Standalone Consolidated Audited Financial Results For The Year Ended March 31, 2011

Standalone Consolidated Audited Financial Results For The Year Ended March 31, 2011

Uploaded by

Santosh VaishyaCopyright:

Available Formats

Standalone Consolidated Audited Financial Results For The Year Ended March 31, 2011

Standalone Consolidated Audited Financial Results For The Year Ended March 31, 2011

Uploaded by

Santosh VaishyaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Standalone Consolidated Audited Financial Results For The Year Ended March 31, 2011

Standalone Consolidated Audited Financial Results For The Year Ended March 31, 2011

Uploaded by

Santosh VaishyaCopyright:

Available Formats

Polyplex Corporation Limited

Registered Office: Lohia Head Road, Khatima - 262308. Distt. Udham Singh Nagar, Uttarakhand, India.

AUDITED FINANCIAL RESULTS FOR THE YEAR ENDED MARCH 31, 2011 CONSOLIDATED

Year Ended 31.03.2011 31.03.2010

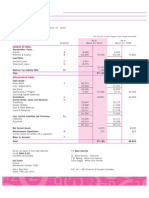

PARTICULARS 121801 499 122300 2. Expenditure (13710) 110317 908 14758 12144 8387 30307 163111 80917 1141 82058 4218 77840 63687 141527 7874 133653 0 133653 28096 105557 3198 161785 (4861) 67158 947 8967 7860 5988 19860 105919 16381 1731 18112 2483 15629 4 15633 1900 13733 0 13733 4334 9399 1599 64485 and Exceptional Items (1-2) 4. Other Income 5. Profit before Interest and Exceptional Items (3+4) 6. Interest (Net) 7. Profit after Interest but before Exceptional Items (5-6) 8. Exceptional Items 9. Profit / (Loss) from Ordinary Activities before Tax 10. Tax Expense 11. Net Profit / (Loss) from Ordinary Activities after Tax (9-10) 12. Extraordinary Items (Net of Tax expense) 13. Net Profit / (Loss) for the period (11-12) 14. Less: Minority Interest 15. Profit after Tax and Minority Interest (13-14) 16. Paid-up equity share capital (Face value ` 10/- each) 17. Reserves excluding revaluation reserves 18. Earnings Per Share (EPS) before & after Extraordinary Items (in `) Not Annualised (Ref. note no. 5 of Consolidated Results & note no. 7 of Standalone Results): 330.03 330.03 16974066 53.07% 29.39 29.26 8487033 53.07% a) Basic b) Diluted 19. Public Shareholding - No. of shares - Percentage of Shareholding 20. Promoters and promoter group Shareholding a) Pledged/Encumbered Nil Nil Nil Nil Nil Nil - Number of shares - Percentage of shares (as a % of the total shareholding of promoter and promoter group) - Percentage of shares (as a % of the total share capital of the company) b) Non-encumbered 15010534 100.00% 46.93% 7505267 100.00% 46.93% - Number of Shares - Percentage of shares (as a % of the total shareholding of promoter and promoter group) - Percentage of shares (as a % of the total share capital of the company) 15010534 100.00% 46.93% 7505267 100.00% 46.93% Nil Nil Nil Nil Nil Nil 16974066 53.07% 8487033 53.07% 55.19 55.19 18.75 18.67 4089 28620 3500 25120 0 25120 7467 17653 0 17653 0 17653 3198 28570 7519 8571 849 7722 4 7726 1728 5998 0 5998 0 5998 1599 16237 a) Decrease/(Increase) in stock in trade b) Consumption of raw materials c) Purchase of traded goods d) Power & Fuel e) Staff Cost f) Depreciation g) Other expenditure Total 3. Profit from Operations before Other Income, interest (4306) 46771 908 7961 4700 3221 10727 69982 24531 (1250) 14822 947 2259 1843 1037 3796 23454 1052 1.a) Net Sales / Income from Operations b) Other Operating Income Total AUDITED 243332 696 244028

STANDALONE

Year Ended 31.03.2011 31.03.2010

AUDITED 94351 162 94513 24155 351 24506

STATEMENT OF ASSETS AND LIABILITIES CONSOLIDATED

As at 31.03.2011 31.03.2010

PARTICULARS Shareholders Funds: 3,256 157,306 58,782 72,833 4,282 296,459 149,970 2,847 0 43,634 33,244 86,078 17,113 24,954 11,473 143,642 296,459 1,657 64,567 20,988 85,396 2,951 175,559 138,827 10 18 21,634 17,552 12,930 9,305 19,937 4,780 36,704 175,559 a) Capital b) Reserves & Surplus Minority Interest Loan Funds Deferred Tax Liability SOURCES OF FUNDS Fixed Assets Investments Foreign Currency Monetary Item Translation Difference Current Assets, Loans & Advances: a) Inventories b) Sundry Debtors c) Cash & Bank Balances d) Loans & Advances Less: Current Liabilities & Provisions a) Liabilities b) Provisions Net Current Assets Application of Funds 9,038 11,093 15,239 78,235 6,386 4,619 4,652 66,593 13,823 7,656 758 13,133 6,013 2,203 1,045 6,396 3,256 28,570 0 42,128 4,281 78,235 60,580 2,416 0 1,657 16,237 0 45,748 2,951 66,593 59,917 2,006 18 AUDITED

STANDALONE

As at 31.03.2011 31.03.2010

AUDITED

Notes: Consolidated Results 1. Figures have been regrouped wherever necessary. 2. Consolidated Financial Results include the results of the following subsidiaries Polyplex (Asia) Pte Ltd. (PAPL), Polyplex (Thailand) Public Company Ltd. (PTL), Polyplex (Singapore) Pte Ltd. (PSPL), Polyplex Europa Polyester Film Sanayi Ve Ticaret A. S. (Polyplex Europa), Polyplex (Americas) Inc. (P .A.) and Polyplex Trading (Shenzhen) Company Ltd. (PTSL). 3. Current Year figures are not comparable with Previous Year figures due to startup of operations at Bazpur plant in India and CPP Film Project in Thailand during the quarter ended March, 2010. 4. Exceptional item for the Year ended March, 2011 represents gain on account of sale of part of stake by PAPL in PTL. 5. The Company has issued and allotted 1,59,92,300 equity shares of the face value of ` 10 each on December 28, 2010 as Bonus Shares by capitalizing Securities Premium Account. Consequently the comparative EPS figures in all the cases have been recalculated giving effect of the issue of Bonus shares, as required by Accounting Standard (AS 20). 6. The following Projects are under implementation by the subsidiaries of the Company: Project Thin PET Film Line, & Metallizer PET Chips Plant Thick PET Film Line & PET Chips Plant Silicon Coating Line 7. Location Corlu, Turkey Corlu, Turkey Rayong, Thailand Rayong, Thailand Status Relocated to North America Progressing satisfactorily Progressing satisfactorily Start up in Q2, 2011-12

The above results have been approved by the Board in its meeting held on May 30, 2011.

Notes: - Standalone Results 1) Figures have been regrouped wherever necessary. 2) The Company does not have more than one reportable segment. Accordingly, pursuant to Accounting Standard (AS 17) on Segment Reporting, segmental information is not required to be provided. 3) Current Year figures are not comparable with Previous Year due to startup of operations at Bazpur plant during the quarter ended March, 2010. 4) Treatment of Foreign Exchange Fluctuation has been done as per MCA Notification No. GSR 225(E) dated March 31, 2009. 5) Exchange (gain) / loss on derivatives relating to acquisition of depreciable fixed assets is treated as carrying cost of assets. 6) `Other Income' for the year ended March 2011 includes ` 3537 Lacs (Previous Year ` 6881 Lacs) on account of dividend received from subsidiaries. 7) The Company has issued and allotted 1,59,92,300 equity shares of Rs.10/- each on December 28, 2010 as Bonus Shares by capitalizing Securities Premium Account. Consequently, the comparative EPS figures in all the periods above have been recalculated after giving effect of issue of Bonus shares, as required by Accounting Standard (AS - 20). 8) The Board of Directors have proposed Final Dividend @ ` 7/- per share (of the face value of ` 10/- each) for the Financial Year 2010-11, subject to approval of shareholders in the ensuing Annual General Meeting. 9) The following Projects are under implementation: a) Conversion of the First PET Film Line into Specialties/Thick Film Line at Khatima, Uttarakhand. b) Additional Metallizer at Bazpur, Uttarakhand. 10) Details of no. of investor complaints for the quarter ended March, 2011: Beginning - 3, Received - 5, Disposed of - 8 and Pending - Nil. 11) These results were reviewed by the Audit Committee and have been approved by the Board in its meeting held on May 30, 2011.

Place: NOIDA Date: May 30, 2011

Pranay Kothari Executive Director

You might also like

- A Vendor May Have Multiple Bank Accounts and May Want You To MakeDocument18 pagesA Vendor May Have Multiple Bank Accounts and May Want You To MakeSantosh Vaishya67% (3)

- Chapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Document44 pagesChapter 31 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din SheryarNo ratings yet

- Example - 1 - Using FM - MASTER - IDOC - DISTRIBUTEDocument30 pagesExample - 1 - Using FM - MASTER - IDOC - DISTRIBUTESantosh VaishyaNo ratings yet

- Chapter 9Document12 pagesChapter 9Cianne Alcantara100% (2)

- Dabur Balance SheetDocument30 pagesDabur Balance SheetKrishan TiwariNo ratings yet

- Supreme Infrastructure: Poised For Growth BuyDocument7 pagesSupreme Infrastructure: Poised For Growth BuySUKHSAGAR1969No ratings yet

- Sebi MillionsDocument3 pagesSebi MillionsShubham TrivediNo ratings yet

- Everest Industries Limited: Investor Presentation 29 April 2011Document12 pagesEverest Industries Limited: Investor Presentation 29 April 2011vejendla_vinod351No ratings yet

- Alok Result 30 Sept 2011Document24 pagesAlok Result 30 Sept 2011Mohnish KatreNo ratings yet

- Consolidated Balance Sheet: As at 31st December, 2011Document21 pagesConsolidated Balance Sheet: As at 31st December, 2011salehin1969No ratings yet

- Summit Bank Annual Report 2012Document200 pagesSummit Bank Annual Report 2012AAqsam0% (1)

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Bajaj Electrical Q1 FY2012Document4 pagesBajaj Electrical Q1 FY2012Tushar DasNo ratings yet

- Wipro Financial StatementsDocument37 pagesWipro Financial StatementssumitpankajNo ratings yet

- KFA Published Results March 2011Document3 pagesKFA Published Results March 2011Abhay AgarwalNo ratings yet

- ICI Pakistan Limited: Balance SheetDocument28 pagesICI Pakistan Limited: Balance SheetArsalan KhanNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- KFA - Published Unaudited Results - Sep 30, 2011Document3 pagesKFA - Published Unaudited Results - Sep 30, 2011Chintan VyasNo ratings yet

- 2009-10 Annual ResultsDocument1 page2009-10 Annual ResultsAshish KadianNo ratings yet

- Annual Report OfRPG Life ScienceDocument8 pagesAnnual Report OfRPG Life ScienceRajesh KumarNo ratings yet

- Tcl Multimedia Technology Holdings Limited TCL 多 媒 體 科 技 控 股 有 限 公 司Document18 pagesTcl Multimedia Technology Holdings Limited TCL 多 媒 體 科 技 控 股 有 限 公 司Cipar ClauNo ratings yet

- FS Final March31 2009Document29 pagesFS Final March31 2009beehajiNo ratings yet

- MSSL Results Quarter Ended 31st December 2011Document4 pagesMSSL Results Quarter Ended 31st December 2011kpatil.kp3750No ratings yet

- Consolidated Financial StatementsDocument78 pagesConsolidated Financial StatementsAbid HussainNo ratings yet

- 494.Hk 2011 AnnReportDocument29 pages494.Hk 2011 AnnReportHenry KwongNo ratings yet

- Biocon - Ratio Calc & Analysis FULLDocument13 pagesBiocon - Ratio Calc & Analysis FULLPankaj GulatiNo ratings yet

- QR Sept10Document1 pageQR Sept10Sagar PatilNo ratings yet

- Result Q-1-11 For PrintDocument1 pageResult Q-1-11 For PrintSagar KadamNo ratings yet

- Avt Naturals (Qtly 2011 03 31) PDFDocument1 pageAvt Naturals (Qtly 2011 03 31) PDFKarl_23No ratings yet

- Bil Quarter 2 ResultsDocument2 pagesBil Quarter 2 Resultspvenkatesh19779434No ratings yet

- Avt Naturals (Qtly 2010 03 31) PDFDocument1 pageAvt Naturals (Qtly 2010 03 31) PDFKarl_23No ratings yet

- Sebi MillionsDocument2 pagesSebi MillionsNitish GargNo ratings yet

- Avt Naturals (Qtly 2011 12 31) PDFDocument1 pageAvt Naturals (Qtly 2011 12 31) PDFKarl_23No ratings yet

- CFAP 6 AARS Summer 2018Document4 pagesCFAP 6 AARS Summer 2018shakilNo ratings yet

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysisSaema JessyNo ratings yet

- Avt Naturals (Qtly 2011 09 30) PDFDocument1 pageAvt Naturals (Qtly 2011 09 30) PDFKarl_23No ratings yet

- PI Industries Q1FY12 Result 1-August-11Document6 pagesPI Industries Q1FY12 Result 1-August-11equityanalystinvestorNo ratings yet

- NFL Results March 2010Document3 pagesNFL Results March 2010Siddharth ReddyNo ratings yet

- Assignments Semester IDocument13 pagesAssignments Semester Idriger43No ratings yet

- Accounts AssignmentDocument7 pagesAccounts AssignmentHari PrasaadhNo ratings yet

- Minmetals Land (230 HK) : Making The Right Moves But Doubts LingerDocument4 pagesMinmetals Land (230 HK) : Making The Right Moves But Doubts LingerChee Siang LimNo ratings yet

- Wipro AnalysisDocument20 pagesWipro AnalysisYamini NegiNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results For March 31, 2016 (Result)Document1 pageStandalone & Consolidated Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderNo ratings yet

- Subject - Analysis of Financial Statements. Topic-Project On Analysis of Financial Statements of "ITC LTD". Submitted To - Prof C.A Sanjay KatiraDocument46 pagesSubject - Analysis of Financial Statements. Topic-Project On Analysis of Financial Statements of "ITC LTD". Submitted To - Prof C.A Sanjay KatiraSabah MemonNo ratings yet

- Letter To Shareholders and Financial Results September 2012Document5 pagesLetter To Shareholders and Financial Results September 2012SwamiNo ratings yet

- NESTLE Financial Report (218KB)Document64 pagesNESTLE Financial Report (218KB)Sivakumar NadarajaNo ratings yet

- Hls Fy2010 Fy Results 20110222Document14 pagesHls Fy2010 Fy Results 20110222Chin Siong GohNo ratings yet

- Pak Elektron Limited: Condensed Interim FinancialDocument16 pagesPak Elektron Limited: Condensed Interim FinancialImran ArshadNo ratings yet

- PI Industries DolatCap 141111Document6 pagesPI Industries DolatCap 141111equityanalystinvestorNo ratings yet

- Alok - Performance Report - q4 2010-11Document24 pagesAlok - Performance Report - q4 2010-11Krishna VaniaNo ratings yet

- FM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocDocument6 pagesFM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocMaxine IgnatiukNo ratings yet

- Case Study - ACI and Marico BDDocument9 pagesCase Study - ACI and Marico BDsadekjakeNo ratings yet

- Avt Naturals (Qtly 2012 12 31)Document1 pageAvt Naturals (Qtly 2012 12 31)Karl_23No ratings yet

- Case Study 2021 Set BDocument4 pagesCase Study 2021 Set Bserge folegweNo ratings yet

- CPA IRELAND Accounting Framework April 07Document14 pagesCPA IRELAND Accounting Framework April 07Luke ShawNo ratings yet

- Standalone Financial Results, Auditors Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Auditors Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Balance Sheet: As at June 30,2011Document108 pagesBalance Sheet: As at June 30,2011Asfandyar NazirNo ratings yet

- FY11 - Investor PresentationDocument11 pagesFY11 - Investor Presentationcooladi$No ratings yet

- Financial Statements: Nine Months Ended 31 March, 2009Document22 pagesFinancial Statements: Nine Months Ended 31 March, 2009Muhammad BakhshNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Procedure Manual KSV5Document6 pagesProcedure Manual KSV5Santosh VaishyaNo ratings yet

- WIP Configuration SettingsDocument6 pagesWIP Configuration SettingsSantosh Vaishya75% (4)

- Journal Entry Adv GuideDocument48 pagesJournal Entry Adv GuideMoyosore OlajigaNo ratings yet

- Tugas GSLC Week 4Document2 pagesTugas GSLC Week 4JSKyungNo ratings yet

- CapbdgtDocument25 pagesCapbdgtmajidNo ratings yet

- Financial Statement Analysis by SACHIN SheoarinDocument19 pagesFinancial Statement Analysis by SACHIN Sheoarinsachin choudhary100% (1)

- IFP From ScotiaDocument11 pagesIFP From ScotiaForexliveNo ratings yet

- Disclosure of Subsidiaries With Non-Controlling Interest in Accordance With IFRS 12 Case of MaterialityDocument7 pagesDisclosure of Subsidiaries With Non-Controlling Interest in Accordance With IFRS 12 Case of Materialityabed abusalamehNo ratings yet

- FSA TutorialDocument3 pagesFSA TutorialCherno B BahNo ratings yet

- Derivatives Rollover Analysis Derivatives Rollover Analysis: May Series ViewDocument8 pagesDerivatives Rollover Analysis Derivatives Rollover Analysis: May Series ViewNehaKarunyaNo ratings yet

- Estimating WACCDocument21 pagesEstimating WACCShruti KhadeNo ratings yet

- Cash Flow Statement UDpdfDocument18 pagesCash Flow Statement UDpdfrizwan ul hassanNo ratings yet

- Olam in Muddy Waters: Case OverviewDocument14 pagesOlam in Muddy Waters: Case OverviewRae WoonNo ratings yet

- Private Equity International - 2017 PerspectivesDocument48 pagesPrivate Equity International - 2017 PerspectivesJim MacaoNo ratings yet

- Set of 15 Half Yearly Sample Papers For Class 11 Accountancy With SolutionsDocument225 pagesSet of 15 Half Yearly Sample Papers For Class 11 Accountancy With SolutionsMs.futuredoc ArmybpNo ratings yet

- Alternate Investment FundsDocument5 pagesAlternate Investment FundsJhansi DevarasettyNo ratings yet

- Abuscom:: Consolidated Financial Statements Subsequent To Date of AcquisitionDocument3 pagesAbuscom:: Consolidated Financial Statements Subsequent To Date of AcquisitionMarynelle SevillaNo ratings yet

- CSTUDY - Jul23 - BCOMFINMGT - CAPITAL BUDGETING ASSESSMENT 2BDocument3 pagesCSTUDY - Jul23 - BCOMFINMGT - CAPITAL BUDGETING ASSESSMENT 2BLeo-nahrd BooysenNo ratings yet

- Multi Finance Business Valuation-Case Study-141128Document20 pagesMulti Finance Business Valuation-Case Study-141128nelvyNo ratings yet

- EF343. FSM (AL-I) Solution CMA January-2024 Exam.Document6 pagesEF343. FSM (AL-I) Solution CMA January-2024 Exam.GT Moringa LimitedNo ratings yet

- 111 - Notes RatiosDocument4 pages111 - Notes RatiosCharlotteNo ratings yet

- Instant Access To (Ebook PDF) Industrial Organization Competition, Strategy and Policy 5th Ebook Full ChaptersDocument41 pagesInstant Access To (Ebook PDF) Industrial Organization Competition, Strategy and Policy 5th Ebook Full Chaptersgusticajab100% (6)

- A Presentation On Financial Statement Analysis of HulDocument16 pagesA Presentation On Financial Statement Analysis of HulArpita sarangiNo ratings yet

- Investment Quiz Test QNST and AnswerDocument9 pagesInvestment Quiz Test QNST and AnswerPrimrose Chisunga100% (1)

- Additional Notes - Chapter 5 - Overview of Risk and ReturnDocument7 pagesAdditional Notes - Chapter 5 - Overview of Risk and ReturnPaupauNo ratings yet

- CH 4 FIIMDocument32 pagesCH 4 FIIMsemahegn amareNo ratings yet

- Mutual Funds SummaryDocument13 pagesMutual Funds SummarysaraNo ratings yet

- Mergers Acquisition in BangladeshDocument29 pagesMergers Acquisition in BangladeshMD Sazzadur RahmanNo ratings yet

- Conclusion of Camel ModelDocument2 pagesConclusion of Camel ModelSanjeev PadhaNo ratings yet

- Introduction To FABM 2Document4 pagesIntroduction To FABM 2dharsy tadifaNo ratings yet

- Course Outline BA142Document4 pagesCourse Outline BA142Marinette Baquiran Dela FuenteNo ratings yet

- Assets: Café Richard Balance Sheet As at 31 December 2019 & 2020Document3 pagesAssets: Café Richard Balance Sheet As at 31 December 2019 & 2020Jannatul Ferdousi PrïtyNo ratings yet