Discounted Cash Flow Model For Dam Phu My: Asset Beta A Equity Beta E

Discounted Cash Flow Model For Dam Phu My: Asset Beta A Equity Beta E

Uploaded by

Phan GiápCopyright:

Available Formats

Discounted Cash Flow Model For Dam Phu My: Asset Beta A Equity Beta E

Discounted Cash Flow Model For Dam Phu My: Asset Beta A Equity Beta E

Uploaded by

Phan GiápOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Discounted Cash Flow Model For Dam Phu My: Asset Beta A Equity Beta E

Discounted Cash Flow Model For Dam Phu My: Asset Beta A Equity Beta E

Uploaded by

Phan GiápCopyright:

Available Formats

Discounted Cash Flow Model for Dam Phu My

Unlevered beta = Asset beta = Equity beta * E/A + Debt beta *D/A

General data

(debt beta is assumed to be 0)

Share price as of last close 32.250,00 --> Asset beta = Equity beta*E/A OR Asset beta*A = Equity beta*E

Latest closing share price date 02/06/2023 With A = E+D*(1-t)

Latest basic share count 391.334.260,000

--> Asset beta = Equity beta*E/(E+D*(1-t))

Case Base case

--> Asset beta = Equity beta*1/(1+(D/E)*(1-t))

Industry average Beta calculation

Observed b Share price Share count Market cap Debt Tax rate Unlev. b Relev. b

DCM 0,99 23.550,00 529.400.000,0 12.467.370.000.000 3.760.418.031.622 20,0% 0,80 0,96

LAS 1,41 10.100,00 112.856.400,0 1.139.849.640.000 594.910.708.655 20,0% 0,99 1,10

DPM 0,63 32.250,00 391.334.260,0 12.620.529.885.000 3.097.689.072.508 20,0% 0,53 0,92

Average Releverage Beta 0,78 Industry average unlevered beta 0,77

CAPM (Capital Asset Pricing Model): Cost of equity kE=Rf+beta*ERP with ERP=Equity Risk Premium=(RM-Rf+CRP) with CRP=Sovereign spr* Multiplier

Cost of equity Calculating ERP for Vietnam, using Damodaran's data & approach:

Observed beta 0,63 Multiplier 3,28

Select beta (observed or industry) Average Equity Risk Premium (RM-Rf) of US 5,9%

Beta selected 0,78 Method 1 Method 2

Risk-Free Rate (Rf) (US) 3,76% Sovereign spread 2,20% 3,13%

Equity Risk Premium 14,69% CRP (Equity Country Risk Premium) 7,22% 10,28%

Cost of equity 15,18% ERP (Equity risk premium) for Vietnam 13,16% 16,22%

ERP average for Vietnam 14,69%

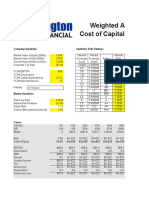

WACC (Weighted Average Cost of Capital): WACC = kE* E/V + kD* (1-t)*D/V

Cost of capital Capital structure

Cost of debt before tax 12,0% Share price as of last close 32.250,00

Tax rate 20,0% Latest basic share count 391.334.260,00 %

Cost of debt after tax 9,6% Market value of equity 12.620.529.885.000 80,3%

Cost of capital (WACC) 14,1% Debt 3.097.689.072.508 19,7%

FCFF=CFO+Int*(1-t)-FCInv. (=Unlevered CFO-FCInv.) Assets = Enterprise Value +

=NI+all NCC-WCInv+Int*(1-t)-FCInv. + Cash (less trapped cash)

=(EBIT-Int)*(1-t)+NCC before EBIT-WCInv.+Int*(1-t)-FCInv. + Marketable securities

=EBIT*(1-t)+NCC-WCInv-FCInv. + Investment in affiliates

=EBIAT+NCC-WCInv-FCInv. Assets = Equity Value +

PV of FCFF = Enterprise Value = Value from core business (not including excess cash and assets for + Debt

+ Minority Interest

Free cash flow buildup

Fiscal year 2020A 2021A 2022A 2023P 2024P 2025P 2026P 2027P

Fiscal year end date 31/12/2020 31/12/2021 31/12/2022 31/12/2023 31/12/2024 31/12/2025 31/12/2026 31/12/2027

EBITDA 1.312 4.235 6.840 7.997 6.800 5.521 5.477 5.433

EBIT 763 3.698 6.325 7.462 6.310 5.077 5.077 5.078

Tax rate 19,7% 15,9% 17,1% 17,1% 18,0% 17,0% 16,0% 15,0%

EBIAT (NOPAT) 613 3.109 5.244 6.186 5.174 4.214 4.265 4.316

Plus: Depreciation and amortization 535 490 445 400 356

Plus: Stock based compensation 0 0 0 0 0

Less: change in Accounts receivable 28 28 28 28 28

Less: change in Inventory -1.096 -1.500 -2.000 -2.500 -2.500

Less: change in Other current assets (inc. non-trade receivables) -7 -7 -7 -7 -7

Less: change in Deferred tax assets (DTAs) -109 -109 -109 -109 -109

Plus: change in Accounts payable 98 98 98 98 98

Plus: change in Other payables & deferred revenues (current & non-current) 550 550 550 550 550

Plus: change in Deferred tax liabilities (DTLs) 0 0 0 0 0

Less: change in Other non current assets -40 -40 -40 -40 -40

Plus: change in Other non current liabilities 0 0 0 0 0

Unlevered CFO (unlevered CFO=CFO+int*(1-t)) 6.146 4.684 3.179 2.685 2.692

Less: Capital expenditures -52 -68 -75 -75 -75

Less: Purchases of intangible assets -1 -1 -1 -1 -1

FCFF (before adjustment for timing factor) 6.093 4.615 3.103 2.610 2.617

% growth (24,2%) (32,8%) (15,9%) 0,3%

Assume the above cash flows are generated at: End of Fiscal Year

Timing adjustment factor (multiply FCFF by) 1,00x

FCFF at End of Fiscal Year 6.093 4.615 3.103 2.610 2.617

Discount number of years 0,58 1,58 2,58 3,58 4,58

Present value of Unlevered FCFF 5.644 3.747 2.209 1.628 1.431

Computing Enterprise Value

Perpetuity approach Exit EBITDA multiple approach

Long term growth rate (g) 3,0% Terminal value EBITDA multiple 4,00x

Normalized FCFFt+1 2.695 Terminal year EBITDA 5.433

Terminal value 24.324 Terminal value 21.734

Present value of terminal value 13.303 Present value of terminal value 11.887

Present value of stage 1 cash flows 14.659 Present value of stage 1 cash flows 14.659

Enterprise value 27.963 Enterprise value 26.546

Implied TV exit EBITDA multiple 4,5x Implied TV perpetual growth rate 1,8%

Options / warrants data Equity Value and Fair Value per share

Number of exercisable options (mm) 0,00 Perpetuity EBITDA

Exercise price - Enterprise value 27.963 26.546

Current market price 32.250,00 Plus: Cash & marketable securities 1.879 1.879

Number of exercisable options in-the-money 0,00 Less: Trapped cash (enter as -) 0 0

Total proceeds ($mm) 0 Plus: Investment in affiliates 29 29

Number of shares repurchased (mm) 0,00 Less: Debt (ST+LT) (enter as -) -3.098 -3.098

Number of shares issued (mm) 0,00 Less: Preferred stock (enter as -) 0 0

Less: Minority Interest (enter as -) -188 -188

Basic shares outstanding 391.334.260,00 Equity value 26.584 25.168

Dilutuve impact of options/warrants 0,00 Diluted shares outstanding 391.334.260,000 391.334.260,000

Dilutive impact of shares from other securities 0 Equity value per share VND 67.932,526 VND 64.312,915

Net diluted shares outstanding 391.334.260,00 Market premium / (discount) to fair value (52,5%) (49,9%)

Net Debt = Debt + Preferred stock + Minority Interest -Cash & marketable securities - Investment in affiliates

Sensitivity analysis

Equity value per share

Long term growth rate (g):

VND67.932,526 2,00% 2,50% 3,00% 3,50% 4,00%

17,1% 54.153,7 53.344,7 53.344,7 54.153,7 55.944,09

16,1% 49.061,1 48.465,3 48.465,3 49.061,1 50.363,7

WACC: 15,1% 46.919,8 46.403,0 46.403,0 46.919,8 48.044,2

14,1% 46.919,8 46.403,0 46.403,0 46.919,8 48.044,2

13,1% 49.061,1 48.465,3 48.465,3 49.061,1 50.363,7

12,1% 54.153,7 53.344,7 53.344,7 54.153,7 55.944,1

Equity value per share

Exit EBITDA Multiple

VND64.312,915 2,00x 3,00x 4,00x 5,00x 6,00x

17,1% 45.676,7 38.934,4 38.934,4 45.676,7 59.161,4

16,1% 43.596,6 37.357,7 37.357,7 43.596,6 56.074,5

WACC: 15,1% 42.615,8 36.611,4 36.611,4 42.615,8 54.624,7

14,1% 42.615,8 36.611,4 36.611,4 42.615,8 54.624,7

13,1% 43.596,6 37.357,7 37.357,7 43.596,6 56.074,5

12,1% 45.676,7 38.934,4 38.934,4 45.676,7 59.161,4

Equity value per share

Exit EBITDA Multiple

EBITDA % of plan VND64.312,915 2,00x 3,00x 4,00x 5,00x

80% 4.347 46.088,0 40.013,1 40.013,1 46.088,0

90% 4.890 33.938,1 27.103,8 27.103,8 33.938,1

100% 5.433 18.750,7 11.157,0 11.157,0 18.750,7

110% 5.977 525,8 (7.827,3) (7.827,3) 525,8

120% 6.520 (20.736,6) (29.849,0) (29.849,0) (20.736,6)

130% 7.064 (45.036,4) (54.908,3) (54.908,3) (45.036,4)

Football field LTM EBITDA multiple

LTM calculations

DCF Valuation Summary Operating income 1.151

48,0442

D&A 330

50,00

Stock based compensation

45,00 54,6247 LTM EBITDA 1.481

46,9198 25,200

40,00 42,6158 Market cap 12.620.529.885.000

Enterprise value 15.718.218.957.508

35,00

EV/EBITDA 10613247101,6x

30,00 Comps derived EV/EBITDA 4,0x

31,2

25,00

20,00

15,00

10,00

5,00

,00

DCF Value at 002x-006x Exit DCF Value at 02%-04% 52 Week Market High/Low

EBITDA Range Perpetuity Range

Low Diff. High

DCF Value at 002x-006x Exit EBITDA Range 42,6 0,0 54,6

DCF Value at 02%-04% Perpetuity Range 46,9 1,1 48,0

52 Week Market High/Low 31,2 25,2 56,4

References value website https://valueinvesting.io/DPM.VN/valuation/dcf-ebitda-exit-5y

http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/ctryprem.html

Sửa số multiplier 1.5 ở ô màu vàng trên cùng thành 2.01 cho Việt Nam (số 2.01 này lấy

từ 1 worksheet khác bên cạnh, được tính bằng sigma của VNI return chia sigma trái

phiếu CP VN phát hành bằng tiền $)

CRP Country Risk Premium = Sovereign spread x 2.01

(trong bảng thì Damodaran gọi Sovereign spread là Default spread, nhưng mình sẽ gọi

là sovereign cho rõ nghĩa hơn)

Damodaran tính Sovereign spread theo 2 phương pháp:

Một là bằng hiệu CDS spread của 10 year VN bond trừ 10 year US bond (=2.75%-

0.5518%=2.89%) (cột 7).

Hai là dựa trên rating của TPCP hạng B2, thì spread này được tính trung bình là 5,5%

(cột 4), chênh khá nhiều với phương pháp 1.

Sau đó Cost of equty = Rf + beta x (Rm-Rf+CRP) trong đó (Rm-Rf) là 5% (của US)

Rf là risk free rate của US, khoảng 2,4% (10 year T bond).

Vậy theo phương pháp 1 thì cost of equity của 1 cổ phiếu có beta=1 (market) là:

2.4%+1x(5%+(3.35%-0.46%)x2.01)=13.2%

Theo phương pháp 2 thì là 2.4%+1x(5%+5.5%x2.01)=18.5%

10 year T bond của VN khoảng 8%:

http://asianbondsonline.adb.org/vietnam.php

http://www.investing.com/rates-bonds/vietnam-10-year-bond-yield

For g changes Diff:

Min 46.403,0 46.403,0

25% 46.403,0 -

50% 46.919,8 516,81

75% 47.482,0 562,19

Max 48.044,2 562,19

48.044,2 For drawing football field chart with

percentile rankings, but it's not clearer

and more informative, so it's not

For EBITDA multiple recommended.

Diff:changes

Min 36.611,4 36.611,4

25% 36.611,4 -

50% 42.615,8 6.004,46

75% 48.620,3 6.004,46

Max 54.624,7 6.004,46

54.624,7

You might also like

- Chapter 21. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesNo ratings yetChapter 21. Tool Kit For Mergers, Lbos, Divestitures, and Holding Companies21 pages

- FCFE Valuation - 5-Year Forecasted PeriodNo ratings yetFCFE Valuation - 5-Year Forecasted Period1 page

- Dimana: D: Total Debt E: Total Equity: Cost of Equity 12,115 % Market Rate Premium 2,49 %No ratings yetDimana: D: Total Debt E: Total Equity: Cost of Equity 12,115 % Market Rate Premium 2,49 %2 pages

- Beta Apparel Inc. Always-Glory International Inc. B-II Apparel Group Cambridge Inds. Petty Belly Inc. Avg of Peer GroupNo ratings yetBeta Apparel Inc. Always-Glory International Inc. B-II Apparel Group Cambridge Inds. Petty Belly Inc. Avg of Peer Group21 pages

- BLUE STAR LTD - Quantamental Equity Research Report-1No ratings yetBLUE STAR LTD - Quantamental Equity Research Report-11 page

- Learn2Invest Session 10 - Asian Paints ValuationsNo ratings yetLearn2Invest Session 10 - Asian Paints Valuations8 pages

- SanMiguelCorporationPSESMC PublicCompanyNo ratings yetSanMiguelCorporationPSESMC PublicCompany1 page

- Performance Analysis Performance Analysis: Q3 FY 2020 Q2 FY 2021No ratings yetPerformance Analysis Performance Analysis: Q3 FY 2020 Q2 FY 202137 pages

- Banco Santander Chile 3Q18 Earnings Report: October 31, 2018No ratings yetBanco Santander Chile 3Q18 Earnings Report: October 31, 201832 pages

- Vaibhav - Mojidra - Tanla Platforms DCF ValuationNo ratings yetVaibhav - Mojidra - Tanla Platforms DCF Valuation93 pages

- Free Cash Flow To Firm DCF Valuation Model Base Data100% (1)Free Cash Flow To Firm DCF Valuation Model Base Data3 pages

- Chapter 7 - Risk and The Cost of CapitalNo ratings yetChapter 7 - Risk and The Cost of Capital38 pages

- Weighted Average Cost of Capital Calculator: Company Variables: Synthetic Debt RatingsNo ratings yetWeighted Average Cost of Capital Calculator: Company Variables: Synthetic Debt Ratings9 pages

- baruchFin9891_AssetAllocationForAlts_lec7and8_Summer2023No ratings yetbaruchFin9891_AssetAllocationForAlts_lec7and8_Summer202328 pages

- Financial Report On Apple Stock - Jan 2020No ratings yetFinancial Report On Apple Stock - Jan 202013 pages

- Equity Research - Interview Questions and AnswersNo ratings yetEquity Research - Interview Questions and Answers130 pages

- EBW1063 Managerial Finance Tutorial - StockValuation - AnswerNo ratings yetEBW1063 Managerial Finance Tutorial - StockValuation - Answer3 pages

- SL2 - June 24 Suggested Solutions - June 2024No ratings yetSL2 - June 24 Suggested Solutions - June 202416 pages

- Trade Related Property - Valuation Methodology XtendedNo ratings yetTrade Related Property - Valuation Methodology Xtended47 pages

- Topic: Mergers and Takeover Practice QuestionsNo ratings yetTopic: Mergers and Takeover Practice Questions7 pages

- Closure in Valuation: Estimating Terminal Value: Problem 1No ratings yetClosure in Valuation: Estimating Terminal Value: Problem 13 pages

- International Valuation Standards - 2020 MCQ100% (2)International Valuation Standards - 2020 MCQ18 pages

- Audit A Financial Model With Macabacus (Complete)No ratings yetAudit A Financial Model With Macabacus (Complete)7 pages

- 18.1 Goals of Long-Term Financial Planning: Chapter 18 Financial Modeling and Pro Forma AnalysisNo ratings yet18.1 Goals of Long-Term Financial Planning: Chapter 18 Financial Modeling and Pro Forma Analysis34 pages

- Chapter 21. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesChapter 21. Tool Kit For Mergers, Lbos, Divestitures, and Holding Companies

- Dimana: D: Total Debt E: Total Equity: Cost of Equity 12,115 % Market Rate Premium 2,49 %Dimana: D: Total Debt E: Total Equity: Cost of Equity 12,115 % Market Rate Premium 2,49 %

- Beta Apparel Inc. Always-Glory International Inc. B-II Apparel Group Cambridge Inds. Petty Belly Inc. Avg of Peer GroupBeta Apparel Inc. Always-Glory International Inc. B-II Apparel Group Cambridge Inds. Petty Belly Inc. Avg of Peer Group

- BLUE STAR LTD - Quantamental Equity Research Report-1BLUE STAR LTD - Quantamental Equity Research Report-1

- Performance Analysis Performance Analysis: Q3 FY 2020 Q2 FY 2021Performance Analysis Performance Analysis: Q3 FY 2020 Q2 FY 2021

- Banco Santander Chile 3Q18 Earnings Report: October 31, 2018Banco Santander Chile 3Q18 Earnings Report: October 31, 2018

- Free Cash Flow To Firm DCF Valuation Model Base DataFree Cash Flow To Firm DCF Valuation Model Base Data

- Weighted Average Cost of Capital Calculator: Company Variables: Synthetic Debt RatingsWeighted Average Cost of Capital Calculator: Company Variables: Synthetic Debt Ratings

- baruchFin9891_AssetAllocationForAlts_lec7and8_Summer2023baruchFin9891_AssetAllocationForAlts_lec7and8_Summer2023

- EBW1063 Managerial Finance Tutorial - StockValuation - AnswerEBW1063 Managerial Finance Tutorial - StockValuation - Answer

- Trade Related Property - Valuation Methodology XtendedTrade Related Property - Valuation Methodology Xtended

- Closure in Valuation: Estimating Terminal Value: Problem 1Closure in Valuation: Estimating Terminal Value: Problem 1

- 18.1 Goals of Long-Term Financial Planning: Chapter 18 Financial Modeling and Pro Forma Analysis18.1 Goals of Long-Term Financial Planning: Chapter 18 Financial Modeling and Pro Forma Analysis