0 ratings0% found this document useful (0 votes)

48 viewsTax Invoice

Tax Invoice

Uploaded by

29ajayThis tax invoice from Jhalani Electricals documents the sale of 100 pieces of Bajaj ICX 130 induction cooktops to Naina Sales Pvt. Ltd. The total invoice amount is INR 2,05,610 with an integrated GST amount of INR 31,364.28. The goods are to be delivered to Sanjay Bansal of Hotel Ramada in Kasauli, Himachal Pradesh.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Tax Invoice

Tax Invoice

Uploaded by

29ajay0 ratings0% found this document useful (0 votes)

48 views2 pagesThis tax invoice from Jhalani Electricals documents the sale of 100 pieces of Bajaj ICX 130 induction cooktops to Naina Sales Pvt. Ltd. The total invoice amount is INR 2,05,610 with an integrated GST amount of INR 31,364.28. The goods are to be delivered to Sanjay Bansal of Hotel Ramada in Kasauli, Himachal Pradesh.

Original Title

255

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

This tax invoice from Jhalani Electricals documents the sale of 100 pieces of Bajaj ICX 130 induction cooktops to Naina Sales Pvt. Ltd. The total invoice amount is INR 2,05,610 with an integrated GST amount of INR 31,364.28. The goods are to be delivered to Sanjay Bansal of Hotel Ramada in Kasauli, Himachal Pradesh.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

48 views2 pagesTax Invoice

Tax Invoice

Uploaded by

29ajayThis tax invoice from Jhalani Electricals documents the sale of 100 pieces of Bajaj ICX 130 induction cooktops to Naina Sales Pvt. Ltd. The total invoice amount is INR 2,05,610 with an integrated GST amount of INR 31,364.28. The goods are to be delivered to Sanjay Bansal of Hotel Ramada in Kasauli, Himachal Pradesh.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

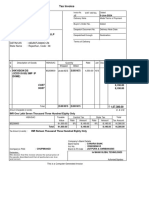

Tax Invoice (ORIGINAL FOR RECIPIENT)

JHALANI ELECTRICALS Invoice No. e-Way Bill No. Dated

A-7A, MAIN PALAM DABRI ROAD JE/22-23/255 751261700672 27-May-22

DASHRATH PURI

NEW DELHI Delivery Note Mode/Terms of Payment

MOB-8510820999, TEL-011-47155036

GSTIN/UIN: 07EJEPK2869E1Z3

State Name : Delhi, Code : 07 Reference No. & Date. Other References

E-Mail : jhalanielectricals@gmail.com

Buyer’s Order No. Dated

Consignee (Ship to)

SANJAY BANSAL Dispatch Doc No. Delivery Note Date

HOTEL RAMADA

KASAULI , HIMACHAL PRADESH Dispatched through Destination

8699914000

GSTIN/UIN : 03AAECN6512F3ZU Terms of Delivery

State Name : Himachal Pradesh, Code : 02

Buyer (Bill to)

NAINA SALES PVT. LTD.

139A, BAHARPUR GARDEN

PATIALA

GSTIN/UIN : 03AAECN6512F3ZU

State Name : Punjab, Code : 03

Sl Description of Goods HSN/SAC Quantity Rate per Disc. % Amount

No.

1 BAJAJ ICX 130 INDUCTION 8516 100 PCS 2,056.00 PCS 15.25 % 1,74,246.00

IGST @18% 18 % 31,364.28

Less : ROUND OFF (-)0.28

Total 100 PCS 2,05,610.00

Amount Chargeable (in words) E. & O.E

INR Two Lakh Five Thousand Six Hundred Ten Only

HSN/SAC Taxable Integrated Tax Total

Value Rate Amount Tax Amount

8516 1,74,246.00 18% 31,364.28 31,364.28

Total 1,74,246.00 31,364.28 31,364.28

Tax Amount (in words) : INR Thirty One Thousand Three Hundred Sixty Four and Twenty Eight paise Only

Company’s Bank Details

Bank Name : CANARA BANK

A/c No. : 2758261025150

Branch & IFS Code : Rohini Sector-15 & CNRB0002758

Company’s PAN : EJEPK2869E

for JHALANI ELECTRICALS

Declaration

We declare that this invoice shows the actual price of the

goods described and that all particulars are true and correct. Authorised Signatory

This is a Computer Generated Invoice

Tax Invoice (DUPLICATE FOR TRANSPORTER)

JHALANI ELECTRICALS Invoice No. e-Way Bill No. Dated

A-7A, MAIN PALAM DABRI ROAD JE/22-23/255 751261700672 27-May-22

DASHRATH PURI

NEW DELHI Delivery Note Mode/Terms of Payment

MOB-8510820999, TEL-011-47155036

GSTIN/UIN: 07EJEPK2869E1Z3

State Name : Delhi, Code : 07 Reference No. & Date. Other References

E-Mail : jhalanielectricals@gmail.com

Buyer’s Order No. Dated

Consignee (Ship to)

SANJAY BANSAL Dispatch Doc No. Delivery Note Date

HOTEL RAMADA

KASAULI , HIMACHAL PRADESH Dispatched through Destination

8699914000

GSTIN/UIN : 03AAECN6512F3ZU Terms of Delivery

State Name : Himachal Pradesh, Code : 02

Buyer (Bill to)

NAINA SALES PVT. LTD.

139A, BAHARPUR GARDEN

PATIALA

GSTIN/UIN : 03AAECN6512F3ZU

State Name : Punjab, Code : 03

Sl Description of Goods HSN/SAC Quantity Rate per Disc. % Amount

No.

1 BAJAJ ICX 130 INDUCTION 8516 100 PCS 2,056.00 PCS 15.25 % 1,74,246.00

IGST @18% 18 % 31,364.28

Less : ROUND OFF (-)0.28

Total 100 PCS 2,05,610.00

Amount Chargeable (in words) E. & O.E

INR Two Lakh Five Thousand Six Hundred Ten Only

HSN/SAC Taxable Integrated Tax Total

Value Rate Amount Tax Amount

8516 1,74,246.00 18% 31,364.28 31,364.28

Total 1,74,246.00 31,364.28 31,364.28

Tax Amount (in words) : INR Thirty One Thousand Three Hundred Sixty Four and Twenty Eight paise Only

Company’s Bank Details

Bank Name : CANARA BANK

A/c No. : 2758261025150

Branch & IFS Code : Rohini Sector-15 & CNRB0002758

Company’s PAN : EJEPK2869E

for JHALANI ELECTRICALS

Declaration

We declare that this invoice shows the actual price of the

goods described and that all particulars are true and correct. Authorised Signatory

This is a Computer Generated Invoice

You might also like

- 456Document1 page456KrishaNo ratings yet

- GoodDocument1 pageGoodEntertain with musicNo ratings yet

- Maheshwari Mining PVT LTD: SL No. 1Document1 pageMaheshwari Mining PVT LTD: SL No. 1Karthii Aju100% (1)

- MTC093Document3 pagesMTC093deepak vashistNo ratings yet

- Tax Invoice: Igst AcDocument1 pageTax Invoice: Igst AcAdarsh NikamNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherVirendra SahuNo ratings yet

- Piperine 2Document1 pagePiperine 2vasavi reddyNo ratings yet

- Proforma Invoice India Traders: IT/2297/24-25 2-Oct-24Document1 pageProforma Invoice India Traders: IT/2297/24-25 2-Oct-24k23694039No ratings yet

- UPS BillDocument2 pagesUPS Billmack100% (1)

- New Bill 0177Document2 pagesNew Bill 0177bunnybug0007No ratings yet

- Accounting VoucherDocument1 pageAccounting Voucherramzanahmad14No ratings yet

- Tax InvoiceDocument1 pageTax InvoiceRatna BharathNo ratings yet

- Accounting Voucher 289Document1 pageAccounting Voucher 289rajesh puhanNo ratings yet

- Jiwan Saree House AkmalDocument1 pageJiwan Saree House AkmalEhtesham FaisalNo ratings yet

- Ganesha Ent 4850Document1 pageGanesha Ent 4850balvantkumar3284No ratings yet

- Accounting VoucherDocument1 pageAccounting Voucheradposting wNo ratings yet

- MP 1602 23 24Document1 pageMP 1602 23 24minarplastic200No ratings yet

- 0081 - Shree Samarth ConstructionDocument2 pages0081 - Shree Samarth ConstructionBhavika JainNo ratings yet

- Tax Invoice - Sheet1Document1 pageTax Invoice - Sheet1nonud1000No ratings yet

- Bill No-065 (New Fashion Garments)Document1 pageBill No-065 (New Fashion Garments)Faizan khan khanNo ratings yet

- Catalyst - C22-2300505Document1 pageCatalyst - C22-2300505Tea CozyNo ratings yet

- Proforma Invoice 002Document1 pageProforma Invoice 002Priyanka YadavNo ratings yet

- Wifi BillDocument1 pageWifi BillAakash PatelNo ratings yet

- 24252592-O P Khurana InvDocument2 pages24252592-O P Khurana InvrituNo ratings yet

- Pi SCS-SP AutoDocument1 pagePi SCS-SP Autosancharstore47No ratings yet

- Ars International, Bill No. 880, DT., 17.12.2021Document1 pageArs International, Bill No. 880, DT., 17.12.2021Ars InternationalNo ratings yet

- Heart N HillsDocument1 pageHeart N HillsPrint Mart digitalNo ratings yet

- Indian Tyres SreDocument1 pageIndian Tyres SreABHISHEK SHARMANo ratings yet

- Bill No. 156Document3 pagesBill No. 156ashiskarmakar93No ratings yet

- Golok Npi00-323Document1 pageGolok Npi00-323Sandeep KhodeNo ratings yet

- Tax Invoice Jaycee Agricultural CorporationDocument1 pageTax Invoice Jaycee Agricultural Corporationjaycee fertilisersNo ratings yet

- M_s Virendra Pal Verma newDocument1 pageM_s Virendra Pal Verma newi.veer.00No ratings yet

- Accounting VoucherDocument1 pageAccounting Vouchergurukulvedant08No ratings yet

- Tax InvoiceDocument1 pageTax Invoicesarifullah khanNo ratings yet

- RzMrc3RPZUpmeGVUZUU5NnJyaUZTUT09 Seller Tax InvoiceDocument1 pageRzMrc3RPZUpmeGVUZUU5NnJyaUZTUT09 Seller Tax InvoicePratyush kumar NayakNo ratings yet

- SV Roofing-13Document1 pageSV Roofing-13bikkumalla shivaprasadNo ratings yet

- Tax Invoice: Gstin/Uin: 24AABCD8132C1Z7 State Name: Gujarat, Code: 24 Place of Supply: GujaratDocument1 pageTax Invoice: Gstin/Uin: 24AABCD8132C1Z7 State Name: Gujarat, Code: 24 Place of Supply: GujaratGaurav ChaudharyNo ratings yet

- 2038 Bos Durgamata PoultryDocument1 page2038 Bos Durgamata PoultryjagannathpressbdkNo ratings yet

- Bar Bending InvoiceDocument1 pageBar Bending InvoicePrasoon sysmindNo ratings yet

- 8863 PDFDocument1 page8863 PDFmalar studioNo ratings yet

- Computer InvoiceDocument1 pageComputer InvoiceMohammed HadiNo ratings yet

- SR 85Document2 pagesSR 85sompanwar1994No ratings yet

- Laptop Repair InvoiceDocument2 pagesLaptop Repair InvoiceSaurabh Prakash DixitNo ratings yet

- Screenshot 2024-04-18 at 6.06.49 AMDocument1 pageScreenshot 2024-04-18 at 6.06.49 AMsyed.saad1355No ratings yet

- 3 1 PDFDocument3 pages3 1 PDFRISHI BABUNo ratings yet

- Elegance Infra-1Document5 pagesElegance Infra-1Awadhesh SahaniNo ratings yet

- Accounting Voucher Display - PDF 783Document1 pageAccounting Voucher Display - PDF 783umeshkumarrr111No ratings yet

- 1 MergedDocument11 pages1 Mergedhimalaya.2343No ratings yet

- Accounting VoucherDocument1 pageAccounting Vouchersangeetaf43No ratings yet

- TVS JUPITER PurchaseDocument2 pagesTVS JUPITER PurchaseVOK AND ASSOCIATESNo ratings yet

- Inv 009Document1 pageInv 009shreebalaji1943No ratings yet

- Sudev Podder 084Document1 pageSudev Podder 084ssd dNo ratings yet

- LimpiDocument1 pageLimpiAmit AcharyaNo ratings yet

- 600 Food For Thought-PuneDocument1 page600 Food For Thought-PuneRohit Singh RajputNo ratings yet

- MANIK 05-12-2024Document3 pagesMANIK 05-12-2024akhileshtrivedi710No ratings yet

- Sales C-24-25 267Document1 pageSales C-24-25 267agamsidakNo ratings yet

- MohanDocument1 pageMohanGAGAN BHATIANo ratings yet

- 158Document2 pages158S MedhiNo ratings yet

- Bill 1391 PDFDocument1 pageBill 1391 PDFDeep GuptaNo ratings yet

- Class-V - Science AnnualDocument3 pagesClass-V - Science Annual29ajayNo ratings yet

- Class 5 Winter Break HHW (2022-23)Document19 pagesClass 5 Winter Break HHW (2022-23)29ajayNo ratings yet

- Practice 2Document8 pagesPractice 229ajayNo ratings yet

- Presentation Fuel and Combustion (F) 1516081318 20707Document26 pagesPresentation Fuel and Combustion (F) 1516081318 2070729ajayNo ratings yet

- Science Class 6 CH 2Document3 pagesScience Class 6 CH 229ajayNo ratings yet

- Chapter-1 Family RelationshipsDocument16 pagesChapter-1 Family Relationships29ajayNo ratings yet

- Class 5Document10 pagesClass 529ajayNo ratings yet

- TOPPERDocument2 pagesTOPPER29ajayNo ratings yet

- Mysha Jain Math Class II ADocument8 pagesMysha Jain Math Class II A29ajayNo ratings yet

- WebView App DocumentationDocument29 pagesWebView App Documentation29ajayNo ratings yet

- Mysha Jain Assignment 29112020Document5 pagesMysha Jain Assignment 2911202029ajayNo ratings yet

- of Class 4 Unit 1Document37 pagesof Class 4 Unit 129ajayNo ratings yet

- Class 3 Revision Worksheet UpdatedDocument4 pagesClass 3 Revision Worksheet Updated29ajayNo ratings yet

- Jinisha Jain Class IV B PDFDocument10 pagesJinisha Jain Class IV B PDF29ajayNo ratings yet

- Jinisha 11082020 PDFDocument4 pagesJinisha 11082020 PDF29ajayNo ratings yet

- Ch-8-Naig Scacia And: Cehuuatcon of AibeDocument9 pagesCh-8-Naig Scacia And: Cehuuatcon of Aibe29ajayNo ratings yet

- Usance LC (Deferred LC) : Definition, How Does Usance LC Work, Charges & CommissionDocument5 pagesUsance LC (Deferred LC) : Definition, How Does Usance LC Work, Charges & CommissionShuvro PaulNo ratings yet

- 4 Sec 186 Laons InvestmentsDocument7 pages4 Sec 186 Laons InvestmentsKumar SwamyNo ratings yet

- Installments in Compound InterestDocument12 pagesInstallments in Compound InterestRitwikNo ratings yet

- Dividends Exercises Chapter 9 For Assignment PDFDocument2 pagesDividends Exercises Chapter 9 For Assignment PDFCharlon OdivelasNo ratings yet

- Financial Markets in IndiaDocument9 pagesFinancial Markets in IndiasajidsfaNo ratings yet

- Lists of Banks and Address: Address No. Name of The Bank Location TelephoneDocument37 pagesLists of Banks and Address: Address No. Name of The Bank Location TelephoneGetu TadesseNo ratings yet

- Careers in Finance and The Successful Entrepreneur in Business IndustryDocument65 pagesCareers in Finance and The Successful Entrepreneur in Business IndustryJose Federico Frias0% (1)

- Eception: The New York Times Fast Company Forbes, The Wall Street JournalDocument1 pageEception: The New York Times Fast Company Forbes, The Wall Street JournalhigherNo ratings yet

- PTX - AssignmentDocument15 pagesPTX - AssignmentNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- How To Apply For Uttarakhand Gramin BankDocument1 pageHow To Apply For Uttarakhand Gramin BankRakesh JhaNo ratings yet

- Tax 2 Finals 404 TranscriptDocument138 pagesTax 2 Finals 404 TranscriptPhil JaramilloNo ratings yet

- Chapter 6 Exercise AnswersDocument6 pagesChapter 6 Exercise AnswersLuong Hoang Vu100% (1)

- Genuine BSP Bank Notes and CoinsDocument5 pagesGenuine BSP Bank Notes and CoinsC H ♥ N T ZNo ratings yet

- TSRTCMSRDEOIDocument15 pagesTSRTCMSRDEOIdishaNo ratings yet

- AbstractDocument2 pagesAbstractkiran_aqsa8935No ratings yet

- Informative Report On Public Deposit Invited by Company - Interest - Loans PDFDocument1 pageInformative Report On Public Deposit Invited by Company - Interest - Loans PDFashishNo ratings yet

- B. 03 CVP AnalysisDocument4 pagesB. 03 CVP AnalysisIssy BNo ratings yet

- Brake Valve, Relay Valve 27.12.19 PDFDocument1 pageBrake Valve, Relay Valve 27.12.19 PDFnithinNo ratings yet

- Tayo RollsDocument7 pagesTayo RollsAkhil ChaudharyNo ratings yet

- Master Thesis Project FinanceDocument6 pagesMaster Thesis Project FinanceBuyingEssaysOnlineNewark100% (2)

- Advanced Payment of TaxDocument2 pagesAdvanced Payment of TaxEngr. Md. Ishtiak HossainNo ratings yet

- Prajwol ShakyaDocument90 pagesPrajwol Shakyarajababu98998No ratings yet

- 5Document42 pages5Jumardi SingareNo ratings yet

- Nidhi Investment Consultant: Magic Mix Illustration For Mr. AB Prafulbhai (Age 18)Document2 pagesNidhi Investment Consultant: Magic Mix Illustration For Mr. AB Prafulbhai (Age 18)jdchandrapal4980No ratings yet

- STAD02Document87 pagesSTAD02Aggelos KotsokolosNo ratings yet

- BADVAC1X Quiz 1 2Document4 pagesBADVAC1X Quiz 1 2dumpyforhimNo ratings yet

- CurtisIrvine-Microeconomics From CH 5Document312 pagesCurtisIrvine-Microeconomics From CH 5horasNo ratings yet

- Yagnesh R. Bhanderi Academic Year: Class: Roll No: Seat No: - Submitted ToDocument72 pagesYagnesh R. Bhanderi Academic Year: Class: Roll No: Seat No: - Submitted ToMini Video AddaNo ratings yet

- Hiranandani Financial Services Private Limited: Statement of AccountDocument2 pagesHiranandani Financial Services Private Limited: Statement of Accountanilguttula2705No ratings yet

- Guarantee/Bond Application Form: To: HSBC Bank Oman SAOGDocument2 pagesGuarantee/Bond Application Form: To: HSBC Bank Oman SAOGVijin BabuNo ratings yet