Fatty Alcohol

Fatty Alcohol

Uploaded by

S Tunkla EcharojCopyright:

Available Formats

Fatty Alcohol

Fatty Alcohol

Uploaded by

S Tunkla EcharojCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Fatty Alcohol

Fatty Alcohol

Uploaded by

S Tunkla EcharojCopyright:

Available Formats

Fatty Alcohol

Long chain aliphatic alcohols are manufactured by a number of processes, but these can be divided into two general categories: Oleochemical - the feedstocks for the most common oleochemical-based processes include plant or animal based oils or fats: coconut, palm kernel oil and tallow fat, or other triglycerides. And: Petrochemical - the most commonly used processes use different petroleum-based feedstocks - olefins (alpha and internal), ethylene, and propylene oligomers. Some commercially available products are blends of two or more specific chain length alcohols to produce mixtures. Different manufacturing methods can lead to different compositional profiles. There are two major commercial processes for converting oleochemicals to alcohols: Methyl ester hydrogenation coconut and palm kernel oils and tallow fat are the major feedstocks for this route to alcohols. The triglycerides that compose the major raw materials are first subject to transesterification with excess methanol using an alkaline catalyst. The resulting fatty acid methyl esters are subject to distillation and then may be converted to alcohols by hydrogenation. And: Fatty acid hydrogenation this process involves the hydrolysis of fats and oils to the corresponding fatty acids followed by the direct catalytic hydrogenation to alcohols. Alcohols manufactured by oleochemical processes have a linear structure and an evennumbered carbon chain usually in the range C 6 to C22. Some members of this category may contain unsaturated primary alcohols. The commercial processes generally used for converting petrochemical feedstocks to alcohols are: From ethylene via the Ziegler process like the alcohols manufactured by oleochemical processes those derived from ethylene via Ziegler chemistry have a linear structure and an even-numbered carbon chain usually in the range C 6 to C22. And: From olefins via OXO and modified-OXO synthesis - the olefin precursors may be linear alpha-olefins (1-alkenes), or linear internal olefins, or mixtures of the two and are reacted with mixture of carbon monoxide and hydrogen. The alcohols produced have one more carbon than the olefin feed and consist of linear alcohols and their corresponding mono C 2-alkyl isomers (predominantly methyl) and may fall in the range C7 C17, contain even and odd numbered carbon chains. The proportion of linear alcohols ranges from approximately 90 to 50% depending on the feed selection and type of OXO process. http://www.aciscience.org/Oleochemical/FattyAlcohol.aspx

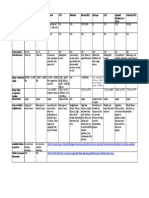

Fatty Alcohols Market Reels From Oversupply, Weak Demand 28 October 2002 00:00 [Source: ICB Americas] The fatty alcohols market is feeling the effects of sliding prices because of overcapacity and weak demand in the wake of a soft economy. Global prices for fatty alcohols in 2002 have plunged by 10 to 15 percent below 2001 price levels. Meanwhile, rising feedstock costs on the oleochemicals side are pressuring natural fatty alcohols producers to increase their prices in an effort to correct a significant price slide in fatty alcohols

during the past 12 to 18 months. On the synthetic side, producers had already announced closures of alcohol facilities to help ease up the market. Procter & Gamble (P&G) Chemicals is among the producers who upped their fatty alcohols pricing in the fourth quarter. In an effort to stem the tide of ebbing margins, the company raised prices for their fatty alcohols in North America by 4 cents per pound. "The overcapacity situat ion and raw material costs have led to weak pricing for fatty alcohol," says Norman Ellard, global sales, P&G Chemicals. Cognis Corp. also announced a global price increase for its fatty al cohols products, effective October 1. The company raised pricing in North America by 3 cents to 5 cents per pound, citing rising costs in raw materials, insurance, security, energy, fuel and higher transportation costs. "Alcohol prices, after peaking in 20 00 in concert with world economic activity, declined as overall manufacturing growth slowed and buyers anticipated new capacity additions," says a Cognis official. "Historically, low raw material costs have also encouraged more natural alcohol production worldwide, which also pressured prices." No price increases were noted on the synthetic side of the market. However, the fatty alcohols industry is anticipating cuts of around 160,000 tons of synthetic alcohol capacity this quarter by BP Chemicals and Shell Chemicals Ltd. BP's plan to exit the linear alcohols industry this year has forced the company to permanently shut down its lone 60,000 ton-per-year alcohol production at Pasadena, Tex., in the fourth quarter. BP says the shutdown will enable the company to focus the plant's operation on linear alpha olefin production. Shell recently idled 100,000 tons per year of Neodol alcohol capacity at its Geismar, La., facility for an indefinite time. According to Shell, the reduction in capacity will not impact the company's ability to supply its customers' needs. Industry observers believe that unless further ca pacity cuts are made, getting to historical price levels in the alcohols market will be difficult, especially given recent global capacity expansions and continued weak demand. Recent capacity expansions in both synthetic and natural alcohols have put the market in oversupply by as much as 300,000 tons, says P&G's Mr. Ellard. A new 150,000 tons-per-year synthetic alcohol capacity from Shell came on stream in midyear. At the same time, Kao Corp. of Japan started its

newly expanded 165,000 tons-per-year natural fatty alcohols plant in Malaysia. The annual production capacity of the site has been upgraded by 50,000 tons. Meanwhile, Sasol recently commissioned a new 120,000 ton-per-year coal-based oxo alcohols plant in South Africa. The company plans to introduce the new product into the market in November. In Asia, an expansion of around 200,000 tons of lauric oil-based fatty alcohols capacity is still under consideration for the next two to three years, despite current market conditions. If pushed through, global fatty alcohols capacity is expected to be around 2.6 million tons by 2005, with capacity utilization projected at around 75 percent, says one observer. Excluding the newly started capacities, global fatty alcohols capacity for 2002 is estimated at around 2.1 million tons. Europe is said to hold 36 percent, followed by North America with 33 percent and Asia with 31 percent. Current global capacity utilization is estimated at around less than 80 percent, says one observer. In 2000, global utilization was in the mid-90 percent range, while last year it fell to the low 80-percent range. However, fatty alcohols demand growth is still projected at an average of 3 percent per year or less. "The alcohol market is anticipated to average slightly less than worldwide gross domestic product over the next 10 years," says Mike Clark, global sales and marketing manager , alcohols, Sasol Olefins and Surfactants. Producers expect fatty alcohols pricing to stabilize or firm slightly in 2003 as potential raw material price increases for both synthetic and natural fatty alcohols loom. Lauric oils are projected to tighten next year, as global vegetable oils supply is forecasted to decline to a historically low level. Meanwhile, troubles brewing in the Middle East are forcing producers to monitor crude oil prices, which could further pressure fatty alcohols prices. Prices for mid-cut fatty alcohols are currently placed at around $900 to $1200 per ton.

You might also like

- Richard M. Stephenson, Stanislaw Malanowski (Auth.) - Handbook of The Thermodynamics of Organic Compounds-Springer Netherlands (1987)Document560 pagesRichard M. Stephenson, Stanislaw Malanowski (Auth.) - Handbook of The Thermodynamics of Organic Compounds-Springer Netherlands (1987)Andina Indah SekararumNo ratings yet

- Chemicals Zetag DATA Inverse Emulsions Zetag 8868 FS - 0410Document2 pagesChemicals Zetag DATA Inverse Emulsions Zetag 8868 FS - 0410PromagEnviro.comNo ratings yet

- Techno-Economic Assessment About Propylene GlycolDocument4 pagesTechno-Economic Assessment About Propylene GlycolIntratec SolutionsNo ratings yet

- Midterm 2018 (Manufacturing)Document1 pageMidterm 2018 (Manufacturing)S Tunkla EcharojNo ratings yet

- Boiler Capacity: Ton/hour Is The Amount of Heat (At 100C) That Can Change Water To Stream (In 1 Hour)Document23 pagesBoiler Capacity: Ton/hour Is The Amount of Heat (At 100C) That Can Change Water To Stream (In 1 Hour)S Tunkla EcharojNo ratings yet

- Misconceptions and Repeated Mistakes Document: DR - Nihal GabrDocument30 pagesMisconceptions and Repeated Mistakes Document: DR - Nihal Gabrbody fayezNo ratings yet

- Higher Alcohols To 2025PRDocument5 pagesHigher Alcohols To 2025PRaabid_chem3363No ratings yet

- CRNM Trade Brief Volume 15Document6 pagesCRNM Trade Brief Volume 15Office of Trade Negotiations (OTN), CARICOM SecretariatNo ratings yet

- Draft Progress Report 110919Document24 pagesDraft Progress Report 110919Suraya JohariNo ratings yet

- Fatty Alcohol Production ProcessDocument9 pagesFatty Alcohol Production ProcessZevaniNo ratings yet

- Alcohols, Higher Aliphatic, SurveyDocument26 pagesAlcohols, Higher Aliphatic, SurveyEmmanuel Chang100% (1)

- Fatty AlcoolDocument16 pagesFatty AlcoolAnamaria UrsuNo ratings yet

- Natural Alcohols ManufactureDocument17 pagesNatural Alcohols ManufactureTheia EosNo ratings yet

- Emery Oleo Chemicals - NEWS .Document6 pagesEmery Oleo Chemicals - NEWS .Mohd ZulazreenNo ratings yet

- Production of Ethanol: Project Year 1Document16 pagesProduction of Ethanol: Project Year 1gongweejie93100% (2)

- Acetic AcidDocument8 pagesAcetic AcidMohammedRahimNo ratings yet

- Oleochemicals 2011Document3 pagesOleochemicals 2011Doris de GuzmanNo ratings yet

- Alcohols, Higher Aliphatic, Synthetic ProcessesDocument21 pagesAlcohols, Higher Aliphatic, Synthetic ProcessesEmmanuel ChangNo ratings yet

- Using Technology To Increase Middle Distillate Production-EnglishDocument6 pagesUsing Technology To Increase Middle Distillate Production-Englishtapanpatni100% (1)

- Sugar Cane Ethanol Plant Best ParcticeDocument23 pagesSugar Cane Ethanol Plant Best ParcticeThiha Myat LwinNo ratings yet

- Draft Progress Report Group 1Document15 pagesDraft Progress Report Group 1Adreana AmirahNo ratings yet

- Visible Alpha Guide To Oil and Gas E&P KPIsDocument29 pagesVisible Alpha Guide To Oil and Gas E&P KPIsdeepikaNo ratings yet

- Economic Analysis and Technicalities of Acrylic Acid Production From Crude GlycerolDocument36 pagesEconomic Analysis and Technicalities of Acrylic Acid Production From Crude Glycerolİrem Demirci100% (1)

- JCL Presentation OPSI June 22 06Document31 pagesJCL Presentation OPSI June 22 06GrignionNo ratings yet

- Acrolein Design ProjectDocument13 pagesAcrolein Design ProjectPeter McCormack100% (1)

- ADRIANO-SALES - FIRJAM - Oleochemicals-from-Palm-Kernel-Oil Fatty Acid N Fatty Alkohol PDFDocument29 pagesADRIANO-SALES - FIRJAM - Oleochemicals-from-Palm-Kernel-Oil Fatty Acid N Fatty Alkohol PDFjayan perkasaNo ratings yet

- Liquefied Petroleum Gas Australia)Document4 pagesLiquefied Petroleum Gas Australia)bolayyyNo ratings yet

- Liquid BiofuelsDocument73 pagesLiquid BiofuelsJohn Kevin San JoseNo ratings yet

- Oxo Alcohols - IndiaDocument7 pagesOxo Alcohols - Indiascribd405No ratings yet

- 8 Consumer Detriment Report - Olive Oil October 2012Document4 pages8 Consumer Detriment Report - Olive Oil October 2012chetan nikamNo ratings yet

- Project Report On Heptaldehyde & Undecylenic Acid (C7 & C11) & Its DerivativesDocument8 pagesProject Report On Heptaldehyde & Undecylenic Acid (C7 & C11) & Its DerivativesEIRI Board of Consultants and PublishersNo ratings yet

- Acetaldehyde SsDocument26 pagesAcetaldehyde Sssangmesh shivpureNo ratings yet

- Chapt 01Document6 pagesChapt 01Jesus LucesNo ratings yet

- Propylene Glycol PDFDocument10 pagesPropylene Glycol PDFGovindanayagi PattabiramanNo ratings yet

- Indian Alcohol Brewaries Industry VCKDocument29 pagesIndian Alcohol Brewaries Industry VCKSubrata Sarkar100% (1)

- Oil Refining 04Document16 pagesOil Refining 04Patel Ashok100% (1)

- Feasibility Study of Epichlorohydrin ProductionDocument4 pagesFeasibility Study of Epichlorohydrin ProductionIntratec Solutions100% (1)

- Cellulosic Ethanol 2010Document2 pagesCellulosic Ethanol 2010Doris de GuzmanNo ratings yet

- The Changing World of OleochemicalsDocument9 pagesThe Changing World of OleochemicalsMarta Szymańska100% (1)

- 2012 PTQ q1Document132 pages2012 PTQ q1jainrakeshj4987No ratings yet

- Bs AssignmentDocument4 pagesBs AssignmentShweta SharmaNo ratings yet

- Ethanol Separation Process CalculationDocument25 pagesEthanol Separation Process CalculationTan Yong Chai100% (1)

- Refinery MarketDocument4 pagesRefinery MarketAsif KhanNo ratings yet

- Acrylic Acid Technical DataDocument39 pagesAcrylic Acid Technical DataJustine Joy SumobaNo ratings yet

- Future Success Strategies For Carbonated Soft Drinks (CSDS) 2010 EditionDocument14 pagesFuture Success Strategies For Carbonated Soft Drinks (CSDS) 2010 EditionHrushikesh ReddyNo ratings yet

- Visit The Vehicle Buyer's Guide (HTTP://WWW - Ccities.doe - Gov/vbg/) To Learn More About Light and Heavy-Duty Alternative Fuel Vehicles AvailableDocument3 pagesVisit The Vehicle Buyer's Guide (HTTP://WWW - Ccities.doe - Gov/vbg/) To Learn More About Light and Heavy-Duty Alternative Fuel Vehicles Availablerushibmr19785604No ratings yet

- Alcohol and Alcohol Based Industries, Alcoholic and Non Alcoholic Beverages, Fruit Juices, Whisky, Beer, Rum, Wine and Sugarcane Bye ProductsDocument8 pagesAlcohol and Alcohol Based Industries, Alcoholic and Non Alcoholic Beverages, Fruit Juices, Whisky, Beer, Rum, Wine and Sugarcane Bye Productsgdmurugan2k7No ratings yet

- Feasibility Study of Lactic Acid ProductionDocument4 pagesFeasibility Study of Lactic Acid ProductionIntratec SolutionsNo ratings yet

- Beer Production Research PaperDocument4 pagesBeer Production Research Paperafedsxmai100% (1)

- Final Repo PDDocument32 pagesFinal Repo PDMULAT DEGAREGENo ratings yet

- Ethanol India Brazil Mar11Document2 pagesEthanol India Brazil Mar11captrohitbNo ratings yet

- Biodiesel - LurgiDocument8 pagesBiodiesel - LurgiElżbieta SkrzyńskaNo ratings yet

- Acrolein-Market SurveyDocument4 pagesAcrolein-Market SurveyChristopher NicholsNo ratings yet

- Bioethanol III SCAgrupis PDFDocument27 pagesBioethanol III SCAgrupis PDFRyan Bacarro BagayanNo ratings yet

- Surfactants For Industrial ApplicationsDocument24 pagesSurfactants For Industrial ApplicationsIgor Sanchez100% (3)

- Coca-Cola Strategies - 108 - 126 Project ReportDocument43 pagesCoca-Cola Strategies - 108 - 126 Project Report2K19/BBA/108 SIDHARTH GUPTANo ratings yet

- World Market Analysis of GlycerineDocument44 pagesWorld Market Analysis of GlycerineSyamala AriyanchiraNo ratings yet

- Comparative Life Cycle Assessment of Malt-Based Beer and 100% Barley BeerDocument66 pagesComparative Life Cycle Assessment of Malt-Based Beer and 100% Barley BeerWajahat WarraichNo ratings yet

- CaprolactamDocument4 pagesCaprolactamArchie HisolerNo ratings yet

- Trends in Biotechnological Production of Fuel Ethanol From Different FeedstocksDocument26 pagesTrends in Biotechnological Production of Fuel Ethanol From Different FeedstocksPatricio LeonardoNo ratings yet

- EthanolDocument2 pagesEthanolsanjayshah99No ratings yet

- Solar Powered Agro Industrial Project of Cassava Based Bioethanol Processing UnitFrom EverandSolar Powered Agro Industrial Project of Cassava Based Bioethanol Processing UnitNo ratings yet

- Ethyl Alcohol World Summary: Market Values & Financials by CountryFrom EverandEthyl Alcohol World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Basic Inorganic Chemicals World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Basic Inorganic Chemicals World Summary: Market Values & Financials by CountryNo ratings yet

- Invitation Letter For Investment Into The CompanyDocument2 pagesInvitation Letter For Investment Into The CompanyS Tunkla Echaroj50% (2)

- Facile Preparation of Graphene Oxide Membranes For Gas SeparationDocument8 pagesFacile Preparation of Graphene Oxide Membranes For Gas SeparationS Tunkla EcharojNo ratings yet

- CL - 2010 Marin INTECH - Strategic - Priorities - and - Lean - Manufacturing - Practices - in - Automotive - Suppliers PDFDocument14 pagesCL - 2010 Marin INTECH - Strategic - Priorities - and - Lean - Manufacturing - Practices - in - Automotive - Suppliers PDFS Tunkla EcharojNo ratings yet

- cm5b04475 Si 001 PDFDocument7 pagescm5b04475 Si 001 PDFS Tunkla EcharojNo ratings yet

- Thermodynamics 2Document29 pagesThermodynamics 2S Tunkla EcharojNo ratings yet

- Fully Dispersed RH Ensemble Catalyst To Enhance Low-Temperature ActivityDocument23 pagesFully Dispersed RH Ensemble Catalyst To Enhance Low-Temperature ActivityS Tunkla EcharojNo ratings yet

- Practice Test: Question Set - 07: Correct AnswerDocument8 pagesPractice Test: Question Set - 07: Correct AnswerS Tunkla EcharojNo ratings yet

- Kinetic Modelling Studies of Heterogeneously Catalyzed Biodiesel Synthesis Reactions Ankur Kapil, Karen Wilson, Adam F Lee, Jhuma SadhukhanDocument42 pagesKinetic Modelling Studies of Heterogeneously Catalyzed Biodiesel Synthesis Reactions Ankur Kapil, Karen Wilson, Adam F Lee, Jhuma SadhukhanS Tunkla EcharojNo ratings yet

- Evaluation of Fruit Peels For Ethanol ProductionDocument1 pageEvaluation of Fruit Peels For Ethanol ProductionS Tunkla EcharojNo ratings yet

- As1 Sol (Thermodynamics)Document2 pagesAs1 Sol (Thermodynamics)S Tunkla EcharojNo ratings yet

- Bpsmail - Patana.ac - TH OWA Ae Item&t IPM - Note&id RgAAAABDocument3 pagesBpsmail - Patana.ac - TH OWA Ae Item&t IPM - Note&id RgAAAABS Tunkla EcharojNo ratings yet

- Catalyst BR Nsted Acid Lewis Acid Lewis AcidDocument1 pageCatalyst BR Nsted Acid Lewis Acid Lewis AcidS Tunkla EcharojNo ratings yet

- Retirement/Replacement DecisionsDocument33 pagesRetirement/Replacement DecisionsS Tunkla EcharojNo ratings yet

- Project Description (Elecpro)Document21 pagesProject Description (Elecpro)S Tunkla EcharojNo ratings yet

- Determination of DODocument5 pagesDetermination of DOTimothy LaiNo ratings yet

- Unit 11 (Ethers) PDFDocument9 pagesUnit 11 (Ethers) PDFManjil SthaNo ratings yet

- Emergency Escape Solutions Brochure - EMEAI (EN - Rev4)Document24 pagesEmergency Escape Solutions Brochure - EMEAI (EN - Rev4)Rafael FonsecaNo ratings yet

- BSPD5500 2018 FlierDocument1 pageBSPD5500 2018 FlierO VishaikNo ratings yet

- Assignment#1: Water Engineering CEE-307Document7 pagesAssignment#1: Water Engineering CEE-307Muhammad ShahzaibNo ratings yet

- PWHT of Dissimilar: Metal WeldsDocument48 pagesPWHT of Dissimilar: Metal WeldswchavezbNo ratings yet

- I. Multiple Choice Questions (Type-I) : S F P FDocument12 pagesI. Multiple Choice Questions (Type-I) : S F P FAditya SallyNo ratings yet

- Quartz GroupDocument10 pagesQuartz GroupJICA DE LA CRUZNo ratings yet

- Principles of Medicinal Chemistry 1Document14 pagesPrinciples of Medicinal Chemistry 1J'mhaeGamboaNo ratings yet

- Specification For General Requirements For Steel Plates For Pressure VesselsDocument34 pagesSpecification For General Requirements For Steel Plates For Pressure Vesselsedisson_barreraNo ratings yet

- General Biology 1: Quarter I - Module 7 Biological Molecules-EnzymesDocument27 pagesGeneral Biology 1: Quarter I - Module 7 Biological Molecules-EnzymesJohn Joseph Jalandoni75% (4)

- Merged Heat BalanceDocument56 pagesMerged Heat Balancehmaza shakeel100% (2)

- Department ofDocument13 pagesDepartment ofAmal ANo ratings yet

- 9th Chemistry Full BookDocument2 pages9th Chemistry Full BookCRO TJSSNo ratings yet

- K100 Application InstructionsDocument11 pagesK100 Application InstructionsHelen A. Rusinoff100% (1)

- Why Does Copper Not React With Nitrogen?: ChemistryDocument2 pagesWhy Does Copper Not React With Nitrogen?: ChemistryDoaa NassarNo ratings yet

- D3703 22556Document5 pagesD3703 22556Hamid HamidNo ratings yet

- 3.7 EmpiricalformulaDocument6 pages3.7 EmpiricalformulaBenedict John RocilloNo ratings yet

- Xiameter 6300 VtmoDocument2 pagesXiameter 6300 VtmoDR.BIYANINo ratings yet

- Production of 100 MTPD of Oxirane by Epoxidation of EthyleneDocument8 pagesProduction of 100 MTPD of Oxirane by Epoxidation of EthyleneAsad RazaNo ratings yet

- CSA G40.21 50W or Metric 350W Class H Submittal SheetDocument2 pagesCSA G40.21 50W or Metric 350W Class H Submittal SheetKusmayana NuryadiNo ratings yet

- Product Brochure Riken Keiki SP-220Document4 pagesProduct Brochure Riken Keiki SP-220Anticristh6666No ratings yet

- Bab 2 Pengukuran Dan Estimasi Volume Molar Serta Densitas Cairan Pada Berbagai TemperaturDocument11 pagesBab 2 Pengukuran Dan Estimasi Volume Molar Serta Densitas Cairan Pada Berbagai TemperaturMarshanda IraNo ratings yet

- Revision & High-Level Exercises in Chemistry, Egyptian Curriculum, 1 Sec, For Chemistry Teacher Andrew Medhat 2023-2024Document70 pagesRevision & High-Level Exercises in Chemistry, Egyptian Curriculum, 1 Sec, For Chemistry Teacher Andrew Medhat 2023-2024yassin.study2008No ratings yet

- Edited - Sanaa Anderson - Copy of Counting Atoms1 - WorksheetDocument1 pageEdited - Sanaa Anderson - Copy of Counting Atoms1 - WorksheetSanaa AndersonNo ratings yet

- Chelating AgentsDocument26 pagesChelating AgentsUmesh BabuNo ratings yet

- Chapter.5 MethodologyDocument14 pagesChapter.5 MethodologyUmesh PrajapatiNo ratings yet