SBI Small Cap Fund Factsheet

SBI Small Cap Fund Factsheet

Uploaded by

Palam PvrCopyright:

Available Formats

SBI Small Cap Fund Factsheet

SBI Small Cap Fund Factsheet

Uploaded by

Palam PvrOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

SBI Small Cap Fund Factsheet

SBI Small Cap Fund Factsheet

Uploaded by

Palam PvrCopyright:

Available Formats

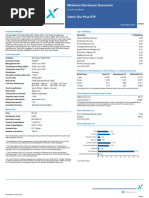

EQUITY-SMALL CAP FUND

NET ASSET VALUE LAST IDCW Face value: `10

Option NAV (`) Record Date IDCW (in `/Unit) NAV (`)

Reg-Plan-IDCW 67.3610 09-Mar-18 (Reg Plan) 9.10 33.3383

09-Mar-18 (Dir Plan) 11.10 40.7137

Reg-Plan-Growth 114.0211

28-Aug-15 (Reg Plan) 3.60 23.5236

(Previously known as SBI Small & Midcap Fund) Dir-Plan-IDCW 86.9102 28-Aug-15 (Dir Plan) 4.30 27.8630

Dir-Plan-Growth 127.3358 30-Jan-15 (Reg Plan) 4.00 26.0785

Investment Objective

Pursuant to payment of IDCW, the NAV of IDCW Option of scheme/plans

To provide investors with opportunities would fall to the extent of payout and statutory levy, if applicable.

for long-term growth in capital along with

the liquidity of an open-ended scheme by

investing predominantly in a well

diversified basket of equity stocks of

small cap companies. PORTFOLIO

Stock Name (%) Of Total % of AUM Net % Stock Name (%) Of Total % of AUM Net %

Fund Details Equity Shares

AUM Derivatives of AUM

VST Industries Ltd.

AUM

1.39

Derivatives of AUM

- 1.39

• Type of Scheme Blue Star Ltd. 3.67 - 3.67 V-Mart Retail Ltd. 1.39 - 1.39

An open-ended Equity Scheme predominantly Vedant Fashions Ltd. 3.05 - 3.05 City Union Bank Ltd. 1.29 - 1.29

investing in small cap stocks. V-Guard Industries Ltd. 2.90 - 2.90 KNR Constructions Ltd. 1.28 - 1.28

• Date of Allotment: 09/09/2009 Finolex Industries Ltd. 2.86 - 2.86 Go Fashion (India) Ltd. 1.25 - 1.25

Carborundum Universal Ltd. 2.82 - 2.82 Dodla Dairy Ltd. 1.21 - 1.21

• Report As On: 31/12/2022

Lemon Tree Hotels Ltd. 2.79 - 2.79 Chemplast Sanmar Ltd. 1.15 - 1.15

• AAUM for the Month of December 2022 Elgi Equipments Ltd. 2.73 - 2.73 Ratnamani Metals & Tubes Ltd. 1.08 - 1.08

` 15,417.19 Crores Sheela Foam Ltd. 2.66 - 2.66 Relaxo Footwears Ltd. 1.07 - 1.07

• AUM as on December 31, 2022 Triveni Turbine Ltd. 2.62 - 2.62 Star Cement Ltd. 1.03 - 1.03

` 15,348.55 Crores Fine Organic Industries Ltd. 2.62 - 2.62 Rossari Biotech Ltd. 0.96 - 0.96

• Fund Manager: Mr. R. Srinivasan & *Mr. Mohit Jain Kalpataru Power Transmission Ltd. 2.49 - 2.49 Nuvoco Vistas Corporation Ltd. 0.79 - 0.79

Managing Since: ESAB India Ltd. 2.43 - 2.43 Brigade Enterprises Ltd. 0.67 - 0.67

Mr. R. Srinivasan Nov - 2013 Timken India Ltd. 2.40 - 2.40 Ge T&D India Ltd. 0.63 - 0.63

Mr. Mohit Jain Nov - 2017 Westlife Foodworld Ltd. 2.26 - 2.26 Engineers India Ltd. 0.60 - 0.60

Total Experience: Over 30 years Chalet Hotels Ltd. 2.20 - 2.20 Narayana Hrudayalaya Ltd. 0.49 - 0.49

Rajratan Global Wire Ltd. 2.18 - 2.18 Alembic Ltd. 0.46 - 0.46

• First Tier Benchmark:

LIC Housing Finance Ltd. 2.08 - 2.08 Garware Technical Fibres Ltd. 0.42 - 0.42

S&P BSE 250 Small Cap Index TRI

PVR Ltd. 2.06 - 2.06 Thangamayil Jewellery Ltd. 0.41 - 0.41

• Exit Load: For exit within one year from the date

GR Infra Projects Ltd. 2.01 - 2.01 Anand Rathi Wealth Ltd. 0.32 - 0.32

of allotment -1%

Navin Fluorine International Ltd. 1.86 - 1.86 Zydus Wellness Ltd. 0.19 - 0.19

For exit after one year from the date of allotment

Global Health Ltd. 1.76 - 1.76 Gujarat State Petronet Ltd. 0.14 - 0.14

– Nil

Hatsun Agro Product Ltd. 1.72 - 1.72 National Stock Exchange Of India Ltd.

• Entry Load: N.A. CMS Infosystems Ltd. 1.69 - 1.69 -25-Jan-23 - 8.30 8.30

• Plans Available: Regular, Direct Grindwell Norton Ltd. 1.68 - 1.68 Total 83.38 8.30 91.68

• Options: Growth, IDCW

CSB Bank Ltd. 1.68 - 1.68 Non-Convertible Preference Shares

TTK Prestige Ltd. 1.52 - 1.52 Shreno Ltd. 0.11 - -

• SIP

ZF Commercial Vehicle Control Total 0.11 - -

Fresh registration through SIP/STP-in on or after

Systems India Ltd. 1.51 - 1.51 Cash, Cash Equivalents

February 04, 2021 in the Scheme will be capped

Hawkins Cookers Ltd. 1.51 - 1.51 And Others 8.21 - -

at `25,000 per month per PAN (first

Ahluwalia Contracts (India) Ltd. 1.40 - 1.40 Grand Total 100.00

holder/guardian PAN) for daily, weekly, monthly

and quarterly frequencies. The caps for various

frequencies will be as under:

Daily SIP/STP-in: `1,250, PORTFOLIO CLASSIFICATION BY PORTFOLIO CLASSIFICATION BY

Weekly SIP/STP-in: `6,250, INDUSTRY ALLOCATION (%) ASSET ALLOCATION (%)

Monthly SIP/STP-in: `25,000,

Quarterly SIP/STP-in: `75,000 Capital Goods 19.36

All other terms and conditions pertaining to Consumer Durables 13.74

8.21

SIPs/STPs remain unchanged under the Scheme. Consumer Services 12.94 17.99

Construction 7.78 8.30

Kindly refer notice cum addendum dated February

03, 2021 for further details. Chemicals 6.59 0.11

• Minimum Investment and Additional

Financial Services 5.37

Investment: Fast Moving Consumer Goods 4.51

Automobile And Auto Components 3.69

Fresh subscriptions through lumpsum investment

Healthcare 2.25

(including additional investments / Switch in) in

Media, Entertainment & Publication 2.06

the Scheme is discontinued till further notice in

terms of notice cum addendum dated September

Construction Materials 1.82

04, 2020. Services 1.69 65.39

Realty 1.13

Quantitative Data Textiles 0.42 Mid Cap Smallcap

Standard Deviation

#

: 23.56% Oil, Gas & Consumable Fuels 0.14

Derivatives Non-convertible Preference Shares

Beta# : 0.76 Derivatives 8.30

Sharpe Ratio# : 0.93 Cash, Cash Equivalents And Others 8.21 Cash, Cash Equivalents, And Others

Portfolio Turnover*

Equity Turnover : 0.11

SBI Small Cap Fund

Total Turnover : 0.54 This product is suitable for investors who are seeking^:

Total Turnover = Equity + Debt + Derivatives

#

Source: CRISIL Fund Analyser • Long term capital appreciation

*Portfolio Turnover = lower of total sale or total • Investment in equity and equity-related securities

purchase for the last 12 months (including equity

predominantly of small cap companies.

derivatives) upon Avg. AUM of trailing twelve months. Investors understand that their principal

Risk Free rate: FBIL Overnight Mibor rate (6.60% as on ^Investors should consult their financial advisers if in

will be at Very High risk

30th December 2022) Basis for Ratio Calculation: 3 doubt about whether the product is suitable for them.

Years Monthly Data Points

*Mr. Mohit Jain is the dedicated fund manager for managing overseas investments of the Scheme.

Ratios are computed using Total Return Index (TRI) as

per SEBI Circular dated Jan 4, 2018 21

You might also like

- 5 - Granados y Gupta (2013) - Transparency Strategy - Competing With Information in A Digital WorldDocument6 pages5 - Granados y Gupta (2013) - Transparency Strategy - Competing With Information in A Digital WorldErika SanNo ratings yet

- BVP Venture Debt ModelDocument3 pagesBVP Venture Debt ModelJack MillerNo ratings yet

- MS Traffic Signs Installations (Rev. 01)Document6 pagesMS Traffic Signs Installations (Rev. 01)moytabura96100% (1)

- Mutual Funds Industry in India and Its Comparative AnalysisDocument46 pagesMutual Funds Industry in India and Its Comparative AnalysisShahzad SaifNo ratings yet

- Candlestick CheatsheetDocument1 pageCandlestick CheatsheetArie PutrantoNo ratings yet

- A Simple Guide To Investing in Turnaround Stocks - How To Successfully Invest in Stocks of Turnaround CompaniesDocument54 pagesA Simple Guide To Investing in Turnaround Stocks - How To Successfully Invest in Stocks of Turnaround CompaniesAnonymous sDnT9yu100% (2)

- SBI Small Cap Fund Factsheet July 2024Document1 pageSBI Small Cap Fund Factsheet July 2024akshayjoshi638No ratings yet

- SBI Small Cap Fund Factsheet October 2024Document1 pageSBI Small Cap Fund Factsheet October 2024nikhileshchatNo ratings yet

- SBI Large Midcap Fund Factsheet April 2024Document1 pageSBI Large Midcap Fund Factsheet April 2024Hitesh MiskinNo ratings yet

- SBI Small Cap PDFDocument1 pageSBI Small Cap PDFJasmeet Singh NagpalNo ratings yet

- Sbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFDocument1 pageSbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFavinash sengarNo ratings yet

- Sbi Large and Midcap Fund Factsheet (June-2021!2!1)Document1 pageSbi Large and Midcap Fund Factsheet (June-2021!2!1)Gaurav NagpalNo ratings yet

- SBI Contra Fund Factsheet May 2024Document1 pageSBI Contra Fund Factsheet May 2024Amit ChoudharyNo ratings yet

- SBI Contra Fund Factsheet April 2024Document1 pageSBI Contra Fund Factsheet April 2024skbmnnitNo ratings yet

- SBI Bluechip Fund - One PagerDocument1 pageSBI Bluechip Fund - One PagerjoycoolNo ratings yet

- SBI Contra Fund FactsheetDocument1 pageSBI Contra Fund FactsheetAkshad KhedkarNo ratings yet

- SBI Long Term Equity Fund Factsheet April 2024Document1 pageSBI Long Term Equity Fund Factsheet April 2024chayamadhu1No ratings yet

- SBI Contra Fund Factsheet September 2024Document1 pageSBI Contra Fund Factsheet September 2024saurav8912sharmaNo ratings yet

- SBI Flexicap Fund Factsheet October 2024Document1 pageSBI Flexicap Fund Factsheet October 2024vanshchaturvedi182No ratings yet

- SBI Contra Fund FactsheetDocument1 pageSBI Contra Fund FactsheetAman VermaNo ratings yet

- SBI Small and Mid Cap Fund FactsheetDocument1 pageSBI Small and Mid Cap Fund Factsheetfinal bossuNo ratings yet

- Sbi Magnum Taxgain Scheme Factsheet (March-2017!3!1)Document1 pageSbi Magnum Taxgain Scheme Factsheet (March-2017!3!1)Saranya KrishnamurthyNo ratings yet

- SBI Long Term Equity Fund FactsheetDocument1 pageSBI Long Term Equity Fund FactsheetAwakening with EnlightenmentNo ratings yet

- Sbi Focused Equity Fund Factsheet (May-2019!25!1)Document1 pageSbi Focused Equity Fund Factsheet (May-2019!25!1)Chandrasekar Attayampatty TamilarasanNo ratings yet

- SBI Long Term Equity Fund Factsheet 62c6e895 82d5 4411 8714 6dfcec432a91Document1 pageSBI Long Term Equity Fund Factsheet 62c6e895 82d5 4411 8714 6dfcec432a91ja3mf29gNo ratings yet

- Sbi Psu Fund Factsheet (June-2021-137-1)Document1 pageSbi Psu Fund Factsheet (June-2021-137-1)Gaurav NagpalNo ratings yet

- Announce 202415octDocument1 pageAnnounce 202415octKashf e HaqNo ratings yet

- General Instruction Manual: Saudi Arabian Oil Company (Saudi Aramco)Document10 pagesGeneral Instruction Manual: Saudi Arabian Oil Company (Saudi Aramco)Aldrien CabinteNo ratings yet

- Audit2 20220525 0001Document2 pagesAudit2 20220525 0001HoodaNo ratings yet

- STXDIV MDD November 2023Document2 pagesSTXDIV MDD November 2023mkhize.christian.21No ratings yet

- Barclays India Cement On The Road To Recovery Initiate On Ultratech and Grasim ADocument115 pagesBarclays India Cement On The Road To Recovery Initiate On Ultratech and Grasim AChirag shahNo ratings yet

- Almonty Industries Inc.: On Course To Realise The World'S Premier Tungsten ProjectDocument11 pagesAlmonty Industries Inc.: On Course To Realise The World'S Premier Tungsten ProjecteditorialmiovNo ratings yet

- Fund Facts - HDFC Small Cap Fund - May 24Document3 pagesFund Facts - HDFC Small Cap Fund - May 24mk2bmh9sNo ratings yet

- Cost Reduction Through Industrialization, Standardization and SimplificationDocument16 pagesCost Reduction Through Industrialization, Standardization and SimplificationRoo FaNo ratings yet

- SBI Smallcap Fund (1) 09162022Document4 pagesSBI Smallcap Fund (1) 09162022chandana kumar0% (1)

- APM Automotive Holdings Berhad: Riding On Motor Sector's Growth Cycle - 29/7/2010Document7 pagesAPM Automotive Holdings Berhad: Riding On Motor Sector's Growth Cycle - 29/7/2010Rhb InvestNo ratings yet

- SBI RETIREMENT BENEFIT FUND - AGGRESSIVE PLAN Factsheet August 2024Document1 pageSBI RETIREMENT BENEFIT FUND - AGGRESSIVE PLAN Factsheet August 2024Abhra MukherjeeNo ratings yet

- Morning India 20241018 Mosl Mi Pg054Document54 pagesMorning India 20241018 Mosl Mi Pg054dps83No ratings yet

- Sbi Nifty Index Fund Factsheet (December-2020!13!11) PDFDocument1 pageSbi Nifty Index Fund Factsheet (December-2020!13!11) PDFSubscriptionNo ratings yet

- Rt Assessment -0207 Ngl Pr-1,3,4Document1 pageRt Assessment -0207 Ngl Pr-1,3,4sudiaaribia8No ratings yet

- Gamuda Berhad: Served A Request For Arbitration Amounting To RM51.5m - 10/03/2010Document3 pagesGamuda Berhad: Served A Request For Arbitration Amounting To RM51.5m - 10/03/2010Rhb InvestNo ratings yet

- (77-E-VAF-SBM) Vendor Approval (Rev.0-Jan 23) - UMJ - SignedDocument1 page(77-E-VAF-SBM) Vendor Approval (Rev.0-Jan 23) - UMJ - SignedDennis OngNo ratings yet

- M'sian Airline System Berhad: Flights To Europe To Resume Today, To Cap Net Gearing at 2x Over The Next Three Years - 21/04/2010Document4 pagesM'sian Airline System Berhad: Flights To Europe To Resume Today, To Cap Net Gearing at 2x Over The Next Three Years - 21/04/2010Rhb InvestNo ratings yet

- Divgi TorqTransfer Systems IPO Note Axis Capital PDFDocument12 pagesDivgi TorqTransfer Systems IPO Note Axis Capital PDFKyle KonjeNo ratings yet

- General Instruction Manual: Accounting Policy, Methods & Systems DepartmentDocument15 pagesGeneral Instruction Manual: Accounting Policy, Methods & Systems DepartmentAldrien CabinteNo ratings yet

- Industies Alloted Land JKDocument205 pagesIndusties Alloted Land JKarupeakNo ratings yet

- Sbi Life Pure Fund PerformanceDocument1 pageSbi Life Pure Fund PerformanceVishal Vijay SoniNo ratings yet

- SBI Magnum Children's Benefit Fund Investment Plan Factsheet October 2024Document1 pageSBI Magnum Children's Benefit Fund Investment Plan Factsheet October 2024nikhileshchatNo ratings yet

- HDFC Defence FundDocument1 pageHDFC Defence Fundskipperparth108No ratings yet

- Contract 205687113Document5 pagesContract 205687113Muhtasim IbtidaNo ratings yet

- India To Open Up Cowin For The World: PM: Bourses, Top Executives To Pay For Technical GlitchesDocument20 pagesIndia To Open Up Cowin For The World: PM: Bourses, Top Executives To Pay For Technical GlitchesSatish WadawadagiNo ratings yet

- Tendernotice_1 (4)Document2 pagesTendernotice_1 (4)everestinfratechinc1No ratings yet

- Chennai (VOMM_MAA) - Airport and Route Briefing GuideDocument9 pagesChennai (VOMM_MAA) - Airport and Route Briefing GuidenishantNo ratings yet

- IDFC Factsheet March 2021Document72 pagesIDFC Factsheet March 2021Karambir Singh DhayalNo ratings yet

- Bajaj AcceleratorMidCap LL FundDocument1 pageBajaj AcceleratorMidCap LL FundHarsh SrivastavaNo ratings yet

- Inf200k01t28 - Sbi SmallcapDocument1 pageInf200k01t28 - Sbi SmallcapKiran ChilukaNo ratings yet

- Revenue & Capital Exp 2Document2 pagesRevenue & Capital Exp 2Piyush SinglaNo ratings yet

- IDFC Factsheet January 2021 16Document64 pagesIDFC Factsheet January 2021 16partner712No ratings yet

- ATRAM Global Technology Feeder Fund Fact Sheet Jan 2020Document2 pagesATRAM Global Technology Feeder Fund Fact Sheet Jan 2020anton clementeNo ratings yet

- Newsletter 27 DEC.Document3 pagesNewsletter 27 DEC.wasimexpressNo ratings yet

- Nabors Industries Inc 2Q20 Credit ReportDocument7 pagesNabors Industries Inc 2Q20 Credit ReportKaramo CisséNo ratings yet

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- Archaic GlobalizationDocument8 pagesArchaic Globalizationvaibhav tomarNo ratings yet

- Ford MotorDocument19 pagesFord MotorAlamin MohammadNo ratings yet

- On EscortDocument24 pagesOn EscortVikaskundu28No ratings yet

- SMB106 WBDocument111 pagesSMB106 WBHussain AhmedNo ratings yet

- Session 4Document21 pagesSession 4Dikshant LalNo ratings yet

- Yap - ACP312 - ULOb - Let's CheckDocument4 pagesYap - ACP312 - ULOb - Let's CheckJunzen Ralph YapNo ratings yet

- McDonald's Strategic Plan FinalDocument23 pagesMcDonald's Strategic Plan FinalMuhammad AzeemNo ratings yet

- Problem Set 9: The Black and Scholes ModelDocument12 pagesProblem Set 9: The Black and Scholes ModelmariaNo ratings yet

- Unit 7: Joint and By-Product Costing SystemDocument8 pagesUnit 7: Joint and By-Product Costing SystemCielo PulmaNo ratings yet

- Managing Personal CommunicationsDocument10 pagesManaging Personal CommunicationsPY SorianoNo ratings yet

- MTF SignedDocument4 pagesMTF Signedsnehashisban007No ratings yet

- Marketing Strategy Followed by Godrej & WhirlpoolDocument9 pagesMarketing Strategy Followed by Godrej & WhirlpoolArun PrakashNo ratings yet

- Bank Capital RefresherDocument16 pagesBank Capital RefresherrouphaelrNo ratings yet

- Green Marketing Mix A Review of Literatu PDFDocument17 pagesGreen Marketing Mix A Review of Literatu PDFvrnNo ratings yet

- AFM MAY 24 QUESTION PAPER ANALYSISDocument2 pagesAFM MAY 24 QUESTION PAPER ANALYSISkevinnash8398No ratings yet

- Group Assignment - Nestle Malaysia Berhad - Ba2415bDocument56 pagesGroup Assignment - Nestle Malaysia Berhad - Ba2415bAhmad Izzuddin MohamadNo ratings yet

- Book Summary (Lite) of The Next Evolution of MarketingDocument2 pagesBook Summary (Lite) of The Next Evolution of MarketingBusiness Book SummariesNo ratings yet

- Agri-Supply Chain Management: To Stimulate Cross-Border Trade in Developing Countries and Emerging EconomiesDocument25 pagesAgri-Supply Chain Management: To Stimulate Cross-Border Trade in Developing Countries and Emerging EconomiesKen ChepkwonyNo ratings yet

- TMB EASTSPRING Global Innovation Fund: FactsheetDocument20 pagesTMB EASTSPRING Global Innovation Fund: FactsheetRithi JantararatNo ratings yet

- Marketing Strategy of Mcdonald'S in India: Abv-Indian Institute of Information Technology and Management, GwaliorDocument38 pagesMarketing Strategy of Mcdonald'S in India: Abv-Indian Institute of Information Technology and Management, GwaliorHenry WaribuhNo ratings yet

- Stock Market Special ReportDocument7 pagesStock Market Special ReportBhargavasreeNo ratings yet

- Project: E-Guard Professor Dr. Ahmed FouadDocument23 pagesProject: E-Guard Professor Dr. Ahmed FouadNehal NabilNo ratings yet

- MicroEconomics 2012 Midterms at IIM KozhikodeDocument5 pagesMicroEconomics 2012 Midterms at IIM KozhikodeShri Dhar100% (1)

- BDM Project Organic WorldDocument23 pagesBDM Project Organic WorldManveer SinghNo ratings yet

- Non-Programmed DecisionDocument4 pagesNon-Programmed DecisionAmira Syifa AtullahNo ratings yet