P 87p 2

P 87p 2

Uploaded by

Jalaj GuptaCopyright:

Available Formats

P 87p 2

P 87p 2

Uploaded by

Jalaj GuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

P 87p 2

P 87p 2

Uploaded by

Jalaj GuptaCopyright:

Available Formats

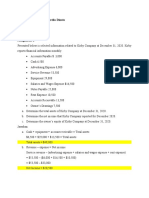

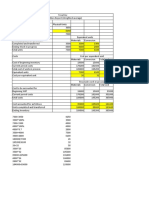

Ques 1

Music Is Us Inc

Bank Reconciliation

31-Dec-09

Balance per bank statement, December 31, 2009 $ 49,980

Add: Deposits in transit not recorded by bank $ 16,800

$ 66,780

Deduct: Outstanding checks

No. 508 $ 4,000

No. 511 $ 9,100

No. 521 $ 7,800 $ 20,900

Adjusted cash balance $ 45,880

Balance per depositor's records, December 31, 2009 $ 48,000

Deduct:

Bank service charge $ 20

NSF check from Iggy Bates $ 2,100 $ 2,120

Adjusted cash balance (as above) $ 45,880

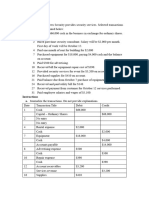

Ques 2

General Journal

a. Bank Service Charges $ 20

Accounts Receivable $ 2,100

Cash $ 2,120

To record bank service charges for December and

the NSF check received from Iggy Bates.

b. Marketable Securities $ 2,100

Unrealized Holding Gain on Investments $ 2,100

30100-28000

c. Uncollectible Accounts Expense $ 2,400

Allowance for Doubtful Accounts $ 2,400

7900-5500

d. Cost of Goods Sold $ 1,100

Inventory $ 1,100

To record inventory shrinkage of missing guitars.

e. Office Supplies Expense $ 930

Office Supplies $ 930

To record office supplies used in December.

1800-870

f. Insurance Expense $ 560

Prepaid Insurance $ 560

6160/11

g. Depreciation Expense $ 4,000

Accumulated Depreciation $ 4,000

To record depreciation expense for December.

h. Unearned Customer Deposits $ 3,100

Sales $ 3,100

To record revenue earned from advance special

orders.

7100-4000

i. Income Tax Expense $ 9,000

Income Tax Payable $ 9,000

To account for accrued income taxes in

December.

82000-73000

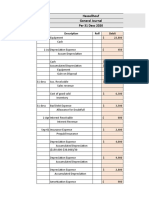

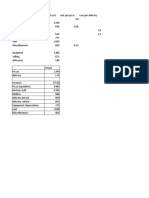

Ques 3

Music Is Us Inc

Adjusted Trial Balance

As of December 31, 2009

Cash $ 45,880

Marketable securities $ 30,100

Accounts receivable $ 135,100

Allowance for doubtful accounts $ 7,900

Merchandise inventory $ 251,900

Office supplies $ 870

Prepaid insurance $ 5,600

Building and fixtures $ 1,793,000

Accumulated depreciation $ 801,000

Land $ 72,800

Accounts payable $ 62,000

Unearned customer deposits $ 4,000

Income taxes payable $ 82,000

Capital stock $ 910,000

Retained earnings $ 239,200

Unrealized holding gain on investments $ 8,000

Sales $ 1,722,020

Cost of goods sold $ 959,100

Bank service charges $ 180

Uncollectible accounts expense $ 11,000

Salary and wages expense $ 390,000

Office supplies expense $ 1,330

Insurance expense $ 6,360

Utilities expense $ 2,900

Depreciation expense $ 48,000

Income tax expense $ 82,000

$ 3,836,120 $ 3,836,120

You might also like

- ReSA AP Quiz 5B43Document42 pagesReSA AP Quiz 5B43Rafael Bautista75% (4)

- Q1 - Q4 - Prelim Exam ACC5112 - Auditing and Assurance - Concepts and Applications 1 v2Document72 pagesQ1 - Q4 - Prelim Exam ACC5112 - Auditing and Assurance - Concepts and Applications 1 v2artemisNo ratings yet

- Watson Answering ServiceDocument3 pagesWatson Answering Servicemohitgaba1967% (6)

- Assignment AJE 3 PDFDocument10 pagesAssignment AJE 3 PDFJalaj GuptaNo ratings yet

- Acc. - Assignment - 2Document15 pagesAcc. - Assignment - 2Tanvir RohanNo ratings yet

- On December 31, 20x1, ABC Has Total Expenses of P1,000,000 Before Possible Adjustment For The FollowingDocument12 pagesOn December 31, 20x1, ABC Has Total Expenses of P1,000,000 Before Possible Adjustment For The FollowingKim Cristian MaañoNo ratings yet

- Tan, Vanessa Juventia Aurelia Dinata 2440031572 LG24-IBMDocument6 pagesTan, Vanessa Juventia Aurelia Dinata 2440031572 LG24-IBMvanessaNo ratings yet

- After The Success of The Company's First Two Months, Santana Rey Continues To Operate Business Solutions. The November 30, 2015, Unadjusted Trial Balance of Business Solutions (Reflecting DecDocument3 pagesAfter The Success of The Company's First Two Months, Santana Rey Continues To Operate Business Solutions. The November 30, 2015, Unadjusted Trial Balance of Business Solutions (Reflecting DecJalaj GuptaNo ratings yet

- W. W. Grainger, Inc., Is A Leading Supplier of Maintenance, Repair, and Operating (MRO) Products To Businesses and Institutions in The UnitedDocument3 pagesW. W. Grainger, Inc., Is A Leading Supplier of Maintenance, Repair, and Operating (MRO) Products To Businesses and Institutions in The UnitedJalaj GuptaNo ratings yet

- Ch. 3 HW ExplanationDocument7 pagesCh. 3 HW ExplanationJalaj GuptaNo ratings yet

- China Trade, Inc. Journal Entries: Date GL Number Description Debit CreditDocument7 pagesChina Trade, Inc. Journal Entries: Date GL Number Description Debit CreditJalaj GuptaNo ratings yet

- This Study Resource Was: Adjust CreditDocument4 pagesThis Study Resource Was: Adjust CreditJalaj GuptaNo ratings yet

- Unadjusted Trial BalanceDocument10 pagesUnadjusted Trial BalanceMingxNo ratings yet

- Assignment-4 and 8Document15 pagesAssignment-4 and 8Carla Sader0% (1)

- Assignment CH 6 and 8Document11 pagesAssignment CH 6 and 8Bushra IbrahimNo ratings yet

- Individual ACC101 BA1805Document6 pagesIndividual ACC101 BA1805trongdmcs181973No ratings yet

- Akuntansi Account ReceivableDocument8 pagesAkuntansi Account Receivablem habiburrahman55No ratings yet

- Principles of Accounting: Name: Muhammad Hasnain Shakir Enrolment No: 01-111192-145 Section: BBA4 - 2ADocument3 pagesPrinciples of Accounting: Name: Muhammad Hasnain Shakir Enrolment No: 01-111192-145 Section: BBA4 - 2AOsman Bin SaifNo ratings yet

- Tugas Akuntansi 2Document14 pagesTugas Akuntansi 2eugeniaNo ratings yet

- Question:-: Solution:-Computation of The Classified Year End Balance SheetDocument4 pagesQuestion:-: Solution:-Computation of The Classified Year End Balance SheetShadowmaster LegendNo ratings yet

- General JournalDocument5 pagesGeneral Journalmonicaaa melianaaaNo ratings yet

- General JournalDocument5 pagesGeneral Journal૨εƒ XianNo ratings yet

- Service Business Accounting CycleDocument6 pagesService Business Accounting CycleMarie Kairish Damag Vivar100% (1)

- Latihan AJEDocument13 pagesLatihan AJEkhalzhrni17No ratings yet

- Roshita Desthi Nurimah - A20 - Tugas BAB 3Document12 pagesRoshita Desthi Nurimah - A20 - Tugas BAB 3Roshita Desthi NurimahNo ratings yet

- Nama: Dian Sari NIM: A031171703 Mid Akuntansi Keuangan Lanjutan IiDocument3 pagesNama: Dian Sari NIM: A031171703 Mid Akuntansi Keuangan Lanjutan Iidian sariNo ratings yet

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- Applied Auditing-Prelim FinalDocument3 pagesApplied Auditing-Prelim FinalDominic E. BoticarioNo ratings yet

- UTS AKL 2 - Resky Awaliah (A031181004)Document3 pagesUTS AKL 2 - Resky Awaliah (A031181004)Resky AwaliahNo ratings yet

- ACCT 6010 Assignment #1Document15 pagesACCT 6010 Assignment #1patel avaniNo ratings yet

- Activity 6 and 7 in Module 8Document7 pagesActivity 6 and 7 in Module 8Marc Justine Gamiao GoNo ratings yet

- Unit 3 BBC SlidesDocument12 pagesUnit 3 BBC SlidesKatrina EustaceNo ratings yet

- Fath Abdul Azis - A031211044Document6 pagesFath Abdul Azis - A031211044Fath Abdul AzisNo ratings yet

- Accounting Assignment 2 PDFDocument6 pagesAccounting Assignment 2 PDFA. HanifahNo ratings yet

- Financial Accounting Discussion Week 2s UPDATEDDocument8 pagesFinancial Accounting Discussion Week 2s UPDATEDharrisonromario19No ratings yet

- Nomor 1: Gain From Bargain Purchase $ - 9,000Document3 pagesNomor 1: Gain From Bargain Purchase $ - 9,000Sherlin KhuNo ratings yet

- Accounting II-1Document151 pagesAccounting II-1Adnan KanwalNo ratings yet

- Assignment 1Document6 pagesAssignment 1Pushpinder KaurNo ratings yet

- Exercises Chapter 2 Group 4Document8 pagesExercises Chapter 2 Group 4Phạm Ngọc Uyên NhiNo ratings yet

- Accounting Lab - Romi PrabowoDocument9 pagesAccounting Lab - Romi PrabowoRomi Prabowo De jongNo ratings yet

- CH 2 - HomeworkDocument5 pagesCH 2 - HomeworkAxel OngNo ratings yet

- Jawaban Latihan SoalDocument31 pagesJawaban Latihan SoalRizalMawardiNo ratings yet

- Younger CorporationDocument26 pagesYounger CorporationMuhamad RamzyNo ratings yet

- ACCT EXAM 1Document12 pagesACCT EXAM 1racheli7252No ratings yet

- Acc101 - Chapter 2: Accounting For TransactionsDocument16 pagesAcc101 - Chapter 2: Accounting For TransactionsMauricio AceNo ratings yet

- Uas Pengakun 2Document4 pagesUas Pengakun 2Givania RahmadhaniNo ratings yet

- Week 4 PDF FreeDocument5 pagesWeek 4 PDF FreeM. Gibran KhalilNo ratings yet

- Buenaventuraej Bsa1bmidterm Activity 1 Edgar DetoyaDocument21 pagesBuenaventuraej Bsa1bmidterm Activity 1 Edgar DetoyaAnonnNo ratings yet

- The Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekDocument4 pagesThe Alphabetical Listing Below Includes All of The Adjusted Account Balances of Battle CreekKailash KumarNo ratings yet

- Chapter 4 4 4 4 4Document7 pagesChapter 4 4 4 4 4Rabie HarounNo ratings yet

- QUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanDocument4 pagesQUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanDaffa Ramadhan ArcheryNo ratings yet

- Test 3, Montolalu, Wahyu YohanesDocument7 pagesTest 3, Montolalu, Wahyu YohanesDimas LimpongNo ratings yet

- Accounting Assignment3Document12 pagesAccounting Assignment3Ann Catherine SeeNo ratings yet

- Third Quiz For FABM2 (On Adjusting, Closing, and Reversing Entries)Document2 pagesThird Quiz For FABM2 (On Adjusting, Closing, and Reversing Entries)SITTIE RAYMAH ABDULLAHNo ratings yet

- Chapter 5Document27 pagesChapter 5nadima behzadNo ratings yet

- 6 DesemberDocument8 pages6 DesemberKezia N. ApriliaNo ratings yet

- Acc HWDocument5 pagesAcc HWHasan NajiNo ratings yet

- MerchandisingDocument11 pagesMerchandisingAIRA NHAIRE MECATE100% (1)

- PA-HW Chap3 + 4Document8 pagesPA-HW Chap3 + 4Hà Anh ĐỗNo ratings yet

- Accounting AssignmentDocument10 pagesAccounting AssignmentKotha SarkerNo ratings yet

- Financial & Managerial Accounting - JunXianDocument5 pagesFinancial & Managerial Accounting - JunXianhashtagjxNo ratings yet

- Acc. - Assignment - 1 - TonushreeDocument9 pagesAcc. - Assignment - 1 - TonushreeTanvir RohanNo ratings yet

- HUM 121assignment 1Document6 pagesHUM 121assignment 1Nayeem HossainNo ratings yet

- Accounting Fundamentals - Financial StatementsDocument20 pagesAccounting Fundamentals - Financial StatementsseracasedvisaNo ratings yet

- Forum ACC WM - Sesi 2Document3 pagesForum ACC WM - Sesi 2Windy MartaputriNo ratings yet

- MGMT200 Section1 Team22Document94 pagesMGMT200 Section1 Team22Joseph ToneyNo ratings yet

- AkunDocument9 pagesAkunmorinNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Mickley Company's Plantwide Predetermined Overhead Rate IsDocument1 pageMickley Company's Plantwide Predetermined Overhead Rate IsJalaj GuptaNo ratings yet

- Phelps Corporation Received A Charter Granting The Right To IssueDocument3 pagesPhelps Corporation Received A Charter Granting The Right To IssueJalaj GuptaNo ratings yet

- Fanelli Corporation, A Merchandising CompanyDocument2 pagesFanelli Corporation, A Merchandising CompanyJalaj GuptaNo ratings yet

- PLDocument2 pagesPLJalaj GuptaNo ratings yet

- PoqDocument3 pagesPoqJalaj GuptaNo ratings yet

- Chapter 1 - Text ExercisesDocument35 pagesChapter 1 - Text ExercisesJalaj GuptaNo ratings yet

- Winslow Inc. Manufactures and Sells Three Types of Shoes. TDocument3 pagesWinslow Inc. Manufactures and Sells Three Types of Shoes. TJalaj GuptaNo ratings yet

- Trout Inc. Prepared The Following Production Report-Weighted AverageDocument4 pagesTrout Inc. Prepared The Following Production Report-Weighted AverageJalaj GuptaNo ratings yet

- Izabela Cullumber Opened A Medical Office Under The Name Izabela CullumberDocument4 pagesIzabela Cullumber Opened A Medical Office Under The Name Izabela CullumberJalaj GuptaNo ratings yet

- Chapter 12 Testbank PDFDocument76 pagesChapter 12 Testbank PDFJalaj GuptaNo ratings yet

- This Study Resource Was: Award: 10.00 PointsDocument4 pagesThis Study Resource Was: Award: 10.00 PointsJalaj GuptaNo ratings yet

- Milano Pizza Is A Small Neighborhood PizzeriaDocument3 pagesMilano Pizza Is A Small Neighborhood PizzeriaJalaj GuptaNo ratings yet

- This Study Resource Was: Award: 10.00 PointsDocument4 pagesThis Study Resource Was: Award: 10.00 PointsJalaj GuptaNo ratings yet

- Fidelity Engineering Reported Pretax Accounting IncomeDocument2 pagesFidelity Engineering Reported Pretax Accounting IncomeJalaj GuptaNo ratings yet

- Journal Entries in The Books of Santana Rey Date Particulars Debit CreditDocument12 pagesJournal Entries in The Books of Santana Rey Date Particulars Debit CreditJalaj GuptaNo ratings yet

- This Study Resource Was: Problem 21-6A (Part Level Submission)Document3 pagesThis Study Resource Was: Problem 21-6A (Part Level Submission)Jalaj GuptaNo ratings yet

- Date General Journal Debit CreditDocument14 pagesDate General Journal Debit CreditJalaj GuptaNo ratings yet

- Pam Corporation Paid $170,000 For An 80 Percent Interest in Sun CorporationDocument3 pagesPam Corporation Paid $170,000 For An 80 Percent Interest in Sun CorporationJalaj GuptaNo ratings yet

- On January 1, Year 4, Grant Corporation BoughtDocument4 pagesOn January 1, Year 4, Grant Corporation BoughtJalaj GuptaNo ratings yet

- Chapter 21 BMWDocument22 pagesChapter 21 BMWSincero MilanNo ratings yet

- Chapter 1 Problems HDocument14 pagesChapter 1 Problems Hbalaji RNo ratings yet

- Question Paper 11 Accounts Time: 3Hrs Max Marks: 80Document5 pagesQuestion Paper 11 Accounts Time: 3Hrs Max Marks: 80manish jangidNo ratings yet

- Review Questions For Final Exam ACC210Document13 pagesReview Questions For Final Exam ACC210AaaNo ratings yet

- Financial Statements II Class 11 Notes CBSE Accountancy Chapter 10 PDF 1Document7 pagesFinancial Statements II Class 11 Notes CBSE Accountancy Chapter 10 PDF 1Parth PahwaNo ratings yet

- Accounting For Receivables: Learning ObjectivesDocument44 pagesAccounting For Receivables: Learning ObjectivesIsyraf Hatim Mohd TamizamNo ratings yet

- August 2023 GTE Question PaperDocument142 pagesAugust 2023 GTE Question PaperceodecmacNo ratings yet

- Audit ReviewDocument9 pagesAudit ReviewephraimNo ratings yet

- This Study Resource Was: Fundamentals of Accounting - Multiple Choice Questions (MCQ) With AnswersDocument8 pagesThis Study Resource Was: Fundamentals of Accounting - Multiple Choice Questions (MCQ) With AnswersFunny idolNo ratings yet

- Preparation of Financial Statements - QBDocument26 pagesPreparation of Financial Statements - QBHindutav arya100% (1)

- Minimalist Business Report-WPS OfficeDocument21 pagesMinimalist Business Report-WPS Officewilhelmina romanNo ratings yet

- Jawaban 3.1 SD 3.7Document16 pagesJawaban 3.1 SD 3.7KaitoNo ratings yet

- Accounting: Cambridge International Examinations International General Certificate of Secondary EducationDocument16 pagesAccounting: Cambridge International Examinations International General Certificate of Secondary EducationOmar BilalNo ratings yet

- Incomplete Records: Problems You Need To SolveDocument2 pagesIncomplete Records: Problems You Need To SolveFegason FegyNo ratings yet

- University of The Cordilleras Accounting 1/2 Lecture AidDocument3 pagesUniversity of The Cordilleras Accounting 1/2 Lecture AidJesseca JosafatNo ratings yet

- Advanced Level Accounting Answer Key ForDocument106 pagesAdvanced Level Accounting Answer Key ForSarmad NawazNo ratings yet

- Summative Assessment Test 1-APPLIED AUDITDocument5 pagesSummative Assessment Test 1-APPLIED AUDITChristine Rey RocoNo ratings yet

- Deans Exam Reviewer AnswersDocument24 pagesDeans Exam Reviewer AnswersRJ 1No ratings yet

- ReceivablesDocument58 pagesReceivablesHannah OrosNo ratings yet

- Final Review Jawaban IntermediateDocument33 pagesFinal Review Jawaban Intermediatelukes12No ratings yet

- Accrual AccountingDocument20 pagesAccrual AccountingBill Sharman100% (2)

- Adjusting Journal EntriesDocument8 pagesAdjusting Journal EntriesChaaaNo ratings yet

- Deemed IncomeDocument8 pagesDeemed IncomeHarshit ShrivastavaNo ratings yet

- Part IIDocument58 pagesPart IIhaaasaaNo ratings yet

- Topic 7 Receivables Rev StudentsDocument74 pagesTopic 7 Receivables Rev StudentsNemalai VitalNo ratings yet

- Rapid Review Kieso v1Document12 pagesRapid Review Kieso v1mehmood981460No ratings yet

- REGULATIONS & SYLLABUS B-ComDocument65 pagesREGULATIONS & SYLLABUS B-ComRAMESHKUMAR.S MCE-LECT/MECHNo ratings yet