Blues Here Again: Slowdown

Blues Here Again: Slowdown

Uploaded by

Aditya EthapeCopyright:

Available Formats

Blues Here Again: Slowdown

Blues Here Again: Slowdown

Uploaded by

Aditya EthapeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Blues Here Again: Slowdown

Blues Here Again: Slowdown

Uploaded by

Aditya EthapeCopyright:

Available Formats

18 |

NIFTY 5,654.6 -97.4

business

SENSEX 18,860.4 -322.4 TATA MOTORS 1,178.6 -57.1 HDFC BANK 2,053.0 -89.2 HDFC 641.6 -26.4 STERLITE 176.4 -6.3 BAJAJ AUTO 1,246.9 -39.8 NIKKEI 225 10,499.0 -90.7

20.00%

R555.70 3:30 pm

short stories

INTRA-DAY

Prev. close Todays close

R463.10

HURDLES AHOY TATA COFFEE UP Corruption scandals ON STARBUCKS and food prices have compounded Indias Boosted by the tieup with US coffee chain troubles as it eyes Starbucks, Tata group firm Tata Coffee on Friday China-style growth extended its morning

9:00 am

Slowdown blues here again

10

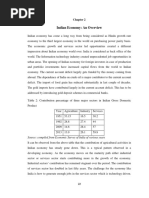

CHALLENGES THAT HURT THE INDIA STORY

Scamonomics

scandals are hitting political sentiment that can in turn hurt business climate. India has been rocked by five major scams last year. 2G spectrum sale and the Common wealth Games have put government behaviour under scrutiny

Corruption

HANG SENG 24,283.2 +44.3

KOSPI 2,108.2 +18.7

SHANGHAI 2,791.3 -36.4

H I N D U STA N T I M E S , M U M B A I S AT U R DAY, J A N U A RY 1 5 . 2 0 1 1

In 2011, everything gets a little better. Intel is very well positioned to benefit from the growth in data centres.

RUPEE/ 72.0 -0.7 BRENT CRUDE 98.3 $/bbl +0.2 LME COPPER 9,620.0 $/tn -45.0

quotemartial

PA U L S O T E L L I N I , chief executive of Intel, which saw record

profit and revenue at $3.39 bn and $11.46 bn respectively for Oct-Dec, riding on cloud-computing

NICKEL 25,750.0 $/tn +50.0

Indias economy is stuck with at least 10 headaches just when it looked like a challenger to China as the worlds fastest growing economy. From food prices that threaten stability to a worrying budget deficit, a welter of issues are haunting policy-makers again.

MUMBAI:

Spike in prices

Copious capital inflows

Foreign funds are causing a problem of plenty for India the only emerging economy which has not restricted foreign capital inflows. But these flows can go as fast as they come. What the country really needs is foreign direct investment (FDI)

Budget gaps

Policy uncertainties loom ahead of the budget, threatening the governments aim to rein in its deficit Runaway prices have upset the governments plans of implementing a carefully calibrated exit plan of the fiscal stimulus package set in motion during the world economic crisis. The plan was to fully withdraw the stimulus measures introduced to boost demand when the recovery in private demand both consumption and investment is sufficiently robust.

INFLATION DUE TO SUPPLY-SIDE BOTTLENECKS, SAYS ZOELLICK

HT Correspondent

gains and advanced by 20% to touch its upper limit on BSE. Defying the broad bearish market sentiment, the scrip reached the upper limit of R555.70 on BSE, and R557.50 also 20% up. More than 16 lakh crore shares of the company were traded.

HT Correspondent

letters@hindustantimes.com

PTI

Oil prices plunge to near $90 on US jobs

NEW YORK:

Oil prices fell to near $90 a barrel on Friday as a disappointing US jobs figure and a move by China to cool off economic growth dampened expectations of higher crude demand. By early afternoon in Europe, benchmark oil for February delivery was down $1.1 to $90.0 a barrel in electronic trading on the New York Mercantile Exchange. Brent crude was up 28 cents to $98.3 a barrel on the ICE Futures exchange in London.

REUTERS

Just when things seemed to be easing and India was raring to go in the high-growth league, the heat is on again. Food inflation has remained stubbornly high in the past few weeks, factory output growth has plunged to an 18-month low and the governments macro-economic managers are grappling for options to sustain growth while keeping prices under check. As if natural economic woes are not enough, we have seen the spectre of corruption scandals hurting governance and politics and in turn, policy-making. Last year, India was rocked by five major scamsfour of these in the last four months. India has slipped to 87th spot in Transparency International's latest ranking of nations based on the level of corruption, with the global watchdog asserting that perceptions about corruption in the country increased in the wake of the scam-tainted Commonwealth Games.

NEW DELHI:

CONTINUED ON PAGE 20

Food price inflation was at 16.9% at December-end. Food prices have knocked up prices of other goods. Weather problems in Australia, Argentina and Russia have hit global food and commodity prices, while oil prices are nudging $100 a barrel

letters@hindustantimes.com

NEW DELHI:

Industrial sluggishness

Indias industrial growth fell to 2.7% in November, the slowest in 18 months but an export uptick and strong consumer demand are encouraging.

Policy standstill

There have been no major policy decisions in recent months because policy-makers cannot agree on critical issues. Spats between ministers and a parliamentary logjam have hurt governance

Infrastructure crunch

Time and cost overruns have been a bane for Indias infrastructure projects. Equipment shortages, bad weather and delays in government clearances have resulted in major slippages in projects.

High interest rates

The RBI has raised key policy rates six times so far this fiscal year to cool prices. Costlier loans means costlier credit for consumers and higher expenses for manufacturers. Both could hit demand and growth. Most banks have hiked rates.

Inclusive growth conundrum

Not many innovative policy decisions have been taken in recent months to reach out to the poor, whose votes are vital for the Congress-led UPA. Consensus eludes proposed food security Act, while micro-finance institutions are mired in controversy.

Terror threats

Law and order and terror threats remain Indias key worry as an investment hotspot. Investment remains concentrated heavily in favour of few states.

World Bank Group president Robert B Zoellick said here on Friday that the high inflation in India has been caused more by bottlenecks on the supply side than by strong demand. As opposed to necessarily tightening monetary policy, I think the focus has to be on the increased production and productivity of agricultural products and thereby making the markets work more effectively, Zoellick said at a joint press conference with finance minister Pranab Mukherjee. Describing India as a global player and rising economic power, he said the high-level of growth in the country is helping the international economy recover from the crippling effects of recent financial turmoil. World Banks efforts are to bring the best development practices from around the globe to India and to share Indias experience and expertise with others. Infrastructure and agriculture are the key areas, which will help in solving the increasing food prices, said Zoellick. Mukherjee said India wants to reach a double-digit growth with moderate inflation and fiscal prudent policies.

CONTINUED ON PAGE 20

Text: Gaurav Choudhury/Icons: Abhimanyu Sinha

Tata Motors global sales up 21% in Dec

Tata Motors said its global sales increased by 21% in December 2010 to 90,294 units on robust demand for commercial vehicles but sales of luxury brands from Jaguar Land Rover remained flat. JaguarLand Rover sales were at 21,353 units during December, up just 1% from a year ago, Tata Motors said. Of this, Land Rover sales rose 4% while Jaguar fell 10%, it said.

NEW DELHI:

PTI

HDFC Q3 NET PROFIT UP 33% AT R891 CRORE

HT Correspondent

letters@hindustantimes.com

Super Religare Labs expects IPO soon

Religare Laboratories (SRL) on Friday said it expects to come up with its initial public offer (IPO) in the next couple of months. The company said it plans to invest R100 crore in 2011 to add 40 laboratories. We are preparing for it (IPO). It should happen in the next couple of months, SRL CEO Sanjeev K Chaudhury said.

PTI

NEW DELHI: Super

MUMBAI: Leading home loan provider HDFC on Friday announced a 33% growth in its profit at R891 crore in the quarter-ended December 2010 over the corresponding quarter last year on the back of a strong R167-crore profit booked on sale of investments. The company also saw its income rise by 16% at R3,149 crore during the quarter as a result of growth in disbursements. The incomes from operations stood at R2,705 crore in the quarter ended December 2009. The companys net profit witnessed a thrust as a result of treasury profits.

HT Correspondent

Sensex sinks again, 8.3% lost in nine sessions

letters@hindustantimes.com

INTRA-DAY

Prev. close

1.68%

INTRA-DAY

Prev. close

3.95%

R 667.95

Todays close

R641.55

9:00 am

3:30 pm

Ill winds continued to blow through the bourses on Friday, with the Bombay Stock Exchange (BSE) benchmark Sensex ending below the 19,000mark the NSE Nifty below the 5,700 mark for the first time in four months. Market sentiments remained weak on account of rising inflation and expectation of a hike in interest rates by RBI later this month. The Sensex closed the day 1.7% below its previous close to 18,860 and the broader Nifty by by the same proportion to close the day at 5,654. The markets were volatile during the days trading, with the Sensex touching an intraday high of 19,447 and sinking to a low of 18,811 during the day. The Sensex has lost 1,700 points or 8.3% over the last nine trading sessions and has had a

MUMBAI:

19,192.82 18,860.44

3:30 pm

Todays close

9:00 am

weak beginning in the new year. Weak IIP numbers that were announced earlier in the week and the continuing rise in overall inflation impacted the market sentiments. Clearly, the Indian economy is confronting a few headwinds and one needs to be careful in the near term till there is more clarity, said Amar Ambani, head of research at India Infoline. The biggest losers of the day were the BSE real estate and banking indices, falling 2.8% and 2.6% respectively. Among Sensex companies Tata Motors and HDFC Bank fell the most and lost 4.6% and 4.2% respectively.

JP Morgan profit beats expectations

NEW YORK: JP

Morgan Chase & Co reported higher-than-expected quarterly earnings, helped by narrowing losses on bad loans that allowed it to release $2 billion in reserves. JPMorgan, the first of the major United States banks to report earnings for the fourth quarter, said profit increased to $4.8 billion, or $1.12 a share, from $3.3 billion, or 74 cents a share, a year earlier. Revenue increased 6% to $26.7 billion.

REUTERS

Saving grace: Indians fare better in money management

HT Correspondent

S A F E T Y PAY S

letters@hindustantimes.com

IN CONTROL

Hyundai launches Grandeur

South Koreas Hyundai Motor said it aims to sell 100,000 units of the redesigned Grandeur luxury sedans, which it launched on Thursday, globally this year. Hyundai launched the new model in South Korea on Thursday, and plans a gradual global rollout.

SEOUL:

REUTERS

managing finances, Indians are ahead of citizens of United States, Japan, South Korea and some other developed countries, says the ING Consumer Resourcefulness Survey. Also, Indians turn out to be the second, out of 10 leading nations in the world, to have a basic financial literacy level (55%), just behind the Japanese. The survey shows that Indians are better at managing their finances than most of the other countries in the survey, including being better prepared for their various life stages, especially retirement, said Uco Vegter, chief marketing and strategy officer, ING Life . However, they do tend to get lost in

MUMBAI: When it comes to

55% 87%

of the Indians have basic financial literacy. of Indian households have an emergency fund versus 33% globally

sourcing good advice to become better at money. The survey, conducted by ING Group, in association with the research consultancy firm Epiphany, was car-

ried out among 5,000 consumers across 10 nations. Majority of Indian consumers have shown better skills in managing their household financial budget and are confident of facing any financial impediments in future, as compared to citizens of 9 other countries, said the survey. The survey shows a staggering 84% Indians prefer buying life insurance products compared to 54% globally and a similar percentage of Indians believe in maintaining a household budget with focus on savings. Indians are much risk averse in case of borrowing money. While average Indians manage their finances in a much organised manner, they borrow money in case of needs such as buying a home (50%) and a car (43%).

You might also like

- Askari Bank Internship ReportDocument75 pagesAskari Bank Internship Reportbbaahmad89100% (1)

- Case Study Royal Bank of Scotland (RBS)Document20 pagesCase Study Royal Bank of Scotland (RBS)Vadan Mehta100% (2)

- Five Trillion Us Dollar Economy Target of IndiaDocument25 pagesFive Trillion Us Dollar Economy Target of Indiasrishti sharma.ayush1995No ratings yet

- I - China ?: Ndia VS Which IS Better EconomyDocument6 pagesI - China ?: Ndia VS Which IS Better EconomyViral JainNo ratings yet

- This Time, India's Rapid Economic Growth Has Legs - Nikkei AsiaDocument5 pagesThis Time, India's Rapid Economic Growth Has Legs - Nikkei AsiakavitaashokNo ratings yet

- Niveshak Niveshak: Financial Woes of India'S Rising SunDocument24 pagesNiveshak Niveshak: Financial Woes of India'S Rising SunNiveshak - The InvestorNo ratings yet

- Indian EconomyDocument38 pagesIndian EconomyIQAC VMDCNo ratings yet

- IndiaEconomicGrowth SDocument16 pagesIndiaEconomicGrowth SAmol SaxenaNo ratings yet

- Financial Markets AND Services: Presented To. Dr. Mrityunjaya CDocument62 pagesFinancial Markets AND Services: Presented To. Dr. Mrityunjaya CPoornima NayakNo ratings yet

- RBG Financial News LetterDocument2 pagesRBG Financial News Lettermarketing2871No ratings yet

- JSTREET Volume 322Document10 pagesJSTREET Volume 322JhaveritradeNo ratings yet

- Rama Krishna Vadlamudi, HYDERABAD July 11, 2011: What Investors IgnoredDocument4 pagesRama Krishna Vadlamudi, HYDERABAD July 11, 2011: What Investors IgnoredRamaKrishna Vadlamudi, CFANo ratings yet

- 10Document22 pages10AkashNo ratings yet

- Indian EconomyDocument13 pagesIndian EconomyPraval SaiNo ratings yet

- Quest Smart Alpha - Sector Rotation Series II - Quarterly Update Oct 2024_FinalDocument33 pagesQuest Smart Alpha - Sector Rotation Series II - Quarterly Update Oct 2024_Finalaankit78No ratings yet

- Abhyaas Business Bulletin - January 16th, 2012Document4 pagesAbhyaas Business Bulletin - January 16th, 2012Abhyaas Edu CorpNo ratings yet

- International Trade SlowdownDocument4 pagesInternational Trade SlowdownParveen DhimanNo ratings yet

- Indian Economy - Nov 2019Document6 pagesIndian Economy - Nov 2019Rajeshree JadhavNo ratings yet

- Niveshak Niveshak: India Vision 2020Document24 pagesNiveshak Niveshak: India Vision 2020Niveshak - The InvestorNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument6 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- India On The MoveDocument15 pagesIndia On The MoveInsha RahmanNo ratings yet

- India Will RiseDocument6 pagesIndia Will RisebsrpropNo ratings yet

- Top Ten Largest Trading Partners During 2006-07 Country Trade Volume (Rs. in Crores) Trade BalanceDocument6 pagesTop Ten Largest Trading Partners During 2006-07 Country Trade Volume (Rs. in Crores) Trade BalanceShru SharmaNo ratings yet

- OwowDocument46 pagesOwowprasadsangamNo ratings yet

- Summer Internship Report On LenovoDocument74 pagesSummer Internship Report On Lenovoshimpi244197100% (1)

- PL Top LargeCap MidCap StocksDocument60 pagesPL Top LargeCap MidCap StocksYakub PashaNo ratings yet

- Market View: Market Is at Crucial JunctionDocument10 pagesMarket View: Market Is at Crucial JunctionJhaveritradeNo ratings yet

- Key Macro-Economic Challenges For India, at Present, Include: InflationDocument5 pagesKey Macro-Economic Challenges For India, at Present, Include: InflationAmita SinwarNo ratings yet

- InFINeet - INDIA DISPLACES CHINA AS THE WORLD'S GROWTH ENGINE - FACT OR FICTON - SiddhanthMurdeshwar - NMIMS MumbaiDocument9 pagesInFINeet - INDIA DISPLACES CHINA AS THE WORLD'S GROWTH ENGINE - FACT OR FICTON - SiddhanthMurdeshwar - NMIMS MumbaisiddhanthNo ratings yet

- India Vs Major Emerging EconomiesDocument1 pageIndia Vs Major Emerging EconomiesNaveen PalNo ratings yet

- Hallenges For The Indian Economy in 2017Document7 pagesHallenges For The Indian Economy in 2017Asrar SheikhNo ratings yet

- Overheating: Niranjan Rajadhyaksha's Previous ColumnsDocument5 pagesOverheating: Niranjan Rajadhyaksha's Previous ColumnsVaibhav KarthikNo ratings yet

- 07 - Chapter 2Document9 pages07 - Chapter 2Sudhit SethiNo ratings yet

- Fundamental Analysis of Hero HondaDocument20 pagesFundamental Analysis of Hero Hondasanjayrammfc100% (2)

- EIC Project Report On Pharmaceutical IndustryDocument52 pagesEIC Project Report On Pharmaceutical IndustrykalpeshsNo ratings yet

- Managerial EconomicsDocument7 pagesManagerial EconomicsTanya Miriam SimonNo ratings yet

- LenovoDocument84 pagesLenovoasifanis100% (1)

- Eic AnalysisDocument17 pagesEic AnalysisJaydeep Bairagi100% (1)

- Project KMFDocument96 pagesProject KMFLabeem SamanthNo ratings yet

- "In The News": Finance Society PresentsDocument14 pages"In The News": Finance Society PresentsChirag JainNo ratings yet

- Indias Problem Is Export Not The RupeeDocument2 pagesIndias Problem Is Export Not The RupeeZiya ShaikhNo ratings yet

- Indian Economy After IndependenceDocument5 pagesIndian Economy After IndependenceShil PiNo ratings yet

- Performance ApppraidDocument81 pagesPerformance ApppraidManisha LatiyanNo ratings yet

- Masala 2011Document9 pagesMasala 2011gauhar77No ratings yet

- The Money Navigator April 2016Document36 pagesThe Money Navigator April 2016JhaveritradeNo ratings yet

- Slowdown of Global Economy Opportunity For India & ChinaDocument13 pagesSlowdown of Global Economy Opportunity For India & ChinaMitul Kirtania50% (2)

- Macro Economics SnapshotDocument12 pagesMacro Economics SnapshotmanjeetsrccNo ratings yet

- Macro Economy Analysis & Monetary DevelopmentDocument18 pagesMacro Economy Analysis & Monetary Developmentluckybhumkar0% (1)

- Market Outlook VRK100 14062011Document3 pagesMarket Outlook VRK100 14062011RamaKrishna Vadlamudi, CFANo ratings yet

- Recent Development in Global Financial MarketDocument8 pagesRecent Development in Global Financial MarketBini MathewNo ratings yet

- Emerging Economy March 2009 Indicus AnalyticsDocument11 pagesEmerging Economy March 2009 Indicus AnalyticsIndicus AnalyticsNo ratings yet

- India's Bubble Economy Headed Towards Iceberg?: CategorizedDocument6 pagesIndia's Bubble Economy Headed Towards Iceberg?: CategorizedMonisa AhmadNo ratings yet

- Current Affairs Assignment: Name: Satyajit Bhandare 33242, MBA 1 (HR) SIBM, PuneDocument7 pagesCurrent Affairs Assignment: Name: Satyajit Bhandare 33242, MBA 1 (HR) SIBM, Punesatyajit_bhandareNo ratings yet

- Economic Report - 03 October 2012Document6 pagesEconomic Report - 03 October 2012Angel BrokingNo ratings yet

- India economic outlook _ Deloitte InsightsDocument12 pagesIndia economic outlook _ Deloitte InsightsabrarshawlofficialNo ratings yet

- Economic Recession by VickyDocument27 pagesEconomic Recession by VickyvijendraNo ratings yet

- Slowdown of Indian EconomyDocument20 pagesSlowdown of Indian EconomyJolly NinanNo ratings yet

- Strategies for Successful Small Business Ownership in an Unstable EconomyFrom EverandStrategies for Successful Small Business Ownership in an Unstable EconomyRating: 5 out of 5 stars5/5 (2)

- Money Markets and Capital MarketsDocument4 pagesMoney Markets and Capital MarketsEmmanuelle RojasNo ratings yet

- Financial Planning - ForecastingDocument4 pagesFinancial Planning - ForecastingPrathamesh411No ratings yet

- Hyundai Motor India Direct Recruitments OfferDocument3 pagesHyundai Motor India Direct Recruitments Offersarathjayan16No ratings yet

- Budget1 Taxation Upto GSTDocument37 pagesBudget1 Taxation Upto GSTbhavyaNo ratings yet

- Legaspi Oil CoDocument3 pagesLegaspi Oil CoErole John AtienzaNo ratings yet

- Lecture 8 (Interest)Document9 pagesLecture 8 (Interest)Tarannum Shireen GhaziNo ratings yet

- Cityam 2012-03-06Document36 pagesCityam 2012-03-06City A.M.No ratings yet

- MCQ-Financial Account-SEM VDocument52 pagesMCQ-Financial Account-SEM VVishnuNadarNo ratings yet

- KPMG Tax Assemblage 2011Document29 pagesKPMG Tax Assemblage 2011aasgroupNo ratings yet

- 1Document131 pages1Jitendra KumarNo ratings yet

- Entrepreneurship Project Report: United Steels LTD, KurukshetraDocument22 pagesEntrepreneurship Project Report: United Steels LTD, KurukshetraBhanuj VermaNo ratings yet

- Credit BossDocument8 pagesCredit Bossuttamdas79No ratings yet

- Organizational Analysis of United Bank Limited: Ms. Sima Kamil President & CEODocument7 pagesOrganizational Analysis of United Bank Limited: Ms. Sima Kamil President & CEOHamza ButtNo ratings yet

- Finxpress: Beyond Towering HeightsDocument9 pagesFinxpress: Beyond Towering HeightsDhiraj JainNo ratings yet

- Negotiation of Hotel Management AgreementsDocument14 pagesNegotiation of Hotel Management AgreementsCalvawell MuzvondiwaNo ratings yet

- 17 - Great - Asian - Sales - Center - Corp. - v. - Court - of - Appeals PDFDocument20 pages17 - Great - Asian - Sales - Center - Corp. - v. - Court - of - Appeals PDFAnne MadambaNo ratings yet

- GRP 1 Financial-Market-Intro-TypesDocument34 pagesGRP 1 Financial-Market-Intro-TypesXander C. PasionNo ratings yet

- Rop PDFDocument4 pagesRop PDFelmyrNo ratings yet

- Luzon Development Bank: Published Balance SheetDocument2 pagesLuzon Development Bank: Published Balance SheetThinkingPinoyNo ratings yet

- BKWeek 2012 01 30Document21 pagesBKWeek 2012 01 30Mbok EmaNo ratings yet

- Fin111 Week 2Document7 pagesFin111 Week 2katewalker01No ratings yet

- Chapter-8 THE COMPANIES ACT, 1956Document62 pagesChapter-8 THE COMPANIES ACT, 1956Hitesh AggarwalNo ratings yet

- Commercial Observer - REBNY Special Issue FullDocument47 pagesCommercial Observer - REBNY Special Issue FullAnna C. LindowNo ratings yet

- Laurent e Answer KeyDocument4 pagesLaurent e Answer KeyZee Santisas86% (7)

- BSES LimitedDocument26 pagesBSES LimitedNeeraj JainNo ratings yet

- Oracle Revaluation BalancesDocument10 pagesOracle Revaluation Balancesknpremkumar-1No ratings yet

- Taxation Challenge - With Answer KeyDocument9 pagesTaxation Challenge - With Answer Keyariaseg100% (1)

- 305 FinalDocument33 pages305 FinalsmithteeNo ratings yet