100%(1)100% found this document useful (1 vote)

111 viewsNotice of Availment of The Substituted Filing of Percentage Tax Return

Notice of Availment of The Substituted Filing of Percentage Tax Return

Uploaded by

ArgielJedTabalBorrasThis document is a Notice of Availment of the Substituted Filing of Percentage Tax Return from the Bureau of Internal Revenue for Ryza Venus A. Sabino. It certifies that Sabino is a non-VAT registered professional who has opted into the 3% Final Percentage Tax Withholding system in lieu of the 3% Creditable Percentage Tax Withholding to be entitled to file substitute percentage tax returns. Sabino declares this notice is sufficient authority for withholding agents to withhold 3% tax from payments for goods and services in lieu of regular withholding, and it was signed under penalty of perjury.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Notice of Availment of The Substituted Filing of Percentage Tax Return

Notice of Availment of The Substituted Filing of Percentage Tax Return

Uploaded by

ArgielJedTabalBorras100%(1)100% found this document useful (1 vote)

111 views1 pageThis document is a Notice of Availment of the Substituted Filing of Percentage Tax Return from the Bureau of Internal Revenue for Ryza Venus A. Sabino. It certifies that Sabino is a non-VAT registered professional who has opted into the 3% Final Percentage Tax Withholding system in lieu of the 3% Creditable Percentage Tax Withholding to be entitled to file substitute percentage tax returns. Sabino declares this notice is sufficient authority for withholding agents to withhold 3% tax from payments for goods and services in lieu of regular withholding, and it was signed under penalty of perjury.

Original Title

GEN BIR-ANNEX-A

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

This document is a Notice of Availment of the Substituted Filing of Percentage Tax Return from the Bureau of Internal Revenue for Ryza Venus A. Sabino. It certifies that Sabino is a non-VAT registered professional who has opted into the 3% Final Percentage Tax Withholding system in lieu of the 3% Creditable Percentage Tax Withholding to be entitled to file substitute percentage tax returns. Sabino declares this notice is sufficient authority for withholding agents to withhold 3% tax from payments for goods and services in lieu of regular withholding, and it was signed under penalty of perjury.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

100%(1)100% found this document useful (1 vote)

111 views1 pageNotice of Availment of The Substituted Filing of Percentage Tax Return

Notice of Availment of The Substituted Filing of Percentage Tax Return

Uploaded by

ArgielJedTabalBorrasThis document is a Notice of Availment of the Substituted Filing of Percentage Tax Return from the Bureau of Internal Revenue for Ryza Venus A. Sabino. It certifies that Sabino is a non-VAT registered professional who has opted into the 3% Final Percentage Tax Withholding system in lieu of the 3% Creditable Percentage Tax Withholding to be entitled to file substitute percentage tax returns. Sabino declares this notice is sufficient authority for withholding agents to withhold 3% tax from payments for goods and services in lieu of regular withholding, and it was signed under penalty of perjury.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

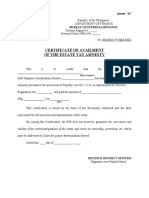

ANNEX “A”

BIR FORM NO.__________

Republic of the Philippines

Department of Finance

BUREAU OF INTERNAL REVENUE

Revenue Region No. ___

Revenue District Office No. ___

__________________________

NOTICE OF AVAILMENT OF THE SUBSTITUTED FILING OF

PERCENTAGE TAX RETURN

Date ___________________

Name of Taxpayer RYZA VENUS A. SABINO __________________________

Address 1920 J BOCOBO STREET BRGY 702 MALATE METRO MANILA____

Taxpayer Identification Number _______ ___176-585-837-

000____________________

Class of Profession or Calling/Business _____PROFESSIONAL__________________

CERTIFICATION

This is to certify that I am a NON-VAT registered person pursuant to the

provisions of REVENUE REGULATIONS NO. ____; that, in accordance with the

said Regulations, I have availed of the “Optional Registration under the 3% Final

Percentage Tax Withholding, in lieu of the 3% Creditable Percentage Tax

Withholding” System, in order to be entitled to the privileges accorded by the

“Substituted Percentage Tax Return System” prescribed thereunder; that, this

Declaration is sufficient authority of the Withholding Agent to withhold 3%

Percentage Tax from payments to me on my sale of goods and/or services, in lieu of

the said 3% Creditable Percentage Tax Withholding; and that, I have executed this

Declaration under penalty of perjury pursuant to the provisions of Section 267,

National Internal Revenue Code of 1997.

RYZA VENUS A. SABINO _

Taxpayer’s Name and Signature

You might also like

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Joeanna100% (13)

- Annex FDocument1 pageAnnex FJoyNo ratings yet

- Annex C.1: Sworn Application For Tax ClearanceDocument1 pageAnnex C.1: Sworn Application For Tax ClearanceKrizza Madrid100% (1)

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Andoy Domingo Carullo100% (2)

- Notice of Availment of The Option To Pay The Tax Through The Withholding ProcessDocument2 pagesNotice of Availment of The Option To Pay The Tax Through The Withholding ProcessArgielJedTabalBorrasNo ratings yet

- Notice of Availment of Substituted Filing of Percentage Tax ReturnsDocument1 pageNotice of Availment of Substituted Filing of Percentage Tax ReturnsJomar TenezaNo ratings yet

- ANNEX eDocument2 pagesANNEX eChristian Sadia0% (1)

- Notice of Cancellation of Availment of The Substituted Filing of Percentage Tax/Vat ReturnDocument1 pageNotice of Cancellation of Availment of The Substituted Filing of Percentage Tax/Vat ReturnWarlie Zambales DiazNo ratings yet

- Republic of The Philippines Department of Finance Bureau of Internal Revenue Revenue Region No. 15 Revenue District Office No. 93A Zamboanga CityDocument1 pageRepublic of The Philippines Department of Finance Bureau of Internal Revenue Revenue Region No. 15 Revenue District Office No. 93A Zamboanga CitySindangan Adventist CenterChurch ChoirNo ratings yet

- Annex E RR14 - 2003Document1 pageAnnex E RR14 - 2003Jomar Teneza100% (1)

- Annex J.5 - TCGP - IndividualDocument1 pageAnnex J.5 - TCGP - Individualmaureen.lumbao95No ratings yet

- Annex CDocument1 pageAnnex CJoel SyNo ratings yet

- Certificate of Availment of The Estate Tax Amnesty: Annex "B" Ver. 2Document1 pageCertificate of Availment of The Estate Tax Amnesty: Annex "B" Ver. 2PaulNo ratings yet

- Annex B - RMC 103-2019Document2 pagesAnnex B - RMC 103-2019Isaac Dominic MacaranasNo ratings yet

- Annex B - RMC 103-2019Document2 pagesAnnex B - RMC 103-2019Ra JeNo ratings yet

- Sworn Application For Tax Clearance Sabiley 2022Document1 pageSworn Application For Tax Clearance Sabiley 2022Ella MariscalNo ratings yet

- Tax FormDocument1 pageTax FormChriestal SorianoNo ratings yet

- Rmo No 9-06 TCVD Tax Mapping Annex A-C, FDocument5 pagesRmo No 9-06 TCVD Tax Mapping Annex A-C, FGil PinoNo ratings yet

- Annex C Tax ClearanceDocument1 pageAnnex C Tax Clearanceanalisa sealmoyNo ratings yet

- Annex C.1Document1 pageAnnex C.1Janice GalsimNo ratings yet

- Annex A-RR22-2020NOD V03Document2 pagesAnnex A-RR22-2020NOD V03Fo LetNo ratings yet

- Sworn Application For Tax Clearance For General Purposes Individual TaxpayersDocument1 pageSworn Application For Tax Clearance For General Purposes Individual Taxpayersjdsindustrial23No ratings yet

- Annex J.3 - TCBP - Non-IndividualDocument1 pageAnnex J.3 - TCBP - Non-Individualmaureen.lumbao95100% (1)

- Sworn Application For Tax Clearance - Non-IndDocument2 pagesSworn Application For Tax Clearance - Non-Indejay niel100% (1)

- Sworn Application For Tax Clearance - Non-IndDocument2 pagesSworn Application For Tax Clearance - Non-IndArchie Lazaro0% (1)

- Sworn Application For Tax Clearance - Non-IndDocument2 pagesSworn Application For Tax Clearance - Non-IndJyznareth Tapia75% (4)

- Sworn Application For Tax Clearance: Annex CDocument1 pageSworn Application For Tax Clearance: Annex CJose Edmundo DayotNo ratings yet

- Tax Amnesty CertificateDocument1 pageTax Amnesty CertificateJewelyn C. Espares-CioconNo ratings yet

- Annex A - Certificate of AvailmentDocument1 pageAnnex A - Certificate of AvailmentJoel SyNo ratings yet

- Sworn Application For Tax Clearance - Non-IndDocument1 pageSworn Application For Tax Clearance - Non-IndIdan AguirreNo ratings yet

- Sworn Application For Tax Clearance: Annex CDocument1 pageSworn Application For Tax Clearance: Annex Cbarsy piadorNo ratings yet

- RMO No 9-06 TCVD Tax Mapping Annex N-QDocument5 pagesRMO No 9-06 TCVD Tax Mapping Annex N-QGil PinoNo ratings yet

- RR No. 11-2018 Annex FDocument1 pageRR No. 11-2018 Annex FRegina MontesNo ratings yet

- Annex J.2 - TCBP - IndividualDocument1 pageAnnex J.2 - TCBP - Individualmaureen.lumbao95No ratings yet

- Annex C.1: Sworn Application For Tax ClearanceDocument1 pageAnnex C.1: Sworn Application For Tax ClearanceJoy Mangale AmidaoNo ratings yet

- Annex CDocument1 pageAnnex CAileen TeoNo ratings yet

- Business Permit License Office Renewal FormDocument1 pageBusiness Permit License Office Renewal FormAdrian Joseph GarciaNo ratings yet

- Sworn Application For Tax Clearance For Bidding Purposes Individual TaxpayersDocument1 pageSworn Application For Tax Clearance For Bidding Purposes Individual TaxpayersdiopenesjoelNo ratings yet

- Form B-2 Sworn Declaration (1) .DocxXDocument1 pageForm B-2 Sworn Declaration (1) .DocxXsernakeisharaeNo ratings yet

- Annex D - Certificate of AvailmentDocument1 pageAnnex D - Certificate of AvailmentJason YangaNo ratings yet

- Annex D - Certificate of AvailmentDocument1 pageAnnex D - Certificate of AvailmentJason YangaNo ratings yet

- Income Payee's Sworn Declaration of Gross Receipts or SalesDocument1 pageIncome Payee's Sworn Declaration of Gross Receipts or SalesApril Lynn Ursal-BelciñaNo ratings yet

- Sworn Application For Tax Clearance: Annex CDocument1 pageSworn Application For Tax Clearance: Annex CpatrickkayeNo ratings yet

- Annex A - Format of Notice of Discrepancy - RMC 102-2020 1Document2 pagesAnnex A - Format of Notice of Discrepancy - RMC 102-2020 1Joanna AbañoNo ratings yet

- Tax Clearance FormDocument1 pageTax Clearance FormJhen FigueroaNo ratings yet

- Annex C.1Document1 pageAnnex C.1Eric OlayNo ratings yet

- Annex J.6 - TCGP - Non-IndividualDocument1 pageAnnex J.6 - TCGP - Non-Individualmaureen.lumbao95No ratings yet

- Mission Order S: Bir Form No. JANUARY, 2001Document1 pageMission Order S: Bir Form No. JANUARY, 2001Gil Pino0% (2)

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Gerynes Mae Bacarra100% (1)

- Annex RR 11-2018Document1 pageAnnex RR 11-2018jayNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018ehhmehhfNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Renz Lorenz100% (1)

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018Erica MailigNo ratings yet

- BIR Sworn Declaration Annex FDocument1 pageBIR Sworn Declaration Annex FgfgfdgfdgdgfdgfdNo ratings yet

- Annex F RR 11-2018Document1 pageAnnex F RR 11-2018grecelyn bianesNo ratings yet

- 1040 Exam Prep - Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep - Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Gen Bir Annex B2Document1 pageGen Bir Annex B2ArgielJedTabalBorrasNo ratings yet

- Gen Bir Annex B2Document2 pagesGen Bir Annex B2ArgielJedTabalBorras100% (2)

- 1 7 6 5 8 5 8 3 7 0 0 0 0 3 3 X ProfessionalDocument3 pages1 7 6 5 8 5 8 3 7 0 0 0 0 3 3 X ProfessionalArgielJedTabalBorrasNo ratings yet

- 1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsDocument1 page1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsArgielJedTabalBorrasNo ratings yet

- Verbal Ability Practice Questions Set 2 1Document7 pagesVerbal Ability Practice Questions Set 2 1ArgielJedTabalBorrasNo ratings yet

- Angel Redongga Borras: Career ObjectiveDocument2 pagesAngel Redongga Borras: Career ObjectiveArgielJedTabalBorrasNo ratings yet

- Verbal Ability Practice Questions: Identifying ErrorsDocument3 pagesVerbal Ability Practice Questions: Identifying ErrorsArgielJedTabalBorras100% (2)

- Philippine Constitution Mock Examination - TOPNOTCHER PHDocument35 pagesPhilippine Constitution Mock Examination - TOPNOTCHER PHArgielJedTabalBorrasNo ratings yet

- Work RelatedDocument2 pagesWork RelatedArgielJedTabalBorrasNo ratings yet

- CPD Council For - : Professional Regulation CommissionDocument2 pagesCPD Council For - : Professional Regulation CommissionArgielJedTabalBorrasNo ratings yet

- mCPD-1 Form4AccreditationAsLocalCPDProviderDocument3 pagesmCPD-1 Form4AccreditationAsLocalCPDProviderArgielJedTabalBorrasNo ratings yet

- Criminologist ReviewerDocument3 pagesCriminologist ReviewerArgielJedTabalBorrasNo ratings yet