0 ratings0% found this document useful (0 votes)

36 viewsFor Information To The Pensioner

For Information To The Pensioner

Uploaded by

RAJESHThis document provides information on pension calculations for two cases: a superannuation case and a family pension case. For the superannuation case, it details the pensioner's service details and calculations for their monthly pension amount, commuted pension amount, death-cum-retirement gratuity (DCRG), and family pension rates. For the family pension case, it similarly details the deceased government servant's service history and calculations for death gratuity, enhanced family pension rate, and normal family pension rate for their surviving family. The document includes abbreviations and formulas used to calculate these retirement benefits.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

For Information To The Pensioner

For Information To The Pensioner

Uploaded by

RAJESH0 ratings0% found this document useful (0 votes)

36 views4 pagesThis document provides information on pension calculations for two cases: a superannuation case and a family pension case. For the superannuation case, it details the pensioner's service details and calculations for their monthly pension amount, commuted pension amount, death-cum-retirement gratuity (DCRG), and family pension rates. For the family pension case, it similarly details the deceased government servant's service history and calculations for death gratuity, enhanced family pension rate, and normal family pension rate for their surviving family. The document includes abbreviations and formulas used to calculate these retirement benefits.

Original Description:

Original Title

FAQ

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

This document provides information on pension calculations for two cases: a superannuation case and a family pension case. For the superannuation case, it details the pensioner's service details and calculations for their monthly pension amount, commuted pension amount, death-cum-retirement gratuity (DCRG), and family pension rates. For the family pension case, it similarly details the deceased government servant's service history and calculations for death gratuity, enhanced family pension rate, and normal family pension rate for their surviving family. The document includes abbreviations and formulas used to calculate these retirement benefits.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

36 views4 pagesFor Information To The Pensioner

For Information To The Pensioner

Uploaded by

RAJESHThis document provides information on pension calculations for two cases: a superannuation case and a family pension case. For the superannuation case, it details the pensioner's service details and calculations for their monthly pension amount, commuted pension amount, death-cum-retirement gratuity (DCRG), and family pension rates. For the family pension case, it similarly details the deceased government servant's service history and calculations for death gratuity, enhanced family pension rate, and normal family pension rate for their surviving family. The document includes abbreviations and formulas used to calculate these retirement benefits.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 4

For Information to the Pensioner

ILLUSTRATION 1

SUPERANNUATION CASE

ABBREVIATIONS

SMPs - Six Monthly Periods

NQS - Net Qualifying Service

1. Name and Designation of the

Retired Govt. Servant : XYZ, Head Master

2. Class of Pension : Superannuation

3. Date of Birth : 16/07/1947

4. Date of Appointment : 05/06/1968

5. Date of Retirement : 31/07/2005

6. Gross Service : 37Y - 01M - 26 D

7. Non-Qualifying Service : 0Y - 0Y - 13 D

8. Net Qualifying Service : 37Y - 01M - 13 D

74 SMPs but limited to a

maximum of 66 SMPs of service

9. Time Scale of pay : 6500 – 200 – 10500

10. Pay Details : Rs.8700/- w.e.f. 01/10/2004

Rs.8900/- w.e.f 01/01/2005

11. Average Emoluments for Pension : 8700 X 3 = 26,100

(based on the pay drawn during 8900 X 7 = 62,300

the last ten months) 88,400

: Rs.88,400 / 10 = Rs.8,840/-

12. Emoluments for Pension : Rs.8,840

Formula for Calculation of Pension : 50% of Average Emoluments

(For a maximum of 66 SMPs

and the pension will be reduced

proportionately according to the

total SMPs of service).

13. Pension : 8840 X 50/100 X 66/66

= Rs.4420/- pm wef 1/08/2005

14. Pension Commuted : Rs.4420 / 3 = Rs.1473/-

(Max. commutable pension is 1/3)

15. Factor : 10.46

16. Reduced Pension : Rs.4420 – Rs.1473 = Rs.2947/-

17. Commuted Value of Pension : Rs.1473 X 10.46 X 12 =

Rs.1,84,891/-

{Commuted pension x Factor based on Age Next Birthday x 12}

Formula for calculation of DCRG : Emoluments for DCRG X

SMPs/4 (limited to a max. of

Rs.3,50,000/-)

18. Last Pay Drawn : Rs.8,900/-

19. DA @ 67% : Rs.5,963/-

20. Emoluments for DCRG : Rs.14,863/-

[DCRG Emoluments is LPD + DA]

21. DCRG : Rs.14,863 X 66/4 =

Rs.2,45,240/-

22. Family Pension : i) Enhanced rate @ Rs.4,420/- pm

upto 15/07/2012 or for 7 years

from the day following the date of

death whichever is earlier.

ii) Normal rate @ Rs.2,670/- pm

thereafter.

ILLUSTRATION 2

FAMILY PENSION CASE

ABBREVIATIONS

SMPs - Six Monthly Periods

NQS - Net Qualifying Service

1. Name and Designation of the

Deceased Govt. Servant : XYZ, Head Master

2. Class of Pension : Family Pension

3. Date of Birth : 17/10/1948

4. Date of Appointment : 04/11/1976

5. Date of Death : 11/08/2005

6. Gross Service : 28 Y - 9 M - 8 D

7. Non-Qualifying Service : 0Y - 0 M - 22 D

8. Net Qualifying Service : 28 Y - 8 M - 16 D

(57 SMPs)

9. Time Scale of Pay : 5900 – 200 – 9900

10. Pay Last Drawn : Rs.7850/-

[Rs.7700 + Rs.150 (PP)]

11. Death Gratuity :

With effect from 14/12/1987

Formula for calculation of Death Gratuity is follows:

Qualifying Service

Less than 9 months = 2 times the emoluments

9 months & above but less than

4 years & 9 months = 6 times the emoluments

4 years 9 months & above but less

than 19 years & 9 months = 12 times the emoluments

19 years 9 months and above = Half the emoluments for each

completed SMPS subject

to maximum of 33 times

12. Last Pay Drawn : Rs.7,850/-

13. DA @ 67% : Rs.5,260/-

14. Emoluments for Death Gratuity : Rs.13,110/-

[Death Gratuiry Emoluments is LPD + DA]

15. Death Gratuity : Rs.13,110 X 57/2 =

Rs.3,73,635/- limited to

Rs.3,50,000/- (Maximum)

16. Enhanced Family Pension : 50% of the pay last drawn

payable from the day following

the Date of Death of the Govt.

Servant upto 65 years of age

Of the Govt servant or 7 years

from the day following the

Date of Death of the Govt.

Servant whichever is earlier.

17. Normal Rate of F.P : 30% of Pay Last Drawn

thereafter

18. Enhanced Rate : 7850/2 = Rs.3925/- payable

from 12.08.2005 to 11.8.2012

19. Normal Rate : 7850 * 30% Rs.2355/- payable

thereafter

You might also like

- Earnings Statement: Total Hours For Hourly Period 11/22/20 - 11/28/20 Worked 41.09 Hours Ovrtime & Dbltime 4.57 HoursDocument2 pagesEarnings Statement: Total Hours For Hourly Period 11/22/20 - 11/28/20 Worked 41.09 Hours Ovrtime & Dbltime 4.57 HoursWilliam Harris100% (1)

- Offer Letter - LokeshwaranDocument3 pagesOffer Letter - LokeshwaranPazhamalairajan Kaliyaperumal50% (2)

- Cprs Payslip1.jspDocument1 pageCprs Payslip1.jspRakesh KumarNo ratings yet

- Pension Calculation Sheet: 1. NameDocument1 pagePension Calculation Sheet: 1. NameANNADURAINo ratings yet

- Formula For Calculation of DCRG: (Based On The Pay Drawn During Last 10 Months)Document2 pagesFormula For Calculation of DCRG: (Based On The Pay Drawn During Last 10 Months)Kudicheti DamodaramNo ratings yet

- How To Calculate PensionDocument5 pagesHow To Calculate PensionEddie GeinNo ratings yet

- Calculation of PensionDocument2 pagesCalculation of Pensionramki240No ratings yet

- Pension Rules:: FormulaDocument4 pagesPension Rules:: FormulaMunnangi NagendrareddyNo ratings yet

- 7THCPCDocument8 pages7THCPCRaj KumarNo ratings yet

- Pension / T B: Erminal EnefitDocument38 pagesPension / T B: Erminal EnefitsaravananNo ratings yet

- LIC Jeevan Utsav PlanDocument3 pagesLIC Jeevan Utsav PlanphotonxcomNo ratings yet

- FD 03 SRP 2020 Dtd-23-03-2020 PDFDocument4 pagesFD 03 SRP 2020 Dtd-23-03-2020 PDFLokesh G NNo ratings yet

- Pension / T B: Erminal EnefitDocument38 pagesPension / T B: Erminal EnefitsaravananNo ratings yet

- 15.1 - PH - II - RETIREMENT BENEFITS-2019Document77 pages15.1 - PH - II - RETIREMENT BENEFITS-2019Ranjeet SinghNo ratings yet

- Self_Explanatory_SettlementDocument13 pagesSelf_Explanatory_SettlementRohitUikeyNo ratings yet

- Sample Structure 10lpa - VI - VIIIDocument1 pageSample Structure 10lpa - VI - VIIIKiran IconNo ratings yet

- ABHISHEK ROY CVGDocument16 pagesABHISHEK ROY CVGAbdulNo ratings yet

- (Based On Presumed Data) File No.: 2-14349 Ddo: (000015) Accounts Officer Dte of TransportDocument2 pages(Based On Presumed Data) File No.: 2-14349 Ddo: (000015) Accounts Officer Dte of TransportD S PNo ratings yet

- SBMA Compensation Package (As of 20160131)Document6 pagesSBMA Compensation Package (As of 20160131)mysubicbayNo ratings yet

- Offer Letter - Ezema OluchukwuDocument3 pagesOffer Letter - Ezema Oluchukwusmart accessNo ratings yet

- Pension e PN 2017 18Document40 pagesPension e PN 2017 18Ancy RajNo ratings yet

- Brahm Pal Singh PA (May-2023Document21 pagesBrahm Pal Singh PA (May-2023Rajender KumarNo ratings yet

- CCK BL 2Document7 pagesCCK BL 2Logeswaran SinnasamyNo ratings yet

- Abang Form PDFDocument2 pagesAbang Form PDFZara QistinaNo ratings yet

- Circular DT 17.08.2009 Reg. 5th Pay Commission ScannedDocument8 pagesCircular DT 17.08.2009 Reg. 5th Pay Commission ScannedM K DOGRANo ratings yet

- Prorata Pension DetailsDocument6 pagesProrata Pension Detailsshaunak_srNo ratings yet

- Go Fin 268 02 pg630 PDFDocument2 pagesGo Fin 268 02 pg630 PDFMani BaluNo ratings yet

- EPF India Higher Pension With Employee Pension Scheme (EPS), Conditions, Formula, Calculation at Various Stages For RetirementDocument9 pagesEPF India Higher Pension With Employee Pension Scheme (EPS), Conditions, Formula, Calculation at Various Stages For RetirementMegastar IQNo ratings yet

- Calculations of Pensions and GratuityDocument2 pagesCalculations of Pensions and GratuitywillbroadolaunNo ratings yet

- Sample Structure 100lpa XII PassDocument1 pageSample Structure 100lpa XII PassKiran IconNo ratings yet

- One Family.. One Vision.. One Mission.. The Spirit of Singareni The Singareni Collieries Company LimitedDocument18 pagesOne Family.. One Vision.. One Mission.. The Spirit of Singareni The Singareni Collieries Company Limitedsaitharunbairu05No ratings yet

- CandidateDocument4 pagesCandidateprashantmali30novNo ratings yet

- GO (P) No 1142-98-Fin Dated 25-03-1998Document6 pagesGO (P) No 1142-98-Fin Dated 25-03-1998Saravanan SubramaniNo ratings yet

- Retirement Workbook 3.2Document31 pagesRetirement Workbook 3.2Tejas Shah83% (6)

- Format PensionDocument4 pagesFormat Pensionsne1971No ratings yet

- Pension Rules 2009trDocument12 pagesPension Rules 2009trjaydeep_chakrabort_2No ratings yet

- Dependents Enrollment Form PDFDocument2 pagesDependents Enrollment Form PDFMaeDaphneYapNo ratings yet

- University Institute of Legal Studies (UILS) Chandigarh UniversityDocument26 pagesUniversity Institute of Legal Studies (UILS) Chandigarh UniversityRishabh GoyalNo ratings yet

- Income From Salary - Allowances and Perks - Feb., 2023Document14 pagesIncome From Salary - Allowances and Perks - Feb., 2023Ayush BholeNo ratings yet

- Bridge Benefit EDocument6 pagesBridge Benefit EvikiNo ratings yet

- Pension Calculation 4 Dept - ExamDocument3 pagesPension Calculation 4 Dept - Examgcrajasekaran100% (1)

- CGHS Revised ContributionDocument7 pagesCGHS Revised ContributionC Ramakrishna PrasadNo ratings yet

- 1683878930963-Settlement BenefitsDocument51 pages1683878930963-Settlement Benefitsdohagox662No ratings yet

- Ongc Pension&mediDocument17 pagesOngc Pension&medidipti bhimNo ratings yet

- Circular For Retired Employee Renewal Policy - 2020-21Document7 pagesCircular For Retired Employee Renewal Policy - 2020-21Suresh SuriNo ratings yet

- Phone: 08744-249992, E-Mail: WebsiteDocument17 pagesPhone: 08744-249992, E-Mail: WebsiteHexaNotesNo ratings yet

- Deepak SumanDocument2 pagesDeepak Sumanrajprajapati467No ratings yet

- Ward Entitlement and CGHS Contribution1 PDFDocument2 pagesWard Entitlement and CGHS Contribution1 PDFashwaniNo ratings yet

- Retirement Workbook 1Document27 pagesRetirement Workbook 1Pankaj Mathpal100% (1)

- Sample Calculation Sheet Superannuation: RemarksDocument1 pageSample Calculation Sheet Superannuation: RemarkspdmittalNo ratings yet

- Week 2 Payroll PDFDocument8 pagesWeek 2 Payroll PDFVassish DassagneNo ratings yet

- JadhavDocument1 pageJadhavpkumeriyaNo ratings yet

- Know Your Retirement BookletDocument21 pagesKnow Your Retirement BookletPushparajan GunasekaranNo ratings yet

- Pension Calculation-UpdatedDocument3 pagesPension Calculation-UpdatedgcrajasekaranNo ratings yet

- CandidateDocument4 pagesCandidateabbai rNo ratings yet

- Offering Dzulfikar - HSE OfficerDocument1 pageOffering Dzulfikar - HSE Officerdzul fikarNo ratings yet

- Pay Structure FinalDocument11 pagesPay Structure Finalboutique2k18No ratings yet

- Higher Pension As Per SC Decision With Calculation - Synopsis1Document13 pagesHigher Pension As Per SC Decision With Calculation - Synopsis1hariveerNo ratings yet

- 3 Salient Features PDFDocument3 pages3 Salient Features PDFjava javaNo ratings yet

- A Investment Platform for Future: Self Help a Self Operating BankingFrom EverandA Investment Platform for Future: Self Help a Self Operating BankingNo ratings yet

- A Haven on Earth: Singapore Economy Without Duties and TaxesFrom EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNo ratings yet

- A Haven on Earth: Singapore Economy Without Duties and TaxesFrom EverandA Haven on Earth: Singapore Economy Without Duties and TaxesNo ratings yet

- 19ucas02 Bca 29 06 2021 FNDocument6 pages19ucas02 Bca 29 06 2021 FNRAJESHNo ratings yet

- CEVS11 Environmental Studies Tamil MediumDocument6 pagesCEVS11 Environmental Studies Tamil MediumRAJESHNo ratings yet

- ECOMModelpaper IDocument4 pagesECOMModelpaper IRAJESHNo ratings yet

- Robbins w3cDocument47 pagesRobbins w3cRAJESHNo ratings yet

- VPM Classes - Sample Theory - New Pattern - Ugc Net Comp. SciDocument13 pagesVPM Classes - Sample Theory - New Pattern - Ugc Net Comp. SciRAJESHNo ratings yet

- Python Function Question and Answers PDFDocument25 pagesPython Function Question and Answers PDFRAJESHNo ratings yet

- VPM Classes - Ugc Net - June 12 - General Paper - 1 - Ans Key - All CodeDocument4 pagesVPM Classes - Ugc Net - June 12 - General Paper - 1 - Ans Key - All CodeRAJESHNo ratings yet

- Dear Winner,: P.O.Box 251 Watford England WD 18 9BR United Kingdom Website: WWW - Bbc.co - Uk/lotteryDocument5 pagesDear Winner,: P.O.Box 251 Watford England WD 18 9BR United Kingdom Website: WWW - Bbc.co - Uk/lotteryRAJESHNo ratings yet

- UntitledDocument9 pagesUntitledRAJESHNo ratings yet

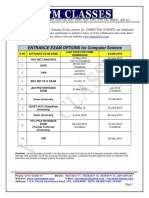

- VPM - Classes - PHD - Computer Science - Exam OptionsDocument1 pageVPM - Classes - PHD - Computer Science - Exam OptionsRAJESHNo ratings yet

- By Patrick Foil Beeson 2008Document248 pagesBy Patrick Foil Beeson 2008RAJESHNo ratings yet

- Data Communication Computer Network Question BankDocument4 pagesData Communication Computer Network Question BankRAJESH100% (5)

- Payment Guarantee: Attention: I.SeetharamanDocument1 pagePayment Guarantee: Attention: I.SeetharamanRAJESHNo ratings yet

- VPM Classes - Ugc Net - June 12 - CS - Ans Key - Paper-Ii & IiiDocument1 pageVPM Classes - Ugc Net - June 12 - CS - Ans Key - Paper-Ii & IiiRAJESHNo ratings yet

- Java Lab ManualDocument32 pagesJava Lab ManualRAJESHNo ratings yet

- June 2021 Model Set Question PaperDocument32 pagesJune 2021 Model Set Question PaperRAJESHNo ratings yet

- DBMS-UNIT-2 R16 (Ref-2)Document26 pagesDBMS-UNIT-2 R16 (Ref-2)RAJESHNo ratings yet

- DBMS-UNIT-1 R16 (Ref-2)Document12 pagesDBMS-UNIT-1 R16 (Ref-2)RAJESHNo ratings yet

- 03 GuiDocument68 pages03 GuiRAJESHNo ratings yet

- Unit 1 Chapter 1: Introduction: Operating System F.Y.Bsc - It Prof. Sujata RizalDocument31 pagesUnit 1 Chapter 1: Introduction: Operating System F.Y.Bsc - It Prof. Sujata RizalRAJESHNo ratings yet

- Java Programming Lab ManualDocument36 pagesJava Programming Lab ManualRAJESHNo ratings yet

- PPS Lab ManualDocument72 pagesPPS Lab ManualRAJESHNo ratings yet

- USIT103 Operating SystemDocument222 pagesUSIT103 Operating SystemRAJESHNo ratings yet

- Mobile Communications Chapter 4: Wireless Telecommunication SystemsDocument74 pagesMobile Communications Chapter 4: Wireless Telecommunication SystemsRAJESHNo ratings yet

- CS8601-Mobile Computing IqDocument12 pagesCS8601-Mobile Computing IqRAJESHNo ratings yet

- CS8601 QB 010-2 Edubuzz360Document3 pagesCS8601 QB 010-2 Edubuzz360RAJESHNo ratings yet

- CS8601 QB 010-1 Edubuzz360Document8 pagesCS8601 QB 010-1 Edubuzz360RAJESHNo ratings yet

- 1.define MANET.: 2. List The Advantages of MANET. IndependenceDocument4 pages1.define MANET.: 2. List The Advantages of MANET. IndependenceRAJESHNo ratings yet

- Unit 1-Software EngineeringDocument20 pagesUnit 1-Software EngineeringRAJESHNo ratings yet

- Infosys Question PaperDocument24 pagesInfosys Question PaperRAJESHNo ratings yet

- Important Simple Interest Questions: For Different Bank ExamsDocument15 pagesImportant Simple Interest Questions: For Different Bank ExamsKothapalli VinayNo ratings yet

- Rental AgreementDocument3 pagesRental AgreementAkbar MohammadNo ratings yet

- Class 10 BankingDocument3 pagesClass 10 BankingPATASHIMUL GRAM PACHAYATNo ratings yet

- 3464 Sukhmani Deposit SchemeDocument3 pages3464 Sukhmani Deposit SchemesunilsupurbNo ratings yet

- Milktea PayrollDocument7 pagesMilktea PayrollPat Dela CruzNo ratings yet

- Rent Receipt: Employee ID Employee Name Name of The Landlord PAN of The LandlordDocument1 pageRent Receipt: Employee ID Employee Name Name of The Landlord PAN of The LandlordpvsairamNo ratings yet

- Awareness Program On NPS by Corporate Retirement CellDocument2 pagesAwareness Program On NPS by Corporate Retirement Cellbramhanand vermaNo ratings yet

- Assignment/ TugasanDocument9 pagesAssignment/ Tugasansuhaili norainiNo ratings yet

- Case Study 2Document5 pagesCase Study 2csthakurvivek1987No ratings yet

- Excel Mate FiDocument4 pagesExcel Mate FiFredy RamosNo ratings yet

- Concentrix Services India Private Limited Payslip For The Month of March - 2022Document1 pageConcentrix Services India Private Limited Payslip For The Month of March - 2022Farhin Laskar100% (1)

- Tata Investment 2016 PDFDocument114 pagesTata Investment 2016 PDFSumit JhaNo ratings yet

- Selected Practice Questions From Chapters 6 - 8, FIN 335, With Dr. GrahamDocument28 pagesSelected Practice Questions From Chapters 6 - 8, FIN 335, With Dr. GrahamSaraNowakNo ratings yet

- Payslip 1Document4 pagesPayslip 1Leo MagnoNo ratings yet

- Exercise Sheet 7 - Employee CompensationDocument1 pageExercise Sheet 7 - Employee CompensationKievs GtsNo ratings yet

- Tabel Bunga Ekonomi TeknikDocument32 pagesTabel Bunga Ekonomi Teknik16 Dwipayana Putra.No ratings yet

- Pandurang Shigvan Mumbai Vidyavihar Quality Checker: Sector 30A, Vashi, Navi Mumbai, Maharashtra 400705Document15 pagesPandurang Shigvan Mumbai Vidyavihar Quality Checker: Sector 30A, Vashi, Navi Mumbai, Maharashtra 400705DS Ghatkopar EastNo ratings yet

- Rent Agreement 2023Document5 pagesRent Agreement 2023Arun RajputNo ratings yet

- Document 1Document1 pageDocument 1Ghasem KhanNo ratings yet

- Chap-5 Interest PDFDocument15 pagesChap-5 Interest PDFRonalie SustuedoNo ratings yet

- Businessfinance12 q3 Mod6.1 Basic Long Term Financial Concepts Simple and Compound InterestDocument27 pagesBusinessfinance12 q3 Mod6.1 Basic Long Term Financial Concepts Simple and Compound InterestMarilyn TamayoNo ratings yet

- 4.3.2 Compound Interest ExamplesDocument11 pages4.3.2 Compound Interest ExamplesTin LauguicoNo ratings yet

- MP2 Dividend CalculatorDocument4 pagesMP2 Dividend Calculatormark.j.c.balinesNo ratings yet

- Personal Loan EMI CalculatorDocument2 pagesPersonal Loan EMI Calculatorgr8chandru100% (1)

- Rental Agreement - RathiDocument3 pagesRental Agreement - RathirelijavNo ratings yet

- True or FalseDocument76 pagesTrue or FalsepangytpangytNo ratings yet

- Employee Related LiabilitiesDocument12 pagesEmployee Related Liabilitiesraymondgunawan37No ratings yet

- 2nd QTR Mastery Assessment 2021Document3 pages2nd QTR Mastery Assessment 2021Farcipanie PerezNo ratings yet