Biweekly 3

Biweekly 3

Uploaded by

Diaa eddin saeed0 ratings0% found this document useful (0 votes)

6 views3 pagesMy portfolio has gained 23% over the last week despite recent market fluctuations. I have invested in options for banks like JPMorgan Chase and Bank of America to protect against losses. While some colleagues lost money last week, my portfolio remained stable due to options strategies. Going forward, I believe my portfolio is stable but I want to invest in riskier stocks to maximize returns while still using options to mitigate downside risk given my low cash levels.

Original Description:

a weekly report for trading simulation fro 608 material.

Original Title

biweekly 3

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMy portfolio has gained 23% over the last week despite recent market fluctuations. I have invested in options for banks like JPMorgan Chase and Bank of America to protect against losses. While some colleagues lost money last week, my portfolio remained stable due to options strategies. Going forward, I believe my portfolio is stable but I want to invest in riskier stocks to maximize returns while still using options to mitigate downside risk given my low cash levels.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

6 views3 pagesBiweekly 3

Biweekly 3

Uploaded by

Diaa eddin saeedMy portfolio has gained 23% over the last week despite recent market fluctuations. I have invested in options for banks like JPMorgan Chase and Bank of America to protect against losses. While some colleagues lost money last week, my portfolio remained stable due to options strategies. Going forward, I believe my portfolio is stable but I want to invest in riskier stocks to maximize returns while still using options to mitigate downside risk given my low cash levels.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

06.

APRIL 2023

BIWEEKLY 3

STOCK TRACK SIMULATION

DIAA EDDIN SAEED

201309832

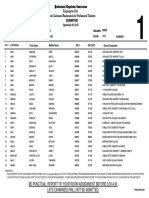

The overall portfolio performance Last week the banks and financial

is quite good, as long as I am gaining. For institutions shares were keep decreasing

the 4th week in a row my portfolio in the after interest rate announcement. So, I

green area and gaining some profit. The already have some options like JPMorgan

moment I am writing this report 05. Apr Chase, Bank of America and I already

2023, my portfolio gaining almost 23%, used the manual strip strategy, and after

after a decrease from the previous days. the announcement and the price got

My portfolio return reached to almost decreased, I sold the call options, and

50% in the last week, but the got kept the put, as I have the best profit in

decreased again in the end of the week, my portfolio.

as my portfolio value reached to

After almost one week from decreasing, I

$277,535. However, as long I am in the

believe the stocks will recover a little in

positive side, as long I am in the safe side.

the coming period, and in the same time,

Despite, the market fluctuation during

I am afraid to keep decreasing for more

the last week, and in some periods all of

period. Therefore, I have invested in

my colleagues were losing, but my

some options banks using long straddle,

portfolio was kind of stable, and the

and bought a 10 straddle options in BAC

reason for this a mentioned earlier for

at 27 $ expire in 19 May 2023 as the

the options strategies that I am using in

current price is almost 27.70 $. In this

my investments.

strategy I protected my self in both sides,

my portfolio value is 246,300 $ and as the underlay got increased or

having some good indicates of my decreased will gain profit.

portfolio performance, such as the sharp

ratio of my portfolio is 1.79 and trying to

increase in the next period.

The most gain in my portfolio from the

financial sector (Bank of America and

JPMorgan) and my vision about google

and amazon was correct, as it is in the top And the graph shows Bank of America

5 gaining in my portfolio after a long price movement for the last month.

decrease for the previous period.

As I have sold some options that I have

the most losing amount, to reinvest again

after not having any cash, and the

options were hopeless to get gain the

short term, as the simulation period is

not giving a long time to wait for a

recover.

I have a good felling and positive look in

the new week. In addition, I believe that

my portfolio is kind of stable, so I want to

invest in more risky stocks to maximize

my portfolio return, and of course using

the options strategies to protect my self

from a massive lose, with this portfolio I

can stay in the green area with some

protection strategies. Besides, my cash is

very low, so, I will invest in not a very

popular companies and with a

reasonable price.

The market now is too much fluctuating,

and the investors are very sensitive to

and news and that effect the market and

the prices, and all of these comes

because of the uncertainty in the market

after the Ukraine war, interest rate, the

high inflation, the currency power. as

now the investors prefer the safe havens

in investment.

You might also like

- TBL - Sars Tax Pin - Aug 2022Document1 pageTBL - Sars Tax Pin - Aug 2022Alfred Nzo TourismNo ratings yet

- Pivot BossDocument36 pagesPivot BossJuna Naelga88% (8)

- Stock Trak ReportDocument5 pagesStock Trak Reportnhausaue100% (6)

- Dan Zanger Trading RulesDocument4 pagesDan Zanger Trading Rulestestpat2267% (3)

- The Araujo Report: Institutional Position Analysis and ForecastDocument7 pagesThe Araujo Report: Institutional Position Analysis and ForecastHoratiuBogdanNo ratings yet

- IBD Sell Buy Rules2 7Document22 pagesIBD Sell Buy Rules2 7Swami100% (2)

- Bobble Pattern Ebook PDFDocument12 pagesBobble Pattern Ebook PDFmiralemh100% (1)

- Ec3314 EssayDocument6 pagesEc3314 EssayIsabellaCLoquita100% (1)

- Power: Passive Option Writing Exceptional Return StrategyFrom EverandPower: Passive Option Writing Exceptional Return StrategyNo ratings yet

- CH 05Document9 pagesCH 05Tien Thanh DangNo ratings yet

- Q2 2013 Market Commentary PDFDocument4 pagesQ2 2013 Market Commentary PDFNorthstar Financial Companies, IncNo ratings yet

- Investment GcashDocument4 pagesInvestment Gcashjay diazNo ratings yet

- Double Calendar Spreads, How Can We Use Them?Document6 pagesDouble Calendar Spreads, How Can We Use Them?John Klein120% (2)

- Ecfp June 2015Document1 pageEcfp June 2015dpbasicNo ratings yet

- 2023 Tutorial Learning Unit 6 Efficient Market HypothesisDocument5 pages2023 Tutorial Learning Unit 6 Efficient Market HypothesisMpiloNo ratings yet

- Aquamarine Fund - Manager Letter 2023Document19 pagesAquamarine Fund - Manager Letter 2023Saham IhsgNo ratings yet

- Short Question of Bond and StockDocument6 pagesShort Question of Bond and StockdoithuhuongNo ratings yet

- Ecfp May 2015Document1 pageEcfp May 2015dpbasicNo ratings yet

- Aileron Market Balance: Issue 18Document6 pagesAileron Market Balance: Issue 18Dan ShyNo ratings yet

- Put Futures Credit Spread Out-Of-The-Money DownsideDocument8 pagesPut Futures Credit Spread Out-Of-The-Money Downsidemm1979No ratings yet

- Market Analysis Feb 2024Document17 pagesMarket Analysis Feb 2024Subba TNo ratings yet

- TUTS from DiscordDocument17 pagesTUTS from DiscordAlen AlNo ratings yet

- Pershing Square Management's Letter To InvestorsDocument7 pagesPershing Square Management's Letter To InvestorsDealBook100% (1)

- FD Report - Final PDFDocument16 pagesFD Report - Final PDFSalman FarooqNo ratings yet

- Genmath - Las - Week 5-6Document6 pagesGenmath - Las - Week 5-6Aguila AlvinNo ratings yet

- Welcome Morning Update & Oscillator Chat Room Charting Programs FAQ'sDocument1 pageWelcome Morning Update & Oscillator Chat Room Charting Programs FAQ'sHarvey DychiaoNo ratings yet

- Learning Activity Sheets in General Mathematics Week 5Document7 pagesLearning Activity Sheets in General Mathematics Week 5Aguila AlvinNo ratings yet

- FIN 542 AssignmentDocument4 pagesFIN 542 AssignmentShaon SahaNo ratings yet

- 529 Plans Quarterly CommentaryDocument4 pages529 Plans Quarterly CommentaryLưuVănViếtNo ratings yet

- 4 Day Timeframe Market ConfidenceDocument6 pages4 Day Timeframe Market ConfidenceDeniss KoroblevNo ratings yet

- Corporate Finance TradingDocument8 pagesCorporate Finance TradingKatrinaNo ratings yet

- Lane Asset Management Stock Market Commentary February 2014Document8 pagesLane Asset Management Stock Market Commentary February 2014Edward C LaneNo ratings yet

- DamodaranA - InvestmentFablesDocument418 pagesDamodaranA - InvestmentFablesLili Emili100% (1)

- Bobble Pattern Ebook PDFDocument12 pagesBobble Pattern Ebook PDFContra_hourNo ratings yet

- Course Handouts For March 28 STDocument7 pagesCourse Handouts For March 28 STDhanaraaj DevelopersNo ratings yet

- Projected Game Plan For September 2012Document2 pagesProjected Game Plan For September 2012kelanio2002780No ratings yet

- TR November 1 2022Document9 pagesTR November 1 2022Rajan PatelNo ratings yet

- Dan Zanger Trading Rules PDFDocument4 pagesDan Zanger Trading Rules PDFljhreNo ratings yet

- A Story of A +1,600 Pip Trade - Long-Term Trading With Volume ProfileDocument1 pageA Story of A +1,600 Pip Trade - Long-Term Trading With Volume ProfileCarolina FloresNo ratings yet

- Virtual Stock Trading JournalDocument16 pagesVirtual Stock Trading JournalMaria100% (1)

- 0307Document3 pages0307haseebNo ratings yet

- Principles of Profit TakingJUL07Document10 pagesPrinciples of Profit TakingJUL07ingcareersNo ratings yet

- Jeff Bishop-10x Portfolio Blueprint PDFDocument61 pagesJeff Bishop-10x Portfolio Blueprint PDFkuda hitam50% (4)

- Company: Bank of America Nyse: Bac $11.95Document1 pageCompany: Bank of America Nyse: Bac $11.95Mrunmayi DeshmukhNo ratings yet

- Why Stocks Generally OutperformBonds - by Diffit (Printable)Document4 pagesWhy Stocks Generally OutperformBonds - by Diffit (Printable)qiuzimingfrank2025No ratings yet

- Weekly Plan 31223-1Document17 pagesWeekly Plan 31223-1Qizhi NeoNo ratings yet

- Corporate Finance TradingDocument8 pagesCorporate Finance TradingKatrinaNo ratings yet

- Active Bond Management StrategiesDocument15 pagesActive Bond Management StrategiesNeeraj BhartiNo ratings yet

- Short Term Trading Strategies That Work Mccord 7-13-09Document8 pagesShort Term Trading Strategies That Work Mccord 7-13-09kjkj9222100% (1)

- Expecting A Breakout FailureDocument9 pagesExpecting A Breakout Failurearan singhNo ratings yet

- Accelerating Dual Momentum Is Better Than Classic Dual MomentumDocument26 pagesAccelerating Dual Momentum Is Better Than Classic Dual MomentumAyhanNo ratings yet

- Put Ratio SpreadsDocument15 pagesPut Ratio SpreadsSasikumar ThangaveluNo ratings yet

- Stock Index FuturesDocument4 pagesStock Index FutureswannaflynowNo ratings yet

- Credit Spreads:Beginners Guide to Low Risk, Secure, Easy to Manage, Consistent Profit for Long Term WealthFrom EverandCredit Spreads:Beginners Guide to Low Risk, Secure, Easy to Manage, Consistent Profit for Long Term WealthNo ratings yet

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- 5 Minutes a Week Winning Strategies: Trading SPY in Bull & Bear MarketFrom Everand5 Minutes a Week Winning Strategies: Trading SPY in Bull & Bear MarketRating: 2.5 out of 5 stars2.5/5 (3)

- A Beginner's Guide to Investing: Investing For Tomorrow - Discover Proven Strategies To Trade and Invest In Any Type of MarketFrom EverandA Beginner's Guide to Investing: Investing For Tomorrow - Discover Proven Strategies To Trade and Invest In Any Type of MarketNo ratings yet

- Investing For Beginners: Introduction to Investing, #1From EverandInvesting For Beginners: Introduction to Investing, #1Rating: 4 out of 5 stars4/5 (6)

- Swing Trading: The Definitive And Step by Step Guide To Swing Trading: Trade Like A ProFrom EverandSwing Trading: The Definitive And Step by Step Guide To Swing Trading: Trade Like A ProRating: 1 out of 5 stars1/5 (2)

- Make the Profits Now: A Comprehensive Guide for Dummies On Proven Strategies for Profiting in Cryptocurrency DipFrom EverandMake the Profits Now: A Comprehensive Guide for Dummies On Proven Strategies for Profiting in Cryptocurrency DipNo ratings yet

- Adidas Group Equity ValueDocument4 pagesAdidas Group Equity ValueDiaa eddin saeedNo ratings yet

- Fiat's ProblemDocument3 pagesFiat's ProblemDiaa eddin saeedNo ratings yet

- Black-Scholes Example.Document3 pagesBlack-Scholes Example.Diaa eddin saeedNo ratings yet

- 1 Introduction To Option Pricing: ESTM 60202: Financial MathematicsDocument8 pages1 Introduction To Option Pricing: ESTM 60202: Financial MathematicsDiaa eddin saeedNo ratings yet

- Individual Assignment: 13. APRIL 2023Document9 pagesIndividual Assignment: 13. APRIL 2023Diaa eddin saeedNo ratings yet

- RA TEACHERS TUGUE Sep2018-ELEM PDFDocument107 pagesRA TEACHERS TUGUE Sep2018-ELEM PDFPhilBoardResults100% (1)

- A Guide To Develop A Personal Plan For RamadanDocument3 pagesA Guide To Develop A Personal Plan For RamadanadilkhaliqueNo ratings yet

- Aiding-and-Abetting-in-ICL-DatasetDocument65 pagesAiding-and-Abetting-in-ICL-DatasetAratrika BrahmachariNo ratings yet

- Maria Business Ethics Course WorkDocument15 pagesMaria Business Ethics Course WorkMicheal BixNo ratings yet

- Module-2 Equity Valuation Numerical For StudentsDocument11 pagesModule-2 Equity Valuation Numerical For Studentsgaurav supadeNo ratings yet

- Device Discovery in IotDocument5 pagesDevice Discovery in Iot532 Hari Hara Reddy GNo ratings yet

- Prospectus For Land Allotment Inbangabandhu Sheikh - 231203 - 183423Document22 pagesProspectus For Land Allotment Inbangabandhu Sheikh - 231203 - 183423hasib.sa.auNo ratings yet

- Conducting Investigator-Initiated StudiDocument15 pagesConducting Investigator-Initiated StudiNaydu Rey ArriagaNo ratings yet

- State Accounting and AuditingDocument2 pagesState Accounting and AuditingTiffany ClamuchaNo ratings yet

- Rules and Regulations Moot CourtDocument17 pagesRules and Regulations Moot CourtAnand RajNo ratings yet

- Introduction To Public Administration - National Open University of PDFDocument214 pagesIntroduction To Public Administration - National Open University of PDFchandramouliNo ratings yet

- J.C. Ryle On The Roman Catholic ChurchDocument6 pagesJ.C. Ryle On The Roman Catholic ChurchJesus LivesNo ratings yet

- Bommai Versus Union of IndiaDocument26 pagesBommai Versus Union of Indiakanishka srivastava100% (1)

- f1040s1 PDFDocument1 pagef1040s1 PDFCarlosNo ratings yet

- Mob Justice: InterpretationDocument2 pagesMob Justice: InterpretationShrujan SinhaNo ratings yet

- Imee Congress CVDocument8 pagesImee Congress CVRapplerNo ratings yet

- Sohal Engineering Works Vs Rustam Jehangir Vakil Mills Co On 3 April 1980Document7 pagesSohal Engineering Works Vs Rustam Jehangir Vakil Mills Co On 3 April 1980MeraNo ratings yet

- Application Form 2010 EnglishDocument3 pagesApplication Form 2010 Englishtester1No ratings yet

- Vendor Management Using COBITDocument24 pagesVendor Management Using COBITrajat_rathNo ratings yet

- Class 8 Revolt 1857 QADocument3 pagesClass 8 Revolt 1857 QAAK ContinentalNo ratings yet

- Holidays 2018Document7 pagesHolidays 2018Pradeep KNo ratings yet

- NipponIndia Vision FundDocument79 pagesNipponIndia Vision FundragrawalNo ratings yet

- The History of Education Educational Practice and Progress Considered As A Phase of The Development and Spread of Western Civilization by Cubberley, Ellwood PattersonDocument619 pagesThe History of Education Educational Practice and Progress Considered As A Phase of The Development and Spread of Western Civilization by Cubberley, Ellwood PattersonGutenberg.orgNo ratings yet

- Administrative Details For AGMDocument6 pagesAdministrative Details For AGMDennis AngNo ratings yet

- People Vs BandianDocument1 pagePeople Vs BandianShiela Pilar100% (5)

- Evac Classic Toilets - 0Document4 pagesEvac Classic Toilets - 0Mohamed Gaber El-NaggarNo ratings yet

- Procurement: Value For Money Governance and ProbityDocument5 pagesProcurement: Value For Money Governance and ProbitychienNo ratings yet