had given an irrevocable and unconditional

performance guarantee in favour of the State Trading

Corporation of India Ltd, ( S,T,C, ) which provided

interalia that in the event of the company's failure

to fulfil their contractual obligations the bank shall

pay to S,T,C, on its first demand the guarantee amount

without any contestation, demur or pro-test and/or

without amy reference to the ccmipany and /or without

questioning the legal relationship subsisting between

S,T,C, and Texrmaco, The guarantee was later invoked

by the S,T,C, and asked the bank for full payment.

313

the petitioner company there upon filed a suit.

A question, therefore« arose whether the Textnaco

was entitled to the Injunction as asked for, res-

training the bank from making any payment to the

S,T»C, In pursuance of the performance guarantee.

The Court said that In the absence of any

special equities and the absence of any clear fraud,

the bank must pay on demand, if so stipulated and

whether the terms are such must have to be found out

from the performance guarantee as such* Though the

guarantee was given for the performance by Te^^aco

In an orderly manner their contractual obligation was

taken by the bank to repay the amount on first demand

and without contestation, demur or protest as without

reference to Te^^aco and without question the legal

relationship subsisting between S.T.c. and Termaco.

The performance guarantee fxorther provided that the

decision of S.T.C. as to the liability of the bank

under the guarantee shall be final and binding on the

bank. It has further stipulated that the bank should

forthwith pay the amount due " notwithstanding any

dispute between S.T.C. and Texmaco." In that context

the moment a demand is without protest and contestation

the bank is obliged to payirrespectlve of any dlsjmte

as to whether there has been performance In an

31J

orderly maaner of the contractual obligation by

the party. There was no question here of any fraud or

equity entitling Tcamaco to an injunction.

Another case on the subject is National Oils

and Chemical Industrie3« Delhi v, Punjab and Said Bank

n

Ltd.J Delhi. In this case it was contended that a

confijnmed letter of credit constitutes a bargain between

the banker and the vendor of the Qoods^ which imposes

on the bank an absolute obligation to pay irrespective

of any dispute which there may be between the parties

and it would be wrong for the courts to interfere with

that established practice by granting and in confirming

the injunction, because an eleborate coramercial system

has been built upon on the footing that the bankerts

confirmed credit raises an rassurance that nothing

will prevent the vendor from receiving the price, that

the character-istlc feature of the irrevocable credit

own

is its/independence of the contract for sale and of

contract between the banker and the buyer and that ano-

^^®^ important feature is the duty of strict compliance

being a mechanism of great* importance in international

trade, interference with which is bound to have serious

32

repercussions on the international trade in the

country and that the letter of credit being the life

blood of international commerce and except possibly

in clear cases of fraud of which the banks have notice,

the courts ought to leave the merchants to settle

their disputes under the Contract by litigation and

arbitration available them as stipulated in the

contracts, the courts being not concerned with the

difficulties of the merchants to enforce their claims

because these are the risks which the merchants take*

In case there are serious allegations of fraud

on prima facie examination of the said allegations in

the light of the averments of the parties, the matter

cannot be allowed to rest at that and deserves to be

fully probed and determined. In such a case the

principle of Independence of bank's obligation under

the letter of credit is not to be extended to protect

the unscrupulous seller.

Pesticides India v, S«C^ and p. Corporation

of India, raised the question of performance guarantees

by banks, particularly in the light of the absolute

nature of liability: of the principal debtor on whose

behalf the guarantee was given. In the instant case

J2'^

the £act8 were*

W« the Statui Bank o£ Bikaner and Jaipur,

Udalpur bind ourselves xincondltlonally and Irrevocably

guarantee and undertake that in the event of any

default/ failure on the part of the Actual user/ Allottee

to observe all or any of the conditions prescribed/

to be prescribed by you. We shall on your first

demand without protest or demur and without reference

to the Actual user/Allottee and notwithstanding any

contestation by actual user/Allottee or existence of

any dispute whatsoever between you and the Actual user/

Allottee pay forth with to you that you may deanand.

It was held that the bank was bound to pay on

the first demand without any contestation by the

Pesticides India, the principal debtor. Thus according

to the Court the unqualified terms of the guaranttee

could not be interfered with by the courts, irrespec-

tive of the existence of the dispute.

The above has been supported bv the Supreme

Court in Centeen (India) Ltd. v. Vlnmor/lnc. The point

before the Suprane Couri; was whether in view of its

earlier decision in United Cooanercial Bank v. Bank of

20

India* it could interfere to grant Injunction for th

Enforcement of the bank gueurantee. The sellers, a

322

Singapore oonoern, agreed to sell high density

polythene to the buyer^ em Indian Company^ Canteix

(India) Ltd. on the basis of an irrevocable letter

of credit in favour of the former. The buyer complied

with the condition. The seller failed to forward,

through bank, the original bills of lading, marine

insurance policy, signed invoices etc, to enable the

buyer to take the delivery of goods. The buyer

secured bank guarantees In favour of the shipping

Company, where-after the latter released the goods

to the buyer without furnishing to it the above

documents. The buyer receive the goods, sold them

and realised the sale proceeds* But no amount was

paid to the seller. The buyer brought a suit for res-

training the bank from paying the money on the alleged

ground of inferiols quality of goods. The Supreme Court

held that the balance of convenience was that the

injunction should not be granted. Affirming the deci-

sion of the High Court the Supreme Court held that

commitments of banks must be allowed to be honoured

free from interference by the courts, otherwise, trust

in international ccxnmerce would be irreparably damaged.

The courts usually r«frain from granting

injunction to restrain the performance of the contractual

liZ.

obligations arising out o£ a letter o£ cjredlt or

bank guarantee between ane bank and another. If

temporary Injunctloas were to be granted In a tran-

saction between a bank and a banker, restraining a

bank fvon recalling the amoiint due when payment Ip

made under reserve to another bank or In terms of

the letter of credit executed by lt« the whole banking

system In the country would fall. In view of the

Banker's obligation under an Irrevocable letter of

credit his buyer customer cannot Instruct him not to

In the following cases the enforcement of bank

guarantee as a qpilck mode of recovery of sums due under

the printed terms of the contract has been considered

and the law Is almost settled.

In National Project Constinictlon Corporation

22

Ltd. V. M/s G. Ranjan^ the bank guaranteed the recovery

of the sumof te, 3,50«000 by the petitioner,corporation.

The bank guarantee provided If the said contractor faljs

to utilise the said advance for the purpose of contract

we the Bank of Baroda, hereby unconditionally and Irre-

vocably undertake to pay the corporation on demand and

without demur and any claim made by the corporation on

:i2

us for the loss or damage caused to or suffered by

reason of the corporation not being able to recover

In full the said sunt*

The trial court Issued an Injunction res-

training the corporation from enforcement of the bank

guarantee. The Calcutta High Court allowed the

revision application and set aside the order of

injunction. The Court cited with approval the deci-

sion of the Supreme Court in MSEB Bombay v» Official

23

Liquidator^ The Cotxrt held thusi

** The petitioner is entitled to fall

back upon the bank guarantee when

the balance sum had not been paid

petitioner's right to realize that

balance is not dependent upon adjudica-

tion of the dispute to arbitration*

To this extent^ the bank guarantee

can very well be enforced on its own terms,"

The law is thus settled that extraneous claims

and counter claims do not injunct the enforcement

of the bank guarantee. The enforcement depends upon

its terms and conditions.

In a recent case D»T»H, Construction (P) Ltd,, v,

24

Steel Authority of India,,# the Calcutta High

Court refused to issue an injunction restraining the

:idJ

enforcement of bank guarantee. The contract In the

Inatant case was for dredging and deepening a reservlor

and the plaintiff received from the defendant No«l

Rs, 30 lakhs for bringing machinery for the work, A

survey revealed that the reservoir could neither be

dredged nor deepened because of the brlck« railway

tracks and rocks under neath. The judge did not accept

the Contention of the bank that under section 56 the

guarantee was rendered void an account of Impossibility

of performance. The Judge observed:

Even If the main contract between

the plaintiff and defendant No.l

was entered Into by the plaintiff

on account of lackof knowledge of

certain facts by the defendant No,l

or even because of misrepresentation

made by defendant No, 1, the bank co\ild

have no say In the matter. This Is

now %rell established by several

decisions of this ootirt as well as

the Supreme Coxirt and of the English

Courts, 25

The decision correctly follows the judicial

preeedctata and Is grounded on the theory that the

contract between bank and defendant No,l was Independent

26

of the Contract between the plaintiff an6 defendant No,l

Again, In United CCTtimerclal Bank v, Hanuman~

27

Synthetlces Ltd,, the latter agreed to buy from a

323

Singapore concern specified quantity of vis core

staple fibre. The purchasers opened an irrevocable

letter of aredit at the Central Bank of India in favour

of the seller. The United Commercial Bank Singapore,

paid the amount ag2Li.n8t the documents for the goods

shipped and forwarded them to Central Bank of India,

Bombay* The united Commercial Bank refunded the amount

on arrival, the customs authorities declared that the

imported stuff was not vis core but polyester fibre.

The purchasers asked its bank to repudiate its liability

and sought a perpetual injunction against it from

making any payment or giving credit to the seller an^er

the irrevocable letter of credit. The Court held that

except possibly in clear caMe of fraud of which the

banks have notice, the courts will leave the merchants

to settle their disputes under the contracts by liti-

gation or arbitration as available to them or stipulated

in the contract.

If the bank guarantees are unconditional the

bank has no defence when its guarantee is sought to be

enforced. It iai :th« document of guarantee that has to be

scanned to ascertain whether the guarantee is conditional

or otherwise and whether it is an autonomous contract by

itself. Only in case of a clear fraud of which the

327

bank haa notice and where the special equity was

in favour of the beneficiary - the courts may grant

an injunction restraining enforcement of bank

28

guarantee*

Recently Sabyasachi Mukharji and Jagannatha

Shetty, JJ, of Supreme Court have considered the

various Supreme Court and High Courts cases in U»P.

Co«>operative Federation Ltd, v» Singh Consultants and

29

Bngineers (P) Ltd, The Court heldi

The principles upon which bank guarantees

could be invoked or restrained are well settled, only

in exceptional circumstances would the courts interfere

with the machinery of irrevocable obligations assured

by the banks. In the case of a confined performance

guarantee^ Just as in the case of a confined letter of

credit, the bank is only concerned to ensure that the

terms of its mandate and confizitnation had been complied

with and is in no way concerned with any contractual

disputes which might have arisen between the parties.

Therefore the commitments of banks must be honoured

free from interference by the courts, otherwise trust

in commerce* internal and international, would be irre-

porably damaged. It is only in exceptional cases of

32J

fraud or in cases of irretrievable injustice to be

done* the courts should interfere.

The facts of the instant case were that the

appellant, a State Government enterprise, on May 17,

1983 entarttd into a contract, a private limited

company for the supply and installation of a vanaspati

manufacturing plant at Hardeecharu in the District

of Nainital. The contract bond contemplated guaranteed

performance of work at various stages in accordance

with schedule prescribed therein and provided for

completion and commissioning of the plant after due

trial run by the May 15, 1984,

Two bank guarantees were executed by the

Bank of India, Ghaziabad, and the bank guarantee

provided, inter alia as followsi

Now, therefore, the Bank hereby guarantees

to make unconditional payments of Rs, 16,5 lacs to the

Federation on demand at its office at Lucknow without

any further question or reference to the on the seller's

failure to fulfil the terms of the sale on the following

terms and conditionsi

(A) The sole judge for deciding whether the seller

has failed to fulfil the terms of the sale, shall be

the PCB.

a2j

(B) This guarantee ahull be valid upto twelve

months from the date of is8ue«i,e« upto June 24,1984«

(C) Claims, if any, must reach the bank in

writing on or before expiry date of this guarantee

after which the bank will no longer be liable to make

payment to PCF.

(D) Bank's liability under this guarantee

deed is limited to 16,5 lacs ( Rupees sixteen lacs

fifty thousand only )«

(£} This guarantee shall not be revoked by the

bank in any case before the expiry of its date without

written permission of the Federation,

And whereas to secure the said advance, the

seller requested the bank to fxirnish a Bank guarantee

of the said amount of Rs. 33 lacs ( Rupees thirty three

lacs) in favour of the PCF and the bank accepted the

said request and agreed to issue the required bank

guarantee in favour of the Federation,

Now, therefore, in consideration of the

aforesaid advance of the said sum of Rs, 33 lacs (Rupees

thirty three iacs) to be paid by the PCF to the seller

as aforesaid the bank hereby agrees and guarantees to

make unconditionally immediate payment to the Federation

at its office at Lucknow of the sum or any part thereof.

33d

as the case may be, due to PCF from the seller

at any time on receipt of the notice of demand

without any question or reference to the PCF or to

the seller on the seller's failure to fulfil the

terms of the said advance.

In the instant case, injunction was sought

against the bank and not against the respondents, it

was held by the Supreme Court that the net effect of

injunction was to restrain the Bank from performing

bank guarantee. That could not be done.one cannot

indirectly do what one is not free to do directly.

But a mal ~ treated man in such circumstances is not

remedyless. The respondent was not to suffer any

injustice which was irretrievable» The respondent

could sue the appellant for damages. This is not a

case where an injunction can be granted. Irrevocable

ccxnmitment either in the form of confirmed bank

guarantee or irrevocable letter of credit cannot be

interfered with except in the case of question of

apprehension of irjretrievable injustice , This is a

well settled principle of law in England, This is

also a well settled principle of law in India,

33x

Each case has to be examined In the light

of the followingI

(1) Whether demands for enforcing the bank

guarantees has been made strictly In accordance

with the terms of the document concerned; or

(2) Whether there is any allegation of fraud

against the beneficiary of which the bank has

notice; or

(3) Whether there is any special equity arising

out of the peurticular situation of the case giving

rise to a strong prima facie arguable case against

enforcement of the bank guarantee or not. This test

was applied in f^/s Banerjee and Banerjee v, Hindustan

Steel Works Construction Ltd, in the instant case

the bank guarantees were g]bren pursuant to the express

terms of the contract entered into between the peti-

tioner, a principal debtor and the respondent No.l,

a beneficiary, a company for constjruction of works in

the Super power Thermal project. Out of the seven

bank guarantees, two were in lieu of security deposit

and five were for securing mobilisation advance by

the respondent No.l to the petitioner under the terms

of guarantees^ for enforcement of the guarantees the

respondent No,l had to make a written demand stating

33^

that the petitioner has coramitteed breach of any

terms of the contract and the extent and the

quantum of JLOSS or damage suffered or to be suffered

by the respondent No.l as a result thereof. The

decision of the respondent No«l regarding the quantum

of damage was not to be questioned or challanged by

the banks or fulfilment of these tvro conditions, the

bank was bound to release the guaranteed amount.

However the respondent No.l while seeking the enforce-

ment of the bank guarantees failed to discharge its

duty as the sole Judge to quantify the damages and

to mention the extent of recoveries made by it although

it was within its special knowledge. Although a

large amount was recovered by the respondent No.l

there was no whisper about the same in the demand

letters.

It was held that by suppressing the material

fact from the bank the respondent No, 1 attempted to

recover the entire sum under the seven guarantees and

the suppression of such material fact in the demand

letters have given rise to a special equity in favour

of the petitioner to stop payment by the bank on the

basis of these demand letters. Although in the

33o

petition, there was no allegation of fraud, the

said wilful flase representation by the beneficiary

that the entire guaranteed amount has become due and

payable by suppressing the facts of recoveries

already made, was a factor, which must be treated

on the same footing as fraud giving rise to a

special equity and must be treated as an exception

to the general rule that the court should not Inter-

fere In these matters.

Similarly in Jute .^^ corporation of India v#

-31

M/s Konark Jute Ltd,, the principal had given two

bank guarantees to the purchasing agent. The principal

sought to restrain the purchasing agent of Jute from

enforcing the bank guarantee and restrain the banks

from making payment thereof. The Court found that

the balance of convenience was in favour of the

principal. It was held that in the peculiar circum-

stances of the case, the receipt of the money on bank

guarantee would ruin of the principal which cannot be

repaired. The balance of convenience in such a situa-

tion would be in favour of the principal.

The Court also wanted to protect the business

of the agent so that the ends of Justice were not

defeated. It, therefore, held that this could be best

,} d -i

done in case the principal securiBd the commercial

rate of interest on the amount on both the bank

guarantees £or six months to the satisfaction of

the trial court.

In M,S,J,R» Enterprises v« M/s State Trading

32

Corpn, of India Ltd,, the bank guarantee provided

that the bank hereby unconditionally and irrevocably

guarantee that if the Agents fall to perform any of

th^i^obligatlons contained in the contract dated

10,9.1982 including any amendments or modifications

to the aforesaid contract dated 10,9,1982 made between

the Agents and STC, The bank shall pay forthwith to

the STC such amount or amounts as the bank may be called

upon to pay subject to the mauclmum of Rs, 10 lakhs pro-

vided -that the guarantee herein furnished shall be

released and discharged after the expiry of 30 days

from the day of the shipment of the I'ost lot of goods,

in respect of the export contracts between the STC and

the foreign buyers.

It has been held that since prima facie the

guarantee stood discharged and although no element of

fraud existed yet the guarantee having been Invoked

after it had prima facie esqpired. It was a fit case

d:i

that during the pendency of the suit the injunc^on

was granted restraining the corporation frcxn realising

the amount o£ the bank guarantee.

Although the courts are not concerned with

the underlying contract on the basis of which the

bank guarantee have been given. Yet the situation

may arise where the underlying contract was not

concluded one. In such a case the cjuestion is v Can

there be enforcement of the bank guarantee or not?

The Bombay High Court in Kirtoskar Pneumatic Co,Ltd»v,

N,T»P, Corpn. Ltd, it was held that there was no

contract between the parties to keep to bid alive

that the bid could be revoked before the acceptance

or the appellant have done, that the respondents did

not act to their detriment relying on the bid of the

appellants, the bid guarantee c o u M only be invoked

if the contract were to be awarded to the appellant•s

and they had failed to pay the amount or to perform

their part which stage never arose. The respondents

could not invoke the bid guarantee in terms of the

contract and hence a clear prima facie case exists,

where in an injunction can be issued whereby the bank

is restrained by making the payment. The court

ri *

J3

further held that the balance of convenience also

Is clearly in favour of the appellants because even

are

if the above findings/ found to be wrong all that

would happen is that at the end of the litigation Appea-

lants would be able to recover the amount of the

bid guarantee or such other sum as may be determined

by the Court, It is nobody's case that the appellant's

are not solvent to the extent of bid guarantee and

hence all the conditions of Issuance of temporary

injunction are satisfied.

In M/s Synthetic Foams Ltd. v, aimplex C»P«

34

(India) Pvt, Ltd», the facts were that the completion

of the contract by the plaintiff has been withheld

not due to any default of the plaintiff but due to

the intervening fire which has taken place at the site.

There is nothing to suggest that the plaintiff has

committed any default in the performance of the contract

or any breach of the terms of the order, where as the

peirusal of letter filed by the plaintiffs shows that

the guarantee was sought to be invoked by the defendant

No, 1 on the ground that the plaintiff have not fulfilled

the obligation contained in the terms and the conditions

of the order, which is misrepresentation of facts.

secondly, the contract has been cancelled by the

defendant No, 1 due to technical reasons and also

due to Increase in prices rather than due to any

fault of the plaintiff.

The bank guarantee was as follows:

••we, Indian overseas Bank hereby

agree and undertake that if in

your opinion any default is made

by M/s Synthetic Foams Ltd, in

performing any of the terms and/or

conditions of the order or if in

your opinion they commit any breach

of the order or there is any demand

by you against ^^/s Synthetic Foams

Ltd, then on notice to us by you,

we shall on demand and without demur

and without reference to M/s Synthetic

Foams Ltd, immediately pay to you, in

any manner in which you may direct,

the said amount of Rs, 1,00,000/-

(Rupeea one lakh only ) or such portion

thereof as may be demanded by you not

exceeding the said seen and as you may

from time to time require . ••

The courts ?Iown where there are allegations of

misrepresentation or suppression of material facts or

violation of the terms of guarantee, the courts would

not hesitate in granting an injunction. In this content,

misrepresentation or suppression of material facts or

violation of the terms of the guarantee can be treated

as a species of the same genus as fraud. What is

necessary that there exists special equity in favour of

li'S

the pl«dntlff to grant of injunction. No doubt an

obligation of a bank under the bank guarantee is'

absolute^ but such an absolute obligation arises

only if the conditions of the bond are satisfied

and if the demand made on the bank is in strict accord

with its terms and there is no element of fraud,

misrepresentation or suppression of material facts

involved but where there are allegations of fraud,

misrepresentation or suppression of facts made by the

party against the beneficieiry and there is prima facie

evidence to suggest that there is some truth in these

allegations then there would possibly be no absolute

bar against the courts from granting an injunction

restraining the bank fran making payment on the basis

of the bank guarantee* Similetr would be the position

where the dememd made by the beneficiary is in violation

of the conditions of the bond or is not in strict

accord with its terms keeping in view the nature of

obligation of the bank the terms of the bank guarantee

would have to be strictly construed in such cases.

Accordingly in the instant case an injunction was

granted restraining the defendants from enforcing the

bank guarantee.

33-

By enunciating the general principle of non-

interference by the courts in respectof the bank

guarantee and letter of credit^ the courts only

Intended that the International trade and commerce

should function smoothly without interference from

court. At the same time, the courts expected that

the merchants and traders in international trade and

ccwnmerce will honour their respective ccxnmitments

and the business honesty would be maintained. By

the theory of non-interference in cases of letters

of cxredit and bank guarantees, certainly the courts

did not intend that international trade and commerce

should flourish by adopting dishonest unscmpulous

practice. These trade practices and the commitments

by the banks are treated on a different level by the

courts and are allowed to function without interference

frcxn courts only with the view that the trust in inter-

national com/nerce is not damaged in any way and not

for encouraging malafide activities of unscrupulous

traders. If so, fraud or the special equity arising

out of the peculiar situation of the case could not

have been made exceptions to the general principles

of non-interference by courts.

REFERENCES

1. (1978) 1 Q,B. 159

2. (1941) 31 N.Y.S. 2d. 631

3. (1975) ILloyds Rep« 444

4« Ibid*« at p, 447

5, Ibid,,at p. 448

6, (1982) 2 Llyod»s Rep, 1

7, (1984) 1 Llyod's Rep, 251

8, (1985) 2 Llyod's Rep, 854

9, Ibid, at p, 561

10, Id, at p. 56

11, John F, Dolan,letters of credit. Article 5

Warranties, Fraud and the BeneiElclary's certi-

ficate. The Business Lawyer, Vol, 41 No,2

P, 347 1986,

12, Boriskozolchyk. The letter sif credit In courtj

An Export Testifies, Banking Law Journal, 340

13, Supra note 11

14, Mlchhale Stern, The Independence Rule In standby

Letters of Credit, The University of ChlcagoLR

vol, 52, 1985,

15, Nussbei,um« Temporary Restraining Orders and

Preliminary Injunctions, The Federal Practice,

26 S.W,L.J. 265, 273 ( 1972) cited by Edward L,

Symons,JR,, Letters of credit. Fraud, Good-faith

and the Basis for Injunctive Relief, TULANE LAW

R, Vol, 54, 1979, p, 380 (1980)

34

16. A.I.R, 1979 Cal, 44; Indian Cable Co, Ltd, v*

M/s Plastic Products Engineering Co,,A,I,R.

1979 Cal. 370,

17, A,I,R, 1979 Del, 9

18, A,I,R. 1982 Del, 76| A same view has been taken

In M/s B,L,R« Mohan y., P,S, Co-op, S.& M,

Federation,Ltd, A,I,R, 1982 Del, 357| B.S.Aujla

Company Pvt, Ltd, v« Kaluram Mohan Deo Prasad,

A.I.R, 1983 Cal, 106; Banwarl Lai v, Punjab

State Co->op, and s,& M, Federation Ltd,(Dell^l}

A,I,R, 1983 Del, 86

19, A,I,R. 1986 S,C. 1924

20, A«I.R, 1981 S,C« 1426

21, Supra note 19 at 1927

22, A.I.R. 1985 Cal.23

23. A.I.R. 1982 S.C. 1947

24. A.I.R, 1986 Cal, 31

25. Id.« at 38

26. I.e. Saxena, Law of Contract, ASIL Vol. XXII,

P. 98 (1986).

27. A.I.R. 1985 Cal, 96; The Calcutta High Court

noted and approved the decision of the Supreme

Court In Tarapore & Co., Madras v. V.D, Tracta

Export MOSCOW, A.I.R. 1970 S.C. 891, the Court

shduld not freese the amount of the Irrevocable

letter of credit.

34-:

28. A.I.R, 1985 Mad. 213; State v, M/s M.K, Patel

& Co., A.I.R. 1985 Guj. 179

29. (1987) 8 Reports (S.C.) 567;

In M/s G,S. Atwal & Co, (Engineers) Pvt.Ltd,

V. N.P, C. Ltd.. A.I.R, 1988 Del. 243, it kaa

been held that where there is a mere allegation

without any prima facie proof of fraudulent act-

the courts cannot and should not interfere

without bank guarantee by issuing an injunction;

M/s Escorts Limited v. Modern Insulators Ltd.,

A.I.R. 1988 Del. 345.

30. A.I.R. 1986 Cal. 374; Allied Resins & Chemicals

Ltd., V. M&M. Trading Corporation, A.I.R. 1986.

Cal. 346.

31. A.I.R. 1986 Ori. 238| M/s Brul Mxumgan Traders v.

R.C. & F. Ltd., Bombay, A.I.R. 1986 Mad. 161.

32. A.I.R. 1987 Delhi 188

33. A.I.R. 1987 Bom. 308

34. A.I.R. 1988 Del. 207

You might also like

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsFrom EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsRating: 5 out of 5 stars5/5 (1)

- Montano vs. Insular GovernmentDocument1 pageMontano vs. Insular GovernmentC.J. EvangelistaNo ratings yet

- NEGO - Letters of Credit - (3) Bank of America v. CA (228 SCRA 357)Document12 pagesNEGO - Letters of Credit - (3) Bank of America v. CA (228 SCRA 357)Choi ChoiNo ratings yet

- Bank of America Vs CA - G.R. No. 105395. December 10, 1993Document8 pagesBank of America Vs CA - G.R. No. 105395. December 10, 1993Ebbe DyNo ratings yet

- Letters of CreditDocument100 pagesLetters of CreditJai Delos Santos100% (3)

- Bank of America, NT & SA, Petitioner, vs. COURT OF Appeals, Inter-Resin Industrial Corporation, Francisco Trajano, John Doe and Jane DOE, RespondentsDocument29 pagesBank of America, NT & SA, Petitioner, vs. COURT OF Appeals, Inter-Resin Industrial Corporation, Francisco Trajano, John Doe and Jane DOE, Respondentseasa^belleNo ratings yet

- International TradeDocument1 pageInternational Tradekeith stevenNo ratings yet

- Feati Vs CA-taxDocument3 pagesFeati Vs CA-taxtiamia_painterNo ratings yet

- Letters of CreditDocument3 pagesLetters of CreditJanine Marmol100% (1)

- Banking Case Notes Corp & Comm Term 3Document32 pagesBanking Case Notes Corp & Comm Term 3Mugabi John BoscoNo ratings yet

- Negotin Commercial LawDocument27 pagesNegotin Commercial LawChristopher Michael OnaNo ratings yet

- Letter of Credit ExplainedDocument6 pagesLetter of Credit ExplainedChux Elumeze0% (1)

- Petitioner Respondents Agcaoili & Associates Valenzuela Law Center, Victor Fernandez Ramon M. GuevaraDocument15 pagesPetitioner Respondents Agcaoili & Associates Valenzuela Law Center, Victor Fernandez Ramon M. GuevaraLiene Lalu Nadonga100% (1)

- Petitioner vs. vs. Respondents Agcaoili & Associates Valenzuela Law Center, Victor Fernandez Ramon M. GuevaraDocument14 pagesPetitioner vs. vs. Respondents Agcaoili & Associates Valenzuela Law Center, Victor Fernandez Ramon M. Guevaraaspiringlawyer1234No ratings yet

- Coverage For 918Document24 pagesCoverage For 918JoyNo ratings yet

- DigestDocument15 pagesDigestdll123No ratings yet

- 1 Transfield Phils., Inc. vs. Luzon Hydro Corp., Et. Al.Document2 pages1 Transfield Phils., Inc. vs. Luzon Hydro Corp., Et. Al.Arthur Archie TiuNo ratings yet

- 2019 Civil and CommercialDocument50 pages2019 Civil and CommercialMay Rosarie Anne LumbreNo ratings yet

- 2019 Pre Week Lecture in MERCANTILE LAW MJRSI 11 15 19 PDFDocument29 pages2019 Pre Week Lecture in MERCANTILE LAW MJRSI 11 15 19 PDFFrankie BacangNo ratings yet

- Merc - Must ReadDocument67 pagesMerc - Must ReadJulchen ReyesNo ratings yet

- Letters of CreditDocument6 pagesLetters of CreditUlrich SantosNo ratings yet

- NOTES From Weekday ClassDocument12 pagesNOTES From Weekday ClassPéddiéGréiéNo ratings yet

- PAPER 2 Paper On Credit TransactionsDocument11 pagesPAPER 2 Paper On Credit TransactionsPouǝllǝ ɐlʎssɐNo ratings yet

- PALS - Bar Ops Corporation Law Must Read CasesDocument70 pagesPALS - Bar Ops Corporation Law Must Read CasesOnat PNo ratings yet

- International Trade LawDocument9 pagesInternational Trade LawOkaka HowardsNo ratings yet

- 2018 Pre Week Lecture in BankingJ SPCL and Negotiable Instruments Law As of November 16 2018Document22 pages2018 Pre Week Lecture in BankingJ SPCL and Negotiable Instruments Law As of November 16 2018Martin MartelNo ratings yet

- Documentary Credit SystemDocument5 pagesDocumentary Credit SystemVivek Pratap SinghNo ratings yet

- UP BOC Commercial Law LMTDocument30 pagesUP BOC Commercial Law LMTJul A.No ratings yet

- Lecture Notes SpeccomDocument7 pagesLecture Notes Speccomjolly faith pariñasNo ratings yet

- Letter of Credit DigestDocument6 pagesLetter of Credit Digestjongreyes100% (1)

- Discussion LCDocument5 pagesDiscussion LCRiona Vince SaliotNo ratings yet

- Merc - Must ReadDocument87 pagesMerc - Must ReadpaulNo ratings yet

- KNJLKM LDocument23 pagesKNJLKM LYrra LimchocNo ratings yet

- Letters of CreditDocument3 pagesLetters of CreditCarlo OroNo ratings yet

- Case DigestDocument4 pagesCase DigestGail FernandezNo ratings yet

- Doctrines of Strict Compliance and AutonDocument11 pagesDoctrines of Strict Compliance and AutonVaibhav GuptaNo ratings yet

- Letters of Credit, TRL and NILDocument11 pagesLetters of Credit, TRL and NILOna DlanorNo ratings yet

- Spec Com Final1Document152 pagesSpec Com Final1Recson BangibangNo ratings yet

- Letters of Credit CasesDocument3 pagesLetters of Credit CasesSam Sy-HenaresNo ratings yet

- BANKINGDocument16 pagesBANKINGFlorentina DiamondNo ratings yet

- AssignmentDocument7 pagesAssignmentDeepanshu ParasharNo ratings yet

- An Act Penalizing The Making or Drawing and Issuance of A Check Without Sufficient Funds or Credit and For Other PurposesDocument69 pagesAn Act Penalizing The Making or Drawing and Issuance of A Check Without Sufficient Funds or Credit and For Other PurposesHermay BanarioNo ratings yet

- Spec Com Final1Document153 pagesSpec Com Final1Paula Bianca EguiaNo ratings yet

- Nego Cases 15-17 (Digested)Document3 pagesNego Cases 15-17 (Digested)Supply ICPONo ratings yet

- Bouncing Checks LawDocument11 pagesBouncing Checks Lawzyphora grace trillanes100% (1)

- HSBC vs. National SteelDocument29 pagesHSBC vs. National SteelAaron CariñoNo ratings yet

- Final Work For BankingDocument14 pagesFinal Work For Bankingrovia2949No ratings yet

- Group 2 BankingDocument22 pagesGroup 2 Bankinggraceatibuni7No ratings yet

- Gempesaw V CADocument3 pagesGempesaw V CAChil BelgiraNo ratings yet

- Letters of Credit and Trust Receipt CasesDocument12 pagesLetters of Credit and Trust Receipt Caseslouis jansen75% (4)

- Lozano vs. MartinezDocument3 pagesLozano vs. MartinezEra GasperNo ratings yet

- Petitioner Respondents L.B. Camins Angara, Abello, Concepcion, Regala & CruzDocument13 pagesPetitioner Respondents L.B. Camins Angara, Abello, Concepcion, Regala & CruzJiro AcuñaNo ratings yet

- 2019 Mercantile Law Reviewer PDFDocument334 pages2019 Mercantile Law Reviewer PDFrobertoii_suarez67% (6)

- Conclusion and Suggestions: Chapte R-9Document24 pagesConclusion and Suggestions: Chapte R-9Hamdan HassinNo ratings yet

- Spec Com (Letters of Credit Cases)Document9 pagesSpec Com (Letters of Credit Cases)Katrina Quinto PetilNo ratings yet

- Batas Pambansa Blg. 22Document7 pagesBatas Pambansa Blg. 22charmssatellNo ratings yet

- BAROPS2010 (Reminders) (1) by Prof. Maria Zarah v. CastroDocument21 pagesBAROPS2010 (Reminders) (1) by Prof. Maria Zarah v. CastroSaintxeNo ratings yet

- Letters of Credit: General Concepts, Code of Commerce, Art. 567, Art. 568, Art. 2Document26 pagesLetters of Credit: General Concepts, Code of Commerce, Art. 567, Art. 568, Art. 2CresteynTeyngNo ratings yet

- Consumer Protection in India: A brief Guide on the Subject along with the Specimen form of a ComplaintFrom EverandConsumer Protection in India: A brief Guide on the Subject along with the Specimen form of a ComplaintNo ratings yet

- 498A IpcDocument26 pages498A IpcVinay Kumar KumarNo ratings yet

- 06 ContentsDocument4 pages06 ContentsVinay Kumar KumarNo ratings yet

- 08 - Chapter 4Document33 pages08 - Chapter 4Vinay Kumar KumarNo ratings yet

- Chapter 4 Suggestions - Recommendations and ConclusionsDocument22 pagesChapter 4 Suggestions - Recommendations and ConclusionsVinay Kumar KumarNo ratings yet

- 07 Chapter 3Document31 pages07 Chapter 3Vinay Kumar KumarNo ratings yet

- Concept of Contempt of Court and Its Development: Chapter-IiDocument63 pagesConcept of Contempt of Court and Its Development: Chapter-IiVinay Kumar KumarNo ratings yet

- 05 - Chapter 1Document39 pages05 - Chapter 1Vinay Kumar KumarNo ratings yet

- 06 - Chapter 1Document22 pages06 - Chapter 1Vinay Kumar KumarNo ratings yet

- Acknowledgement I II List of Cases Hi - VIDocument10 pagesAcknowledgement I II List of Cases Hi - VIVinay Kumar KumarNo ratings yet

- 06 - Chapter 2Document67 pages06 - Chapter 2Vinay Kumar KumarNo ratings yet

- Chapter-Iy: Constitutional. Provisions Regarding Contempt of CourtsDocument44 pagesChapter-Iy: Constitutional. Provisions Regarding Contempt of CourtsVinay Kumar KumarNo ratings yet

- 11 - Chapter 7Document73 pages11 - Chapter 7Vinay Kumar KumarNo ratings yet

- 08 Chapter 03Document42 pages08 Chapter 03Vinay Kumar KumarNo ratings yet

- Test For Determining Agency or Instrumentality of The StateDocument30 pagesTest For Determining Agency or Instrumentality of The StateVinay Kumar KumarNo ratings yet

- Chapter - 7: I. Judicial ActivismDocument45 pagesChapter - 7: I. Judicial ActivismVinay Kumar KumarNo ratings yet

- 10 Chapter 05Document38 pages10 Chapter 05Vinay Kumar KumarNo ratings yet