0 ratings0% found this document useful (0 votes)

140 viewsPANform PDF

PANform PDF

Uploaded by

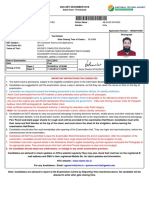

sagar Kumar1. The document is a PAN application acknowledgment receipt for an individual named Heena with application number U-A058998589.

2. It provides details of Heena such as date of birth, father's name, Aadhaar number, contact details, address and the documents submitted as proof of identity, address and date of birth.

3. The receipt acknowledges receipt of Rs. 107 for the application on August 31st, 2022 and provides a payment reference number and details on how Heena can check the status of her application online.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

PANform PDF

PANform PDF

Uploaded by

sagar Kumar0 ratings0% found this document useful (0 votes)

140 views1 page1. The document is a PAN application acknowledgment receipt for an individual named Heena with application number U-A058998589.

2. It provides details of Heena such as date of birth, father's name, Aadhaar number, contact details, address and the documents submitted as proof of identity, address and date of birth.

3. The receipt acknowledges receipt of Rs. 107 for the application on August 31st, 2022 and provides a payment reference number and details on how Heena can check the status of her application online.

Original Title

PANform.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

1. The document is a PAN application acknowledgment receipt for an individual named Heena with application number U-A058998589.

2. It provides details of Heena such as date of birth, father's name, Aadhaar number, contact details, address and the documents submitted as proof of identity, address and date of birth.

3. The receipt acknowledges receipt of Rs. 107 for the application on August 31st, 2022 and provides a payment reference number and details on how Heena can check the status of her application online.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

140 views1 pagePANform PDF

PANform PDF

Uploaded by

sagar Kumar1. The document is a PAN application acknowledgment receipt for an individual named Heena with application number U-A058998589.

2. It provides details of Heena such as date of birth, father's name, Aadhaar number, contact details, address and the documents submitted as proof of identity, address and date of birth.

3. The receipt acknowledges receipt of Rs. 107 for the application on August 31st, 2022 and provides a payment reference number and details on how Heena can check the status of her application online.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

8/31/22, 2:19 PM PANform

Form 49A

Under section 139A of the Income-Tax Act, 1961

PAN Application Acknowledgment Receipt For Form 49A

( Physical Application

)

Received Rs. 107.00/-

(incl of

SMT HEENA

taxes) from

Application No./Coupon No. U-A058998589

Name to be printed on PAN card HEENA

Gender FEMALE

Date of Birth/Incorporation 01/01/1997

Father's Name MOHD ALI

Aadhaar Number/EID Number xxxx-xxxx-6757 (MENTIONED, MATCHED)*

Name as per Aadhaar HEENA

Applicant's Contact details 8439577702 / sagat56780@GMAIL.COM

Communication Address RESIDENCE

Residence State UTTAR PRADESH

Proof of Identity AADHAAR Card issued by UIDAI (In Copy)

Proof of Address AADHAAR Card issued by UIDAI (In Copy)

Proof of DOB AADHAAR Card issued by UIDAI (In Copy)

Date of Receipt 31/08/2022 02:11:32

Mode of Pancard Both physical PAN and e-PAN Card

Payment Ref No 61322231085914128298 / PY0079324060

Payment Date 31/08/2022 02:12:59

*AADHAAR MATCHED USING DEMOGRAPHIC DETAILS - WILL BE LINKED WITH PAN.

PAN Service Center Code 779099 SAGAR KUMAR

PAN Service Center Name (Sign/Stamp)

SAGAR KUMAR Received for submission to UTIITSL

Centre Contact Details:

SAGAT56780@GMAIL.COM

/8430296626

To know your PAN

Application status, you may visit our website: https://www.utiitsl.com.

As per instruction from Income Tax Department, an authorized agency's agent may visit you

for your identity and address

verification as per the documents submitted by you with the PAN application form. You are requested to ask authorization

letter/ID card from the agent before verification.Your cooperation is solicited in this regard.

Download PDF Form

Print Close

https://www.myutiitsl.com/PANform/forms/pan.html/redirectSuccess 1/1

You might also like

- Death CertificateDocument1 pageDeath CertificateMai AbdelgelilNo ratings yet

- E Ticket ReceiptDocument3 pagesE Ticket ReceiptNEERUNo ratings yet

- WWW - Luonline.in Newform Exam Form With PreviousDetails - Aspx PDFDocument1 pageWWW - Luonline.in Newform Exam Form With PreviousDetails - Aspx PDFAman VermaNo ratings yet

- Emudhra Limited: One Year - Unlimited SigningDocument1 pageEmudhra Limited: One Year - Unlimited SigningNivash KrishnanNo ratings yet

- PAN Application Acknowledgment Receipt For Form 49A (Physical Application)Document1 pagePAN Application Acknowledgment Receipt For Form 49A (Physical Application)S CYBER CAFENo ratings yet

- PAN Application Acknowledgment Receipt For Form 49A (Physical Application)Document1 pagePAN Application Acknowledgment Receipt For Form 49A (Physical Application)Shamshavali ButaladinniNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Himanshu JainNo ratings yet

- Print PDFDocument2 pagesPrint PDFAmit SanjanaNo ratings yet

- Acknowledgement 1572947362960Document3 pagesAcknowledgement 1572947362960grand physicist100% (1)

- Gail SF s5Document6 pagesGail SF s5sunny KumarNo ratings yet

- Rtps-Reesa 2023 93322 PDFDocument2 pagesRtps-Reesa 2023 93322 PDFSakhil AhesanNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Arvind MiraseNo ratings yet

- Aadhaar FormDocument3 pagesAadhaar FormNABIN DEURINo ratings yet

- Graduate Pharmacy Aptitude TestDocument1 pageGraduate Pharmacy Aptitude TestKumar LuckyNo ratings yet

- Od126520774203945000 1 PDFDocument2 pagesOd126520774203945000 1 PDFMuthukumaresan ANo ratings yet

- 114 WPIF-MO-01 VGG Application FormDocument6 pages114 WPIF-MO-01 VGG Application FormJithu RajNo ratings yet

- Sta. Cruz Elementary SchoolDocument1 pageSta. Cruz Elementary SchoolLourence Jay EvioNo ratings yet

- StatementDocument4 pagesStatementSUBHAM CHAKRABORTYNo ratings yet

- Acknowledgement 1691049985290Document4 pagesAcknowledgement 1691049985290JHARNA DASNo ratings yet

- Ranjodh SinghDocument2 pagesRanjodh Singhranjodh singhNo ratings yet

- AdmitCard 180520418581Document1 pageAdmitCard 180520418581Rather AarifNo ratings yet

- Leave Revised FloricelDocument2 pagesLeave Revised FloricelLJ AggabaoNo ratings yet

- Mrunal PDFDocument4 pagesMrunal PDFPrajwal LanjewarNo ratings yet

- VTU ResultDocument1 pageVTU Resultwaqar sarwarNo ratings yet

- CBSE NET ApplicationDocument1 pageCBSE NET ApplicationRidan DasNo ratings yet

- Arun ResumeDocument2 pagesArun ResumevigneshNo ratings yet

- View PDFServletDocument1 pageView PDFServletDevansh MishraNo ratings yet

- Click Here To Print LogoutDocument1 pageClick Here To Print LogoutAyush swainNo ratings yet

- .NP 2077 Result With MarksheetDocument2 pages.NP 2077 Result With MarksheetSAMIM ANSARI0% (1)

- िवदेश मं ालय भारत सरकार Ministry of External Affairs Government of India Online Appointment ReceiptDocument2 pagesिवदेश मं ालय भारत सरकार Ministry of External Affairs Government of India Online Appointment ReceiptmalkeetNo ratings yet

- Digital Customer Copy: I Confirm ThatDocument2 pagesDigital Customer Copy: I Confirm ThatTarun KumarNo ratings yet

- Examination Hall Ticket PDFDocument2 pagesExamination Hall Ticket PDFZunaid PathanNo ratings yet

- Invoice 1Document1 pageInvoice 1Anupam PriyamNo ratings yet

- April Elect Bill PDFDocument1 pageApril Elect Bill PDFAbhijitNo ratings yet

- Personal Data SheetDocument12 pagesPersonal Data Sheetdarwin dela cruzNo ratings yet

- Engineering Services (Main) Examination, 2019: Union Public Service Commission Detailed Application FormDocument5 pagesEngineering Services (Main) Examination, 2019: Union Public Service Commission Detailed Application FormVivekMishraNo ratings yet

- HP 15q APU Dual Core E2 - (4 GB/1 TB HDD/Windows 10 Home) 15q-by010AU LaptopDocument1 pageHP 15q APU Dual Core E2 - (4 GB/1 TB HDD/Windows 10 Home) 15q-by010AU LaptopvscomputersNo ratings yet

- Tax Invoice: Vijaya Indane Gas AGENCY (0000125369)Document2 pagesTax Invoice: Vijaya Indane Gas AGENCY (0000125369)Venkat DaimondNo ratings yet

- West Bengal Joint Entrance Examinations Board WBJEE-2018 Admit CardDocument1 pageWest Bengal Joint Entrance Examinations Board WBJEE-2018 Admit CardTanmoy GhoshNo ratings yet

- Prefix First Name Middle Name Last NameDocument6 pagesPrefix First Name Middle Name Last NameMad AnshumanNo ratings yet

- Statement of Account - 18 - 03 - 14 PDFDocument2 pagesStatement of Account - 18 - 03 - 14 PDFShantesh AroraNo ratings yet

- OJEE2019C AdmitCardDocument1 pageOJEE2019C AdmitCardAswini Kumar PaloNo ratings yet

- Online Form: The Institute of Chartered Accountants of India Final Examination - November 2015Document4 pagesOnline Form: The Institute of Chartered Accountants of India Final Examination - November 2015Akash SrivastavaNo ratings yet

- Commercial Invoice: Tape Drive FailedDocument1 pageCommercial Invoice: Tape Drive FailedKhang DươngNo ratings yet

- Student ResultDocument4 pagesStudent ResultRakesh MauryaNo ratings yet

- Letter of Credit Bank Specific !Document17 pagesLetter of Credit Bank Specific !JOEMEETSMONUNo ratings yet

- Msu PDFDocument2 pagesMsu PDFTaarak Mehta Ka Ooltah ChashmahNo ratings yet

- Summary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377Document4 pagesSummary of Current Charges Amount (RS.) : Bill Enquiries: 3033 7777 or 377rahuljaiswal20097313No ratings yet

- EMS ResultDocument1 pageEMS ResultRitvikNo ratings yet

- Pramit Appointment RecieptDocument3 pagesPramit Appointment RecieptPramit SaranNo ratings yet

- FormDocument4 pagesFormShehRoxe MubarikNo ratings yet

- Appointment Preparation of SlsDocument4 pagesAppointment Preparation of SlsSai CharanNo ratings yet

- British CouponDocument45 pagesBritish CouponKakouris AndreasNo ratings yet

- Print PDFDocument1 pagePrint PDFArjun KohliNo ratings yet

- Telangana State Power Generation Corporation LTD Bhadradri Thermal Power Project: ManuguruDocument1 pageTelangana State Power Generation Corporation LTD Bhadradri Thermal Power Project: ManuguruSuresh DoosaNo ratings yet

- Rashtriya Madhyamik Shiksha Abhiyan Recruitment For Ap-Model SchoolsDocument2 pagesRashtriya Madhyamik Shiksha Abhiyan Recruitment For Ap-Model SchoolsrasweetNo ratings yet

- Loan Account Statement For LACHD00039394344Document4 pagesLoan Account Statement For LACHD00039394344abhishek parasarNo ratings yet

- Federal University of Technology, Owerri: Student Payment ReceiptDocument1 pageFederal University of Technology, Owerri: Student Payment ReceiptOkoronkwo AugustineNo ratings yet

- Form 2Document1 pageForm 2Ganesh DasaraNo ratings yet

- PANformDocument1 pagePANformTech PointNo ratings yet