Tybbi Sem5 Ibf Apr19

Tybbi Sem5 Ibf Apr19

Uploaded by

kumar shahCopyright:

Available Formats

Tybbi Sem5 Ibf Apr19

Tybbi Sem5 Ibf Apr19

Uploaded by

kumar shahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Tybbi Sem5 Ibf Apr19

Tybbi Sem5 Ibf Apr19

Uploaded by

kumar shahCopyright:

Available Formats

Paper / Subject Code: 44301/ International Banking anOn'inangii.

TY gBI | 3."n^E / fiTFr I "o"os-,1 .,'

. ....)

Duration l2YzHoars Marlis,;.?5

Notes : Figures to the right indicate full marks

Ql.A Multiple choice questions (Answer any eight)

I . International finance is an important tool.

a. To find the exchange rates

b. Compare inflatiorr rates

c. Ascertain the economic stanrs of other countries

d. All of the above

2. Tlre collapse of the following system is related to Triffins paradox

a. Gold Standard

b. Bretton Woods

c. Snake in the Tunnel

d. None olthe above

3. Exchange rate system where the central bank inlervenes to smootlrerr

out the exchange rate fluctuation is

a. Free Float

b. Managed Float

c. Fixed Exchange Rate systeln

d. Dollarisation

4. The bank which opens the letter of credit in favor of the beneficiary is

a. Issuing Bank

b. Advising Bank

c. Confirming Bank

d. Nominated Bank

5. Foreign Exclrange Transactions in India are regulated by

a. FEDAI

b. FIMMDA

c. FEMA

d. AMFI

6. A negotiable instrument issued by the international depository bank

representing foreign company's stock trading globally

a. GDR

b. IDR

c. ADR

d. None o[the above

7. Which of the following are foreign bonds

a. Samurai Bond

b. Bull dog bond

c. Yankee Bond

d. AII of the above

8. The first stage in the process of loan syndication

a. Mandate

b. Pre mandate

c. Disbursement

d. Post disbursement

54811 Page 1 of 3

FA5DF3 55BB6 I C3 7A3 1EDC57EDD7ABO49

Paper / Subject code: 4430r / Internationar

Banking andFinance

9' The risk that a government may default its

debt obligation

a. political risk

b. Sovereign risk

d. Transaction risk

10. The act of trading in different curencies

is called

a. Foreign Exchange

b. Arbitrage

c. Foreign Trade

d. Exports

B. State whether the following statements are

True or False (Any Seven)

.

I If imporr ir rhan exporl . ar rhar time

r_of. eoi wiri'd. ,rrr"l*ur"

2. Internationar Monetary Fund was given the

i"rt *ol.."ria*

"o --.

3'

monitoring gold standard. "i "*

In the floating exchange rate system, government

officialsstrive to keep

the excharrge rale pegged.

4. Euro Currency loans carry a variable interest rate.

5. ADR and GDR are cornmonry used by Indian corpurr", to raise

funcls

from Foreign Capital Market.

6. Zero Coupon bonds pay coupon interest annually.

7' Speculators try to profit from sirnultaneous .r.tlung. rate difference

in

different markets.

8' Increase in interest rate causes a country's currency to appreciate.

9. Bircoin became the first decentrarisJ;;ro;;;ncy in the year

2000.

l0' In l973,the reform of the international *on"tury .ystem

resulted in the

change from adjustable pegged rates to rnunug"i

float rates.

Q2. A Define International Finance and discuss its scope.

B Explain in brief the components of Bulun.. of p'ayments. 8

7

OR

c Define Fixecl Exchange rate system. H.-o* i, it differenr from flexible exchange

rate system?

D Discuss tlre reasous for colrapse of Bretton woods

system.

Q3. A Explain the concept of Euro currency. what are its advantages and

disadvantages?

B Discttss the problems and prospects of having offshore

banking units in India.

Define GDR and explain the issue,r.?tlnir. of

9

D What are the different types of Euro Bonds?

GDR. 8

7

54811 page 2 of3

FA5DF355BB 61C37 A3 I EDC57EDD7ABO49

Paper/ Subject Code: 44301 / International Banking andFinance

: .: :.. l

Q4. A What are the various internal and external hedging techniques used in forex 8

market? Explain in brief.

B Discuss the structure of Indian Forex Market. nt

OR

.^i

C Given USD /CAD 1.1620 SPOT

USD/CAD 1.1640 3 months forward

USD Interestrate 4Yo p.a .:

CAD Interest rate 5 o/o p.a ,.. ll

Identiff and Calculate Interest rate arbitrage.

D. Calculate the rate of'the fbl currencies against INR 7

BID OFFER

l USD 40.60 40,90,,

1 GBP USD 3:0200 3.031 1

1 EUR USD-1:5090 L5Z0-A

I USD IPY 114.901 I15..91,1

Q5.A Explain in brief the functions of International Banking. 8

B Explain the stages in loan syndication. 7

OR

C Write Short Notes on (Any Three) 15

a. Role of Credit Rating Agencies

b. Types of Crypto Currency

c. Difference between Letter of Credit and Guarantee

d. Features ol FERA

e. SWIFT

s4811 Page 3 of 3

FA5DF355 BB 6 I C37 A3 I EDC57EDD7ABO49

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2024 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2024 Edition)No ratings yet

- Test Bank For Financial Markets and Institutions 8th Edition Anthony Saunders Marcia Cornett Otgo ErhemjamtsDocument23 pagesTest Bank For Financial Markets and Institutions 8th Edition Anthony Saunders Marcia Cornett Otgo Erhemjamtsreem.alrshoudiNo ratings yet

- MUDA (7 Waste)Document3 pagesMUDA (7 Waste)Shamshair Ali100% (1)

- Ifm MCQDocument4 pagesIfm MCQjoycepaul147No ratings yet

- TestBank Chapter-1Document16 pagesTestBank Chapter-1Maha Bianca Charisma CastroNo ratings yet

- Multinational Financial Management: Alan Shapiro 7 Edition J.Wiley & SonsDocument18 pagesMultinational Financial Management: Alan Shapiro 7 Edition J.Wiley & SonsNiharika Satyadev JaiswalNo ratings yet

- 403 FIN: International FinanceDocument1 page403 FIN: International FinancePravin GosaviNo ratings yet

- 5 The Foreign Exchange Market and Parity Conditions: Chapter ObjectivesDocument15 pages5 The Foreign Exchange Market and Parity Conditions: Chapter Objectiveslala loopsyNo ratings yet

- Merged Sample QuestionsDocument55 pagesMerged Sample QuestionsAlaye OgbeniNo ratings yet

- MBA7427 Sample Questions CH1-4 2019Document8 pagesMBA7427 Sample Questions CH1-4 2019Alaye OgbeniNo ratings yet

- Chapter 1_version1Document23 pagesChapter 1_version1meetwchxiNo ratings yet

- Chapter 32 Exchange Rates Balance of Payments and International DebtDocument18 pagesChapter 32 Exchange Rates Balance of Payments and International DebtMary Chrisdel Obinque GarciaNo ratings yet

- 11 International Financial Markets: Chapter ObjectivesDocument19 pages11 International Financial Markets: Chapter ObjectivesrohitkalidasNo ratings yet

- Commerce Bcom Banking and Insurance Semester 5 2022 November International Banking Finance CbcgsDocument2 pagesCommerce Bcom Banking and Insurance Semester 5 2022 November International Banking Finance CbcgssamymadheNo ratings yet

- FinancialDocument4 pagesFinancialnathaliefayeb.tajaNo ratings yet

- Chapter 3 International Financial Markets MCQ PDFDocument3 pagesChapter 3 International Financial Markets MCQ PDFtsamrotulj3No ratings yet

- Worksheet - QuizizzDocument4 pagesWorksheet - QuizizzAdam LuyenNo ratings yet

- Test I. Identifications-Write The Answer On The Space ProvidedDocument3 pagesTest I. Identifications-Write The Answer On The Space ProvidedCindy BartolayNo ratings yet

- International Financing and International Financial MarketsDocument40 pagesInternational Financing and International Financial MarketsAnmol GoyalNo ratings yet

- Test 7Document8 pagesTest 7Trịnh Trân TrânNo ratings yet

- CISI - 1. Financial Service IndustryDocument4 pagesCISI - 1. Financial Service Industrykhushi chaudhariNo ratings yet

- Chapter 01 Role of Financial Markets and Institutions-1Document8 pagesChapter 01 Role of Financial Markets and Institutions-1مؤمن عثمان علي محمدNo ratings yet

- Unit 3 - Exercises To StsDocument7 pagesUnit 3 - Exercises To Stsyenxom1007No ratings yet

- Foundations of Multinational Financial Management: Babasab PatilDocument29 pagesFoundations of Multinational Financial Management: Babasab PatilBabasab Patil (Karrisatte)No ratings yet

- International Financing and International Financial MarketsDocument40 pagesInternational Financing and International Financial MarketslalitNo ratings yet

- CISI - 3. Financial Assets and MarketsDocument10 pagesCISI - 3. Financial Assets and Marketskhushi chaudhariNo ratings yet

- 11 Lecture PDFDocument23 pages11 Lecture PDFПоля КаменчукNo ratings yet

- Unit 3 - Exercises To StsDocument5 pagesUnit 3 - Exercises To StsHà ThưNo ratings yet

- Malinao, Chatty Bsa 3 - 1A: Name: Date: ScoreDocument3 pagesMalinao, Chatty Bsa 3 - 1A: Name: Date: ScoreChatty MalinaoNo ratings yet

- Commerce Bms Bachelor of Management Studies Semester 6 2024 April Elective Finance International Finance CbcgsDocument4 pagesCommerce Bms Bachelor of Management Studies Semester 6 2024 April Elective Finance International Finance Cbcgsdeval5258No ratings yet

- Review of The Subject International EconomicsDocument64 pagesReview of The Subject International EconomicsPhan Hà TrangNo ratings yet

- Econ 442 - Problem Set 3Document6 pagesEcon 442 - Problem Set 3Nguyễn Hải GiangNo ratings yet

- Cross Border BnkingDocument3 pagesCross Border BnkingPenn CollinsNo ratings yet

- Quiz 3Document5 pagesQuiz 3natashaNo ratings yet

- Topic 1: Overview of Financial Systems Test 1 SECTION1: Match The Terms With Suitable Explanations ExplanationsDocument33 pagesTopic 1: Overview of Financial Systems Test 1 SECTION1: Match The Terms With Suitable Explanations Explanationsnghiep tranNo ratings yet

- ASSIGNMENT 2 Financial Market &institution - Docx To BeDocument2 pagesASSIGNMENT 2 Financial Market &institution - Docx To BealemayehuNo ratings yet

- Chapter 02 OverviewDocument5 pagesChapter 02 OverviewavisitorNo ratings yet

- International Economics, 7e (Husted/Melvin) Chapter 19 Alternative International Monetary StandardsDocument15 pagesInternational Economics, 7e (Husted/Melvin) Chapter 19 Alternative International Monetary Standardsjermaine brownNo ratings yet

- Investing 101 Course OutlineDocument4 pagesInvesting 101 Course OutlinePrashant TapkeerNo ratings yet

- Fin Past Years July 2021Document7 pagesFin Past Years July 2021Khairi HuzaifiNo ratings yet

- Section A (Multiple Choice Questions) : Ractice EcturesDocument4 pagesSection A (Multiple Choice Questions) : Ractice Ecturesolaef1445No ratings yet

- Tybbi Sem5 FSM Nov19Document2 pagesTybbi Sem5 FSM Nov19parchavinit35No ratings yet

- International LL OwnDocument56 pagesInternational LL OwnTeddy DerNo ratings yet

- Questions (1) - PartDocument6 pagesQuestions (1) - Partakandel9999No ratings yet

- Multiple Choice Questions Financial MarketsDocument16 pagesMultiple Choice Questions Financial Marketshannabee00No ratings yet

- 01 Task Performance 12Document3 pages01 Task Performance 12Adrasteia ZachryNo ratings yet

- Ibe MCQ PDFDocument9 pagesIbe MCQ PDFpavandongreNo ratings yet

- International Finance - QBDocument5 pagesInternational Finance - QBGeetha aptdcNo ratings yet

- CH 07Document12 pagesCH 07Mahmoud HamedNo ratings yet

- Chapter 03 International Financial MarketsDocument12 pagesChapter 03 International Financial MarketsmahraNo ratings yet

- Krasheninnikova IFF18-3kDocument7 pagesKrasheninnikova IFF18-3kAnastasia KrasheninnikovaNo ratings yet

- Chapter 1 HWDocument5 pagesChapter 1 HWValerie Bodden Kluge100% (1)

- Full Name of Our Finance 33 ProfessorDocument3 pagesFull Name of Our Finance 33 ProfessorLhadii LeiNo ratings yet

- Practice Multiple Choice Qs For Mid S1 2010Document5 pagesPractice Multiple Choice Qs For Mid S1 2010ElaineKongNo ratings yet

- Section A: (30 Marks) Part I: Multiple Choice Questions: Confidential Afd 3023 / July - November 2007Document6 pagesSection A: (30 Marks) Part I: Multiple Choice Questions: Confidential Afd 3023 / July - November 2007Vijay ThapliyalNo ratings yet

- Top 50 CAIIB Practice Questions For BFM: Download Free PDF NowDocument10 pagesTop 50 CAIIB Practice Questions For BFM: Download Free PDF NowAkthar fathimaNo ratings yet

- International Finance MCQDocument21 pagesInternational Finance MCQsydneytran167No ratings yet

- Finance 1Document12 pagesFinance 1Mary Ann AntenorNo ratings yet

- Unit 3 Exercises To StsDocument5 pagesUnit 3 Exercises To StsHoàng Lâm NguyễnNo ratings yet

- Glob Finc - Practice Set For Exam 1 - SolutionsDocument7 pagesGlob Finc - Practice Set For Exam 1 - SolutionsInesNo ratings yet

- Report On Utilization of LDRRMFDocument1 pageReport On Utilization of LDRRMFLan ZhanNo ratings yet

- 12.sickness in Small Scale Industries Causes RemediesDocument9 pages12.sickness in Small Scale Industries Causes RemediesKruttika MohapatraNo ratings yet

- DaewooDocument18 pagesDaewooapoorva498No ratings yet

- Afm010 Topic06 Lecture01Document18 pagesAfm010 Topic06 Lecture01sornsreynich9No ratings yet

- Risk Analytics - Tutorial - w2Document30 pagesRisk Analytics - Tutorial - w2palasek182No ratings yet

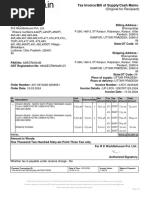

- InvoiceDocument2 pagesInvoiceBhanupratapNo ratings yet

- Financial Statements AnalysisDocument5 pagesFinancial Statements AnalysisShaheen MahmudNo ratings yet

- Filipino Values and Management Practices in The Philippines: Lislie D. RoyoDocument34 pagesFilipino Values and Management Practices in The Philippines: Lislie D. RoyoLily CruzNo ratings yet

- Thesis Research ProposalDocument63 pagesThesis Research ProposalJustine DinglasanNo ratings yet

- Group 7 CitibankDocument22 pagesGroup 7 CitibankPooja SinghiNo ratings yet

- BusinessDocument10 pagesBusinessIdris Aji DaudaNo ratings yet

- Supply Chain Management Solved Mcq's and PDF Download Set-1Document6 pagesSupply Chain Management Solved Mcq's and PDF Download Set-1jayant bansalNo ratings yet

- Service Quality of Public Sector Banks - A Study: ManagementDocument7 pagesService Quality of Public Sector Banks - A Study: ManagementgherijaNo ratings yet

- Chapter 9: Health-Related Entrepreneurial Activities in The Community SettingDocument3 pagesChapter 9: Health-Related Entrepreneurial Activities in The Community SettingXandra Riosa100% (5)

- AB-ECM FlowchartDocument2 pagesAB-ECM FlowchartCarlosJohn02100% (1)

- Assignment 2: Sustainable EntrepreneurshipDocument11 pagesAssignment 2: Sustainable Entrepreneurshiphetvi parekhNo ratings yet

- Ipoh Main 1 28/02/23Document6 pagesIpoh Main 1 28/02/23Remy YamahaNo ratings yet

- Fintech Chapter 13: Startup FinancingDocument28 pagesFintech Chapter 13: Startup FinancingAllen Uhomist AuNo ratings yet

- SCM Lec 5 - (Chopra Chapter - 4)Document29 pagesSCM Lec 5 - (Chopra Chapter - 4)gr8_amara0% (1)

- Quiz 4Document3 pagesQuiz 4lumiradutNo ratings yet

- Analysis of Procter & Gamble Company's Business StrategyDocument7 pagesAnalysis of Procter & Gamble Company's Business StrategyAbid KhawajaNo ratings yet

- Global Trade Operation - A1Document11 pagesGlobal Trade Operation - A1Phuong Anh TranNo ratings yet

- Introduction of Vedanta GroupDocument7 pagesIntroduction of Vedanta Groupgreen_destiny0999No ratings yet

- Datascope Reference DataDocument3 pagesDatascope Reference DataGurupraNo ratings yet

- Financial Education and Behavior Formation:: Large-Scale Experimental Evidence From BrazilDocument67 pagesFinancial Education and Behavior Formation:: Large-Scale Experimental Evidence From BrazilJefersonNo ratings yet

- ExxonMobil Capital Employed and ROACEDocument2 pagesExxonMobil Capital Employed and ROACEsam101sam101No ratings yet

- Risk and RewardsDocument2 pagesRisk and Rewardscourse shtsNo ratings yet

- Askari BankDocument2 pagesAskari Banksyed tayyab sherazi100% (1)

- ACC802 Tutorial Questions Topic 9Document2 pagesACC802 Tutorial Questions Topic 9sanjeet kumarNo ratings yet