FRS 107 Ie 2016BB

FRS 107 Ie 2016BB

Uploaded by

Amelia RahmawatiCopyright:

Available Formats

FRS 107 Ie 2016BB

FRS 107 Ie 2016BB

Uploaded by

Amelia RahmawatiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

FRS 107 Ie 2016BB

FRS 107 Ie 2016BB

Uploaded by

Amelia RahmawatiCopyright:

Available Formats

FRS 107 IE*

Illustrative Examples on

FRS 107 Statement of Cash Flows

These Illustrative Examples accompany, but are not part of, FRS 107.

FRS 107 is based on IAS 7 Statement of Cash Flows. In approving FRS 107,

MASB considered and concurred with the provisions of IAS 7.

The IASB’s Illustrative Examples on implementing IAS 7 are reproduced

below for reference.

* This version does not contain changes to Standards with an effective date

after 1 January 2016.

Readers seeking a version that includes amendments to Standards that have

an effective date after 13 January 2016 should refer to FRS 107 IE.

IAS 7 IE

Illustrative examples

These illustrative examples accompany, but are not part of, IAS 7.

A Statement of cash flows for an entity other than a financial

institution

1 The examples show only current period amounts. Corresponding amounts for

the preceding period are required to be presented in accordance with IAS 1

Presentation of Financial Statements.

2 Information from the statement of comprehensive income and statement of

financial position is provided to show how the statements of cash flows under

the direct method and indirect method have been derived. Neither the

statement of comprehensive income nor the statement of financial position is

presented in conformity with the disclosure and presentation requirements of

other Standards.

3 The following additional information is also relevant for the preparation of the

statements of cash flows:

● all of the shares of a subsidiary were acquired for 590. The fair values of

assets acquired and liabilities assumed were as follows:

Inventories 100

Accounts receivable 100

Cash 40

Property, plant and equipment 650

Trade payables 100

Long-term debt 200

● 250 was raised from the issue of share capital and a further 250 was

raised from long-term borrowings.

● interest expense was 400, of which 170 was paid during the period. Also,

100 relating to interest expense of the prior period was paid during the

period.

● dividends paid were 1,200.

● the liability for tax at the beginning and end of the period was 1,000 and

400 respectively. During the period, a further 200 tax was provided for.

Withholding tax on dividends received amounted to 100.

● during the period, the group acquired property, plant and equipment

with an aggregate cost of 1,250 of which 900 was acquired by means of

finance leases. Cash payments of 350 were made to purchase property,

plant and equipment.

● plant with original cost of 80 and accumulated depreciation of 60 was

sold for 20.

● accounts receivable as at the end of 20X2 include 100 of interest

receivable.

B1080 姝 IFRS Foundation

IAS 7 IE

Consolidated statement of comprehensive income for the period ended

20X2(a)

Sales 30,650

Cost of sales (26,000)

Gross profit 4,650

Depreciation (450)

Administrative and selling expenses (910)

Interest expense (400)

Investment income 500

Foreign exchange loss (40)

Profit before taxation 3,350

Taxes on income (300)

Profit 3,050

(a) The entity did not recognise any components of other comprehensive income in the

period ended 20X2

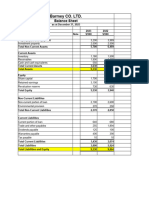

Consolidated statement of financial position as at end of 20X2

20X2 20X1

Assets

Cash and cash equivalents 230 160

Accounts receivable 1,900 1,200

Inventory 1,000 1,950

Portfolio investments 2,500 2,500

Property, plant and equipment

at cost 3,730 1,910

Accumulated depreciation (1,450) (1,060)

Property, plant and equipment

net 2,280 850

Total assets 7,910 6,660

Liabilities

Trade payables 250 1,890

Interest payable 230 100

Income taxes payable 400 1,000

Long-term debt 2,300 1,040

Total liabilities 3,180 4,030

continued...

姝 IFRS Foundation B1081

IAS 7 IE

...continued

Consolidated statement of financial position as at end of 20X2

20X2 20X1

Shareholders’ equity

Share capital 1,500 1,250

Retained earnings 3,230 1,380

Total shareholders’ equity 4,730 2,630

Total liabilities and

shareholders’ equity 7,910 6,660

Direct method statement of cash flows (paragraph 18(a))

20X2

Cash flows from operating activities

Cash receipts from customers 30,150

Cash paid to suppliers and employees (27,600)

Cash generated from operations 2,550

Interest paid (270)

Income taxes paid (900)

Net cash from operating activities 1,380

Cash flows from investing activities

Acquisition of subsidiary X, net of cash acquired

(Note A) (550)

Purchase of property, plant and equipment (Note B) (350)

Proceeds from sale of equipment 20

Interest received 200

Dividends received 200

Net cash used in investing activities (480)

continued...

B1082 姝 IFRS Foundation

IAS 7 IE

...continued

Direct method statement of cash flows (paragraph 18(a))

20X2

Cash flows from financing activities

Proceeds from issue of share capital 250

Proceeds from long-term borrowings 250

Payment of finance lease liabilities (90)

Dividends paid(a) (1,200)

Net cash used in financing activities (790)

Net increase in cash and cash equivalents 110

Cash and cash equivalents at beginning of

period (Note C) 120

Cash and cash equivalents at end of period

(Note C) 230

(a) This could also be shown as an operating cash flow.

Indirect method statement of cash flows (paragraph 18(b))

20X2

Cash flows from operating activities

Profit before taxation 3,350

Adjustments for:

Depreciation 450

Foreign exchange loss 40

Investment income (500)

Interest expense 400

3,740

Increase in trade and other receivables (500)

Decrease in inventories 1,050

Decrease in trade payables (1,740)

Cash generated from operations 2,550

Interest paid (270)

Income taxes paid (900)

Net cash from operating activities 1,380

continued...

姝 IFRS Foundation B1083

IAS 7 IE

...continued

Indirect method statement of cash flows (paragraph 18(b))

20X2

Cash flows from investing activities

Acquisition of subsidiary X net of cash acquired

(Note A) (550)

Purchase of property, plant and equipment (Note B) (350)

Proceeds from sale of equipment 20

Interest received 200

Dividends received 200

Net cash used in investing activities (480)

Cash flows from financing activities

Proceeds from issue of share capital 250

Proceeds from long-term borrowings 250

Payment of finance lease liabilities (90)

Dividends paid(a) (1,200)

Net cash used in financing activities (790)

Net increase in cash and cash equivalents 110

Cash and cash equivalents at beginning of

period (Note C) 120

Cash and cash equivalents at end of period

(Note C) 230

(a) This could also be shown as an operating cash flow.

Notes to the statement of cash flows (direct method and

indirect method)

A. Obtaining control of subsidiary

During the period the Group obtained control of subsidiary X. The fair values of assets

acquired and liabilities assumed were as follows:

B1084 姝 IFRS Foundation

IAS 7 IE

Cash 40

Inventories 100

Accounts receivable 100

Property, plant and equipment 650

Trade payables (100)

Long-term debt (200)

Total purchase price paid in cash 590

Less: Cash of subsidiary X acquired (40)

Cash paid to obtain control net of cash acquired 550

B. Property, plant and equipment

During the period, the Group acquired property, plant and equipment with an aggregate

cost of 1,250 of which 900 was acquired by means of finance leases. Cash payments of 350

were made to purchase property, plant and equipment.

C. Cash and cash equivalents

Cash and cash equivalents consist of cash on hand and balances with banks, and

investments in money market instruments. Cash and cash equivalents included in the

statement of cash flows comprise the following amounts in the statement of financial

position:

20X2 20X1

Cash on hand and balances with banks 40 25

Short-term investments 190 135

Cash and cash equivalents as previously reported 230 160

Effect of exchange rate changes – (40)

Cash and cash equivalents as restated 230 120

Cash and cash equivalents at the end of the period include deposits with banks of 100 held

by a subsidiary which are not freely remissible to the holding company because of currency

exchange restrictions.

The Group has undrawn borrowing facilities of 2,000 of which 700 may be used only for

future expansion.

D. Segment information

Segment A Segment B Total

Cash flows from:

Operating activities 1,520 (140) 1,380

Investing activities (640) 160 (480)

Financing activities (570) (220) (790)

310 (200) 110

姝 IFRS Foundation B1085

IAS 7 IE

Alternative presentation (indirect method)

As an alternative, in an indirect method statement of cash flows, operating profit before

working capital changes is sometimes presented as follows:

Revenues excluding investment income 30,650

Operating expense excluding depreciation (26,910)

Operating profit before working capital changes 3,740

B Statement of cash flows for a financial institution

1 The example shows only current period amounts. Comparative amounts for the

preceding period are required to be presented in accordance with IAS 1

Presentation of Financial Statements.

2 The example is presented using the direct method.

20X2

Cash flows from operating activities

Interest and commission receipts 28,447

Interest payments (23,463)

Recoveries on loans previously written off 237

Cash payments to employees and suppliers (997)

4,224

(Increase) decrease in operating assets:

Short-term funds (650)

Deposits held for regulatory or monetary control

purposes 234

Funds advanced to customers (288)

Net increase in credit card receivables (360)

Other short-term negotiable securities (120)

Increase (decrease) in operating liabilities:

Deposits from customers 600

Negotiable certificates of deposit (200)

Net cash from operating activities before income tax 3,440

Income taxes paid (100)

Net cash from operating activities 3,340

continued...

B1086 姝 IFRS Foundation

IAS 7 IE

...continued

20X2

Cash flows from investing activities

Disposal of subsidiary Y 50

Dividends received 200

Interest received 300

Proceeds from sales of non-dealing securities 1,200

Purchase of non-dealing securities (600)

Purchase of property, plant and equipment (500)

Net cash from investing activities 650

Cash flows from financing activities

Issue of loan capital 1,000

Issue of preference shares by subsidiary

undertaking 800

Repayment of long-term borrowings (200)

Net decrease in other borrowings (1,000)

Dividends paid (400)

Net cash from financing activities 200

Effects of exchange rate changes on cash and cash

equivalents 600

Net increase in cash and cash equivalents 4,790

Cash and cash equivalents at beginning of

period 4,050

Cash and cash equivalents at end of period 8,840

姝 IFRS Foundation B1087

You might also like

- Practice Question On Group AccountsDocument12 pagesPractice Question On Group Accountsemerald75% (4)

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision Questionskelvinmunashenyamutumba100% (1)

- Chapter 1 Review of The Accounting CycleDocument13 pagesChapter 1 Review of The Accounting CycleLouriel MartinezNo ratings yet

- Business Finance Lesson 3Document34 pagesBusiness Finance Lesson 3Iekzkad RealvillaNo ratings yet

- FCF Ch10 Excel Master StudentDocument68 pagesFCF Ch10 Excel Master StudentSilviaKartikaNo ratings yet

- FRS - 7 - Ie - (2016)Document9 pagesFRS - 7 - Ie - (2016)David LeeNo ratings yet

- Cash Flow Statement ExerciseDocument3 pagesCash Flow Statement ExerciseVikas YadavNo ratings yet

- From The Following Information, Prepare A Cash Flow StatementDocument2 pagesFrom The Following Information, Prepare A Cash Flow StatementAgANo ratings yet

- Statement of Cash Flows Lecture Questions and AnswersDocument9 pagesStatement of Cash Flows Lecture Questions and AnswersSaaniya AbbasiNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- 3.BACC III 2016 End - Docx ModeratedDocument7 pages3.BACC III 2016 End - Docx ModeratedsmlingwaNo ratings yet

- Statement of CF - Dallas LTD - Intermediate Level ExerciseDocument4 pagesStatement of CF - Dallas LTD - Intermediate Level ExerciseNhư QuỳnhNo ratings yet

- P2 AFA August 05 071205Document20 pagesP2 AFA August 05 071205cliffton malcolm tshumaNo ratings yet

- CR Inter QuestionsDocument22 pagesCR Inter QuestionsRichie BoomaNo ratings yet

- Cashflwo TABBA F7Document6 pagesCashflwo TABBA F7Pocpoca100% (2)

- Cash FlowDocument7 pagesCash Flowrafanashwa.ayuNo ratings yet

- SCF With DODocument3 pagesSCF With DOMuhammad Asif KhanNo ratings yet

- Jeopardy SolutionsDocument14 pagesJeopardy SolutionsMirkan OrdeNo ratings yet

- OLC Chap 5Document6 pagesOLC Chap 5Isha SinghNo ratings yet

- Cash Flow QuestionsDocument5 pagesCash Flow QuestionssigiryaNo ratings yet

- Consolidation Q55Document8 pagesConsolidation Q55Krishna 11No ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- Cash Flow Tutorial QnsDocument13 pagesCash Flow Tutorial QnsCristian Renatus100% (1)

- Final ExaminationsDocument5 pagesFinal ExaminationsBilal Khan BangashNo ratings yet

- Apply Your Knowledge: Case Study 1Document3 pagesApply Your Knowledge: Case Study 1Queen ValleNo ratings yet

- Test 1Document3 pagesTest 1tshepomoejanejrNo ratings yet

- CORPORATE REPORTING Icag PDFDocument31 pagesCORPORATE REPORTING Icag PDFmohedNo ratings yet

- Accountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsDocument5 pagesAccountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsEricha MutiaNo ratings yet

- Malik Group of Companies (Disposal + Acquisition) : Cfap 1: A A F RDocument1 pageMalik Group of Companies (Disposal + Acquisition) : Cfap 1: A A F R.No ratings yet

- Assets 2005 2004: Ques2. Prepare A Cash Flow Statement As Per As-3Document4 pagesAssets 2005 2004: Ques2. Prepare A Cash Flow Statement As Per As-3Harsh GuptaNo ratings yet

- Question Example 1Document2 pagesQuestion Example 1Nur farah AfiqahNo ratings yet

- ACC9005M - Lecture 4 - Financial Analysis (Recycle LTD) QUESTIONDocument2 pagesACC9005M - Lecture 4 - Financial Analysis (Recycle LTD) QUESTIONPravallika RavikumarNo ratings yet

- Practice QNSDocument2 pagesPractice QNSIan chisemaNo ratings yet

- Chapters ExcelDocument121 pagesChapters ExcelRohan VermaNo ratings yet

- Tutorial 2 A192 QuestionDocument9 pagesTutorial 2 A192 QuestionMastura Abd HamidNo ratings yet

- CAC1201201008 Financial Accounting 1BDocument6 pagesCAC1201201008 Financial Accounting 1Bnyasha gundaniNo ratings yet

- Practice Exercise - Cobble Hill Part 3 Cash Flow - SolutionDocument4 pagesPractice Exercise - Cobble Hill Part 3 Cash Flow - Solution155- Salsabila GadingNo ratings yet

- Chapter 2. Understanding The Income StatementDocument10 pagesChapter 2. Understanding The Income StatementVượng TạNo ratings yet

- Batch 18 Final Preboard (P1)Document16 pagesBatch 18 Final Preboard (P1)Mike Oliver NualNo ratings yet

- Statement of Cash Flow - Thorstved CoDocument5 pagesStatement of Cash Flow - Thorstved Cotun ibrahimNo ratings yet

- Practice-Assignment - Afs - 31-Augsut-2019Document10 pagesPractice-Assignment - Afs - 31-Augsut-2019Waqar AhmadNo ratings yet

- Duch Ravi (16ACT41sb1)Document3 pagesDuch Ravi (16ACT41sb1)chhayloeng60No ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- FR 1 QDocument17 pagesFR 1 QG INo ratings yet

- Ac 4052qa Coursework Augs24 Intake Assignment Brief 01Document2 pagesAc 4052qa Coursework Augs24 Intake Assignment Brief 01collojaiwhiteNo ratings yet

- Lecture-1 FAC Final AccountsDocument3 pagesLecture-1 FAC Final AccountsFaruque Abdullah RumonNo ratings yet

- Cash Flow Statement (BBA-H)Document5 pagesCash Flow Statement (BBA-H)asiharry037No ratings yet

- W2D2C1&2 Interpretation FS ActivitiesDocument13 pagesW2D2C1&2 Interpretation FS ActivitiesMaximillian GleichmannNo ratings yet

- Exhibit 3.1 Balance Sheet of Horizon Limited As at March 31, 20x1Document121 pagesExhibit 3.1 Balance Sheet of Horizon Limited As at March 31, 20x1DrSwati BhargavaNo ratings yet

- 2020 1 Accounting in Organisations and Society Assignment-3Document7 pages2020 1 Accounting in Organisations and Society Assignment-3Abs PangaderNo ratings yet

- Lecture 1 & 2 ExamplesDocument5 pagesLecture 1 & 2 ExamplesAbubakari Abdul MananNo ratings yet

- Chapter 3Document4 pagesChapter 324a4013096No ratings yet

- CAFM FULL SYLLABUS FREE TEST DEC 23-Executive-RevisionDocument7 pagesCAFM FULL SYLLABUS FREE TEST DEC 23-Executive-Revisionyogeetha saiNo ratings yet

- Cash FlowsDocument18 pagesCash FlowsTamlyn MaistryNo ratings yet

- Хариу HW2 ACC732Document6 pagesХариу HW2 ACC732ZayaNo ratings yet

- HKICPA QP Exam (Module A) Feb2006 Question PaperDocument7 pagesHKICPA QP Exam (Module A) Feb2006 Question Papercynthia tsuiNo ratings yet

- Income Statements For The November: @Chapter7AnalyslngandlnterpretlngflnanclalstatementsDocument1 pageIncome Statements For The November: @Chapter7AnalyslngandlnterpretlngflnanclalstatementsAik Luen LimNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- Assignment 2Document4 pagesAssignment 2Loveness Mphande100% (1)

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Assignment 1: 1991 1990 1989 Alpha CorporationDocument6 pagesAssignment 1: 1991 1990 1989 Alpha CorporationNiteshNo ratings yet

- Objective Type Questions: True or FalseDocument25 pagesObjective Type Questions: True or Falsesameeksha kosariaNo ratings yet

- File Tổng Hợp Quizz Ktqt 1: File này mấy bạn muốn sao chép, chia sẻ, hay đi phô tô thì thoải mái nhaDocument38 pagesFile Tổng Hợp Quizz Ktqt 1: File này mấy bạn muốn sao chép, chia sẻ, hay đi phô tô thì thoải mái nhaDANH LÊ VĂNNo ratings yet

- MFM RM SixDocument7 pagesMFM RM SixMayank PitariyaNo ratings yet

- Answer 11Document10 pagesAnswer 11kamallNo ratings yet

- Ratio Analysis Practice QuestionsDocument4 pagesRatio Analysis Practice Questionswahab_pakistan100% (1)

- Single Entry System and Cash To Accrual AccountingDocument2 pagesSingle Entry System and Cash To Accrual AccountingRandom AcNo ratings yet

- NakakaxDocument3 pagesNakakaxPaula Villarubia100% (1)

- Unit .2 The Accounting CycleDocument29 pagesUnit .2 The Accounting CycleYonas100% (1)

- Capital BudgetingDocument87 pagesCapital BudgetingCBSE UGC NET EXAMNo ratings yet

- Summary FSAPresentation FinalDocument14 pagesSummary FSAPresentation FinalShereen HossamNo ratings yet

- Home Office Books Mandaue Books Date Account Title Debit Credit DateDocument27 pagesHome Office Books Mandaue Books Date Account Title Debit Credit DateVon Andrei MedinaNo ratings yet

- Accounting Cycle 6Document49 pagesAccounting Cycle 6buuh abdi100% (1)

- RWJ Chapter 3 Financial Statements Analysis and Financial ModelsDocument34 pagesRWJ Chapter 3 Financial Statements Analysis and Financial ModelsAshekin Mahadi100% (1)

- Group D - Case 32 California Pizza Kitchen-2Document91 pagesGroup D - Case 32 California Pizza Kitchen-2Vinithi ThongkampalaNo ratings yet

- Jubasan Inopacan Leyte CY 2020-2022Document47 pagesJubasan Inopacan Leyte CY 2020-2022Ken BocsNo ratings yet

- Exercises in Statement of Financial PositionDocument5 pagesExercises in Statement of Financial PositionQueen ValleNo ratings yet

- Week11 CH5 SeminarAssignmentDocument10 pagesWeek11 CH5 SeminarAssignmentbhattfenil29No ratings yet

- Project FOR New Unit of CNC Machine Under Pmegp Scheme: Shine EngineerDocument21 pagesProject FOR New Unit of CNC Machine Under Pmegp Scheme: Shine Engineerraiyani sampatNo ratings yet

- AFM-Assignment Ratio Analysis (1) - Priya ChauhanDocument2 pagesAFM-Assignment Ratio Analysis (1) - Priya ChauhanTulika S. NarayanNo ratings yet

- Tutorial 1 - Scope and Nature of Managerial FinanceDocument2 pagesTutorial 1 - Scope and Nature of Managerial FinanceShi ManNo ratings yet

- CoaDocument5 pagesCoaSanto MulyonoNo ratings yet

- Philippine Government Accounting StandardsDocument9 pagesPhilippine Government Accounting StandardsShien AgucayNo ratings yet

- Adobe Scan Mar 01, 2024Document8 pagesAdobe Scan Mar 01, 2024waseerasul37No ratings yet

- ICAEW - Chapter 13 - Statement of Cash FlowDocument43 pagesICAEW - Chapter 13 - Statement of Cash Flowvothituongnhi7703100% (1)

- Ratio Ultratech Cement FinalDocument89 pagesRatio Ultratech Cement FinalDeepti Sharma100% (3)

- Working Capital and Cash Management ExercisesDocument4 pagesWorking Capital and Cash Management ExercisesjoytheoneNo ratings yet