Sunrise GST Calculation For Mar-21

Sunrise GST Calculation For Mar-21

Uploaded by

Gaurav RawatCopyright:

Available Formats

Sunrise GST Calculation For Mar-21

Sunrise GST Calculation For Mar-21

Uploaded by

Gaurav RawatOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Sunrise GST Calculation For Mar-21

Sunrise GST Calculation For Mar-21

Uploaded by

Gaurav RawatCopyright:

Available Formats

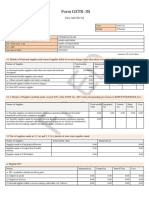

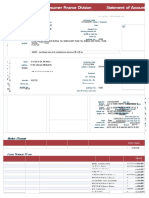

GSTR-3B CALCULATION

3.1 Details of Outward Supplies and inward supplies liable to reverse charge

Nature of Supplies Total Taxable value Integrated Tax Central Tax State/UT Tax Cess

(a) Outward Taxable supplies (other than zero rated, nil rated and exempted) 592790.00 0 48060.75 48060.75 0 96121.50 540496.50

(b) Outward Taxable supplies (zero rated ) 0 0

(c) Other Outward Taxable supplies (Nil rated, exempted) 0

(d) Inward supplies (liable to reverse charge) 0 0

Total 592790.00 0 48060.75 48060.75 0 96121.50

4. Eligible ITC

Details Integrated Tax Central Tax State/UT Tax Cess

(A) ITC Available (Whether in full or part)

(1) Import of goods

(2) Import of services

(3) Inward supplies liable to reverse charge (other than 1 & 2 above)

(4) Inward supplies from ISD

(5) All other ITC taken only matched input + Previous Month Input

(B) ITC Reversed

(1) As per Rule 42 & 43 of SGST/CGST rules

(2) Others

(C) Net ITC Available (A)-(B) 0 0 0 0 0

(D) Ineligible ITC 0 0 0 0

(1) As per section 17(5) of CGST//SGST Act 0 0 0 0

(2) Others 0 0 0 0

Balance as per credit Ledger 30738 3929.13 3929.13 38596.26 57,525.24

Total Input 30738.00 3929.13 3929.13

Mannual Liability Calculation

Input Set off Balance Payable/(Excess RCM Out Net I

OutPut Amount Total Payable

IGST CGST SGST Input) Put Payable n

IGST - - 0.00 0 0.00

CGST 48060.75 15369.00 3929.13 28,762.62 28762.62 0.00 28762.62

SGST 48,060.75 15369.00 3929.13 28,762.62 28762.62 0.00 28762.62

0.00 57525.24 0.00 57525.24

57525.24 Net payable

You might also like

- Ncnda+ ImfpaDocument10 pagesNcnda+ ImfpaRailesUsados89% (9)

- Audit Fot Liability Problem #6Document2 pagesAudit Fot Liability Problem #6Ma Teresa B. CerezoNo ratings yet

- Provisional Agreement For Sale and PurchaseDocument7 pagesProvisional Agreement For Sale and Purchase030093No ratings yet

- Dela Salle University Vs Dela SALLE UNIVERSITY EMPLOYEES ASSOCIATION DIGESTDocument1 pageDela Salle University Vs Dela SALLE UNIVERSITY EMPLOYEES ASSOCIATION DIGESTJay RibsNo ratings yet

- 19blwph6736c1zo - 112022 - GSTR-3B MDocument4 pages19blwph6736c1zo - 112022 - GSTR-3B MSheksNo ratings yet

- 19blwph6736c1zo - 062023 - GSTR-3B MDocument4 pages19blwph6736c1zo - 062023 - GSTR-3B MSheksNo ratings yet

- 19blwph6736c1zo - 092022 - GSTR-3B MDocument4 pages19blwph6736c1zo - 092022 - GSTR-3B MSheksNo ratings yet

- GSTR3B 19bexpa5457f1z3 072019Document3 pagesGSTR3B 19bexpa5457f1z3 072019najimabibi18021975No ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3Bhussain28097373No ratings yet

- GSTR3B 36aqipb5567d2zx 122020Document3 pagesGSTR3B 36aqipb5567d2zx 122020murali vottipoguNo ratings yet

- 24BHNPP5843B1ZB - 032019 - GSTR-3B MDocument4 pages24BHNPP5843B1ZB - 032019 - GSTR-3B MGST Range5 Division1No ratings yet

- GSTR3B 27aaypj1435a1zt 122022Document2 pagesGSTR3B 27aaypj1435a1zt 122022vijayjoshitempNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BkaranNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BameygandhiNo ratings yet

- GSTR3B 27aaypj1435a1zt 092022Document2 pagesGSTR3B 27aaypj1435a1zt 092022vijayjoshitempNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BameygandhiNo ratings yet

- GSTR3B 27afxpr6875g1ze 082020Document3 pagesGSTR3B 27afxpr6875g1ze 082020fintrustbankingNo ratings yet

- GSTR3B May 2020Document3 pagesGSTR3B May 2020Sagar BahetiNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BAmit GolaNo ratings yet

- GSTR - 3b - POPPAT JAMALS ANNA NAGAR - 2021 - 2022 - 11Document2 pagesGSTR - 3b - POPPAT JAMALS ANNA NAGAR - 2021 - 2022 - 11annanagarstoreNo ratings yet

- Form Gstr-3B: (See Rule 61 (5) )Document16 pagesForm Gstr-3B: (See Rule 61 (5) )AMAN AILSINGHANINo ratings yet

- GSTR3B 27afxpr6875g1ze 072020Document3 pagesGSTR3B 27afxpr6875g1ze 072020fintrustbankingNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BSainath ReddyNo ratings yet

- GSTR3B 19bexpa5457f1z3 082019Document3 pagesGSTR3B 19bexpa5457f1z3 082019najimabibi18021975No ratings yet

- April 3bDocument2 pagesApril 3bUjjwal GoyalNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BAmit GolaNo ratings yet

- GSTR3B 19bexpa5457f1z3 122019Document3 pagesGSTR3B 19bexpa5457f1z3 122019najimabibi18021975No ratings yet

- GSTR3B 27BTXPG8803J1Z0 082023Document2 pagesGSTR3B 27BTXPG8803J1Z0 082023AMAN AILSINGHANINo ratings yet

- GSTR3B 09hbjps0079a1zi 052022Document3 pagesGSTR3B 09hbjps0079a1zi 052022birpal singhNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BVenkatesh JekkulaNo ratings yet

- GSTR3B 29aaifa3562d1zl 042019Document3 pagesGSTR3B 29aaifa3562d1zl 042019HEMANTH kumarNo ratings yet

- GSTR3B 27agypd6805a1zf 012019-1Document3 pagesGSTR3B 27agypd6805a1zf 012019-1dinowinsonNo ratings yet

- GSTR3B 07bqqpa6547k1ze 022024Document3 pagesGSTR3B 07bqqpa6547k1ze 022024unitedcapitaladvisoryNo ratings yet

- GSTR3B 27aaypj1435a1zt 102022Document2 pagesGSTR3B 27aaypj1435a1zt 102022vijayjoshitempNo ratings yet

- GSTR3B 18acvpa7546a1zk 032023Document4 pagesGSTR3B 18acvpa7546a1zk 032023SUBHASH MOURNo ratings yet

- GSTR3B 19bexpa5457f1z3 042019Document3 pagesGSTR3B 19bexpa5457f1z3 042019najimabibi18021975No ratings yet

- GSTR3B 27BTXPG8803J1Z0 062023Document2 pagesGSTR3B 27BTXPG8803J1Z0 062023AMAN AILSINGHANINo ratings yet

- GSTR3B 19bexpa5457f1z3 092019Document3 pagesGSTR3B 19bexpa5457f1z3 092019najimabibi18021975No ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BRishav AnandNo ratings yet

- Form GSTR-3B (See Rule 61 (5) )Document6 pagesForm GSTR-3B (See Rule 61 (5) )Asma KhanNo ratings yet

- Form Gstr-3B: (See Rule 61 (5) )Document8 pagesForm Gstr-3B: (See Rule 61 (5) )AMAN AILSINGHANINo ratings yet

- GSTR3B 09hbjps0079a1zi 062022Document3 pagesGSTR3B 09hbjps0079a1zi 062022birpal singhNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BAjit GuptaNo ratings yet

- GSTR3B 03adgpk5731k1zm 062019Document3 pagesGSTR3B 03adgpk5731k1zm 0620199463684355No ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3Bavijit dasNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BSainath ReddyNo ratings yet

- GSTR3B 09hbjps0079a1zi 032022Document3 pagesGSTR3B 09hbjps0079a1zi 032022birpal singhNo ratings yet

- GSTR3B 19bexpa5457f1z3 062019Document3 pagesGSTR3B 19bexpa5457f1z3 062019najimabibi18021975No ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BJaideep MishraNo ratings yet

- GSTR3B 27abdpd2705m1zu 042019 PDFDocument3 pagesGSTR3B 27abdpd2705m1zu 042019 PDFtaitilNo ratings yet

- Hans GTR ReturnDocument3 pagesHans GTR Returnshivi mishraNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BTushar Prakash ChaudhariNo ratings yet

- GSTR3B 09hbjps0079a1zi 042022Document3 pagesGSTR3B 09hbjps0079a1zi 042022birpal singhNo ratings yet

- GSTR3B - 22-23 MayDocument4 pagesGSTR3B - 22-23 MayLogesh Waran KmlNo ratings yet

- Vijayawada 1532065123Document3 pagesVijayawada 1532065123BASHA RIZWANNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BsamaadhuNo ratings yet

- GSTR3B 27aaypj1435a1zt 112022Document2 pagesGSTR3B 27aaypj1435a1zt 112022vijayjoshitempNo ratings yet

- GSTR3B 03ajdpk8658g1z5 032023Document4 pagesGSTR3B 03ajdpk8658g1z5 032023SANJEEV KUMARNo ratings yet

- GSTR3B 29aaifa3562d1zl 022020Document3 pagesGSTR3B 29aaifa3562d1zl 022020HEMANTH kumarNo ratings yet

- GSTR3B 27ayvpm3783d1zv 062024Document2 pagesGSTR3B 27ayvpm3783d1zv 062024patilrajshree684No ratings yet

- GSTR3B 27aaufr3550j1zn 012018 PDFDocument3 pagesGSTR3B 27aaufr3550j1zn 012018 PDFNiraj KulkarniNo ratings yet

- GSTR3B 19bexpa5457f1z3 112019Document3 pagesGSTR3B 19bexpa5457f1z3 112019najimabibi18021975No ratings yet

- Muslim LawDocument12 pagesMuslim LawKramedon CaskbladeNo ratings yet

- Chapter 23 CPWD ACCOUNTS CODEDocument17 pagesChapter 23 CPWD ACCOUNTS CODEarulraj1971No ratings yet

- UPSC CDS Final ResultDocument5 pagesUPSC CDS Final ResultNDTVNo ratings yet

- Vinyl Chloride MonomerDocument6 pagesVinyl Chloride MonomerRizqia Putri ZakkaNo ratings yet

- Cyient-BCP - PandemicEvent - Annexure-6 - Candidate Declaration FormDocument2 pagesCyient-BCP - PandemicEvent - Annexure-6 - Candidate Declaration FormManoj EmmidesettyNo ratings yet

- 0fficials, Duties and ResponsibilitiesDocument4 pages0fficials, Duties and Responsibilitiesstacey dianne BoylesNo ratings yet

- Tafseer Ibn-e-Kaseer - para 8Document91 pagesTafseer Ibn-e-Kaseer - para 8Shian-e-Ali NetworkNo ratings yet

- 43-Bonifacio Bros. vs. Mora, 20 SCRA 261Document4 pages43-Bonifacio Bros. vs. Mora, 20 SCRA 261Jopan SJNo ratings yet

- Japan RoomDocument4 pagesJapan RoomTheodore69No ratings yet

- Legal NormsDocument6 pagesLegal NormsTrâm Ái TrịnhNo ratings yet

- Banda V Zambia Publishing Company Limited 1982 ZMHC 7 28 July 1982Document6 pagesBanda V Zambia Publishing Company Limited 1982 ZMHC 7 28 July 1982mwenyasteven8No ratings yet

- Francis Haskell, Art and The Language of Politics, Journal of European Studies 1974 Haskell 215 32Document19 pagesFrancis Haskell, Art and The Language of Politics, Journal of European Studies 1974 Haskell 215 32meeeemail5322No ratings yet

- Karmani Gati NyariDocument48 pagesKarmani Gati NyariGPOdhavNo ratings yet

- G.R. No. 204659, September 19, 2016 JESTER MABUNOT, Petitioner, v. PEOPLE OF THE PHILIPPINES, Respondent. Resolution Reyes, J.Document9 pagesG.R. No. 204659, September 19, 2016 JESTER MABUNOT, Petitioner, v. PEOPLE OF THE PHILIPPINES, Respondent. Resolution Reyes, J.Nica ChanNo ratings yet

- Medici PaperDocument5 pagesMedici Paperapi-282056127No ratings yet

- The Doon SchoolDocument5 pagesThe Doon SchoolnahiNo ratings yet

- Chanakya Neeti Slokas: Chapter 1Document5 pagesChanakya Neeti Slokas: Chapter 1Seema NaikNo ratings yet

- United States v. Robert Chestman, 947 F.2d 551, 2d Cir. (1991)Document54 pagesUnited States v. Robert Chestman, 947 F.2d 551, 2d Cir. (1991)Scribd Government DocsNo ratings yet

- Andhra Pradesh Municipal Laws Amendment Act 1986Document199 pagesAndhra Pradesh Municipal Laws Amendment Act 1986Latest Laws Team100% (1)

- Case Digest - Cruz vs. DENR - Atty. LumiquedDocument4 pagesCase Digest - Cruz vs. DENR - Atty. LumiquedSeverino LumiquedNo ratings yet

- MIT Technology Review Business Report Cyber SurvivalDocument16 pagesMIT Technology Review Business Report Cyber SurvivalSiddhantDayalNo ratings yet

- RFS Profile1Document12 pagesRFS Profile1Assesa DouglasNo ratings yet

- Public Notice 01-2023Document1 pagePublic Notice 01-2023AqsaNo ratings yet

- Nism Ii B - Registrar - Practice Test 4Document19 pagesNism Ii B - Registrar - Practice Test 4HEMANSH vNo ratings yet

- MQC00190DDocument5 pagesMQC00190DGaneshkumar AmbedkarNo ratings yet

- Document 15Document5 pagesDocument 15Tanya SinghNo ratings yet