Cases&Exercises - Chapter 1

Uploaded by

Barbara AraujoCases&Exercises - Chapter 1

Uploaded by

Barbara AraujoEscola de Economia e Gestão

Departamento de Gestão

COURSE UNIT:

FINANCIAL ANALYSIS AND PLANNING

LECTURER: SÓNIA MILLÁN

BACHELOR IN MANAGEMENT (3rd YEAR)

CASES & EXERCISES

Academic Year 2022/2023 – 1st Semester

1. Relevance of Financial Analysis

1.1. Introduction to financial analysis

1.2. Objectives and different approaches of users of financial statements

1.3. Relevant information: financial statements and other information (company information and

its business environment)

1.4. Main financial statement analysis methods and techniques

1.5. Relation with finance theory: market efficiency hypothesis, modern portfolio theory and the

capital asset pricing model

RATIO ANALYSIS

1. Taking into account the balance sheet information presented in the table below for Company

ONE and Company TWO, compute the Current ratio, the Quick ratio and the Cash to current

liabilities ratio for the two companies and comment the results.

ONE TWO

Non current assets (Ativos não correntes) 15000 3000

Inventories(Inventários) 48000 1000

Accounts Receivable(Clientes) 12000 900

Cash and Cash Equivalents (Meios Financeiros Liquidos) 1000 100

Shareholders' Equity (Capital Próprio) 6000 1000

Non-current Liabilities(Passivo não corrente) 40000 3000

Current Liabilities(Passivo corrente) 30000 1000

Current ratio (Rácio Liquidez Geral)

Quick ratio(Rácio Liquidez Reduzida)

Cash to current liabilities ratio(Rácio Liquidez Imediata)

Céu Cortez / Benilde Oliveira 2

2. The table below reports Liquidity and Solvency ratios for Company X and Company Y. What

may you conclude from the analysis of the ratios? Comparing the two companies, what are the main

differences?

Company P Company X

Financial ratios Year N Year N+1 Year N Year N+1

Current ratio 2.32 2.19 1.4 1.45

=Current Assets/Current Liabilities

Quick ratio 1.36 1.17 0.9 0.85

=(Current Assets-Inventories)/Current Liabilities

Collection Period (months) 2.30 2.08 2.56 2.3

= Accounts Receivable/Sales*12

Days Accounts Payables Outstanding (months) 3.46 2.92 3 3

= Accounts Payables/Purchases*12)

Inventory Turnover 3.63 4.13 6 5

= Cost of sales/Inventories

Shareholders' equity to total liabilities 3.16 3.00 0.61 0.62

= Shareholders' Equity/Total Liabilities

Shareholders' equity to total assets 0.76 0.75 0.38 0.38

= Shareholders' Equity/Total Assets

Financial leverage 0.24 0.25 0.62 0.62

= Total Liabilities/Total Assets

Non-current financing to non-current assets 1.72 1.65 1.23 1.38

= (Shareholders' Equity + Non-current Liabilities)/Non-

current Assets

Céu Cortez / Benilde Oliveira 3

COMPARATIVE AND COMMON-SIZE FINANCIAL STATEMENTS ANALYSIS

Founded in 1927, Riopele is one of the oldest textile companies in Portugal and an international

reference in the creation and production of fabrics for fashion and clothing collections. The table

below presents the balance sheet for the period 1993-1996. This was a period of high difficulties for

the company. Make a brief comment on the financial performance of the company, focusing on its

main investments and main sources of financing.

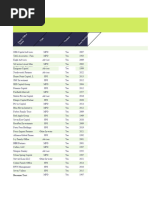

Balance Sheets of Riopele, S.A. for the period 1993-1996

1993 % 1994 % 1995 % 1996 %

Non-current Assets 9116995 41.1% 7982709 40.2% 7469003 37.9% 7307029 37.3%

Intangible Assets 32521 0.1% 29108 0.1% 114938 0.6% 184482 0.9%

Property, Plant and Equipment 25124530 113.3% 25075566 126.1% 25176207 127.7% 25361798 129.6%

Amortization and Depreciation -16486884 -74.3% -17532916 -88.2% -18230222 -92.5% -18587428 -95.0%

Financial Investments 471330 2.1% 471330 2.4% 463907 2.4% 404346 2.1%

Impairments of Financial Investments -24502 -0.1% -60379 -0.3% -55827 -0.3% -56169 -0.3%

Current Assets 13062853 58.9% 11898470 59.8% 12246397 62.1% 12256929 62.7%

Inventories 8104062 36.5% 7760753 39.0% 7868922 39.9% 6992342 35.7%

Raw materials 1118242 5.0% 1004173 5.1% 1102583 5.6% 788776 4.0%

Work in progress 1890835 8.5% 1879721 9.5% 1932388 9.8% 1895407 9.7%

Finished Products 5094985 23.0% 4876859 24.5% 4832963 24.5% 4585836 23.4%

Goods 0 0.0% 0 0.0% 988 0.0% 365 0.0%

Impairments of Inventories 0 0.0% 0 0.0% 0 0.0% -278042 -1.4%

Accounts Receivables 4721110 21.3% 4077813 20.5% 3903888 19.8% 4111398 21.0%

Impairments of Accounts Receivable -387657 -1.7% -360890 -1.8% -299769 -1.5% -293722 -1.5%

Other current assets 378927 1.7% 211139 1.1% 328604 1.7% 1015066 5.2%

State and other public entities 0 0.0% 60199 0.3% 14376 0.1% 93743 0.5%

Cash and Cash Equivalents 246411 1.1% 149456 0.8% 430376 2.2% 338102 1.7%

Total Assets 22179848 100% 19881179 100% 19715400 100% 19563958 100%

Shareholders' Equity 10749131 48.5% 10451171 52.6% 10241106 51.9% 10298102 52.6%

Share Capital 6500000 29.3% 6500000 32.7% 6500000 33.0% 6500000 33.2%

Reserves 5736846 25.9% 5736846 28.9% 5736846 29.1% 5736846 29.3%

Retained Earnings 0 0.0% -1823840 -9.2% -1720640 -8.7% -1956021 -10.0%

Net Income for the period -1487715 -6.7% 38165 0.2% -275100 -1.4% 17277 0.1%

Total Liabilities 11430717 51.5% 9430008 47.4% 9474294 48.1% 9265856 47.4%

Non-current Liabilities 4338933 19.6% 2976881 15.0% 3217445 16.3% 3420333 17.5%

Provisions 0 0.0% 0 0.0% 0 0.0% 81367 0.4%

Bank Loans 2338933 10.5% 1976881 9.9% 3217445 16.3% 3338966 17.1%

Bond Loans 2000000 9.0% 1000000 5.0% 0 0.0% 0 0.0%

Current Liabilities 7091784 32.0% 6453127 32.5% 6256849 31.7% 5845523 29.9%

Accounts Payable 1812830 8.2% 1430273 7.2% 1677095 8.5% 1271756 6.5%

State ans other public entities 231317 1.0% 271231 1.4% 173024 0.9% 185077 0.9%

Bank loans 3693552 16.7% 2663227 13.4% 2275430 11.5% 2619104 13.4%

Bond loans 0 0.0% 1000000 5.0% 1000000 5.1% 0 0.0%

Other current liabilities 1354085 6.1% 1088396 5.5% 1131300 5.7% 1769586 9.0%

Total Shareholders' equity + Total Liabilities 22179848 100% 19881179 100% 19715400 100% 19563958 100%

Céu Cortez / Benilde Oliveira 4

RECOMMENDED ADDITIONAL CASES

Subramanyam (2014) - Chapter 1

Questions 1-8, 1-9, 1-14, 1-23, 1-25, 1-26 (p.47-48)

Exercises 1-3, 1-4 (p. 49)

Problem 1-10 (p. 59)

Case 1-4 (p. 62)

Céu Cortez / Benilde Oliveira 5

You might also like

- Report On Ratio Analysis (Reliance Infrastructure Limited)No ratings yetReport On Ratio Analysis (Reliance Infrastructure Limited)21 pages

- The Stockholders' Report: © 2012 Pearson Prentice Hall. All Rights ReservedNo ratings yetThe Stockholders' Report: © 2012 Pearson Prentice Hall. All Rights Reserved185 pages

- Financial Ratio Analyses and Their Implications To ManagementNo ratings yetFinancial Ratio Analyses and Their Implications To Management31 pages

- Chapter 4. Financial Ratio Analyses and Their Implications To Management Learning ObjectivesNo ratings yetChapter 4. Financial Ratio Analyses and Their Implications To Management Learning Objectives29 pages

- IN Financial Management 1: Leyte CollegesNo ratings yetIN Financial Management 1: Leyte Colleges20 pages

- Grade 12- Fundamentals of Accountancy - Module 5.2No ratings yetGrade 12- Fundamentals of Accountancy - Module 5.214 pages

- Topic 3 Ratio Analysis_65ca3d60b36bfb706490c4c1ad85ccb9No ratings yetTopic 3 Ratio Analysis_65ca3d60b36bfb706490c4c1ad85ccb99 pages

- Module 2- Focus on Finncial Ratio Su24 (updated)No ratings yetModule 2- Focus on Finncial Ratio Su24 (updated)22 pages

- A Comparative Analysis of The Financial Ratios of Listed Firms Belonging To The Education Subsector in The Philippines For The Years 2009-2011No ratings yetA Comparative Analysis of The Financial Ratios of Listed Firms Belonging To The Education Subsector in The Philippines For The Years 2009-201118 pages

- The Stockholders' Report: © 2012 Pearson Prentice Hall. All Rights ReservedNo ratings yetThe Stockholders' Report: © 2012 Pearson Prentice Hall. All Rights Reserved56 pages

- Training Manual: The Basics of Financing AgricultureNo ratings yetTraining Manual: The Basics of Financing Agriculture39 pages

- BCOM 111 Topic Analysis and Interpretation of Financial StatementsNo ratings yetBCOM 111 Topic Analysis and Interpretation of Financial Statements13 pages

- Analysis of Financial Statements - Ratio Analysis100% (1)Analysis of Financial Statements - Ratio Analysis14 pages

- Curso DE Finanzas Corporativas. Material Tomado De: Financial Statements and Ratio AnalysisNo ratings yetCurso DE Finanzas Corporativas. Material Tomado De: Financial Statements and Ratio Analysis58 pages

- Corporate Finance and Financial AnalysisNo ratings yetCorporate Finance and Financial Analysis4 pages

- Guide to Strategic Management Accounting for Managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?From EverandGuide to Strategic Management Accounting for Managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?No ratings yet

- Download Complete Principles of Managerial Finance 16th Edition Chad J Zutter Scott B Smart PDF for All Chapters100% (1)Download Complete Principles of Managerial Finance 16th Edition Chad J Zutter Scott B Smart PDF for All Chapters65 pages

- FM Theory Book - B73e8e56 Ad98 4d52 B7e7 Fb1341e39ab2No ratings yetFM Theory Book - B73e8e56 Ad98 4d52 B7e7 Fb1341e39ab2138 pages

- Practice For Quiz #3 Solutions For StudentsNo ratings yetPractice For Quiz #3 Solutions For Students10 pages

- CA Final SFM Chalisa Book by CA Aaditya Jain For Nov 2021 ExamNo ratings yetCA Final SFM Chalisa Book by CA Aaditya Jain For Nov 2021 Exam48 pages

- Accounting Principles, 13th Edition Jerry J. Weygandt All Chapters Instant Download100% (2)Accounting Principles, 13th Edition Jerry J. Weygandt All Chapters Instant Download62 pages

- Our Telegram Channel " ": T.me/capsbeniwalclassesNo ratings yetOur Telegram Channel " ": T.me/capsbeniwalclasses13 pages

- Investment Appraisal - Discounted Cash Flow TechniquesNo ratings yetInvestment Appraisal - Discounted Cash Flow Techniques9 pages

- Report On Ratio Analysis (Reliance Infrastructure Limited)Report On Ratio Analysis (Reliance Infrastructure Limited)

- The Stockholders' Report: © 2012 Pearson Prentice Hall. All Rights ReservedThe Stockholders' Report: © 2012 Pearson Prentice Hall. All Rights Reserved

- Financial Ratio Analyses and Their Implications To ManagementFinancial Ratio Analyses and Their Implications To Management

- Chapter 4. Financial Ratio Analyses and Their Implications To Management Learning ObjectivesChapter 4. Financial Ratio Analyses and Their Implications To Management Learning Objectives

- Grade 12- Fundamentals of Accountancy - Module 5.2Grade 12- Fundamentals of Accountancy - Module 5.2

- Topic 3 Ratio Analysis_65ca3d60b36bfb706490c4c1ad85ccb9Topic 3 Ratio Analysis_65ca3d60b36bfb706490c4c1ad85ccb9

- A Comparative Analysis of The Financial Ratios of Listed Firms Belonging To The Education Subsector in The Philippines For The Years 2009-2011A Comparative Analysis of The Financial Ratios of Listed Firms Belonging To The Education Subsector in The Philippines For The Years 2009-2011

- The Stockholders' Report: © 2012 Pearson Prentice Hall. All Rights ReservedThe Stockholders' Report: © 2012 Pearson Prentice Hall. All Rights Reserved

- Training Manual: The Basics of Financing AgricultureTraining Manual: The Basics of Financing Agriculture

- BCOM 111 Topic Analysis and Interpretation of Financial StatementsBCOM 111 Topic Analysis and Interpretation of Financial Statements

- Curso DE Finanzas Corporativas. Material Tomado De: Financial Statements and Ratio AnalysisCurso DE Finanzas Corporativas. Material Tomado De: Financial Statements and Ratio Analysis

- Guide to Strategic Management Accounting for Managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?From EverandGuide to Strategic Management Accounting for Managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?

- Guide to Strategic Management Accounting for ManagerrsFrom EverandGuide to Strategic Management Accounting for Managerrs

- International Revenue Administration: Managing Global TaxesFrom EverandInternational Revenue Administration: Managing Global Taxes

- Download Complete Principles of Managerial Finance 16th Edition Chad J Zutter Scott B Smart PDF for All ChaptersDownload Complete Principles of Managerial Finance 16th Edition Chad J Zutter Scott B Smart PDF for All Chapters

- FM Theory Book - B73e8e56 Ad98 4d52 B7e7 Fb1341e39ab2FM Theory Book - B73e8e56 Ad98 4d52 B7e7 Fb1341e39ab2

- CA Final SFM Chalisa Book by CA Aaditya Jain For Nov 2021 ExamCA Final SFM Chalisa Book by CA Aaditya Jain For Nov 2021 Exam

- Accounting Principles, 13th Edition Jerry J. Weygandt All Chapters Instant DownloadAccounting Principles, 13th Edition Jerry J. Weygandt All Chapters Instant Download

- Investment Appraisal - Discounted Cash Flow TechniquesInvestment Appraisal - Discounted Cash Flow Techniques