Alternative Investments: Syllabus

Alternative Investments: Syllabus

Uploaded by

Vishwadeep SrivastavaCopyright:

Available Formats

Alternative Investments: Syllabus

Alternative Investments: Syllabus

Uploaded by

Vishwadeep SrivastavaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Alternative Investments: Syllabus

Alternative Investments: Syllabus

Uploaded by

Vishwadeep SrivastavaCopyright:

Available Formats

Alternative Investments Syllabus

Alternative Investments will equip you with the skills, confidence, and strategies to assess potential investment opportunities in

private equity, private debt, hedge funds, and real estate. You will learn how to speak the language of alternative investments,

evaluate types of alternative investments and their defining qualities, and develop the confidence and ability to assess potential

investment opportunities and maximize the value of your portfolio.

Modules Case Studies Takeaways Key Exercises

• BC Partners Acquires • Learn what private equity is, • Calculate the value of equity

Acuris sources of risk and value, and

Module 1

• Identify and rank private equity

how it is funded

Private Equity segments by their attributes and skills

• Analyze the different segments required

of private equity: growth equity,

• Quiz #1

buyouts, and venture capital

• Oaktree Capital • Compare and contrast private • Classify attributes of investment

Management Acquires equity and debt opportunities

Pierre Foods’s Debt

Private • Analyze investment strategies and • Rank deals by their characteristics

Module 2

Debt, Distress • Blackstone’s GSO sources of value

• Quiz #2

Investing, and Capital Invests in

• Identify skills needed for

Crosstex

Secondaries successful distress investing

• Compare and contrast secondaries

and traditional private equity

• Activist Investing • Learn key elements of hedge • Calculate alpha and beta

with The Children’s funds, including fee structure and

• Arbitrage trading simulation

Investment Fund sources of risk and value

Module 3

• Quiz #3

Hedge Funds • Understand types of arbitrage and

strategies

• Characterize core quantitative

investing strategies

• Real Estate Valuation • Learn how real estate differs from • Identify phases of the real estate market

with 625 Ground the rest of the alternatives space

• Prepare for a real estate negotiation

Lessor LLC

Module 4

• Understand types of real estate

• Conduct valuation analysis

Real Estate investments

• Classify real estate products based on

their diversification potential

• Quiz #4

• Challenges of • Describe the “money journey” • Test knowledge of lockup period,

Alternatives with PFA and the key players involved liquidity frequency, and notice period

Pension Fund

Module 5

• Interpret metrics to analyze • Practice analysis of key metrics

Portfolio performance

Construction • Rank investment risks

• Understand risk and

• Quiz #5

complementarity in portfolios

• Discuss trends in alternatives

Learning requirements: In order to earn a Certificate of Completion, participants must thoughtfully complete all 5 modules,

including satisfactory completion of associated quizzes, by stated deadlines.

For more information, visit online.hbs.edu or email us at hbsonline@hbs.edu

© Copyright 2022. President and Fellows of Harvard College. All Rights Reserved.

You might also like

- CFD Forex Broker Report - 7th EditionDocument75 pagesCFD Forex Broker Report - 7th EditiongghghgfhfghNo ratings yet

- CaiaDocument2 pagesCaiaOsiris316No ratings yet

- Forex Trading Bootcamp Day 5 - Imbalance, Liquidity and Indicator Based StrategiesDocument46 pagesForex Trading Bootcamp Day 5 - Imbalance, Liquidity and Indicator Based StrategiesArrow Builders100% (10)

- Harvard Business School PDFDocument1 pageHarvard Business School PDFNIKUNJ JAINNo ratings yet

- Private Equity Fund Investment Due DiligenceDocument16 pagesPrivate Equity Fund Investment Due DiligenceThierry100% (3)

- Project On Prudent Cas Ltd.Document48 pagesProject On Prudent Cas Ltd.vaibhav_sharma_650% (4)

- TNEB Online PaymentDocument1 pageTNEB Online PaymentRaghavendra RaoNo ratings yet

- Seminar 3 Self-Study - Understanding Costs-Qu-Ans SVDocument3 pagesSeminar 3 Self-Study - Understanding Costs-Qu-Ans SVMd. Sumon Chowdhury 152-11-4644No ratings yet

- Curriculum Overview: Level I TextsDocument2 pagesCurriculum Overview: Level I TextsAkshat JainNo ratings yet

- Course HandoutDocument4 pagesCourse HandoutRicha ChauhanNo ratings yet

- Syllabus Leading With Finance PDFDocument1 pageSyllabus Leading With Finance PDFTanmoy GhoraiNo ratings yet

- Gitam - Valuation of EquityDocument23 pagesGitam - Valuation of EquityvaddalapupavanNo ratings yet

- FA +TA - Sep 24Document24 pagesFA +TA - Sep 24hayai10010No ratings yet

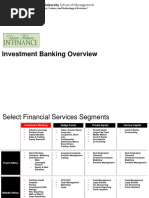

- Private Equity Investment Banking Hedge Funds Venture CapitalDocument26 pagesPrivate Equity Investment Banking Hedge Funds Venture Capitalpankaj_xaviersNo ratings yet

- Lecture 4 - FIN 566Document20 pagesLecture 4 - FIN 566mf-shroomNo ratings yet

- Valuation of Securities Rajesh ShahDocument30 pagesValuation of Securities Rajesh ShahHarsh SoniNo ratings yet

- Investment Banking - SMG 211Document32 pagesInvestment Banking - SMG 211Hesham Abd-Alrahman100% (3)

- WP Contentuploads202209Internship Program Flyer WEB 2023 PDFDocument2 pagesWP Contentuploads202209Internship Program Flyer WEB 2023 PDFagoncalves7No ratings yet

- FINA201 Topic 3 CH 6 Slides Valuations and Bonds PrintingDocument8 pagesFINA201 Topic 3 CH 6 Slides Valuations and Bonds Printingayushmaharaj68No ratings yet

- Introduction 2023Document44 pagesIntroduction 2023Richa ChauhanNo ratings yet

- Wealth Management - D&B Program OutlineDocument4 pagesWealth Management - D&B Program OutlineParijat ChoudhuryNo ratings yet

- M A Materials 1712069489Document10 pagesM A Materials 1712069489Izabella AndradeNo ratings yet

- Small Cap & Special SituationsDocument3 pagesSmall Cap & Special SituationsAnthony DavianNo ratings yet

- M&A BundleDocument10 pagesM&A BundlegfraoterNo ratings yet

- Sustainable Investing SyllabusDocument2 pagesSustainable Investing SyllabusNIrmalya SenguptaNo ratings yet

- CSC BrochureDocument2 pagesCSC BrochureAbhinaya .SNo ratings yet

- ACC 107 - Table of Specifications Final Exam CoverageDocument1 pageACC 107 - Table of Specifications Final Exam CoverageEunice Lyafe PanilagNo ratings yet

- Fixed Income Analyst Jan 2023Document2 pagesFixed Income Analyst Jan 2023FransNo ratings yet

- Ambit - IIM Calcutta Job Description FormDocument2 pagesAmbit - IIM Calcutta Job Description Formdeepakcool208No ratings yet

- Credit RatingDocument3 pagesCredit Ratingsanjay parmar100% (4)

- Week 3Document74 pagesWeek 3kameshperi7996No ratings yet

- 3 BondsDocument16 pages3 BondsSrinithi kesavadossNo ratings yet

- Chapter 1Document7 pagesChapter 1Chu Thị Thanh ThảoNo ratings yet

- Operational Due Dilligence v2Document4 pagesOperational Due Dilligence v2Mary YipNo ratings yet

- Fnce 110 Principles of Finance Course Outline Sep-Dec 2023Document2 pagesFnce 110 Principles of Finance Course Outline Sep-Dec 2023mwendaflaviushilelmutembeiNo ratings yet

- Entrepreneurship Course OverviewDocument13 pagesEntrepreneurship Course OverviewMarcelo RzNo ratings yet

- M&A HandbookDocument1 pageM&A Handbookidan28No ratings yet

- Alternative Investment2Document39 pagesAlternative Investment2kenNo ratings yet

- Proposal For DYPIMR 10oct 22 PK Ver 1.1Document16 pagesProposal For DYPIMR 10oct 22 PK Ver 1.1abhas2121No ratings yet

- FM 4Document19 pagesFM 4Taaran ReddyNo ratings yet

- B&K Wealth Management Introduction & CapabilitiesDocument18 pagesB&K Wealth Management Introduction & Capabilitiesiifl dataNo ratings yet

- IB - Lecture 1Document42 pagesIB - Lecture 1hoang phuongthao25No ratings yet

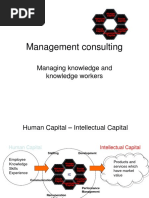

- Management Consulting: Managing Knowledge and Knowledge WorkersDocument29 pagesManagement Consulting: Managing Knowledge and Knowledge WorkersMadhu Gupta100% (2)

- Instruments Rated by Crisil, Care, IcraDocument6 pagesInstruments Rated by Crisil, Care, IcraSmriti DurehaNo ratings yet

- DeepakInterview CreditDocument4 pagesDeepakInterview Creditbhatiadeepak37No ratings yet

- Strategic Perspectives: Mcgraw-Hill/IrwinDocument20 pagesStrategic Perspectives: Mcgraw-Hill/IrwinRabya AmjadNo ratings yet

- JD Investment Analyst (Associate)Document2 pagesJD Investment Analyst (Associate)iqmobiletutorNo ratings yet

- ePGPx02 MIS Project - Group 10 - Lemon - BrothersDocument12 pagesePGPx02 MIS Project - Group 10 - Lemon - BrothersChaman KumarNo ratings yet

- Mortage LoansDocument3 pagesMortage Loanssanjay_shrNo ratings yet

- Tute 08 - Business ValuationDocument15 pagesTute 08 - Business ValuationLakshani fernandoNo ratings yet

- The World's Most Admired Bank: Who We Are: A Leading Global BankDocument10 pagesThe World's Most Admired Bank: Who We Are: A Leading Global BankwhartonfinanceclubNo ratings yet

- Equity - Valuation Introduction PDFDocument17 pagesEquity - Valuation Introduction PDFhukaNo ratings yet

- TFG2971 - 6.15 Transamerica ONE Presentation - DIGITALDocument12 pagesTFG2971 - 6.15 Transamerica ONE Presentation - DIGITALachow04311No ratings yet

- JAIIB Paper 4 RMWM Module D Wealth Management PDFDocument51 pagesJAIIB Paper 4 RMWM Module D Wealth Management PDFAssr MurtyNo ratings yet

- Lu - Valuation Challenges Credit Institutions Investment Firms - 03072015Document17 pagesLu - Valuation Challenges Credit Institutions Investment Firms - 03072015Simon AltkornNo ratings yet

- VALUATION OF GOODWILLDocument21 pagesVALUATION OF GOODWILLdhiwarbabitaNo ratings yet

- Week 6 Topic 7 Debentures and Loan Capital: Textbook Chapter 18Document32 pagesWeek 6 Topic 7 Debentures and Loan Capital: Textbook Chapter 18mendiexiaNo ratings yet

- Investment Management: by BanksDocument9 pagesInvestment Management: by Banksvivek0020No ratings yet

- ACCOUNTINGDocument36 pagesACCOUNTINGCaptain StrangeNo ratings yet

- Careers in Finance and Finance Interview PrepDocument14 pagesCareers in Finance and Finance Interview PrepAlyssa HarrisonNo ratings yet

- Chapter 2 - Asset Allocation DecisionDocument24 pagesChapter 2 - Asset Allocation DecisionImejah FaviNo ratings yet

- FINANCE 2 (1)Document2 pagesFINANCE 2 (1)Blessy Mae GeneraleNo ratings yet

- 1) Lecture 1 Portfolio Management EnvironmentDocument6 pages1) Lecture 1 Portfolio Management EnvironmentqwertyuiopNo ratings yet

- Chapter 1Document31 pagesChapter 1Nguyễn Mai AnhNo ratings yet

- Investment Pricing Methods: A Guide for Accounting and Financial ProfessionalsFrom EverandInvestment Pricing Methods: A Guide for Accounting and Financial ProfessionalsNo ratings yet

- R13-Brand ValuationDocument3 pagesR13-Brand ValuationYashi GuptaNo ratings yet

- Starbucks Scanned in 2nd Case PDFDocument18 pagesStarbucks Scanned in 2nd Case PDFAce ReytaNo ratings yet

- Zest O CorporationDocument22 pagesZest O CorporationCarlo MedenillaNo ratings yet

- MA 668 2024 Lecture 01Document14 pagesMA 668 2024 Lecture 01TusharNo ratings yet

- Kiarra Nicel R. de Torres - Ecoweek3and4Document5 pagesKiarra Nicel R. de Torres - Ecoweek3and4Kiarra Nicel De TorresNo ratings yet

- Privatisation in NigeriaDocument17 pagesPrivatisation in NigeriaOluwaseun LotoNo ratings yet

- PaymentDocument1 pagePaymentkoray.ferdunNo ratings yet

- Idfc (Idfc) : Strong Growth Ahead, Dilution ExpectedDocument7 pagesIdfc (Idfc) : Strong Growth Ahead, Dilution ExpectedKaushal KumarNo ratings yet

- Cesar Daly Paris and The Emergence of Modern Urban PlanningDocument23 pagesCesar Daly Paris and The Emergence of Modern Urban Planningweareyoung5833No ratings yet

- Financing and Raising Capital PDFDocument258 pagesFinancing and Raising Capital PDFbaxter100% (1)

- AuditDocument6 pagesAuditShaiNo ratings yet

- Lazard Interim 2024 Secondary Market ReportDocument24 pagesLazard Interim 2024 Secondary Market Reportbogifid539No ratings yet

- Tiffany's Little Blue BoxDocument21 pagesTiffany's Little Blue BoxPranjal SharmaNo ratings yet

- Marketing Mix in Financial ServicesDocument15 pagesMarketing Mix in Financial ServicesRtr Iliyas SalmaniNo ratings yet

- StrategiesDocument4 pagesStrategiesRajaNo ratings yet

- Workers, Unite!: More InfoDocument2 pagesWorkers, Unite!: More InfoSONNEILLONNo ratings yet

- Topic 2 - The Allocation of Resources 5 PDFDocument18 pagesTopic 2 - The Allocation of Resources 5 PDFMxni ChyNo ratings yet

- Customer - Loyalty - L2Document27 pagesCustomer - Loyalty - L2Ivelina AndonovaNo ratings yet

- Two Primary Reasons For Writing A Business PlanDocument6 pagesTwo Primary Reasons For Writing A Business PlanKote GagnidzeNo ratings yet

- Pricing With Market PowerDocument29 pagesPricing With Market PowerZoey O'BrienNo ratings yet

- CH 11 Presentation PDFDocument23 pagesCH 11 Presentation PDFKevin OrtizNo ratings yet

- Proper Trend TradingDocument4 pagesProper Trend TradingMichael MarioNo ratings yet

- Lesson 5 A World of RegionsDocument20 pagesLesson 5 A World of RegionsJamivia Shayne MacasayonNo ratings yet

- Chase February StatementDocument6 pagesChase February StatementdanteNo ratings yet

- AI Technologies in The Analysis of Visual Advertising Messages: Survey and ApplicationDocument24 pagesAI Technologies in The Analysis of Visual Advertising Messages: Survey and ApplicationLinh ThuỳNo ratings yet