Chapter 11

Chapter 11

Uploaded by

Alyssa BerangberangCopyright:

Available Formats

Chapter 11

Chapter 11

Uploaded by

Alyssa BerangberangCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Chapter 11

Chapter 11

Uploaded by

Alyssa BerangberangCopyright:

Available Formats

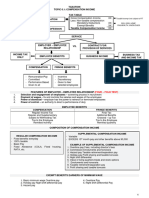

Chapter 11: FRINGE BENEFIT TAX Hybrid Expenses

Fringe Benefits - When the employer incurs expenses

which is purported partly for business

- Pertains to all other benefits or

and partly for employee’s incentive,

incentives of employees other than the

only 50% of the expense representing

basic pay

the employee incentive is subject to the

- Under the NIRC, it pertains to goods,

fringe benefit tax

services, or other benefits furnished by

the employer to the employee EXEMPT FRINGE BENEFIT

GENERAL CATEGORIES OF FRINGE BENEFITS 1. Authorized and exempted from tax

SUBJECT TO FINAL TAX under special laws

2. Benefits required by the nature of, or

1. Management perquisite benefits

necessary to the trade, business or

2. Employee personal expenses

profession of the employer

shouldered by the employer

3. Benefit given for the convenience or

3. Taxable de minimis benefit

advantage of the employer

a. Excess de minimis over their limit

4. Contributions of the employer for the

b. Benefits not included in the de

benefit of the employee to retirement,

minimis list

insurance and hospitalization benefit

(one) Management Perquisite Benefits plans

5. Benefits given to rank and file

- Also called as “management perks” are employees whether or not granted

highly privileged incentives given only under a collective bargaining agreement

to a special group of employees 6. De minimis benefits within their legal

- Non-performance based limits

- Not considered as compensation but as

fringe benefits subject to fringe benefit FRINGE BENEFIT TAX

tax

- Is a final tax imposed on the fringe

benefit furnished, granted or paid by

the employer to the employee

(two) Employee Personal Expenses 1. Housing Benefits

- When an expense takes the nature of 2. Expense account

an employee personal expense or 3. Vehicles of any kind

expenditure and is paid or assumed by 4. Household personnel such as maid,

the employer in default of a proximate driver and others

business necessity, it is deemed fringe 5. Interest for the difference between the

benefit in its entirety even if the market rate (12%) and the actual

expense is receipted in the name of the interest granted

employer 6. Membership fees, dues and other

expenses borne by the employer for the

employee in social and athletic clubs or

other similar organizations

7. Expense for foreign travel

8. Holiday and vacation expense

9. Educational assistance to the employee

or his dependent

10. Life or health and other non-life

insurance premiums or similar accounts

in excess of what the law allows

CHARACTERISTICS OF THE FRINGE BENEFIT TAX

1. Final tax

- Withheld by the employer at source

- The employee need not report the

fringe benefits in his income tax return

2. Tax upon the fringe benefits of

managerial and supervisory employees

- It is a tax upon the fringe benefit

realized by the managerial or

supervisory employee

- It is a tax to the employee and not to

the employer

3. Paid by the employer

- The tax is presumed withheld at source

and remitted by the employer to the

government

4. Grossed-up tax

- The monetary value or the amount of

fringe benefit realized or taken home by

the employee is effectively net of the

final tax

- The monetary value is first grossed-up

by the complement percentage of the

applicable fringe benefit tax rate before

the fringe benefit tax rate is applied

5. Due quarterly

- Reported quarterly through BIR Form

1603Q

You might also like

- Tax Invoice For: Your Telstra BillDocument8 pagesTax Invoice For: Your Telstra BillmaryannemooreNo ratings yet

- 1TCS India Separation Kit PDFDocument18 pages1TCS India Separation Kit PDFSiva chowdaryNo ratings yet

- CHAPTER 11 - IncomeTaxDocument2 pagesCHAPTER 11 - IncomeTaxVicente, Liza Mae C.No ratings yet

- CHAPTER 11 Flashcards - QuizletDocument11 pagesCHAPTER 11 Flashcards - QuizletTokis SabaNo ratings yet

- Module 3 Fringe Benefits Tax and de Minimis BenefitsDocument15 pagesModule 3 Fringe Benefits Tax and de Minimis BenefitscomedieroanabelleNo ratings yet

- Fringe Benefits Tax and de MinimisDocument6 pagesFringe Benefits Tax and de MinimisL.ShinNo ratings yet

- Module 3 Fringe Benefits Tax and de Minimis BenefitsDocument15 pagesModule 3 Fringe Benefits Tax and de Minimis BenefitsJericho PapioNo ratings yet

- Tax Treatments of Fringe BenefitsDocument14 pagesTax Treatments of Fringe BenefitsAdmNo ratings yet

- Tax Treatments of Fringe BenefitsDocument63 pagesTax Treatments of Fringe BenefitsAdmNo ratings yet

- Additional Notes Fringe Benefit TaxDocument10 pagesAdditional Notes Fringe Benefit TaxAngela Nicole NobletaNo ratings yet

- BA 127 Notes PDFDocument12 pagesBA 127 Notes PDFLorenz De Lemios NalicaNo ratings yet

- Fringe Benefits TaxDocument4 pagesFringe Benefits TaxSato TsuyoshiNo ratings yet

- IncomeTax Valuation PerquisitesDocument19 pagesIncomeTax Valuation PerquisitesSanjeevNo ratings yet

- Fringe Benefits 2Document45 pagesFringe Benefits 2Ajey MendiolaNo ratings yet

- 6 - Concept of Income 1Document13 pages6 - Concept of Income 1RylleMatthanCorderoNo ratings yet

- W6 Module 5 - Fringe Benefits and Dealings in PropertyDocument13 pagesW6 Module 5 - Fringe Benefits and Dealings in PropertyElmeerajh JudavarNo ratings yet

- Module 4 - Fringe Benefits Tax and de Minimis BenefitsDocument15 pagesModule 4 - Fringe Benefits Tax and de Minimis Benefitsjustine panaliganNo ratings yet

- Fringe Benefits - Income Tax NotesDocument3 pagesFringe Benefits - Income Tax NotesMa Terresa TejadaNo ratings yet

- W6-Module Concept of Income-Part 1Document14 pagesW6-Module Concept of Income-Part 1Danica VetuzNo ratings yet

- TAX 06.1 - RIT Compensation IncomeDocument3 pagesTAX 06.1 - RIT Compensation Incomejonlisong976No ratings yet

- Chapter 11Document16 pagesChapter 11Rein ConcepcionNo ratings yet

- Fringe Benefit TaxDocument30 pagesFringe Benefit Taxrav danoNo ratings yet

- Salary Income-4Document92 pagesSalary Income-4Abu SufyanNo ratings yet

- Fringe BenefitsDocument5 pagesFringe BenefitsPatricia100% (1)

- Gross IncomeDocument5 pagesGross IncomeNavarro Cristine C.No ratings yet

- INCOME TAXATION Pre Final ReviewerDocument4 pagesINCOME TAXATION Pre Final ReviewerRhea Mae LazarteNo ratings yet

- Adobe Scan Dec 09, 2023Document7 pagesAdobe Scan Dec 09, 2023Renalyn Ps MewagNo ratings yet

- Bam031 Income Taxation P2 NotesDocument8 pagesBam031 Income Taxation P2 NotesRyan Malanum AbrioNo ratings yet

- CHAPTER 10 - IncomeTaxDocument3 pagesCHAPTER 10 - IncomeTaxVicente, Liza Mae C.No ratings yet

- TAX 06.2 - Fringe Benefit TaxDocument2 pagesTAX 06.2 - Fringe Benefit TaxMary Louise CamposanoNo ratings yet

- Ch06 Taxation of Fringe BenefitsDocument6 pagesCh06 Taxation of Fringe BenefitsKyla ArcillaNo ratings yet

- Chapter 3: Fringe Benefits Tax and de Minimis Benefits Fringe BenefitDocument8 pagesChapter 3: Fringe Benefits Tax and de Minimis Benefits Fringe BenefitMARIA BELEN GUTIERREZNo ratings yet

- Chapter 10 v2Document15 pagesChapter 10 v2Sheilamae Sernadilla Gregorio0% (1)

- MODULE 3.1 - Fringe Benefit Taxation Lecture Without QuizzerDocument4 pagesMODULE 3.1 - Fringe Benefit Taxation Lecture Without QuizzerGabs SolivenNo ratings yet

- Module 05 Income Tax On Individuals Fringe BenefitDocument6 pagesModule 05 Income Tax On Individuals Fringe BenefitZoren LegaspiNo ratings yet

- Income Taxation Week 5Document14 pagesIncome Taxation Week 5Hannah Rae ChingNo ratings yet

- IA3 - Accounting For Employee BenefitsDocument6 pagesIA3 - Accounting For Employee BenefitsHannah Jane Arevalo LafuenteNo ratings yet

- Fringe BenefitsDocument16 pagesFringe BenefitsVenz LacreNo ratings yet

- Fringe Benefit Tax Lesson 11Document24 pagesFringe Benefit Tax Lesson 11lc100% (1)

- Ast TX 901 Fringe Benefits Tax (Batch 22)Document6 pagesAst TX 901 Fringe Benefits Tax (Batch 22)Shining LightNo ratings yet

- Written Report Special Treatment of Fringe Benefits FINAL....Document13 pagesWritten Report Special Treatment of Fringe Benefits FINAL....SANTIAGO CHESKAMAE OQUIANo ratings yet

- Fringe Benefits TaxDocument38 pagesFringe Benefits Taxkeisha santosNo ratings yet

- HQ06-1 - Fringe BenefitsDocument7 pagesHQ06-1 - Fringe BenefitsHannah Jane Oblena100% (1)

- Fringe Benefit Tax Dealings in PropertiesDocument13 pagesFringe Benefit Tax Dealings in PropertiesBea Marie BernardoNo ratings yet

- Week 3-Fringe Benefit TaxDocument51 pagesWeek 3-Fringe Benefit TaxMARCIAL, Althea Kate A.No ratings yet

- Part 3 - Beda NotesDocument6 pagesPart 3 - Beda NotesNoelle SanidadNo ratings yet

- Gros Income and It's CoverageDocument122 pagesGros Income and It's CoverageCenelyn PajarillaNo ratings yet

- CHAPTER 9 Regular Income TaxDocument8 pagesCHAPTER 9 Regular Income TaxAlyssa BerangberangNo ratings yet

- Taxation of Fringe Benefits: (Art 212, Labor Code)Document7 pagesTaxation of Fringe Benefits: (Art 212, Labor Code)Lyca ValtiendazNo ratings yet

- Module 10 - Fringe Benefit TaxDocument27 pagesModule 10 - Fringe Benefit Taxairwaller rNo ratings yet

- DEDUCTIONSDocument9 pagesDEDUCTIONSAisaia Jay ToralNo ratings yet

- Chapter 4 - ReviewerDocument11 pagesChapter 4 - Reviewerdevy mar topiaNo ratings yet

- 1 IAS 19 EMPLOYEE BENEFITS With Suggested Answers As of 11 10Document13 pages1 IAS 19 EMPLOYEE BENEFITS With Suggested Answers As of 11 10Kimberly IgnacioNo ratings yet

- QQ Employees Benefit 4Document2 pagesQQ Employees Benefit 4Norlailah AmanollahNo ratings yet

- Ia 3Document3 pagesIa 3Auguste Anthony SisperezNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document28 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Ange - Chapter 4 Reviewer TaxationDocument11 pagesAnge - Chapter 4 Reviewer Taxationdevy mar topiaNo ratings yet

- Ange - Chapter 4 Reviewer TaxationDocument11 pagesAnge - Chapter 4 Reviewer Taxationdevy mar topiaNo ratings yet

- Fringe Benefit TaxDocument5 pagesFringe Benefit Taxricamae saladagaNo ratings yet

- Northern CPAR: Taxation - Fringe Benefit Taxation: Rex B. Banggawan, Cpa, MbaDocument7 pagesNorthern CPAR: Taxation - Fringe Benefit Taxation: Rex B. Banggawan, Cpa, MbaLouiseNo ratings yet

- Assignment 6 Agricultural Transformation and Rural DevelopmentDocument3 pagesAssignment 6 Agricultural Transformation and Rural DevelopmentAlyssa BerangberangNo ratings yet

- Assignment 7 The Environment and DevelopmentDocument2 pagesAssignment 7 The Environment and DevelopmentAlyssa BerangberangNo ratings yet

- Assignment 9 Human CapitalDocument8 pagesAssignment 9 Human CapitalAlyssa BerangberangNo ratings yet

- SNOWDEN - A Movie ReviewDocument4 pagesSNOWDEN - A Movie ReviewAlyssa BerangberangNo ratings yet

- Chapter 1 (The Information Environment)Document13 pagesChapter 1 (The Information Environment)Alyssa BerangberangNo ratings yet

- Chapter 2Document12 pagesChapter 2Alyssa BerangberangNo ratings yet

- Chapter 4Document7 pagesChapter 4Alyssa BerangberangNo ratings yet

- Chapter 12 Dealings in PropertiesDocument6 pagesChapter 12 Dealings in PropertiesAlyssa BerangberangNo ratings yet

- Chapter 13 REGULAR ALLOWABLE ITEMIZED DEDUCTIONSDocument3 pagesChapter 13 REGULAR ALLOWABLE ITEMIZED DEDUCTIONSAlyssa BerangberangNo ratings yet

- CHAPTER 9 Regular Income TaxDocument8 pagesCHAPTER 9 Regular Income TaxAlyssa BerangberangNo ratings yet

- Screenshot 2022-12-18 at 17.49.01Document33 pagesScreenshot 2022-12-18 at 17.49.01j75xwwtbd8No ratings yet

- Ino-RacunDocument1 pageIno-RacunNikšićko TamnoNo ratings yet

- TRA Taxes at Glance - 2016-17Document22 pagesTRA Taxes at Glance - 2016-17Timothy Rogatus67% (3)

- Proforma Invoice: Global Biotech and ConsultancyDocument1 pageProforma Invoice: Global Biotech and ConsultancySaurabh MishraNo ratings yet

- Mrs Sohini Mitra QueryDocument3 pagesMrs Sohini Mitra QuerysoumenmukherjeeskailNo ratings yet

- Cycle To Work Scheme: WWW - Cyclescheme.co - UkDocument4 pagesCycle To Work Scheme: WWW - Cyclescheme.co - UkAndrew ReidNo ratings yet

- Reserva HotelDocument2 pagesReserva HotelMariana nogueraNo ratings yet

- Tabunting Pawnshop V CirDocument2 pagesTabunting Pawnshop V CirNezte VirtudazoNo ratings yet

- EFPS Home - EFiling and Payment SystemDocument1 pageEFPS Home - EFiling and Payment SystemIra MejiaNo ratings yet

- Income TaxationDocument3 pagesIncome TaxationshenafaithmNo ratings yet

- Transfer Agreement For Income Tax, Rural Electric Cooperatives Tax, or Insurance Premium Tax CreditDocument3 pagesTransfer Agreement For Income Tax, Rural Electric Cooperatives Tax, or Insurance Premium Tax CreditNite OwlNo ratings yet

- How To Prepare BillDocument1 pageHow To Prepare Billbaiju bawraNo ratings yet

- 2018 Edition: Solutions Manual Income Taxation By: Tabag & GarciaDocument33 pages2018 Edition: Solutions Manual Income Taxation By: Tabag & GarciaMia Jeruve Javier BautistaNo ratings yet

- Acct Statement - XX5402 - 13082022Document22 pagesAcct Statement - XX5402 - 13082022Harsh KardamNo ratings yet

- Kra Pin (1) - 1Document1 pageKra Pin (1) - 1whitneykasudi42No ratings yet

- Taxation and Fiscal PoliciesDocument279 pagesTaxation and Fiscal PoliciesFun DietNo ratings yet

- Prepation of Bank StateDocument2 pagesPrepation of Bank StateMonish Venkat SaiNo ratings yet

- Card BankingDocument25 pagesCard BankingGemechu Fikadu0% (1)

- SAP HR Common Error Messages: Personnel AdministrationDocument12 pagesSAP HR Common Error Messages: Personnel AdministrationDinkan TalesNo ratings yet

- Chapter 3: Adjusting Entries - Lecture Notes: Truongthihanhdung@uel - Edu.vnDocument9 pagesChapter 3: Adjusting Entries - Lecture Notes: Truongthihanhdung@uel - Edu.vnĐỗ LinhNo ratings yet

- Payroll Answer Scheme (Part B)Document3 pagesPayroll Answer Scheme (Part B)Lilian OngNo ratings yet

- Employment IncomeDocument26 pagesEmployment IncomeEhsan KhanNo ratings yet

- Lab 3-1 Adaptive Solutions Online Eight-Year Financial ProjectionDocument5 pagesLab 3-1 Adaptive Solutions Online Eight-Year Financial Projectionapi-2363561930% (1)

- Nfcu 633Document1 pageNfcu 633Akinwumi AdeyemiNo ratings yet

- Income Tax: Introduction and Important DefinitionsDocument25 pagesIncome Tax: Introduction and Important DefinitionsVicky DNo ratings yet

- May 2022 - PresentDocument2 pagesMay 2022 - PresentFahad ZaidNo ratings yet

- ReceiptDocument1 pageReceiptCOLLINS KIPROPNo ratings yet

- Last Pay CertificateDocument2 pagesLast Pay CertificateMuhammad Ramzan Burfat100% (2)