Anwar Group of Industries

Uploaded by

Moment RevealersAnwar Group of Industries

Uploaded by

Moment RevealersAnwar Group of Industries

Baitul Hossain Building, 27 Dilkusha C/A, Dhaka-1000

Tel: Phone: +88 02 9564033; Fax: +88 027124264

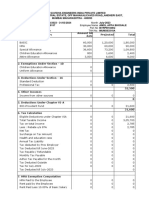

Name Of The Assessee: Alamgir Kabir

Employee No: 010930

Designation: Manager

Division: Corporate

TIN No: 358665297390

Income Tax Assesment Year: 2022-2023

Income Tax Fiscal Year: 2021-2022

Income Head Paid Till Date This Month Projected Amount Per Less Exepted Total

Annum Taxable

Amount

Basic Salary 120,000.00 40,000.00 320,000.00 480,000.00 0.00 480,000.00

House Rent Allowance 72,000.00 24,000.00 192,000.00 288,000.00 240,000.00 48,000.00

Conveyance Allowance 24,000.00 8,000.00 64,000.00 96,000.00 30,000.00 66,000.00

Medical Allowance 24,000.00 8,000.00 64,000.00 96,000.00 48,000.00 48,000.00

Bonus 0.00 0.00 0.00 0.00 0.00 0.00

Total Salary Income 240,000.00 80,000.00 640,000.00 960,000.00 318,000.00 642,000.00

Total Annual Income 240,000.00 80,000.00 640,000.00 960,000.00 318,000.00 642,000.00

Current Parameter Taxable Income Individual Tax Liability

Rate

0% On First BDT-300000 300,000.00 0.00

5% On Next BDT-100000 100,000.00 5,000.00

10% On Next BDT-300000 242,000.00 24,200.00

15% On Next BDT-400000 0.00 0.00

20% On Next BDT-500000 0.00 0.00

25% On Remaining Balance 0.00 0.00

Total: 642,000.00 29,200.00

Tax rebate for investment Amount

Investment allowed(a)

25 % of annual taxable income less employee's 160,500.00

contribution to PF

Maximum investment allowed 10,000,000.00

Lower one 160,500.00

PF contribution by Employee(b) 0.00

PF contribution by Company(c) 0.00

Other Investment( d ) 0

Other investment to be made by the employee(d=a-b-c) 160,500.00

Tax Rebate on Investment (24,075)

Net Tax Payable 5125.00

Tax paid up to previous month 2,806.20

Tax paid this month 257.60

Tax to be paid upto June 2,061.20

Print Date & Time: 26 Oct 2021 Page 1 of 1

You might also like

- Income Tax Calculation For The Period 01/04/2021 To 07/07/2021No ratings yetIncome Tax Calculation For The Period 01/04/2021 To 07/07/20214 pages

- Itemized Deduction Vs Optional Standard Deductions 40OSDNo ratings yetItemized Deduction Vs Optional Standard Deductions 40OSD4 pages

- Projected Income Tax Computation Statement For The Month of Apr 2021No ratings yetProjected Income Tax Computation Statement For The Month of Apr 20212 pages

- Luminous Power Technologies Private Limited: Earnings DeductionsNo ratings yetLuminous Power Technologies Private Limited: Earnings Deductions1 page

- Sify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113No ratings yetSify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-6001131 page

- Quali Review Statement of Cash Flows Complete SolutionNo ratings yetQuali Review Statement of Cash Flows Complete Solution5 pages

- Concentrix Daksh Services India Private Limited: Income Tax Calculation For The PeriodNo ratings yetConcentrix Daksh Services India Private Limited: Income Tax Calculation For The Period5 pages

- R2. TAX (M.L) Solution CMA May-2023 ExamNo ratings yetR2. TAX (M.L) Solution CMA May-2023 Exam5 pages

- Adecco India Private Limited: Payslip For The Month of October 2022No ratings yetAdecco India Private Limited: Payslip For The Month of October 20221 page

- FIN702: Corporate Financial Management 1 Tutorial 2: Financial Statement AnalysisNo ratings yetFIN702: Corporate Financial Management 1 Tutorial 2: Financial Statement Analysis3 pages

- 58 - 1 - McKinsey Manual For Entrepreneurs PDFNo ratings yet58 - 1 - McKinsey Manual For Entrepreneurs PDF65 pages

- Financial Statement Analysis 11th Edition Subramanyam Test Bank 1100% (62)Financial Statement Analysis 11th Edition Subramanyam Test Bank 170 pages

- Horizintal and Vertical Analysis of Jollibee Foods Corp100% (1)Horizintal and Vertical Analysis of Jollibee Foods Corp9 pages

- "Fundamental Analysis of Selected Automobile Sector Companies For DSIJPL" - MBA Internship Report by Sameer Sawant67% (3)"Fundamental Analysis of Selected Automobile Sector Companies For DSIJPL" - MBA Internship Report by Sameer Sawant75 pages

- NC1 - Principles - Multiple Choice Questions PDFNo ratings yetNC1 - Principles - Multiple Choice Questions PDF6 pages

- CSEC Principles of Accounts SEC. 9-Cooperative Accounting100% (1)CSEC Principles of Accounts SEC. 9-Cooperative Accounting31 pages

- Dear Shareholders of Biglari Holdings Inc.No ratings yetDear Shareholders of Biglari Holdings Inc.9 pages