DF

DF

Uploaded by

Janesene SolCopyright:

Available Formats

DF

DF

Uploaded by

Janesene SolOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DF

DF

Uploaded by

Janesene SolCopyright:

Available Formats

Financial Management Course Portfolio

Section: C

ID Number: 46691

Last Name: Sol

First Name: Janesene

Examination: Preliminary Examination

Chapter Question Type Question and Answer Solution (if Applicable)

1 MULTIPLE CHOICE QUESTIONS Question 1: What is the primary goal of financial management?

Answer: C. Maximizing shareholder's wealth.

Question 2: Proper-risk return management means that

Answer: B. Consistent with the objectives of the firm, an appropriate trade-off between risk and return should be determined.

Question 3: Which of the following is not a major area of concern and emphasis in modern financial management?

Answer: B. Stable short-term interest rates.

Question 4: Which of the following is not a major area of concern and emphasis in modern financial management?

Answer: C. Commodity Trading

Question 5: A financial manager’s goal of maximizing current or short-term earnings may not be appropriate because

Answer: D. All of the given choices.

Question 6: All of the following are functions of the financial manager except

Answer: C. Assigning the market price of the company's stock.

Question 7: Which of the following statements is false?

Answer: B. The treasurer would be responsible for activities such asmanaging cash balances, granting credit to customers and managing the process of issuing new securities.

2 MULTIPLE CHOICE QUESTIONS Question 1: Which of the following statements is true?

Answer: D. There are some serious problems with the financial goal of maximizing the earning of the firm.

Question 2: Corporate social responsibility is

Answer: C. The duty to embrace service to the public interest.

Question 3: A common argument against corporate involvement in socially responsible behavior is that

Answer: D. In a competitive market, such behavior incurs costs that place the company at a disadvantage

Question 4: Which of the following statements is false?

Answer: A. Because socially desirable goals can impede profitability in many instances, managers should try not to operate under the assumption of wealth maximization.

Question 5: Which of the following statement is false?

Answer: D. For as long as satisfactory level of profit is earned, the financial manager need not be concdeerned with unethical behavior.

Question 6: Integrity is an ethical requirement of all financial managers. One aspect of integrity requires

Answer: B. Avoidance of conflict of interest

3 MULTIPLE CHOICE QUESTIONS Question 1: All of the following are functions of the financial manager except

Answer: C. Assigning the market price off the company's stock.

Question 2: Which of the following statement is false?

Answer: B. The treasurer would be responsible for activities such as managing cash balances, granting credit to customers and managing the process of issuing new securities.

Question 3: Regine is a financial manager who has discovered that her company is violating environmental regulations. If her immediate superior is involved, her appropriate action is to

Answer: C. Present the matter to the next higher managerial level.

Question 4: If a financial manager discovers unethical conduct in his/her organization and fails to act, he/she will be in violation of which ethical standard(s)?

Answer: D. All of the answers are correct.

Question 5: Integrity is an ethical requirement for all financial managers. One aspect of integrity requires

Answer: B. Avoidance of conflict of interest

Question 6: A financial manager discovers a problem that could mislead users of the firm’s financial data and has informed his/her immediate superior. He/she should report the circumstances to the audit committee and/or the board of directors only if

Answer: D. the immediate superior, the firm’s chief executive officer, knows about the situation but refuses to correct it.

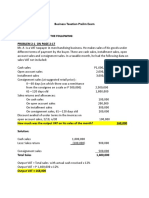

4 EXERCISES Exercise 1:

H. PAR VALUE 1. An arbitrary value placed on either common stock or preferred stock at the time a corporation is formed

F. BOARD OF DIRECTORS 2. The group of men and women who have the ultimate responsibility of managing the corporation.

D. STOCKHOLDERS 3. The owners of acorporation.

I. ADDITIONAL PAID IN CAPITAL 4. Any amount received by a corporation when it issues stock that is greater than the par value of the stock issued.

B. CHARTER 5. The formal document that legally allows a corporation to start operations.

G. CORPORATE OFFICERS 6. The group of men and women who manage the day-to-day operation of the corporation.

A. INCORPORATORS 7. The person or persons who submit a formal application to the appropriate government agencies to form a corporation.

E. STOCK CERTIFICATE 8. A legal document providing evidence of ownership in a corporation.

C. BYLAWS 9. Rules established to conduct the business of the corporation.

Exercise 2:

The question below are based on this selected information from the balance sheet Excelsior and Company.

Issued stocks 20x1 669847961 Issued stocks 20x2 671242137

a. What was the average selling price of the stock that had been issued as of Dec 31, 20x1? P60.01 Par value ₱60.00 Total authorized shares 900000000

Additional paid in capital 2021 ₱4,342,000.00

Average selling price = ((Number of shares issued * par value) + additional paid in capital))/ no. of shares issued 40,190,877,660 ₱40,195,219,660.00 ₱60.01

b. The par value of the outstanding shares of ordinary shares as of Dec 31, 20x2 is shown as 403 million. This is actually a rounded amount. What is the exact par value of the common stock outstanding as of that date? P40,274,528,220 Exact par value of common stock, Dec 31, 20x2 = Issued shares 20x2* par value ₱ 40,274,528,220.00

c. How many shares of common stock were issued during 20x2? 1,394,176 Issued shares of common stock 20x2= Issued shares 20x2 -Issued shares 20x1 1,394,176

d. How many shares would Excelsior be allowed to issue during 20x2? 230,152,039 Shares allowed for issuance 20x2 = Total authorized shares- Shares issued 2021 230,152,039

Exercise 3:

On Jan 2, 20x2, Hellen Sanchez formed a company called Baby Covers, Inc., which sells expensive infant clothig. Originally Hellen invested P50,000 in cash in exchange for 5,000 of the company's 50,000 authorized P1 par shares of Authorized stocks 50000 Issued stocks to Hellen 5000

common stock. By 20x7, he company had grownfrom one store to 3 successful stores. In January of 20x8, Hellen decided to finance further expansion of Baby Covers by selling additional stock.

1. How many additional shares can Baby Covers, Inc. issue during 20x8? 45,000 Additional shares available for issue = Authorized stocks - stocks issued to Hellen 45000

2. If 20,000 addditional shares were sold for P35 per share, what would the balance sheet show for ordinary shares and additional paid in capital ordinary shares? Balance sheet-Ordinary Shares: Additional Paid In Capital:

Issued stocks-Hellen 5000 Issued Stocks - Hellen 5000 ₱50,000.00 PAR VALUE Additional Issued shares 20000 ₱700,000.00 MV

Additional issued stocks 20000 5,000.00 5,000.00 ₱1.00 20000 ₱20,000.00 ₱35.00

Total stocks 25,000 APIC 45,000.00 APIC ₱680,000.00

Total Additional paid-in capital 725,000.00

3. If Hellen wanted to raise money for expansion of the company, what would be the advantage to issuing preferred stock instead of ordinary shares?

Answer: The advantage of issuing preferred stock instead of ordinary shares is that investors want more consistent dividends and they can have more dividends than common stock, so the tendency will be that the

investors will prefer more the preferred stock, hence, will lead to raising of money which is favorable to Hellen if preferred stocks will be issued.

MULTIPLE CHOICE QUESTIONS Question 1: One of the major disadvantages of a sole proprietorship is

Answer: A. That there is unlimited liability to the owner.

Question 2: The partnership form of organization

Answer: A. Avoids the double taxation of earnings and dividends found in the corporate form of organization.

Question 3: A corporation is

Answer: D. All of the above.

You might also like

- Original PDF Capital Markets Institutions Instruments and Risk Management 5th EditionDocument62 pagesOriginal PDF Capital Markets Institutions Instruments and Risk Management 5th Editionbetty.barabas34998% (54)

- Ch05 TB RankinDocument8 pagesCh05 TB RankinAnton VitaliNo ratings yet

- A Trader's Guide To Using FractalsDocument3 pagesA Trader's Guide To Using FractalsTita Valencia100% (2)

- BEAM038J-Exam Paper BEAM038J-22AUGDocument6 pagesBEAM038J-Exam Paper BEAM038J-22AUGHoàng TrầnNo ratings yet

- DTDocument19 pagesDTJanesene Sol100% (4)

- Chapter 5 Financial Management by CabreraDocument19 pagesChapter 5 Financial Management by CabreraLars FriasNo ratings yet

- A. Trend Percentages: RequiredDocument5 pagesA. Trend Percentages: RequiredAngel NuevoNo ratings yet

- CHAPTER 8 AnswerDocument14 pagesCHAPTER 8 AnswerKenncyNo ratings yet

- DT 2Document8 pagesDT 2Janesene SolNo ratings yet

- Exercise 1Document4 pagesExercise 1Nyster Ann RebenitoNo ratings yet

- Acc 223a - Answers To CH 15 AssignmentDocument7 pagesAcc 223a - Answers To CH 15 AssignmentAna Leah DelfinNo ratings yet

- TAX2 ReyesDocument9 pagesTAX2 ReyesClaire BarrettoNo ratings yet

- Pagupat Financial-Management Chapter-910Document10 pagesPagupat Financial-Management Chapter-910Rey HandumonNo ratings yet

- Forecasting Short Term Operating Sample ProblemsDocument8 pagesForecasting Short Term Operating Sample ProblemsJanaisa BugayongNo ratings yet

- Chapter 18 - Investment in Associate 2 PDFDocument15 pagesChapter 18 - Investment in Associate 2 PDFTurksNo ratings yet

- CH 27 FinmanDocument3 pagesCH 27 FinmanKismith Aile MacedaNo ratings yet

- 62230126Document20 pages62230126ROMULO CUBIDNo ratings yet

- Chapter 27 AnswerDocument5 pagesChapter 27 AnswerporchieeannNo ratings yet

- Busaing, Ma. Christina - Chapter#5Document3 pagesBusaing, Ma. Christina - Chapter#5Tina GandaNo ratings yet

- Short-Term Sources For Financing Current AssetsDocument11 pagesShort-Term Sources For Financing Current AssetsAlexandra TagleNo ratings yet

- FINANCIAL MANAGEMENT AssignmentDocument2 pagesFINANCIAL MANAGEMENT Assignmentfinn mertensNo ratings yet

- Audit of Shareholders' Equity - July 22, 2021Document35 pagesAudit of Shareholders' Equity - July 22, 2021Kathrina RoxasNo ratings yet

- Fman April 3,2020 - Operating and Financial LeverageDocument2 pagesFman April 3,2020 - Operating and Financial LeverageAngela Dela PeñaNo ratings yet

- Problem 2 8 IAADocument5 pagesProblem 2 8 IAAAbe Mayores CañasNo ratings yet

- SCM Midterm Exercises Answer KeyDocument30 pagesSCM Midterm Exercises Answer KeyChin FiguraNo ratings yet

- This Study Resource Was Shared Via: Solution 23-2 Answer DDocument5 pagesThis Study Resource Was Shared Via: Solution 23-2 Answer DDummy GoogleNo ratings yet

- Sale and LeasebackDocument10 pagesSale and LeasebackShinny Jewel VingnoNo ratings yet

- Arabian Company Reported The Following at YearDocument1 pageArabian Company Reported The Following at YearKatrina Dela CruzNo ratings yet

- Big Picture: MetalanguageDocument25 pagesBig Picture: MetalanguageANGEL ROSALNo ratings yet

- Practice Set Review - Current LiabilitiesDocument12 pagesPractice Set Review - Current LiabilitiesKayla MirandaNo ratings yet

- Problem 5-31 (Verna Company)Document7 pagesProblem 5-31 (Verna Company)Jannefah Irish SaglayanNo ratings yet

- PRELIMDocument2 pagesPRELIMlatte aeriNo ratings yet

- Lobrigas Unit3 Topic1 AssessmentDocument9 pagesLobrigas Unit3 Topic1 AssessmentClaudine LobrigasNo ratings yet

- Employee Benefit Expense 1,650,000Document14 pagesEmployee Benefit Expense 1,650,000Jud Rossette ArcebesNo ratings yet

- Management Accountants. Classify Each of The End-Of-Year Games (A-G) As (I) AcceptableDocument3 pagesManagement Accountants. Classify Each of The End-Of-Year Games (A-G) As (I) AcceptableRhea OraaNo ratings yet

- Quiz ReorganizationDocument7 pagesQuiz ReorganizationJam SurdivillaNo ratings yet

- Montealto FinMan Chapter910Document7 pagesMontealto FinMan Chapter910Rey HandumonNo ratings yet

- Chapter 17Document3 pagesChapter 17Michael CarlayNo ratings yet

- Chapter22 BuenaventuraDocument4 pagesChapter22 BuenaventuraAnonnNo ratings yet

- Intermediate Accounting Chapters 19 21Document61 pagesIntermediate Accounting Chapters 19 21Jonathan NavalloNo ratings yet

- Exercise 4 Shareholders EquityDocument9 pagesExercise 4 Shareholders EquityNimfa SantiagoNo ratings yet

- Assign 2 Chapter 5 Understanding The Financial Statements Prob 8 Answer Cabrera 2019-2020Document5 pagesAssign 2 Chapter 5 Understanding The Financial Statements Prob 8 Answer Cabrera 2019-2020mhikeedelantar100% (1)

- Rezy Pablio Mabao - SAS 3Document7 pagesRezy Pablio Mabao - SAS 3Reymark BaldoNo ratings yet

- IA2 Quiz 1 QuestionsDocument6 pagesIA2 Quiz 1 QuestionsJames Daniel SwintonNo ratings yet

- (Solved) 1. Mr. Lolong, Supervisory Employee, Received The Following Income... - Course HeroDocument11 pages(Solved) 1. Mr. Lolong, Supervisory Employee, Received The Following Income... - Course HeroBisag AsaNo ratings yet

- Group 1 - Chapter 16Document8 pagesGroup 1 - Chapter 16Cherie Soriano AnanayoNo ratings yet

- Practice Set Short Term Budgeting PDFDocument12 pagesPractice Set Short Term Budgeting PDFRujean Salar AltejarNo ratings yet

- Assign 6 Chapter 8 Operating and Financial Leverage Cabrera 2019-2020Document12 pagesAssign 6 Chapter 8 Operating and Financial Leverage Cabrera 2019-2020mhikeedelantar100% (1)

- Accrued Liabilities: Problem 3-1 (AICPA Adapted)Document15 pagesAccrued Liabilities: Problem 3-1 (AICPA Adapted)Nila FranciaNo ratings yet

- Compilation of ExercisesDocument15 pagesCompilation of ExercisesHazel MoradaNo ratings yet

- IA 2 Chapter 5 ActivitiesDocument12 pagesIA 2 Chapter 5 ActivitiesShaina TorraineNo ratings yet

- Activity 3-4 SB CompensationDocument3 pagesActivity 3-4 SB CompensationNhel Alvaro0% (1)

- Liabilities and Equity Sample Problems Premiums and Warranty Liability - CompressDocument93 pagesLiabilities and Equity Sample Problems Premiums and Warranty Liability - CompressKiahna Clare ArdaNo ratings yet

- Friendship CoDocument3 pagesFriendship CoKeahlyn BoticarioNo ratings yet

- Business Tax Chapter 8 ReviewerDocument5 pagesBusiness Tax Chapter 8 ReviewerMurien LimNo ratings yet

- Easy Problem Chapter 5Document5 pagesEasy Problem Chapter 5Natally LangfeldtNo ratings yet

- Pre-Test 9Document3 pagesPre-Test 9BLACKPINKLisaRoseJisooJennieNo ratings yet

- FINACC 2 - Quiz 4Document9 pagesFINACC 2 - Quiz 4Kim Ruwen AblazaNo ratings yet

- TOA03 04 Leases Income Tax Employee Benefits CharlenesDocument3 pagesTOA03 04 Leases Income Tax Employee Benefits CharlenesMerliza JusayanNo ratings yet

- Morning CoDocument3 pagesMorning CoKeahlyn BoticarioNo ratings yet

- St. Vincent College of CabuyaoDocument2 pagesSt. Vincent College of CabuyaoJessaNo ratings yet

- Full Economics Fourteenth Canadian Edition Canadian 14Th Edition Ragan Test Bank Online PDF All ChapterDocument60 pagesFull Economics Fourteenth Canadian Edition Canadian 14Th Edition Ragan Test Bank Online PDF All Chaptermfrticfmofning506100% (10)

- Tutorial 1 Choose ONE Correct Answer ONLYDocument4 pagesTutorial 1 Choose ONE Correct Answer ONLYnhoctracyNo ratings yet

- Introduction To Financial Management Quiz 1 - CompressDocument3 pagesIntroduction To Financial Management Quiz 1 - CompressLenson NatividadNo ratings yet

- ABC MIDTERMS PROJECT Sene Di Pa TaposDocument11 pagesABC MIDTERMS PROJECT Sene Di Pa TaposJanesene SolNo ratings yet

- CH 07Document50 pagesCH 07Janesene SolNo ratings yet

- AC - IntAcctg-A LSLiquidation.Document41 pagesAC - IntAcctg-A LSLiquidation.Janesene SolNo ratings yet

- TTH 9-10 Pe3 SolDocument2 pagesTTH 9-10 Pe3 SolJanesene SolNo ratings yet

- Cost Accounting: Janesene N. Sol 9:00-10:00 MWFDocument6 pagesCost Accounting: Janesene N. Sol 9:00-10:00 MWFJanesene SolNo ratings yet

- AC - IntAcctg-C Prelims Solutions Sol, Janesene NDocument36 pagesAC - IntAcctg-C Prelims Solutions Sol, Janesene NJanesene SolNo ratings yet

- Conceptual Framework and Accounting Standards: Janesene N. Sol MWF 1:00-2:00 PMDocument4 pagesConceptual Framework and Accounting Standards: Janesene N. Sol MWF 1:00-2:00 PMJanesene SolNo ratings yet

- Table Tennis HistoryDocument19 pagesTable Tennis HistoryJanesene SolNo ratings yet

- Module 1Document4 pagesModule 1Janesene SolNo ratings yet

- Routsis Training GuidebookDocument20 pagesRoutsis Training GuidebooktechgovindNo ratings yet

- 429266Document45 pages429266Shofiana Ifada100% (1)

- Forms of Business OrganizationDocument18 pagesForms of Business OrganizationEthan Manuel Del ValleNo ratings yet

- 04 Notes - The Net Present Value (NPV) PDFDocument7 pages04 Notes - The Net Present Value (NPV) PDFAlberto ElquetedejoNo ratings yet

- EconIssues RMValientes DepEdDocument16 pagesEconIssues RMValientes DepEdAV MontesNo ratings yet

- ForexDocument20 pagesForexmail2piyush0% (2)

- SIP Final Report - GETIT INFOMEDIA Pvt. Ltd.Document95 pagesSIP Final Report - GETIT INFOMEDIA Pvt. Ltd.hscorpior100% (3)

- Ease of Doing BusinessDocument15 pagesEase of Doing BusinessPragyaNo ratings yet

- Aswath Damodaran CVDocument2 pagesAswath Damodaran CVJM KoffiNo ratings yet

- Accounting ConceptsDocument4 pagesAccounting ConceptsAjmal KhanNo ratings yet

- 629 19PCM10 19PCZ09 Mcom Mcom CA 05 02 2022 FNDocument19 pages629 19PCM10 19PCZ09 Mcom Mcom CA 05 02 2022 FNMukesh kannan MahiNo ratings yet

- The Halal Investment Checklist V5Document21 pagesThe Halal Investment Checklist V5Mahmoud SafaaNo ratings yet

- ProjectDocument55 pagesProjectKaran MokhaNo ratings yet

- I Am Sharing 'Afar Quiz' With YouDocument20 pagesI Am Sharing 'Afar Quiz' With YouAmie Jane MirandaNo ratings yet

- 1 Piping CostingDocument33 pages1 Piping Costingamoldhole97% (36)

- Mohamad Badr - CV2Document4 pagesMohamad Badr - CV2محمد بدرNo ratings yet

- Chapter 2 Advanced AccountingDocument9 pagesChapter 2 Advanced AccountingMohamad Adel Al AyoubiNo ratings yet

- Arpita MAJOR RESEARCH PROJECTDocument31 pagesArpita MAJOR RESEARCH PROJECTSukhvinder SinghNo ratings yet

- Proyecto de Modificaciones A La Niif para Las PymesDocument60 pagesProyecto de Modificaciones A La Niif para Las PymesKevin JimenezNo ratings yet

- ECO415 (Sesi 2 2006)Document5 pagesECO415 (Sesi 2 2006)Dayah FaujanNo ratings yet

- 3 BDS CCP 2-Stage Final V2Document4 pages3 BDS CCP 2-Stage Final V2bvdbNo ratings yet

- CV English NVDDocument5 pagesCV English NVDapi-19969643No ratings yet

- Restaurant Business PlanDocument4 pagesRestaurant Business Plandaniel.dupre100% (6)

- Submarine Networks World 2016 ProspectusDocument7 pagesSubmarine Networks World 2016 ProspectusAnonymous TVdKmkNo ratings yet

- Answers To Practice Questions: Capital Budgeting and RiskDocument9 pagesAnswers To Practice Questions: Capital Budgeting and RiskAndrea RobinsonNo ratings yet

- R57 Derivative Markets and Instruments PDFDocument29 pagesR57 Derivative Markets and Instruments PDFRayePenburNo ratings yet

- Research PaperDocument14 pagesResearch PaperJoshua RafalNo ratings yet