Recurring Deposit Confirmation

Recurring Deposit Confirmation

Uploaded by

Shubhra Kanti GopeCopyright:

Available Formats

Recurring Deposit Confirmation

Recurring Deposit Confirmation

Uploaded by

Shubhra Kanti GopeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Recurring Deposit Confirmation

Recurring Deposit Confirmation

Uploaded by

Shubhra Kanti GopeCopyright:

Available Formats

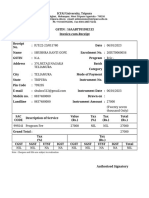

RECURRING DEPOSIT CONFIRMATION

Deposit Account Number: 50400260896146

SAMIR GOPE Cust ID of 1st Applicant: 173134977

284 NETAJINAGAR PASHCHIMANGSH Deposit Branch Name: SHANKAR CHOWMANI

GRAM KRISHNAPUR PO NETAJINAGAR Deposit Type: RECURRING DEPOSIT

DIST KHOWAI NEAR TELIAMURA

MOTORSTA PAN No: ANKPG5332Q

AGARTALA-799205

INDIA

Deposit Installment Deposit Period Rate of Deposit Maturity +

Amount( In Rs.) Amount( In Rs.) Start Date of Deposit(in Months) Interest(%p.a.) Maturity Date Amount (in Rs.)

20391.00 2000.00 18 Dec 2021 27 Month(s) 5.15 18 Mar 2024 57352.00

Deposit Amount (in words) : TWENTY THOUSAND THREE HUNDRED NINETY ONE ONLY Thank you for banking with us.

Mode of operations : Single This is a system generated Advice, hence does not require any Signature.

Nomination : KALYANI GHOSH GOPE

Interest Payment Frequency : ON MATURITY

Maturity Instruction : REDEEM TO 50100435984927

For more information log on to : www.hdfcbank.com

Terms & Conditions

Payment of interest • In the event of death of one of the joint account holders, the right to the deposit proceeds does

not automatically devolve on the surviving joint deposit account holder, unless there is a

• Interest on a Recurring Deposit will be calculated from the date the instalment is paid survivorship clause.

• The method of calculation of interest on RDs will be on Actual / Actual Quarterly • In case of joint deposits with a survivorship clause, the Bank shall be discharged by paying the

Compounding. Bank computes interest based on the actual number of days in a year. In case, Deposit proceeds prematurely to survivor/s, on request, in the event of oneor more Joint

deposit is spread over a leap or a non-leap year, interest is calculated based on the number of Depositor

days i.e. 366 days in a leap year & 365 days in a non- leap year.

• The interest for Recurring Deposits will be corresponding rate as applicable for a Fixed Deposit. • In case joint holder mandate submitted to the bank, any of the holders can sign where mode of

operation is either or survivor / former or survivor.

• Interest on the deposits is compounded at quarterly intervals, at the applicable rates.

• Partial withdrawal/ sweep in / OD not allowed on Recurring deposits

• Interest payment on Recurring deposit is only on maturity.

• All premature encashment will be governed by rules of Reserve Bank of India prevalent at the

Resident-Lock in period time of encashment.

• The Recurring Deposits account has a minimum lock in of one month. • As per Income Tax laws, if the aggregate amount of the deposit/(s) held by a person with the

branch either in his own name or jointly with any person on the date of repayment together with

• In case of premature closure within a month, no interest shall be paid out & only principal the interest at payable is equal to or exceeds 20,000/- then the amount will be paid by bank draft

amount shall be returned. drawn in the name of the deposit holder or by crediting the savings/ current account of the deposit

holder.

NRI-Lock in period

• Effective 01st Dec'06, the interest rate applicable for premature closure of deposits (all

• The minimum lock in period for NRE RD is one year and NRO RD is one month. amounts) will be lower of:

The original rate at which the deposit has been booked OR

• In case of premature closure within a year and NRO RD within a month, no interest will be paid The base rate applicable for the tenure for which the deposit has been in force with the Bank.

out to the depositor & only principal amount shall be returned.

• For deposits booked on or after 7th March’19 the base rate is the rate applicable to deposits of

Maturity less than Rs.2 Cr as on the date of booking the deposit. Prior to this the base rate is the rate

applicable to deposits of less than Rs.1 Cr as on the date of booking the deposit.

• The deposit shall be due for repayment & shall mature on completion of the contracted tenure

even if there are installments remaining to be paid. • In case of death of the primary holder of the Recurring deposits prior to the maturity date,

premature termination of the deposit would be allowed as per the terms of contract subject to

• The maturity amount mentioned on the Recurring Deposit confirmation advice is subject to necessary verifications and submission of proof of death of the depositor.

payment of all installments on time.

• Such premature withdrawals will not attract any penal charge.

• In case of any delay in payment of scheduled installments, the maturity amount shall change

due to delay in payments . Insurance Cover for Deposits

• Maturity amount mentioned on the confirmation advice shall also change in case of TDS • The deposits in the Bank are insured with DICGC for an amount of Rs 5 lakhs (principal +

recovery . interest) per depositor.

Tax Deduction at Source (TDS)

Payment of Installment

• Interest paid on resident recurring Deposit would be liable to TDS (Tax Deducted at Source)

• The Installment amount once fixed will not be allowed to be altered at a later date. @10%, under section 194A similar to that of interest paid on FD. TDS applicable on interest paid

on NRO RD would be @ 30% plus applicable surcharge (Not Applicable for NRE RD).

• In case of more than one installment is being overdue at the time of payment, the paid

installment if sufficient to cover only one. installment will be appropriate towards first/earliest • TDS rates will be as applicable from time to time as per the Income Tax Act, 1961 and Income

installment overdue. Tax rules. The current rates applicable for TDS would be displayed by the Bank on Its website.

Currently, TDS is deducted when interest payable or reinvested on FD AND RD per customer,

• Partial payment of installment will not be permitted. across all Branch, exceeds Rs 40,000/- (Rs. 50,000/- for senior citizen) in a Financial Year.

Further, TDS is deducted at the end of the financial year on Interest accruals if applicable.

• HDFC bank shall not be responsible for informing the depositor to maintain adequate balance in

his/her HDFC bank account in recurring deposit to pay his/her installments in the event of failure • If interest amount is not sufficient to recover the TDS amount the same may get recovered from

of the standing instruction due to shortfall of funds in the transacting amount. the principal amount of Fixed Deposit. If customer wishes to have TDS deduction from CASA,

same can be availed by filling separate declaration at branch.

Overdue Installments

• As Per Section 139A(5A) of the Income Tax Act, every person receiving any sum of income or

• If frequent defaults (non-payments) are observed in the monthly installments and six amount from which tax has been deducted under the provisions of the Income Tax Act shall

installments fall in arrears, the bank reserves the right to close the RD account. The interest rate provide his PAN number to the person responsible for deducting such tax. In case your PAN is

applicable on such closed accounts will be as per the premature withdrawal policy of the bank. not updated with the Bank or is incorrect; please visit your nearest HDFC Bank branch to submit

your PAN details.

Premature withdrawal

• In case the PAN number is not provided to the Bank as required, the bank shall not be liable for

• In the case of premature encashment, all signatories to the deposit must sign the encashment the non availment of the credit of Tax deducted at Source and non-issuance of TDS certificate.

instruction.

• No deductions of Tax shall be made from the taxable interest in the case of an individual resident in

India, if such individual furnishes to the Bank, a declaration in writing in the prescribed Format (Form • In case if the RD is not booked as per the applicable T & C of the bank, Bank reserves the right to

15G / Form 15H as applicable) to the effect that the tax on his estimated total income for the year in rebook the same with correct details.

which such interest income is to be included in computing his total income will be Nil. This is subject

to PAN availability on Bank records.

• Minimum installment is Rs. 1000. (in multiples of 100 thereafter) Maximum installment: 1.99 Cr.

• If aggregated value of all outstanding FDs/RDs booked in same customer id during the Financial

Year exceeds INR 5Lakhs limit (*) then PAN/Form 60 is mandatory. • Minimum tenure for resident and NRO RD is 6 months (and in multiples of 3 months thereafter)

upto a maximum of 10 years and minimum tenure for NRE RD is 1 year.

In absence of PAN/Form 60:

• Only Senior Citizens / Retired Personnel (60 years and above) who are Resident Indians are eligible

• (a) FD/RD will not be renewed on maturity and maturity proceeds will be credited to your linked for senior citizen rates. The senior citizen rates are applicable only for Resident deposits.

account or a Demand Draft will be sent to your mailing address as updated in Bank's records.

• The benefit of additional interest rate on deposits on account of being bank’s own staff or senior

• (b) Maturity instructions to convert RD proceeds to FD will not be acted upon and RD proceeds will citizens shall not be applicable to NRE / NRO Deposits.

be credited to your linked account on maturity.

• Form 15G/H is not applicable to NRIs

• The maximum interest not charged to tax during the financial year where form 15 G/H is

submitted is as below: • Please Ignore this advice if you have redeemed this deposit on or after the maturity date as

mentioned herein.

• Upto 2,50,000/- for residents of India below the age of 60 years or a person (not being a company or

firm). • Any changes made online in respect to change in maturity instruction / tenure, details can be viewed

online itself post the changes

• Upto 5,00,000/- for senior citizen residents of India who are between the age of 60-79 years at any

time during the FY • In case your recurring deposit is booked without nomination details, please visit the Branch to update

the same.

• Upto 5,00,000/- for senior citizen residents of India who is 80 years or more at any time during the

FY. • Please visit our website / nearest branch / contact Relationship Manager for further clarification.

• In case of Non-filer of income Tax return, TDS shall also be deducted at higher rate as provided by

• Form 15 G / H should be submitted by customer in Triplicate copy to the bank, for submitting one Section 206AB w.e.f 1-Jul-2021.

copy to Income Tax Department, one copy for use by Branch and the third copy to be returned to the • Income-tax provisions outlined in this document are updated as of the Finance Act, 2021.

customer with Branch seal as an acknowledgment copy.

• A fresh Form 15G / 15H needs to be submitted in each new Financial Year by the start of the

Financial Year. In case form 15G/H is submitted post interest payout/credit, waiver shall be effective

from the day next to the interest payout /credit immediately preceding the date of submission of form

15G/H.

• Form 15G / H needs to be submitted for every recurring Deposits booked with bank for Tax

exemption. .

• The bank shall not be liable for any consequences arising due to delay or non-submission of Form

15G/ Form 15H

• To enable us to serve you better kindly submit the Form No. 15G/15H latest by April 1st of the new

financial year.

Note: The above guidelines are subject to change as per Income Tax regulations / directives of

Finance Ministry Govt of India prevalent from time to time

Important Points:

• Please record change of maturity instructions with us well in advance to enable us serve you better.

Maturity Instructions: __________________________________________________________________________________

_______________________________________

Signature

For Office Use only:

Liquidation Instructions

Liquidation : On Maturity / Premature withdrawal

Credit Account No. : ____________________________

Issue Pay order favouring : ____________________________

Date of Liquidation : ____________________________

You might also like

- DOA Straumann 2024N+PGLDocument39 pagesDOA Straumann 2024N+PGLxhxbxbxbbx79No ratings yet

- Green Dot StatementDocument2 pagesGreen Dot StatementTerry WinegarNo ratings yet

- Teliamura: ICFAI University, TripuraDocument1 pageTeliamura: ICFAI University, TripuraShubhra Kanti GopeNo ratings yet

- Execution Plan of IFIC BankDocument8 pagesExecution Plan of IFIC BankAhsan Sayeed Nabeel DeproNo ratings yet

- Rulessyllabus DraDocument8 pagesRulessyllabus Drakhnatesh100% (1)

- Recurring Deposit ConfirmationDocument2 pagesRecurring Deposit ConfirmationLokesh ShettyNo ratings yet

- Recurring Deposit ConfirmationDocument2 pagesRecurring Deposit ConfirmationMANISH KUMARNo ratings yet

- 50400221609097Document2 pages50400221609097madhiwalsawanNo ratings yet

- Recurring Deposit Confirmation: Navdeep Dogra 271 Lig Urban Estate PHAGWARA-144401 IndiaDocument2 pagesRecurring Deposit Confirmation: Navdeep Dogra 271 Lig Urban Estate PHAGWARA-144401 Indianavdeep dograNo ratings yet

- Recurring Deposit Confirmation: Ashima Gupta Hno 108 Anand Avenue AMRITSAR-143001 IndiaDocument2 pagesRecurring Deposit Confirmation: Ashima Gupta Hno 108 Anand Avenue AMRITSAR-143001 Indiaashimagupta2016No ratings yet

- Recurring Deposit ConfirmationDocument2 pagesRecurring Deposit Confirmationsanneytyagi000No ratings yet

- 50400338878210Document2 pages50400338878210amarjyotiengineering2021No ratings yet

- RDAdvice 10126649787 114128620Document2 pagesRDAdvice 10126649787 114128620Yo GiNo ratings yet

- Samula Naresh_FD Confirmation-1Document2 pagesSamula Naresh_FD Confirmation-1billdata15No ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal Advicemozo dingdongNo ratings yet

- FDAdvice 10153571792 134129209Document2 pagesFDAdvice 10153571792 134129209Manjeet SharmaNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal AdviceSharvil Vikram SinghNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal AdviceSethurajan ShanmugamNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal AdviceChumma LolloloikkuNo ratings yet

- FD DT.01.11.2023 - 61772430 - 1698855257950Document2 pagesFD DT.01.11.2023 - 61772430 - 1698855257950parinitakhardekar1986No ratings yet

- RD - HDFC YoungDocument1 pageRD - HDFC YoungShanmuganathan RamanathanNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal Advicepramodyad5810No ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal AdviceVishu GargNo ratings yet

- Ravula Kavya_FD ConfirmationDocument2 pagesRavula Kavya_FD Confirmationbilldata15No ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal AdviceChetan ChaudhariNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal Advicesg_319553No ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal AdviceMohinder KumarNo ratings yet

- HDFC YsDocument2 pagesHDFC YsAkshat ShahNo ratings yet

- Sathish_FD ConfirmationDocument2 pagesSathish_FD Confirmationbilldata15No ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal AdviceRitu PatelNo ratings yet

- FDAdvice 10200252821 065658940Document2 pagesFDAdvice 10200252821 065658940tera.baap.hun.bete.zeeshanNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal AdviceJasjeet KaurNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal Advicemadhuramfoods.chiralaNo ratings yet

- 281422635_1732114693801Document2 pages281422635_1732114693801shivanshukumar043No ratings yet

- 299962545_1734325359944Document2 pages299962545_1734325359944chandankumar789No ratings yet

- Sma CertificateDocument2 pagesSma CertificateAnil MishraNo ratings yet

- 4515822_1731304396955Document2 pages4515822_1731304396955hs3915425No ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal Advicechhungiralte10No ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal Adviceshyamborntowin95No ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal Adviceimhindustani43No ratings yet

- 282640797_1725603717764Document2 pages282640797_1725603717764ravishekhar811No ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal Advicedlimaye2002No ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal AdviceShashidar SagaramNo ratings yet

- 281587000_1724267393060Document2 pages281587000_1724267393060sahil.rs4567No ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal Advicesampada.khopadeNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal Advicediamondprakash1992No ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal AdvicemuskanNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal AdvicethisissandeepsudNo ratings yet

- 181763207_1671520811675Document2 pages181763207_1671520811675RAJEEV KUMARNo ratings yet

- FDAdvice 10117476643Document2 pagesFDAdvice 10117476643pravinacute15No ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal AdviceVasanthi VasuNo ratings yet

- FDAdvice 10157741355 153214457Document2 pagesFDAdvice 10157741355 153214457Nagaraj VukkadapuNo ratings yet

- 301232753_1732185033837Document2 pages301232753_1732185033837sarfarajkjanNo ratings yet

- 39625052_1689850618166Document2 pages39625052_1689850618166rxpfr5nxhnNo ratings yet

- FDAdvice_10110307818Document2 pagesFDAdvice_10110307818kohliassociate07No ratings yet

- Yes FD Sunil Kumar (3) - 240201 - 205332Document2 pagesYes FD Sunil Kumar (3) - 240201 - 205332abdulvajidparuthikkattilNo ratings yet

- FDAdvice 10133626748Document2 pagesFDAdvice 10133626748Spandana Madhan SmrbNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal AdviceAster D SilvaNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal AdviceTrisha RawatNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal Advicedivya sathvika machavoluNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal Adviceparthadas48No ratings yet

- Deposit Confirmation/Renewal AdviceDocument2 pagesDeposit Confirmation/Renewal AdviceVasanthi VasuNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal AdvicemudrikaNo ratings yet

- ReceiptDocument2 pagesReceiptAjinder Pal Singh ChawlaNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- 10th Marksheet and Certificate - 11zonDocument2 pages10th Marksheet and Certificate - 11zonShubhra Kanti GopeNo ratings yet

- VacanciesDocument2 pagesVacanciesShubhra Kanti GopeNo ratings yet

- Placement Registration Form-Amended Version For 2022-23Document3 pagesPlacement Registration Form-Amended Version For 2022-23Shubhra Kanti GopeNo ratings yet

- PHY103 assignment-IIDocument2 pagesPHY103 assignment-IIShubhra Kanti GopeNo ratings yet

- University Format - Batch 2023 Copy 1Document2 pagesUniversity Format - Batch 2023 Copy 1Shubhra Kanti GopeNo ratings yet

- User Login CredentialsDocument242 pagesUser Login CredentialsShubhra Kanti GopeNo ratings yet

- Au Abhi 31-MarchDocument2 pagesAu Abhi 31-MarchShubhra Kanti GopeNo ratings yet

- Pediatry Opthalmo Medicine Ortha DIA E.N.T. Gyna G.P. Homo/Ay SkinDocument3 pagesPediatry Opthalmo Medicine Ortha DIA E.N.T. Gyna G.P. Homo/Ay SkinShubhra Kanti GopeNo ratings yet

- SBM Bank (India) LTD: From: June 1, 2021Document2 pagesSBM Bank (India) LTD: From: June 1, 2021Shubhra Kanti GopeNo ratings yet

- For Any Reference Visit: Https://sarathi - Parivahan.gov - In/sarathiserviceDocument1 pageFor Any Reference Visit: Https://sarathi - Parivahan.gov - In/sarathiserviceShubhra Kanti GopeNo ratings yet

- CompressedDocument11 pagesCompressedShubhra Kanti GopeNo ratings yet

- Hazardous Chemicals in Health Care PDFDocument40 pagesHazardous Chemicals in Health Care PDFShubhra Kanti GopeNo ratings yet

- MBBSProspectus2018 TmcwijnDocument46 pagesMBBSProspectus2018 TmcwijnShubhra Kanti Gope0% (1)

- Hazardous Chemicals in Health Care PDFDocument40 pagesHazardous Chemicals in Health Care PDFShubhra Kanti GopeNo ratings yet

- Imu Previous Year Question Paper 2017 PG Diploma in Marine Engineering PDFDocument19 pagesImu Previous Year Question Paper 2017 PG Diploma in Marine Engineering PDFShubhra Kanti GopeNo ratings yet

- Pre Medical AIIMS CBT SyllabusDocument12 pagesPre Medical AIIMS CBT SyllabusShubhra Kanti GopeNo ratings yet

- Syllabus ElectronicsDocument12 pagesSyllabus ElectronicsShubhra Kanti GopeNo ratings yet

- NDA 2 2018 Maths Answer Key Major Kalshi PDFDocument2 pagesNDA 2 2018 Maths Answer Key Major Kalshi PDFShubhra Kanti GopeNo ratings yet

- Full (Ebook PDF) Personal Finance 6th Canadian Edition by Jack R. Kapoor Ebook All ChaptersDocument41 pagesFull (Ebook PDF) Personal Finance 6th Canadian Edition by Jack R. Kapoor Ebook All Chapterszequimmcdon33100% (4)

- Salami Taofiq Bolaji: Customer StatementDocument30 pagesSalami Taofiq Bolaji: Customer StatementbolajiNo ratings yet

- Phone Access BrochureDocument4 pagesPhone Access BrochureキムリンKimu RinNo ratings yet

- Indian Banking: By, Saloni Gupta (20im21) Satyam Thakare (20im22) Shivam Patel (20im23)Document8 pagesIndian Banking: By, Saloni Gupta (20im21) Satyam Thakare (20im22) Shivam Patel (20im23)Shreyans JainNo ratings yet

- Compensation Policy 2020 21Document14 pagesCompensation Policy 2020 21K. NikhilNo ratings yet

- The Roles of Perceived Risk and Trust On E-Payment Adoption: Studies in Computational Intelligence January 2018Document16 pagesThe Roles of Perceived Risk and Trust On E-Payment Adoption: Studies in Computational Intelligence January 2018K61 TRƯƠNG THỊ MAI TRÂMNo ratings yet

- 02 The Meaning of Interest RatesDocument62 pages02 The Meaning of Interest RatesCatherine ChouNo ratings yet

- Marvels Software Pvt. LTD.: Group MembersDocument8 pagesMarvels Software Pvt. LTD.: Group Memberssharad_bajajNo ratings yet

- BP 5Document35 pagesBP 5Abirami.sNo ratings yet

- Online StatementDocument4 pagesOnline Statementjumminah789No ratings yet

- Taker SummaryDocument2 pagesTaker Summarysalam abuNo ratings yet

- Are We Headed For A Trap?: Buy Now, Pay Later Schemes Are Mushrooming. They Are Nifty, Useful, But Risky, TooDocument88 pagesAre We Headed For A Trap?: Buy Now, Pay Later Schemes Are Mushrooming. They Are Nifty, Useful, But Risky, TooBhupendra SengarNo ratings yet

- Canara - Epassbook - 2024-08-22 17:51:02.743865Document134 pagesCanara - Epassbook - 2024-08-22 17:51:02.743865mittasuresh6196No ratings yet

- Direct Deposit Sign Up (BAC - NU)Document1 pageDirect Deposit Sign Up (BAC - NU)Cyber GemelasNo ratings yet

- Internship ReportDocument22 pagesInternship ReportmirzafarvaNo ratings yet

- CRA Evaluation Charter 000008 - JPMC CRA Performance Evaluation 1.1.07-12.31.10Document599 pagesCRA Evaluation Charter 000008 - JPMC CRA Performance Evaluation 1.1.07-12.31.10lschneider68No ratings yet

- Army Institute of Business Administration (AIBA) : Term Paper OnDocument30 pagesArmy Institute of Business Administration (AIBA) : Term Paper OnFahimNo ratings yet

- Aab - Rdo 98 - 2023Document4 pagesAab - Rdo 98 - 2023veloxenergy.taxcompspecialistNo ratings yet

- VOC Money Test 1Document1 pageVOC Money Test 1jaxes79020No ratings yet

- Advantages of DoubleDocument2 pagesAdvantages of Doublesadatfaheem6No ratings yet

- Project Report ON Idfc Bank: A Project Report Submitted in Partial Fulfillment of The Department of CommerceDocument25 pagesProject Report ON Idfc Bank: A Project Report Submitted in Partial Fulfillment of The Department of CommerceHitesh kumar jenaNo ratings yet

- IIFSS Branch ListDocument18 pagesIIFSS Branch Listarbaz khanNo ratings yet

- Hyston International Trade Co.,Limited: NO.290 Wangjiazhuang Industrial Park, Shangma Street, Chengyang Dist, Qingdao ChinaDocument1 pageHyston International Trade Co.,Limited: NO.290 Wangjiazhuang Industrial Park, Shangma Street, Chengyang Dist, Qingdao Chinar34syaNo ratings yet

- b20211202JY丨China attempts to clean up its sleaziest regional banksDocument6 pagesb20211202JY丨China attempts to clean up its sleaziest regional banksenfance2013No ratings yet

- Bank Atanga Loan Lak Dan AwlsamDocument11 pagesBank Atanga Loan Lak Dan AwlsamPascal Chhakchhuak100% (2)

- Step by Step Tally Question Practice SBSCDocument2 pagesStep by Step Tally Question Practice SBSCBalkrishan AgarwalNo ratings yet