Annual Information Statement (AIS) : ATVPM9844L XXXX XXX X 80 99 Priya Ramchandra Malvankar

Annual Information Statement (AIS) : ATVPM9844L XXXX XXX X 80 99 Priya Ramchandra Malvankar

Uploaded by

Kamalalakshmi NarayananCopyright:

Available Formats

Annual Information Statement (AIS) : ATVPM9844L XXXX XXX X 80 99 Priya Ramchandra Malvankar

Annual Information Statement (AIS) : ATVPM9844L XXXX XXX X 80 99 Priya Ramchandra Malvankar

Uploaded by

Kamalalakshmi NarayananOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Annual Information Statement (AIS) : ATVPM9844L XXXX XXX X 80 99 Priya Ramchandra Malvankar

Annual Information Statement (AIS) : ATVPM9844L XXXX XXX X 80 99 Priya Ramchandra Malvankar

Uploaded by

Kamalalakshmi NarayananCopyright:

Available Formats

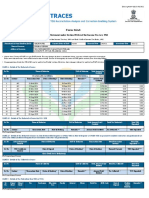

Annual Information Statement (AIS)

Financial Year 2020-21

Assessment Year 2021-22

Part A

Permanent Account Number (PAN) Aadhaar Number Name of Assessee

ATVPM9844L XXXX XXX X 80 99 PRIYA RAMCHANDRA MALVANKAR

Date of Birth Mobile Number E-mail Address

14/04/1987 8879798745 malvankar_priya@outlook.com

Address

B 25,GORAI SAI GHARKUL,PLOT NO. 66,GORAI 2, BORIVALI WEST,MUMBAI,MUMBAI,400092,MAHARASHTRA

-------------------------------------------------------------------- Annual Information Statement (Part B) --------------------------------------------------------------------

(All amount values are in INR)

Part B1-Information relating to tax deducted or collected at source

Outward foreign remittance/purchase of foreign currency

SR. NO. INFORMATION CODE INFORMATION DESCRIPTION INFORMATION SOURCE COUNT AMOUNT

1 TCS-206CQ Remittance under LRS (u/s 206C(1G(a))) HDFC BANK LIMITED (MUMH03189E) 21 19,444

SR. NO. QUARTER DATE OF RECEIPT/ DEBIT AMOUNT RECEIVED/DEBITED TAX COLLECTED TCS DEPOSITED STATUS

1 Q4(Jan-Mar) 29/03/2021 219 0 0 Active

2 Q4(Jan-Mar) 18/03/2021 150 0 0 Active

3 Q4(Jan-Mar) 05/03/2021 518 0 0 Active

4 Q4(Jan-Mar) 03/03/2021 99 0 0 Active

5 Q4(Jan-Mar) 03/02/2021 99 0 0 Active

6 Q4(Jan-Mar) 28/01/2021 219 0 0 Active

7 Q4(Jan-Mar) 24/01/2021 299 0 0 Active

8 Q4(Jan-Mar) 07/01/2021 99 0 0 Active

9 Q3(Oct-Dec) 30/12/2020 1,496 0 0 Active

10 Q3(Oct-Dec) 28/12/2020 518 0 0 Active

11 Q3(Oct-Dec) 27/12/2020 1,874 0 0 Active

12 Q3(Oct-Dec) 21/12/2020 4,509 0 0 Active

13 Q3(Oct-Dec) 20/12/2020 4,802 0 0 Active

14 Q3(Oct-Dec) 30/11/2020 219 0 0 Active

15 Q3(Oct-Dec) 22/11/2020 299 0 0 Active

16 Q3(Oct-Dec) 04/11/2020 99 0 0 Active

17 Q3(Oct-Dec) 01/11/2020 219 0 0 Active

18 Q3(Oct-Dec) 26/10/2020 958 0 0 Active

19 Q3(Oct-Dec) 21/10/2020 219 0 0 Active

20 Q3(Oct-Dec) 19/10/2020 1,561 0 0 Active

21 Q3(Oct-Dec) 18/10/2020 969 0 0 Active

Note - If there is variation between the TDS/TCS information as displayed in Form26AS on TRACES portal, and the TDS/TCS information as displayed in AIS on

Compliance Portal, the taxpayer may rely on the information displayed on TRACES portal for the purpose of filing of tax return and for other tax compliance purposes.

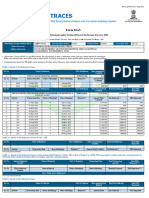

Part B2-Information relating to specified financial transaction (SFT)

Sale of securities and units of mutual fund

Download ID : ATVPM9844L202203221202 IP Address : 103.42.194.176

Download Date : 22/03/2022, 12:02:00 Page 1 of 3

PAN Name Assessment Year

ATVPM9844L PRIYA RAMCHANDRA MALVANKAR 2021-22

SR. NO. INFORMATION INFORMATION DESCRIPTION INFORMATION SOURCE COUNT AMOUNT

CODE

1 SFT-17-LES(M) Sale of listed equity share CENTRAL DEPOSITORY SERVICES(I) LIMITED 8 66,142

(Depository) (AAACC6233AMUMC09975A)

SR. DATE OF SECURITY NAME (SECURITY CODE) SECURITY DEBIT ASSET QUANTITY SALE SALES STATUS

NO. SALE/ CLASS TYPE TYPE PRICE CONSIDERATION

TRANSFER PER

UNIT

1 31/03/2021 JSW ENERGY LIMITED - EQUITY Listed Market Short 35 88 3,078 Active

SHARES(INE121E01018) Equity term

Share

2 30/03/2021 STEEL AUTHORITY OF INDIA LIMITED Listed Market Short 26 79 2,058 Active

EQUITY SHARES(INE114A01011) Equity term

Share

3 24/03/2021 ASIAN PAINTS LIMITED # NEW EQUITY Listed Market Short 5 2,444 12,221 Active

SHARES OF RE.1/- AFTER SUB Equity term

DIVISION(INE021A01026) Share

4 23/03/2021 BRITANNIA INDUSTRIES LIMITED#NEW Listed Market Short 3 3,567 10,701 Active

EQUITY SHARES FACE VALUE RE. 1/- Equity term

AFTER SUB DIVISION(INE216A01030) Share

5 09/03/2021 THE SOUTH INDIAN BANK LIMITED-NEW Listed Market Short 100 9 949 Active

EQUITY SHARES OF RE. 1/- AFTER SUB- Equity term

DIVISION(INE683A01023) Share

6 05/02/2021 DIVIS LABORATORIES LIMITED - EQUITY Listed Market Short 3 3,820 11,459 Active

SHARES(INE361B01024) Equity term

Share

7 03/02/2021 INDUSIND BANK LIMITED EQUITY Listed Market Short 10 1,050 10,496 Active

SHARES(INE095A01012) Equity term

Share

8 01/02/2021 BAJAJ FINANCE LIMITED # NEW EQ SH Listed Market Short 3 5,060 15,180 Active

WITH FV RS.2/- AFTER SUB Equity term

DIVISION(INE296A01024) Share

Purchase of securities and units of mutual funds

SR. NO. INFORMATION INFORMATION DESCRIPTION INFORMATION SOURCE COUNT AMOUNT

CODE

1 SFT-17(Pur) Purchase of securities (SFT - CENTRAL DEPOSITORY SERVICES(I) LIMITED 1 62,767

017) (AAACC6233AMUMC09975A)

SR. NO. CLIENT ID HOLDER FLAG MARKET PURCHASE MARKET SALES STATUS

1 58180005 First 62,767 0 Active

Part B3-Information relating to payment of taxes

SR. NO. ASSESSMENT MAJOR MINOR TAX (A) SURCHARGE EDUCATION OTHERS TOTAL (A DATE OF CHALLAN

YEAR HEAD HEAD (B) CESS (C) (D) +B+C+D) DEPOSIT IDENTIFICATION

NUMBER (CIN)

No Transactions Present

Note - If there is variation between the details of tax paid as displayed in Form26AS on TRACES portal and the information relating to tax payment as displayed in AIS

on Compliance Portal, the taxpayer may rely on the information displayed on TRACES portal for the purpose of filing of tax return and for other tax compliance

purposes.

Part B4-Information relating to demand and refund

Download ID : ATVPM9844L202203221202 IP Address : 103.42.194.176

Download Date : 22/03/2022, 12:02:00 Page 2 of 3

PAN Name Assessment Year

ATVPM9844L PRIYA RAMCHANDRA MALVANKAR 2021-22

Refund

SR. NO. ASSESSMENT YEAR MODE NATURE OF REFUND REFUND AMOUNT DATE OF PAYMENT

No Transactions Present

Part B7-Any other information in relation to sub-rule (2) of rule 114-I

SR. NO. INFORMATION CODE INFORMATION DESCRIPTION INFORMATION SOURCE COUNT AMOUNT

No Transactions Present

Download ID : ATVPM9844L202203221202 IP Address : 103.42.194.176

Download Date : 22/03/2022, 12:02:00 Page 3 of 3

You might also like

- (KMBN-308) : Summer Internship ReportDocument106 pages(KMBN-308) : Summer Internship ReportNeetika TripathiNo ratings yet

- Guzman Cruz Cpas and Co.: Guideline For BIR Tax Deadlines During Enhanced Community Quarantine (ECQ) PeriodDocument2 pagesGuzman Cruz Cpas and Co.: Guideline For BIR Tax Deadlines During Enhanced Community Quarantine (ECQ) PeriodGerald SantosNo ratings yet

- MyviDocument2 pagesMyviamran5973No ratings yet

- Assignment 4, Real Estate Scenario in FaridabadDocument20 pagesAssignment 4, Real Estate Scenario in FaridabadpriyushiNo ratings yet

- Ex. NH Map of West Bengal R-12 (10.01Document1 pageEx. NH Map of West Bengal R-12 (10.01pubgmobile21909No ratings yet

- Licence Details Upto June 2015Document74 pagesLicence Details Upto June 2015piudevaNo ratings yet

- On mAYURDocument61 pagesOn mAYURvimalNo ratings yet

- GT Bicycle OwnersManualDocument108 pagesGT Bicycle OwnersManualH100% (1)

- 2010 Nissan Sentra 28Document94 pages2010 Nissan Sentra 28Jhonatan Zamora SolisNo ratings yet

- Bearing Timken Automotive.Document27 pagesBearing Timken Automotive.Mijail RangelNo ratings yet

- Carbomastic 15: Selection & Specification Data Substrates & Surface PreparationDocument2 pagesCarbomastic 15: Selection & Specification Data Substrates & Surface PreparationMarcos MacaiaNo ratings yet

- DC3 UnlockedDocument5 pagesDC3 UnlockedRajesh Kumar SinghNo ratings yet

- Annual Information Statement (AIS) PDFDocument15 pagesAnnual Information Statement (AIS) PDFVineet KhuranaNo ratings yet

- Annual Information Statement (AIS) : BNNPM9483N XXXX XXX X 86 93 Mohd Arshad Mohd Aslam QureshiDocument2 pagesAnnual Information Statement (AIS) : BNNPM9483N XXXX XXX X 86 93 Mohd Arshad Mohd Aslam QureshiKamalalakshmi NarayananNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Sanjay SinghNo ratings yet

- ABBPM0700D-2024_AIS_19-Oct-2024 04.39.12 PMDocument3 pagesABBPM0700D-2024_AIS_19-Oct-2024 04.39.12 PMayush.mscaNo ratings yet

- Santosh AisDocument1 pageSantosh Aisjaigovind boobNo ratings yet

- Annual Information Statement (AIS) : BQBPR5441J XXXX XXX X 60 05 Jogin Sanganakal Ravi KumarDocument2 pagesAnnual Information Statement (AIS) : BQBPR5441J XXXX XXX X 60 05 Jogin Sanganakal Ravi KumarravikumarNo ratings yet

- Bkspm0398a 2021Document4 pagesBkspm0398a 2021tax fileNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Prateek AgarwalNo ratings yet

- Ekxps0001n 2021Document4 pagesEkxps0001n 2021SiddharthNo ratings yet

- XXXPV8956X_2023-24_AIS (1)Document5 pagesXXXPV8956X_2023-24_AIS (1)Nishant Jha Mcom 2No ratings yet

- A.Y. 2021-22Document4 pagesA.Y. 2021-22LAXMI FINANCENo ratings yet

- Apbpp9808b 2023Document4 pagesApbpp9808b 2023pramraj51184No ratings yet

- ATUPA8667Q-2022 (1) - EditedDocument6 pagesATUPA8667Q-2022 (1) - EditedDharamjot singhNo ratings yet

- Annual Information Statement (AIS) : BNTPS8633N XXXX XXXX 2410 Amuela ShaikDocument4 pagesAnnual Information Statement (AIS) : BNTPS8633N XXXX XXXX 2410 Amuela Shaikeshanshaik2010No ratings yet

- Aaefk7065p 2020Document18 pagesAaefk7065p 2020Vineet KhuranaNo ratings yet

- XXXPK6879X_2022-23_AISDocument32 pagesXXXPK6879X_2022-23_AISamitkumar.id007No ratings yet

- Cbops9538j 2021Document4 pagesCbops9538j 2021Nirav ChauhanNo ratings yet

- Annual Information Statement (AIS) : Part ADocument3 pagesAnnual Information Statement (AIS) : Part AbhavdeepsinhNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Ashutosh SinhaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document5 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Shivansh BansalNo ratings yet

- Cash-In & Cash-Out (CashFlow CY2020)Document50 pagesCash-In & Cash-Out (CashFlow CY2020)Peter Fritz BoholstNo ratings yet

- Etqpm8729b 2022Document4 pagesEtqpm8729b 2022rvimeena57No ratings yet

- Sri Shabari AisDocument12 pagesSri Shabari AisKATTA VENKATA KRISHNAIAHNo ratings yet

- AJYPA7542E-2022Document4 pagesAJYPA7542E-2022gangaurassociates1No ratings yet

- DMXPK9005F 2021Document4 pagesDMXPK9005F 2021sonuNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961anvi jainNo ratings yet

- Acvpg9128n 2021Document4 pagesAcvpg9128n 2021SRI KALALAYA CHARITABLE TRUSTNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Xen Operation DPHNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Maryam ZahraNo ratings yet

- JITENDRA DEVA 21-22Document4 pagesJITENDRA DEVA 21-22saransh.garg01No ratings yet

- Beypc6802h 2022Document4 pagesBeypc6802h 2022Anilkumar ChennamsettiNo ratings yet

- Sro0766052 - Computer Periperals GSTR-1: Included in HSN/SAC Summary 0 Incomplete HSN/SAC Information (To Be Provided) 0Document2 pagesSro0766052 - Computer Periperals GSTR-1: Included in HSN/SAC Summary 0 Incomplete HSN/SAC Information (To Be Provided) 0Karthick KartyNo ratings yet

- Edifice_FY2019-20_26ASDocument10 pagesEdifice_FY2019-20_26ASSuresh KumarNo ratings yet

- Atlpr9507m 2021Document4 pagesAtlpr9507m 2021chandra DiveshNo ratings yet

- Akepv7393m 2021Document4 pagesAkepv7393m 2021Biomedical EngineerNo ratings yet

- Rjraj00297020000019093 2020Document1 pageRjraj00297020000019093 2020bsjrenterprisesNo ratings yet

- AVSPG8680R-2022Document5 pagesAVSPG8680R-2022milanbehera4242No ratings yet

- Abxpb2605e 2022Document7 pagesAbxpb2605e 2022Vineet KhuranaNo ratings yet

- Ajqph9031d 2022Document4 pagesAjqph9031d 2022AnilNo ratings yet

- Eewps2060j 2023Document4 pagesEewps2060j 2023priyatoshdwivedi2010No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Rakshit KashyapNo ratings yet

- AQPPA5838D-2022Document4 pagesAQPPA5838D-2022shankarkjha1984No ratings yet

- Rupees: Cost Center - DAODocument6 pagesRupees: Cost Center - DAOMuhammad SafdarNo ratings yet

- LaporanHistoryPayment 020420113952Document1 pageLaporanHistoryPayment 020420113952putri indah nurul insaniNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Economic Indicators for Southeast Asia and the Pacific: Input–Output TablesFrom EverandEconomic Indicators for Southeast Asia and the Pacific: Input–Output TablesNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Economic Indicators for Eastern Asia: Input–Output TablesFrom EverandEconomic Indicators for Eastern Asia: Input–Output TablesNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- Weside BilpDocument3 pagesWeside Bilpwvastore2No ratings yet

- ELP Knowledge Series India Update Part 4 of 2019 PDFDocument38 pagesELP Knowledge Series India Update Part 4 of 2019 PDFAman DwivediNo ratings yet

- Depreciation, Depletion and ITC: 1 - Principles of AccountingDocument11 pagesDepreciation, Depletion and ITC: 1 - Principles of AccountingAthena Satria TumambingNo ratings yet

- Gasbill 3851735781 202005 20200609192830Document1 pageGasbill 3851735781 202005 20200609192830Shahzaib GujjarNo ratings yet

- Planning and Economic Reforms in IndiaDocument18 pagesPlanning and Economic Reforms in IndiaProfessor Tarun Das50% (2)

- Lesson 2 Residential Status & Scope of Total IncomeDocument27 pagesLesson 2 Residential Status & Scope of Total Income1A 10 ASWIN RNo ratings yet

- Elie Habib - Business Plan Smart Bus StopDocument6 pagesElie Habib - Business Plan Smart Bus StopElie HabibNo ratings yet

- Income Tax in India - Wikipedia, The Free EncyclopediaDocument13 pagesIncome Tax in India - Wikipedia, The Free EncyclopediaAnonymous utfuIcnNo ratings yet

- The Coca-Cola Company CAGNY 2024Document47 pagesThe Coca-Cola Company CAGNY 2024BowenNo ratings yet

- A Guid To Living and Working in Germany PDFDocument46 pagesA Guid To Living and Working in Germany PDFIqbal Meskinzada100% (2)

- Joint Request Letter From Seller and Buyer For Mutation-FloorsDocument3 pagesJoint Request Letter From Seller and Buyer For Mutation-FloorsjoyofhelpingngoNo ratings yet

- Business Plan Sample Tranquility Day Spa PlanDocument28 pagesBusiness Plan Sample Tranquility Day Spa Plankenyamontgomery50% (2)

- Presented By:: Neerav Singh Chib - B (41) Soumendra Mahapatra - BDocument15 pagesPresented By:: Neerav Singh Chib - B (41) Soumendra Mahapatra - BVivek SirohiNo ratings yet

- Volkov - The Political Economy of Protection Rackets in The Past and The PresentDocument37 pagesVolkov - The Political Economy of Protection Rackets in The Past and The PresentRoberto RamosNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument23 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledRaVz DelRosarioNo ratings yet

- Assumption About Oporto Based On Income Statement and Balance SheetDocument3 pagesAssumption About Oporto Based On Income Statement and Balance SheetSadia RahiNo ratings yet

- Caf 6 PT QB Icap Caf 6 Question Bank Caf 6 Principles of TaxationDocument167 pagesCaf 6 PT QB Icap Caf 6 Question Bank Caf 6 Principles of TaxationRabiya AsifNo ratings yet

- MakmurGroup Employee Handbook June2021 Ver21.02 30062021 1.Document44 pagesMakmurGroup Employee Handbook June2021 Ver21.02 30062021 1.yuszriNo ratings yet

- Sample DPRDocument9 pagesSample DPRKunal KakadeNo ratings yet

- Form GST REG-06: Government of IndiaDocument3 pagesForm GST REG-06: Government of IndiaRugved RajpurkarNo ratings yet

- Name: Tel - No.: Mobile: Email: Address: Date of Birth: Place of Birth: Marital StatusDocument4 pagesName: Tel - No.: Mobile: Email: Address: Date of Birth: Place of Birth: Marital StatusrudraNo ratings yet

- Form 15G 3Document1 pageForm 15G 3lakshmananksme3007No ratings yet

- Einvoice 1661931542084Document1 pageEinvoice 1661931542084Jessica MathisNo ratings yet

- Internship Report On Corporate Taxation System in Bangladesh (A Case Study On QUASEM DRYCELL LTD.)Document53 pagesInternship Report On Corporate Taxation System in Bangladesh (A Case Study On QUASEM DRYCELL LTD.)rukaiya ivy80% (5)

- Important Economic Terms For Competitive ExamsDocument9 pagesImportant Economic Terms For Competitive ExamsIjas IjuNo ratings yet

- PartDocument362 pagesPartPaoNo ratings yet

- Entrance Awards GuideDocument16 pagesEntrance Awards GuideTrials SartajNo ratings yet

- Gorna Satinali Panchbibi MST Momotaj Begom: Bangladesh Power Development Board Electricity BillDocument1 pageGorna Satinali Panchbibi MST Momotaj Begom: Bangladesh Power Development Board Electricity BillAieubNo ratings yet

- Lecture 2Document24 pagesLecture 2Bình Minh100% (1)