FW 8 Ben

FW 8 Ben

Uploaded by

Nakan GantengCopyright:

Available Formats

FW 8 Ben

FW 8 Ben

Uploaded by

Nakan GantengOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

FW 8 Ben

FW 8 Ben

Uploaded by

Nakan GantengCopyright:

Available Formats

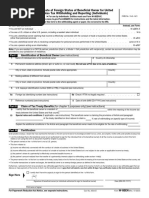

Form W-8BEN Certificate of Foreign Status of Beneficial Owner for United

States Tax Withholding and Reporting (Individuals)

(Rev. October 2021) ▶ For use by individuals. Entities must use Form W-8BEN-E. OMB No. 1545-1621

Department of the Treasury Go to www.irs.gov/FormW8BEN for instructions and the latest information.

▶

Internal Revenue Service ▶ Give this form to the withholding agent or payer. Do not send to the IRS.

Do NOT use this form if: Instead, use Form:

• You are NOT an individual . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . W-8BEN-E

• You are a U.S. citizen or other U.S. person, including a resident alien individual . . . . . . . . . . . . . . . . . . . W-9

• You are a beneficial owner claiming that income is effectively connected with the conduct of trade or business within the United States

(other than personal services) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . W-8ECI

• You are a beneficial owner who is receiving compensation for personal services performed in the United States . . . . . . . 8233 or W-4

• You are a person acting as an intermediary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . W-8IMY

Note: If you are resident in a FATCA partner jurisdiction (that is, a Model 1 IGA jurisdiction with reciprocity), certain tax account information may be

provided to your jurisdiction of residence.

Part I Identification of Beneficial Owner (see instructions)

1 Name of individual who is the beneficial owner 2 Country of citizenship

Musrihal Fikri Indonesia

3 Permanent residence address (street, apt. or suite no., or rural route). Do not use a P.O. box or in-care-of address.

Dusun III Sibiruang Rt/Rw 002/001 Desa Siberuang Kecamatan Koto Kampar Hulu

City or town, state or province. Include postal code where appropriate. Country

Kabupaten Kampar Kota Bangkinang Provinsi Riau Indonesia

4 Mailing address (if different from above)

jl. Manunggal Indah Perumahan Griya Manggugal Indah Blok H.10 Kecamatan Tampan

City or town, state or province. Include postal code where appropriate. Country

Kota Pekanbaru, Provinsi Riau Indonesia

5 U.S. taxpayer identification number (SSN or ITIN), if required (see instructions)

6a Foreign tax identifying number (see instructions) 6b Check if FTIN not legally required . . . . . . . . . . . ✔

1401040712920003

7 Reference number(s) (see instructions) 8 Date of birth (MM-DD-YYYY) (see instructions)

12-07-1992

Part II Claim of Tax Treaty Benefits (for chapter 3 purposes only) (see instructions)

9 I certify that the beneficial owner is a resident of Indonesia within the meaning of the income tax

treaty between the United States and that country.

10 Special rates and conditions (if applicable—see instructions): The beneficial owner is claiming the provisions of Article and paragraph

of the treaty identified on line 9 above to claim a % rate of withholding on (specify type of income):

.

Explain the additional conditions in the Article and paragraph the beneficial owner meets to be eligible for the rate of withholding:

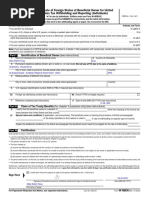

Part III Certification

Under penalties of perjury, I declare that I have examined the information on this form and to the best of my knowledge and belief it is true, correct, and complete. I further certify under penalties of perjury that:

• I am the individual that is the beneficial owner (or am authorized to sign for the individual that is the beneficial owner) of all the income or proceeds to which this form

relates or am using this form to document myself for chapter 4 purposes;

• The person named on line 1 of this form is not a U.S. person;

• This form relates to:

(a) income not effectively connected with the conduct of a trade or business in the United States;

(b) income effectively connected with the conduct of a trade or business in the United States but is not subject to tax under an applicable income tax treaty;

(c) the partner’s share of a partnership’s effectively connected taxable income; or

(d) the partner’s amount realized from the transfer of a partnership interest subject to withholding under section 1446(f);

• The person named on line 1 of this form is a resident of the treaty country listed on line 9 of the form (if any) within the meaning of the income tax treaty between the United States and that country; and

• For broker transactions or barter exchanges, the beneficial owner is an exempt foreign person as defined in the instructions.

Furthermore, I authorize this form to be provided to any withholding agent that has control, receipt, or custody of the income of which I am the beneficial owner or any withholding agent that can

disburse or make payments of the income of which I am the beneficial owner. I agree that I will submit a new form within 30 days if any certification made on this form becomes incorrect.

✔ I certify that I have the capacity to sign for the person identified on line 1 of this form.

▲

Sign Here

07-05-2022

Signature of beneficial owner (or individual authorized to sign for beneficial owner) Date (MM-DD-YYYY)

Musrihal Fikri

Print name of signer

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 25047Z Form W-8BEN (Rev. 10-2021)

You might also like

- Iso TR 20172-2021Document40 pagesIso TR 20172-2021Franco100% (7)

- Dazn InvoiceDocument2 pagesDazn InvoicebbbhadauriaNo ratings yet

- DetailsDocument201 pagesDetailsAbin ThampyNo ratings yet

- MOA WITH Transport GroupDocument3 pagesMOA WITH Transport Groupkaren100% (1)

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Fahrizal KasepNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Adam AkbarNo ratings yet

- W8BENDocument1 pageW8BENzeitgenstdNo ratings yet

- (DEV) W-8 BenDocument2 pages(DEV) W-8 BenDivyanshu TewariNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)DupanNo ratings yet

- Contoh Lampiran Pajak Luar Negri W8benDocument1 pageContoh Lampiran Pajak Luar Negri W8benIyap TriyadiNo ratings yet

- (DEV) W-8 BenDocument2 pages(DEV) W-8 BenTheRitikNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)adeeshagimshan95No ratings yet

- Fw8ben SignedDocument1 pageFw8ben Signedaini.jeniever2No ratings yet

- Here Is Your Signed Document HMARUFDocument1 pageHere Is Your Signed Document HMARUFRadha DasyamNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Alfian MaulanaNo ratings yet

- fw8ben 3Document1 pagefw8ben 3marziakhansiminNo ratings yet

- W 8benDocument1 pageW 8benRudi100% (1)

- Blank W8BEN Form (For Individuals)Document1 pageBlank W8BEN Form (For Individuals)poloy6300No ratings yet

- W-8BEN Form Joselin VargasDocument1 pageW-8BEN Form Joselin Vargasyonosequiensoy997No ratings yet

- Fw8ben SignedDocument1 pageFw8ben SignedLakmal WansekaraNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Titovilla Nova AjahNo ratings yet

- FW 8 BenDocument1 pageFW 8 BenWilliam RodriguezNo ratings yet

- Ginantaka EncryptedDocument1 pageGinantaka EncryptedgntkxartNo ratings yet

- Dokumen PDFDocument1 pageDokumen PDFkairirisolmayo2611No ratings yet

- FW 8 BenDocument1 pageFW 8 BenELNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Ajmain Abdullah Utshow100% (1)

- fw8benDocument1 pagefw8benpoi0987654321.tvNo ratings yet

- HMARUFDocument1 pageHMARUFRadha DasyamNo ratings yet

- W-8benDocument1 pageW-8bengabriel09.bNo ratings yet

- FW 8 Ben 2Document1 pageFW 8 Ben 2DCOM SoftwaresNo ratings yet

- 6o19pyvf4g5i8z3k Yhz2dqtm4kjv395eDocument1 page6o19pyvf4g5i8z3k Yhz2dqtm4kjv395eEd LucasNo ratings yet

- FW 8 BenDocument1 pageFW 8 BenscribdNo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document2 pagesCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)fanuel ashokNo ratings yet

- TopCoder Member Tax Form W-8BENDocument1 pageTopCoder Member Tax Form W-8BENAnonymous LsohjUSo100% (1)

- FW 8 BenDocument1 pageFW 8 Benعاصمة الجهة ERRACHIDIANo ratings yet

- W-8BEN Tax Form OOC Letter AP Vendor Form 102645Document13 pagesW-8BEN Tax Form OOC Letter AP Vendor Form 102645Rial Mollik, Jagannath UniversityNo ratings yet

- W8 BenDocument1 pageW8 Benadeeshagimshan95No ratings yet

- Oxzi38n09ah61vq2 54lkefxw8i3t6ogvDocument1 pageOxzi38n09ah61vq2 54lkefxw8i3t6ogvEd LucasNo ratings yet

- VVQjb9XZmUm94q2eLRR0Fg PDFDocument4 pagesVVQjb9XZmUm94q2eLRR0Fg PDFObnoNo ratings yet

- W-8BEN Individuo VigenteDocument1 pageW-8BEN Individuo VigentemiguelturriNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)MatNo ratings yet

- W 8benDocument1 pageW 8benleozin ffNo ratings yet

- W-8benDocument1 pageW-8benalanagallvaoNo ratings yet

- Foreign Independent Contractor FormCDocument1 pageForeign Independent Contractor FormCSalkic HamdijaNo ratings yet

- W 8benDocument1 pageW 8benAdam AkbarNo ratings yet

- W8BENIC16Document2 pagesW8BENIC16vindhyaNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Suhar Lina100% (1)

- 2977365_W-8BENDocument1 page2977365_W-8BENpulsarpolestudioNo ratings yet

- International Contractors - Tax Waiver Form - Fw8benDocument3 pagesInternational Contractors - Tax Waiver Form - Fw8benLimbo, Mary Joyce P.No ratings yet

- W8BEN FormDocument1 pageW8BEN Formgodfree.henwoodNo ratings yet

- FormW8 19192Document1 pageFormW8 19192Matt HeafyNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)gghu07192No ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Cobby Dollar AnnorNo ratings yet

- FW 8 BenDocument1 pageFW 8 BenynnewrozNo ratings yet

- W-8benDocument1 pageW-8benerazomariela296No ratings yet

- Déclaration W-8BENDocument1 pageDéclaration W-8BENhabibdiangone2016No ratings yet

- Pamela L. SahagunDocument1 pagePamela L. SahagunEd LucasNo ratings yet

- Form TaxDocument1 pageForm TaxYon ChhannakNo ratings yet

- Bank PapersDocument1 pageBank PapersLuis Emilio Santana Diaz100% (3)

- W-8BEN FormDocument1 pageW-8BEN Formramcruise2No ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNo ratings yet

- PPP KsaDocument59 pagesPPP KsaRachid HCNo ratings yet

- Reflection Paper For LOCAL GOVERNMENT ACCOUNTING AND AUDITING SYSTEMS IN THE PHILIPPINESDocument3 pagesReflection Paper For LOCAL GOVERNMENT ACCOUNTING AND AUDITING SYSTEMS IN THE PHILIPPINESJoyang ObenzaNo ratings yet

- Policy No. 2990100801371400000: Home Shield InsuranceDocument2 pagesPolicy No. 2990100801371400000: Home Shield InsuranceAviontus IeltsNo ratings yet

- Digital Transformation Maturity ModelDocument46 pagesDigital Transformation Maturity ModelNgô Văn Ninh100% (2)

- QUIZDocument4 pagesQUIZBryan Ibarrientos100% (2)

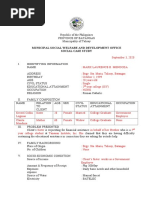

- Municipal Social Welfare and Development Office Social Case StudyDocument2 pagesMunicipal Social Welfare and Development Office Social Case StudyHannah Naki MedinaNo ratings yet

- Chapter 13 - Returns Under GSTDocument11 pagesChapter 13 - Returns Under GSTJay PawarNo ratings yet

- Minutes For 1st Meeting Dec3Document3 pagesMinutes For 1st Meeting Dec3Re Yah AnoosNo ratings yet

- 1BILL Biller Prefix 3Document5 pages1BILL Biller Prefix 3MirzaNo ratings yet

- Applicant Print PGTTCE ENGLISH SHIPRA BERADocument2 pagesApplicant Print PGTTCE ENGLISH SHIPRA BERAVikrant BeraNo ratings yet

- Kasambahay MasterlistDocument1 pageKasambahay MasterlistMARILIE MULANo ratings yet

- Pabustan CivPro Task2Document1 pagePabustan CivPro Task2Mheryza De Castro PabustanNo ratings yet

- Supplemental International Student Information Form: Legal Name As It Appears On Your PassportDocument3 pagesSupplemental International Student Information Form: Legal Name As It Appears On Your PassportRohit Chabukswar100% (1)

- Cramer For SenateDocument1,359 pagesCramer For SenateRob PortNo ratings yet

- 206300287252023_1Document3 pages206300287252023_1Chandra Sekhar VaddemanuNo ratings yet

- G.O.Ms - No.59 - House Building AdvanceDocument3 pagesG.O.Ms - No.59 - House Building AdvanceMahendar Erram100% (2)

- Iain 66id24a1442577 4 20240321 031222Document2 pagesIain 66id24a1442577 4 20240321 031222Sahaj KhuranaNo ratings yet

- Benefits InvoiceDocument4 pagesBenefits Invoicesaad.asifhamidNo ratings yet

- Ce5Kov1Eqyk6: Professional Regulation Commission Order of Payment Archives and Records DivisionDocument1 pageCe5Kov1Eqyk6: Professional Regulation Commission Order of Payment Archives and Records DivisionJessa Mae JabegueroNo ratings yet

- Offer Letter: Offer To Join Alu FacadesDocument2 pagesOffer Letter: Offer To Join Alu FacadesSales AlufacadesNo ratings yet

- Proposal - Virtual Office - FDICompanyDocument14 pagesProposal - Virtual Office - FDICompanyCường NguyễnNo ratings yet

- BEM Sole Proprietor GuidelinesDocument11 pagesBEM Sole Proprietor GuidelinesSiaw Ming ChianNo ratings yet

- Open Competitive Examination For Recruitment To Class I of The Government Translator ServiceDocument7 pagesOpen Competitive Examination For Recruitment To Class I of The Government Translator ServiceNalin HettiarachchiNo ratings yet

- Sirigandha IVDocument4 pagesSirigandha IVSudish BhatNo ratings yet

- Approved OTA GuidelinesDocument14 pagesApproved OTA GuidelinesSalil YadavNo ratings yet

- 57 Nit Lt+Panel Dg+Panel Apfc+Panel Nari Pune (Recall I)Document38 pages57 Nit Lt+Panel Dg+Panel Apfc+Panel Nari Pune (Recall I)zubinNo ratings yet