Opensky Secured Visa Credit Cardholder Agreement: Interest Rates and Interest Charges

Opensky Secured Visa Credit Cardholder Agreement: Interest Rates and Interest Charges

Uploaded by

Chris brownCopyright:

Available Formats

Opensky Secured Visa Credit Cardholder Agreement: Interest Rates and Interest Charges

Opensky Secured Visa Credit Cardholder Agreement: Interest Rates and Interest Charges

Uploaded by

Chris brownOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Opensky Secured Visa Credit Cardholder Agreement: Interest Rates and Interest Charges

Opensky Secured Visa Credit Cardholder Agreement: Interest Rates and Interest Charges

Uploaded by

Chris brownCopyright:

Available Formats

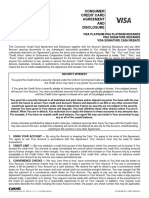

OPENSKY® SECURED VISA®

CREDIT CARDHOLDER AGREEMENT

INTEREST RATES AND INTEREST CHARGES

Annual Percentage Rate (APR) for 19.64%

Purchases This APR will vary with the market based on the Prime Rate plus a margin.

APR for Cash Advances

19.64%

This APR will vary with the market based on the Prime Rate plus a margin.

How to Avoid Paying Interest on Your due date is at least 25 days after the close of each billing cycle. We

Purchases will not charge you interest on new purchases, provided you have paid

your previous balance in full by the due date each month. We will begin

charging interest on cash advances on the transaction date.

Minimum Interest Charge If you are charged interest, the charge will be no less than $1.00.

For Credit Card Tips from the To learn more about factors to consider when applying for or using a credit

Consumer Financial Protection card, visit the website of the Consumer Financial Protection Bureau at

Bureau https://www. Consumerfinance.gov/learnmore.

FEES

Annual Fee $35 annually.

Transaction Fees

• Cash Advance Either $6 or 5% of the amount of each cash advance, whichever is greater.

• Foreign Transaction 3% of each Transaction in U.S. dollars

Penalty Fees

• Late Payment Up to $38

• Returned Payment Up to $25

How We Will Calculate Your Balance: We use a method called “average daily balance (including new

Transactions).” Please see Section 7.(c) of this Agreement for further details.

Billing Rights: Information on your rights to dispute transactions and how to exercise those rights is provided in the

section titled “Your Billing Rights” at the end of this Agreement.

MILITARY LENDING ACT NOTICE: Federal law provides important protections to members of the Armed Forces

and their dependents related to extentsion of consumer credit. In general, the cost of consumer credit to a member

of the Armed Forces andhis or her dependent may not exceed an annual percentage rate of 36 percent. This rate

must include, as applicable to the credit transaction or account; The costs associated with credit insurance

premiums; fees for ancillary products sold in connection with the credit transaction; any application fee charged

(other than certain application fees for specified credit transactions or accounts); and any participation fee charged

(other than certain participation fees for a credit card account). To receive this information and a description of your

payment obligation verbally, please call us toll free 855-763-6736.

The information described here about the costs of the OpenSky Secured Visa Credit Card issued by Capital Bank,

NA is accurate as of 1/1/19. This information may have changed after that date.

OpenSky Secured Visa Credit Card Agreement SKY1-043

Page 1 Jan 2019

SECTION 19 OF THIS AGREEMENT IS AN ARBITRATION PROVISION. UNLESS YOU ACT PROMPTLY TO REJECT THE

ARBITRATION PROVISION, IT WILL HAVE A SUBSTANTIAL EFFECT ON YOUR RIGHTS IN THE EVENT OF A DISPUTE.

FOR EXAMPLE, YOU WILL NOT BE ABLE TO BRING OR PARTICIPATE IN ANY CLASS PROCEEDING SUBJECT TO

ARBITRATION.

This Agreement governs the secured credit card account (“Account”) and related credit card (“Card”) provided by

Capital Bank, a nationally chartered, FDIC-insured Bank headquartered in Rockville, MD (the “Bank”). In this

Agreement, the words “we,” “us,” and “our” mean the Bank, its successors and assigns, and, for purposes of the

Arbitration Provision (Section 19) the other persons identified in the Arbitration Provision. The words “you,” “your”,

“yours” and “Cardholder” mean everyone responsible for this Account, including the person who applied for, received

and accepted this Account and the person to whom we provide the Account Statements after each monthly billing

cycle. You agree, jointly and severally, if more than one person is contractually liable for the Account, to comply with,

and be bound by, this entire Agreement. You should retain and carefully review this entire Agreement, and sign your

Card before using it. Intending to be legally bound, you and we agree as follows:

1. Accepting this Agreement. You accept and agree to the terms and conditions of this Agreement when you first use

the Account or the Card.

2. Purchases and Cash Advances. You may use your Account to purchase or lease goods or services (each, a

“Purchase”) by presenting your Card or providing your Card number and additional information (for example, in online

or telephone transactions) to participating merchants and establishments that honor the Card. You may also receive

“Cash Advances” on your Account: (a) to obtain cash or cash-like equivalents (for example, money orders, traveler’s

checks, stamps or other instruments convertible into cash) from any bank or other person that accepts the Card for

such purpose; (b) to make a withdrawal of cash from an automated teller machine (“ATM”); (c) to make a person-to-

person transfer conducted through the Internet or otherwise; and/or (d) to cash or make a payment using any check

we provide to access the Account (a “Statement Check”). To qualify for Statement Checks, your Credit Limit must be

greater than $500.00, your Account must be current and you may not have been 30 days’ late in paying your Minimum

Payment Due on more than two occasions since you opened your Account. Additional qualifications may apply.

For all purposes of this Agreement, and no matter how they are implemented, Balance Transfers are treated as a

kind of Cash Advances. Purchases and Cash Advances (including Balance Transfers) are collectively referred to as

“Transactions.” We will not be liable to you (or anyone else) if any ATM, merchant or other person cannot or will not

process a Transaction permitted under this Agreement. Unless prohibited by applicable law, we may from time to

time limit the type, number and dollar amount of any Transaction, even if you have sufficient Available Credit (defined

in 5.(e) below) to complete the Transaction, and may terminate or suspend your use of the Card or the Account, with

or without notice to you before or at the time we take such action.

3. Use of the Account and the Card. You agree to use your Account and your Card only for personal, family or

household purposes. You agree that you will not use your Account for any unlawful purpose or to engage in or

facilitate Internet gambling. Your breach of this Agreement will not affect or limit your liability to us with respect to any

Transactions or Balance Type.

4. Authorized User(s). If you allow any other person to use your Account or your Card, that person will be an

“Authorized User.” You are responsible for all use of your Account, including Transactions by an Authorized User. If

you allow an Authorized User to use your Account, such authorization will be deemed to extend to all Transactions

by such Authorized User, even if not intended by you, and will continue until you have taken all steps necessary to

prevent any further use of your Account by such Authorized User, even if you have advised us that such Authorized

User is no longer authorized to use the Account. It is your responsibility to get any cards, checks or any other means

of access to your Account from the Authorized User and destroy them or return them to us upon request.

5. Secured Card; Pledged Deposit Account.

(a) As a condition to obtaining this Account, you are opening a deposit account at the Bank, or at another

FDIC-insured institution designated by the Bank in its discretion (the “Deposit Bank”), in a minimum amount

of at least $200.00. We need not notify you of the identity of the Deposit Bank, if any, unless you expressly

request such information. The deposit account we open for you, with us or the Deposit Bank, and any

substitutions or renewals thereof, is referred to herein as the “Pledged Deposit Account.” You hereby

appoint us your agent and attorney-in-fact and direct us to open the Pledged Deposit Account, to maintain

records and deliver disclosures with respect to the Pledged Deposit Account (including records on behalf of

the Deposit Bank, if any) and to take or initiate all actions with respect to the Pledged Deposit Account as

are contemplated hereunder. You hereby direct the Deposit Bank to deal exclusively and directly with us

concerning the Pledged Deposit Account, to comply with our instructions directing disposition of the funds

on deposit in the Pledged Deposit Account from time to time, including any funds deposited after the

effective date of this Agreement (the “Deposit Funds”), without further consent by you, and to disregard any

OpenSky Secured Visa Credit Card Agreement SKY1-043

Page 2 Jan 2019

instructions received directly from you (whether or not such instructions are contrary to any instructions we

have given the Deposit Bank).

(b) You hereby pledge, assign and grant us a first priority security interest in the Pledged Deposit

Account and the Deposit Funds (together, the “Pledged Collateral”), and you authorize and direct us and the

Deposit Bank to take all actions necessary or appropriate to ensure our rights in the Pledged Collateral. You

acknowledge that, during the term of this Agreement, you may not sell, transfer, assign, pledge or create any

security interest (except the security interest created hereby) in the Pledged Collateral. You agree to sign all

applications and further documents that we may request from time to time to confirm and evidence the

creation of the Pledged Deposit Account and our security interest in the Pledged Collateral, and you

authorize us to sign such documents on your behalf. If you do not pay your Account balance as and when

due or you or we decide to close your Account for any reason, you authorize us to apply any or all of the

Deposit Funds to your outstanding Account balance. We expressly disclaim any security interest in your

other property in connection with your Account.

(c) You may not make withdrawals of Deposit Funds. You will not receive any Deposit Funds until we are

reasonably assured that the remaining Deposit Funds will be sufficient to secure in full all your obligations

to us under this Agreement. This may take up to ten (10) weeks in some circumstances. You will not receive

a Deposit Funds refund if the remaining Deposit Funds are less than $1.00 in the event the Deposit Funds

are used to fully satisfy your obligations to us under the Agreement.

(d) If you default under this Agreement (see Section 14) and we exercise our rights as a secured creditor

with respect to the Pledged Collateral (see Section 15.(e)) but the outstanding Account balance exceeds the

Deposit Funds, you are and will remain liable for the difference, plus any further Fees and Interest that may

subsequently accrue, until the Account balance is paid in full.

(e) Deposit Funds do not pay interest. Accordingly, the interest rate and annual percentage yield on the

Pledged Deposit Account are both 0.00% for the entire life of the Pledged Deposit Account.

6. Credit Limit; Transaction Limits; Available Credit.

(a) Your initial Credit Limit is disclosed on the card carrier used to deliver the Card to you. Your initial Credit Limit

is based on the amount of Deposit Funds that you initially deposited to the Pledged Deposit Account. However, we

will charge your $35.00 Annual Fee to your Account, which will reduce your Available Credit by that amount. (See

6.(d) below.)

(b) You may request an increase in your Credit Limit at any time or from time to time, provided that,

notwithstanding any language in this Agreement to the contrary: (i) any increase will be subject to underwriting

approval; (ii) your Credit Limit will never without our express approval exceed the amount of Deposit Funds in the

Pledged Deposit Account or the amount that we reasonably believe will allow you to pay the Minimum Payment Due,

together with your other monthly expenses, each month; (iii) any deposit of additional Deposit Funds must be in the

form of a check, money order or wire transfer (and not an ACH payment); (iv) the amount of a Cash Advance may

not be less than $20 and the outstanding balance of Cash Advances (including Balance Transfers and including

Interest Charges and Fees treated as Cash Advances) may never exceed 50% of your Credit Limit; and (v) we may

delay increasing your Credit Limit for up to five (5) business days after we approve the increase in Credit Limit and

receive additional Deposit Funds, in order to ensure that the payment to us has cleared. You agree to provide us

from time to time with any information we reasonably request in order to assess your ability to make payments of the

Minimum Payment Due based on the current Credit Limit or any contemplated Credit Limit.

(c) After the first year of the Account, you may also request a decrease in your Credit Limit to a level not below

$200.00 and a reduction in the Deposit Funds in the Pledged Deposit Account to a level not exceeding the reduced

Credit Limit. In such event, we will immediately reduce your Credit Limit but you will not receive any Deposit Funds

until we are reasonably assured that the remaining Deposit Funds will be sufficient to secure in full all your obligations

to us under this Agreement, including your Account balance and obligations relating to authorized Transactions that

are not yet reflected in your Account balance (“Pending Transactions”). This may take up to ten (10) weeks in certain

circumstances.

(d) The amount by which your Credit Limit exceeds the sum of: (i) your outstanding Account balance (including

principal, Fees and Interest Charges); (ii) the dollar amount of all Pending Transactions; and (iii) funds you have sent

us that are not yet treated as “good” funds under Section 11.(e) for purposes of determining credit availability is

referred to as your “Available Credit.” We are not required to approve any Transaction if the amount of the Transaction

exceeds your Available Credit. However, we may authorize and pay any such Transaction in our absolute discretion.

Whenever the outstanding balance of the Account exceeds your Credit Limit, you agree to pay us the difference on

demand.

OpenSky Secured Visa Credit Card Agreement SKY1-043

Page 3 Jan 2019

(e) (i) Subject to applicable law, we may from time to time and in our sole discretion increase your Credit Limit to

any level of our choice, even if the new Credit Limit exceeds the Deposit Funds in the Pledged Deposit Account. We

may also decrease your Credit Limit in our sole discretion, as low as $0. Additionally, we may at any time close your

Account, or limit the number or amount of Transactions that can be charged to your Account based on an evaluation

of various factors. We will promptly notify you in writing in the event we decide to take any such action on your

Account.

(ii) If we close your Account without cause or if we take any action described in Section 6.(e)(i) without cause

and you give us written notice within thirty (30) days that you are closing your Account, we will disregard any reduction

in your Credit Limit for purposes of determining your Annual Percentage Rate (“APR”). Also, if we reduce your Credit

Limit without cause, we will not demand immediate payment of any excess of the Account Balance over the reduced

Credit Limit until such time as the reduced Credit Limit first equals or exceeds the outstanding Account Balance.

7. Interest Charges.

(a) General. Each Billing Cycle, we separately determine the Interest Charges on Purchases and the Interest

Charges on Cash Advances (including Balance Transfers). Both for Purchases and Cash Advances (each, a “Balance

Type”), we determine Interest Charges each Billing Cycle by multiplying the Balance Subject to Interest Charges (see

7.(c) below) by the daily Periodic Rate and by then multiplying the result by the number of days in the Billing Cycle.

For each Balance Type, the Balance Subject to Interest Charges is the Average Daily Balance (including new

Transactions), as calculated pursuant to Section 6.(c) below. To get the total Interest Charges each Billing Cycle, we

add together the Interest Charges for Purchases and the Interest Charges for Cash Advances.

(b) Interest Rates.

(i) For each Balance Type, the Daily Periodic Rate and APR will equal the sum of a Margin and the Prime

Rate determined as of the third Friday of the last calendar month ended before the beginning of the applicable Billing

Cycle (the “Determination Date”). The Margin for Purchase and Cash Balance Types is 14.14%. The “Prime Rate”

is the highest U.S. Prime Rate as published in the “Money Rates” section of The Wall Street Journal on the

Determination Date (or, if The Wall Street Journal does not publish such rate on such day, the previous day it does

publish such rate). (If The Wall Street Journal stops publishing the U.S. Prime Rate in its “Money Rates” section, then

we may substitute another index and margin, in our sole discretion, subject to applicable law.) For each Balance

Type, your rate will vary with the market based on the Prime Rate. The Daily Periodic Rate will be 1/365th of the APR

rounded to the nearest 1/100,000th of 1%. The Daily Periodic Rate in effect at any time is disclosed on the monthly

statement under “Interest Charge Calculation”. The Daily Periodic Rate for your Purchase and Cash APR is

0.05381%.Notwithstanding the foregoing, the Daily Periodic Rate and APR will never exceed the maximum rates

permitted by applicable law.

(ii) Your APR may increase. If and when the APR for each Balance Type increases, more Interest Charges

will accrue and more of each payment will be applied to Interest Charges and less to principal. This will result in

higher and/or more payments if you pay the Minimum Payment Due each month. If and when the APR decreases,

less Interest Charges will accrue and less of each payment will be applied to Interest Charges and more to principal.

This will result in lower and/or fewer payments if you pay the Minimum Payment Due each month.

(c) Balances Subject to Interest Charge.

(i) For each Balance Type, the Balance Subject to Interest Charges is the Average Daily Balance for such

Balance Type. The Average Daily Balance for a Billing Cycle equals the sum of the daily Purchases or Cash Advances

balances, as applicable, for each day of the Billing Cycle, divided by the number of days in the Billing Cycle.

(ii)The Purchases balance for each day in the Billing Cycle is computed as follows:

(A) For each day (including the first day of the Billing Cycle), we start with the prior day’s closing balance

of Purchases, if any.

(B) For the first day of the Billing cycle, we add any unpaid Interest Charges on Purchases that accrued

during the prior Billing Cycle. (This results in the monthly compounding of Interest Charges.)

(C) For each day in the Billing Cycle (including the first day of the Billing Cycle), we add any new

Purchases posted to your Account and subtract any payments or credits applied to Purchases. However, we do not

subtract a second time any payments or credits that have already been subtracted in step (B) above.

(D) We treat any negative daily balance as $0.

(iii) To get the daily balance of Cash Advances (including Balance Transfers) each day: (i) we take the

previous day’s balance of Cash Advances (if any); (ii) we add any new Cash Advances; and (iii) we subtract any new

payments or credits applied to Cash Advances. For the first day of each Billing Cycle, we also add any unpaid Interest

Charges on Cash Advances that accrued during the prior Billing Cycle. (This results in the monthly compounding of

OpenSky Secured Visa Credit Card Agreement SKY1-043

Page 4 Jan 2019

Interest Charges.) If a Cash Advance obtained in a Billing Cycle is not posted in that Billing Cycle, we add the Cash

Advance to the daily balance on the first day of the next Billing Cycle instead of the day it was obtained. We treat any

negative daily balance as $0.

(d) Interest Accrual Periods. We charge Interest Charges over the following periods:

(i) On each Cash Advance, we charge Interest Charges from the later of the Cash Advance transaction or

the first day of the Billing Cycle in which it is posted to your Account until it is repaid in full.

(ii) On each Purchase, we charge Interest Charges from the day the Purchase is posted to the Account

through the Interest End Date.

(e) Classification of Fees as Purchases or Cash Advances (including Balance Transfers). For purposes of

computing Interest Charges, Cash Advance Fees are treated as Cash Advances and all other Fees are treated as

Purchases.

(f) Avoid Interest Charges on Purchases. We will not charge you Interest on Purchases if you pay the entire

New Balance by the payment due date each billing cycle.

8. Fees. Subject to applicable law, including the federal Truth in Lending Act and Regulation Z, you paid or agree to

pay the following Fees:

(a) Set-Up and Maintenance Fees. You paid or agree to pay the following Set-Up and Maintenance Fees:

(i) When we open your Account and each year following the anniversary date of your Account opening, we

will charge you an Annual Fee of $35.00.

(ii) If you requested us to expedite shipping of your Card, you also paid a one-time, non-refundable Expedited

Card Fee of $50.00.

(b) Transaction Fees; Currency Conversion.

(i) Each time you obtain a Cash Advance (including a Balance Transfer), we will charge a Cash Advance Fee

equal to the greater of $6 or 5% of the dollar amount of the Cash Advance.

(ii) If you make a Purchase or obtain a Cash Advance in a foreign currency, the Transaction will be converted

into a U.S. dollar amount in accordance with operating regulations or conversion procedures of Visa International

(“Visa”) in effect at the time the Transaction is processed. Currently, Visa regulations and procedures provide that

the currency conversion rate will be either a wholesale market rate or a government-mandated rate in effect one day

prior to the processing date. We charge a Foreign Currency Transaction Fee equal to three percent (3%) of the gross

amount of the Transaction in U.S. Currency. The foreign merchant or financial institution may charge a separate fee.

(c) Penalty Fees.

(i) If we do not receive a payment from you in at least the amount of your Minimum Payment Due within one

(1) day after the Payment Due Date shown on your monthly statement, you will be charged a Late Payment Fee up

to $27 for the first Late Payment and up to $38 for a subsequent Late Payment within the following six (6) months.

(ii) Each time a check, instrument or other payment on your Account is returned to us unpaid for any reason

or we must return any check or instrument you send us because it is not signed or is otherwise incomplete, we will

charge you a Returned Payment Fee of $25.00. We will not charge a Returned Payment Fee if we are charging a

Late Fee with respect to the same Minimum Payment Due and will never charge a Returned Payment Fee exceeding

the related Minimum Payment Due.

(d) Additional Fees.

(i) We will charge an Expedited Pay By Phone Fee of $10.00 each time you arrange for an expedited payment

by calling us and obtaining the assistance of a live representative or agent of ours. Your payment will be credited to

your Account the same day, if received on or before 5:00 p.m. Eastern Time on a business day and otherwise on the

next business day.

(ii) We will charge you a Document Retrieval Fee of $5.00 each time you request and we provide you with a

copy of any monthly Account Statement (“Account Statement”), sales draft or payment instrument previously provided

you, unless the request is made in connection with a written notice of a billing error.

(iii) We will charge you Paper Statement Fee of $3.00 if you request us to deliver your Account Statements

to you in paper through the U.S. Postal Service rather than accessing them online. For more details about delivery

of your Account Statements, please refer to Section 10. below.

(iv) We may charge additional fees for separate services we provide you in accordance with applicable law.

OpenSky Secured Visa Credit Card Agreement SKY1-043

Page 5 Jan 2019

9. Limits on Interest Charges and Fees.

(a) Notwithstanding any language in this Agreement to the contrary, we will limit the total amount of any

Transaction Fees (listed on the first page) that we impose during the first year after the Account is opened to twenty-

five percent (25%) of your initial Credit Limit (or any lower Credit Limit that may apply during the first year after the

Account is opened). If a charge is imposed that would otherwise exceed this limit, then, in accordance with applicable

law, we will make the necessary corrections within a reasonable amount of time but no later than the end of the Billing

Cycle following the Billing Cycle during which the limit was exceeded.

(b) It is not the intention of the parties that anything in this Agreement should result in the assessment of Interest

Charges or Fees in excess of those permitted by applicable law. If any Interest Charge or Fee assessed under this

Agreement is finally determined to be in excess of that permitted by applicable law, the excess amount will be applied

to reduce the outstanding balance in your Account or, if there is no outstanding balance, will be refunded to you.

10. Periodic Account Statements. We will send you an Account Statement shortly after the end of each monthly Billing

Cycle if your Account has a debit or credit balance in excess of $1.00 at the end of the Billing Cycle or any Interest

Charge has been imposed during the Billing Cycle. However, we are not obligated to send you an Account Statement

if we deem your Account to be uncollectible or applicable law does not require us to send you an Account Statement

for other reasons. Your Account Statements will show Transactions; payments, credits and adjustments; Interest

Charges and Fees; the Previous Balance and New Balance on your Account; your Credit Limit and Available Credit;

and the Minimum Payment Due and Payment Due Date. As you consented to receive e-disclosures when you applied

for this Account, your Account Statements are posted online and can be accessed at MyAccount, our secure online

Cardholder Center. At any time you may notify us that you withdraw your consent to receive electronic statements

and we will deliver your Account Statements to you in paper through the U.S. Postal Service. However, we will charge

you a $3.00 Paper Statement Fee for each Account Statement we deliver to you in paper.

11. Payments.

(a) Each month, you must pay at least the Minimum Payment Due shown on your Account Statement by the

“Cut-Off Time” on the Payment Due Date shown on your Account Statement, which will be at least twenty-five (25)

days after the date of the Account Statement, typically on the same day of each calendar month. However, if the

Payment Due Date falls on a day we do not receive mail (“non-business day”), we will not treat your payment as late

for any purpose if we receive it by the Cut-Off Time on the next day we receive mail (a “business day”). The “Cut-Off

Time” is 5:00 p.m. local time at the payment address specified on the Account Statement (or closing time of any of

our offices at which you make payment in person).

(b) If the total outstanding balance under your Account at the end of a Billing Cycle, as shown on your Account

Statement (the “New Balance”), is less than $25.00, the Minimum Payment Due equals the New Balance. Otherwise,

the Minimum Payment Due equals the sum of: (i) any amount past due; plus (ii) any amount by which the New

Balance exceeds your Credit Limit; and (iii) the greatest of: (A) the sum of the Interest Charges and Fees reflected

on your Account Statement; (B) two percent (2%) of the New Balance; or (C) $25.00.

(c) You agree to make all payments by check or other negotiable instrument drawn on a financial institution

located in the U.S. or by money order. Payments must be made in U.S. dollars. All payments, except disputed

payments, must be mailed or delivered to us at the payment address shown on the front of your Account Statement

(the “Payment Address”). Any payments received after the Cut-Off Time on a business day will be credited on the

next business day. However, credit to your Account may be delayed for up to five (5) days if we accept a payment

that is: (i) not received by mail or messenger service at the Payment Address or in-person at one of our branches;

(ii) not made in U.S. dollars by a check or other negotiable instrument drawn on a financial institution located in the

U.S. or by money order; or (iii) not accompanied by the top portion of your Account Statement. Delayed crediting may

cause you to incur additional Fees and Interest Charges, subject to applicable law. You may not use a Statement

Check to pay any amount you owe under this Agreement or any other amount you owe us. None of the

following will constitute a payment made by you: (i) a credit posting from a merchant; (ii) a reversal of fees

by us; or (iii) our offset of the Deposit Funds in the Pledged Deposit Account.

(d) Subject to applicable law, we may apply payments and other credits to your Account in any manner we choose

in our sole discretion. For payments up to the Minimum Payment Due, we typically apply payments based on the

APR of different balances, first to the lowest APR, next to the next-lowest APR and so on. For payments in excess

of the Minimum Payment Due, we apply payments in the reverse order, first to balances with the highest APR.

(e) All credits for payments to your Card are subject to final payment by the institution on which the item of

payment was drawn. Your Available Credit may not be restored for up to twenty (20) days after we receive your

payment.

OpenSky Secured Visa Credit Card Agreement SKY1-043

Page 6 Jan 2019

12. Prepayment. At any time, you may pay all or any part of your outstanding Account balance. Payment of more

than the Minimum Payment Due in one Billing Cycle will not relieve you of the obligation to pay the entire Minimum

Payment Due in subsequent Billing Cycles.

13. Termination. Subject to applicable law, we may terminate your right to credit under the Account at any time in our

absolute discretion. You may also terminate your right to credit under the Account by calling Customer Service or

writing to the OpenSky Card Services, P.O. Box 9224, Old Bethpage, NY 11804-9224. Any request to terminate your

credit privileges will be effective only after we have had a reasonable opportunity to act on such request. We will

close the Pledged Deposit Account after your credit privileges are terminated and all amounts owing to us are repaid

in full. However, it could take up to ten (10) weeks before we close the Pledged Deposit Account and return to you

any Deposit Funds that remain after all your obligations to us have been paid in full. Except as provided above,

termination of credit privileges, whether initiated by us or by you, will not affect any of your or our rights and obligations

under this Agreement, including without limitation, your obligation to repay any amounts you owe us according to the

terms of this Agreement. On our demand or upon termination of credit privileges, you agree to surrender to us or

destroy the Card. You agree that, if you attempt to use the Card after the termination of credit privileges (whether or

not we have provided notice of such termination), the Card may be retained by a merchant, ATM or financial institution

where you attempt to use the Card.

14. Default. Subject to applicable law, we may declare you to be in default under this Agreement if any one or more

of the following events occurs:

(a) you fail to pay any Minimum Payment Due on or before your Payment Due Date;

(b) you exceed your Credit Limit;

(c) you use a check or instrument for payment which is dishonored;

(d) you die or are declared legally incompetent;

(e) any other creditor tries by legal process to take money of yours, including Deposit Funds, in our possession;

(f) a petition is filed or other proceeding is commenced by or against you under the Federal Bankruptcy Code or

any other applicable federal or state insolvency laws;

(g) you become generally unable to pay your debts;

(h) you provide us with any false or misleading information;

(i) you breach any of your other obligations under this Agreement; or

(j) you are in default of any other credit agreement you have with us or any of our affiliates.

15. Remedies. In the event of any default under this Agreement, we may, subject to applicable law (including any

applicable notice requirement):

(a) without waiving any rights under subsection (b), allow you to repay your Account balance by paying the

Minimum Payment Due each Billing Cycle;

(b) declare all or any portion of your outstanding Account balance to be immediately due and payable,

(c) immediately terminate or suspend your Account privileges and/or cancel your Card;

(d) reduce your Credit Limit or otherwise limit your ability to make Transactions;

(e) exercise our rights as a secured creditor with respect to the Pledged Deposit Account and the Deposit Funds;

and/or

(f) commence an action against you to collect all amounts owed in connection with this Agreement.

We also may charge you court costs and reasonable attorneys’ fees that we actually incur, as permitted by applicable

law, if your Account is sent for collection to an attorney who is not our salaried employee. We will not be obligated to

honor any attempted Transaction if your Card is in default or we have determined to terminate or suspend your

Account privileges or limit your ability to make Transactions. Interest Charges will continue to accrue until your total

Account balance, including accrued Interest Charges, is paid in full. You understand and agree that, subject to

applicable law, if you are in default under this Agreement, we may make collection calls to your home or cell phone

and may use an automatic dialer and/or prerecorded messages with respect to such calls, even if the message is left

on an answering machine. You agree such calls will not be considered “unsolicited” calls or telemarketing calls for

purposes of state or federal law.

16. Delay in Enforcement. We may at any time and in our sole discretion delay or waive enforcing any of our rights

or remedies under this Agreement or under applicable law without losing any of those or any other rights or remedies.

OpenSky Secured Visa Credit Card Agreement SKY1-043

Page 7 Jan 2019

Even if we do not enforce our rights or remedies at any one time, we may enforce them at a later date. For example,

we may accept late payments or payments that are marked “payment in full” or with other restrictive endorsements

without losing any of our rights under this Agreement.

17. Notice and Cure. Prior to initiating a lawsuit or arbitration regarding a legal dispute or claim relating in any way to

this Agreement or the Account (as more fully defined in Section 19.(b)(iii), a “Claim”), the party asserting the Claim

(the “Claimant”) shall give the other party (the “Defending Party”) written notice of the Claim (a “Claim Notice”) and a

reasonable opportunity, not less than thirty (30) days, to resolve the Claim on an individual basis. Any Claim Notice

to you shall be sent in writing by mail to the address for you maintained in our records. Any Claim Notice to us shall

be sent by mail to OpenSky Card Services, P.O. Box 9224, Old Bethpage, NY 11804-9224, attention Legal Claim (or

such other address as we subsequently provide you). Any Claim Notice you send must provide your Account Number

and telephone number. Any Claim Notice must explain the nature of the Claim and the relief that is demanded. The

Claimant must reasonably cooperate in providing any information about the Claim that the Defending Party

reasonably requests.

18. Waiver of Right to Trial by Jury. YOU AND WE ACKNOWLEDGE THAT THE RIGHT TO TRIAL BY JURY IS A

CONSTITUTIONAL RIGHT BUT MAY BE WAIVED IN CERTAIN CIRCUMSTANCES. TO THE EXTENT

PERMITTED BY LAW, YOU AND WE KNOWINGLY AND VOLUNTARILY WAIVE ANY RIGHT TO TRIAL BY

JURY IN THE EVENT OF LITIGATION ARISING OUT OF OR RELATED TO THIS AGREEMENT. THIS JURY

TRIAL WAIVER SHALL NOT AFFECT OR BE INTERPRETED AS MODIFYING IN ANY FASHION THE

ARBITRATION PROVISION SET FORTH IN SECTION 19, IF APPLICABLE, WHICH CONTAINS ITS OWN

SEPARATE JURY TRIAL WAIVER.

19. Arbitration Provision. Unless you have exercised your right to reject arbitration under subsection (m) below,

the following Arbitration Provision will apply:

(a) General: Either you or we may elect to arbitrate - and require the other party to arbitrate - any Claim (as

defined below) under the following terms and conditions. If you or we elect to arbitrate a Claim, neither you nor we

will have the right to: (i) have a court or a jury decide the Claim; (ii) participate in a class action in court or in arbitration,

either as a class representative or a class member; (iii) act as a private attorney general in court or in arbitration; or

(iv) join or consolidate your Claim(s) with claims of any other person. The right to appeal and the right to pre-arbitration

discovery are more limited in arbitration than in court. Other rights that you would have if you went to court may also

not be available in arbitration.

(b) Definitions: The following definitions apply to this Arbitration Provision, even if terms defined in this Arbitration

Provision are defined differently elsewhere in this Agreement:

(i) “We,” “us” and “our” mean the Bank, together with any subsequent holder of this Agreement. Also,

these terms include the parents, subsidiaries, affiliates and successors of such companies, as well as the officers,

directors, agents and employees of any of the foregoing. These terms also include any party named as a co-defendant

with us in a Claim asserted by you, such as marketing companies, credit bureaus, credit insurance companies, credit

card servicers and debt collectors. “You,” “your” and “yours” include each and every person who uses a Card.

(ii) “Administrator” means the American Arbitration Association (“AAA”), 1633 Broadway, 10th Floor,

New York, NY 10019, www.adr.org, 800-778-7879; JAMS, 620 Eighth Avenue, 34th Floor, New York, NY 10018,

www.jamsadr.com, 800-352-5267; or any other company selected by mutual agreement of the parties. If both AAA

and JAMS cannot or will not serve and the parties are unable to select an Administrator by mutual consent, the

Administrator will be selected by a court. You get to select the Administrator if you give us written notice of your

selection with your notice that you are electing to arbitrate any Claim or within twenty (20) days after we give you

notice that we are electing to arbitrate any Claim (or, if you dispute our right to require arbitration of the Claim, within

twenty (20) days after that dispute is finally resolved). If you do not select the Administrator on time, we may do it.

Notwithstanding any language in this Arbitration Provision to the contrary, no arbitration may be administered, without

the consent of all parties to the arbitration, by any Administrator that has in place a formal or informal policy that is

inconsistent with subsection (d) below captioned “No Class Actions” (the “Class Action Waiver”).

(iii) “Claim” means any claim, dispute or controversy between you and us that in any way arises from or

relates to this Agreement or the Account, including disputes arising from actions or omissions prior to the date of this

Agreement. “Claim” has the broadest reasonable meaning, and includes initial claims, counterclaims, cross-claims

and third-party claims. It includes disputes based upon contract, tort, consumer rights, fraud and other intentional

torts, constitution, statute, regulation, ordinance, common law and equity (including any claim for injunctive or

declaratory relief). However, it does not include disputes about the validity, enforceability, coverage or scope of this

Arbitration Agreement or any part thereof (including, without limitation, the Class Action Waiver, the final sentence in

Section 19.(j) under the caption “Survival, Severability, Primacy” and/or this sentence); all such disputes are for a

court and not an arbitrator to decide. However, any dispute or argument that concerns the validity or enforceability of

the Agreement as a whole is for the arbitrator, not a court, to decide.

OpenSky Secured Visa Credit Card Agreement SKY1-043

Page 8 Jan 2019

(c) Starting Arbitration: To start an arbitration, you or we must give written notice of an election to arbitrate. This

notice may be given after a lawsuit has been filed and may be given in papers or motions in the lawsuit. If such a

notice is given, the Claim shall be resolved by arbitration under this Arbitration Provision and the applicable rules of

the Administrator then in effect. We will not elect to arbitrate any individual action brought by you in small claims court

or your state’s equivalent court, when such action is transferred, removed, or appealed to a different court

(d) No Class Actions: Notwithstanding any language herein to the contrary, if you or we elect to arbitrate

a Claim, neither you nor we will have the right to: (i) participate in a class action in court or in arbitration,

either as a class representative, class member or class opponent; (ii) act as a private attorney general in

court or in arbitration; or (iii) join or consolidate your Claims with claims of any other person, and the

arbitrator shall have no authority to conduct any such class, private attorney general or multiple-party

proceeding.

(e) Location and Costs: Any arbitration hearing that you attend will take place in a location that is reasonably

convenient for you. If you cannot obtain a waiver of the Administrator’s or arbitrator’s filing, administrative, hearing

and/or other fees, we will consider in good faith any request by you for us to bear such fees. We will pay for our own

attorneys, experts and witnesses and will pay the reasonable fees and charges of your attorneys, experts and

witnesses if you win the arbitration. We will pay any of the Administrator’s or arbitrator’s filing, administrative, hearing

and/or other fees, and the fees and charges of your attorneys, experts and witnesses, if and to the extent we are

required to pay such fees and charges by law or in order to make this Arbitration Provision enforceable.

(f) Arbitrator Selection: The arbitrator will be appointed by the Administrator in accordance with the rules of the

Administrator. However, unless the parties agree otherwise, the arbitrator must be a retired or former judge or a

lawyer with at least ten (10) years of experience.

(g) Discovery; Getting Information: In addition to the parties’ rights under the Administrator’s rules to obtain

information prior to the hearing, either party may ask the arbitrator for more information from the other party. The

arbitrator will decide the issue in his or her sole discretion, after allowing the other party the opportunity to object.

(h) Effect of Arbitration Award: Any court with jurisdiction may enter judgment upon the arbitrator’s award. The

arbitrator’s award will be final and binding, except for: (1) any appeal right under the Federal Arbitration Act, 9 U.S.C.

§1 et seq. (the “FAA”); and (2) Claims involving more than $50,000. For Claims involving more than $50,000, any

party may appeal the award to a three-arbitrator panel appointed by the Administrator, which will reconsider anew

any aspect of the initial award that is appealed. The panel’s decision will be final and binding, except for any appeal

right under the FAA. The costs of any appeal will be borne in accordance with subsection (e) above captioned

“Location and Costs.”

(i) Governing Law: This Agreement governs transactions involving interstate commerce and accordingly this

Arbitration Provision shall be governed by the FAA and not by any state law concerning arbitration. The arbitrator

shall follow applicable substantive law to the extent consistent with the FAA, applicable statutes of limitation and

applicable privilege rules, and shall be authorized to award all remedies available in an individual lawsuit under

applicable substantive law, including, without limitation, compensatory, statutory and punitive damages (which shall

be governed by the constitutional standards applicable in judicial proceedings), declaratory, injunctive and other

equitable relief, and attorneys’ fees and costs. Upon the timely request of either party, the arbitrator shall write a brief

explanation of the basis of his or her award. The arbitrator will follow rules of procedure and evidence consistent with

the FAA, this Arbitration Provision and the Administrator’s rules.

(j) Survival, Severability, Primacy: This Arbitration Provision shall survive the termination of this Agreement,

your fulfillment or default of your obligations under this Agreement and/or your or our bankruptcy (to the extent

permitted by applicable law). In the event of any conflict or inconsistency between this Arbitration Provision and the

Administrator’s rules or this Agreement, this Arbitration Provision will govern. If any portion of this Arbitration

Provision, other than the Class Action Waiver, is deemed invalid or unenforceable, the remaining portions shall

nevertheless remain in force. If a determination is made that the Class Action Waiver is unenforceable, only this

sentence of the Arbitration Provision will remain in force and the remaining provisions shall be null and void, provided

that the determination concerning the Class Action Waiver shall be subject to appeal.

(k) Amendment/Termination: Notwithstanding any provision of this Agreement to the contrary, we will not amend

this Arbitration Provision in a manner that adversely affects your rights or responsibilities in a material manner unless

we give you a right to reject the amendment and/or the Arbitration Provision in its entirety.

(l) Special Payment: If (i) you submit a Claim Notice on your own behalf (and not on behalf of any other party)

in accordance with Section 17., captioned “Notice and Cure” (including the timing requirements thereof); (ii) we refuse

to provide you with the relief you request; and (iii) an arbitrator subsequently determines that you were entitled to

such relief (or greater relief), the arbitrator shall award you at least $7,500 and will double the attorneys’ fees to which

you would otherwise be entitled.

OpenSky Secured Visa Credit Card Agreement SKY1-043

Page 9 Jan 2019

(m) RIGHT TO REJECT ARBITRATION. You may reject this Arbitration Provision by mailing a special

rejection notice to OpenSky Card Services, P.O. Box 9224, Old Bethpage, NY 11804-9224, attention

Arbitration Rejection, within sixty (60) days after you apply for your Account. Any rejection notice must

include your name, address, telephone number, and Account number.

20. Changes to this Agreement. Subject to applicable law, including the Truth in Lending Act and Regulation Z:

(a) You agree that we may, in our sole discretion, from time to time change any of the terms and conditions of,

or add new terms and conditions to, this Agreement, including changing the formula used to compute Interest

Charges (including terms and conditions increasing margins, switching to a fixed APR, changing the method of

computing Balances Subject to Interest Charge), increasing or adding Fees (including annual or other periodic fees)

or changing your Credit Limit.

(b) Any such changes will generally be effective immediately unless we are required by applicable law or elect,

in our discretion, to provide you with advance written notice of the changes (and/or the reasons for the changes),

afford you the right to reject the change and/or obtain your consent to the change (whether by written agreement,

through the initiation of a Transaction after a specified date or through some other means). In such instances, those

changes will be effective if, when and as stated in such notice.

(c) Any changes may apply to your outstanding Account balance on the effective date of the change and to any

future balances created after that date.

(d) No change to any term of this Agreement will excuse your obligation to pay all amounts owing under this

Agreement.

21. Governing Law. This Agreement is entered into between you and us in the State of Maryland, and your Account

and this Agreement are established in Maryland. Except as set forth to the contrary in the Arbitration Provision, any

claim, dispute or controversy arising from or relating to your Account or this Agreement, whether based in contract,

tort, fraud or otherwise and regardless of the place of your residence, is governed by, and construed in accordance

with, the laws of the State of Maryland, without regard to Maryland’s conflict of laws principles, and applicable federal

laws and regulations.

22. Unauthorized Use of Your Card or Account. You agree to promptly notify us if you believe that your Card has

been lost or stolen or that someone has used or may use your Card or Account without your permission by calling

the Customer Service or writing to the OpenSky Card Services, P.O. Box 9224, Old Bethpage, NY 11804-9224. TO

HELP PROTECT AGAINST THE UNAUTHORIZED USE OF YOUR CARD OR ACCOUNT, YOU SHOULD NEVER

WRITE YOUR PERSONAL IDENTIFICATION NUMBER (PIN) ON YOUR CARD OR KEEP ANY WRITTEN

RECORD OF IT ON ANY MATERIAL THAT IS KEPT WITH YOUR CARD.

You agree to assist us in determining the facts, circumstances and other pertinent information related to any loss,

theft or possible unauthorized use of your Card or Account and to comply with such procedures as we may reasonably

require in connection with our investigation, this may include the filing of one or more reports with the appropriate law

enforcement authorities. Subject to applicable law, you acknowledge and agree that we may terminate our

investigation if you fail to cooperate to provide us with assistance or to comply with such procedures, and we

otherwise have no information or knowledge of facts confirming the unauthorized use of your Card or Account. In

such circumstances, we will deem any such use as having been authorized by you and you will be liable for the

amount of any Transactions plus Interest Charges and Fees incurred with any such use. Subject to applicable law,

you also acknowledge and agree that unauthorized Card or Account use does not include use of your Card or Account

by any person to whom you have given authority to use your Card or Account, even if you have attempted to limit the

scope of the authority you have granted to any Authorized User and such Authorized User has exceeded his or her

authority. You will be liable for all use of the Account or any Card by any such Authorized User, even if that person

uses the Account or Card in ways you did not intend.

23. Verifications. We verify your age, social security number, residence and other identifying information as required

by applicable law.

24. Re-evaluation of Financial Condition and Credit History. We may re-evaluate your financial condition and

investigate any information you provided on your Card application at any time, and in the course of doing so, we may

obtain a current credit report and ask you for any additional information about your financial condition by completing

a Personal Financial Account Statement or such other form that we request from time to time. You authorize us and

give us your permission to obtain any information about you that we believe would be beneficial to facilitate our

determination of your eligibility for the Account and the Card, including credit reports from consumer reporting

agencies.

25. Privacy Notice. We respect the privacy of information about you and your Account. Please read our Privacy Notice

as it is part of this Agreement. We provide our Privacy Notice to all new customers and to current customers on an

OpenSky Secured Visa Credit Card Agreement SKY1-043

Page 10 Jan 2019

annual basis. Changes may be made to our Privacy Notice. Our current Privacy Notice is always available at

www.capitalbankmd.com.

26. Reporting Information to Credit Bureaus; Identity Theft. We may report information about your Account to credit

bureaus. Late payments, missed payments or other defaults on your Account may be reflected in your credit report

even if funds from your pledged deposit account are applied to balances owed. You have the right to dispute the

accuracy of information we have reported. If you believe that any information about your Account that we have

reported to a credit bureau is inaccurate, or if you believe that you have been the victim of identity theft in connection

with your Account or in connection with any other loan or extension of credit made by us, write us at: OpenSky Card

Services, Attn. Fraud/Dispute Department, P.O. Box 9224, Bethpage, NY 11804-9224. Please include your name,

address, Account number, telephone number and a brief description of the problem. If available, please include a

copy of the credit report in question. If you believe that you have been the victim of identity theft, submit an identity

theft affidavit or identity theft report and, if applicable, and you have this information; include the number of the other

loan or extension of credit made by us.

27. Questions. If you have any questions about this Agreement or your Card, please contact Customer Service at the

number on your statement or on the back of your Card.

28. Account Settlements. Any settlement of your Account balance for less than what is owed requires our written

agreement.

29. Bankruptcy Notification. All bankruptcy notices and related correspondence to us should be sent to the following

address: OpenSky Card Services, Attn. Bankruptcy Department, P.O. Box 9224, Bethpage, NY 11804-9224.

30. Change of Address and Other Information. You must notify us of any changes to your name, mailing or email

address, home, cell or business phone number, employment or income within 15 days. You can update your contact

information by accessing MyAccount, our online Cardholder Center, or by writing to OpenSky Card Services, PO Box

9224, Old Bethpage, NY 11804-9224. We will rely on your mail and email addresses as they appear on our records

for any and all Account communications we send to you unless and until either you or, in the case of your mailing

address, the U.S. Postal Service, notifies us of a change of address and we have had a reasonable opportunity to

act on such notice.

31. Correspondence. To the extent permitted under applicable law, any written or electronic correspondence you

send to us will not be effective until we receive and have had a reasonable opportunity to act on such correspondence.

Any written or electronic correspondence we send to you will, however, be effective and deemed delivered when

mailed to you at your mail address (or your email address if you have authorized electronic communications) as it

appears on our records.

32. Telephone Monitoring and Recording. You agree that we may monitor, record, retain and reproduce your

telephone calls and any other communications you provide to us, regardless of how transmitted to us, for training

and quality control purposes and as evidence of your authorization to act in connection with any Transaction or

service contemplated by this Agreement. However, we are not under any obligation to monitor, record, retain or

reproduce such items, unless required to do so by applicable law.

33. Waiver of Rights. Except as may be prohibited by law or regulation, you agree to waive any right you may have

for us to act promptly in bringing any action(s) against you (known as diligence); to demand payments of amounts

due (known as presentment); to obtain an official certification of non-payment (known as protest); and to give notice

that amounts due have not been paid (known as notice of dishonor or notice of default and non-payment).

34. Third-Party Claims or Defenses. Except as otherwise provided in this Agreement and as required by applicable

law, we will not be responsible for any claim or defense you may have against any third party that arises out of or in

connection with any Transaction.

35. Assignment. You may not sell, assign or transfer your Account or Card or any of your rights and obligations under

this Agreement. We may, however, sell, assign or transfer your Account, or any balance due thereunder, and/or any

of our rights and obligations under this Agreement, to another bank or other third party without prior notice to, or

consent by, you, which notice or consent is hereby waived. Should we do so, then to the extent of any such sale,

assignment or transfer, that bank or third party will take our place in this Agreement.

36. Severability. Except as provided otherwise with respect to the Arbitration Provision, if any provision of this

Agreement is deemed to be void or unenforceable by a court of competent jurisdiction or any governmental agency,

that provision will continue to be enforceable to the extent permitted by that court or agency, and the remainder of

that provision will no longer be considered as part of this Agreement. All other provisions of this Agreement will,

however, remain in full force and effect.

37. Section Headings. The Section headings used in this Agreement are for convenience of reference only and do

not in any way limit or define your or our rights or obligations hereunder.

OpenSky Secured Visa Credit Card Agreement SKY1-043

Page 11 Jan 2019

38. Entire Agreement. You acknowledge that the terms and conditions set forth in this Agreement and on your card

carrier constitute the entire agreement between you and us with respect to the Account, and supersede and may not

be contradicted by evidence of any prior or contemporaneous written or oral communications and understandings

between you and us concerning the Account or the Card.

Your Billing Rights: Keep This Document for Future Use

This notice tells you about your rights and our responsibilities under the Fair Credit Billing Act.

What To Do If You Find A Mistake On Your Account Statement

If you think there is an error on your statement, write to us at:

OpenSky Card Services

P.O. Box 9224

Old Bethpage, NY 11804-9224

In your letter, give us the following information:

Account information: Your name and account number.

Dollar amount: The dollar amount of the suspected error.

Description of problem: If you think there is an error on your bill, describe what you believe is wrong and why

you believe it is a mistake.

You must contact us:

Within 60 days after the error appeared on your statement.

At least 3 business days before an automated payment is scheduled, if you want to stop payment on the

amount you think is wrong.

You must notify us of any potential errors in writing. You may call us, but if you do we are not required to investigate

any potential errors and you may have to pay the amount in question.

What Will Happen After We Receive Your Letter

When we receive your letter, we must do two things:

1. Within 30 days of receiving your letter, we must tell you that we received your letter. We will also tell you if

we have already corrected the error.

2. Within 90 days of receiving your letter, we must either correct the error or explain to you why we believe the

bill is correct.

While we investigate whether or not there has been an error:

We cannot try to collect the amount in question, or report you as delinquent on that amount.

The charge in question may remain on your statement, and we may continue to charge you interest on that

amount.

While you do not have to pay the amount in question, you are responsible for the remainder of your

balance.

We can apply any unpaid amount against your credit limit.

After we finish our investigation, one of two things will happen:

If we made a mistake: You will not have to pay the amount in question or any interest or other fees related

to that amount.

If we do not believe there was a mistake: You will have to pay the amount in question, along with applicable

interest and fees. We will send you a statement of the amount you owe and the date payment is due. We

may then report you as delinquent if you do not pay the amount we think you owe.

OpenSky Secured Visa Credit Card Agreement SKY1-043

Page 12 Jan 2019

If you receive our explanation but still believe your bill is wrong, you must write to us within 10 days telling us that you

still refuse to pay. If you do so, we cannot report you as delinquent without also reporting that you are questioning

your bill. We must tell you the name of anyone to whom we reported you as delinquent, and we must let those

organizations know when the matter has been settled between us.

If we do not follow all of the rules above, you do not have to pay the first $50 of the amount you question even if

your bill is correct.

Your Rights If You Are Dissatisfied With Your Credit Card Purchases

If you are dissatisfied with the goods or services that you have purchased with your credit card, and you have tried

in good faith to correct the problem with the merchant, you may have the right not to pay the remaining amount due

on the purchase.

To use this right, all of the following must be true:

1. The purchase must have been made in your home state or within 100 miles of your current mailing address, and

the purchase price must have been more than $50. (Note: Neither of these are necessary if your purchase was based

on an advertisement we mailed to you, or if we own the company that sold you the goods or services.)

2. You must have used your credit card for the purchase. Purchases made with cash advances from an ATM or with

a check that accesses your credit card account do not qualify.

3. You must not yet have fully paid for the purchase.

If all of the criteria above are met and you are still dissatisfied with the purchase, contact us in writing at:

OpenSky Card Services

P.O. Box 9224

Old Bethpage, NY 11804-9224

While we investigate, the same rules apply to the disputed amount as discussed above. After we finish our

investigation, we will tell you our decision. At that point, if we think you owe an amount and you do not pay, we may

report you as delinquent.

Additional Disclosures

CALIFORNIA RESIDENTS: You may apply for an account in your name alone, regardless of your marital status.

NEW YORK RESIDENTS: You may contact the New York State Banking Department at 1-877-

226-5697 to obtain a comparative listing of all credit card rates, fees and grace periods.

OHIO RESIDENTS: The Ohio rules against discrimination require that all creditors make credit equally available

to all creditworthy customers and that credit reporting agencies maintain separate credit histories on each individual

upon request. The Ohio Civil Rights Commission administers compliance with this law.

VERMONT, RHODE ISLAND AND NEW YORK RESIDENTS: A credit report may be requested in connection

with your application. At your request, Capital Bank (CNB) will tell you whether or not a credit report was obtained

and, if so, the name and address of the consumer reporting agency that furnished the report. CNB may also request

credit reports from time to time in connection with any update, renewal or extension of the credit account, whenever

CNB believes that such action is appropriate.

MARRIED WISCONSIN RESIDENTS: No provisions of any marital property agreement, unilateral statement under

§766.59 of the Wisconsin Statutes, or court decree under §766.70 will adversely affect a creditor’s interest unless,

prior to the time credit is granted, the creditor is furnished a copy of the agreement, statement or decree or has actual

knowledge of the adverse provision. If an Account is opened for you, you must notify your spouse about the Account

before any payment on the Account is due. YOUR SIGNATURE CONFIRMS THAT CREDIT EXTENDED UNDER

THIS ACCOUNT WILL BE INCURRED IN THE INTEREST OF YOUR MARRIAGE OR FAMILY.

OpenSky Secured Visa Credit Card Agreement SKY1-043

Page 13 Jan 2019

Customer Identification Program

In accordance with the USA PATRIOT Act, Federal law requires all financial institutions to obtain, verify, and record

information that identifies each individual or entity opening an account. This includes all personal and commercial

accounts.

What This Means to Our Customers

When you open an account, you will be asked for your name, address, social security or tax identification number,

date of birth (if applicable) and other information that will allow us to identify you. You will also be asked to furnish

your driver’s license or other identifying documents. We are required to follow this procedure each time an account

is opened, even if you are a current customer. Thank you for helping us to follow this Federally-mandated procedure.

You can view a complete copy of the current Account Agreement on our website at www.openskycc.com.

For Further Information: Call the Customer Service number shown on your statement or on the back of your

Card if you need more information.

OpenSky Secured Visa Credit Card Agreement SKY1-043

Page 14 Jan 2019

You might also like

- Employment Bond BTW Company and EmployerDocument3 pagesEmployment Bond BTW Company and EmployerAmrinder Kaur100% (2)

- Credit Card Agreement For Consumer Cards in Capital One N.ADocument8 pagesCredit Card Agreement For Consumer Cards in Capital One N.AChisom ChidiNo ratings yet

- Cardmember Agreement - Carte Blanche CardDocument10 pagesCardmember Agreement - Carte Blanche CardEric WeiNo ratings yet

- Unlimited Cash Back Bank Account, by Green Dot Deposit Account AgreementDocument49 pagesUnlimited Cash Back Bank Account, by Green Dot Deposit Account AgreementalanNo ratings yet

- Grievance Machinery and Voluntary ArbitrationDocument18 pagesGrievance Machinery and Voluntary Arbitrationeasa^belleNo ratings yet

- BrightWay Cardholder Agreement AMF75 35.99 MDocument16 pagesBrightWay Cardholder Agreement AMF75 35.99 Mhamrickclaude02No ratings yet

- Build Card Military Lending Act Cardholder AgreementDocument8 pagesBuild Card Military Lending Act Cardholder Agreementprateekmehta92No ratings yet

- Firstprogress Important Disclosures SelectDocument3 pagesFirstprogress Important Disclosures Selectbethanyhurst1024No ratings yet

- RFCL_202408FPP_2Document3 pagesRFCL_202408FPP_2marywhite332211No ratings yet

- Zerocard AgreementDocument20 pagesZerocard AgreementFdgdeethNo ratings yet

- Opensky Secured Visa Credit Card - Important Disclosures: Interest Rates and Interest ChargesDocument3 pagesOpensky Secured Visa Credit Card - Important Disclosures: Interest Rates and Interest ChargesTony SparksNo ratings yet

- IM318R15U 1CXT1 v3Document16 pagesIM318R15U 1CXT1 v3bethanyhurst1024No ratings yet

- TC Sky1p 007Document4 pagesTC Sky1p 0074gfswp95xjNo ratings yet

- Bbva Clearspend Card Terms and ConditionsDocument15 pagesBbva Clearspend Card Terms and ConditionsKahtanNo ratings yet

- MINI Card Cardholder AgreementDocument5 pagesMINI Card Cardholder AgreementCloud FarisNo ratings yet

- TC Sky1 062Document4 pagesTC Sky1 062jeffreygrimm8No ratings yet

- Destiny 200Document11 pagesDestiny 200Jeanine WallaceNo ratings yet

- Firstprogress Cardholder AgreementDocument12 pagesFirstprogress Cardholder Agreementdeskmaster90No ratings yet

- BrightWay Acquistion Terms AMF89 35.99 NDocument6 pagesBrightWay Acquistion Terms AMF89 35.99 Njlp036046gmail.comNo ratings yet

- Visa Rewards App DisclosureDocument4 pagesVisa Rewards App Disclosureznb2015No ratings yet

- Current PDFDocument6 pagesCurrent PDFAnonymous h485ZTKO5No ratings yet

- "Registering Your Card" and "Personal Identification Number"Document11 pages"Registering Your Card" and "Personal Identification Number"Ivan MilosavljevicNo ratings yet

- Card Agreement: Pricing SummaryDocument11 pagesCard Agreement: Pricing Summaryfamilylawmatters1952No ratings yet

- BD Silver Gold Credit Card Terms Conditions BrochureDocument8 pagesBD Silver Gold Credit Card Terms Conditions Brochurehasan raisNo ratings yet

- Example of Credit Card Agreement For Bank of America® Visa Signature® AccountsDocument13 pagesExample of Credit Card Agreement For Bank of America® Visa Signature® AccountsDEShifNo ratings yet

- Terms and ConditionsDocument6 pagesTerms and ConditionsRobin HoodNo ratings yet

- Wells Fargo Advisors Premium Rewards Visa Signature CardDocument13 pagesWells Fargo Advisors Premium Rewards Visa Signature CardRalph YoungNo ratings yet

- Indigo 602Document15 pagesIndigo 602OneNationNo ratings yet

- Secured Personal Terms enDocument8 pagesSecured Personal Terms enluiscelis01No ratings yet

- Personal Card Agreement 011221 033122 enDocument9 pagesPersonal Card Agreement 011221 033122 enfukuiu505No ratings yet

- Ngopa 600 0630Document4 pagesNgopa 600 0630wesleyphillips1971No ratings yet

- Interest Rates and Interest Charges: Important DisclosuresDocument5 pagesInterest Rates and Interest Charges: Important DisclosuresataraNo ratings yet

- Including The Long Form Fee Disclosure ("List of All Fees.")Document9 pagesIncluding The Long Form Fee Disclosure ("List of All Fees.")Shamara LoganNo ratings yet

- Current PDFDocument4 pagesCurrent PDFBrian SmithNo ratings yet

- BN Credit Cards v11Document41 pagesBN Credit Cards v11shekharsap284No ratings yet

- Visa AgreementDocument6 pagesVisa AgreementRaheem ParnellNo ratings yet

- Credit Card AgreementDocument34 pagesCredit Card Agreementdarindevine10No ratings yet

- Mmcpa - 330 - 0201 2Document4 pagesMmcpa - 330 - 0201 2Yeisdaliz Ramos0% (1)

- Milestone® Gold Mastercard® The Bank of Missouri: Interest Rates and Interest ChargesDocument4 pagesMilestone® Gold Mastercard® The Bank of Missouri: Interest Rates and Interest ChargesDelois RoseboroNo ratings yet

- World Credit Card Agreement and DisclosureDocument11 pagesWorld Credit Card Agreement and DisclosureMacrobiM Reklam Ajansı100% (1)

- Loan Agreement PDFDocument10 pagesLoan Agreement PDFgraye.scayleNo ratings yet

- D347 Web Cha 300Document17 pagesD347 Web Cha 300nodaysoffcryptoNo ratings yet

- Kohls Cardmember AgreementDocument3 pagesKohls Cardmember AgreementADEDAMOPE ODUESONo ratings yet

- CC tnc1Document2 pagesCC tnc1rinku.markaNo ratings yet

- Milestone® Gold Mastercard® The Bank of Missouri: Interest Rates and Interest ChargesDocument4 pagesMilestone® Gold Mastercard® The Bank of Missouri: Interest Rates and Interest ChargesMatthew BassNo ratings yet

- Airmiles World Elite enDocument56 pagesAirmiles World Elite enmahmoud jalloulNo ratings yet

- Cardholder AgreementDocument12 pagesCardholder Agreementbethanyhurst1024No ratings yet

- CC TNCDocument2 pagesCC TNCDaxesh ShahNo ratings yet

- MyECP Terms and ConditionsDocument1 pageMyECP Terms and Conditionsgoyneser1No ratings yet

- Go2bankdaa PDFDocument44 pagesGo2bankdaa PDFJose FernandezNo ratings yet

- Cibc Bank Usa Smart Account Agreements and DisclosuresDocument29 pagesCibc Bank Usa Smart Account Agreements and Disclosureshino hinxNo ratings yet

- Terms & Conditions of PayPal CreditDocument23 pagesTerms & Conditions of PayPal CreditL.E.A.D Holding LLCNo ratings yet

- Choice - Mercury Commercial Debit Card AgreementDocument7 pagesChoice - Mercury Commercial Debit Card Agreementfulbert.nguessanNo ratings yet

- Discover Card ApplicationDocument6 pagesDiscover Card ApplicationAnthony ANTONIO TONY LABRON ADAMSNo ratings yet

- Boa CardDocument5 pagesBoa Cardapi-285069637100% (1)

- PayPal Debit MasterCard® Cardholder AgreementDocument15 pagesPayPal Debit MasterCard® Cardholder Agreementb8m467bqnnNo ratings yet

- Cardmember Agreement Rates and Fees TableDocument15 pagesCardmember Agreement Rates and Fees TableMatt D FNo ratings yet

- Nfcu AgreementsDocument2 pagesNfcu Agreements4rz6n7f5k2No ratings yet

- CC DCBDocument7 pagesCC DCBHugo DivalNo ratings yet

- ChaseDocument4 pagesChaseemilybella822No ratings yet

- Newtek Bank, N.A.: Member FDICDocument30 pagesNewtek Bank, N.A.: Member FDICjoshuaharaldNo ratings yet

- Credit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsFrom EverandCredit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsNo ratings yet

- The Specific Relief Act of Bangladesh 1Document6 pagesThe Specific Relief Act of Bangladesh 1Shovon50% (2)

- What Is The Point of Commercial LawDocument24 pagesWhat Is The Point of Commercial LawkbenkheddaNo ratings yet

- 9 Bughaw, Jr. vs. Treasure Island Industrial CorporationDocument22 pages9 Bughaw, Jr. vs. Treasure Island Industrial CorporationjoyeduardoNo ratings yet

- G.R. No 162308 G&M Phils Vs CuambotDocument13 pagesG.R. No 162308 G&M Phils Vs CuambotLala ReyesNo ratings yet

- FIFA Statutes (2004 Edition)Document37 pagesFIFA Statutes (2004 Edition)Blue LouNo ratings yet

- Prospecto El Salvador Eurosv2035Document80 pagesProspecto El Salvador Eurosv2035Karla AlvarengaNo ratings yet

- China Banking Corporation v. BorromeoDocument3 pagesChina Banking Corporation v. BorromeoTeff QuibodNo ratings yet

- Module-II: Arbitration Governed Under Part-IDocument81 pagesModule-II: Arbitration Governed Under Part-IAyush BakshiNo ratings yet

- TEMP TifDocument3 pagesTEMP TifMateusz DorobekNo ratings yet

- De La Salle Vs de La Salle EmployeesDocument14 pagesDe La Salle Vs de La Salle EmployeesJay RibsNo ratings yet

- E-Notes - Political Science - Unit-3Document24 pagesE-Notes - Political Science - Unit-3Kanu Priya GuptaNo ratings yet

- Amity Law School, Noida: Conciliation and MediationDocument20 pagesAmity Law School, Noida: Conciliation and Mediationaakarsh07chauhanNo ratings yet

- Case Brief ArbitrationDocument10 pagesCase Brief ArbitrationishikaNo ratings yet

- ADR AssignmentDocument7 pagesADR AssignmentVishwas AgarwalNo ratings yet

- Constitution OF: Draft LimitedDocument24 pagesConstitution OF: Draft LimitedChristopher AiyapiNo ratings yet

- 2015 (G.R. No. 192947, de Ocampo V RPN-9) PDFDocument8 pages2015 (G.R. No. 192947, de Ocampo V RPN-9) PDFFrance SanchezNo ratings yet

- Am-Phil Food Concepts, Inc. vs. Paolo Jesus T. PadillaDocument8 pagesAm-Phil Food Concepts, Inc. vs. Paolo Jesus T. PadillaaldinNo ratings yet

- Business Law - Exam Part IDocument8 pagesBusiness Law - Exam Part IPhuongRabbit IouNo ratings yet