(Corporate Finance) Practice Questions - Week 13 Derivatives

Uploaded by

kashan khan(Corporate Finance) Practice Questions - Week 13 Derivatives

Uploaded by

kashan khan[Corporate Finance]

Practice Questions - Week 13

Derivatives

1. An investor enters into a short forward contract to sell 100,000 British pounds for US

dollars at an exchange rate of 1.5000 US dollars per pound. How much does the investor

gain or lose if the exchange rate at the end of the contract is (a) 1.4900 and (b) 1.5200?

2. A trader enters into a short cotton futures contract when the futures price is 50 cents per

pound. The contract is for the delivery of 50,000 pounds. How much does the trader gain

or lose if the cotton price at the end of the contract is (a) 48.20 cents per pound and (b)

51.30 cents per pound?

3. Suppose that a March call option on a stock with a strike price of $50 costs $2.50 and is

held until March. Under what circumstances will the holder of the option make a gain?

Under what circumstances will the option be exercised? Draw a diagram showing how

the profit on a long position in the option depends on the stock price at the maturity of the

option.

You might also like

- Solutions for Options Futures and Other Derivatives 11th Edition by HullNo ratings yetSolutions for Options Futures and Other Derivatives 11th Edition by Hull15 pages

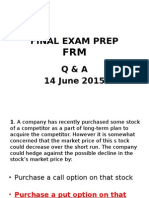

- FRM Financial Markets and Products Test 1No ratings yetFRM Financial Markets and Products Test 19 pages

- Futures Trading Strategies: Enter and Exit the Market Like a Pro with Proven and Powerful Techniques For ProfitsFrom EverandFutures Trading Strategies: Enter and Exit the Market Like a Pro with Proven and Powerful Techniques For Profits1/5 (1)

- Questions For Tutorials Topic: DerivativesNo ratings yetQuestions For Tutorials Topic: Derivatives2 pages

- Suggested Solutions To Chapter 8 Problems: NswerNo ratings yetSuggested Solutions To Chapter 8 Problems: Nswer5 pages

- Suggested Solutions To Chapter 8 Problems: NswerNo ratings yetSuggested Solutions To Chapter 8 Problems: Nswer5 pages

- Chapter 7 Futures and Options On Foreign Exchange Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsNo ratings yetChapter 7 Futures and Options On Foreign Exchange Suggested Answers and Solutions To End-Of-Chapter Questions and Problems12 pages

- Answer - CHAPTER 7 FUTURES AND OPTIONS ON FOREIGN EXCHANGENo ratings yetAnswer - CHAPTER 7 FUTURES AND OPTIONS ON FOREIGN EXCHANGE7 pages

- Reading-30-Pricing-and-Valuation - CFA Level 2No ratings yetReading-30-Pricing-and-Valuation - CFA Level 212 pages

- Derivatives-Practice Questions-Students-BFSI-2020-21No ratings yetDerivatives-Practice Questions-Students-BFSI-2020-212 pages

- Financial-Derivatives-And-Risk-Management (Set 1)No ratings yetFinancial-Derivatives-And-Risk-Management (Set 1)21 pages

- Ty BFM - Financial Derivatives - InternalsNo ratings yetTy BFM - Financial Derivatives - Internals4 pages

- Derivatives and Related Accounting IssuesNo ratings yetDerivatives and Related Accounting Issues34 pages

- University Name Gujarat University Course Name MBA-Financial Services Semester 4No ratings yetUniversity Name Gujarat University Course Name MBA-Financial Services Semester 411 pages

- Commerce - Bcom Financial Markets - Semester 5 - 2023 - April - Financial Derivatives FD CbcgsNo ratings yetCommerce - Bcom Financial Markets - Semester 5 - 2023 - April - Financial Derivatives FD Cbcgs3 pages