Foreign Person's U.S. Source Income Subject To Withholding: Copy B

Foreign Person's U.S. Source Income Subject To Withholding: Copy B

Uploaded by

shamlaCopyright:

Available Formats

Foreign Person's U.S. Source Income Subject To Withholding: Copy B

Foreign Person's U.S. Source Income Subject To Withholding: Copy B

Uploaded by

shamlaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Foreign Person's U.S. Source Income Subject To Withholding: Copy B

Foreign Person's U.S. Source Income Subject To Withholding: Copy B

Uploaded by

shamlaCopyright:

Available Formats

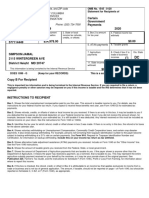

Form Reference ID

US_2020_1042S_1008164703_0

AMAZON.COM, INC.

PO BOX 80683

SEATTLE, WA 98108-0683

1-425-697-9440

SAAJU

90, ANBU ROAD, AKKARAIPATTU 12

AMPARA, EASTERN 32400

SRI LANKA

Form 1042-S Foreign Person’s U.S. Source Income Subject to Withholding

Go to www.irs.gov/Form1042S for instructions and the latest information.

2020 OMB No. 1545-0096

Copy B

Department of the Treasury

Internal Revenue Service 1 0 0 8 1 6 4 7 0 3 UNIQUE FORM IDENTIFIER AMENDED AMENDMENT NO. for Recipient

1 Income 2 Gross income 3 Chapter indicator. Enter “3” or “4” 3 13e Recipient’s U.S. TIN, if any 13f Ch. 3 status code 16

code

3a Exemption code 00 4a Exemption code 16 13g Ch. 4 status code

12 116 3b Tax rate 10.00 4b Tax rate 00.00 13h Recipient’s GIIN 13i Recipient’s foreign tax identification 13j LOB code

number, if any

5 Withholding allowance

6 Net income XXXXXX582V

7a Federal tax withheld 12 13k Recipient’s account number

7b Check if federal tax withheld was not deposited with the IRS because

escrow procedures were applied (see instructions) . . . . . . 13l Recipient’s date of birth (YYYYMMDD)

7c Check if withholding occurred in subsequent year with respect to a

partnership interest . . . . . . . . . . . . . .

8 Tax withheld by other agents 14a Primary Withholding Agent’s Name (if applicable)

9 Overwithheld tax repaid to recipient pursuant to adjustment procedures (see instructions)

(0 ) 14b Primary Withholding Agent’s EIN

15 Check if pro-rata basis reporting

10 Total withholding credit (combine boxes 7a, 8, and 9)

12 15a Intermediary or flow-through entity’s EIN, if any 15b Ch. 3 status code 15c Ch. 4 status code

11 Tax paid by withholding agent (amounts not withheld) (see instructions)

0 15d Intermediary or flow-through entity’s name

12a Withholding agent’s EIN 12b Ch. 3 status code 12c Ch. 4 status code

91-1646860 15 02 15e Intermediary or flow-through entity’s GIIN

12d Withholding agent’s name 15f Country code 15g Foreign tax identification number, if any

AMAZON.COM, INC.

12e Withholding agent’s Global Intermediary Identification Number (GIIN) 15h Address (number and street)

12f Country code 12g Foreign tax identification number, if any 15i City or town, state or province, country, ZIP or foreign postal code

12h Address (number and street) 16a Payer’s name 16b Payer’s TIN

PO BOX 80683

12i City or town, state or province, country, ZIP or foreign postal code 16c Payer’s GIIN 16d Ch. 3 status code 16e Ch. 4 status code

SEATTLE, WA 98108-0683

13a Recipient’s name 13b Recipient’s country code 17a State income tax withheld 17b Payer’s state tax no. 17c Name of state

SAAJU CE

13c Address (number and street)

90, ANBU ROAD, AKKARAIPATTU 12

13d City or town, state or province, country, ZIP or foreign postal code

AMPARA, EASTERN SRI LANKA 32400

(keep for your records) Form 1042-S (2020)

Printed on Mar 01, 2021

The 1042-S form is an informational tax statement the U.S. Internal Revenue Service (IRS) requires Amazon to

provide. Amazon will not be able to advise you on how to use the statement.

What is Form 1042-S?

The U.S. Internal Revenue Service (IRS) requires Amazon to provide the Form 1042-S every year. Amazon provides the Form

1042-S to all non-U.S. persons who receive U.S. sourced payments. The form reports gross income and U.S. tax withholding, if

any, for royalties, services, rent, and other withholdable payments during the calendar year 2020.

The box 7a shows the withholding tax that Amazon paid to the IRS on your behalf. You may be able to claim a tax credit in

your country of tax residence or claim a refund for any excess tax that you paid by filing a U.S. non-resident tax return directly

with the IRS.

Note: Amazon cannot provide tax advice. If you have questions, consult with your tax advisor or go to www.irs.gov.

What's represented in the table on the Form 1042-S?

Your form summarizes the payments you received from Amazon in 2020. This table is only for your information, Amazon will

not submit it to the IRS.

Note: If multiple Amazon businesses have paid you, we have consolidated these payments on one form.

Company Name Box 1 Box 2 Box 7a

(Income Code & Income Code Description) (Gross Income) (Federal Tax Withheld)

Amazon.com Services, Inc. 12 Other royalties (for example, copyright, software, broadcasting, endorsement payments) 115.61 11.58

Total - Pre-rounding 115.61 11.58

Total - Rounded per Form 1042-S specifications* 116 12

*All values in the table above are USD($). Values have been rounded and reported per IRS requirements.

Have a 1042-S related question?

- Visit the Help section on kdp.amazon.com and submit your question by clicking on 'Contact US'. Select Payments, Taxes, and

Reports --> U.S. Tax Information

- or Login to https://taxcentral.amazon.com and click 'Contact us' button.

Printed on Mar 01, 2021

You might also like

- Chase 1099int 2013Document2 pagesChase 1099int 2013Srikala Venkatesan100% (1)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4.5 out of 5 stars4.5/5 (6)

- Bir 1701a FormDocument2 pagesBir 1701a FormChe CacatianNo ratings yet

- Sales Agreement FormDocument3 pagesSales Agreement FormbencransonNo ratings yet

- Foreign Person's U.S. Source Income Subject To Withholding: Copy BDocument2 pagesForeign Person's U.S. Source Income Subject To Withholding: Copy Balexacas51993No ratings yet

- Foreign Person's U.S. Source Income Subject To Withholding: Copy BDocument2 pagesForeign Person's U.S. Source Income Subject To Withholding: Copy BalexxxeosNo ratings yet

- PrintDocument5 pagesPrintErikaNo ratings yet

- Google 1042-S 2022Document3 pagesGoogle 1042-S 2022Slshare PappaNo ratings yet

- Foreign Person's U.S. Source Income Subject To Withholding: Copy BDocument8 pagesForeign Person's U.S. Source Income Subject To Withholding: Copy BjayNo ratings yet

- Shutterstock - 2022 - Tax - Form - DANIEL CONSTANTE-3Document2 pagesShutterstock - 2022 - Tax - Form - DANIEL CONSTANTE-3Daniel ConstanteNo ratings yet

- Foreign Person's U.S. Source Income Subject To Withholding: Copy CDocument4 pagesForeign Person's U.S. Source Income Subject To Withholding: Copy Cemiliowebster6833No ratings yet

- Document 3292024 95828 AM bR3dloIFDocument14 pagesDocument 3292024 95828 AM bR3dloIFkenikuchanNo ratings yet

- Formulario 1042 S Marzo 2020Document2 pagesFormulario 1042 S Marzo 2020martin_kubrickNo ratings yet

- Bigstock 2018 Tax Form PDFDocument1 pageBigstock 2018 Tax Form PDFBalint RoxanaNo ratings yet

- Bir Form 1600wpDocument2 pagesBir Form 1600wpmaeshachNo ratings yet

- EWT For The OCT-23 PeriodDocument12 pagesEWT For The OCT-23 Periodqhi.cgmacatiagNo ratings yet

- Same-Day Worksheet 1010Document2 pagesSame-Day Worksheet 1010Hans GadamerNo ratings yet

- Robinhood Crypto LLC 85 Willow Road Menlo Park, Ca 94025Document4 pagesRobinhood Crypto LLC 85 Willow Road Menlo Park, Ca 94025Jack BotNo ratings yet

- 1601E - August 2008Document3 pages1601E - August 2008Jaime II LustadoNo ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document2 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Games NathanNo ratings yet

- Monthly Remittance Form: For Creditable Income Taxes Withheld (Expanded)Document1 pageMonthly Remittance Form: For Creditable Income Taxes Withheld (Expanded)Jonalyn BalerosNo ratings yet

- 2017 Uber 1099-MISCDocument2 pages2017 Uber 1099-MISCelpumaflores326No ratings yet

- 06 PANRAMA TECHNOLOGIES - June 2014Document36 pages06 PANRAMA TECHNOLOGIES - June 2014gerlyn.gamboa.cpaNo ratings yet

- 1601E Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document3 pages1601E Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Ivan ChuaNo ratings yet

- Annex A - 1701A Jan 2018481Document3 pagesAnnex A - 1701A Jan 2018481Rhon MarlNo ratings yet

- 20992NAP Payment Form ReDocument1 page20992NAP Payment Form ReTzuyu TchaikovskyNo ratings yet

- Sample Check: Direct Deposit of Corporate Tax RefundDocument1 pageSample Check: Direct Deposit of Corporate Tax RefundIRSNo ratings yet

- 398 2019 ArchiveTaxReturnDocument10 pages398 2019 ArchiveTaxReturnjimmy naranjoNo ratings yet

- Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document4 pagesFill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Emelyn Ventura SantosNo ratings yet

- Income Taxation Bir FormDocument2 pagesIncome Taxation Bir FormVince AbabonNo ratings yet

- Annex A - 1701A Jan 2018Document2 pagesAnnex A - 1701A Jan 2018jeffrey josol100% (2)

- Bir05 PDFDocument3 pagesBir05 PDFBarangay LumbangNo ratings yet

- Company Return IT 11 GHA 2023 (Return For Company Tax Payers)Document8 pagesCompany Return IT 11 GHA 2023 (Return For Company Tax Payers)Subrata RajbongshiNo ratings yet

- Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document5 pagesFill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"May Joy DepalomaNo ratings yet

- Intertech Fluid Power 2019Document38 pagesIntertech Fluid Power 2019Sue StevenNo ratings yet

- 05 PANRAMA TECHNOLOGIES - May 2014Document27 pages05 PANRAMA TECHNOLOGIES - May 2014gerlyn.gamboa.cpaNo ratings yet

- 04 PANRAMA TECHNOLOGIES - April 2014Document26 pages04 PANRAMA TECHNOLOGIES - April 2014gerlyn.gamboa.cpaNo ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document3 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Mavi Manalo-NarvaezNo ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document3 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Alexa Reyes de GuzmanNo ratings yet

- 1099G ReportDocument1 page1099G Reporttg8j7jq6w5No ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document3 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)appipinnim100% (2)

- 1601 eDocument3 pages1601 eJulius Sangalang100% (1)

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationcoldsunlightNo ratings yet

- 1099-INTDocument1 page1099-INTnoniwa8073No ratings yet

- 15 Ca CBDocument6 pages15 Ca CBMithileshNo ratings yet

- Form 1099-INT - 2022 - Template1 - Document 01Document9 pagesForm 1099-INT - 2022 - Template1 - Document 01chamuditha dilshanNo ratings yet

- 2019 Form 1099-MISC - IRS - Gov-PdffillerDocument8 pages2019 Form 1099-MISC - IRS - Gov-PdffillerAaron FuchsNo ratings yet

- Special Tax Registration and Return National Firearms Act (NFA)Document2 pagesSpecial Tax Registration and Return National Firearms Act (NFA)MattRogersNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and Certificationsharongavin5252No ratings yet

- Quarterly Income Tax Return: Yes NoDocument3 pagesQuarterly Income Tax Return: Yes NoSusan P LauronNo ratings yet

- BIR Form 1702QDocument3 pagesBIR Form 1702QMique VillanuevaNo ratings yet

- Fix Appliances Inc 2020-1Document1 pageFix Appliances Inc 2020-1valerii92iudinNo ratings yet

- Annex A - 1701A Jan 2018 - RMC 17-2019Document2 pagesAnnex A - 1701A Jan 2018 - RMC 17-2019Joe75% (4)

- 1600Document9 pages1600jbabellarNo ratings yet

- FATCA CORP English - Bank Muscat 1Document17 pagesFATCA CORP English - Bank Muscat 1reema-algheshyanNo ratings yet

- Bir Form 1600 FinalDocument4 pagesBir Form 1600 Finaljhonnamaemaygue08No ratings yet

- 1099 Misc 1Document1 page1099 Misc 1Anonymous FR8yGDSVgNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- GPNBS - Benefits and Costs of NBS For Climate Resilience - Spreads - LRDocument99 pagesGPNBS - Benefits and Costs of NBS For Climate Resilience - Spreads - LRCarlos Ramos100% (1)

- ASTM A426 Centrifugally Cast Ferritic Alloy Steel Pipe For High - Temperature ServiceDocument4 pagesASTM A426 Centrifugally Cast Ferritic Alloy Steel Pipe For High - Temperature ServiceSumedh ParadkarNo ratings yet

- 2011 NRLCA Mail Count Guide Support Docs 8-4-2011Document122 pages2011 NRLCA Mail Count Guide Support Docs 8-4-2011postaltexanNo ratings yet

- Fluke 1587 PDFDocument48 pagesFluke 1587 PDFArnel Pascual LaquindanumNo ratings yet

- ANDE - Informix - AuditingDocument62 pagesANDE - Informix - AuditingDulce MuñozNo ratings yet

- Madden NFL 25 Manuals Microsoft XBOX360Document32 pagesMadden NFL 25 Manuals Microsoft XBOX360normal barkNo ratings yet

- Bio efficacyofOrganicFormulationsonCropProduction AReviewDocument18 pagesBio efficacyofOrganicFormulationsonCropProduction AReviewArsh SidhuNo ratings yet

- Tom Sawyer and The Construction ValueDocument31 pagesTom Sawyer and The Construction Valuejarbox0No ratings yet

- 4.1 Anchor Principles and Design (130-148) PDFDocument22 pages4.1 Anchor Principles and Design (130-148) PDFpabmataNo ratings yet

- PN2222ADocument8 pagesPN2222AtarpinoNo ratings yet

- Lab Report 1Document28 pagesLab Report 1PAULUS MAONGONo ratings yet

- Principles of Marketing Chapter 5 Managing The Marketing EffortDocument12 pagesPrinciples of Marketing Chapter 5 Managing The Marketing EffortHIEZEL BAYUGNo ratings yet

- 2013 Fema Vs Cpa-LgaDocument44 pages2013 Fema Vs Cpa-LgaMinnesota House Public Information ServicesNo ratings yet

- Shanta Bai CaseDocument5 pagesShanta Bai CasePravar Jain0% (1)

- Tseries 2007Document356 pagesTseries 2007Teddy KhantNo ratings yet

- Iplex G: Instructions Industrial EndoscopeDocument126 pagesIplex G: Instructions Industrial EndoscopeEDBNo ratings yet

- Competative Exams After 12Document24 pagesCompetative Exams After 12Barun SinghNo ratings yet

- Polo-Ecosan: Technical ManualDocument100 pagesPolo-Ecosan: Technical ManualasasbNo ratings yet

- Case Study On Organistional StructureDocument13 pagesCase Study On Organistional StructureAman Agarwal100% (2)

- ACDF WITHOUT IMPLANT (Orthopaedy)Document3 pagesACDF WITHOUT IMPLANT (Orthopaedy)mhjs ward6No ratings yet

- Sunny Beutler Named CEO of Sunrider InternationalDocument2 pagesSunny Beutler Named CEO of Sunrider InternationalPR.comNo ratings yet

- Electrical Part IO List of DCSDocument4 pagesElectrical Part IO List of DCSTri SetyaNo ratings yet

- SOP For...Document5 pagesSOP For...dinesh kumarNo ratings yet

- Acti 9 iEM3000 - A9MEM3250Document3 pagesActi 9 iEM3000 - A9MEM3250ٍJordan SportNo ratings yet

- Cinco Vs CADocument15 pagesCinco Vs CAJennyNo ratings yet

- Introduction To MechatronicsDocument46 pagesIntroduction To MechatronicsChristian Breth Burgos100% (2)

- Cloud Web HelpDocument306 pagesCloud Web Helpveejay78No ratings yet

- An Outdoor Comfort Index Framework Based On GIS For Supporting Optimal EnvironmentDocument10 pagesAn Outdoor Comfort Index Framework Based On GIS For Supporting Optimal EnvironmentOrlando DunstNo ratings yet

- A Reexamination International Space Law and Space MiningDocument44 pagesA Reexamination International Space Law and Space MiningLucia Charlón GonzálezNo ratings yet