© The Institute of Chartered Accountants of India

© The Institute of Chartered Accountants of India

Uploaded by

GowriCopyright:

Available Formats

© The Institute of Chartered Accountants of India

© The Institute of Chartered Accountants of India

Uploaded by

GowriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

© The Institute of Chartered Accountants of India

© The Institute of Chartered Accountants of India

Uploaded by

GowriCopyright:

Available Formats

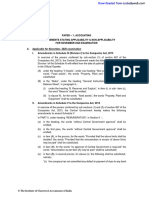

PAPER – 1: ACCOUNTING

PART – I: ANNOUNCEMENTS STATING APPLICABILITY & NON-APPLICABILITY

FOR NOVEMBER 2021 EXAMINATION

A. Applicable for November, 2021 examination

I. Amendments in Schedule III (Division I) to the Companies Act, 2013

In exercise of the powers conferred by sub-section (1) of section 467 of the

Companies Act, 2013), the Central Government made the following amendments in

Division I of the Schedule III with effect from the date of publication of this notification

in the Official Gazette:

(A) under the heading “II Assets”, under sub-heading “Non-current assets”, for the

words “Fixed assets”, the words “Property, Plant and Equipment” shall be

substituted;

(B) in the “Notes”, under the heading “General Instructions for preparation of

Balance Sheet”, in paragraph 6,-

(I) under the heading “B. Reserves and Surplus”, in item (i), in sub- item (c),

the word “Reserve” shall be omitted;

(II) in clause W., for the words “fixed assets”, the words “Property, Plant and

Equipment” shall be substituted.

II. Amendments in Schedule V to the Companies Act, 2013

In exercise of the powers conferred by sub-sections (1) and (2) of section 467 of the

Companies Act, 2013, the Central Government hereby makes the following

amendments to amend Schedule V.

In PART II, under heading “REMUNERATION”, in Section II - ,

(a) in the heading, the words “without Central Government approval” shall be

omitted;

(b) in the first para, the words “without Central Government approval” shall be

omitted;

(c) in item (A), in the proviso, for the words “Provided that the above limits shall be

doubled” the words “Provided that the remuneration in excess of above limits

may be paid” shall be substituted;

(d) in item (B), for the words “no approval of Central Government is requi red” the

words “remuneration as per item (A) may be paid” shall be substituted;

(e) in Item (B), in second proviso, for clause (ii), the following shall be substituted,

namely:-

© The Institute of Chartered Accountants of India

2 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2021

“(ii) the company has not committed any default in payment of dues to any bank

or public financial institution or non-convertible debenture holders or any other

secured creditor, and in case of default, the prior approval of the bank or public

financial institution concerned or the non-convertible debenture holders or other

secured creditor, as the case may be, shall be obtained by the company before

obtaining the approval in the general meeting.";

(f) in item (B), in second proviso, in clause (iii), the words “the limits laid down in”

shall be omitted;

In PART II, under the heading “REMUNERATION”, in Section III, –

(a) in the heading, the words “without Central Government approval” shall be

omitted;

(b) in first para, the words “without the Central Government approval” shall be

omitted;

(c) in clause (b), in the long line, for the words “remuneration up to two times the

amount permissible under Section II” the words “any remuneration to its

managerial persons”, shall be substituted;

III. Notification to exempt startup private companies from preparation of Cash Flow

Statement as per Section 462 of the Companies Act 2013

As per the Amendment, under Chapter I, clause (40) of section 2, an exemption has

been provided to a startup private company besides one person company, small

company and dormant company. Accordingly, a startup private company is not

required to include the cash flow statement in the financial statements.

Thus the financial statements, with respect to one person company, small company,

dormant company and private company (if such a private company is a start-up), may

not include the cash flow statement.

IV. Amendment in AS 11 “The Effects of Changes in Foreign Exchange Rates”

In exercise of the powers conferred by clause (a) of sub-section (1) of section 642 of

the Companies Act, 1956, the Central Government, in consultation with National

Advisory Committee on Accounting Standards, hereby made the amendment in the

Companies (Accounting Standards) Rules, 2006, in the "ANNEXURE", under the

heading "ACCOUNTING STANDARDS" under "AS 11 on The Effects of Changes in

Foreign Exchange Rates", for the paragraph 32, the following paragraph shall be

substituted, namely :-

"32. An enterprise may dispose of its interest in a non-integral foreign operation

through sale, liquidation, repayment of share capital, or abandonment of all, or part

of, that operation. The payment of a dividend forms part of a disposal only when it

constitutes a return of the investment. Remittance from a non-integral foreign

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 3

operation by way of repatriation of accumulated profits does not form part of a

disposal unless it constitutes return of the investment. In the case of a partial disposal,

only the proportionate share of the related accumulated exchange differences is

included in the gain or loss. A write-down of the carrying amount of a non-integral

foreign operation does not constitute a partial disposal. Accordingly, no part of the

deferred foreign exchange gain or loss is recognized at the time of a write-down".

V. SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 (reg.

Issue of Bonus Shares)

A listed company, while issuing bonus shares to its members, must comply with the

following requirements under the SEBI (Issue of Capital and Disclosure

Requirements) Regulations, 2018:

Regulation 293 - Conditions for Bonus Issue

Subject to the provisions of the Companies Act, 2013 or any other applicable law, a

listed issuer shall be eligible to issue bonus shares to its members if:

(a) it is authorized by its articles of association for issue of bonus shares,

capitalization of reserves, etc.: Provided that if there is no such provision in the

articles of association, the issuer shall pass a resolution at its general body

meeting making provisions in the articles of associations for capitalization of

reserve;

(b) it has not defaulted in payment of interest or principal in respect of fixed deposits

or debt securities issued by it;

(c) it has not defaulted in respect of the payment of statutory dues of the employees

such as contribution to provident fund, gratuity and bonus;

(d) any outstanding partly paid shares on the date of the allotment of the bonus

shares, are made fully paid-up;

(e) any of its promoters or directors is not a fugitive economic offender.

Regulation 294 - Restrictions on a bonus issue

(1) An issuer shall make a bonus issue of equity shares only if it has made

reservation of equity shares of the same class in favour of the holders of

outstanding compulsorily convertible debt instruments if any, in proportion to the

convertible part thereof.

(2) The equity shares so reserved for the holders of fully or partly compulsorily

convertible debt instruments, shall be issued to the holder of such convertible

debt instruments or warrants at the time of conversion of such convertible debt

instruments, optionally convertible instruments, warrants, as the case may be,

on the same terms or same proportion at which the bonus shares were issued.

© The Institute of Chartered Accountants of India

4 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2021

(3) A bonus issue shall be made only out of free reserves, securities premium

account or capital redemption reserve account and built out of the genuine

profits or securities premium collected in cash and reserves created by

revaluation of fixed assets shall not be capitalized for this purpose.

(4) Without prejudice to the provisions of sub-regulation (3), bonus shares shall not

be issued in lieu of dividends.

(5) If an issuer has issued Superior Voting Right (SR) equity shares to its promoters

or founders, any bonus issue on the SR equity shares shall carry the same ratio

of voting rights compared to ordinary shares and the SR equity shares issued in

a bonus issue shall also be converted to equity shares having voting rights same

as that of ordinary equity shares along with existing SR equity shares.]

Regulation 295 - Completion of a bonus issue

(1) An issuer, announcing a bonus issue after approval by its board of directors and

not requiring shareholders’ approval for capitalization of profits or reserves for

making the bonus issue, shall implement the bonus issue within fifteen days

from the date of approval of the issue by its board of directors: Provided that

where the issuer is required to seek shareholders’ approval for capitalization of

profits or reserves for making the bonus issue, the bonus issue shall be

implemented within two months from the date of the meeting of its board of

directors wherein the decision to announce the bonus issue was taken subject

to shareholders’ approval.

Explanation:

For the purpose of a bonus issue to be considered as ‘implemented’ the date of

commencement of trading shall be considered.

(2) A bonus issue, once announced, shall not be withdrawn.

VI. Companies (Share Capital and Debentures) Amendment Rules, 2019 – reg.

Debenture Redemption Reserve

In exercise of the powers conferred by sub-sections (1) and (2) of section 469 of the

Companies Act, 2013 (18 of 2013), the Central Government made the Companies

(Share Capital and Debentures) Amendment Rules, 2019 dated 16th August, 2019 to

amend the Companies (Share Capital and Debentures) Rules, 2014. As per the

Companies (Share Capital and Debentures) Amendment Rules, under principal rules,

in rule 18, for sub-rule (7), the following sub-rule shall be substituted, namely: -

“(7) The company shall comply with the requirements with regard to Debenture

Redemption Reserve (DRR) and investment or deposit of sum in respect of

debentures maturing during the year ending on the 31st day of March of next year, in

accordance with the conditions given below:-

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 5

(a) Debenture Redemption Reserve shall be created out of profits of the company

available for payment of dividend;

(b) the limits with respect to adequacy of Debenture Redemption Reserve and

investment or deposits, as the case may be, shall be as under;-

(i) Debenture Redemption Reserve is not required for debentures issued by

All India Financial Institutions regulated by Reserve Bank of India and

Banking Companies for both public as well as privately placed debentures;

(ii) For other Financial Institutions within the meaning of clause (72) of section

2 of the Companies Act, 2013, Debenture Redemption Reserve shall be as

applicable to Non –Banking Finance Companies registered with Reserve

Bank of India.

(iii) For listed companies (other than All India Financial Institutions and Banking

Companies as specified in sub-clause (i)), Debenture Redemption Reserve

is not required in the following cases - (A) in case of public issue of

debentures – A. for NBFCs registered with Reserve Bank of India under

section 45-IA of the RBI Act, 1934 and for Housing Finance Companies

registered with National Housing Bank; B. for other listed companies; (B)

in case of privately placed debentures, for companies specified in sub-

items A and B.

(iv) for unlisted companies, (other than All India Financial Institutions and

Banking Companies as specified in sub-clause (i)) -

(A) for NBFCs registered with RBI under section 45-IA of the Reserve

Bank of India Act, 1934 and for Housing Finance Companies

registered with National Housing Bank, Debenture Redemption

Reserve is not required in case of privately placed debentures.

(B) for other unlisted companies, the adequacy of Debenture Redemption

Reserve shall be ten percent. of the value of the outstanding

debentures;

(v) In case a company is covered in item (A) or item (B) of sub-clause (iii) of

clause (b) or item (B) of sub-clause (iv) of clause (b), it shall on or before

the 30th day of April in each year, in respect of debentures issued by a

company covered in item (A) or item (B) of sub clause (iii) of clause (b) or

item (B) of sub-clause (iv) of clause (b), invest or deposit, as the case may

be, a sum which shall not be less than fifteen per cent., of the amount of

© The Institute of Chartered Accountants of India

6 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2021

its debentures maturing during the year, ending on the 31st day of March

of the next year in any one or more methods of investments or deposits as

provided in sub-clause (vi):

Provided that the amount remaining invested or deposited, as the case may

be, shall not at any time fall below fifteen percent. of the amount of the

debentures maturing during the year ending on 31st day of March of that

year.

(vi) for the purpose of sub-clause (v), the methods of deposits or investments,

as the case may be, are as follows:— (A) in deposits with any scheduled

bank, free from any charge or lien; (B) in unencumbered securities of the

Central Government or any State Government; (C) in unencumbered

securities mentioned in sub-clause (a) to (d) and (ee) of section 20 of the

Indian Trusts Act, 1882; (D) in unencumbered bonds issued by any other

company which is notified under sub-clause (f) of section 20 of the Indian

Trusts Act, 1882:

Provided that the amount invested or deposited as above shall not be used

for any purpose other than for redemption of debentures maturing during

the year referred above.

(c) in case of partly convertible debentures, Debenture Redemption Reserve shall

be created in respect of non-convertible portion of debenture issue in

accordance with this sub-rule.

(d) the amount credited to Debenture Redemption Reserve shall not be utilized by

the company except for the purpose of redemption of debentures.”

NOTE: October, 2020 Edition of the Study Material on Paper 1 Accounting is applicable

for November, 2021 Examination which incorporates the above amendments. The students

who have editions prior to October, 2020 may refer above amendments.

B. Not applicable for November, 2021 examination

Non-Applicability of Ind AS for November, 2021 Examination

The Ministry of Corporate Affairs has notified Companies (Indian Accounting Standards)

Rules, 2015 on 16 th February, 2015, for compliance by certain class of companies. These

Ind AS are not applicable for November, 2021 Examination.

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 7

PART – II: QUESTIONS AND ANSWERS

QUESTIONS

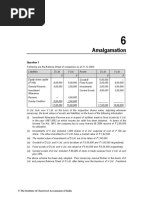

Preparation of Statement of Profit and Loss and Balance Sheet

1. Om Ltd. has the Authorised Capital of ` 15,00,000 consisting of 6,000 6% Redeemable

Preference shares of ` 100 each and 90,000 equity Shares of `10 each. The following was

the Trial Balance of the Company as on 31 st March, 2021:

Particulars Dr. Cr.

Investment in shares at cost (non-current investment) 1,50,000

Purchases 14,71,500

Selling expenses 2,37,300

Inventory as at the beginning of the year 4,35,600

Salaries and wages (included ` 30,000 being Director's

1,56,000

Remuneration)

Cash on hand 84,000

Bills receivable 1,24,500

Interest on Bank overdraft 29,400

Interest on debentures upto 30 th Sep (1st half year) 11,250

Sundry Debtors and Sundry Creditors 1,50,300 2,63,550

Freehold property at cost 10,50,000

Furniture at cost less depreciation of ` 45,000 1,05,000

6% Redeemable Preference share capital 6,00,000

Equity share capital fully paid up 6,00,000

5% mortgage debentures secured on freehold properties 4,50,000

Dividends received 12,750

Profit and Loss A/c (opening balance) 85,500

Sales (Net) 20,11,050

Bank overdraft (secured by hypothecation of stocks and

receivables) 4,50,000

Technical knowhow fees (cost paid during the year) 4,50,000

Audit fees 18,000

Total 44,72,850 44,72,850

© The Institute of Chartered Accountants of India

8 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2021

Other Information:

1. Closing Stock was valued at ` 4,27,500.

2. Purchases include ` 15,000 worth of goods and articles distributed among valued

customers.

3. Salaries and Wages include ` 6,000 being Wages incurred for installation of Electrical

Fittings which were recorded under "Furniture".

4. Bills Receivable include ` 4,500 being dishonoured bills. 50% of which had been

considered irrecoverable.

5. Bills Receivable of ` 6,000 maturing after 31 st March were discounted.

6. Depreciation on Furniture to be charged at 10% on Written Down Value.

7. Interest on Debentures for the half year ending on 31 st March was due on that date.

8. Technical Knowhow Fees is to be written off over a period of 10 years.

9. Trade receivables include ` 18,000 due for more than six months.

You are required to prepare the Balance Sheet as at 31 st March, 2021 and Statement of

Profit and Loss for the year ended 31 st March, 2021 as per Schedule III to the Companies

Act, 2013 after taking into account the above information. Ignore taxation.

2. (a) Star Ltd. gives the following information the year ended 31st March, 2021:

`

Gross profit 60,38,048

Subsidies received from Govt. 4,10,888

Administrative, Selling and distribution expenses 12,33,813

Directors’ fees 2,02,170

Interest on debentures 46,860

Managerial remuneration 4,28,025

Depreciation on Property, plant and equipment (PPE) 7,83,815

Provision for Taxation 18,63,750

Transfer to General Reserve 6,00,000

Transfer to Investment Revaluation Reserve 18,750

Depreciation on PPE as per Schedule II of the Companies Act, 2013 was ` 8,63,018

You are required to calculate the maximum amount of the managerial remuneration

as allowed as per Companies Act, 2013.

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 9

(b) State under which head these accounts should be classified in Balance Sheet, as per

Schedule III of the Companies Act, 2013:

(i) Share application money received in excess of issued share capital.

(ii) Share option outstanding account.

(iii) Unpaid matured debenture and interest accrued thereon.

(iv) Uncalled liability on shares and other partly paid investments.

(v) Calls unpaid.

Cash Flow Statement

3 On the basis of the following information prepare a Cash Flow Statement for the year ended

31st March, 2021 (Using direct method):

(i) Total sales for the year were ` 597 crores out of which cash sales amounted to

` 393 crores.

(ii) Receipts from credit customers during the year, totalled ` 201 crores.

(iii) Purchases for the year amounted to ` 330 crores out of which credit purchases were

80%.

Balance in creditors as on

1.4.2020 ` 126 crores

31.3.2021 ` 138 crores

(iv) Suppliers of other consumables and services were paid ` 28.5 crores in cash.

(v) Employees of the enterprises were paid 30 crores in cash.

(vi) Fully paid preference shares of the face value of ` 48 crores were redeemed. Equity

shares of the face value of ` 30 crores were allotted as fully paid up at premium of

20%.

(vii) Debentures of ` 30 crores at a premium of 10% were redeemed. Debenture holders

were issued equity shares in lieu of their debentures.

(viii) ` 39 crores were paid by way of income tax.

(ix) A new machinery costing ` 15 was purchased.

(x) Investment costing ` 27 cores were sold at a loss of ` 3 crores.

(xi) Dividends totalling ` 22.5 crores was also paid.

(xii) Debenture interest amounting ` 3 crore was paid.

(xiii) On 31st March 2020, Balance with Bank and Cash on hand totalled ` 3 crores.

© The Institute of Chartered Accountants of India

10 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2021

Profit/Loss prior to Incorporation

4. New Limited was incorporated on 01.08.2020 to take-over the business of a partnership

firm w.e.f. 01.04.2020. It provides you the following information for the year ended

31.03.2021:

`

Gross profit 9,00,000

Expenses:

Salaries 1,80,000

Rent, Rates & Taxes 1,20,000

Depreciation 37,500

Commission on Sales 31,500

Interest on Debentures 48,000

Director’s Fees 18,000

Advertisement 54,000

Net Profit for the Year 4,11,000

(i) New Limited initiated an advertising campaign which resulted increase in monthly

average sales by 25% post incorporation.

(ii) The Gross profit ratio post incorporation increased to 30% from 25%.

You are required to apportion the profit for the year between pre-incorporation and post-

incorporation periods.

Accounting for Bonus Issue

5. Raman Ltd. gives the following information as at 31 st March, 2021:

`

Authorised capital:

45,000 12% Preference shares of ` 10 each 4,50,000

6,00,000 Equity shares of ` 10 each 60,00,000

64,50,000

Issued and Subscribed capital:

36,000 12% Preference shares of ` 10 each fully paid 3,60,000

4,05,000 Equity shares of ` 10 each, ` 8 paid up 32,40,000

Reserves and surplus:

General Reserve 5,40,000

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 11

Capital Redemption Reserve 1,80,000

Securities premium (collected in cash) 1,12,500

Profit and Loss Account 9,00,000

On 1st April, 2021, the Company has made final call @ ` 2 each on 4,05,000 equity shares.

The call money was received by 20 th April, 2021. Thereafter, the company decided to

capitalize its reserves by way of bonus at the rate of one share for every four shares held.

Show necessary journal entries in the books of the company.

Issue of Right Shares

6. Super company offers new shares of ` 100 each at 20% premium to existing shareholders

on the basis one for four shares. The cum-right market price of a share is ` 190.

You are required to calculate the value of a right share.

Redemption of Preference Shares

7. Neeraj Ltd.’s capital structure consists of 45,000 Equity Shares of ` 10 each fully paid up

and 3,000 9% Redeemable Preference Shares of ` 100 each fully paid up as on

31.03.2021. The other particulars as at 31.03.2021 are as follows:

Amount (`)

General Reserve 1,80,000

Profit & Loss Account 90,000

Investment Allowance Reserve (not free for distribution as dividend) 22,500

Cash at bank 2,92,500

Preference Shares are to be redeemed at a premium of 10%. For the purpose of

redemption, the directors are empowered to make fresh issue of Equity Shares at par after

utilizing the undistributed reserve & surplus, subject to the conditions that a sum of `

60,000 shall be retained in General Reserve and which should not be utilized. Company

also sold investment of 6,750 Equity Shares in Kumar Ltd., costing `67,500 at ` 9 per

share.

Pass Journal entries to give effect to the above arrangements and also sho w how the

relevant items will appear in the Balance Sheet as at 31.03.2021 of Neeraj Ltd. after the

redemption is carried out.

Redemption of Debentures

8. Jeet Limited (listed company) recently made a public issue in respect of which the following

information is available:

(a) No. of partly convertible debentures issued - 1,00,000; face value and issue price-

` 100 per debenture.

© The Institute of Chartered Accountants of India

12 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2021

(b) Convertible portion per debenture- 60%, date of conversion- on expiry of 6 months

from the date of closing of issue i.e 31.10.2020.

(c) Date of closure of subscription lists - 1.5.2020, date of allotment- 1.6.2020, rate of

interest on debenture- 15% payable from the date of allotment, value of equity share

for the purpose of conversion- ` 60 (Face Value ` 10).

(d) Underwriting Commission- 2%.

(e) Number of debentures applied for - 75,000.

(f) Interest payable on debentures half-yearly on 30th September and 31st March.

Write relevant journal entries for all transactions arising out of the above during the year

ended 31st March, 2021 (including cash and bank entries).

Investment Accounts

9. Following transactions of Meeta took place during the financial year 2020 -21:

1st April, 2020 Purchased ` 4,500 8% bonds of ` 100 each at ` 80.50

cum-interest. Interest is payable on 1st November and

1st May.

1st May, 2020 Received half year’s interest on 8% bonds.

10 July, 2020 Purchased 6,000 equity shares of ` 10 each in Kamal

Limited for ` 44 each through a broker, who charged

brokerage @ 2%.

1st October 2020 Sold 1,125 8% bonds at ` 81 Ex-interest.

1st November, 2020 Received half year’s interest on 8% bonds.

15th January, 2021 Received 18% interim dividend on equity shares of Kamal

Limited.

15th March, 2021 Kamal Limited made a rights issue of one equity share for

every four Equity shares held at ` 5 per share. Meeta

exercised the option for 40% of her entitlements and sold

the balance rights in the market at ` 2.25 per share.

Prepare separate investment account for 8% bonds and equity shares of Kamal Limited in

the books of Meeta for the year ended on 31 st March, 2021. Assume that the average cost

method is followed.

Insurance Claim for loss of stock or loss of profit

10. On 2.6.2021 the stock of Mr. Heera was destroyed by fire. However, following particulars

were furnished from the records saved:

`

Stock at cost on 1.4.2020 2,02,500

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 13

Stock at 90% of cost on 31.3.2021 2,43,000

Purchases for the year ended 31.3.2021 9,67,500

Sales for the year ended 31.3.2021 13,50,000

Purchases from 1.4.2021 to 2.6.2021 3,37,500

Sales from 1.4.2021 to 2.6.2021 7,20,000

Sales up to 2.6.2021 includes ` 1,12,500 being the goods not dispatched to the customers.

The sales (invoice) price is ` 1,12,500.

Purchases up to 2.6.2021 includes a machinery acquired for ` 22,500.

Purchases up to 2.6.2021 does not include goods worth ` 45,000 received from suppliers,

as invoice not received up to the date of fire. These goods have remained in the godown

at the time of fire. The insurance policy is for ` 1,80,000 and it is subject to average clause.

Ascertain the amount of claim for loss of stock.

Hire Purchase Transactions

11. On January 1, 2018 M/s Hello acquired a Machine on hire purchase from M/s Pass. The

terms of the contract were as follows:

(a) The cash price of the Machine was ` 2,00,000.

(b) ` 80,000 were to be paid on signing of the contract.

(c) The balance was to be paid in annual instalments of ` 40,000 plus interest. The first

instalment was to be paid on 31 st Dec. 2018.

(d) Interest chargeable on the outstanding balance was 6% p.a.

(e) Depreciation at 10% p.a. is to be written-off using the WDV method.

You are required to give Journal Entries in the books of M/s Hello from January 1, 2018 to

December 31, 2020.

Departmental Accounts

12. M/s. Hero is a Departmental Store having three departments X, Y and Z. The information

regarding three departments for the year ended 31 st March, 2021 are given below:

Particulars Dept. X Dept. Y Dept. Z

Opening Stock 18,000 12,000 10,000

Purchases 66,000 44,000 22,000

Debtors at end 7,500 5,000 5,000

Sales 90,000 67,500 45,000

Closing Stock 22,500 8,750 10,500

Value of furniture in each Department 10,000 10,000 5,000

Floor space occupied by each Dept. (in Sq. ft.) 1,500 1,250 1,000

© The Institute of Chartered Accountants of India

14 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2021

Number of employees in each Department 25 20 15

Electricity consumed by each Department (in units) 300 200 100

Additional Information:

Amount (`)

Carriage inwards 1,500

Carriage outwards 2,700

Salaries 24,000

Advertisement 2,700

Discount allowed 2,250

Discount received 1,800

Rent, Rates and Taxes 7,500

Depreciation on furniture 1,000

Electricity Expenses 3,000

Labour welfare expenses 2,400

Prepare Departmental Trading and Profit & Loss Account for the year ended

31st March, 2021 after providing provision for Bad Debts at 5%.

Accounting for Branches

13. Lal & Co. of Jaipur has a branch in Patna to which goods are sent @ 20% above cost. T he

branch makes both cash & credit sales. Branch expenses are paid direct from Head office

and the branch has to remit all cash received into the bank account of Head office. Branch

doesn't maintain any books of accounts but sends monthly returns to the head office.

Following further details are given for the year ended 31st March, 2020:

Amount (`)

Goods received from Head office at Invoice Price 4,20,000

Goods returned to Head office at Invoice Price 30,000

Cash sales for the year 2019-20 92,500

Credit Sales for the year 2019-20 3,12,500

Stock at Branch as on 01-04-2019 at Invoice price 36,000

Sundry Debtors at Patna branch as on 01-04-2019 48,000

Cash received from Debtors 2,19,000

Discount allowed to Debtors 3,750

Goods returned by customer at Patna Branch 7,000

Bad debts written off 2,750

Amount recovered from Bad debts previously written off as Bad 500

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 15

Rent, Rates & taxes at Branch 12,000

Salaries & wages at Branch 36,000

Office Expenses (at Branch) 4,600

Stock at Branch as on 31-03-2020 at cost price 62,500

Prepare necessary ledger accounts in the books of Head office by following Stock and

Debtors method and ascertain Branch profit.

Accounts from Incomplete Records

14. From the following details furnished by Mittal ji, prepare Trading and Profit and Loss

account for the year ended 31.3.2021. Also draft his Balance Sheet as at 31.3.2021:

1.4.2020 31.3.2021

` `

Creditors 3,15,400 2,48,000

Expenses outstanding 12,000 6,600

Plant and Machinery 2,32,200 2,40,800

Stock in hand 1,60,800 2,22,400

Cash in hand 59,200 24,000

Cash at bank 80,000 1,37,600

Sundry debtors 3,30,600 ?

Details of the year’s transactions are as follows:

Cash and discount credited to debtors 12,80,000

Returns from debtors 29,000

Bad debts 8,400

Sales (Both cash and credit) 14,36,200

Discount allowed by creditors 14,000

Returns to creditors 8,000

Capital introduced by cheque 1,70,000

Collection from debtors (Deposited into bank after 12,50,000

receiving cash)

Cash purchases 20,600

Expenses paid by cash 1,91,400

Drawings by cheque 8,600

Machinery acquired by cheque 63,600

Cash deposited into bank 1,00,000

© The Institute of Chartered Accountants of India

16 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2021

Cash withdrawn from bank 1,84,800

Cash sales 92,000

Payment to creditors by cheque 12,05,400

Note: Mittalji has not sold any machinery during the year.

Framework for Preparation and Presentation of Financial Statements

15. What is meant by ‘Measurement’? What are the bases of measurement of Elements of

Financial Statements? Explain in brief.

AS 2 Valuation of Inventories

16. On 31st March 2020, a business firm finds that cost of a partly finished unit on that date is

` 430. The unit can be finished in 2020-21 by an additional expenditure of ` 310. The

finished unit can be sold for ` 750 subject to payment of 2% brokerage on selling price.

The firm seeks your advice regarding the amount at which the unfinished unit should be

valued as at 31st March, 2020 for preparation of final accounts. Assume that the partly

finished unit cannot be sold in semi-finished form and its NRV is zero without processing

it further.

AS 10 Property, Plant and Equipment

17. A property costing ` 10,00,000 is bought on 1.4.2020. Its estimated total physical life is 50

years. However, the company considers it likely that it will sell the property after 25 years.

The estimated residual value in 25 years' time, based on current year prices, is:

Case (a) ` 10,00,000

Case (b) ` 9,00,000

You are required to compute the amount of depreciation charged for the year ended

31.3.2021.

AS 11 The Effects of Changes in Foreign Exchange Rates

18. Mona Ltd. purchased a plant for US$ 1,00,000 on 01 st December 2020, payable after three

months. Company entered into a forward contract for three months @ ` 49.15 per dollar.

Exchange rate per dollar on 01 st December was ` 48.85. How will you recognize the profit

or loss on forward contract in the books of Mona Ltd for the year ended 31 st March, 2021?

AS 12 Accounting for Government Grants

19. (a) D Ltd. acquired a machine on 01-04-2017 for ` 20,00,000. The useful life is 5 years.

The company had applied on 01-04-2017, for a subsidy to the tune of 80% of the cost.

The sanction letter for subsidy was received in November 2020. The Company’s Fixed

Assets Account for the financial year 2020-21 shows a credit balance as under:

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 17

Particulars `

Machine (Original Cost) 20,00,000

Less: Accumulated Depreciation (from 2017-18- to 2019-20 on

Straight Line Method) 12,00,000

8,00,000

Less: Grant received (16,00,000)

Balance (8,00,000)

You are required to explain how should the company deal with this asset in its

accounts for 2020-21?

AS 13 Accounting for Investments

(b) Z Bank has classified its total investment on 31-3-2021 into three categories (a) held

to maturity (b) available for sale (c) held for trading as per the RBI Guidelines.

‘Held to maturity’ investments are carried at acquisition cost less amortised amount.

‘Available for sale’ investments are carried at marked to market. ‘Held for trading’

investments are valued at weekly intervals at market rates. Net depreciation, if any,

is charged to revenue and net appreciation, if any, is ignored. Comment whether the

policy of the bank is in accordance with AS 13?

AS 16 Borrowing Costs

20. In May, 2020, Omega Ltd. took a bank loan from a Bank. This loan was to be used

specifically for the construction of a new factory building. The construction was completed

in January, 2021 and the building was put to its use immediately thereafter. Interest on the

actual amount used for construction of the building till its completion was ` 18 lakhs,

whereas the total interest payable to the bank on the loan for the period till 31 st March,

2021 amounted to ` 25 lakhs.

the company wants to treat ` 25 lakhs as part of the cost of factory building and thus

capitalize it on the plea that the loan was specifically taken for the construction of factory

building? Explain the treatment in line with the provisions of AS 16.

SUGGESTED ANSWERS

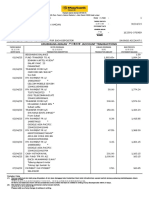

1. Balance sheet of Om Ltd. as at 31st March, 2021

Note (`)

I Equity and Liabilities

(1) Shareholders’ funds:

(a) Share capital 1 12,00,000

(b) Reserves and surplus 2 1,14,150

© The Institute of Chartered Accountants of India

18 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2021

(2) Non-current liabilities:

Long term borrowings 3 4,50,000

(3) Current liabilities:

(a) Short term borrowings 4 4,50,000

(b) Trade payables 2,63,550

(c) Other current liabilities 5 11,250

Total 24,88,950

II ASSETS

(1) Non- Current Assets:

(a) Property, plant and equipment 6 11,49,900

(b) Intangible assets 7 4,05,000

(c) Non-current investments (Shares at cost) 1,50,000

(2) Current Assets:

(a) Inventories 4,27,500

(b) Trade receivables 8 2,72,550

(c) Cash and Cash equivalents – Cash on hand 84,000

Total 24,88,950

Note: There is a Contingent liability for Bills receivable discounted with Bank ` 6000.

Statement of Profit and Loss of Om Ltd. for the year ended 31 st March, 2021

Particulars Note `

I Revenue from Operations 20,11,050

II Other income (Dividend income) 12,750

III Total Revenue (I &+ II) 20,23,800

IV Expenses:

(a) Purchases of Inventory (14,71,500 – Advertisement

14,56,500

Expenses 15,000)

(b) Changes in Inventories of finished Goods / Work in

8,100

progress & inventory (4,35,600 – 4,27,500)

(c) Employee Benefits expense 9 1,20,000

(d) Finance costs 10 51,900

(e) Depreciation & Amortization Expenses 11 56,100

(f) Other Expenses 12 3,02,550

Total Expenses 19,95,150

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 19

V Profit before exceptional, extraordinary items and tax 28,650

VI Exceptional items -

VII Profit before extra-ordinary items and tax 28,650

VIII Extraordinary items -

IX Profit before tax 28,650

Notes to accounts

(` )

1. Share Capital

Authorized capital:

90,000 Equity Shares of ` 10 each. 9,00,000

6,000 6% Preference shares of ` 100 each 6,00,000

Issued, subscribed & called up:

60,000, Equity Shares of ` 10 each 6,00,000

6,000 6% Redeemable Preference Shares of 100 each 6,00,000

12,00,000

2. Reserves and Surplus

Balance as on 1st April, 2020 85,500

Add: Surplus for current year 28,650

Balance as on 31st March, 2021 1,14,150

3. Long Term Borrowings

5% Mortgage Debentures (Secured against Freehold 4,50,000

Properties)

4. Short Term Borrowings

Secured Borrowings: Loans Repayable on Demand 4,50,000

Overdraft from Banks (Secured by Hypothecation of

Stocks & Receivables)

5. Other Current liabilities

Interest due on Borrowings (5% Debentures) 11,250

6. Property, plant and equipment

Furniture

Furniture at Cost Less depreciation ` 45,000 (as

given in Trial Balance 1,05,000

Add: Depreciation 45,000

Cost of Furniture 1,50,000

© The Institute of Chartered Accountants of India

20 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2021

Add: Installation charge of Electrical Fittings wrongly

included under the heading Salaries and Wages 6,000

Total Gross block of Furniture A/c 1,56,000

Accumulated Depreciation Account: Opening

Balance-given in Trial Balance 45,000

Depreciation for the year:

On Opening WDV at 10% i.e.

(10% x 1,05,000) 10,500

On additional purchase during the year

at 10% i.e. (10% x 6,000) 600

Less: Accumulated Depreciation 56,100 99,900

Freehold property (at cost) 10,50,000

11,49,900

7. Intangible Assets

Technical knowhow 4,50,000

Less: Written off 45,000 4,05,000

8. Trade Receivables

Sundry Debtors (a) Debt outstanding due more than

18,000

six months

(b) Other Debts (refer Working Note) 1,34,550

Bills Receivable (1,24,500 - 4,500) 1,20,000 2,72,550

9. Employee benefit expenses

Salaries & Wages 1,56,000

Less: Wages incurred for installation of electrical

6,000

fittings to be capitalised

Less: Directors’ Remuneration shown separately 30,000

Balance amount 1,20,000

10. Finance Costs

Interest on bank overdraft 29,400

Interest on debentures 22,500

51,900

11. Depreciation & Amortisation Expenses

Depreciation [10% of (1,05,000 + 6,000)] 11,100

Technical knowhow written of (4,50,000/10) 45,000 56,100

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 21

12. Other Expenses

Payment to the auditors 18,000

Director’s remuneration 30,000

Selling expenses 2,37,300

Advertisement (Goods and Articles Distributed) 15,000

Bad Debts (4,500 x 50%) 2,250 3,02,550

Working Note:

Calculation of Sundry Debtors-Other Debts

Sundry Debtors as given in Trial Balance 1,50,300

Add Back: Bills Receivables Dishonoured 4,500

1,54,800

Less: Bad Debts written off – 50% ` 4,500 (2,250)

Adjusted Sundry Debtors 1,52,550

Less: Debts due for more than 6 months (as per information given) (18,000)

Total of other Debtors i.e. Debtors outstanding for less than 6 months 1,34,550

2. (a) Calculation of net profit u/s 198 of the Companies Act, 2013

` `

Gross profit 60,38,048

Add: Subsidies received from Government 4,10,888

64,48,936

Less: Administrative, selling and distribution

12,33,813

expenses

Director’s fees 2,02,170

Interest on debentures 46,860

Depreciation on PPE as per Schedule II 8,63,018 (23,45,861)

Profit u/s 198 41,03,075

Maximum Managerial remuneration under Companies Act, 2013= 11% of ` 41,03,075

= ` 4,51,338

(b) (i) Current Liabilities/ Other Current Liabilities

(ii) Shareholders' Fund / Reserve & Surplus

(iii) Current liabilities/Other Current Liabilities

(iv) Contingent Liabilities and Commitments

(v) Shareholders' Fund / Share Capital

© The Institute of Chartered Accountants of India

22 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2021

3. Cash flow statement (using direct method) for the year ended 31 st March, 2021

(` in crores) (` in crores)

Cash flow from operating activities

Cash sales 393

Cash collected from credit customers 201

Less: Cash paid to suppliers for goods & services and

(376.5)

to employees (Refer Working Note)

Cash from operations 217.5

Less: Income tax paid (39)

Net cash generated from operating activities 178.5

Cash flow from investing activities

Payment for purchase of Machine (15)

Proceeds from sale of investments 24

Net cash used in investing activities 9

Cash flow from financing activities

Redemption of Preference shares (48)

Proceeds from issue of Equity shares 36

Debenture interest paid (3)

Dividend Paid (22.5)

Net cash used in financing activities (37.5)

Net increase in cash and cash equivalents 150

Add: Cash and cash equivalents as on 1.04.2020 3

Cash and cash equivalents as on 31.3.2021 153

Working Note:

Calculation of cash paid to suppliers of goods and services and to employees

(` in crores)

Opening Balance in creditors Account 126

Add: Purchases (330x .8) 264

Total 390

Less: Closing balance in Creditors Account 138

Cash paid to suppliers of goods 252

Add: Cash purchases (330x .2) 66

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 23

Total cash paid for purchases to suppliers (a) 318

Add: Cash paid to suppliers of other consumables and services (b) 28.5

Add: Payment to employees (c) 30

Total cash paid to suppliers of goods & services and to employees

376.5

[(a)+ (b) + (c)]

4. Statement showing the calculation of Profits for the pre-incorporation and post-

incorporation periods

Particulars Total Basis of Pre- Post-

Amount Allocation incorporation incorporation

` ` `

Gross Profit 9,00,000 1:3 2,25,000 6,75,000

Less: Salaries 1,80,000 Time 60,000 1,20,000

Rent, rates and taxes 1,20,000 Time 40,000 80,000

Commission on sales 31,500 Sales(2:5) 9,000 22,500

Depreciation 37,500 Time 12,500 25,000

Interest on debentures 48,000 Post 48,000

Directors’ fee 18,000 Post 18,000

Advertisement 54,000 post 54,000

Net profit 4,11,000 1,03,500 3,07,500

Working Notes:

1. Sales ratio

Let the monthly sales for first 4 months (i.e. from 1.4.2020 to 31.7.2020) be = x

Then, sales for 4 months = 4x

Monthly sales for next 8 months (i.e. from 1.8.20 to 31.3.2021) = x + 25% of x= 1.25x

Then, sales for next 8 months = 1.25x X 8 = 10x

Total sales for the year = 4x + 10x = 14x

Sales Ratio = 4 x :10x i.e. 2:5

2. Gross profit ratio

From 1.4.2020 to 31.7.2020 gross profit is 25% of sales

Then, 25% of 4x= 1x

gross profit for next 8 months (i.e. from 1.8.20 to 31.3.2021) is 30%

Then, 30% of 10x = 3x

Therefore gross profit ratio will be 1:3

© The Institute of Chartered Accountants of India

24 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2021

3. Time ratio

1st April, 2020 to 31 st July, 2020 : 1 st August, 2020 to 31 st March, 2021

= 4 months: 8 months = 1:2

Thus, time ratio is 1:2.

5. Journal Entries in the books of Raman Ltd.

` `

1-4-2021 Equity share final call A/c Dr. 8,10,000

To Equity share capital A/c 8,10,000

(For final calls of ` 2 per share on 4,05,000

equity shares due as per Board’s Resolution

dated….)

20-4-2021 Bank A/c Dr. 8,10,000

To Equity share final call A/c 8,10,000

(For final call money on 4,05,000 equity

shares received)

Securities Premium A/c Dr. 1,12,500

Capital Redemption Reserve A/c Dr. 1,80,000

General Reserve A/c Dr. 5,40,000

Profit and Loss A/c (b.f.) Dr. 1,80,000

To Bonus to shareholders A/c 10,12,500

(For making provision for bonus issue of

one share for every four shares held)

Bonus to shareholders A/c Dr. 10,12,500

To Equity share capital A/c 10,12,500

(For issue of bonus shares)

6. Value of right = Cum-right value of the share – Ex-right value of the share (as computed

in Working Note)

= ` 190 – ` 176 = ` 14 per share.

Working Note:

Ex-right value of the shares

= (Cum-right value of the existing shares + Rights shares x Issue Price) / (Existing

No. of shares + No. of right shares) = (` 190 X 4 Shares + ` 120 X 1 Share) /

(4 + 1) Shares

= ` 880 / 5 shares = ` 176 per share.

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 25

7. Journal Entries

Date Particulars Dr. (`) Cr. (`)

Bank A/c Dr. 1,26,750

To Equity Share Capital A/c 1,26,750

(Being the issue of 12,675 Equity Shares of

` 10 each as per Board’s Resolution No....dated….)

9% Redeemable Preference Share Capital A/c Dr. 3,00,000

Premium on Redemption of Preference Shares A/c Dr. 30,000

To Preference Shareholders A/c 3,30,000

(Being the amount paid on redemption transferred to

Preference Shareholders Account)

Bank A/c Dr. 60,750

Profit and Loss A/c (loss on sale) A/c Dr. 6,750

To Investment A/c 67,500

(Being investment sold at loss of ` 6,750)

Preference Shareholders A/c Dr. 3,30,000

To Bank A/c 3,30,000

(Being the amount paid on redemption of preference

shares)

Profit & Loss A/c Dr. 30,000

To Premium on Redemption of

Preference Shares A/c 30,000

(Being the premium payable on redemption is

adjusted against Profit & Loss Account)

General Reserve A/c Dr. 1,20,000

Profit & Loss A/c Dr. 53,250

To Capital Redemption Reserve A/c 1,73,250

(Being the amount transferred to Capital Redemption

Reserve Account)

Balance Sheet as at 31.3.2021[Extracts]

Particulars Notes `

No.

EQUITY AND LIABILITIES

1. Shareholders’ funds

a Share capital 1 5,76,750

© The Institute of Chartered Accountants of India

26 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2021

b Reserves and Surplus 2 2,55,750

ASSETS

2. Current Assets

Cash and cash equivalents

(2,92,500 + 1,26,750+ 60,750 – 3,30,000) 1,50,000

Notes to accounts

1. Share Capital

57,675 Equity shares (45,000 + 12,675) of `10 each fully paid up 5,76,750

2. Reserves and Surplus

General Reserve 60,000

Profit and loss account NIL

Capital Redemption Reserve 1,73,250

Investment Allowance Reserve 22,500

2,55,750

Working Note:

Number of Shares to be issued for redemption of Preference Shares:

Face value of shares redeemed ` 3,00,000

Less: Profit available for distribution as dividend:

General Reserve: ` (1,80,000-60,000) ` 1,20,000

Profit and Loss (90,000 less 30,000 set aside for

adjusting premium payable on redemption of Pref.

shares less 6,750 loss on sale of investments) ` c 53,250

` (1,73,250)

` 1,26,750

Therefore, No. of shares to be issued = ` 1,26,750/`10 = 12,675 shares.

8. Journal Entries in the books of Jeet Ltd.

Journal Entries

Date Particulars Amount Dr. Amount Cr.

` `

1.5.2020 Bank A/c Dr. 75,00,000

To Debenture Application A/c 75,00,000

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 27

(Application money received on 75,000

debentures @ ` 100 each)

1.6.2020 Debenture Application A/c Dr. 75,00,000

Underwriters A/c Dr. 25,00,000

To 15% Debentures A/c 1,00,00,000

(Allotment of 75,000 debentures to

applicants and 25,000 debentures to

underwriters)

Underwriting Commission Dr. 2,00,000

To Underwriters A/c 2,00,000

(Commission payable to underwriters @

2% on ` 1,00,00,000)

Bank A/c Dr. 23,00,000

To Underwriters A/c 23,00,000

(Amount received from underwriters in

settlement of account)

1.6.2020 Debenture Redemption Reserve 6,00,000

Investment A/c

To Bank A/c (1,00,000x100x15%x 40%) Dr. 6,00,000

(Being Investments made for redemption

purpose)

30.9.2020 Debenture Interest A/c Dr. 5,00,000

To Bank A/c 5,00,000

(Interest paid on debentures for 4 months

@ 15% on ` 1,00,00,000)

31.10.2020 15% Debentures A/c Dr. 60,00,000

To Equity Share Capital A/c 10,00,000

To Securities Premium A/c 50,00,000

(Conversion of 60% of debentures into

shares of ` 60 each with a face value of

` 10)

31.3.2021 Debenture Interest A/c Dr. 3,75,000

To Bank A/c 3,75,000

(Interest paid on debentures for the half

year) (refer working note below)

© The Institute of Chartered Accountants of India

28 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2021

Working Note :

Calculation of Debenture Interest for the half year ended 31st March, 2021

On ` 40,00,000 for 6 months @ 15% = ` 3,00,000

On ` 60,00,000 for 1 months @ 15% = ` 75,000

` 3,75,000

9. In the books of Meeta

8% Bonds for the year ended 31 st March, 2021

Date Particulars No. Income Amount Date Particulars No. Income Amount

` ` ` `

2020 1 May By Bank- - 18,000

1 April, To Bank A/c 4,500 15,000 3,47,250 2020 Interest

Oct. 1

2021 To P & L A/c - - 4,312.50 1 Oct. By Bank A/c 1,125 3,750 91,125

March 31 (W.N.1) 2020

To P & L A/c 20,250 1 Nov. By Bank- 13,500

2021 Interest

2021 By Balance 3,375 - 2,60,437.50

Mar. c/d

31 (W.N.2)

4,500 35,250 3,51,562.50 4,500 35,250 3,51,562.50

Investment in Equity shares of Kamal Ltd. for the year ended 31 st March, 2021

Date Particulars No. Income Amount Date Particulars No. Income Amount

` ` ` `

2020 To Bank 6,000 -- 2,69,280 2021 By Bank – - 10,800

July 10 A/c Jan dividend

15

2021 To Bank 600 - 3,000 March By Balance 6,600 2,72,280

March A/c 31 c/d

15 (W.N. 3) (bal. fig.)

March To P & L

31 A/c - 10,800

6,600 10,800 2,72,280 6,600 10,800 2,72,280

Working Notes:

1. Profit on sale of 8% Bonds

Sales price ` 91,125

Less: Cost of bonds sold = 3,47,250/4,500x 1,125 (` 86,812.50)

Profit on sale ` 4,312.50

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 29

2. Closing balance as on 31.3.2021 of 8 % Bonds

3,47,250/4,500x 3,375= ` 2,60,437.50

3. Calculation of right shares subscribed by Kamal Ltd.

Right Shares = 6,000/4 x 1= 1,500 shares

Shares subscribed by Meeta = 1,500 x 40%= 600 shares

Value of right shares subscribed = 600 shares @ ` 5 per share = ` 3,000

4. Calculation of sale of right entitlement by Kamal Ltd.

No. of right shares sold = 1,500 – 600 = 900 rights for 2,025

Note: As per para 13 of AS 13, sale proceeds of rights are to be credited to P & L

A/c.

10. In the books of Mr. Heera

Trading Account for the year ended 31.3.2021

` `

To Opening Stock 2,02,500 By Sales 13,50,000

To Purchases 9,67,500 By Closing Stock at cost 2,70,000

To Gross Profit 4,50,000 100

(2,43,000× )

90

16,20,000 16,20,000

Memorandum Trading A/c

for the period from 1.4.2021 to 02.06.2021

` `

To Opening Stock (at cost) 2,70,000 By Sales 7,20,000

To Purchases 3,37,500 Less: Goods not

Add: Goods received but dispatched 1,12,500 6,07,500

invoice not received 45,000 By Closing stock (Balancing 2,25,000

3,82,500 figure)

Less: Machinery 22,500 3,60,000

To Gross Profit (Refer W.N.) 2,02,500

8,32,500 8,32,500

© The Institute of Chartered Accountants of India

30 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2021

Calculation of Insurance Claim

Actual loss of stock

Claim subject to average clause = ×Amount of policy

Value of stock on the date of fire

2,25,000

= 1,80,000 x ( )= ` 1,80,000

2,25,000

Working Note:

4,50,000

G.P. ratio = ×100 = 33 1 %

13,50,000 3

1

Amount of Gross Profit = ` 6,07,500 x 33 % = ` 2,02,500

3

11. In the books of M/s Hello

Journal Entries

Date Particulars Dr. Cr.

` `

2018 Machine A/c Dr. 2,00,000

Jan. 1 To M/s Pass A/c 2,00,000

(Being the purchase of a Machine on hire

purchase from M/s Pass)

“ M/s Pass A/c Dr. 80,000

To Bank A/c 80,000

(Being the amount paid on signing the H.P.

contract)

Dec. 31 Interest A/c Dr. 7,200

To M/s Pass A/c 7,200

(Being the interest payable @ 6% on

` 1,20,000

“ M/s Pass A/c (` 40,000+` 7,200) Dr. 47,200

To Bank A/c 47,200

(Being the payment of 1 st instalment along

with interest)

“ Depreciation A/c Dr. 20,000

To Machine A/c 20,000

(Being the depreciation charged @ 10% p.a.

on ` 2,00,000)

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 31

“ Profit & Loss A/c Dr. 27,200

To Depreciation A/c 20,000

To Interest A/c 7,200

(Being the depreciation and interest

transferred to Profit and Loss Account)

2019 Interest A/c Dr. 4,800

Dec. 31 To M/s Pass A/c 4,800

(Being the interest payable @ 6% on

` 80,000)

M/s Pass A/c (` 40,000 + ` 4,800) Dr. 44,800

To Bank A/c 44,800

(Being the payment of 2 nd instalment along

with interest)

Depreciation A/c Dr. 18,000

To Machine A/c 18,000

(Being the depreciation charged @ 10% p.a.)

Profit & Loss A/c Dr. 22,800

To Depreciation A/c 18,000

To Interest A/c 4,800

(Being the depreciation and interest charged

to Profit and Loss Account)

2020 Interest A/c Dr. 2,400

Dec. 31 To M/s Pass A/c 2,400

(Being the interest payable @ 6% on

` 40,000)

M/s Pass A/c (` 40000 + ` 2,400) Dr. 42,400

To Bank A/c 42,400

(Being the payment of final instalment along

with interest)

Depreciation A/c Dr. 16,200

To Machine A/c 16,200

(Being the depreciation charged @ 10% p.a.)

Profit & Loss A/c Dr. 18,600

To Depreciation A/c 16,200

© The Institute of Chartered Accountants of India

32 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2021

To Interest A/c 2,400

(Being the interest and depreciation charged

to Profit and Loss Account)

12. In the Books of M/s Hero

Departmental Trading and Profit and Loss Account

for the year ended 31 st March, 2021

Particulars Deptt.X Deptt.Y Deptt.Z Total Particulars Deptt.X Deptt.Y Deptt.Z Total

` ` ` ` ` ` ` `

To Stock 18,000 12,000 10,000 40,000 By Sales 90,000 67,500 45,000 2,02,500

(opening)

To Purchases 66,000 44,000 22,000 1,32,000 By Stock 22,500 8,750 10,500 41,750

(closing)

To Carriage 750 500 250 1,500

Inwards

To Gross Profit 27,750 19,750 23,250 70,750

c/d (b.f.)

1,12,500 76,250 55,500 2,44,250 1,12,500 76,250 55,500 2,44,250

To Carriage 1,200 900 600 2,700 By Gross 27,750 19,750 23,250 70,750

Outwards Profit b/d

To Electricity 1,500 1,000 500 3,000 By Discount 900 600 300 1,800

received

To Salaries 10,000 8,000 6,000 24,000

To Advertisement 1,200 900 600 2,700

To Discount 1,000 750 500 2,250

allowed

To Rent, Rates 3,000 2,500 2,000 7,500

and Taxes

To Depreciation 400 400 200 1,000

To Provision for 375 250 250 875

Bad Debts @ 5%

of debtors

To Labour 1,000 800 600 2,400

welfare expenses

To Net Profit (b.f.) 8,975 4,850 12,300 26,125

28,650 20,350 23,550 72,550 28,650 20,350 23,550 72,550

Working Note:

Basis of allocation of expenses

Carriage inwards Purchases (3:2:1)

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 33

Carriage outwards Turnover (4:3:2)

Salaries No. of Employees (5:4:3)

Advertisement Turnover (4:3:2)

Discount allowed Turnover (4:3:2)

Discount received Purchases (3:2:1)

Rent, Rates and Taxes Floor Space occupied (6:5:4)

Depreciation on furniture Value of furniture (2:2:1)

Labour welfare expenses No. of Employees (5:4:3)

Electricity expense Units consumed (3:2:1)

Provision for bad debts Debtors balances (3:2:2)

13. Branch Stock Account

` ` ` `

1.4.19 To Balance b/d 36,000 31.3.20 By Sales:

(opening

stock)

31.3.20 To Goods Sent 4,20,000 Cash 92,500

to Branch A/c Credit 3,12,500

To Branch P&L 47,000 Less: (7,000) 3,05,500 3,98,000

Return

By Goods 30,000

sent to

branch -

returns

By Balance 75,000

c/d

(closing

stock)

5,03,000 5,03,000

1.4.20 To Balance b/d 75,000

Branch Debtors Account

` `

1.4.19 To Balance b/d 48,000 31.3.20 By Cash 2,19,000

31.3.20 To Sales 3,12,500 By Returns 7,000

By Discounts 3,750

By Bad debts 2,750

By Balance c/d 1,28,000

3,60,500 3,60,500

1.4.20 To Balance b/d 1,28,000

© The Institute of Chartered Accountants of India

34 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2021

Branch Expenses Account

` `

31.3.20 To Salaries & Wages 36,000 31.3.20 By Branch P&L 59,100

A/c

To Rent, Rates &

Taxes 12,000

To Office Expenses 4,600

To Discounts 3,750

To Bad Debts 2,750

59,100 59,100

Branch Profit & Loss Account for year ended 31.3.20

` `

31.3.20 To Branch 59,100 31.3.20 By Branch stock 47,000

Expenses A/c

To Net Profit By Branch Stock

transferred to Adjustment

account 58,500

General P & L By Bad debts

A/c 46,900 recovered 500

1,06,000 106,000

Branch Stock Adjustment Account for year ended 31.3.20

` `

31.3.20 To Goods sent to 5,000 31.3.20 By Balance b/d 6,000

branch (30,000x1/6) (36,000x1/6)

-returns

To Branch P & L A/c 58,500 By Goods sent to 70,000

branch

(4,20,000x1/6)

To Balance c/d

(75,000x1/6) 12,500

76,000 76,000

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 35

14. In the books of Mittal ji

Trading and Profit and Loss Account

for the year ended 31st March, 2021

` ` ` `

To Opening stock 1,60,800 By Sales:

To Purchases: Cash 92,000

Cash 20,600 Credit 13,44,200

Credit (W.N. 3) 11,60,000 14,36,200

11,80,600 Less: Returns (29,000) 14,07,200

Less: Returns (8,000) 11,72,600

To Gross Profit c/d 2,96,200 By Closing stock 2,22,400

16,29,600 16,29,600

To Discount allowed 30,000 By Gross profit b/d 2,96,200

To Bad debts 8,400 By Discount 14,000

To General expenses 1,86,000

(W.N. 5)

To Depreciation 55,000

(W.N. 4)

To Net profit 30,800

3,10,200 3,10,200

Balance Sheet as at 31st March, 2021

Liabilities ` Assets `

Capital (W.N. 1) 5,35,400 Plant & Machinery 2,32,200

Add: Additional 1,70,000 Add: New

capital machinery 63,600

Net profit 30,800 2,95,800

7,36,200 Less: Depreciation (55,000) 2,40,800

Less: Drawings (8,600) 7,27,600 Stock in trade 2,22,400

Sundry creditors 2,48,000 Sundry debtors (W.N. 2) 3,57,400

Expenses 6,600 Cash in hand 24,000

outstanding

Cash in Bank 1,37,600

9,82,200 9,82,200

© The Institute of Chartered Accountants of India

36 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2021

Working Notes:

(1) Statement of Affairs as at 31st March, 2020

Liabilities ` Assets `

Sundry creditors 3,15,400 Plant & Machinery 2,32,200

Outstanding expenses 12,000 Stock 1,60,800

Mittal’s Capital Debtors 3,30,600

(Balancing figure) 5,35,400 Cash in hand 59,200

_______ Cash at Bank 80,000

8,62,800 8,62,800

(2) Sundry Debtors Account

` `

To Balance b/d 3,30,600 By Cash 12,50,000

To Sales 13,44,200 By Discount 30,000

(14,36,200 – 92,000)

By Returns (sales) 29,000

By Bad debts 8,400

________ By Balance c/d (Bal. fig.) 3,57,400

16,74,800 16,74,800

(3) Sundry Creditors Account

` `

To Bank – Payments 12,05,400 By Balance b/d 3,15,400

To Discount 14,000 By Purchases credit 11,60,000

To Returns 8,000 (Balancing figure)

To Balance c/d (closing

balance) 2,48,000

14,75,400 14,75,400

(4)

Depreciation on Plant & Machinery: `

Opening balance 2,32,200

Add: Additions 63,600

2,95,800

Less: Closing balance (2,40,800)

Depreciation 55,000

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 37

(5) Expenses to be shown in profit and loss account

Expenses (in cash) 1,91,400

Add: Outstanding of 2021 6,600

1,98,000

Less: Outstanding of 2020 12,000

1,86,000

(6) Cash and Bank Account

Cash Bank Cash Bank

` ` ` `

To Balance b/d 59,200 80,000 By Purchases 20,600 −

To Capital 1,70,000 By Expenses 1,91,400

To Debtors 12,50,000 By Plant and 63,600

Machinery

To Bank 1,84,800 By Drawings 8,600

To Cash 1,00,000 By Creditors 12,05,400

To Sales 92,000 By Cash 1,84,800

By Bank 1,00,000

_______ ________ By Balance c/d 24,000 1,37,600

3,36,000 16,00,000 3,36,000 16,00,000

15. Measurement is the process of determining money value at which an element can be

recognized in the balance sheet or statement of profit and loss. The framework recognizes

four alternative measurement bases for the purpose. These bases can be explained as:

Historical cost This is the Acquisition price. According to this, assets are

recorded at an amount of cash and cash equivalent paid or

the fair value of the assets at time of acquisition.

Current Cost Assets are carried out at the amount of cash or cash

equivalent that would have to be paid if the same or an

equivalent asset was acquired currently. Liabilities are

carried at the undiscounted amount of cash or cash

equivalents that would be required to settle the obligation

currently.

Realisable (Settlement) For assets, amount currently realizable on sale of the asset

Value in an orderly disposal. For liabilities, this is the undiscounted

amount expected to be paid on settlement of liability in the

normal course of business.

© The Institute of Chartered Accountants of India

38 INTERMEDIATE (NEW) EXAMINATION: NOVEMBER, 2021

Present Value Assets are carried at present value of future net cash flows

generated by the concerned assets in the normal course of

business. Liabilities are carried at present value of future net

cash flows that are expected to be required to settle the

liability in the normal course of business.

In preparation of financial statements, all or any of the measurement basis can be used in

varying combinations to assign money values to financial items.

16. Valuation of unfinished unit

`

Net selling price 750

Less: Estimated cost of completion (310)

440

Less: Brokerage (2 % of 750) (15)

Net Realisable Value 425

Cost of inventory 430

Value of inventory (Lower of cost and net realisable value) 425

17. Case (a)

The company considers that the residual value, based on prices prevailing at the balance

sheet date, will equal the cost.

There is, therefore, no depreciable amount and depreciation is zero.

Case (b)

The company considers that the residual value, based on prices prevailing at the balance

sheet date, will be ` 9,00,000 and the depreciable amount is, therefore, ` 1,00,000.

Annual depreciation (on a straight line basis) will be ` 4,000 [{10,00,000 – 9,00,000} ÷ 25].

18. Forward Rate ` 49.15

Less: Spot Rate (` 48.85)

Premium on Contract ` 0.30

Contract Amount US$ 1,00,000

Total Loss (1,00,000 x 0.30) ` 30,000 to be recognized in year ended 31.3.2021.

19. (a) From the above account, it is inferred that the Company has deducted grant from the

book value of asset for accounting of Government Grants. Accordingly, out of the `

16,00,000 that has been received, ` 8,00,000 (being the balance in Machinery A/c)

should be credited to the machinery A/c.

© The Institute of Chartered Accountants of India

PAPER – 1 : ACCOUNTING 39

The balance ` 8,00,000 may be credited to P&L A/c, since already the cost of the

asset to the tune of ` 12,00,000 had been debited to P&L A/c in the earlier years by

way of depreciation charge, and ` 8,00,000 transferred to P&L A/c now would be

partial recovery of that cost.

There is no need to provide depreciation for 2020-21 or 2021-22 as the depreciable

amount is now Nil.

(b) As per AS 13 ‘Accounting for Investments’, the accounting standard is not applicable

to Bank, Insurance Company, Mutual Funds. In this case Z Bank is a bank, therefore,

AS 13 does not apply to it. For banks, the RBI has issued guidelines for classification

and valuation of its investment and Z Bank should comply with those RBI

Guidelines/Norms. Therefore, though Z Bank has not followed the provisions of

AS 13, yet it would not be said as non-compliance since, it is complying with the

norms stipulated by the RBI.

20. AS 16 clearly states that capitalization of borrowing costs should cease when substantially

all the activities necessary to prepare the qualifying asset for its intended use are

completed. Therefore, interest on the amount that has been used for the construction of

the building up to the date of completion (January, 2021) i.e. ` 18 lakhs alone can be

capitalized. It cannot be extended to ` 25 lakhs.

© The Institute of Chartered Accountants of India

You might also like

- Branch AccountingDocument38 pagesBranch AccountingUmra khatoonNo ratings yet

- Rapid Plant Assessment - BKDocument25 pagesRapid Plant Assessment - BKeragonindiaNo ratings yet

- Chapter 2 - Strategic Leadership - Managing The Strategy Process (1) 2Document56 pagesChapter 2 - Strategic Leadership - Managing The Strategy Process (1) 2Alex RossiNo ratings yet

- Chap 6Document27 pagesChap 6Basant OjhaNo ratings yet

- Business English Compound Nouns Direct Method Activities 111808Document2 pagesBusiness English Compound Nouns Direct Method Activities 111808Julio MoreiraNo ratings yet

- Practice Accounts Prime PDFDocument56 pagesPractice Accounts Prime PDFShraddha NepalNo ratings yet

- Accounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of IndiaDocument53 pagesAccounting For Branches Including Foreign Branch Accounts: © The Institute of Chartered Accountants of IndiaHarikrishna100% (1)

- AS 25 Interim Financial ReportingDocument22 pagesAS 25 Interim Financial ReportingHemanth SNo ratings yet

- 5 6084915055709651012Document8 pages5 6084915055709651012Ajit Yadav100% (1)

- CA Inter Adv Accounts (New) Suggested Answer Dec21Document30 pagesCA Inter Adv Accounts (New) Suggested Answer Dec21omaisNo ratings yet

- AS-20 QuestionDocument7 pagesAS-20 QuestionDeepthi R TejurNo ratings yet

- 15-Mca-Nr-Accounting and Financial ManagementDocument4 pages15-Mca-Nr-Accounting and Financial ManagementSRINIVASA RAO GANTA0% (2)

- Group - I Paper - 1 Accounting V2 Chapter 13 PDFDocument13 pagesGroup - I Paper - 1 Accounting V2 Chapter 13 PDFjashveer rekhiNo ratings yet

- 35 Resource 11Document16 pages35 Resource 11Anonymous bf1cFDuepPNo ratings yet

- Ca Ipcc Costing and Financial Management Suggested Answers May 2015Document20 pagesCa Ipcc Costing and Financial Management Suggested Answers May 2015Prasanna KumarNo ratings yet

- CA IPCC Accounting Guideline Answers May 2015Document24 pagesCA IPCC Accounting Guideline Answers May 2015Prashant PandeyNo ratings yet

- Test Paper 6 With Suggested AnswersDocument5 pagesTest Paper 6 With Suggested Answersdivyaagrawal701No ratings yet

- Department AccountsDocument14 pagesDepartment Accountsjashveer rekhiNo ratings yet

- AS 17 Segment ReportingDocument11 pagesAS 17 Segment ReportingNishant Jha Mcom 2No ratings yet

- As 11 Question 12 SolutionDocument3 pagesAs 11 Question 12 SolutionDebjit Raha100% (1)

- Finance RTP Cap-II June 2016Document37 pagesFinance RTP Cap-II June 2016Artha sarokarNo ratings yet

- Banking CompaniesDocument34 pagesBanking CompaniesLodaNo ratings yet

- 5 Debenture Material3619080524732228932Document14 pages5 Debenture Material3619080524732228932Prabin stha100% (1)

- Group 2 May 07Document73 pagesGroup 2 May 07princeoftolgate100% (1)

- Study Note 3, Page 114-142Document29 pagesStudy Note 3, Page 114-142s4sahithNo ratings yet

- Buyback of SharesDocument68 pagesBuyback of SharesStreeCreteNo ratings yet

- As-2 Inventory Valuation: 1) IntroductionDocument17 pagesAs-2 Inventory Valuation: 1) IntroductionDipen AdhikariNo ratings yet

- CA Inter Advacned Accounts AmalgamationDocument4 pagesCA Inter Advacned Accounts AmalgamationJagriti SharmaNo ratings yet

- Capital Gain & IFOS - PaperDocument6 pagesCapital Gain & IFOS - PaperVenkataRajuNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Pe2 Acc Nov05Document19 pagesPe2 Acc Nov05api-3825774No ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument31 pagesPaper - 3: Cost and Management Accounting Questions Material CostMohammed Mustafa KampuNo ratings yet

- Unit 3 Retirement of A Partner - Problems With AnswersDocument13 pagesUnit 3 Retirement of A Partner - Problems With Answersds1619231No ratings yet

- CG Notes PDFDocument49 pagesCG Notes PDFT S NarasimhanNo ratings yet

- Partnership PDFDocument28 pagesPartnership PDFBasant OjhaNo ratings yet

- Decemeber 2020 Examinations: Suggested Answers ToDocument41 pagesDecemeber 2020 Examinations: Suggested Answers ToDipen AdhikariNo ratings yet

- Dissolution of Partnership Firm - ICAIDocument70 pagesDissolution of Partnership Firm - ICAIDbNo ratings yet

- Account Past Questions Compilation (2009june - 2020 Dec.)Document246 pagesAccount Past Questions Compilation (2009june - 2020 Dec.)Prashant Sagar Gautam100% (2)

- Suggested Answers: QuestionsDocument104 pagesSuggested Answers: QuestionsabhishekkgargNo ratings yet

- Costing FM Mock Test May 2019Document20 pagesCosting FM Mock Test May 2019Roshinisai VuppalaNo ratings yet

- Advanced Accounts 1 PDFDocument304 pagesAdvanced Accounts 1 PDFJohn Louie NunezNo ratings yet

- 13 17227rtp Ipcc Nov09 Paper3aDocument24 pages13 17227rtp Ipcc Nov09 Paper3aemmanuel JohnyNo ratings yet

- CA Inter Cost Important Questions For CA Nov'22Document93 pagesCA Inter Cost Important Questions For CA Nov'2202 Tapasvee ShahNo ratings yet

- Operating CostingDocument13 pagesOperating CostingJoydip DasguptaNo ratings yet

- Chap 5 PDFDocument22 pagesChap 5 PDFHiren ChauhanNo ratings yet

- Not For Profit OrganizationDocument69 pagesNot For Profit OrganizationDristi SaudNo ratings yet

- PCC 2008 NPO QuestionDocument10 pagesPCC 2008 NPO QuestionVaibhav MaheshwariNo ratings yet

- Liquidation of Company: Important Points of Our Notes/BooksDocument20 pagesLiquidation of Company: Important Points of Our Notes/BooksBhavesh RathodNo ratings yet

- Amalgamation, Absorption Etc PDFDocument21 pagesAmalgamation, Absorption Etc PDFYashodhan MithareNo ratings yet

- Chapter 9 Accounting For Branches Including Foreign Branches PMDocument48 pagesChapter 9 Accounting For Branches Including Foreign Branches PMviji88mba60% (5)

- 7948final Adv Acc Nov05Document16 pages7948final Adv Acc Nov05Kushan MistryNo ratings yet

- Ca Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFDocument28 pagesCa Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFHIMANSHU N0% (1)

- Royalty AccountsDocument11 pagesRoyalty AccountsVipin Mandyam Kadubi0% (1)

- 3 Underwriting of SharesDocument8 pages3 Underwriting of SharesJai Ganesh100% (3)

- Problems From Unit - 5Document8 pagesProblems From Unit - 5jeganrajraj0% (1)

- Chapter 9 Accounting For Branches Including Foreign Branches PDFDocument61 pagesChapter 9 Accounting For Branches Including Foreign Branches PDFAkshansh Mahajan100% (1)

- Revision Test Paper: Cap-Ii: Advanced Accounting: QuestionsDocument158 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questionsshankar k.c.No ratings yet

- Accounts Ques Nov06Document48 pagesAccounts Ques Nov06api-3825774No ratings yet

- WN - 1 Resource Test WN-2 Shares Outstanding TestDocument8 pagesWN - 1 Resource Test WN-2 Shares Outstanding TestSimran KhandujaNo ratings yet

- Conversion or Sale of Partnership Firm Into Limited CompanyDocument24 pagesConversion or Sale of Partnership Firm Into Limited CompanyMadhav TailorNo ratings yet

- Chap 11 Hire Purchase and Instalment Sale Transactions PDFDocument41 pagesChap 11 Hire Purchase and Instalment Sale Transactions PDFsaddamNo ratings yet

- Nov 20Document33 pagesNov 20lakshitashree3420No ratings yet

- Advanced AccountingDocument33 pagesAdvanced AccountingvijaykumartaxNo ratings yet

- Implementing and Validating The Quality SystemDocument23 pagesImplementing and Validating The Quality SystemΑυτός είμαι εγώNo ratings yet

- Private Equity Funds Case StudyDocument13 pagesPrivate Equity Funds Case StudyJaimin VasaniNo ratings yet

- Meaning of RecruitmentDocument24 pagesMeaning of RecruitmentSagar RajpathakNo ratings yet

- Mir Asad Waseem: High Impact Operations Management ProfessionalDocument3 pagesMir Asad Waseem: High Impact Operations Management ProfessionalRukhshindaNo ratings yet

- Jio Niharika BB BillDocument2 pagesJio Niharika BB BillThrived krishna murthyNo ratings yet

- Good Agricultural Practice For ChilliDocument12 pagesGood Agricultural Practice For ChilliAkila N ChandranNo ratings yet

- Fringe Benefits in Tanzania Meaning Objectives TYPES PROBLEMS Prepared by Charles J. MwamtobeDocument6 pagesFringe Benefits in Tanzania Meaning Objectives TYPES PROBLEMS Prepared by Charles J. MwamtobeABILAH SALUM100% (1)

- For Unexempted Establishment OnlyDocument2 pagesFor Unexempted Establishment OnlyPennyLiNo ratings yet

- Waste Mngt. ScandalDocument3 pagesWaste Mngt. ScandalVilma HoseñaNo ratings yet