Preparation of Income Tax Return Individual

Preparation of Income Tax Return Individual

Uploaded by

FRAULIEN GLINKA FANUGAOCopyright:

Available Formats

Preparation of Income Tax Return Individual

Preparation of Income Tax Return Individual

Uploaded by

FRAULIEN GLINKA FANUGAOOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Preparation of Income Tax Return Individual

Preparation of Income Tax Return Individual

Uploaded by

FRAULIEN GLINKA FANUGAOCopyright:

Available Formats

Preparation of Income Tax Return-Individual Taxpayer

A. Mimi Yuuuh, single mother with 3 children is a resident of P-22, Calinan, Davao City and is an

Employee of Buskupan Corporation with the following data for 2021:

Gross Compensation Income P450,000.00

Deductions made by the employer:

SSS Premiums Contributions 6,000.00

Philhealth Contributions 8,400.00

Pag-ibig Contributions 2,400.00

Union Dues 1,200.00

Income Tax Withheld 38,000.00

1. How much is her income tax payable?

2. Does she need to file an income tax return?

B. Mimi Yuuuh, married to Darryl Yuuuh who is a full-time house-husband taking care of their 3

children, a resident of P-22, Calinan, Davao City and is an Employee of Buskupan Corporation

and U-tube Plumbing, Inc. She received the following from the two companies for 2021:

Gross Compensation Income P450,000.00

Deductions made by the employer:

SSS Premiums Contributions 6,000.00

Philhealth Contributions 8,400.00

Pag-ibig Contributions 2,400.00

Union Dues 1,200.00

Income Tax Withheld 38,000.00

1. How much is her income tax payable?

2. Does she need to file an income tax return?

C. Spouses Jake and Amy provided the following data for the year:

Jake Amy Jake and Amy

Gross Income of Profession P800,000.00

Gross Compensation Income P400,000.00

Dividend Income

From Domestic corporation 5,000.00 5,000.00

From Resident Foreign corporation 12,000.00

Interest on Notes Receivable 4,000.00

Interest on Philippine Bank Deposit 2,000.00 3,000.00 6,000.00

Royalty Income 2,000.00

Miscellaneous Income 10,000.00 60,000.00

Capital Gain on sale of shares of 99, Co. 80,000.00

(Domestic Corp) sold directly to a buyer

Capital Loss on Sale of shares of Lakehouse, Co. (20,000.00)

(Domestic Corp) sold directly to buyer

Capital Gain on sale of land in Davao Occidental; 2,000,00.00

FMV-P12M, SP-P10M, Cost-P8M

Expenses, Business/Profession 425,000.00 20,000.00

Determine the following:

1. Total capital gain taxes paid by the spouses

2. Total final taxes paid on passive income by the spouses

3. Taxable Income of Jake and Income Tax Payable if they elect to file their income tax separately

4. Taxable Income of Amy and Income Tax Payable if they elect to file their income tax separately

5. Income tax payable if the spouses elect to file their taxes jointly.

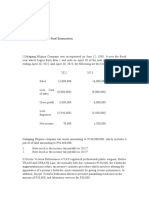

D. Quarterly Tax Returns

The following cumulative balances on income and expense in 2021 of Juan Dela Cruz were given

to you:

1st Quarter 2nd Quarter 3rd Quarter 4th

Quarter/Annual

Gross Sales P1,200,000.00 P2,100,000.00 P3,000,000.00 P3,700,000.00

Cost of Sales 700,000.00 1,200,000.00 1,800,000.00 2,200,000.00

Business 200,000.00 325,000.00 550,000.00 700,000.00

Expenses

Income Tax Paid on:

Interest 1,560.00 3,040.00 4,520.00 5,960.00

Income

Sale of Land 24,000.00 24,000.00 24,000.00 24,000.00

Dividend 10,000.00 10,000.00 20,000.00 20,000.00

received from

domestic corp

Interest Income from

BPI 2,000.00 4,000.00 6,000.00 8,000.00

UCPB 800.00 1,200.00 1,600.00 1,800.00

Metrobank 5,000.00 10,000.00 15,000.00 20,000.00

Capital Gain 80,000.00 80,000.00 80,000.00 80,000.00

sale of land

Selling Price: P400,000.00

Cost: P320,000.00

Using the above information, compute the following for 2021:

1. Income tax payable, first quarter

2. Income tax payable, second quarter

3. Income tax payable, third quarter

4. Income tax payable, fourth quarter

5. Final Tax on passive income

6. Capital Gains Tax

7. Prepare his 1st -3rd quarterly and annual income tax return with the following data:

a. TIN: 123-456-789-000

b. RDO: 113A

c. Registered Address: Purok 4, Crossing Bayabas, Toril, Davao City

d. Date of Birth: October 6, 1994

e. Email Address: jdc1994@gmail.com

f. Civil Status: Widower

E. Juan Dela Cruz is a Mixed Income Earner. He is a self-employed resident citizen and currently the

Finance Manager of Omega Corporation. The following data were provided for the taxable year

2021:

Compensation Income P1,800,000.00

Sales 2,800,000.00

Cost of Sales 1,125,000.00

Business Expenses 650,000.00

Interest Income from Peso Bank Deposit 80,000.00

Interest Income from bank deposit under FCDS 120,000.00

Gain on Sale of Land in the Philippines held as Capital asset with

cost of P1,500,000.00 when the zonal value is P1,200,000.00 500,000.00

Creditable Withholding Tax on Compensation Income 448,000.00

13th month pay and other benefits 150,000.00

Creditable Withholding Tax on Sale of Goods 28,000.00

8. How much is his total income tax expense assuming he opted to be taxed at 8%?

9. How much is the income tax payable of Juan for the year?

10. Prepare his income tax return with the following data:

g. TIN: 123-456-789-000

h. RDO: 113A

i. Registered Address: Purok 4, Crossing Bayabas, Toril, Davao City

j. Date of Birth: October 6, 1994

k. Email Address: jdc1994@gmail.com

l. Civil Status: Widower

You might also like

- TAXDocument10 pagesTAXJeana Segumalian100% (3)

- Ebook PDF Criminal Justice in Action 9th Edition by Larry K Gaines PDFDocument41 pagesEbook PDF Criminal Justice in Action 9th Edition by Larry K Gaines PDFnick.rivera855100% (53)

- Timeless Calling, Timely Response - Tenkei CoppensDocument294 pagesTimeless Calling, Timely Response - Tenkei CoppensFaustNo ratings yet

- SW05Document7 pagesSW05Nadi HoodNo ratings yet

- Taxation - Gross Income - Quizzer - 2018 - MayDocument5 pagesTaxation - Gross Income - Quizzer - 2018 - MayKenneth Bryan Tegerero TegioNo ratings yet

- Taxation First Preboard 93 - QuestionnaireDocument16 pagesTaxation First Preboard 93 - QuestionnaireAmeroden AbdullahNo ratings yet

- Tax On Individuals Quiz - ProblemsDocument3 pagesTax On Individuals Quiz - ProblemsJP Mirafuentes100% (2)

- Pa-Note Nalang Pag May Babaguhin Kayong SagotDocument26 pagesPa-Note Nalang Pag May Babaguhin Kayong SagotErika Mae LegaspiNo ratings yet

- Corporation ActivityDocument4 pagesCorporation ActivityLFGS FinalsNo ratings yet

- Tax1 Q Chapter-11 12 13 With-AnswerDocument2 pagesTax1 Q Chapter-11 12 13 With-AnswerPrincess Edelyn CastorNo ratings yet

- Tax On Compensation, Dealings in Properties and CorporationDocument6 pagesTax On Compensation, Dealings in Properties and CorporationOG FAM0% (1)

- Assignment No. 2: Part 1: Determination of Income Tax Due/PayableDocument4 pagesAssignment No. 2: Part 1: Determination of Income Tax Due/PayableKenneth Pimentel100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Handbook of Research On Digital Media andDocument771 pagesHandbook of Research On Digital Media andCIBERNONTROPPO100% (2)

- Ama Aia - Tax01-Final Exam-Casilla 2nd Sem Ay 2021-2022Document9 pagesAma Aia - Tax01-Final Exam-Casilla 2nd Sem Ay 2021-2022Meg CruzNo ratings yet

- Tax Final TaxDocument19 pagesTax Final TaxSittie Aisah AmpatuaNo ratings yet

- Individual Illustration and Activity No. 2Document22 pagesIndividual Illustration and Activity No. 2Angela CanayaNo ratings yet

- Individual Illustration and Activity No. 2Document18 pagesIndividual Illustration and Activity No. 2Kathleen FeliciaNo ratings yet

- Taxation Elims 1Document3 pagesTaxation Elims 1Valerie Faye BadajosNo ratings yet

- Individual Illustration and Activity No. 2Document19 pagesIndividual Illustration and Activity No. 2김유나100% (1)

- TAXN 2000 SECOND TERM EXAM SY22 23 QuestionnaireDocument15 pagesTAXN 2000 SECOND TERM EXAM SY22 23 QuestionnaireGrace Love Yzyry LuNo ratings yet

- MASTERY TAXATION October-2019 PDFDocument12 pagesMASTERY TAXATION October-2019 PDFJuvelyn Gregorio100% (1)

- PRe Departmental ReviwersDocument7 pagesPRe Departmental ReviwersCañon, Lorenz GeneNo ratings yet

- Tax QuizDocument3 pagesTax QuizLora Mae JuanitoNo ratings yet

- Project Taxation (Ouano)Document16 pagesProject Taxation (Ouano)GuiltyCrownNo ratings yet

- Income Taxation Semi-Final ExaminationDocument12 pagesIncome Taxation Semi-Final ExaminationlalagunajoyNo ratings yet

- Average Quiz Set ADocument5 pagesAverage Quiz Set AMarvin AndresNo ratings yet

- Individual Taxation ExercisesDocument3 pagesIndividual Taxation ExercisesMargaux CornetaNo ratings yet

- DE TaxationDocument22 pagesDE TaxationHappy MagdangalNo ratings yet

- San Beda University: Department of Accountancy and TaxationDocument11 pagesSan Beda University: Department of Accountancy and TaxationOG FAMNo ratings yet

- Midterm ExamDocument5 pagesMidterm ExamhafidahmmaunaNo ratings yet

- TAX.03 Exercises On Corporate Income TaxationDocument7 pagesTAX.03 Exercises On Corporate Income Taxationleon gumbocNo ratings yet

- TaxationDocument10 pagesTaxationSteven Mark MananguNo ratings yet

- Tax Quiz 1Document3 pagesTax Quiz 1KimbabNo ratings yet

- 4BSA TAX SET A No Answer PDFDocument10 pages4BSA TAX SET A No Answer PDFLayca Clarice BrimbuelaNo ratings yet

- Tax On Corporations (Additional Exercises)Document2 pagesTax On Corporations (Additional Exercises)April PacanasNo ratings yet

- Prv-Tax 1Document4 pagesPrv-Tax 1Kathylene GomezNo ratings yet

- Tax 1 Problem SolvingDocument4 pagesTax 1 Problem SolvingSheila Mae Araman100% (2)

- Take Home Seatwork 11.25.2023Document2 pagesTake Home Seatwork 11.25.2023rhenzadrian.11No ratings yet

- Microsoft Word - 6. Gross Income-Discussion Assignment November 14, 2022Document9 pagesMicrosoft Word - 6. Gross Income-Discussion Assignment November 14, 2022Erika Jamine SantosNo ratings yet

- Income Tax Finals Sample Questions Final ExamDocument19 pagesIncome Tax Finals Sample Questions Final ExamAnie P. Martinez0% (1)

- Ea - TaxDocument8 pagesEa - TaxKc SevillaNo ratings yet

- Take Home Quiz 2Document6 pagesTake Home Quiz 2Jane Tuazon100% (1)

- Tax Pre TestDocument40 pagesTax Pre TestjohnlerrysilvaNo ratings yet

- Corporation Income Tax ProblemsDocument3 pagesCorporation Income Tax ProblemsRandy Manzano50% (2)

- Tax On PartnershipDocument3 pagesTax On PartnershipPrankyJellyNo ratings yet

- Quiz Tax On IndividualsDocument2 pagesQuiz Tax On IndividualsAirah Shane B. DianaNo ratings yet

- TAX RefExamDocument16 pagesTAX RefExamjeralyn juditNo ratings yet

- Straight Problems Income Tax Bsa2Document2 pagesStraight Problems Income Tax Bsa2dimpy dNo ratings yet

- Quiz 1 - StrataxDocument3 pagesQuiz 1 - Strataxspongebob SquarepantsNo ratings yet

- Taxation Final Preboard 91 SolutionsDocument23 pagesTaxation Final Preboard 91 SolutionsJean TatsadoNo ratings yet

- Reviewer For Final Examination - ProblemsDocument11 pagesReviewer For Final Examination - Problemsreynald animosNo ratings yet

- Tax Midterm ExamDocument21 pagesTax Midterm ExamLili esNo ratings yet

- Sample Problem Accounting Taxation 1Document4 pagesSample Problem Accounting Taxation 1carl patNo ratings yet

- BSA1202-FS2425B-INCOMECONCEPT-03Document3 pagesBSA1202-FS2425B-INCOMECONCEPT-03Alyssa Lee GarciaNo ratings yet

- Tax On Individuals QuizDocument6 pagesTax On Individuals QuizJomarNo ratings yet

- IAET TaxationDocument2 pagesIAET TaxationRandy Manzano100% (1)

- Prefinal Exam Phil TaxDocument4 pagesPrefinal Exam Phil TaxDarren GreNo ratings yet

- Tax 1st Drills Answer KeyDocument18 pagesTax 1st Drills Answer KeyJerma Dela Cruz100% (1)

- 8.6 Assignment - Regular Income Tax On CorporationsDocument3 pages8.6 Assignment - Regular Income Tax On CorporationsRoselyn LumbaoNo ratings yet

- Income Taxation - Regular Income TaxDocument4 pagesIncome Taxation - Regular Income TaxDrew BanlutaNo ratings yet

- UntitledDocument4 pagesUntitledFRAULIEN GLINKA FANUGAONo ratings yet

- Borrowing Costs - Assignment - Answer Key - v2: DownloadDocument2 pagesBorrowing Costs - Assignment - Answer Key - v2: DownloadFRAULIEN GLINKA FANUGAONo ratings yet

- ACP323 Audit of Iib and Ppe ReviewerDocument4 pagesACP323 Audit of Iib and Ppe ReviewerFRAULIEN GLINKA FANUGAONo ratings yet

- UntitledDocument3 pagesUntitledFRAULIEN GLINKA FANUGAONo ratings yet

- UntitledDocument131 pagesUntitledFRAULIEN GLINKA FANUGAONo ratings yet

- UntitledDocument10 pagesUntitledFRAULIEN GLINKA FANUGAONo ratings yet

- MethodDocument10 pagesMethodFRAULIEN GLINKA FANUGAONo ratings yet

- Friedrich Glenn U. Fanugao: Career ObjectiveDocument3 pagesFriedrich Glenn U. Fanugao: Career ObjectiveFRAULIEN GLINKA FANUGAONo ratings yet

- ACC 225 Business Laws and RegulationsDocument209 pagesACC 225 Business Laws and RegulationsFRAULIEN GLINKA FANUGAONo ratings yet

- Netsuite Practice Set Beta Draft 1Document34 pagesNetsuite Practice Set Beta Draft 1FRAULIEN GLINKA FANUGAONo ratings yet

- ACC 225 Business Laws and Regulations Rev. 1 1st Sem SY 2020-2021 FINALDocument13 pagesACC 225 Business Laws and Regulations Rev. 1 1st Sem SY 2020-2021 FINALFRAULIEN GLINKA FANUGAONo ratings yet

- Resume GlinkaDocument1 pageResume GlinkaFRAULIEN GLINKA FANUGAONo ratings yet

- Ge 20 Midterm Exam 1Document3 pagesGe 20 Midterm Exam 1FRAULIEN GLINKA FANUGAONo ratings yet

- Info Sheet IndivDocument2 pagesInfo Sheet IndivFRAULIEN GLINKA FANUGAONo ratings yet

- Digitel Outbound Transfer Script UpdatedDocument2 pagesDigitel Outbound Transfer Script UpdatedFRAULIEN GLINKA FANUGAONo ratings yet

- Digitel Outbound Transfer Script UpdatedDocument2 pagesDigitel Outbound Transfer Script UpdatedFRAULIEN GLINKA FANUGAONo ratings yet

- Approved CAE BSA ACP 311 PetalcorinDocument132 pagesApproved CAE BSA ACP 311 PetalcorinFRAULIEN GLINKA FANUGAONo ratings yet

- Miss Yvonne B. LuceroDocument10 pagesMiss Yvonne B. LuceroFRAULIEN GLINKA FANUGAONo ratings yet

- Approved CAE BSA ACP 311 PetalcorinDocument131 pagesApproved CAE BSA ACP 311 PetalcorinFRAULIEN GLINKA FANUGAONo ratings yet

- DocxDocument2 pagesDocxFRAULIEN GLINKA FANUGAONo ratings yet

- Chapter 22-10-00 AutopilotDocument62 pagesChapter 22-10-00 AutopilotAnggarda Bagus SejatiNo ratings yet

- Hardware Manual: Programmable ControllerDocument199 pagesHardware Manual: Programmable ControllerQuang BáchNo ratings yet

- APD2750MDocument4 pagesAPD2750MParinyaNo ratings yet

- BALLB - 501 JurisprudenceDocument3 pagesBALLB - 501 Jurisprudencekhadija khanNo ratings yet

- Muhammad Sami Ahmed: ProfileDocument3 pagesMuhammad Sami Ahmed: ProfileMohammedNo ratings yet

- An Efficient Frontier For Retirement IncomeDocument12 pagesAn Efficient Frontier For Retirement IncomeJulian Restrepo0% (1)

- Factors Associated With Depression Among Healthcare Workers at Jinja Regional Referral Hospital UgandaDocument11 pagesFactors Associated With Depression Among Healthcare Workers at Jinja Regional Referral Hospital UgandaKIU PUBLICATION AND EXTENSIONNo ratings yet

- Smart Irrigation System Using IOT: Submitted in Partial Fulfillment of The Requirements For The Award of The Degree ofDocument48 pagesSmart Irrigation System Using IOT: Submitted in Partial Fulfillment of The Requirements For The Award of The Degree ofsaikiran velidiNo ratings yet

- Saids Dec 22Document3 pagesSaids Dec 223277harshalahireNo ratings yet

- Fairmate Waterproofing - PunjabDocument128 pagesFairmate Waterproofing - PunjabAyush GoyalNo ratings yet

- VX PDFDocument4 pagesVX PDFLive FlightsNo ratings yet

- Wajo 18 QnsolnDocument16 pagesWajo 18 QnsolnSmpnsatubontang KaltimNo ratings yet

- Framed, Damned, Acquitted: Dossiers of A Very 'Special' CellDocument308 pagesFramed, Damned, Acquitted: Dossiers of A Very 'Special' CellIndiloguesNo ratings yet

- Myth, Politics and Ethnography in Amitav Ghosh's The Hungry Tide PDFDocument5 pagesMyth, Politics and Ethnography in Amitav Ghosh's The Hungry Tide PDFOliurRahmanSunNo ratings yet

- Skin Friction in Shale Results TPDocument6 pagesSkin Friction in Shale Results TPSteven LongNo ratings yet

- Elements of Matlab SimulinkDocument27 pagesElements of Matlab SimulinkJojo KawayNo ratings yet

- 6th Eng Study Material Modified 2022-23Document16 pages6th Eng Study Material Modified 2022-23NON OFFICIALNo ratings yet

- HawaiianbeliefsDocument33 pagesHawaiianbeliefsapi-280221981100% (3)

- Important QnA Problem Scoping Class 10Document5 pagesImportant QnA Problem Scoping Class 10pratheeshNo ratings yet

- Properties of ConductorsDocument9 pagesProperties of ConductorsDinesh KumarNo ratings yet

- Positive Discipline Vs PunishmentDocument5 pagesPositive Discipline Vs PunishmentGatoy GadotNo ratings yet

- Inglés 8° - Reading Comprehension Per IiDocument1 pageInglés 8° - Reading Comprehension Per IiNacho MeneesNo ratings yet

- Group Assignment FinalDocument26 pagesGroup Assignment FinalIqbal JoyNo ratings yet

- FX1S FX2N FX1NDocument82 pagesFX1S FX2N FX1Ngalih kalokaNo ratings yet

- Analytical Chemistry PDFDocument9 pagesAnalytical Chemistry PDFSagar AnawadeNo ratings yet

- MCQ From Chapter 1 and 2Document4 pagesMCQ From Chapter 1 and 2Purushottam KumarNo ratings yet

- 02 Ch2 TheRelationalModelofDataDocument71 pages02 Ch2 TheRelationalModelofDataLuu Duc Lam (k17 HCM)No ratings yet