Effects of Creative Accounting On Corporate Image of Companies in Nigeria

Effects of Creative Accounting On Corporate Image of Companies in Nigeria

Uploaded by

AngelaCopyright:

Available Formats

Effects of Creative Accounting On Corporate Image of Companies in Nigeria

Effects of Creative Accounting On Corporate Image of Companies in Nigeria

Uploaded by

AngelaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Effects of Creative Accounting On Corporate Image of Companies in Nigeria

Effects of Creative Accounting On Corporate Image of Companies in Nigeria

Uploaded by

AngelaCopyright:

Available Formats

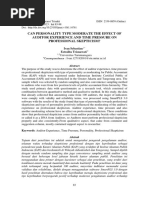

International Journal of Advanced Research in ISSN: 2278-6236

Management and Social Sciences Impact Factor: 7.624

EFFECTS OF CREATIVE ACCOUNTING ON CORPORATE IMAGE OF COMPANIES

IN NIGERIA

1

ADEOSUN O. A. (PhD) & 2OLORUNFEMI O. E.

1,2

Department of Management Science, Bamidele Olumilua University of Education, Science

and Technology, Ikere Ekiti.

ABSTRACT

THE study examines the effect of creative accounting on corporate image of companies in

Nigeria. It defines creative accounting as accounting practices that tend to circumvent, or

manipulate the rules of standard accounting practices or the spirit of those values

characterized by dubious complication and use of “novel” way of presenting incomes, assets

or liabilities. However, since it is predicated on deceit, namely, altering financial reports to

either mislead some stakeholders or to influence contractual outcome that depend on

reported accounting numbers it can at best give a temporary positive impression for as long

as the lie goes undiscovered. The effects of creative accounting on corporate image may

include among others, corporate bankruptcy, relevant governance agencies that are meant

to exercise control are often blacklisted when bubble of hidden deceit is exposed. High profile

individuals may be criminally investigated resulting in loss of public image and job. The study

concludes that no individual or organization can hope to gain an enduring positive corporate

image by engaging in fraudulent manipulation of its accounting records because honesty

remains the best policy while the cost of corporate misconduct is usually very high.

Keywords: Creative accounting, Corporate image, financial reports, stakeholders

INTRODUCTION

Managers of whatever description have access and control over the resources of

their employers. As agents, managers, posturing as General Manager, Managing Director or

even members of board of directors of a company have a responsibility to prepare and

render account of their stewardship to their principals - shareholders, individual or

corporate employers at agreed intervals. The account must be prepared based on some

generally agreed principles and prescribed standards set by relevant regulatory agencies.

Thus, the stewardship accounting requirement is normally satisfied by financial statements

prepared and presented at Annual General Meeting of companies by directors.

For obvious reason by Management to deceive stakeholders in the affairs of a

company, it may resort to what Healy & Wahlem (1999) refer to as "systematic

misrepresentation of the true income and assets of corporations or other organizations

which is at the root of a number of accounting scandals". Creative accounting practice led to

the collapse of big corporations around the world. For example in 2001 and 2002, corporate

giants like Enron, Global Crossing and WorldCom were forced into bankruptcy, and massive

accounting and other irregularities were revealed at this and other companies. In Nigeria,

Okoye & Alao (2008) reported that Cadbury Nigeria Plc sacked its Managing Director and

Finance Directors on account of manipulating the company's financial records, book padding

scandal and corruption". Creative accounting is therefore established as a global threat to

corporate trust, as company owners and sundry stakeholders find it difficult to rely on

Vol. 11 | No. 8 |August 2022 www.garph.co.uk IJARMSS | 6

International Journal of Advanced Research in ISSN: 2278-6236

Management and Social Sciences Impact Factor: 7.624

accounts prepared by boards of directors, as they often contain falsehood, intended to

mislead users of such accounts.

Glautier & Underdown (2001), infer that the main objective of financial reporting is

to communicate economic information about resources held by an entity and its

performances to those having the right to such information. This paper, therefore, examines

the effects of creative accounting on corporate image of companies in Nigeria.

What is Creative Accounting?

Creative accounting is the process of changing the financial information from what it should

be to what the company wants relying on the existing loopholes of law or financial

standards (IFRS) flexibility that allows firm to choose method and rate of asset depreciation

and inventory valuation. However this act has derogative effect on integrity of financial

statement and audit profession and this corporate scandal disrupts capital market,

reduction in GDP, massive loss in jobs and investments, (Adetayo & Ajiga, 2017). According

to Haruna & Emmanuel, (2017) these manipulative behaviours of figures in accounting

reporting are often called “creative accounting”. In reality, financial accounting reports are

produced to show the true and fair view of the financial positions of reporting entities in

order to help stakeholders in making appropriate decisions, however, current accounting

practices which allow different policies and professional judgments are being manipulated

to boost the companies’ present image at the expense of the information provided to the

users and the future of the corporate entities.

Okoye & Alao (2008) define creative accounting (earning management) as

euphemisms for accounting practices that tend to circumvent, albeit cleverly, or manipulate

the rules of standard accounting practices or the spirit of those values. They are

characterized by dubious complication and use of “novel” ways of presenting incomes,

assets or liabilities. It is the deliberate dampening of fluctuations about “some levels of

earnings considered to being normal for the firm”. Schipper (1989) agrees that creative

accounting can be equated with “disclosure management”, in the sense of a purposeful

intervention in the financial reporting processes. Okoye & Alao (2008) further contends that

the information perspective is a key element underpinning the creative accounting

phenomenon. Thus a conflict is created by the information asymmetry that exists in

complex corporate structures between a privileged management and more remote body of

stakeholders. Furthermore, managers may choose to exploit their privileged position for

private gain, by managing financial reporting disclosures in their own favour. Naser (1993)

views creative accounting as the transformation of financial accounting figures from what

they actually are to what prepares desire, by taking advantage of the existing rules and/or

ignoring some or all of them.

On a final note, Healy & Wahlem (1999) observes that "earning management"

(another name for window dressing or creative accounting) occurs when managers use

judgment in financial reporting and in structuring transactions to alter financial reports to

either mislead some stake holder about the underlying economic performance of company

or to influence contractual outcomes that depend on reported accounting numbers. These

creative accounting practices in financial reporting have been termed by Fizza & Malik

Vol. 11 | No. 8 |August 2022 www.garph.co.uk IJARMSS | 7

International Journal of Advanced Research in ISSN: 2278-6236

Management and Social Sciences Impact Factor: 7.624

(2015) as “the art of faking or calculating or presenting the balance sheet, and the art of

saving money.”

Corporate Image

The advanced Learners Dictionary defines image as mental picture, idea or concept

of something or somebody e.g. a politician, political party or commercial firm, product, held

by the public. Thus, image has to do with how the public perceives, thinks or imagines an

entity. The mental picture of a firm, an establishment or a corporation defines its corporate

image. Every establishment struggles to outdo one another in the rate race for positive

public perception. It is not new to see nations engaging in image laundering in order to

achieve positive international acceptability. Positive corporate image drive informs the idea

of corporate social responsibility which Johnson et al (2008) say is concerned with the ways

in which an organization exceeds its minimum obligations to stakeholders specified through

regulations.

Creative Accounting and Corporate Image

Creative accounting refers to accounting practices that follows the letter or rules of

standard accounting practices but certainly deviate from the spirit of those rules. Creative

accounting practices are different from fraudulent practices and thus are not illegal but

immoral in terms of misguiding investors. The practices, which are followed in manipulating

the books, are duly authorized by accounting system and thus cannot be considered as a

violation of any rule or regulations. It is characterized by excessive compliance and the use

of novel ways of characterizing income, assets, or liabilities and the intent to influence

readers towards the interpretations of desired results. Creative accounting is the root cause

of a number of accounting scandals and many proposals for accounting reform are focusing

on removing such practices (Egolum et. al.., 2019).

Creative accounting is intended by company management to achieve positive

corporate image but in a way that is socially unacceptable. In creative accounting,

management wants to create a positive public image by making its account look attractive.

A cosmetic effort intended to mask the true economic performance of a firm in order to

achieve public applause. However, since creative accounting is predicated on deceit,

namely, altering financial reports to either mislead some stakeholders or to influence

contractual outcome that depend on reported accounting numbers it can at best give a

temporary positive impression for as long as the lie goes undiscovered. Writing on the

Theme: The Enron Affairs - A High Cost of Corporate Misconduct, Odozi (2002) comments as

follows “one of the most enduring lessons that flow from these cases (failure and serious

scandals associated with Johnson Matheys Bank (JMB), Bank for Credit and Commerce

International (BCCI), Baring Brothers, Nomura Securities, Bre-X and Long Term Capital

Management (LTCM) of the 1980s and 1990s and of course, the most epoch- making

scandal so far in the 21" century associated with ENRON, which collapsed in 2002, (all in

USA), is that honesty is the best policy not only because of the benefits associated with

being highly regarded and trusted as a good corporate citizen but also because of the

consequences of illegality and unethical behaviour. Corporate failure is perceived as when a

company becomes insolvent or goes out of business as witnessed, “failure and distress”

Vol. 11 | No. 8 |August 2022 www.garph.co.uk IJARMSS | 8

International Journal of Advanced Research in ISSN: 2278-6236

Management and Social Sciences Impact Factor: 7.624

associated with fraudulent accounting and window dressing of financial statement such as

in Enron,2001, WorldCom scandal 2002, Olympus, 2011, Lehman Brothers 2008 and

recently; Thomas Cook, 2019 in UK and USA. In the case of Nigeria; bank PHB, Spring Bank

and Diamond Bank are examples of corporate failures and Akintola William and Deloitte

were indicted for facilitating the falsification of accounts of Afribankplc (Main Stream Bank

Plc) and for deliberately overstating the profits of Cadbury Plc. It is reported that between

1990 and 1994, Nigeria lost more than ₦6b ($42.9m) within the banking sector, Oluwagbuyi,

(2013) cited in (Bankole, 2018).

The systemic failure of the above corporations were attributed to unethical practices

and financial mismanagement by the directors and non-discovery of same by the external

auditors (professional accountants). It is argued that without the connivance of professional

accountants the above manipulations could not be successful.

As will be pointed out in our conclusion, any corporate image drive that is dependent

on deceit can only give a temporary image boost, ultimately, when bubbles eventually burst,

the damage to such firm's image would far outweigh the temporary positive image gained

through deceit.

The following are the impacts of creative accounting on corporate image of

companies:

1. Corporate bankruptcy. Enron, an energy giant was declared bankrupt (once

America's 7lh biggest company) on December, 2, 2001and it is perhaps, the biggest

corporate bankruptcy in America history. In similar version, Cadbury Nigeria Plc,

after sacking its Managing Director and Finance Director on account of manipulating

the company's financial records... By the time an independent audit firm carried out

a review of the company's accounting records, it was discovered that over a period,

profit was overstated by between N13 and N15 billion and this warranted an

adjustment to reflect an operating loss of between N1 and N2 billion. In the event of

bankruptcy and adverse profit adjustment as we have in Cadbury Nigeria Plc,

adverse corporate image and associated loss to stakeholders is set in motion.

2. The roles of various parties whose concerted efforts should have prevented or

minimized creative accounting may be called to serious questioning. The audit

committee, the Board of Directors, the external auditors, rating agencies, analysts

and investment bankers etc may suffer adverse public image.

3. The role of the various personalities in exposed creative accounting scenario have

sometimes been investigated by state institutions e.g. the Economic and Financial

Crimes Commission (EFCC), Independent Corrupt Practices Commission(ICPC),

Securities and Exchange Commission (in Nigeria) and in USA by the Capitol Hill. These

have produced very adverse consequences on the affected organizations and their

officers. Odozi (2002) reported that Mr. Clifford Baxter, a former Vice Chairman of

Enron and the company's Chief Strategy Officer committed suicide when their deeds

were uncovered, while Mr. Kenneth Lay, Chairman and Chief Executive of Enron

resigned a few days later.

Vol. 11 | No. 8 |August 2022 www.garph.co.uk IJARMSS | 9

International Journal of Advanced Research in ISSN: 2278-6236

Management and Social Sciences Impact Factor: 7.624

The plight of Mrs. Cecilia Ibru of Oceanic Bank Plc and Chief Erastus Akingbola

of Intercontinental Bank Plc are clear cases of what creative accounting practice can

do to the image of firms and highly placed individuals when exposed.

4. While concluding his write up, Odozi (2002) observes there is the issue of the high

cost of corporate sandal. He listed these to include, loss of jobs, loss of income,

criminal prosecution, erosion of corporate and individual reputation etc.

5. On the issue of reputation of indicted or accused persons in connection with creative

accounting practice, Emmanel Ikazoboh, a CEO in Akintola Williams Deloitte, (the

firm of auditors of Cadbury for more than 40 years), when asked to comment about

his firm's tough moments such as the Cadbury scandal, in "Sunday Punch" of

February 14, 2009, he says "we challenged the SEC findings by going to the

Investment and Security Tribunal to appeal that even though we had paid the fine,

we were appealing against it because we didn't believe we did anything wrong". It is

only easy to imagine what the singular episode of Cadbury scandal had done to more

than 50 years accountancy practice of Akintola Williams.

CONCLUSION

One incontrovertible lesson that flow from Enron and other monumental scandal

and corporate failure traced to creative accounting is that honesty is the best policy. No

individual or organization can hope to gain an enduring positive corporate image by

engaging in fraudulent manipulation of its accounting records. Furthermore, the cost of

corporate misconduct is usually very high. Finally, management of firms should try to base

their investment decision on financial report that has not been manipulated. What shall it

profit a company management to gain huge financial advantage through creative accounting

practice, only to lose more than what is gained in financial terms to destroyed long and hard

earned personal reputation of top officers of such companies and that of the company in a

fell swoop.

RECOMMENDATION

It is recommended that:

(a) Creative accounting should be considered a serious crime and accounting bodies and

other regulatory authorities need to adopt strict measures to stop these practices and duly

punish the offenders;

(b) Accountants should hold high ethical standards and maintain integrity in all their

professional dealings. They need to ensure that the accounting profession rests on ethical

principles and value, commanding national and international respect, stopping the

unscrupulous practice of creative accounting;

Vol. 11 | No. 8 |August 2022 www.garph.co.uk IJARMSS | 10

International Journal of Advanced Research in ISSN: 2278-6236

Management and Social Sciences Impact Factor: 7.624

REFERENCES

Adetoso, J. A., & Ajiga, O. F. (2017). Creative accounting practices among Nigeria listed

commercial banks: Curtailing effect of IFRS adoption. Journal of Resources

Development and Management, 38(54), 12-19.

Bankole, K. O. (2018). Creative accounting practices and shareholders' wealth.

Egolum, P. U., Okoye, E. I. & Eze, M. N. (2019). Effect of Fraud Pentagon Model on Fraud

Assessment in the Deposit Money Banks in Nigeria: Journal of Global Accounting

Department of Accountancy; 6(3) 124-142: ISSN: 1118-6828

Glautier, M. W. E., & Underdown, B. (2001). Accounting theory and practice. Pearson

education.

Haruna, N. & Emmanuel, T. S. (2017). Analyzing the critical effects of creative accounting

practices in the corporate sector of Ghana. Retrieved from Munich Personal RePEc

Archive website: http://mpra.ub.uni-muenchen.de/81113/

Hearly, P.M. & Wahlen, J.M. (1999). "A Review of the Earnings Management Literature and

its Implications for Standard Setting", Accounting Horizons, December 1999, pp.

365 -283

Johnson, G; Scholes, K & Whittington, R. (2008). Exploring Corporate Strategy; Text and

Cass; 8th Edition. Prentice Hall, London.

Naser; K. (1993). Creative Financial Accounting: Its Nature and Use. London: Prentice Hall.

Odozi.V. (2002). "The Enron Affair-the high cost of corporate Misconduct. The Nigerian

Banker. Jan - June 2002.

Okoye, E.I. & Alao, B.B. (2008). The Ethnics of Creative Accounting in Financial Reporting:

The Challenges of Regulatory Agencies in Nigeria: The Certified National

Accountant. Vol. 16 No. 1, Jan-Mar 2008. pp 45-5

Oluwagbuyi, O., & Ogungbenle, S. (2013). Cost implications of unemployment on the Nigeria

economy. Journal of Accountancy and Economics, 3(14), 27-42.

Schipper, W.M. (1989): Creative Accounting, in Inquirer, Breakthrough Publishers Ltd.

Tassadaq, F., & Malik, Q. A. (2015). Creative accounting & financial reporting: model

development & empirical testing. International Journal of Economics and Financial

Issues, 5(2), 544-551.

Vol. 11 | No. 8 |August 2022 www.garph.co.uk IJARMSS | 11

You might also like

- QSP - Quality and Safety Plan For Railway Civil WorksDocument41 pagesQSP - Quality and Safety Plan For Railway Civil WorksAnonymous eKt1FCD78% (9)

- Effect of Creative Accounting On Shareholders Wealth Among Listed Deposited Banks in NigeriaDocument40 pagesEffect of Creative Accounting On Shareholders Wealth Among Listed Deposited Banks in Nigeriaadewale abiodunNo ratings yet

- Energy Audit Handbook 2nd EditionDocument32 pagesEnergy Audit Handbook 2nd EditionmohammadtaheriNo ratings yet

- Abstract This Study Was Designed To Establish The Effect of Creative Accounting On ShareholdersDocument10 pagesAbstract This Study Was Designed To Establish The Effect of Creative Accounting On ShareholdersAhmad KamalNo ratings yet

- Admin,+artikel+2 Erni+ (JMK) +26-1-2024 REVDocument13 pagesAdmin,+artikel+2 Erni+ (JMK) +26-1-2024 REVClarissa BelvaNo ratings yet

- Creative Accounting: A Literature ReviewDocument13 pagesCreative Accounting: A Literature ReviewthesijNo ratings yet

- The Effect of Creative Accounting On The Job Performance of Accountants Auditors in Reporting Financial Statementin Nigeria 2224 8358-1-173Document30 pagesThe Effect of Creative Accounting On The Job Performance of Accountants Auditors in Reporting Financial Statementin Nigeria 2224 8358-1-173Harshini RamasNo ratings yet

- Literature Review On Accounting StandardsDocument8 pagesLiterature Review On Accounting Standardsafmzywxfelvqoj100% (1)

- Creative AccountingDocument7 pagesCreative AccountingAtif AnwarNo ratings yet

- Creative Accounting, Ethics and Professional DevelomentDocument21 pagesCreative Accounting, Ethics and Professional DevelomentFaiz FaisalNo ratings yet

- Effect of Creative Accounting On Shareholders Wealth Among Listed Deposited Banks in NigeriaDocument52 pagesEffect of Creative Accounting On Shareholders Wealth Among Listed Deposited Banks in Nigeriaadewale abiodun100% (1)

- Creative Accounting Dynamics and Financial Reporting Quality in Public Corporations in NigeriaDocument6 pagesCreative Accounting Dynamics and Financial Reporting Quality in Public Corporations in NigeriaEditor IJTSRDNo ratings yet

- Shsconf Glob2020 01004Document8 pagesShsconf Glob2020 01004Thiviyani SivaguruNo ratings yet

- To Fiddle or Not To FiddleDocument7 pagesTo Fiddle or Not To FiddleUmmu Atiqah Zainulabid100% (1)

- Creative Accounting and Accounting Scandals: Case Lets of Indian CompaniesDocument4 pagesCreative Accounting and Accounting Scandals: Case Lets of Indian Companiespranshu jaiswalNo ratings yet

- Creative Accounting Practices: Ethical Challenges in Nigerian Corporate EnvironmentDocument15 pagesCreative Accounting Practices: Ethical Challenges in Nigerian Corporate Environmentadewale abiodunNo ratings yet

- Creative AccountingDocument13 pagesCreative Accountinghhazlina66No ratings yet

- Creative - Accounting - Ms - Saloni Gupta & DR - Reshma RajaniDocument9 pagesCreative - Accounting - Ms - Saloni Gupta & DR - Reshma Rajanisalonigupta3No ratings yet

- Creative Accounting and Financial Reporting: Model Development and Empirical TestingDocument11 pagesCreative Accounting and Financial Reporting: Model Development and Empirical TestingPutri ElisaNo ratings yet

- AuditDocument10 pagesAuditSimonsNo ratings yet

- MPRA Paper 81113Document41 pagesMPRA Paper 81113aaadfdNo ratings yet

- Bukola 2%3Document31 pagesBukola 2%3adewale abiodunNo ratings yet

- Acc Ass1Document24 pagesAcc Ass1Phương ThảoNo ratings yet

- Accounting Grp AssignDocument9 pagesAccounting Grp AssignIden KerryNo ratings yet

- Financial Statement FraudDocument19 pagesFinancial Statement FraudAulia HidayatNo ratings yet

- Oyeleye Tofunmi Advanced Accounting Theory AssignmentDocument39 pagesOyeleye Tofunmi Advanced Accounting Theory AssignmentOyeleye TofunmiNo ratings yet

- Creative accountingDocument3 pagesCreative accountingလဲ့ မြန္မြန္No ratings yet

- Creative AccountingDocument8 pagesCreative AccountingKaiwenNo ratings yet

- Creative Accounting: Just or UnjustDocument38 pagesCreative Accounting: Just or Unjustfaraazxbox1100% (1)

- KB Agt Nina 752 1671184347 681 PDFDocument10 pagesKB Agt Nina 752 1671184347 681 PDFHero PratikNo ratings yet

- cREATIVE ACCOUNTINGDocument12 pagescREATIVE ACCOUNTINGAshraful Jaygirdar0% (1)

- Investor Skepticism and Creative Accounting: The Case of A French SME Listed On AlternextDocument22 pagesInvestor Skepticism and Creative Accounting: The Case of A French SME Listed On AlternextIvanTurbincaNo ratings yet

- Emailing Jurnal PertamaDocument9 pagesEmailing Jurnal PertamaEka TitianNo ratings yet

- The General Tenets of Positive Accounting Theory Towards Accounting Practice and Disclosure in Corporate Organizations in NigeriaDocument11 pagesThe General Tenets of Positive Accounting Theory Towards Accounting Practice and Disclosure in Corporate Organizations in Nigeriaamal benramdhaneNo ratings yet

- UEU Journal - Income Smoothing Anaysis in Snacks IndustryDocument14 pagesUEU Journal - Income Smoothing Anaysis in Snacks Industrykanina.putri4No ratings yet

- Workbook AccountsDocument38 pagesWorkbook AccountsSummyyaNo ratings yet

- Bachelor Thesis: Name: Nadim SakkalDocument38 pagesBachelor Thesis: Name: Nadim SakkalJehana DarpingNo ratings yet

- Earning Management A Study ADocument6 pagesEarning Management A Study AFilzah AmnahNo ratings yet

- Chapter1 5importance JRJDocument45 pagesChapter1 5importance JRJJames R JunioNo ratings yet

- CAPTER 3 IhechiDocument66 pagesCAPTER 3 Ihechivictor wizvikNo ratings yet

- 3 Book Accounting For ManagerDocument53 pages3 Book Accounting For ManagerFilomena AndjambaNo ratings yet

- Accounts NotesDocument15 pagesAccounts NotessharadkulloliNo ratings yet

- MODULE Session 13 - The Role of AccountantsDocument24 pagesMODULE Session 13 - The Role of AccountantsOlivioNo ratings yet

- Accounting Theory Handout 1Document43 pagesAccounting Theory Handout 1Ockouri Barnes100% (4)

- Tax Accounting AuditingDocument3 pagesTax Accounting AuditingDanica BalinasNo ratings yet

- Other PapersDocument7 pagesOther PapersKarnelia NormanNo ratings yet

- AbstractDocument13 pagesAbstractKhooshal Yadhav RamphulNo ratings yet

- Unit 5 - ApDocument24 pagesUnit 5 - Apkundusoumik007No ratings yet

- 5038 Kế ToánDocument27 pages5038 Kế ToánDo Ngoc Dat (FPI HN)No ratings yet

- Industrial Application On Financial AccountingDocument6 pagesIndustrial Application On Financial AccountingTanya Garg XI FNo ratings yet

- Principles of Accounting - Chapter One Upto FiveDocument87 pagesPrinciples of Accounting - Chapter One Upto FiveJacelow Íñä CiiseNo ratings yet

- Corporate Finance First Internal Assignment - 10887Document5 pagesCorporate Finance First Internal Assignment - 10887jessicabenny08No ratings yet

- Earnings MGMTDocument5 pagesEarnings MGMTHasanNo ratings yet

- The Ethics of Creative Accounting: Does It All Add Up?Document3 pagesThe Ethics of Creative Accounting: Does It All Add Up?qwertyNo ratings yet

- Study Pack 29Document4 pagesStudy Pack 29Sachin KumarNo ratings yet

- The Nature and Scope of Financial AccountingDocument6 pagesThe Nature and Scope of Financial AccountingShannoyia D'Neila ClarkeNo ratings yet

- A Conceptual Framework For Financial Accounting and ReportingDocument70 pagesA Conceptual Framework For Financial Accounting and ReportingAyesha ZakiNo ratings yet

- Exemplu Big BathDocument16 pagesExemplu Big BathValentin BurcaNo ratings yet

- Unit5v FinalDocument23 pagesUnit5v FinalcristinaNo ratings yet

- Errors and Abuses in Financial Accounting and Results: SciencedirectDocument7 pagesErrors and Abuses in Financial Accounting and Results: SciencedirectAnonymous 90K2swQNo ratings yet

- Creative Accounting: A Literature Review: Brijesh YadavDocument13 pagesCreative Accounting: A Literature Review: Brijesh YadavAnonymous ckTjn7RCq8No ratings yet

- DK Essential Managers: Understanding AccountsFrom EverandDK Essential Managers: Understanding AccountsRating: 4 out of 5 stars4/5 (2)

- Question - Analysis Audit and Assurance Application LevelDocument28 pagesQuestion - Analysis Audit and Assurance Application LevelIQBAL MAHMUDNo ratings yet

- Areas of MAS Part 2Document13 pagesAreas of MAS Part 2JaneNo ratings yet

- PBC List For RFPDocument4 pagesPBC List For RFPMDS TeamNo ratings yet

- Bolz Office Supply Company Recently Changed Its System of InternalDocument1 pageBolz Office Supply Company Recently Changed Its System of InternalAmit PandeyNo ratings yet

- AGRS06-09 Web Version PDFDocument198 pagesAGRS06-09 Web Version PDFFathurohman Ocimh100% (1)

- The Information System: An Accountant's PerspectiveDocument4 pagesThe Information System: An Accountant's PerspectiveDenise ZurbanoNo ratings yet

- HSE Management in Petroleum Facilities-2Document59 pagesHSE Management in Petroleum Facilities-2tissaanuradhaNo ratings yet

- PREQUALIFICATION FORM For CIDocument10 pagesPREQUALIFICATION FORM For CIJervie JalaNo ratings yet

- FM 12 Reporting and AnalysisDocument12 pagesFM 12 Reporting and AnalysisMark Anthony Jr. Yanson50% (2)

- ResourcesDocument74 pagesResourcesDarshan LunawatNo ratings yet

- Audit Program-Cash FundsDocument2 pagesAudit Program-Cash FundsCristina RosalNo ratings yet

- Examiner's Report: Strategic Business Reporting (SBR) July 2020Document7 pagesExaminer's Report: Strategic Business Reporting (SBR) July 2020OzzNo ratings yet

- The Impact of COVID 19 On Going Concern Status of Restaurant Industry in The PhilippinesDocument6 pagesThe Impact of COVID 19 On Going Concern Status of Restaurant Industry in The PhilippinesGlyde Vince Isidore DuriaNo ratings yet

- Case Digest - Enron CorporationDocument3 pagesCase Digest - Enron CorporationChristine BNo ratings yet

- Financial Accounting Test One (01) James MejaDocument21 pagesFinancial Accounting Test One (01) James MejaroydkaswekaNo ratings yet

- Getting To Know Internal Auditing - IIADocument16 pagesGetting To Know Internal Auditing - IIAJoeFSabaterNo ratings yet

- Resume - Finance - Manager - Kannan - S - 2023Document6 pagesResume - Finance - Manager - Kannan - S - 2023Sigma DaniNo ratings yet

- Accessure Auditing Firm - Audit Working PaperDocument189 pagesAccessure Auditing Firm - Audit Working PaperMaycacayan, Charlene M.No ratings yet

- Tax Manager in Dallas TX Resume Karen SmithDocument3 pagesTax Manager in Dallas TX Resume Karen Smithkarensmith2No ratings yet

- ch01 - ST - Principle of AccountingDocument46 pagesch01 - ST - Principle of AccountingKaseyNo ratings yet

- S P A PLC Presentation ProcessweaverDocument26 pagesS P A PLC Presentation ProcessweavergvrnaiduNo ratings yet

- Bir Rulings 370-478Document69 pagesBir Rulings 370-478Daisy Ducepec100% (1)

- 5.+10781+ +Done+Translate+ +SKEPTISME+PROFESIONAL+ +Ivan+Sebastian To+copyedit+Document16 pages5.+10781+ +Done+Translate+ +SKEPTISME+PROFESIONAL+ +Ivan+Sebastian To+copyedit+lumumba kuyelaNo ratings yet

- Carson Block: Muddy Waters 101Document60 pagesCarson Block: Muddy Waters 101ValueWalkNo ratings yet

- Midterm Exam in Treasury ManagementDocument5 pagesMidterm Exam in Treasury ManagementJoel PangisbanNo ratings yet

- CGBERMIC S1 Corporate Governance PDFDocument35 pagesCGBERMIC S1 Corporate Governance PDFRhandel John ResiduoNo ratings yet

- QMS Document Management and Record ControlDocument3 pagesQMS Document Management and Record ControlNurul AfizaNo ratings yet

- MES AAO ManualDocument141 pagesMES AAO ManualcdranuragNo ratings yet