0 ratings0% found this document useful (0 votes)

21 viewsSunil B

Sunil B

Uploaded by

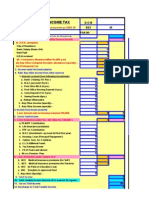

placementcell Govt ITI Attingal1. The document provides salary details of an employee named Sunil B for the financial year 2023-24.

2. It lists his gross salary as Rs. 843244, deductions under section 16 as Rs. 52500, and taxable income as Rs. 790744.

3. It also provides monthly breakdown of his salary from March 2023 to November 2023, including details of basic pay, deductions and gross salary.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Sunil B

Sunil B

Uploaded by

placementcell Govt ITI Attingal0 ratings0% found this document useful (0 votes)

21 views2 pages1. The document provides salary details of an employee named Sunil B for the financial year 2023-24.

2. It lists his gross salary as Rs. 843244, deductions under section 16 as Rs. 52500, and taxable income as Rs. 790744.

3. It also provides monthly breakdown of his salary from March 2023 to November 2023, including details of basic pay, deductions and gross salary.

Original Title

SUNIL B

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

1. The document provides salary details of an employee named Sunil B for the financial year 2023-24.

2. It lists his gross salary as Rs. 843244, deductions under section 16 as Rs. 52500, and taxable income as Rs. 790744.

3. It also provides monthly breakdown of his salary from March 2023 to November 2023, including details of basic pay, deductions and gross salary.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

21 views2 pagesSunil B

Sunil B

Uploaded by

placementcell Govt ITI Attingal1. The document provides salary details of an employee named Sunil B for the financial year 2023-24.

2. It lists his gross salary as Rs. 843244, deductions under section 16 as Rs. 52500, and taxable income as Rs. 790744.

3. It also provides monthly breakdown of his salary from March 2023 to November 2023, including details of basic pay, deductions and gross salary.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Old Regime

Name of Employee : SUNIL B PAN : APSPB7588K

Designation & Office : SENIOR INSTRUCTOR, GOVERNMENT ITI ATTINGAL Cat: Others

1 i) Gross Salary (a+b+c) 843244

a) Salary as per Section 17(1) 843244

b) Value of Perquisites 0

c) Profits in lieu of salary under section 17(3) 0

Less Recoveries Like Dies Non, Excess Pay Drawn, etc 0

Balance 0 843244

ii) Less Allowances to the extent excempt u/s 10 (First inclued it in salary)

HRA in the case of persons who actually incur expenditure by way of Rent

a) Actual HRA Received 0

b) Rent paid in excess 1/10th of the salary 0

c) 40% of Salary (Salary means Basic + DA) 0

(a) to (c) whichever is least is exempted 0

Other Allowances to the extent exempt u/s 10 0 0

iii) Net Salary ( i-ii) 843244

iv) Deduction u/s 16 (iv-a + iv-b + iv-c ) 52500

a) Standard Deduction 50000

b) Entertainment Allowance 0

c) Professional Tax 2500

v) Income Chargeable under the head Salaries (iii-iv) 790744

2 Income from House Property () 0

(Net Annual Rent - Municipal Tax) -30% - Ineterest on Housing Loan

Max Loss Allowed 2Lac 0

3 Income from Business 0

4 Income from Capital Gains 0

5 Income from Other Sources : Interest on Savings Bank Deposits 0 0

Interest on Fixed / Term Deposits 0

Any Other - 0

6 Gross Total Income (Total of 1 to 5) 790744

7 A - Deduction under section 80C

a) Life Insurance Premia of self, spouse and children 1980

b) Purchase of NSC VII issue 0

c) State Life Insurance Policy (SLI) 15000

d) Group Insurance Scheme (GIS) 9600

e) Contribution towards approved Provident Fund including PPF 120000

f) Tax saver Fixed Deposits in bank / Post Office ( 5 years or more) 0

g) Deposit scheme or pension fund set up by NHB 0

h) Tuition Fees ( Paid to university, college, school or educational institution

situated within India for full time education to any two children) 0

i) Housing Loan Repayment(Principal),Stamp duty paid for purchase 0

j) Subscription to equity shares or debentures of an eligible issue 0

k) Subscription to eligible units of Mutual Fund 0

l) GPAIS 875

m) Any Others Items-2 0

B Contribution to Pension Fund (80CCC) 0

C NPS (Total :0). Deducion U/s 80CCD(1) (Max.10% of Basic+DA of this Yr) 0

Totalto

Contribution Deduction u/s 80 CCE(Max

NPS u/s 80CCD(1B) (A+B+C) =147455

Rs.50,000)

147455

8 a) Contribution to NPS u/s 80CCD(1B) (Max Rs.50,000) 0

b) Mediclaim ( Maximum of Rs.25,000 for self, spouse, dependent children and

Rs.25000 for Parents. if Parents are senior citizens Rs. 50,000) U/s 80D 6000

c) Expenditure on Medical treatment of mentally or physically handicapped

dependents (including the amount deposited in their name. ( Max.

Rs. 75,000/- in case of 80% disability max. Rs.1,25,000) U/s 80DD 0

d) Expenditure on medical treatment of the employee/dependent for specified diseases

or ailment like cancer, AIDS, etc. ( Max. Rs.40,000/- in case of treatment is made to a

person who is a senior citizen Rs.1,00,000) U/s 80DDB 0

e) Interest paid for Educational Loan for higher education U/s 80E 0

f) Donation to various charitable and other funds including PM's National Relief Fund 80-G 0

g) Deduction for interest on loan taken this year for residential house property (80EE) 0

h) Interest on loan taken for purchase of Electronic Vehicles (80EEB)-Max 1.5 Lakhs 0

i) Dedution for Handicapped Employees (80U) 0

j) Contribution made to Political Party (80GGC) 0

k) Deduct Rent Paid (If not receiving HRA and incuring Rent) (80GG) 0

l) Deduct Interest on SB Deposit (Max.Rs.10000 u/s 80TTA) 0

Total of (a) to (l) 6000

9 Total Deduction (7+8) 153455

10 Total Income (6-9) (Rounded to the nearest multiple of ten as per Sec. 288 A ) 637290

11 Tax on Total Income 39958

12 Less : Rebate u/s 87A 0

13 Income Tax after Rebate 39958

14 Health and Education cess @ 4% of 13 1598

15 Total Tax Payable (13+14) 41556

16 Less : Relief for Arrears of Salary u/s 89(1) 0

17 Balance Tax Payable (15-16) 41556

18 Total Amount of Tax already deducted 0

19 Balance Tax to be paid 41556

20 Monthly TDS = Rs.41556/10 Months 4156

ATTINGAL THIRUVANANTHAPURAM Signature

30-03-2023 SUNIL B

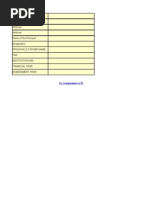

SALARY PARTICULARS - 2023-24

Month Basic DA HRA CCA Other Gross PF SLI GIS LIC NPS M.Sep Ded

Mar-23 60700 4249 3642 68591 10000 1250 800 165 500 12715

Apr-23 62100 4347 3726 70173 10000 1250 800 165 500 12715

May-23 62100 4347 3726 70173 10000 1250 800 165 500 12715

Jun-22 62100 4347 3726 70173 10000 1250 800 165 500 12715

Jul-23 62100 4347 3726 70173 10000 1250 800 165 500 12715

Aug-23 62100 4347 3726 70173 10000 1250 800 165 500 12715

Sep-23 62100 4347 3726 70173 10000 1250 800 165 500 12715

Oct-23 62100 4347 3726 70173 10000 1250 800 165 500 12715

Nov-23 62100 4347 3726 70173 10000 1250 800 165 500 12715

Dec-23 62100 4347 3726 70173 10000 1250 800 165 500 12715

Jan-24 62100 4347 3726 70173 10000 1250 800 165 500 12715

Feb-24 62100 4347 3726 70173 10000 1250 800 165 500 12715

Sal.Arr 0 0

DA Arr 0 0

PR Arr 0 0 0

Earned Leave Surrender 0

Festival Allowance 2750

Total 743800 52066 44628 0 0 843244 120000 15000 9600 1980 0 6000 152580

Details of Tax already paid

Mar-23 Apr-23 May-23 Jun-23 Jul-23 Aug-23 Sep-23 Oct-23 Nov-23 Dec-23 Jan-24 Feb-24 Other Direct Bank

Printed on 30-03-2023 at 15:03:10 Easy Tax : by alrahiman

You might also like

- Tangerine-eStatement Jul19 PDFDocument2 pagesTangerine-eStatement Jul19 PDFRudyard Martin Cardozo33% (6)

- Midterm Quiz 2 Afar2Document8 pagesMidterm Quiz 2 Afar2LJ Diane TuazonNo ratings yet

- Financial Analysis and Reporting Midterm Quiz 1Document8 pagesFinancial Analysis and Reporting Midterm Quiz 1Santi SeguinNo ratings yet

- Bose Tax 2024Document2 pagesBose Tax 2024placementcell Govt ITI AttingalNo ratings yet

- ASWATHYDocument2 pagesASWATHYplacementcell Govt ITI AttingalNo ratings yet

- Afsal TaxDocument2 pagesAfsal Taxplacementcell Govt ITI AttingalNo ratings yet

- AMJITHDocument2 pagesAMJITHplacementcell Govt ITI AttingalNo ratings yet

- LALYDocument2 pagesLALYplacementcell Govt ITI AttingalNo ratings yet

- StatementDocument2 pagesStatementabinand29No ratings yet

- Kiran VDocument2 pagesKiran VSooraj S KollamNo ratings yet

- Income Tax Slab 2 Scheme2021Document14 pagesIncome Tax Slab 2 Scheme2021palharjeetNo ratings yet

- Income Tax Calculator Fy 2020 21 v1Document8 pagesIncome Tax Calculator Fy 2020 21 v1Yogesh BajajNo ratings yet

- IT Calculation New RegimeDocument4 pagesIT Calculation New Regimeyelrihs23No ratings yet

- Income Tax Calculator Fy 2019 20 v4Document9 pagesIncome Tax Calculator Fy 2019 20 v4Anil KesarkarNo ratings yet

- Income Tax Calculator Fy 2020 21 v2Document12 pagesIncome Tax Calculator Fy 2020 21 v2GautamNo ratings yet

- Income Tax Calculator Fy 2020 21 v1Document11 pagesIncome Tax Calculator Fy 2020 21 v1nach.nachiketNo ratings yet

- Income Tax CalculatorDocument9 pagesIncome Tax Calculatorchandu halwaeeNo ratings yet

- Income Tax Calculator Fy 2021 22 v2Document15 pagesIncome Tax Calculator Fy 2021 22 v2KumardasNsNo ratings yet

- Pravin Shinde-ARMS-01-TDS-FY 2019-20Document12 pagesPravin Shinde-ARMS-01-TDS-FY 2019-20Udaysinh PatilNo ratings yet

- Tax Calc_2024-25_Vijay Chavan (MTS)Document5 pagesTax Calc_2024-25_Vijay Chavan (MTS)amit jadhavNo ratings yet

- Income TaxDocument11 pagesIncome Taxci_balaNo ratings yet

- Income Tax Calculation F.Y.2019-20 AGIPC1111K Particulars AmountDocument3 pagesIncome Tax Calculation F.Y.2019-20 AGIPC1111K Particulars AmountNihit SandNo ratings yet

- IT Calculator 2018 LiteDocument6 pagesIT Calculator 2018 LiteHr PoonamNo ratings yet

- Calculation FormatDocument13 pagesCalculation FormatSahil Swaynshree SahooNo ratings yet

- Tax Calculator - Indian Income Tax 2008-09Document7 pagesTax Calculator - Indian Income Tax 2008-09Jayamohan100% (29)

- Free Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Document16 pagesFree Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Bijender Pal ChoudharyNo ratings yet

- Income Tax Calculator FY 2017 18Document11 pagesIncome Tax Calculator FY 2017 18Ali BaigNo ratings yet

- It Return BHK 2022-23Document2 pagesIt Return BHK 2022-23Ganesh PawarNo ratings yet

- Calculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10Document10 pagesCalculation of Income Tax: For Thefinancial Yr 2008-09/ Assessment Yr 2009-10api-19754583No ratings yet

- Latest Tax CalculatIor 3.3.2Document16 pagesLatest Tax CalculatIor 3.3.2Bijender Pal Choudhary100% (3)

- Annexure Ii Income Tax Calculation For The Financial Year 2020-2021 Name: Jeevana Jyothi. B Designation: Junior Lecturer in ZoologyDocument3 pagesAnnexure Ii Income Tax Calculation For The Financial Year 2020-2021 Name: Jeevana Jyothi. B Designation: Junior Lecturer in ZoologySampath SanguNo ratings yet

- Income Tax Calculator For F.YDocument8 pagesIncome Tax Calculator For F.YRavindra BagateNo ratings yet

- Form16-Part B-as per Old RegimeDocument1 pageForm16-Part B-as per Old RegimecamantriofficialNo ratings yet

- EXWPR9467M - 2024-25 - Part B - 1.pdf117119170479383783Document4 pagesEXWPR9467M - 2024-25 - Part B - 1.pdf117119170479383783vidhyasagarinvestmentNo ratings yet

- F0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentDocument1 pageF0RM NO. 16 (See Rule 31 (1) (A) ) (Annexure-B) : (B) Tax On EmploymentSourabhthakral_1No ratings yet

- Form 16 BDocument2 pagesForm 16 Bmaheshaa7829No ratings yet

- Tax CalculationDocument3 pagesTax Calculationreach2hardyNo ratings yet

- Sushma ViewReportIncomeTaxAssessmentDocument2 pagesSushma ViewReportIncomeTaxAssessmentKashvi DevNo ratings yet

- Income Tax Calculator 2018-19Document15 pagesIncome Tax Calculator 2018-19Raju Ranjan SinghNo ratings yet

- Itr-1 Sahaj Individual Income Tax Return: Part A General InformationDocument5 pagesItr-1 Sahaj Individual Income Tax Return: Part A General Informationrajesh kumar sharmaNo ratings yet

- Income Tax Calculator - Victorpravilesh@GmailDocument7 pagesIncome Tax Calculator - Victorpravilesh@Gmailvictorpravilesh6703No ratings yet

- Salary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Document1 pageSalary Working For The FY 2014 - 15 Name Arpit Upadhyay Employee Code 7461 PART B (Annexure)Siddhartha SharmaNo ratings yet

- Wa0016Document3 pagesWa0016Vinay DahiyaNo ratings yet

- RupalDocument6 pagesRupalsivaganga MNo ratings yet

- Calculation Sheet 2022 - 23 OLDDocument2 pagesCalculation Sheet 2022 - 23 OLDmandalsomithmandal1986No ratings yet

- CA Intermediate Taxation November 2022 Suggested AnswersDocument19 pagesCA Intermediate Taxation November 2022 Suggested AnswersBhawna KapoorNo ratings yet

- MR A TAX CALCULATORDocument6 pagesMR A TAX CALCULATORnufail darNo ratings yet

- Wa0007.Document4 pagesWa0007.vidhyasagarinvestmentNo ratings yet

- c91cdcb0-2b62-4b4a-9f3a-c2f82124965bDocument11 pagesc91cdcb0-2b62-4b4a-9f3a-c2f82124965bAvnish KhuranaNo ratings yet

- PARTICULARS FOR F.Y. 2023 - 24 Old FormateDocument3 pagesPARTICULARS FOR F.Y. 2023 - 24 Old Formateiwd.abhiNo ratings yet

- Vikash Pay SlipDocument3 pagesVikash Pay Slipayanbhargav3No ratings yet

- Income Tax Calculator FY 2016 17Document11 pagesIncome Tax Calculator FY 2016 17JITENDRA SHERKHANENo ratings yet

- 11100185_MCNPS1736C 2021-22Document3 pages11100185_MCNPS1736C 2021-22QCPFP RaigarhNo ratings yet

- Itr Anju Bhagat (Ay 2020-21)Document7 pagesItr Anju Bhagat (Ay 2020-21)mathshelpline21No ratings yet

- Vishnu Kumar Pandey Sir IT Cal FY 2024 25 AY 2025 26Document6 pagesVishnu Kumar Pandey Sir IT Cal FY 2024 25 AY 2025 26yogeshNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 524687300050920 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 524687300050920 Assessment Year: 2020-21asmit somNo ratings yet

- Form 16 - TCS Part BDocument4 pagesForm 16 - TCS Part BSai SekharNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21Raj KatochNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Bill Desk Summary PresentationDocument9 pagesBill Desk Summary PresentationJigar UpadhyayNo ratings yet

- Bapa 2020Document130 pagesBapa 2020Dony AdrianNo ratings yet

- ANNEXURE 2 - Guidelines On Supporting For Actual Investment (FY 2021-22)Document7 pagesANNEXURE 2 - Guidelines On Supporting For Actual Investment (FY 2021-22)aasasasNo ratings yet

- Lalican Vs Insular LifeDocument1 pageLalican Vs Insular LifeGian Tristan MadridNo ratings yet

- Research Article: International Journal of Recent Scientific ResearchDocument4 pagesResearch Article: International Journal of Recent Scientific ResearchPrateekNo ratings yet

- Worksheet - Math of InvestmentDocument2 pagesWorksheet - Math of InvestmentReaper UnseenNo ratings yet

- Midterm Review With SolutionsDocument24 pagesMidterm Review With SolutionsCharles ZhangNo ratings yet

- BKM Solution Chapter 4Document8 pagesBKM Solution Chapter 4minibodNo ratings yet

- Mini Project Financial Reporting Statements and Analysis MB20104Document11 pagesMini Project Financial Reporting Statements and Analysis MB20104KISHORE KRISHNo ratings yet

- 2021 Production Goal Chart - IndiaDocument3 pages2021 Production Goal Chart - IndiaVidhyaNo ratings yet

- All Resolutions Ocr)Document62 pagesAll Resolutions Ocr)ibrahim.i.susiwalaNo ratings yet

- Qualifying Asset: Qualifying Asset Is An Asset That Necessarily Takes A Substantial Period ofDocument12 pagesQualifying Asset: Qualifying Asset Is An Asset That Necessarily Takes A Substantial Period ofRITZ BROWNNo ratings yet

- AcFN 3151 CH, 5 CONSOLIDATED FINANCIAL STATEMENTS IFRS 10Document41 pagesAcFN 3151 CH, 5 CONSOLIDATED FINANCIAL STATEMENTS IFRS 10Bethelhem100% (1)

- Banking Terminology: Bank - Basic FunctionsDocument8 pagesBanking Terminology: Bank - Basic Functionsshivam choudharyNo ratings yet

- Law On Negotiable Instruments (Ass1)Document11 pagesLaw On Negotiable Instruments (Ass1)Umbina Gescery100% (3)

- Digital Lending in India - Analysis and ImplicationsDocument7 pagesDigital Lending in India - Analysis and Implicationsshailja singhNo ratings yet

- Excise, Taxation and Narcotics - Government of SindhDocument1 pageExcise, Taxation and Narcotics - Government of SindhMuhammad AbdullahNo ratings yet

- Partnership AccountingDocument21 pagesPartnership AccountingTharun P.Mu.No ratings yet

- Financial Statement AnalysisDocument32 pagesFinancial Statement AnalysisNaimish BodarNo ratings yet

- Chap 4PDocument39 pagesChap 4Pabhinnbhardwaj050701No ratings yet

- Answers Acca GlobalDocument14 pagesAnswers Acca GlobalMUNKHTUUL SAMBUUDORJNo ratings yet

- 100 DataDocument9 pages100 Dataanugrah.elitemindz100% (1)

- Philippine Deposit Insurance Corporation (PDIC)Document4 pagesPhilippine Deposit Insurance Corporation (PDIC)Ria Evita RevitaNo ratings yet

- Ratio Analysis: R K MohantyDocument30 pagesRatio Analysis: R K Mohantybgowda_erp1438No ratings yet

- 1Document10 pages1Sai Krishna DhulipallaNo ratings yet

- Hotel AccountingDocument8 pagesHotel AccountinglindakuttyNo ratings yet

- Case Study 2 - AccountingDocument5 pagesCase Study 2 - AccountingThrowaway TwoNo ratings yet