Cash Budget Question 2 & 3

Cash Budget Question 2 & 3

Uploaded by

NUR FATIN FISALCopyright:

Available Formats

Cash Budget Question 2 & 3

Cash Budget Question 2 & 3

Uploaded by

NUR FATIN FISALCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Cash Budget Question 2 & 3

Cash Budget Question 2 & 3

Uploaded by

NUR FATIN FISALCopyright:

Available Formats

Feb Mar Apr May

500,000 650,000 300,000 360,000

Feb Mar Apr May

1) Cash Sales 15% current 75,000 97,500 45,000 54,000

Credit Sales 85% 425,000 552,500 255,000 306,000

35% 1month 148,750 193,375 89,250

65% 2month 276,250 359,125

Total 500,000 798,750 769,625 808,375

2)

Feb Mar Apr May

Purchase 50% 1month advance 250,000 325,000 150,000

Equally 2months 50% 125,000 162,500

after purchase 50% 125,000

Total - 250,000 450,000 437,500

3)

Feb Mar Apr May

Salary & wages 10% current 50,000 65,000 30,000 36,000

4)

Feb Mar Apr May

Rental Fixed 1,000 1,000 1,000 1,000

Insurance Fixed 1,600 1,600 1,600 1,600

5)

Feb Mar Apr May

Machine - - - 200,000

6)

Feb Mar Apr May

Taxation - - - -

7) Opening Balance April 100,000

Minimum Cash = 18,000

Jun Jul Aug

400,000 420,000 460,000

Jun Jul Aug

60,000 63,000 69,000

340,000 357,000 391,000

107,100 119,000 124,950

165,750 198,900 221,000

672,850 737,900 805,950

Jun Jul Aug

180,000 200,000 210,000

75,000 90,000

162,500 75,000 90,000

417,500 365,000 300,000

Jun Jul Aug

40,000 42,000 46,000

Jun Jul Aug

1,000 1,000 1,000

1,600 1,600 1,600

Jun Jul Aug

- - -

Jun Jul Aug

20,000 - -

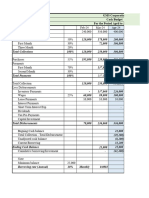

SUNWAY COOPERATION : CASH BUDGET FOR SECOND QUARTER 2021

APRIL MAY JUNE

1. RECEIPTS

TOTAL SALES :

CASH SALES (15%) 45,000 54,000 60,000

TOTAL CREDIT SALES (85%) :

CREDIT SALES (35%) 193,375 89,250 107,100

CREDIT SALES (65%) 276,250 359,125 165,750

TOTAL CASH RECEIPT 514,625 502,375 332,850

2. DISBURSEMENTS

PURCHASES OF MATERIAL (50%) :

CREDIT PURCHASES 1MONTH (50%) 125,000 162,500 75,000

CREDIT PURCHASES 2MONTH (50%) - 125,000 162,500

SALARIES & WAGES 30,000 36,000 40,000

RENT 1,000 1,000 1,000

INSURANCE 1,600 1,600 1,600

MACHINE 200,000

TAXATION 20,000

TOTAL CASH DISBURSEMENT 157,600 526,100 300,100

3 NET CASH FLOW 357,025 (23,725) 32,750

4 CASH RECONCILIATION

NET CASH FLOW 357,025 (23,725) 32,750

LESS INTEREST ON BORROWING - - -

PLUS BEGINNING CASH BALANCE 100,000 457,025 433,300

ENDING CASH BALANCE 457,025 433,300 466,050

LESS CASH REQUIREMENTS (19,000) (19,000) (19,000)

EXCESS 438,025 414,300 447,050

July August September

86,000 95,000 99,000

1) Cash Sales 20% current 17,200 19,000 19,800

Credit Sales 80% 68,800 76,000 79,200

70% 1month 43,680 48,160 53,200

25% 2month 18,600 15,600 15,600

5% Uncollectable 3,440 3,800 3,960

2)

July August September

Purchase 60% 2month advance 55,800 46,800 51,600

Cash Purchase 55% current 30,690 25,740 28,380

Credit Purchase 25% 1month 12,750 13,950 11,700

20% 2month - 10,200 11,160

3)

July August September

Computer 5,000 - -

4)

July August September

Rental Fixed 3,000 3,000 3,000

5)

July August September

Taxation - - 4,000

6)

July August September

Other exp 3% 2,580 2,850 2,970

Labor exp 1% 860 950 990

7) Opening Balance June 20,000

Minimum Cash = 15,000

8) Cost of borrowing = 10%

WADINDA BHD : CASH BUDGET FOR THIRD QUARTER 2022

JULY AUG SEPT

1. RECEIPTS

TOTAL SALES :

CASH SALES (20%) 17,200 19,000 19,800

TOTAL CREDIT SALES (80%) :

CREDIT SALES (70%) 43,680 48,160 53,200

CREDIT SALES (25%) 18,600 15,600 15,600

TOTAL CASH RECEIPT 79,480 82,760 88,600

2. DISBURSEMENTS

PURCHASES OF MATERIAL (60%) :

CASH PURCHASE (55%) 30,690 25,740 28,380

CREDIT PURCHASES 1MONTH (25%) 12,750 13,950 11,700

CREDIT PURCHASES 2MONTH (20%) - 10,200 11,160

COMPUTER 5,000 - -

RENT 3,000 3,000 3,000

TAXATION - - 4,000

OTHER EXPENDITURE 2,580 2,850 2,970

LABOR EXPENDITURE 860 950 990

TOTAL CASH DISBURSEMENT 54,880 56,690 62,200

3. NET CASH FLOW 24,600 26,070 26,400

4 CASH RECONCILIATION

NET CASH FLOW 24,600 26,070 26,400

LESS INTEREST ON BORROWING - - -

PLUS BEGINNING CASH BALANCE 20,000 44,600 70,670

ENDING CASH BALANCE 44,600 70,670 97,070

LESS CASH REQUIREMENTS (15,000) (15,000) (15,000)

EXCESS 29,600 55,670 82,070

You might also like

- Magma Minerals Case StudyDocument6 pagesMagma Minerals Case StudyJoyce De LunaNo ratings yet

- P2.T6. Credit Risk Measurement & Management Jonathan Golin and Philippe Delhaise, The Bank Credit Analysis Handbook Bionic Turtle FRM Study NotesDocument32 pagesP2.T6. Credit Risk Measurement & Management Jonathan Golin and Philippe Delhaise, The Bank Credit Analysis Handbook Bionic Turtle FRM Study Notesericsammy94No ratings yet

- Managerial Accounting Ass Written Ass 1Document1 pageManagerial Accounting Ass Written Ass 1Roba HassanNo ratings yet

- LatestDocument13 pagesLatestNUR FATIN FISALNo ratings yet

- Fin420 AssignmentDocument2 pagesFin420 Assignment2023607226No ratings yet

- Assignments-1 (IBF-SP-20-MBA-0041) Syed Anees AliDocument10 pagesAssignments-1 (IBF-SP-20-MBA-0041) Syed Anees AliSYED ANEES ALINo ratings yet

- Worksheet Master BudgetDocument6 pagesWorksheet Master BudgetRUPIKA R GNo ratings yet

- XYZ SDN - Bhd. Cash Budget From July - September 2011 MAY June JulyDocument4 pagesXYZ SDN - Bhd. Cash Budget From July - September 2011 MAY June JulynurainNo ratings yet

- Example KPI With GraphsDocument4 pagesExample KPI With GraphsSathesh AustinNo ratings yet

- St. Therese Montessori School of San PabloDocument3 pagesSt. Therese Montessori School of San PabloJersey Ann AlcazarNo ratings yet

- Questions On Cash Budget-2Document7 pagesQuestions On Cash Budget-2Mpolokeng HlabanaNo ratings yet

- Flujo de Caja2Document4 pagesFlujo de Caja2cpcmcerdanNo ratings yet

- EllisDocument2 pagesEllisVimal RathodNo ratings yet

- Abubaker, ID 15854 Mid TermDocument3 pagesAbubaker, ID 15854 Mid TermrtsaccofficerNo ratings yet

- Practice Question of Cash BudgetingDocument5 pagesPractice Question of Cash BudgetingHira RaisNo ratings yet

- AF Ch. 4 - Analysis FS - ExcelDocument9 pagesAF Ch. 4 - Analysis FS - ExcelAlfiandriAdinNo ratings yet

- CASH BUDGET Answer - NOV 21Document4 pagesCASH BUDGET Answer - NOV 21Sufiah HazmanNo ratings yet

- Fa correction testDocument5 pagesFa correction testdomitiooNo ratings yet

- Budget - Comprehensive - FinalizedddDocument41 pagesBudget - Comprehensive - Finalizedddsharjeelraja876No ratings yet

- Cash BudgetDocument13 pagesCash BudgetgnanaprakasamcNo ratings yet

- Total Cash Available (1 + 2) 82,500 124,000 89,275Document6 pagesTotal Cash Available (1 + 2) 82,500 124,000 89,275Nischal LawojuNo ratings yet

- Module 11Document3 pagesModule 11Eunice GonzalesNo ratings yet

- Case 8-31: April May June QuarterDocument2 pagesCase 8-31: April May June QuarterileviejoieNo ratings yet

- Name: M.Ahsan Rasheed: Merchandise Purchase BudgetDocument6 pagesName: M.Ahsan Rasheed: Merchandise Purchase BudgetramshaNo ratings yet

- HW # 1 BUDGETED Cash Receipts and Disb 3 Mo ProblemDocument2 pagesHW # 1 BUDGETED Cash Receipts and Disb 3 Mo Problemchristine.chuaNo ratings yet

- Assigment Costing (Ceria Co.)Document4 pagesAssigment Costing (Ceria Co.)Aien NaNo ratings yet

- Group 2 Cash Budget N4ba2503Document3 pagesGroup 2 Cash Budget N4ba2503nuraz3169No ratings yet

- Budget Assignment Sheet1Document6 pagesBudget Assignment Sheet1kykymaegg.galindezNo ratings yet

- Acct203 SW 2 Problems SolutionsDocument4 pagesAcct203 SW 2 Problems Solutionsanimaldoctor23No ratings yet

- Budgetary ControlDocument5 pagesBudgetary ControlJasdeep Singh DeepuNo ratings yet

- Midterm Problems FinmarDocument10 pagesMidterm Problems Finmarmingyu universeNo ratings yet

- CashBudgettutsolnsDocument12 pagesCashBudgettutsolnsuudsefdNo ratings yet

- Template Keuangan VIPDocument10 pagesTemplate Keuangan VIPSt. Hartina TahirNo ratings yet

- Cash Budgeting and Ratio CalculationsDocument14 pagesCash Budgeting and Ratio Calculationsvannessachigalu360No ratings yet

- Acctg 202Document9 pagesAcctg 202Lore Desa CenizaNo ratings yet

- Working Capital Suggested SolutionsDocument7 pagesWorking Capital Suggested SolutionsBulelwa HarrisNo ratings yet

- ARDocument11 pagesARArnold BernasNo ratings yet

- CASE STUDY(2)Document7 pagesCASE STUDY(2)domitiooNo ratings yet

- NO Struktur Biaya Satuan Jumlah Fisik Biaya Per Satuan Jumlah Biaya Per 1 BulanDocument4 pagesNO Struktur Biaya Satuan Jumlah Fisik Biaya Per Satuan Jumlah Biaya Per 1 Bulanyoga permanaNo ratings yet

- TFFC ProjectionDocument15 pagesTFFC ProjectionsameerNo ratings yet

- Nur Atiqah Binti Saadon (Kba2761a) - 2023448576Document3 pagesNur Atiqah Binti Saadon (Kba2761a) - 2023448576nuratiqahsaadon89No ratings yet

- Practical Test Finance & AccountingDocument7 pagesPractical Test Finance & AccountingAlbert CandraNo ratings yet

- Worksheet 05082020Document7 pagesWorksheet 05082020sajedulNo ratings yet

- Financials of StartupDocument31 pagesFinancials of StartupJanine PadillaNo ratings yet

- Cash Budget Problems and SolutionsDocument6 pagesCash Budget Problems and Solutionstamberahul1256100% (1)

- Budgeting 30 NOvDocument8 pagesBudgeting 30 NOvHaris HasanNo ratings yet

- Pro Forma Balance Sheet - Tutorial Question and AnswerDocument5 pagesPro Forma Balance Sheet - Tutorial Question and Answer20231015470% (1)

- Abubaker FME Cash BudgetDocument10 pagesAbubaker FME Cash BudgetrtsaccofficerNo ratings yet

- Chapter 9 2Document34 pagesChapter 9 2Genie MaeNo ratings yet

- Mas ReviewerDocument14 pagesMas ReviewerMichelle AvilesNo ratings yet

- Cash BudgetDocument1 pageCash BudgetatenNo ratings yet

- 3 Months PlanDocument8 pages3 Months PlanWaleed ZakariaNo ratings yet

- Gaelle FarhatDocument5 pagesGaelle FarhatdomitiooNo ratings yet

- Exercise 1: Schedule of Expected Cash CollectionDocument7 pagesExercise 1: Schedule of Expected Cash CollectionLenard Josh IngallaNo ratings yet

- Cash BudgetingDocument3 pagesCash Budgetingsunil.ctNo ratings yet

- Treasury Management Vs Cash Management Answer To Warm Up ExercisesDocument8 pagesTreasury Management Vs Cash Management Answer To Warm Up Exercisesephraim0% (1)

- Installment LiquidationDocument4 pagesInstallment LiquidationVivienne Rozenn LaytoNo ratings yet

- Total Receipts 100,400 132,400 153,000Document3 pagesTotal Receipts 100,400 132,400 153,000Marissa Jem ClaveriaNo ratings yet

- 20 - Assignment 4 CTRDocument2 pages20 - Assignment 4 CTRCamilo ToroNo ratings yet

- Mahyoro Ace Cash Flow Statemet 2020-2021Document4 pagesMahyoro Ace Cash Flow Statemet 2020-2021ssembatya reaganNo ratings yet

- BR Cold Storage - April 4Document9 pagesBR Cold Storage - April 4Randy LandaoNo ratings yet

- Crypto Exchanges in 2021 - ChainalysisDocument16 pagesCrypto Exchanges in 2021 - ChainalysisRedvirus2007No ratings yet

- Far460 Group Project 2Document4 pagesFar460 Group Project 2NURAMIRA AQILANo ratings yet

- Acis 5194Document2 pagesAcis 5194steveNo ratings yet

- PDF For Banking Material-02Document9 pagesPDF For Banking Material-02mairaj zafarNo ratings yet

- Banks ServicesDocument28 pagesBanks ServicesAyushNo ratings yet

- 1992-2007 Kpds Paragraf Tamamlama SorulariDocument36 pages1992-2007 Kpds Paragraf Tamamlama Sorulariahmet parlakNo ratings yet

- Implied Volatility Term Structure and Exchange Rate Predictability Ornelas & MauadDocument14 pagesImplied Volatility Term Structure and Exchange Rate Predictability Ornelas & MauadISRAel JuniorNo ratings yet

- Dangote CementDocument9 pagesDangote CementGodfrey BukomekoNo ratings yet

- MN-M001 Online 24 Hour Exam - August 2024 FINALDocument5 pagesMN-M001 Online 24 Hour Exam - August 2024 FINALDarshan MittalNo ratings yet

- Heads or Tails - Two Sides of The CoinDocument21 pagesHeads or Tails - Two Sides of The CoinHot blooderNo ratings yet

- MTP - FM ECO - Aug18 - Oct18 - Mar19 - Apr19 - Oct19 - May20 - Oct20 - Oct21 - Nov21Document158 pagesMTP - FM ECO - Aug18 - Oct18 - Mar19 - Apr19 - Oct19 - May20 - Oct20 - Oct21 - Nov21sersdrNo ratings yet

- Funds - Transfer Application FormDocument1 pageFunds - Transfer Application FormNaveed Ahmad MushtaqNo ratings yet

- Lecture 13 - AMA - RevisionDocument7 pagesLecture 13 - AMA - Revisionzinoppa0401No ratings yet

- F9 June 2010 Q-4Document1 pageF9 June 2010 Q-4rbaambaNo ratings yet

- Current AccountsDocument21 pagesCurrent AccountsSupriyo SenNo ratings yet

- NationalCreditReport - TransUnion PDFDocument2 pagesNationalCreditReport - TransUnion PDFRaqueldelPilar PeñaNo ratings yet

- IpoDocument22 pagesIpoCheyzeeNo ratings yet

- Kidusan Amha Mbao-6074-15A FMA Assignment-11111Document13 pagesKidusan Amha Mbao-6074-15A FMA Assignment-11111Kidusan AmhaNo ratings yet

- PPSAS 28 - Financial Instruments - Presentation 3-18-2013Document3 pagesPPSAS 28 - Financial Instruments - Presentation 3-18-2013Christian Ian LimNo ratings yet

- altbank-Corporate-AOF FinalDocument12 pagesaltbank-Corporate-AOF FinalAbubakar Sadiq UmarNo ratings yet

- FRTB Ssa: This Document Is Only For Limited Distribution Among FGD ParticipantsDocument42 pagesFRTB Ssa: This Document Is Only For Limited Distribution Among FGD ParticipantsxconvertagentNo ratings yet

- W TCRL 2 Di 4 N 1 MujbzDocument10 pagesW TCRL 2 Di 4 N 1 MujbzKiran KumarNo ratings yet

- Internship Report On General Banking of Islami Bank Bangladesh LimitedDocument85 pagesInternship Report On General Banking of Islami Bank Bangladesh LimitedM Rashedul Islam RashedNo ratings yet

- Introduction To Financial DerivativesDocument81 pagesIntroduction To Financial DerivativesFinancial Management by Dr MujahedNo ratings yet

- Program On Finacle 10Document95 pagesProgram On Finacle 10Mudit100% (1)

- Basel II.5, Basel III, and Other Post-Crisis ChangesDocument5 pagesBasel II.5, Basel III, and Other Post-Crisis ChangesMinh TâmNo ratings yet

- Differences Between Islamic Banks & ConventionalDocument8 pagesDifferences Between Islamic Banks & Conventionalsanzo_reloadNo ratings yet

- FD - Unit - III OptionsDocument11 pagesFD - Unit - III OptionspulpsenseNo ratings yet