Lesson 2: General Purpose Financial Statements: Business Resources Amount From Creditors + Amount From Owners

Lesson 2: General Purpose Financial Statements: Business Resources Amount From Creditors + Amount From Owners

Uploaded by

Romae DomagasCopyright:

Available Formats

Lesson 2: General Purpose Financial Statements: Business Resources Amount From Creditors + Amount From Owners

Lesson 2: General Purpose Financial Statements: Business Resources Amount From Creditors + Amount From Owners

Uploaded by

Romae DomagasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Lesson 2: General Purpose Financial Statements: Business Resources Amount From Creditors + Amount From Owners

Lesson 2: General Purpose Financial Statements: Business Resources Amount From Creditors + Amount From Owners

Uploaded by

Romae DomagasCopyright:

Available Formats

Lesson 2: General Purpose Financial Statements -it is a distribution of income to owners rather than

Profitability Vs. Solvency an expense of doing business

1. Profitability -Dividends are the means by which a corporation

-is the ability to generate income. rewards its stockholders (owners) for providing it with

Companies can sometimes improve their investment funds.Corporations are not required to pay

profitability by borrowing from creditors and using the dividends and because dividends are not an expense,

funds effectively. they do not appear on the income statement.The effect

2. Solvency of a dividend is to reduce cash and retained earnings by

-is the ability to pay debts as they become due. the amount paid out.

The higher the proportion of assets provided by (5) Notes to Financial Statements

owners, the more solvent the company. The Balance Sheet

(3. Liquidity) Basic Accounting Equation

-is the ability to convert asset, or security into cash. Assets= Liabilities + Owners’ Equity

Required Financial Statements under GAAP Business Resources= Amount from Creditors + Amount from Owners

1. Balance Sheet or Statement of Financial Position Unclassified balance sheet has three major

-reflect resources and explain how those resources categories: assets, liabilities, and stockholders' equity.

were capitalized A classified balance sheet contains the same three

A balance sheet is like a photograph; it captures the major categories and subdivides them to provide useful

financial position of a company at a particular point in information for interpretation and analysis by users of

time. The other two statements are for a period of time. financial statements.

2. Income Statement or Statement of Operations 1. Assets

-seeks to represent the results of operation to know -property/rights that provide probable future

whether the company have profit or not. benefits.

-reflects a company’s profitability. *Current Assets

3. Statement of Cash Flows -cash and other assets that a business can convert

-designed to identify the major sources and uses of to cash or uses up in a relatively short period—one year

cash. or one operating cycle, whichever is longer.

-shows the cash inflows and cash outflows from An operating cycle is the time it takes to start with

operating, investing, and financing activities. cash, buy necessary items to produce revenues (such

*Operating activities as materials, supplies, labor, and/or finished goods), sell

-generally include the cash effects of transactions services or goods, and receive cash by collecting the

and other events that enter into the determination of net resulting receivables.

income. Companies in service industries and

*Investing activities merchandising industries generally have operating

-generally include business transactions involving cycles shorter than one year.

the acquisition or disposal of long-term assets Companies in some manufacturing industries, such

such as land, buildings, and equipment. as distilling and lumber, have operating cycles longer

*Financing activities than one year.

-generally include the cash effects of transactions A) Cash includes deposits in banks available for current

and other events involving creditors and owners operations at the balance sheet date plus cash on hand

(stockholders). consisting of currency, undeposited checks, drafts, and

(4) Statement of Retained Earnings money orders. Cash is the first current asset to appear

-shows the change in retained earnings between on a balance sheet. The term cash normally includes

the beginning and end of a period cash equivalents.

-one purpose of the statement of retained earnings B) Cash equivalents are highly liquid, short-term

is to connect the income statement and the balance investments acquired with temporarily idle cash and

sheet. easily convertible into a known cash amount. Examples

*Dividend are Treasury bills, short-term notes maturing within 90

-a payment (usually of cash) to the owners of the days, certificates of deposit, and money market funds.

business C) Marketable securities are temporary investments

such as short-term ownership of stocks and bonds of term purposes. We describe several types of

other companies. Such investments do not qualify as property, plant, and equipment next.

cash equivalents. These investments earn additional Land is ground the company uses for business

money on cash that the business does not need at operations; this includes ground on which the company

present but will probably need within one year. locates its business buildings and that is used for

D) Accounts receivable (also called trade accounts outside storage space or parking. Land owned for

receivable) are amounts owed to a business by investment is not a plant asset because it is a long-term

customers. An account receivable arises when a investment.

company performs a service or sells merchandise on Buildings are structures the company uses to carry

credit. Customers normally provide no written evidence on its business. Again, the buildings that a company

of indebtedness on sales invoices or delivery tickets owns as investments are not plant assets.

except their signatures. Office furniture includes file cabinets, desks, chairs,

E) Merchandise inventories are goods held for sale. and shelves.

Note: A company's inventory should not be recorded on Office equipment includes computers, copiers, FAX

its balance sheet at its cost if it is obsolete and has no machines, and phone answering machines.

resale value, meaning it is destined for the trash bin. Leasehold improvements are any physical

A note is an unconditional written promise to pay alterations made by the lessee to the leased property

another party the amount owed either when demanded when these benefits are expected to last beyond the

or at a certain specified date, usually with interest (a current accounting period. An example is when the

charge made for use of the money) at a specified rate. A lessee builds room partitions in a leased building. (The

note receivable appears on the balance sheet of the lessee is the one obtaining the rights to possess and

company to which the note is given. A note receivable use the property.)

arises (1) when a company makes a sale and receives a Construction in progress represents the partially

note from the customer, (2) when a customer gives a completed stores or other buildings that a company

note for an amount due on an account receivable, or (3) plans to occupy when completed.

when a company loans money and receives a note in Accumulated depreciation is a contra asset account

return. to depreciable assets such as buildings, machinery, and

F) Interest receivable arises when a company has equipment. This account shows the total depreciation

earned but not collected interest by the balance sheet taken for the depreciable assets. On the balance sheet,

date. Usually, the amount is not due until later. companies deduct the accumulated depreciation (as a

G) Prepaid expenses include rent, insurance, and contra asset) from its related asset.

supplies that have been paid for but all the benefits have B) Long-term investments A long-term investment

not yet been realized (or consumed) from these usually consists of securities of another company held

expenses. If prepaid expenses had not been paid for in with the intention of (1) obtaining control of another

advance, they would require the future disbursement of company, (2) securing a permanent source of income

cash. Furthermore, prepaid expenses are considered for the investor, or (3) establishing friendly business

assets because they have service potential. relations. The long-term investment classification in the

*Long-term assets balance sheet does not include those securities

-are assets that a business has on hand or uses for purchased for short-term purposes. For most

a relatively long time. Examples include property, plant, businesses, long-term investments may be stocks or

and equipment; long-term investments; and intangible bonds of other corporations. Occasionally, long-term

assets. investments include funds accumulated for specific

A) Property, plant, and equipment are assets with useful purposes, rental properties, and plant sites for future

lives of more than one year; a company acquires use.

them for use in the business rather than for resale.The C) Intangible assets Intangible assets consist of the

terms plant assets or fixed assets are also used for noncurrent, nonmonetary, nonphysical assets of a

property, plant, and equipment. To agree with the order business. Companies must charge the costs of

in the heading, balance sheets generally list property intangible assets to expense over the period benefited.

first, plant next, and equipment last. These items are Among the

fixed assets because the company uses them for long- intangible assets are rights granted by governmental

bodies, such as patents and copyrights. Other intangible due until later.

assets include leaseholds and goodwill. D) Sales taxes payable are the taxes a company has

A patent is a right granted by the federal collected from customers but not yet remitted to the

government; it gives the owner of an invention the taxing authority, usually the state.

authority to manufacture a product or to use a process Other accrued expenses might include taxes withheld

for a specified time. from employees, income taxes payable, and interest

A copyright granted by the federal government payable.

gives the owner the exclusive privilege of publishing Taxes withheld from employees include federal

written income taxes, state income taxes, and social security

material for a specified time. taxes withheld from employees' paychecks. The

Leaseholds are rights to use rented properties, company plans to pay these amounts to the proper

usually for several years. governmental agencies within a short period.

Goodwill is an intangible value attached to a Income taxes payable are the taxes paid to the

business, evidenced by the ability to earn larger net state and federal governments by a corporation on its

income per dollar of investment than that earned by income. Interest payable is interest that the company

competitors in the same industry. The ability to produce has accumulated on notes or bonds but has not paid by

superior profits is a valuable resource of a business. the balance sheet date because it is not due until later.

Normally, companies record goodwill only at the time of E) Dividends payable, or amounts the company has

purchase and then only at the price paid for it. declared payable to stockholders, represent a

Accumulated amortization is a contra asset account distribution of income. Since the corporation has not

to intangible assets. This account shows the total paid these declared dividends by the balance sheet

amortization taken on the intangible assets. date, they are a liability.

2. Liabilities F) Unearned revenues (revenues received in advance)

-probable future obligations/company’s debts. result when a company receives payment for goods or

Warranty Obligations - promise to provide future service under services before earning the revenue, such as payments

warranty

for subscriptions to a magazine. These unearned

*Current liabilities

revenues represent a liability to perform the agreed

-are debts due within one year or one operating

services or other contractual requirements or to return

cycle, whichever is longer. The payment of current

the assets received.

liabilities normally requires the use of current assets.

Companies report any current installment on long-

Balance sheets list current liabilities in the order they

term debt due within one year under current liabilities.

must be paid; the sooner a liability must be paid, the

The remaining portion continues to be reported as a

earlier it is listed. Examples of current liabilities follow.

long-term liability.

A) Accounts payable are amounts owed to suppliers for

*Long-term liabilities

goods or services purchased on credit. Accounts

-are debts such as a mortgage payable and bonds

payable are generally due in 30 or 60 days and do not

payable that are not due for more than one year.

bear interest. In the balance sheet, the accounts

Companies should show maturity dates in the balance

payable amount is the sum of the individual accounts

sheet for all long-term liabilities. Normally, the

payable to suppliers shown in a subsidiary ledger or file.

liabilities with the earliest due dates are listed first.

B) Notes payable are unconditional written promises by

A) Notes payable with maturity dates at least one year

the company to pay a specific sum of money at a certain

beyond the balance sheet date are long-term liabilities.

future date. The notes may arise from borrowing money

B) Bonds payable are long-term liabilities and are

from a bank, from the purchase of assets, or from the

evidenced by formal printed certificates sometimes

giving of a note in settlement of an account payable.

secured by liens (claims) on property, such as

Generally, only notes payable due in one year or less

mortgages. Maturity dates should appear on the balance

are

sheet for all major longterm liabilities.

included as current liabilities.

3. Owners’ Equity

C) Salaries payable are amounts owed to employees for

-the amount of assets minus the amount of liabilities

services rendered. The company has not paid these

equals the amount of owners’ equity

salaries by the balance sheet date because they are not

-the amount provided by the owners to the business

-equal to the amount of Capital Stock plus the assets

amount of Retained Earnings A) Wage Expense - salary

-shows the owners' interest in the business. This B) Cost of Goods Sold - cost of inventory

interest is equal to the amount contributed plus the % Operating revenues are the revenues generated by

income left in the business. the major activities of the business—usually the sale of

A) Paid-in capital shows the capital paid into the products or services or both.

company as the owners' investment. % Cost of goods sold is the major expense in

B) Retained earnings shows the cumulative income of merchandising companies.

the company less the amounts distributed to the owners % Operating expenses for a merchandising company

in the form of dividends. are those expenses, other than cost of goods sold,

Owners Provide Assets in Two Possible Ways incurred in the normal business functions of a company.

A) Contributing money or other resources in exchange Usually, operating expenses are either selling expenses

for ownership evidenced by shares of stock or administrative expenses.

-called Contributed Capital / Capital Stock Selling expenses are expenses a company incurs

-the amount of assets contributed by owners in selling and marketing efforts. Examples include

for a stock. salaries and commissions of salespersons, expenses for

-shows the amount of the owners’ investment salespersons' travel, delivery, advertising, rent (or

in the corporation depreciation, if owned) and utilities on a sales building,

B) Allowing any increase in assets from profitable sales supplies used, and depreciation on delivery trucks

operations to be retained in the business rather than used in sales.

distributed to owners as a dividend. Administrative expenses are expenses a company

- called Retained Earnings incurs in the overall management of a business.

-the amount of assets created through profits Examples include administrative salaries, rent (or

and retained in the business. depreciation, if owned) and utilities on an administrative

-generally consists of the accumulated net building, insurance expense, administrative supplies

income of the corporation minus dividends used, and depreciation on office equipment.

distributed to stockholders Certain operating expenses may be shared by the

Income Statement selling and administrative functions. For example, a

Revenue - Expenses = NI / NL company might incur rent, taxes, and insurance on a

Revenue > Expenses = Net Income building for both sales and administrative purposes.

Revenue < Expenses = Net Loss

Expenses covering both the selling and administrative

An unclassified income statement has only two

functions must be analyzed and prorated between the

categories—revenues and expenses.

two functions on the income statement. For instance, if

In contrast, a classified income statement divides

USD 1,000 of depreciation expense relates 60 per cent

both revenues and expenses into operating and

to selling and 40 per cent to administrative based on the

nonoperating items. The statement also separates

square footage or number of employees, the income

operating expenses into selling and administrative

statement would show USD 600 as a selling expense

expenses. A classified income statement is also called a

and USD 400 as an administrative expense.

multiple-step income statement.

% Nonoperating revenues (other revenues) and

1. Revenues

nonoperating expenses (other expenses) are revenues

-amount of in-flowing assets from the sale or

and expenses not related to the sale of products or

providing services to customers.

services regularly offered for sale by a business. An

-”sales price”

example of a nonoperating revenue is interest that a

A) Sales Revenue - merchandising

business earns on notes receivable. An example of a

B) Consulting Fee Revenues - consultation

nonoperating expense is interest incurred on money

C) Interest Revenue - loaning money

borrowed by the company.

2. Expenses

To summarize the more important relationships in

-the amount of out-flowing assets that represents a

the income statement of a merchandising firm in

cost for providing goods or services.

equation form:

-incurring of liabilities requiring the future outflow of

A) Net sales = Gross sales - (Sales discounts + Sales

returns and allowances).

B) Net purchases = Purchases - (Purchase discounts +

Purchase returns and allowances).

C) Net cost of purchases = Net purchases +

Transportation-in.

D) Cost of goods sold = Beginning inventory + Net

cost of purchases - Ending inventory.

E) Gross margin = Net sales - Cost of goods sold.

F) Income from operations = Gross margin - Operating

(selling and administrative) expenses.

G) Net income = Income from operations +

Nonoperating revenues - Nonoperating expenses.

Each of these relationships is important because of

the way it relates to an overall measure of business

profitability. For example, a company may produce a

high gross margin on sales. However, because of large

sales commissions and delivery expenses, the owner

may realize only a very small percentage of the gross

margin as profit. The classifications in the income

statement allow a user to focus on the whole picture as

well as on how net income was derived (statement

relationships).

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5935)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1106)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (879)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (598)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (925)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (545)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (353)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (476)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (831)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (274)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (419)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2271)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (99)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (270)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (235)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (232)

- SROI Excel Model ToolDocument17 pagesSROI Excel Model ToolswelagiriNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (75)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Lake TheaterDocument4 pagesThe Lake Theaterwaywardguy_6950% (2)

- Etr Template ExampleDocument56 pagesEtr Template ExampleNur Fadhlin SakinaNo ratings yet

- Lecture 9 - Allied Components Case SolutionDocument4 pagesLecture 9 - Allied Components Case SolutionMs ShoaibNo ratings yet

- Steve Ballmer Email To Microsoft EmployeesDocument2 pagesSteve Ballmer Email To Microsoft EmployeesFOXBusiness.comNo ratings yet

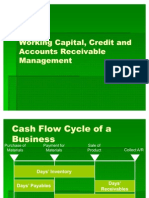

- Working Capital, Credit and Accounts Receivable ManagementDocument31 pagesWorking Capital, Credit and Accounts Receivable ManagementAnkit Agarwal100% (1)

- About GenpactDocument3 pagesAbout GenpactShreyans JainNo ratings yet

- Corporate ReputationDocument357 pagesCorporate ReputationZahid Islamli100% (1)

- Attock Oil RefineryDocument2 pagesAttock Oil RefineryOvais HussainNo ratings yet

- Altair 2015 Relocation Tax Issues & AnswersDocument40 pagesAltair 2015 Relocation Tax Issues & AnswersHenry MajorosNo ratings yet

- Toehold Acquisition PDFDocument33 pagesToehold Acquisition PDFMeMuluNo ratings yet

- UNIT 2: Time Value of Money: New Law College, BBA LLB 3 Yr Notes For Limited CirculationDocument6 pagesUNIT 2: Time Value of Money: New Law College, BBA LLB 3 Yr Notes For Limited CirculationSneha SenNo ratings yet

- FQM 1Document1 pageFQM 1Sarah HernandezNo ratings yet

- Mitchells Balance Sheet: Question 1)Document3 pagesMitchells Balance Sheet: Question 1)Hamna RizwanNo ratings yet

- Pas 40 Investment PropertyDocument6 pagesPas 40 Investment PropertyElaiza Jane CruzNo ratings yet

- Course Contents Financial Market 1Document2 pagesCourse Contents Financial Market 1Shariz ParvezNo ratings yet

- Risk Management Changes in Insurance CompaniesDocument390 pagesRisk Management Changes in Insurance CompaniesESTHERNo ratings yet

- Unit 2 Accounting Concepts and Standards: ObjectivesDocument19 pagesUnit 2 Accounting Concepts and Standards: ObjectivesAshish AroraNo ratings yet

- FEB, 2017 Wolkite EthiopiaDocument29 pagesFEB, 2017 Wolkite Ethiopiaunknown nameNo ratings yet

- WEL Annual Report 2019 14 14 PDFDocument156 pagesWEL Annual Report 2019 14 14 PDFShashank DewanganNo ratings yet

- The Payment of Bonus Act, 1965Document15 pagesThe Payment of Bonus Act, 1965Raman GhaiNo ratings yet

- DILG BNEO PresentationDocument119 pagesDILG BNEO PresentationNlNl Palmes Bermeo0% (1)

- Swot Analysis & MKT Plan (Quiz)Document32 pagesSwot Analysis & MKT Plan (Quiz)Rao Shoaib100% (1)

- What Is Bitcoin and How Does It WorkDocument3 pagesWhat Is Bitcoin and How Does It WorkShrinivasan ParthasarathyNo ratings yet

- WCM ProblemsDocument9 pagesWCM Problemsparika khannaNo ratings yet

- Central Bank of Sri Lanka: Selected Weekly Economic IndicatorsDocument12 pagesCentral Bank of Sri Lanka: Selected Weekly Economic IndicatorsRandora LkNo ratings yet

- Cost of CapitalDocument16 pagesCost of CapitalReiner NuludNo ratings yet

- OFR Report December2010Document15 pagesOFR Report December2010Neil GillespieNo ratings yet

- REFLECTION PAPER #4 Sir JunsayDocument3 pagesREFLECTION PAPER #4 Sir Junsayjoseph jandaNo ratings yet

- Angkasa Pura II - AR 2020 - 210813Document598 pagesAngkasa Pura II - AR 2020 - 210813Shreelalitha KarthikNo ratings yet