Fabm 12 Q2 1002 Ak

Fabm 12 Q2 1002 Ak

Uploaded by

anna paulaCopyright:

Available Formats

Fabm 12 Q2 1002 Ak

Fabm 12 Q2 1002 Ak

Uploaded by

anna paulaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Fabm 12 Q2 1002 Ak

Fabm 12 Q2 1002 Ak

Uploaded by

anna paulaCopyright:

Available Formats

Unit 10: Income and Business Taxation

10.2. Introduction to Taxation

Questions to Ponder

1. How does income taxation affect the progress of the nation?

Answers may vary. Income taxation supports the nation’s progress by pooling funds from

the income-generating activities of citizens. These funds are used for services and

projects enjoyed by the whole society. Just, fair, and effective taxation can also help

distribute the wealth created by society.

2. Is it beneficial to an individual or business to pay taxes? Why?

Yes. Paying taxes is an enforced obligation. However, it is also beneficial for taxpayers

since they can benefit from government services and projects.

3. Why do some individuals hesitate to pay taxes?

Answers may vary. Some individuals hesitate to pay taxes either because they do not

know the tax laws and regulations or they do not believe that they are benefitting from

the taxes that they pay.

Check Your Progress

1. Why is reciprocity a consideration in Philippine taxation?

Answers may vary. Reciprocity is considered in making tax regulations because the

country is still developing. Taxation, which plays a major role in distributing wealth,

could bring improvements in society.

2. What is the importance of using various forms in filing for income tax?

Using different tax forms when filing is important because it will enable the BIR and the

one filing to understand their classification better. Moreover, it will be easier to track if

such forms are imposed and used.

10.2. Introduction to Taxation 1

Unit 10: Income and Business Taxation

Try This

True or False. Write true if the statement is correct. Otherwise, write false.

True 1. Different principles underlie the system of taxation.

False 2. Taxation is not an inherent power of the government.

True 3. Taxes are not only imposed on the income of individuals and

businesses.

True 4. In general, the subject of taxation is unlimited.

True 5. In the absence of expressed law stating otherwise, the

principles of taxation shall prevail.

False 6. The secondary purpose of taxation is to provide funds to the

government.

True 7. A secondary purpose of taxation is to regulate certain activities

and businesses.

True 8. Gross salary includes basic pay.

False 9. SSS is not a mandatory government contribution.

True 10. Pag-IBIG contributions are utilized mainly for housing

assistance.

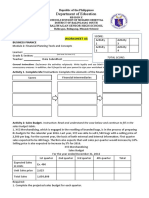

Practice Your Skills

Read the following situations and calculate the taxable income and tax due.

1. Carol is an employee of ABC Corporation. Her annual gross income is ₱420,000. Her

compensation package includes all government-mandated benefits. Assume that

the total contributions are the following:

SSS: ₱18,900

10.2. Introduction to Taxation 2

Unit 10: Income and Business Taxation

PhilHealth: ₱11,550

Pag-IBIG: ₱1,200

How much is Carol’s taxable income, and how much is her tax due?

Taxable income = 420,000 – (18,900 + 11,500 + 1,200)

= 420,000 – 31,650

Taxable Income = ₱388,400

Tax Due = 20% of the excess over P250,000

= (388,400 – 250,000) x 0.20

= 138,400 x 0.20

Tax Due= ₱27,680

2. Ely is a freelance marketing professional. His quarterly gross income is ₱350,000.

Suppose that he opted for optional deduction and graduated rates. How much is his

taxable income and tax due?

Taxable income under the Graduated Tax Rate (Optional Deduction) = Gross Sales

– (40% of gross sales)

= 350,000 – (350,000 x 0.40)

= 350,000 – 140,000

Taxable income under the Graduated Tax Rate (Optional Deduction) =

₱210,000

Ely’s taxable income did not exceed ₱250,000, therefore, he has ₱0 tax due for

the quarter.

3. Suppose Ely decided to use the 8% Income Tax Rate option. How much is his tax

due?

Taxable income under the 8% Rate = Gross Sales – 250,000

= 350,000 – 250,000

10.2. Introduction to Taxation 3

Unit 10: Income and Business Taxation

Taxable income under the 8% Rate = ₱100,000

Tax Due for 8% Income Tax Rate = Taxable Income x 0.08

= 100,000 x 0.08

Tax Due for 8% Income Tax Rate = ₱8,000

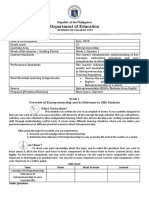

4. Kristine’s business, which is a domestic corporation, has the following financial data

for three years.

2020 2021 2022

Gross Income, Ph 740,580 85,390 232,466

Gross Income, Au 50,000 20,000 50,000

Expense, Ph 100,000 140,000 120,000

Expense, Au 15,000 25,000 30,000

Calculate the MCIT for 2020.

𝑀𝑖𝑛𝑖𝑚𝑢𝑚 𝐶𝑜𝑟𝑝𝑜𝑟𝑎𝑡𝑒 𝐼𝑛𝑐𝑜𝑚𝑒 𝑇𝑎𝑥 (𝑀𝐶𝐼𝑇) = 𝐺𝑟𝑜𝑠𝑠 𝐼𝑛𝑐𝑜𝑚𝑒 𝑥 1%

MCIT= (740,580+50,000)x1%

MCIT = 7,905.80

5. Calculate the NCIT for 2021.

𝑁𝑜𝑟𝑚𝑎𝑙 𝐶𝑜𝑟𝑝𝑜𝑟𝑎𝑡𝑒 𝐼𝑛𝑐𝑜𝑚𝑒 𝑇𝑎𝑥 (𝑁𝐶𝐼𝑇) = 𝑇𝑎𝑥𝑎𝑏𝑙𝑒 𝐼𝑛𝑐𝑜𝑚𝑒 𝑥 𝑁𝐶𝐼𝑇 𝑅𝑎𝑡𝑒

NCIT =[(85,390+20,000) – (140,000+25,000)] x 2%

NCIT = -11,922

10.2. Introduction to Taxation 4

Unit 10: Income and Business Taxation

Challenge Yourself

Answer the following questions:

1. What is the significance of having different tax computation options for Individuals

Earning Business Income and/or Professional Income?

Different tax computation options for Individuals Earning Business Income and/or

Professional Income allow them to determine which option is best depending on their

business income and expenses. In some instances, the 8% Income Tax Rate has lower tax

due, while the Graduated Tax Rate is a better option at other times.

2. What are the similarities and differences in the computation of taxable income and

tax due for individuals and businesses?

The computation of taxable income for both individuals and businesses follows the same

principle: expenses or deductions shall be deducted from the gross income to obtain the

taxable income. However, each method differs in terms of allowable deductions. For

instance, individuals earning purely from compensation can only deduct their

contributions for government-mandated benefits. On the other hand, businesses can

choose between itemized or optional deduction schemes, whichever is more

advantageous to them.

3. An individual earning business income opted for an income tax rate with the least

amount of tax due. Is this good or bad? Justify your answer.

Answers may vary. Choosing the income tax rate with the least amount of tax due is not

necessarily bad. All these options are legal and mandated by law. These options exist so

taxpayers can determine which is the most advantageous to their situations or

circumstances.

10.2. Introduction to Taxation 5

You might also like

- Varo Bank Account Statement: AmountDocument2 pagesVaro Bank Account Statement: Amountmichael100% (1)

- DO 54 S 2022 PresentationDocument27 pagesDO 54 S 2022 Presentationanna paula100% (3)

- Transit-Oriented Development A Review of Research Achievements and Challenges PDFDocument21 pagesTransit-Oriented Development A Review of Research Achievements and Challenges PDFGherbi MohamedNo ratings yet

- ABM - Culminating Activity - Business Enterprise Simulation CG - 2-2 PDFDocument4 pagesABM - Culminating Activity - Business Enterprise Simulation CG - 2-2 PDFMonica RiveraNo ratings yet

- PRINCIPLES OF MARKETING Week 1-2Document33 pagesPRINCIPLES OF MARKETING Week 1-2M.E.M Gayeta100% (1)

- PRINMAR 4th APPROACHESDocument17 pagesPRINMAR 4th APPROACHESKassandra Kay100% (1)

- SLM Module in Fabm2 Q1Document53 pagesSLM Module in Fabm2 Q1Fredgy R BanicoNo ratings yet

- Q1 W2 Users of Accounting InformationDocument16 pagesQ1 W2 Users of Accounting Informationmarissa casareno almueteNo ratings yet

- Forecasting RevenuesDocument14 pagesForecasting RevenuesMariel AlquisolaNo ratings yet

- Worksheet FINANCE Q1 M2 Fin'l Planning Tools & ConceptsDocument3 pagesWorksheet FINANCE Q1 M2 Fin'l Planning Tools & ConceptsMarjun AbogNo ratings yet

- Abm 005Document3 pagesAbm 005Shekinah HuertaNo ratings yet

- ABM - Business Ethics and Social Responsibility CGDocument5 pagesABM - Business Ethics and Social Responsibility CGapollo acunaNo ratings yet

- Lesson 1 (RESPONSIBILITIES AND ACCOUNTABILITIES OF ENTREPRENEURS TO EMPLOYEES, GOVERNMENT, CREDITORS AND SUPPLIERS)Document40 pagesLesson 1 (RESPONSIBILITIES AND ACCOUNTABILITIES OF ENTREPRENEURS TO EMPLOYEES, GOVERNMENT, CREDITORS AND SUPPLIERS)kc.malimbanNo ratings yet

- Business Finance - 12 - Third - Week 5Document11 pagesBusiness Finance - 12 - Third - Week 5AngelicaHermoParasNo ratings yet

- 2ND Quarter Exam FABM2 2023 2024 ANSWER KEYDocument8 pages2ND Quarter Exam FABM2 2023 2024 ANSWER KEYJanine Oliver VenusNo ratings yet

- Contemporary Phil. Arts From The Regions: Prepared By: Maricel P. LlorenDocument36 pagesContemporary Phil. Arts From The Regions: Prepared By: Maricel P. LlorenWarren Dela Peña100% (1)

- Business FinanceDocument18 pagesBusiness FinanceFriedrich Mariveles100% (1)

- Entrepreneurship Lesson 1Document46 pagesEntrepreneurship Lesson 1Mark Nelson A. MontemayorNo ratings yet

- LAS 1 To 5 FABM 1 GAGALACDocument11 pagesLAS 1 To 5 FABM 1 GAGALACAira Venice GuyadaNo ratings yet

- Unit 1 Module 1 Applied EcodocxDocument11 pagesUnit 1 Module 1 Applied EcodocxMa DistrictNo ratings yet

- 09 Books of AccountsDocument17 pages09 Books of AccountsKezia Gwyneth Bofill Oris100% (1)

- Entrep 2nd Quarter 2020Document4 pagesEntrep 2nd Quarter 2020Marie VillanuevaNo ratings yet

- ApEc - Q2 M2 - Socio Economic Factors Affecting Business and IndustryDocument37 pagesApEc - Q2 M2 - Socio Economic Factors Affecting Business and IndustryMaria anjilu VillanuevaNo ratings yet

- The Nature and Forms of Business Organization Week 1Document15 pagesThe Nature and Forms of Business Organization Week 1RanielJohn GutierrezNo ratings yet

- Week 3 and 4 Modules Business FinanceDocument17 pagesWeek 3 and 4 Modules Business FinanceWayne GodioNo ratings yet

- Entrepreneurial Mind: Nature and Development of EntrepreneurshipDocument55 pagesEntrepreneurial Mind: Nature and Development of EntrepreneurshipWayne Logronio SevandalNo ratings yet

- (Business Finance) - M1 - LOLO - GATESDocument3 pages(Business Finance) - M1 - LOLO - GATESCriestefiel LoloNo ratings yet

- Q4 ABM Business Finance 12 Week 3 4Document5 pagesQ4 ABM Business Finance 12 Week 3 4Kinn JayNo ratings yet

- Business Finance - LAS - q1 - w1 Introduction To Financial Management PDFDocument9 pagesBusiness Finance - LAS - q1 - w1 Introduction To Financial Management PDFJustineNo ratings yet

- DLP in Business FinanceDocument2 pagesDLP in Business Financerobelyn veranoNo ratings yet

- Explore (As) : Types of Commission and InterestsDocument4 pagesExplore (As) : Types of Commission and InterestsTiffany Joy Lencioco GambalanNo ratings yet

- Acc106 Rubrics For Assignment - For Student RefDocument2 pagesAcc106 Rubrics For Assignment - For Student RefItik BerendamNo ratings yet

- Business Ethics & Social Responsibility 1-5Document15 pagesBusiness Ethics & Social Responsibility 1-5JanineNo ratings yet

- ENTREP Lesson 1-4Document8 pagesENTREP Lesson 1-4FruitySaladNo ratings yet

- Business Finance (Quarter 1 - Weeks 3 & 4)Document11 pagesBusiness Finance (Quarter 1 - Weeks 3 & 4)Francine Dominique CollantesNo ratings yet

- Lesson 5 - The Impact of Belief System in Business PracticesDocument17 pagesLesson 5 - The Impact of Belief System in Business PracticesIzzy AmorosoNo ratings yet

- Activity Fam B 2Document1 pageActivity Fam B 2Emarilyn Bayot100% (1)

- Fabm NATURE OF MERCHANDISING BUSINESSDocument1 pageFabm NATURE OF MERCHANDISING BUSINESSPhegiel Honculada MagamayNo ratings yet

- Entrep Module 1 Q1week 1Document5 pagesEntrep Module 1 Q1week 1Liezel Maranan100% (1)

- Business Finance 1 ModuleDocument15 pagesBusiness Finance 1 ModuleWayne GodioNo ratings yet

- Fundamentals of Accounting Business and Management 1Document140 pagesFundamentals of Accounting Business and Management 1Marie FeNo ratings yet

- The and It's 21 Century: Philippine Economy Socioeconomic ChallengesDocument28 pagesThe and It's 21 Century: Philippine Economy Socioeconomic ChallengesRocky PacpacoNo ratings yet

- Review of Financial Statement PreparationDocument2 pagesReview of Financial Statement PreparationNiccaP100% (3)

- Business Simulation Letter To PrincipalDocument8 pagesBusiness Simulation Letter To Principalwilhelmina romanNo ratings yet

- Lesson 2 in EntrepreneurshipDocument21 pagesLesson 2 in EntrepreneurshipRhea May PeducaNo ratings yet

- Bus.-Finance LAS 5-6 QTR 2Document18 pagesBus.-Finance LAS 5-6 QTR 2lun zagaNo ratings yet

- ABM - Culminating Activity - Business Enterprise Simulation CG - 2 PDFDocument4 pagesABM - Culminating Activity - Business Enterprise Simulation CG - 2 PDFjhomalynNo ratings yet

- Entrep 11 - 1st QTR - L5 Handouts 1Document6 pagesEntrep 11 - 1st QTR - L5 Handouts 1Stormy TabatNo ratings yet

- Business Finance Q3 Module 1Document11 pagesBusiness Finance Q3 Module 1Ahrcelie FranciscoNo ratings yet

- Fundamentals of Abm 1 Quarter 2, Week 1Document2 pagesFundamentals of Abm 1 Quarter 2, Week 1Shiellai Mae PolintangNo ratings yet

- Business Ethics Week 1Document5 pagesBusiness Ethics Week 1Jethro OrejuelaNo ratings yet

- Applied Economics-Worksheet-Week 1Document1 pageApplied Economics-Worksheet-Week 1Christine Joy CalupigNo ratings yet

- Business Beyond Profit MotivationDocument6 pagesBusiness Beyond Profit MotivationTantan WhootNo ratings yet

- Rubrics Practice SetDocument1 pageRubrics Practice SetAnonymous 5npGhmNo ratings yet

- Accounting ActivityDocument3 pagesAccounting ActivityKae Abegail GarciaNo ratings yet

- ABM Culminating Activity Business Enterprise Simulation CG 2Document4 pagesABM Culminating Activity Business Enterprise Simulation CG 2Bayug HiezelNo ratings yet

- Chapter 6 - Accounting Books-Journal and LedgerDocument18 pagesChapter 6 - Accounting Books-Journal and LedgerAmie Jane MirandaNo ratings yet

- Business Simulation RubricDocument2 pagesBusiness Simulation RubricMae Anne VistaNo ratings yet

- Unemployment Rate Unemployed Labor Force Labor Force Participation Rate Labor Force Civilian Non Institutionalized PopulationDocument5 pagesUnemployment Rate Unemployed Labor Force Labor Force Participation Rate Labor Force Civilian Non Institutionalized PopulationericacadagoNo ratings yet

- Practice Set 1Document1 pagePractice Set 1marissa casareno almuete100% (2)

- Project Proposal EAPP 12 ABM - V.C.L.Document2 pagesProject Proposal EAPP 12 ABM - V.C.L.FERLYN PASCUANo ratings yet

- Assessment 1 - Written or Oral QuestionsDocument7 pagesAssessment 1 - Written or Oral Questionswilson garzonNo ratings yet

- INCOME AND BUSINESS TAXATION FinalsDocument21 pagesINCOME AND BUSINESS TAXATION FinalsAbegail BlancoNo ratings yet

- Fabm 1 LeapDocument4 pagesFabm 1 Leapanna paulaNo ratings yet

- SDO-Imus City-LeaP-ABM-FABM1-3RD QTR-WEEK6Document4 pagesSDO-Imus City-LeaP-ABM-FABM1-3RD QTR-WEEK6anna paulaNo ratings yet

- Fabm 1 LeapDocument4 pagesFabm 1 Leapanna paulaNo ratings yet

- Sample Answer SheetDocument1 pageSample Answer Sheetanna paulaNo ratings yet

- Lesson 26Document7 pagesLesson 26anna paulaNo ratings yet

- SDO CAVITE PROV. WI PREPAREDNESS ASSESSMENT TOOLSDocument11 pagesSDO CAVITE PROV. WI PREPAREDNESS ASSESSMENT TOOLSanna paulaNo ratings yet

- Perdev Test Q2 Solo FrameworkDocument5 pagesPerdev Test Q2 Solo Frameworkanna paulaNo ratings yet

- OPICDocument2 pagesOPICanna paulaNo ratings yet

- The Government Accounting ProcessDocument33 pagesThe Government Accounting Processanna paulaNo ratings yet

- Financial AssetsDocument43 pagesFinancial Assetsanna paulaNo ratings yet

- Agriculture For Government AccountingDocument15 pagesAgriculture For Government Accountinganna paula100% (1)

- Budget ProcessDocument14 pagesBudget Processanna paulaNo ratings yet

- Provincial Accountant's Office: Richel R. Okit, CPA, MBA, REA, REB Meridith S. SaysonDocument24 pagesProvincial Accountant's Office: Richel R. Okit, CPA, MBA, REA, REB Meridith S. SaysonSon Gabriel UyNo ratings yet

- The Role of International Financial Reporting Standards in Supporting The Competitiveness of The Economies of The Arab CountriesDocument16 pagesThe Role of International Financial Reporting Standards in Supporting The Competitiveness of The Economies of The Arab Countrieslakhdimi abdelhamidNo ratings yet

- Roozan Aggarwal: Profile SummaryDocument3 pagesRoozan Aggarwal: Profile SummaryArisha NarangNo ratings yet

- McDonald's India OpeationDocument5 pagesMcDonald's India OpeationShantnu SharmaNo ratings yet

- Writing Workplace DocumentsDocument34 pagesWriting Workplace DocumentsHARLEY L. TANNo ratings yet

- Aa2701231854581 RC13022023Document3 pagesAa2701231854581 RC13022023kalesarthak329No ratings yet

- Question Book PDFDocument65 pagesQuestion Book PDFHarsha VardhanNo ratings yet

- Instant Ebooks Textbook Jacaranda New Concepts in Commerce NSW Australian Curriculum Fourth Edition Stephen Chapman Download All ChaptersDocument53 pagesInstant Ebooks Textbook Jacaranda New Concepts in Commerce NSW Australian Curriculum Fourth Edition Stephen Chapman Download All ChaptersholovalaauNo ratings yet

- Intrusion Prevention & Active Response - Deploying Network & Host IPSDocument425 pagesIntrusion Prevention & Active Response - Deploying Network & Host IPSMarcos PerdomoNo ratings yet

- SAP - Career OpportunitiesDocument13 pagesSAP - Career OpportunitiesMD NASEERUDDINNo ratings yet

- CAE 10 Strategic Cost Management: Lyceum-Northwestern UniversityDocument7 pagesCAE 10 Strategic Cost Management: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- And BDD: Dan NorthDocument20 pagesAnd BDD: Dan NorthHernan Julho MuñozNo ratings yet

- JD SportsDocument12 pagesJD SportsRaquelle MasoudiNo ratings yet

- AIX On Oracle ARPUG Presentation PDFDocument72 pagesAIX On Oracle ARPUG Presentation PDFOscar Humberto Torres CarranzaNo ratings yet

- BM Suggested AnswersDocument6 pagesBM Suggested AnswersGorakh IngaleNo ratings yet

- CV Ahmed Elshbokshy CV-1Document2 pagesCV Ahmed Elshbokshy CV-1aligazy6114No ratings yet

- Airflow 101 MobileDocument48 pagesAirflow 101 Mobilebasit faisalNo ratings yet

- EmeraldDocument11 pagesEmeralddidiNo ratings yet

- FMR-TRL MapDocument1 pageFMR-TRL MapJames SnodgrassNo ratings yet

- CV - Aftab Hussain (PMI-ACP) ®Document2 pagesCV - Aftab Hussain (PMI-ACP) ®mahiir.consultingNo ratings yet

- Covering The IRSDocument31 pagesCovering The IRSNational Press FoundationNo ratings yet

- Case Study Ch. 1 XIDocument1 pageCase Study Ch. 1 XIpiyushaggarwal2916No ratings yet

- Evaluating Messages WPS OfficeDocument2 pagesEvaluating Messages WPS OfficejessicacgarciaNo ratings yet

- Data Analysis Portfolio SampleDocument25 pagesData Analysis Portfolio SampleFigopec EduNo ratings yet

- BOG Notice No. BG GOV SEC 2021 13 Requirement To Paticipate in The Credit Reporting SystemDocument2 pagesBOG Notice No. BG GOV SEC 2021 13 Requirement To Paticipate in The Credit Reporting SystemFuaad DodooNo ratings yet

- RULE 69 (PARTITION) ReviewerDocument6 pagesRULE 69 (PARTITION) ReviewerNeon True Beldia100% (1)

- Training & DevelopmentDocument25 pagesTraining & DevelopmentAadil KakarNo ratings yet

- Unit 9Document11 pagesUnit 9Mustafizur Rahman JoyNo ratings yet