32877310-Pdm Med Ext Offer

32877310-Pdm Med Ext Offer

Uploaded by

Shermin NgCopyright:

Available Formats

32877310-Pdm Med Ext Offer

32877310-Pdm Med Ext Offer

Uploaded by

Shermin NgCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

32877310-Pdm Med Ext Offer

32877310-Pdm Med Ext Offer

Uploaded by

Shermin NgCopyright:

Available Formats

Dear Valued Policyholder,

Thank you for choosing Prudential as your preferred insurer. At Prudential, we are committed to providing

you with financial freedom and peace of mind with the necessary coverage to better suit your protection

needs.

We are excited to announce the launch of Medical Extension Campaign! This campaign is offered to our loyal

customers and is in line with our continuous efforts to ensure that your medical protection is taken care of.

Under this campaign, we will be extending your medical plan expiry date with no question asked. All you need

to do is return the duly completed Medical Extension Campaign Reply Slip before 31-05-2022. Please check

out the attached letter for more details.

Thank you for your support and trust in Prudential. We remain committed to serving your long-term

protection needs to help you get the most out of life.

Prudential Assurance Malaysia Berhad 198301012262 (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala Lumpur,

Malaysia. P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778 3888 www.prudential.com.my

Customer Service Tel (603) 2771 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

P1_C1 Page 1 of 4

TAN PEI YOONG

NO 9 JALAN 2/38H

TAMAN SRI BINTANG

52100 KUALA LUMPUR

MALAYSIA

Date : 20-01-2022 Restricted

Ref : ILPSPDM_0001_001

Dear Sir/Madam,

Policy Number : 32877310

Assured : TAN PEI YOONG

Life Assured : TAN PEI YOONG

Subject : Medical Extension Campaign

In line with our continuous effort to ensure that your medical protection is taken care of, we are pleased to

offer you the option to extend the expiry date of your PRUHealth benefit to the policy anniversary when the

Life Assured attains age next birthday of 100, or the expiry date of the Death Benefit as specified in Schedule 2

of your Policy, whichever is earlier (“extended expiry date”), with no further underwriting. This offer includes

your existing sub-rider(s) of PRUHealth, if any.

If you decide to accept this offer, any loading and exclusion terms that currently apply to your PRUHealth

benefit and its sub-rider(s) (“Medical Plan”) will also continue to apply until the extended expiry date, except

when your Policy specifies an earlier end date for the loading or exclusion terms. As for insurance charges that

apply to your Medical Plan, you can refer to the attached Appendix: PRUHealth for Projected Insurance

Charges for details on the projected annual insurance charges until age next birthday of 100. You will continue

paying the amount of premium as mentioned currently in your Policy, till the end of its premium payment

term/ period.

As this is an investment-linked plan, do ensure that there are sufficient units for us to deduct for the insurance

charges and other charges. You may increase the units in your policy either by adding a regular investment

rider with additional premium amount or performing a single premium top-up to your Policy.

We wish to advise you that by extending the expiry date of your Medical Plan, it will reduce the expected

duration of your insurance coverage, as shown in the next paragraph. This is because the relevant charges,

fees and taxes will continue to be deducted from your policy account throughout the Policy Term as long as

the policy is in force.

*Based on sustainability evaluation as at 14-01-2022, your Policy is projected to sustain until 84 age next

birthday as long as your Policy remains in force and assuming future premiums due are paid on time,

investment-linked funds are earning the expected return, and bonuses / rewards (if applicable) are credited to

your Policy in full.

To restore the policy sustainability to its Policy Term (after this extension), we recommend you taking one of

the following actions:

Options Amount (RM) Allocation Rate1 (%) Commission Rate2 (%)

Regular Premium Top-up 56.00 Monthly 95.00 3.00

Single Premium Top-up 9,123.00 95.00 3.00

The additional Regular Premium or Single Premium Top-Up amount recommended (if any) is in addition to

your instalment premium after this extension takes effect. Subject to your Policy, you may be required to

increase the amount of benefit for the Payor rider (if any) upon increased in Regular Premium Top-Up and

may be subject to underwriting.

If you are keen to accept this offer, kindly respond to us by returning the reply slip as attached before

31-05-2022. You may consult your Prudential Wealth Planner or Bank Representative, CHONG FUI FAN at

0178836483 for more information.

Prudential Assurance Malaysia Berhad 198301012262 (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala Lumpur,

Malaysia. P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778 3888 www.prudential.com.my

Customer Service Tel (603) 2771 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

P1_C1 Page 2 of 4

Kindly ignore this letter if your Medical Plan is lapsed or cancelled. Should you require further clarification,

please contact our Customer Service Representatives at this dedicated phone number 03-2771 2450.

Once again, thank you for your support and trust in Prudential. We look forward to continuing to serve you in

the future.

Yours sincerely,

Eric Wong Wai Yuen

Chief Customer and Marketing Officer

Prudential Assurance Malaysia Berhad

c.c. : PB100004 CHONG FUI FAN

15TH FLR, DAMANSARA INTAN

Note: The content of this offer letter does not consider any alteration made to this policy after 14-01-2022.

Important Notes:

*Please note that the sustainability of the Policy might vary depending on factors such as actual investment return, premium payments

(if any), actual crediting of bonuses / rewards (if applicable) and alterations to your Policy (if any). As such, we recommend regular policy

reviews to be conducted to ensure your coverage remains effective. Please refer to the policy contract for more details.

1

Allocation Rate: Percentage of premium used to purchase units in the fund(s).

2

Commission Rate: Percentage of premium that will be paid to the sales representative.

51201061

Prudential Assurance Malaysia Berhad 198301012262 (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala Lumpur,

Malaysia. P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778 3888 www.prudential.com.my

Customer Service Tel (603) 2771 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

P1_C1 Page 3 of 4

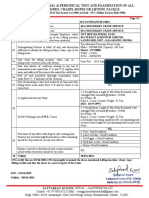

Summary of Projected Insurance Charges of PRUHealth / Ringkasan Unjuran Caj Insurans untuk PRUHealth

The annual Insurance Charges (COI) of PRUHealth stated below are only applicable to Occupational Class 1 & 2.

The COI of Occupational Class 3 & 4 are 1.25 & 1.5 times the COI for Occupation Class 1 & 2.

With coinsurance

ANB PRUHealth 100 PRUHealth 150 PRUHealth 200 PRUHealth 300 PRUHealth 400

Male Female Male Female Male Female Male Female Male Female

70 4,219 3,330 4,709 3,745 5,315 4,168 7,109 5,610 9,236 7,380

71 4,505 3,552 5,074 4,031 5,718 4,490 7,780 6,137 10,116 8,051

72 4,795 3,777 5,442 4,320 6,124 4,814 8,457 6,669 11,006 8,729

73 5,087 4,003 5,813 4,612 6,533 5,140 9,139 7,204 11,902 9,411

74 5,381 4,232 6,187 4,905 6,943 5,465 9,823 7,740 12,803 10,096

75 5,677 4,461 6,563 5,199 7,351 5,789 10,508 8,273 13,706 10,779

76 5,950 4,684 6,875 5,451 7,705 6,074 11,021 8,683 14,399 11,323

77 6,226 4,910 7,191 5,705 8,059 6,359 11,535 9,090 15,095 11,867

78 6,507 5,140 7,511 5,962 8,415 6,644 12,053 9,498 15,798 12,415

79 6,795 5,376 7,840 6,226 8,781 6,937 12,585 9,919 16,521 12,979

80 7,094 5,621 8,182 6,502 9,168 7,249 13,147 10,366 17,279 13,574

81 7,405 5,877 8,540 6,793 9,581 7,586 13,746 10,848 18,082 14,210

82 7,727 6,142 8,912 7,096 10,015 7,942 14,375 11,358 18,920 14,878

83 8,057 6,414 9,294 7,407 10,461 8,309 15,022 11,882 19,781 15,566

84 8,394 6,692 9,684 7,725 10,918 8,684 15,683 12,419 20,661 16,268

85 8,737 6,976 10,081 8,049 11,383 9,067 16,358 12,966 21,559 16,985

86 9,111 7,282 10,513 8,402 11,871 9,465 17,058 13,535 22,482 17,731

87 9,491 7,592 10,951 8,760 12,365 9,868 17,768 14,112 23,418 18,486

88 9,875 7,906 11,394 9,122 12,865 10,276 18,487 14,694 24,367 19,250

89 10,263 8,222 11,842 9,487 13,372 10,688 19,215 15,283 25,326 20,021

90 10,656 8,542 12,296 9,856 13,884 11,103 19,951 15,877 26,295 20,799

91 11,053 8,864 12,753 10,228 14,400 11,521 20,693 16,476 27,273 21,583

92 11,453 9,188 13,215 10,602 14,921 11,943 21,442 17,078 28,260 22,372

93 11,856 9,514 13,680 10,978 15,446 12,366 22,196 17,684 29,255 23,166

94 12,261 9,841 14,148 11,355 15,975 12,792 22,956 18,292 30,255 23,963

95 12,669 10,170 14,618 11,734 16,506 13,219 23,719 18,902 31,262 24,762

96 13,079 10,499 15,091 12,114 17,040 13,646 24,486 19,514 32,273 25,564

97 13,490 10,829 15,566 12,494 17,576 14,075 25,256 20,127 33,288 26,366

98 13,903 11,158 16,042 12,875 18,113 14,503 26,029 20,740 34,306 27,169

99 14,316 11,488 16,519 13,255 18,652 14,932 26,803 21,353 35,326 27,972

100 14,730 11,817 16,996 13,635 19,191 15,360 27,578 21,964 36,347 28,773

Note / Nota:

1. The projected Insurance Charges shown above are based on our current scales of charges and we shall deduct them from your Policy in future when the Life Assured reaches that

age on the Life Assured’s next birthday, until the expiry of this benefit. / Caj Insurans yang diunjurkan di atas adalah berdasarkan pada skala caj semasa kami dan akan ditolak

daripada Polisi anda pada masa hadapan apabila Hayat Yang Diinsuranskan mencapai umur tersebut pada hari jadi Hayat Yang Diinsuranskan yang akan datang, sehingga

tamat tempoh manfaat.

2. These rates are annual rates and based on standard risk (“Annual Insurance Rate”). We will deduct Insurance Charges, amongst others based on any underwriting-based loading

imposed for sub-standard risk. / Kadar-kadar ini adalah kadar tahunan dan berdasarkan risiko standard (“Kadar Tahunan Insurans”). Kami akan menolak Caj Insurans, antara

lain berdasarkan sebarang loading tambahan yang dikenakan mengikut dasar pengunderaitan untuk risiko sub-standard.

Prudential Assurance Malaysia Berhad (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala Lumpur, Malaysia. P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778

3888 www.prudential.com.my

Customer Service Tel (603) 2116 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

You might also like

- Structural Analysis & Design of 2 Storey Residential BuildingDocument104 pagesStructural Analysis & Design of 2 Storey Residential BuildingForceNo ratings yet

- Lesson 4 Mastering Technical Analysis: by Adam KhooDocument57 pagesLesson 4 Mastering Technical Analysis: by Adam Khoosesilya 14No ratings yet

- AIA BHD Brochure Protection Whole Life Plus Non ParDocument18 pagesAIA BHD Brochure Protection Whole Life Plus Non ParbelrayNo ratings yet

- 35183192-Pdm Med Ext OfferDocument4 pages35183192-Pdm Med Ext OfferNg Siaw LanNo ratings yet

- Takaful Myclick MediCare PDS - v10Document5 pagesTakaful Myclick MediCare PDS - v10Wan RuschdeyNo ratings yet

- Medical Repricing RevisionDocument6 pagesMedical Repricing RevisionSarveshrau SarveshNo ratings yet

- ITGI Critical Illness Benefit ProspectusDocument4 pagesITGI Critical Illness Benefit ProspectusMagix MoviesNo ratings yet

- HDFC Life Crest IllustrationDocument0 pagesHDFC Life Crest IllustrationAnkur SrivastavNo ratings yet

- TATA Medicare 997f212ecbDocument8 pagesTATA Medicare 997f212ecbetyala maniNo ratings yet

- Seasons 100 ProposalDocument3 pagesSeasons 100 ProposalAlvin Dela Cruz100% (1)

- HDFC Life ProGrowth Plus IllustrationDocument3 pagesHDFC Life ProGrowth Plus IllustrationSrikanth DornaluNo ratings yet

- NMP Rate Chart - 0Document1 pageNMP Rate Chart - 0abhishek basakNo ratings yet

- Combination of Umang & AnandDocument3 pagesCombination of Umang & AnandsatyakamNo ratings yet

- HLM Takaful I-Hospital Care A5 Brochure - V3 - 020524 R1 FA ENG WebDocument5 pagesHLM Takaful I-Hospital Care A5 Brochure - V3 - 020524 R1 FA ENG Websharifa08No ratings yet

- Sales IllustrationDocument8 pagesSales IllustrationmymiserabledaysNo ratings yet

- Tata Aig Mediprime Insurance BrochureDocument2 pagesTata Aig Mediprime Insurance Brochurerehmy082No ratings yet

- RkriDocument19 pagesRkriKalai Vani KarthiNo ratings yet

- National Insurance Company Limited: N A T I o N A L M e D I C L A I M P o L I C yDocument1 pageNational Insurance Company Limited: N A T I o N A L M e D I C L A I M P o L I C ySIMON DSOUZANo ratings yet

- Invest MaximiserDocument301 pagesInvest MaximiseradarshsinghNo ratings yet

- Prominence Max - Peso Global Technology FundDocument2 pagesProminence Max - Peso Global Technology FundDarrenfel SantizoNo ratings yet

- Corona Kavach Policy-Oriental Insurance - Rate Chart - RRDocument2 pagesCorona Kavach Policy-Oriental Insurance - Rate Chart - RRNagaraj BVNo ratings yet

- Sales Brochure 91Document3 pagesSales Brochure 91prudhvi rajNo ratings yet

- Institute of Actuaries of India: ExaminationsDocument6 pagesInstitute of Actuaries of India: ExaminationsWilson ManyongaNo ratings yet

- ican-brochureDocument16 pagesican-brochureakhil kwatraNo ratings yet

- MoneyWorks Proposal38yoDocument5 pagesMoneyWorks Proposal38yoMorg ActusNo ratings yet

- Policy ScheduleDocument7 pagesPolicy SchedulerajaNo ratings yet

- Arogya Sanjeevni Policy 1 PDFDocument9 pagesArogya Sanjeevni Policy 1 PDFkrishna-almightyNo ratings yet

- Conrad R. Quebral Prosperity TreeDocument10 pagesConrad R. Quebral Prosperity TreeLuis C DauigoyNo ratings yet

- Today's Equity Market Report and Equity Tips 15 MayDocument7 pagesToday's Equity Market Report and Equity Tips 15 MayTheequicom AdvisoryNo ratings yet

- QuotationPDF (1)Document2 pagesQuotationPDF (1)sunethrahettigoda07No ratings yet

- Servicereport - 2024-12-18T181427.970Document3 pagesServicereport - 2024-12-18T181427.970hargopalyadav111No ratings yet

- Group Medical Insurance ICICI LombardDocument1 pageGroup Medical Insurance ICICI LombardgeethamruthaNo ratings yet

- HDFC Life YoungStar Super Premium (SPL) IllustrationDocument0 pagesHDFC Life YoungStar Super Premium (SPL) IllustrationAnkur MittalNo ratings yet

- New India Floater Mediclaim Policy Premium ChartDocument2 pagesNew India Floater Mediclaim Policy Premium ChartSnehaAnilSurveNo ratings yet

- Policy OwnerDocument4 pagesPolicy OwnerRichard GuillermoNo ratings yet

- Dividend Yield Stock 231213Document2 pagesDividend Yield Stock 231213Shaikh Abdur RahmanNo ratings yet

- FinalPremiumNewIndiaMediclaimPolicy(NIAHLIP23187V052223)Document2 pagesFinalPremiumNewIndiaMediclaimPolicy(NIAHLIP23187V052223)sohelmukadam023No ratings yet

- New India Floater Mediclaim Policy Premium ChartDocument1 pageNew India Floater Mediclaim Policy Premium Chartmandarkolhe9No ratings yet

- Prudential BSN Takaful Berhad Investment-Linked Plan IllustrationDocument19 pagesPrudential BSN Takaful Berhad Investment-Linked Plan IllustrationhilmiyaidinNo ratings yet

- SGHI Revised Premium CircularDocument11 pagesSGHI Revised Premium CircularsuryamuruganomNo ratings yet

- HDFC Life Sampoorn Samridhi Insurance Plan (SPL) IllustrationDocument0 pagesHDFC Life Sampoorn Samridhi Insurance Plan (SPL) IllustrationAakash MazumderNo ratings yet

- Corona Kavach Policy Premium Rate Tables Excl. GSTDocument2 pagesCorona Kavach Policy Premium Rate Tables Excl. GSTPustak BhandarNo ratings yet

- Ma 9354Document5 pagesMa 9354Sachin ShendeNo ratings yet

- Daily News Letter 06sep2012Document7 pagesDaily News Letter 06sep2012Theequicom AdvisoryNo ratings yet

- QuotationPDF (35)Document3 pagesQuotationPDF (35)sunethrahettigoda07No ratings yet

- Daily News Letter 27aug2012Document7 pagesDaily News Letter 27aug2012mishramahi02No ratings yet

- Century Plus Brochure 2022Document14 pagesCentury Plus Brochure 2022Shirish UmadiNo ratings yet

- AIG Insurance Policy 2023Document25 pagesAIG Insurance Policy 2023Ismail bin SuarnoNo ratings yet

- Portfolio Review Genus: Alternative To Ultra-Short Duration FundsDocument8 pagesPortfolio Review Genus: Alternative To Ultra-Short Duration FundsspeedenquiryNo ratings yet

- Illustration PDFDocument3 pagesIllustration PDFrahulNo ratings yet

- Daily Technical Analysis For Equity Market For 28 MayDocument7 pagesDaily Technical Analysis For Equity Market For 28 MayTheequicom AdvisoryNo ratings yet

- JuanDelaCruz AxeleratorDocument8 pagesJuanDelaCruz AxeleratorOmar Jayson Siao VallejeraNo ratings yet

- Equity Market Analysis or Levels On 23th AugustDocument7 pagesEquity Market Analysis or Levels On 23th AugustTheequicom AdvisoryNo ratings yet

- Pension PlusDocument3 pagesPension PlusDhaval KotakNo ratings yet

- Policy DocDocument4 pagesPolicy DocsrisaravananNo ratings yet

- IM - Cogent HRDocument14 pagesIM - Cogent HRAaron WilsonNo ratings yet

- Daily News Letter 04sep2012Document7 pagesDaily News Letter 04sep2012Theequicom AdvisoryNo ratings yet

- Corona Kavach - BrochureDocument2 pagesCorona Kavach - BrochurekouijNo ratings yet

- R10 - Medicare Premier Development - E-Brochure - 02 - 13-02-23Document10 pagesR10 - Medicare Premier Development - E-Brochure - 02 - 13-02-23Nirranjan JNo ratings yet

- Pt. Ratu Banua Jaya Perumahan Ratu Mas Pinang Awan - Dusun Menanti, Pinang Awan Kec. Torgamba LabuselDocument2 pagesPt. Ratu Banua Jaya Perumahan Ratu Mas Pinang Awan - Dusun Menanti, Pinang Awan Kec. Torgamba LabuselMuhammad Soleh SahnanNo ratings yet

- Arogya Sanjeevani - Premium Chart Excl. GSTDocument5 pagesArogya Sanjeevani - Premium Chart Excl. GSTsonNo ratings yet

- A Investment Platform for Future: Self Help a Self Operating BankingFrom EverandA Investment Platform for Future: Self Help a Self Operating BankingNo ratings yet

- Furniture - Office Desks Tables - CIDER LA MANUFACTURE - Delta Slim Incline BenchDocument28 pagesFurniture - Office Desks Tables - CIDER LA MANUFACTURE - Delta Slim Incline BenchOmar AmirNo ratings yet

- BookingReceipt S9NXCMDocument2 pagesBookingReceipt S9NXCMRayo muñañyoNo ratings yet

- Tutorial Sheet 2Document4 pagesTutorial Sheet 2Cantona HimanNo ratings yet

- Doh DC 2018-0288Document8 pagesDoh DC 2018-0288MenGuitarNo ratings yet

- Zoomlion 80 Ton - 011Document2 pagesZoomlion 80 Ton - 011Susil Kumar SahooNo ratings yet

- The Archaeology and History of The Carpi From The Second To The Fourth Century A.DDocument416 pagesThe Archaeology and History of The Carpi From The Second To The Fourth Century A.DMiglactapazaNo ratings yet

- Siemens Limited Announces Q1 FY 2022 ResultsDocument2 pagesSiemens Limited Announces Q1 FY 2022 ResultsMAHESH VALANo ratings yet

- Time Series AnalysisDocument16 pagesTime Series AnalysiszulfadlyNo ratings yet

- Food Cost FNB IndustryDocument6 pagesFood Cost FNB IndustryNicholas SeanNo ratings yet

- A7 INGOT BUYER ~ 20.07.2024 pdf. MİX MT X 12 MONTH (1)Document5 pagesA7 INGOT BUYER ~ 20.07.2024 pdf. MİX MT X 12 MONTH (1)duzelbay.kNo ratings yet

- 33 FCC 941Document7 pages33 FCC 941Sammy DeeNo ratings yet

- Ecn Yr. 10 MDTDocument3 pagesEcn Yr. 10 MDTOluwatobi AkindeNo ratings yet

- Part 2 - Chapter 6 - Future Worth AnalysisDocument17 pagesPart 2 - Chapter 6 - Future Worth AnalysisCharbel YounesNo ratings yet

- Your Texas Exes - University of Texas Adv Tiered Interest CHKGDocument12 pagesYour Texas Exes - University of Texas Adv Tiered Interest CHKGblon majors0% (1)

- The Project For Comprehensive Urban Transport Plan in Phnom Penh Capital City (Pputmp)Document151 pagesThe Project For Comprehensive Urban Transport Plan in Phnom Penh Capital City (Pputmp)TomatoNo ratings yet

- Laibson D. and List, J.A. (2015) Principles of Behavioral EconomicsDocument7 pagesLaibson D. and List, J.A. (2015) Principles of Behavioral EconomicsPaula RodriguezNo ratings yet

- Basic MathsDocument7 pagesBasic MathsMadhurNo ratings yet

- Report On Safety ShoeDocument12 pagesReport On Safety ShoeKabirNo ratings yet

- Review Exercise 3 2022 Menu Engineering SOLUTIONDocument6 pagesReview Exercise 3 2022 Menu Engineering SOLUTIONMilena Nogales RuedaNo ratings yet

- Tax Invoice: Swetha Dweepa Gas SERVICE (0000125391)Document2 pagesTax Invoice: Swetha Dweepa Gas SERVICE (0000125391)JBmohanNo ratings yet

- ACBP5122 Introduction 2022Document9 pagesACBP5122 Introduction 2022Shweta SinghNo ratings yet

- Intermediate Accounting 11th Edition Nikolai Test Bank PDF Download Full Book with All ChaptersDocument41 pagesIntermediate Accounting 11th Edition Nikolai Test Bank PDF Download Full Book with All Chaptersanrindreja22100% (1)

- Infrastructure Financial ManagementDocument56 pagesInfrastructure Financial ManagementMahmoud AhmedNo ratings yet

- Pengaruh Gaya Kepemimpinan Dan Motivasi Kerja Terhadap Kinerja DosenDocument10 pagesPengaruh Gaya Kepemimpinan Dan Motivasi Kerja Terhadap Kinerja DosenMUKRODI UNPAMNo ratings yet

- NSDL Conversion Request FormDocument1 pageNSDL Conversion Request FormDream11 TeamNo ratings yet

- Activated Carbon Charcoal - COADocument1 pageActivated Carbon Charcoal - COAsales.zestkenfoodsNo ratings yet

- The Effect of Remittance On Economic Growth of Ethiopia: A Time Series AnalysisDocument110 pagesThe Effect of Remittance On Economic Growth of Ethiopia: A Time Series AnalysisyohannisNo ratings yet

- Lesson 3 Economic ProblemDocument9 pagesLesson 3 Economic ProblemAbenir Aaron PaulNo ratings yet