Assignment Sir Ram

Uploaded by

Lindbergh SyAssignment Sir Ram

Uploaded by

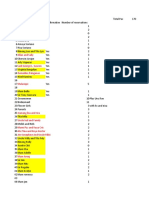

Lindbergh SyABS-CBN and GMA Comparison 2018

Accounts

Abs CBN is better because they can turn their receivables into cash 3.62 times which is

Receivable

more often than GMA can (2.47 times) during the year.

Turnover Ratio

Average Collection ABS-CBN has a better collection period because their collection period of 99.36 days is

Period shorter than GMA which is 145.56 days.

Inventory turnover of GMA is much better than ABS-CBN because they can sell their

Inventory Turnover

inventory 445.40 times each year which is more than ABSCBN (43.09 times each year

Ratio

only)

The average age of inventory of GMA is much better than ABSCBN because it shows

Average Age of

that they can sell their inventory daily. Data shows that GMA holds its inventory for 0.81

Inventory

days only as compared to its rival network which is 8.35 days.

Data shows that ABS-CBN has a better accounts payable ratio because it is able to pay

Accounts Payable

its debts 15.93 times each year which is more often as compared to GMA which pays its

Ratio

debts 8.51 times a year.

ABSCBN has a shorter age of payables which shows that they are able to pay their

Average Age of

debts much earlier than GMA. It takes ABS-CBN 22.60 days to pay its short term debts

Payable

while it takes GMA 42.31 days to pay its short term debts.

ABS CBN has a shorter operating cycle of 107.72 days as compared to GMA which

Operating Cycle

shows that it is slightly better overall when it comes to its operations.

ABS CBN has a shorter cash conversion cycle than GMA which means that it is better

Cash Conversion

at collecting cash than its rival network. ABS-CBN can convert assets into cash im

Cycle

85.11 days while GMA can do it in 104.07 days.

Total Asset GMA has a better total asset turnover of 1.01 than ABS CBN which is 0.50 . Its higher

Turnover Ratio turnover shows that GMA can more efficiently produce sales as compared to ABS CBN.

Fixed Asset GMA has a higher fixed asset turnover ratio of 2.11 as compared to 1.50 for ABSCBN

Turnover Ratio which shows that its fixed assets can generate more sales than ABSCBN

ABS-CBN and GMA Comparison 2019

Accounts ABS CBN has a higher Accounts Receivable turnover ratio which is better than GMA

Receivable because it shows that ABS-CBN can collect its receivables 3.99 times which is slightly

Turnover Ratio more often than that of GMA which is 3.28 times in a year.

Average Collection The average collection period of 92.73 days for ABS CBN is shorter than GMA (109.59

Period days) which shows that ABS-CBN can collect its receivables much faster than GMA.

GMA has a higher inventory turnover than ABS-CBN which shows that it can sell its

Inventory Turnover inventory more often than ABS-CBN during the year. According to the data, GMA can

Ratio sell its inventory 491.66 times in a year while ABS-CBN can only sell its inventory 38.76

times during the year.

GMA has a lower average age of inventory than ABS-CBN which means that it holds its

Average Age of

inventory much less than ABS-CBN. GMA holds its inventory for as long as 0.73 days

Inventory

before it can sell its inventory while ABS-CBN holds its inventory for 9.29 days.

ABS-CBN has a higher accounts payable turnover ratio which means that ABS CBN is

Accounts Payable able to pay its debts more often than GMA. The data shows that ABS CBN can pay its

Ratio Accounts Payable 14.94 times as compare to GMA which is 10.64 times during the

year.

ABS-CBN has a lower average age of payables than GMA which shows that ABS CBN

Average Age of

is able to pay its debts on time. It takes ABS-CBN 24.10 days to settle its accounts

Payable

payable while it takes GMA 33.84 days.

ABS CBN has a shorter operating cycle of 102.01 days as compared to GMA’s 110.33

Operating Cycle

days which shows that it is slightly better overall when it comes to its operations.

ABS CBN has a shorter cash conversion cycle than GMA which means that it is better

Cash Conversion

at collecting cash than its rival network. ABS-CBN can convert its assets into cash

Cycle

within 77.92 days while GMA can do it in 76.58 days.

GMA has a better total asset turnover of 1.04 than that of ABS-CBN which is 0.52. Its

Total Asset

higher turnover shows that GMA can more efficiently produce sales as compared to

Turnover Ratio

ABS CBN

Fixed Asset GMA has a higher fixed asset turnover ratio of 3.01 than ABSCBN (1.55) which shows

Turnover Ratio that its fixed assets can generate more sales than ABSCBN

You might also like

- A) What Recommendations Relative To The Amount and The Handling of Inventory You Make To The New Owner?100% (1)A) What Recommendations Relative To The Amount and The Handling of Inventory You Make To The New Owner?4 pages

- 99'4 Accounting Ratios Orange Ltd. Industry AverageNo ratings yet99'4 Accounting Ratios Orange Ltd. Industry Average6 pages

- Liberty Medical Group Detailed Ratio Analysis - Group ComparisonNo ratings yetLiberty Medical Group Detailed Ratio Analysis - Group Comparison10 pages

- Financial Statement Analysis On Fazal Textile MillsNo ratings yetFinancial Statement Analysis On Fazal Textile Mills5 pages

- Ratio 2009 2010 2011: Problems of ABC Company Gross Profit Margin & Net Profit MarginNo ratings yetRatio 2009 2010 2011: Problems of ABC Company Gross Profit Margin & Net Profit Margin3 pages

- Definition of 'Average Collection Period'No ratings yetDefinition of 'Average Collection Period'6 pages

- Homework Decision Cases - 6: HW-6 Financial Reporting and Analysis Samrat Kanitkar FT222092No ratings yetHomework Decision Cases - 6: HW-6 Financial Reporting and Analysis Samrat Kanitkar FT2220928 pages

- Managerial Finance Final Project: Submitted By: - Samer Ahmed - Karim Tohamy - Salma EzzatNo ratings yetManagerial Finance Final Project: Submitted By: - Samer Ahmed - Karim Tohamy - Salma Ezzat14 pages

- Below Are Balance Sheet, Income Statement, Statement of Cash Flows, and Selected Notes To The Financial StatementsNo ratings yetBelow Are Balance Sheet, Income Statement, Statement of Cash Flows, and Selected Notes To The Financial Statements14 pages

- Topics Audit in Specialized Industries A267No ratings yetTopics Audit in Specialized Industries A2671 page

- CWA ICWA Inter Group I _ Financial Accounting - June 2009No ratings yetCWA ICWA Inter Group I _ Financial Accounting - June 20096 pages

- Cib GH 04-23 Financial Reporting, Planning & Analysis Level Iii Page 1No ratings yetCib GH 04-23 Financial Reporting, Planning & Analysis Level Iii Page 18 pages

- CH 15 Partnerships Formation Operation and Changes in Membership 1No ratings yetCH 15 Partnerships Formation Operation and Changes in Membership 156 pages

- Financial Statement Analysis A Look at The Income SheetNo ratings yetFinancial Statement Analysis A Look at The Income Sheet4 pages

- Home Office, Branch and Agency AccountingNo ratings yetHome Office, Branch and Agency Accounting26 pages

- Advantages and Limitations of AccountingNo ratings yetAdvantages and Limitations of Accounting5 pages

- (SAPP Academy) Tóm Tắt Kiến Thức Quan Trọng Môn FAF3 ACCANo ratings yet(SAPP Academy) Tóm Tắt Kiến Thức Quan Trọng Môn FAF3 ACCA201 pages