MDKA Sucor

MDKA Sucor

Uploaded by

Fathan MujibCopyright:

Available Formats

MDKA Sucor

MDKA Sucor

Uploaded by

Fathan MujibOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

MDKA Sucor

MDKA Sucor

Uploaded by

Fathan MujibCopyright:

Available Formats

equity

research R E S E A R C H R E P O R T

(USD mn) 2019 2020F 2021F 2022F 2023F

Revenue (USD mn) 402 322 321 390 376

EBITDA (USD mn) 160 115 116 172 164

Net profit (USD mn) 69 29 24 71 70

EPS (USD/share) 0.0032 0.0013 0.0011 0.0033 0.0032

ROE (%) 13.2 5.1 3.9 11.6 11.4

P/E ratio (x) 65.4 156.8 187.0 63.5 64.6

P/BV ratio (x) 8.6 8.0 7.4 7.4 7.4

EV/EBITDA (x) 26.7 37.2 37.0 24.8 26.0

2021F 2022F Changes

Old New Old New 2021F 2022F

Revenue 390 321 375 390 -17.7% 4.0%

Gross profit 150 121 158 173 -19.4% 9.5%

EBITDA 143 116 157 172 -19.3% 9.5%

Net profit 36 24 62 71 -33.4% 15.8%

2

70,000 2,500

64,030 63,672

60,000 54,151 54,672 1,910 1,894

2,000 1,779

48,825 1,725

50,000 46,515 1,558

42,997 1,463 1,486

1,500 1,298 1,331

40,000

30,000 1,000

20,000 16,585

11,027 500

10,000

- -

1Q20 2Q20 3Q20 4Q20 1Q20 2Q20 3Q20 4Q20F 1Q21 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21

Gold volume Gold (USD/oz)

Company Company

5,000 4,616 4,596

4,417 9,000

4,500 7,883

8,000 7,191

4,000

7,000 6,217 6,165 6,339

3,500 3,148 5,815 5,791 5,797

6,000 5,169

3,000

2,489 5,000

2,500

4,000

2,000 1,785

1,434 3,000

1,500 1,141 1,112 2,000

1,000 1,000

500 -

- 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21

1Q20 2Q20 3Q20 4Q20 1Q20 2Q20 3Q20 4Q20F 1Q21

Copper (USD/tonnes)

Copper volume

10,000 9,340 9,240 1,600

9,000 8280 1,400 1,342

8200

8,000

1,200

7,000

6,000

1,000

5,340

4,760

5,000 4,120 800 656 658 648 669

641 640

4,000 554 561

2,980 2,980 600

3,000

400

2,000

1,000 200

- -

1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21

AISC Copper (USD/ton) AISC Gold (USD/oz)

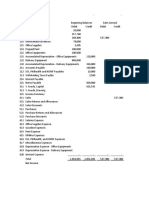

Profit & loss 2019 2020 2021F 2022F 2023F Balance Sheet (IDR bn) 2019 2020 2021F 2022F 2023F

Revenue 402 322 321 390 376 Cash and equivalents 50 51 88 75 78

Cost of revenue (247) (208) (200) (217) (210) Trade receivables 7 6 7 7 8

Gross profit 155 114 121 173 166 Inventories 96 101 108 116 124

Selling expenses - - - - - Net- Fixed assets 320 297 267 347 312

G&A expenses (20) (20) (25) (22) (22) Other assets 478 475 548 718 800

Operating profit 135 94 96 151 143 Total Assets 951 930 1,019 1,264 1,322

EBITDA 160 115 116 172 164 Trade payables 33 20 22 23 25

Other op. income/exp (7) (20) (29) (21) (14) Short-term debt + CMLTD 141 130 139 149 160

Finance expense (20) (18) (19) (20) (21) Long-term debt 98 101 121 145 175

Inc/loss from assoc. - - - - - Other liabilties 154 114 121 384 393

Pre-tax profit 108 56 47 110 108 Total Liabilities 427 366 403 702 752

Tax expense (39) (27) (23) (38) (38) Minority interest 31 29 29 30 30

Minority interest - - - - - Paid capital 287 287 458 458 458

Net profit 69 29 24 71 70 Retained earnings 20 26 12 12 12

EPS (IDR) 46 19 16 47 46 Other equities 0 0 0 0 0

Total Equity 524 564 615 561 570

Cash Flow (IDR bn) 2019 2020F 2021F 2022F 2023F Key Ratios (%) 2019 2020F 2021F 2022F 2023F

Net income 69 29 24 71 70 Revenue growth 36.8 (19.9) (0.4) 21.6 (3.7)

Depreciation & amortization 25 21 20 22 21 EBIT growth 9.8 (30.5) 1.7 57.3 (4.7)

Change in working capital 47 (55) 3 3 4 EBITDA growth 15.3 (28.2) 0.7 48.9 (4.5)

Cash flow from operations 141 (5) 47 96 95 Net profit growth 32.0 (58.3) (16.2) 194.6 (1.8)

Capex (119) 8 (39) (30) (42) Gross margin 38.7 35.5 37.8 44.3 44.1

Others (68) (10) (47) (110) (85) EBIT margin 33.7 29.2 29.8 38.6 38.2

Cash flow from investments (187) (2) (86) (139) (127) EBITDA margin 39.8 35.7 36.1 44.2 43.8

Changes in debt (20) (0) 25 29 35 Net margin 17.2 9.0 7.6 18.3 18.7

Changes in equity 102 39 51 1 1 ROA 7.3 3.1 2.4 5.6 5.3

Dividends paid - - - - - ROE 13.2 5.1 3.9 12.7 12.3

Others - - - - - Net gearing (x) 0.4 0.3 0.3 0.4 0.4

Cash flow from financing 82 39 76 30 35 Net debt/EBITDA (x) 2.4 2.7 2.7 3.6 4.1

Net Cash Flow 36 32 37 (13) 3 Interest coverage ratio (x) 8.2 6.3 6.0 8.5 7.7

You might also like

- IFS - Simple Three Statement ModelDocument1 pageIFS - Simple Three Statement ModelThanh NguyenNo ratings yet

- Small Finance BankDocument9 pagesSmall Finance BankRohit SinghNo ratings yet

- Gross Domestic Product (GDP) at Current PricesDocument4 pagesGross Domestic Product (GDP) at Current PricesChakma MansonNo ratings yet

- Itsa Excel SheetDocument7 pagesItsa Excel SheetraheelehsanNo ratings yet

- Harrisons 2022 Annual Report Final CompressedDocument152 pagesHarrisons 2022 Annual Report Final Compressedarusmajuenterprise80No ratings yet

- Group Assignment 1Document8 pagesGroup Assignment 1Tushar JainNo ratings yet

- Economic Cost and Profit of BeximcoDocument15 pagesEconomic Cost and Profit of BeximcoMamun RashidNo ratings yet

- Aquarius Company Worksheet August 31, 2018: Unadjusted Trial Balance Debit CreditDocument35 pagesAquarius Company Worksheet August 31, 2018: Unadjusted Trial Balance Debit CreditAdam Cuenca100% (1)

- Annual Report 2075 76 EnglishDocument200 pagesAnnual Report 2075 76 Englishram krishnaNo ratings yet

- Transportation Capacity Data: Plane Number Cargo Hold Length Flights Per Year Cargo Capacity Total CapacityDocument9 pagesTransportation Capacity Data: Plane Number Cargo Hold Length Flights Per Year Cargo Capacity Total Capacityaravind kumarNo ratings yet

- Triple - M-Trading - SARAYDocument10 pagesTriple - M-Trading - SARAYLaiza Cristella SarayNo ratings yet

- Inr Cr. Q Revenue Contribution To PE Contribution To Group Fixed Cost TVCDocument12 pagesInr Cr. Q Revenue Contribution To PE Contribution To Group Fixed Cost TVCSaagar ChitkaraNo ratings yet

- Ifs 2024Document1 pageIfs 2024rafiqueahmad9898No ratings yet

- Ifs 2024Document1 pageIfs 2024rafiqueahmad9898No ratings yet

- Sss 2Document12 pagesSss 2Pablo1972 DslNo ratings yet

- PT Mekar Jaya Work Sheet Per 31 Dec 2017Document14 pagesPT Mekar Jaya Work Sheet Per 31 Dec 2017Putudevi FebriadnyaniNo ratings yet

- Capital Investment 12-1 To 6 PanisalesDocument8 pagesCapital Investment 12-1 To 6 PanisalesVincent PanisalesNo ratings yet

- Capital Investment Decisions Answers To End of Chapter ExercisesDocument3 pagesCapital Investment Decisions Answers To End of Chapter ExercisesJay BrockNo ratings yet

- Bsais 4JDocument18 pagesBsais 4JArjay DeausenNo ratings yet

- Terjadi Pada Titik Singgung Antara Kurva Isocost Dan Isoquan TDocument9 pagesTerjadi Pada Titik Singgung Antara Kurva Isocost Dan Isoquan TYudhi SutanaNo ratings yet

- E 00175Document114 pagesE 00175Lieven VermeulenNo ratings yet

- Building: Annual 2 0 2 1 / 2 2Document128 pagesBuilding: Annual 2 0 2 1 / 2 2TharushikaNo ratings yet

- Finance Mid Term Mba - 2B Presented To Wael AbdulkaderDocument4 pagesFinance Mid Term Mba - 2B Presented To Wael AbdulkaderMahmoud RedaNo ratings yet

- Excel Bank Income Statement: Particulars YEAR-1 YEAR-2Document6 pagesExcel Bank Income Statement: Particulars YEAR-1 YEAR-2Munir KhanNo ratings yet

- RAWDocument21 pagesRAWArjay DeausenNo ratings yet

- Diamond Energy Resources StudentDocument2 pagesDiamond Energy Resources StudentDonny BuiNo ratings yet

- Economic Cost and Profit of BeximcoDocument15 pagesEconomic Cost and Profit of BeximcoMamun RashidNo ratings yet

- Opening Trial Balance Debit CreditDocument41 pagesOpening Trial Balance Debit CreditHuu LuatNo ratings yet

- Toko Kenanga Neraca Percobaan / Work Sheet Per 31 Desember 2016 No Keterangan Neraca Saldo Penyesuaian Debet Kredit Debet KreditDocument4 pagesToko Kenanga Neraca Percobaan / Work Sheet Per 31 Desember 2016 No Keterangan Neraca Saldo Penyesuaian Debet Kredit Debet KreditWasiah R MaharyNo ratings yet

- Lux Teddy Student 2020Document6 pagesLux Teddy Student 2020ramya penmatsaNo ratings yet

- Basic Underlying Accounting PrinciplesDocument67 pagesBasic Underlying Accounting Principlesraymond guintibanoNo ratings yet

- UntitledDocument5 pagesUntitledm habiburrahman55No ratings yet

- Capital Budget MOPU Discounted After TaxDocument3 pagesCapital Budget MOPU Discounted After TaxBudi PrasetyoNo ratings yet

- LP Meet Point, J InvestorDocument2 pagesLP Meet Point, J Investorvira marsitaNo ratings yet

- CPSC - TruckingDocument32 pagesCPSC - TruckingSari Sari Store VideoNo ratings yet

- KD. MN Kuwait Maldives PalestineDocument13 pagesKD. MN Kuwait Maldives PalestineSridhar DanduNo ratings yet

- Aisha Steel Mills LTDDocument19 pagesAisha Steel Mills LTDEdnan HanNo ratings yet

- GMA Network Inc.: A Presentation of The FinancialsDocument14 pagesGMA Network Inc.: A Presentation of The FinancialsZed LadjaNo ratings yet

- RM Pipeline Report - WISNU ONLYDocument12 pagesRM Pipeline Report - WISNU ONLYWisnu SaputraNo ratings yet

- How To Link 3 Financial Statements: Financial ModelDocument18 pagesHow To Link 3 Financial Statements: Financial ModelPrerna kumariNo ratings yet

- Excel Merchandising Company WorksheetDocument7 pagesExcel Merchandising Company WorksheetDonna Lyn BoncodinNo ratings yet

- Bethesda & GoodweekDocument8 pagesBethesda & GoodweekDian Pratiwi RusdyNo ratings yet

- Numeric Model MetricsDocument5 pagesNumeric Model MetricsAnkit NarulaNo ratings yet

- IFS Dividends IntroductionDocument2 pagesIFS Dividends IntroductionMohamedNo ratings yet

- STFC - Fleet Commanders and Command CenterDocument30 pagesSTFC - Fleet Commanders and Command CenterJason MillerNo ratings yet

- Case Study CharlieDocument9 pagesCase Study CharlieHIMANSHU AGRAWALNo ratings yet

- Income Statement: General Selling and Administration ExpensesDocument8 pagesIncome Statement: General Selling and Administration ExpensesShehzadi Mahum (F-Name :Sohail Ahmed)No ratings yet

- AFM Updated FileDocument281 pagesAFM Updated FilecmvmybxpfcNo ratings yet

- Q1 2011 Quarterly EarningsDocument15 pagesQ1 2011 Quarterly EarningsRip Empson100% (1)

- Macandili Mariwin P. Martel CompanyDocument46 pagesMacandili Mariwin P. Martel CompanyMariwin MacandiliNo ratings yet

- AKG & CSK January To Juli 2023 Profit & Loss Report - Final (1) GADocument40 pagesAKG & CSK January To Juli 2023 Profit & Loss Report - Final (1) GAmochamadharfisNo ratings yet

- Solution For Practice QuestDocument6 pagesSolution For Practice Questabdulsammad13690No ratings yet

- Salary - TDS - 2020-21 (From July-2020)Document32 pagesSalary - TDS - 2020-21 (From July-2020)abu naymNo ratings yet

- Cash Flow ProjectionsDocument2 pagesCash Flow ProjectionsKabo LucasNo ratings yet

- Thai Restaurant Cash FlowDocument33 pagesThai Restaurant Cash FlowElizabethNo ratings yet

- ToyotaDocument4 pagesToyotaعبدالرحمن منصورNo ratings yet

- Presentation 1Document14 pagesPresentation 1hectorselNo ratings yet

- Q4 2010 Quarterly EarningsDocument15 pagesQ4 2010 Quarterly EarningsAlexia BonatsosNo ratings yet

- Moi QuizDocument3 pagesMoi QuizCelestial Nicole VergañoNo ratings yet

- 2.1. IAS 16 - Lecture NotesDocument33 pages2.1. IAS 16 - Lecture NotesBích TrâmNo ratings yet

- Overall Banking System of NCC Bank LimitedDocument39 pagesOverall Banking System of NCC Bank Limitedashrafulkabir100% (1)

- Wa0008.Document2 pagesWa0008.chagusahoo170No ratings yet

- "Financial Analysis of Banking Industry Bank of Baroda"-1Document86 pages"Financial Analysis of Banking Industry Bank of Baroda"-1avanish chaudharyNo ratings yet

- Chapter 5 - Method of RemittanceDocument23 pagesChapter 5 - Method of RemittanceNguyễn Mạnh Thắng100% (1)

- De Thi - Ta Chuyen Nganh TCNH - 1.1920.4Document2 pagesDe Thi - Ta Chuyen Nganh TCNH - 1.1920.4Võ Ngân AnhNo ratings yet

- Maths Foundation (Simple Interest)Document1 pageMaths Foundation (Simple Interest)rajatNo ratings yet

- f9 Question Bank Tuition Pack 20q Bank June 2017Document21 pagesf9 Question Bank Tuition Pack 20q Bank June 2017Ranjisi chimbangu0% (1)

- Adv Acc Old M 18Document27 pagesAdv Acc Old M 18OkkkNo ratings yet

- Cash of Foregoing A Cash DiscountDocument3 pagesCash of Foregoing A Cash DiscountRNo ratings yet

- Credit Card Terms and ConditionsDocument4 pagesCredit Card Terms and Conditionsfritz frances danielleNo ratings yet

- Chapter 2 - The Regulatory Environment For Financial PlannersDocument14 pagesChapter 2 - The Regulatory Environment For Financial PlannersAisyah HumairahNo ratings yet

- Seabank Statement 20220726Document4 pagesSeabank Statement 20220726Alesa WahabappNo ratings yet

- Zelalem G Audit II CHAP. SIX AUDIT CLDocument7 pagesZelalem G Audit II CHAP. SIX AUDIT CLalemayehuNo ratings yet

- Auditing and Taxation: Ty Bcom - Auditing and Taxation - MCQ - Question Bank - Compiled by Manoj VoraDocument7 pagesAuditing and Taxation: Ty Bcom - Auditing and Taxation - MCQ - Question Bank - Compiled by Manoj VoraSample Use75% (4)

- Policy Doc PDFDocument4 pagesPolicy Doc PDFhiteshmohakar15No ratings yet

- Vietnam Financial Market OverviewDocument15 pagesVietnam Financial Market OverviewTrifan_DumitruNo ratings yet

- Introduction To Financial Management: GROUP PROJECT: Ratio Analysis ofDocument34 pagesIntroduction To Financial Management: GROUP PROJECT: Ratio Analysis ofJahida Akter LovnaNo ratings yet

- Full Prepayment Trial Calculation (Company)Document1 pageFull Prepayment Trial Calculation (Company)muripande pandeNo ratings yet

- Corporate Performance AnalysisDocument217 pagesCorporate Performance Analysisroy_kohinoorNo ratings yet

- Https WWW - Cimb.bizchannel - Com.my Corp Front Transactioninquiry - Do Action Doprint PDFDocument1 pageHttps WWW - Cimb.bizchannel - Com.my Corp Front Transactioninquiry - Do Action Doprint PDFSyed HanafieNo ratings yet

- Corporate Finance Cheat SheetDocument3 pagesCorporate Finance Cheat Sheet050610220479No ratings yet

- Petty Cash & ReconcileDocument9 pagesPetty Cash & ReconcileRirin WidyawatiNo ratings yet

- Disclosure Statement On Loan/Credit Transaction Name: AddressDocument3 pagesDisclosure Statement On Loan/Credit Transaction Name: AddressElmer D. BalidoNo ratings yet

- SS 15 Reading 53 - Introduction To Fixed-Income ValuationDocument11 pagesSS 15 Reading 53 - Introduction To Fixed-Income Valuationb21fa1104No ratings yet

- Basic Accounting Concepts WebsiteDocument45 pagesBasic Accounting Concepts WebsiteMuhammad Usman SharifNo ratings yet

- FIN242Document3 pagesFIN2422022875508No ratings yet

- Sachin Case VIVA 11septDocument2 pagesSachin Case VIVA 11septAYESHA RACHH 2127567No ratings yet

- Revision Fundamentals 1Document7 pagesRevision Fundamentals 1LexNo ratings yet