Tax Quiz 2

Tax Quiz 2

Uploaded by

Peng GuinCopyright:

Available Formats

Tax Quiz 2

Tax Quiz 2

Uploaded by

Peng GuinOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Tax Quiz 2

Tax Quiz 2

Uploaded by

Peng GuinCopyright:

Available Formats

Tax Quiz 2

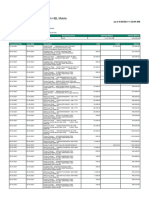

1. A foreign individual who have stayed in the Philippines during the taxable year for more than 180 days

but less than one year is considered a

The correct answer is: nonresident alien doing business in the Philippines

2. A nonresident alien deriving income from Philippine sources claims that he is entitled to personal

exemptions. Which of the following is not a condition for the allowance of personal exemptions to said

taxpayer?

The correct answer is: that he is married to a Filipina.

3. An individual taxpayer, whose personal exemption allowed is the lower amount provided between

Philippine Tax Code and his country’s tax code

Citizenship Residency Business Income

a.

Filipino Outside Yes

b.

Filipino Within No

c.

Alien Outside Yes

d.

Alien Within No

The correct answer is: Alien Outside Yes

4. Dr. X, an expert American Physicist was hired by a Philippine corp. to assist in its organization and

operation for which he had to stay in the Philippines for an indefinite period. His coming to the

Philippines was for a definite purpose which in its nature would require an extended stay and to that

end makes his home temporarily in the Philippines. The American management expert intends to leave

the Philippines as soon as his job is finished. For income tax purposes, the American management expert

shall be classified as

The correct answer is: Resident alien

5. For taxation purposes, a Filipino citizen who stayed outside the Philippines and worked abroad for 182

days during the taxable year is classified as

The correct answer is: resident citizen

6. It is important to know the source of income for income tax purposes (i.e. from within and outside the

Philippines) because

The correct answer is: Some individuals and corporate taxpayers are taxable based on their worldwide

income while others are taxable only on their income from sources within the Philippines.

7. Victoria, an American singer, was engaged to sing for one week at the Victory Plaza after which she

returned to USA. For income tax purposes, she shall be classified as

The correct answer is: Nonresident alien not engaged in trade or business

8. Which of the following is taxable based on world income?

The correct answer is: Resident citizen

9. Which of the following statements is incorrect?

The correct answer is: Lotto winnings in foreign countries are exempt from income taxation in the

Philippines.

10. Which of the following statements is not correct?

The correct answer is: A prize of P10,000 and below is subject to 20% final tax

You might also like

- The Spring Breaks "R" Us Travel Service Booking SystemDocument3 pagesThe Spring Breaks "R" Us Travel Service Booking SystemPeng GuinNo ratings yet

- Western Union Money Transfer ConfirmedDocument4 pagesWestern Union Money Transfer Confirmedramgelgarcia24No ratings yet

- Gujarat Gas - Temp. Disconnection & Reconnection FormDocument2 pagesGujarat Gas - Temp. Disconnection & Reconnection Formmohsinkachot7750% (2)

- RER FormDocument4 pagesRER FormadamfugueNo ratings yet

- (KMS1013) Assignment 2 by Group 19Document10 pages(KMS1013) Assignment 2 by Group 19Nur Sabrina AfiqahNo ratings yet

- Tax 06-Tax On IndividualsDocument12 pagesTax 06-Tax On IndividualsDin Rose Gonzales80% (5)

- Income Tax: Chapter 2: Income Taxes For IndividualDocument87 pagesIncome Tax: Chapter 2: Income Taxes For IndividualMaria Maganda MalditaNo ratings yet

- Tax Quiz 1Document4 pagesTax Quiz 1Peng GuinNo ratings yet

- Brookhurst Company A U S Based Company Established A Subsidiary in SouthDocument1 pageBrookhurst Company A U S Based Company Established A Subsidiary in SouthFreelance WorkerNo ratings yet

- Account Activity Generated Through HBL MobileDocument2 pagesAccount Activity Generated Through HBL MobileKhabeer AiliaNo ratings yet

- Chapter 11 12Document29 pagesChapter 11 12Add All31% (13)

- Individual Taxpayer.2Document10 pagesIndividual Taxpayer.2sgopublication.balbuenaNo ratings yet

- Tax Quiz 2Document5 pagesTax Quiz 2Garcia Alizsandra L.No ratings yet

- Individual TaxationDocument38 pagesIndividual TaxationannyeongchinguNo ratings yet

- Taxation of IndividualsDocument49 pagesTaxation of IndividualsAnastasha Grey100% (2)

- Introduction To Income TaxDocument28 pagesIntroduction To Income TaxGeena Chavez GabrielNo ratings yet

- Tax1 LLB404 2012-2013 Prefinals NotesDocument33 pagesTax1 LLB404 2012-2013 Prefinals NotesDrew RodriguezNo ratings yet

- Chapter 11-12 VDocument30 pagesChapter 11-12 VAdd AllNo ratings yet

- Answer in Tax-Prelim ExamDocument5 pagesAnswer in Tax-Prelim ExamCharina Balunso-BasiloniaNo ratings yet

- MIDTERM September 7, 2024 - Lesson 5 - Income TaxpayersDocument19 pagesMIDTERM September 7, 2024 - Lesson 5 - Income Taxpayersit.ospitalngimusNo ratings yet

- Income Taxes For IndividualsDocument30 pagesIncome Taxes For IndividualsDarrr RumbinesNo ratings yet

- Additional ReferenceDocument378 pagesAdditional Referenceaicelleg.redondoNo ratings yet

- Tax 06-Tax On IndividualsDocument9 pagesTax 06-Tax On IndividualsDin Rose GonzalesNo ratings yet

- Introduction To Income TaxationDocument3 pagesIntroduction To Income TaxationescrowNo ratings yet

- Practical QuizDocument4 pagesPractical QuizKathlyn PostreNo ratings yet

- Classification of TaxpayerDocument2 pagesClassification of Taxpayerhannahmousa84% (25)

- Tax Chapter 3 Answer KeyDocument6 pagesTax Chapter 3 Answer KeyayefNo ratings yet

- Exercises On Individual Income Taxation 3BDocument11 pagesExercises On Individual Income Taxation 3BSean San AntonioNo ratings yet

- Module 2 - Income Taxes For Individuals - Lecture NotesDocument52 pagesModule 2 - Income Taxes For Individuals - Lecture NotesRina Bico Advincula100% (1)

- Cpa Review School of The Philippines For Psba Integrated ReviewDocument13 pagesCpa Review School of The Philippines For Psba Integrated ReviewKathleenCusipagNo ratings yet

- PWC QaDocument14 pagesPWC QaClyde RamosNo ratings yet

- 16 18 20 21Document21 pages16 18 20 21jhouvan100% (1)

- TAX HO1002 Individual Taxation StudentDocument12 pagesTAX HO1002 Individual Taxation StudentYuri CaguioaNo ratings yet

- Tax On Individuals, Estates and TrustsDocument21 pagesTax On Individuals, Estates and TrustsPipz G. CastroNo ratings yet

- Classification of TaxpayerDocument2 pagesClassification of TaxpayerEduard Morelos100% (1)

- Inclusions in The Gross IncomeDocument7 pagesInclusions in The Gross Incomedarlene floresNo ratings yet

- CH 3 Intro To Income TaxDocument16 pagesCH 3 Intro To Income TaxGabriel Trinidad SonielNo ratings yet

- Introduction To Income TaxationDocument4 pagesIntroduction To Income TaxationJean Diane JoveloNo ratings yet

- Review of Income Tax Reporting For Individuals & Corporate TaxpayersDocument159 pagesReview of Income Tax Reporting For Individuals & Corporate TaxpayersRyan Christian BalanquitNo ratings yet

- Person or Entity Classification: Individual TaxpayersDocument4 pagesPerson or Entity Classification: Individual TaxpayersJenny BernardinoNo ratings yet

- Chapter 2 Income Tax For IndividualsDocument43 pagesChapter 2 Income Tax For Individualsferrerapril37No ratings yet

- Tax - Income Tax Individuals (Easy)Document28 pagesTax - Income Tax Individuals (Easy)Kristine Lirose BordeosNo ratings yet

- SW02Document4 pagesSW02Nadi HoodNo ratings yet

- Individual Income TaxationDocument8 pagesIndividual Income TaxationApril VelascoNo ratings yet

- TAX 1A QuizDocument2 pagesTAX 1A QuizJenn DajaoNo ratings yet

- TAX.02 Exercises On Individual TaxationDocument5 pagesTAX.02 Exercises On Individual Taxationleon gumboc100% (1)

- Tax ReviewerDocument103 pagesTax ReviewerOscar Ryan SantillanNo ratings yet

- 2425.MIDTERM EXAMINATIONS IN BAC 5Document3 pages2425.MIDTERM EXAMINATIONS IN BAC 5Grace Anne Adoracion-BellogaNo ratings yet

- Act Lesson4Document5 pagesAct Lesson4Johnloyd daracanNo ratings yet

- Introduction To Individual Income Taxation Chapter Overview and ObjectivesDocument25 pagesIntroduction To Individual Income Taxation Chapter Overview and ObjectivesMatta, Jherrie MaeNo ratings yet

- Individual TaxpayersDocument4 pagesIndividual TaxpayersJane TuazonNo ratings yet

- What Are The Kinds of TaxpayersDocument4 pagesWhat Are The Kinds of TaxpayersALee Bud100% (1)

- Chapter 2Document9 pagesChapter 2Sheilamae Sernadilla GregorioNo ratings yet

- Income-tax-chap-2-part1 (2)Document25 pagesIncome-tax-chap-2-part1 (2)itsdaloveshot naNANAnanaNo ratings yet

- Gross IncomeDocument33 pagesGross IncomeRey ViloriaNo ratings yet

- Income Taxation IndividualsDocument19 pagesIncome Taxation IndividualsJenniNo ratings yet

- (Cpar2016) Tax-8002 (Individual Taxpayer)Document10 pages(Cpar2016) Tax-8002 (Individual Taxpayer)Ralph SantosNo ratings yet

- INCOME TAX CASE STUDYDocument2 pagesINCOME TAX CASE STUDYkatiegaradoNo ratings yet

- Individual TaxpayersDocument4 pagesIndividual TaxpayersathenaenchantraNo ratings yet

- Mary Joy P. Junio, Cpa Notre Dame of Midsayap College Midsayap, CotabatoDocument8 pagesMary Joy P. Junio, Cpa Notre Dame of Midsayap College Midsayap, CotabatoJonathan JunioNo ratings yet

- Taxation of Individuals QuizzerDocument38 pagesTaxation of Individuals QuizzerCookie Pookie BallerShopNo ratings yet

- Taxation of Individuals QuizzerDocument37 pagesTaxation of Individuals QuizzerCharry Ramos64% (14)

- (Cpar2016) Tax-8002 (Individual Taxpayer)Document10 pages(Cpar2016) Tax-8002 (Individual Taxpayer)Rose VeeNo ratings yet

- Introduction To Income TaxDocument4 pagesIntroduction To Income Taxkimberlyann ongNo ratings yet

- TaxDocument4 pagesTaxCielito AlvarezNo ratings yet

- Ind. TaxpayerDocument8 pagesInd. Taxpayersgopublication.balbuenaNo ratings yet

- Assignment 5Document4 pagesAssignment 5Peng GuinNo ratings yet

- Assignment 2 WK 6to7Document6 pagesAssignment 2 WK 6to7Peng GuinNo ratings yet

- Assignment 1Document1 pageAssignment 1Peng GuinNo ratings yet

- Assignment 3Document9 pagesAssignment 3Peng GuinNo ratings yet

- Key Areas of Project ManagementDocument3 pagesKey Areas of Project ManagementPeng GuinNo ratings yet

- Let's Check 3Document1 pageLet's Check 3Peng GuinNo ratings yet

- 2nd ExamDocument4 pages2nd ExamPeng GuinNo ratings yet

- Intro To Business AnalyticsDocument1 pageIntro To Business AnalyticsPeng GuinNo ratings yet

- Assignment 1Document1 pageAssignment 1Peng GuinNo ratings yet

- Approved CAE - BSA BSMA BSAIS BSIA - ACC 311 - Clarito - Page-0055-0064Document17 pagesApproved CAE - BSA BSMA BSAIS BSIA - ACC 311 - Clarito - Page-0055-0064Peng GuinNo ratings yet

- What Is Natural LawDocument2 pagesWhat Is Natural LawPeng GuinNo ratings yet

- Notes For My ReportDocument11 pagesNotes For My ReportPeng GuinNo ratings yet

- Standards For Email SecurityDocument2 pagesStandards For Email SecurityPeng GuinNo ratings yet

- Cost Benefits SampleDocument4 pagesCost Benefits SamplePeng GuinNo ratings yet

- Capital Budgeting 1st PartDocument8 pagesCapital Budgeting 1st PartPeng Guin100% (1)

- ReportingDocument2 pagesReportingPeng GuinNo ratings yet

- Relevant Costing Sim ActivityDocument11 pagesRelevant Costing Sim ActivityPeng Guin100% (1)

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument3 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasAurora Pelagio VallejosNo ratings yet

- San Beda College Alabang School of Law Taxation Ii Atty. Deborah S. Acosta-Cajustin Second Semester Sy 2018-2019Document14 pagesSan Beda College Alabang School of Law Taxation Ii Atty. Deborah S. Acosta-Cajustin Second Semester Sy 2018-2019Sham GaerlanNo ratings yet

- De Minimis Benefits: An Update On The Salary-And-Benefits' Mini-Me'sDocument3 pagesDe Minimis Benefits: An Update On The Salary-And-Benefits' Mini-Me'sMNo ratings yet

- VAT ReportDocument32 pagesVAT ReportNoel Christopher G. BellezaNo ratings yet

- 2019-01-24-Amit Swaroop - Atgps5835e - 2018Document8 pages2019-01-24-Amit Swaroop - Atgps5835e - 2018ApoorvNo ratings yet

- PROSIELCODocument1 pagePROSIELCOnarras11No ratings yet

- IDFC FIRST Bank Credit Card Statement 24052022Document3 pagesIDFC FIRST Bank Credit Card Statement 24052022avisinghoo7No ratings yet

- Mrunal Economy 2020 Handputs 1-11 Complete @UpscMaterials PDFDocument335 pagesMrunal Economy 2020 Handputs 1-11 Complete @UpscMaterials PDFSiddharth KumarNo ratings yet

- Acct Statement XX0891 17012023Document22 pagesAcct Statement XX0891 17012023rishi pandeyNo ratings yet

- Barclays Original STDocument1 pageBarclays Original STmdabir44567No ratings yet

- Guerero CHAPTER 5Document15 pagesGuerero CHAPTER 5MARC OLIVER CASTANEDANo ratings yet

- Rmo 22 01Document20 pagesRmo 22 01Maria Leonora Bornales100% (1)

- Mastering The Expenditure Cycle (Human Resource and Payroll)Document3 pagesMastering The Expenditure Cycle (Human Resource and Payroll)Rio BuenaventuraNo ratings yet

- Lesson 4 Final Income Taxation PDFDocument4 pagesLesson 4 Final Income Taxation PDFErika ApitaNo ratings yet

- 535 - I, BLDH No 4, Govardhan Nagar, Poisur Gymkhana Road, Opp Poisar Gymkhana, Kandivali (W), Mumbai, 400067Document2 pages535 - I, BLDH No 4, Govardhan Nagar, Poisur Gymkhana Road, Opp Poisar Gymkhana, Kandivali (W), Mumbai, 400067chetankvoraNo ratings yet

- Wa0001.Document1 pageWa0001.vinodyogi7888No ratings yet

- EMMAR Sales Offer 1 PDFDocument8 pagesEMMAR Sales Offer 1 PDFTyler JohnsonNo ratings yet

- Proposal KTC Coal Mining & EnergyDocument9 pagesProposal KTC Coal Mining & Energymuhammad firdausNo ratings yet

- Current-Account-Statement 01032024 BRETTDocument3 pagesCurrent-Account-Statement 01032024 BRETTjohnsonwto15No ratings yet

- Fee Structure For Academic Program 2020 21Document1 pageFee Structure For Academic Program 2020 21Faheem AwanNo ratings yet

- Košická 24/1 SK-94501 Komárno: Tel.: +421-9-05729685 Open Ways Delivery, S.R.ODocument3 pagesKošická 24/1 SK-94501 Komárno: Tel.: +421-9-05729685 Open Ways Delivery, S.R.OChri xtinaNo ratings yet

- Tax Invoice/Bill of Supply/Cash MemoDocument1 pageTax Invoice/Bill of Supply/Cash Memosatyarout855No ratings yet

- Supplier Information FormDocument23 pagesSupplier Information FormStephen KasinaNo ratings yet

- Assignment No. 2 PGB-20-078Document3 pagesAssignment No. 2 PGB-20-078kishan kanojiaNo ratings yet