Final Accounts - That's It Batch

Final Accounts - That's It Batch

Uploaded by

Kunika PimparkarCopyright:

Available Formats

Final Accounts - That's It Batch

Final Accounts - That's It Batch

Uploaded by

Kunika PimparkarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Final Accounts - That's It Batch

Final Accounts - That's It Batch

Uploaded by

Kunika PimparkarCopyright:

Available Formats

Chapter 3

Preparation of Financial

Statements of Commercial

Organisations

Learning Objectives:

Meaning of Financial Statements

Objectives or Importance of Financial Statements

Steps for the preparation of the Financial Statements

Bad Debts and Provision for Doubtful Debts

Adjustments while preparing Financial Statements

Financial Statements following cash basis of accounting

Adjustments related to Rectification of Errors

Q1 What is Final Accounts?

Sol: Final destination of the accounting process.

It Includes Trading A/c, Profit & Loss A/c, Profit & Loss Appropriation A/c

and Balance Sheet.

Q2 Why to do Final Accounts?

Sol: To ascertain the Profit or Loss in an Accounting period and to know the

Financial Position of the Business as on a date.

Final Accounts achieves the most important objectives of doing Accounting.

Q3 How to do Final Accounts?

Sol:

Accounting Process

Transaction

Journal / Subsidiary Books

3.1 | F i n a n c i a l S t a t e m e n t CA Bishnu Kedia

Ledger

Trail Balance

Final Accounts

Final Accounts is prepared on the basis of Trial Balance and Adjustment

Entries (Entries which have not already been reflected in Trial Balance i.e.

which have not passed through the double entry system)

Steps to prepare Final Accounts:

Step 1: Prepare the format of Trading and Profit & Loss Account

Step 2: Read the adjustments and mark the Items in Trial Balance which will be

affected.

Step 3: Pick up the items from Trial Balance serially and drop at the correct place in

Final Accounts (At any one place in Final Accounts. Marked items to be

placed in the internal column)

Correct place in Final Accounts means:

Items to pick from Trial Balance Place at

Opening Stock, Purchases and Direct Expenses Trading Account Dr Side

Sales Trading Account Credit Side

All Other Expenses P/L A/c Dr Side

All Other Income P/L A/c Cr Side

All Assets Balance Sheet Asset Side

Capital and All Liabilities Balance Sheet Liability Side

Some items to be deducted from other specific items:

Purchase Return / Return Outward Deduct from Purchases

Sales Return / Return Inward Deduct from Sales

Drawings Deduct from Capital

Step 4: Analyse adjustments and give the Debit and Credit effect of each

Adjustment entry in the Final Accounts (Refer Summary sheet for Effect of

Adjustments). (Debit and Credit, both the effect is to be given for

adjustments).

Step 5: Transfer Gross Profit / Gross Loss from Trading A/c to Profit & Loss A/c, Net

Profit / Net Loss from Profit & Loss A/c to Capital and Close the Final

Accounts.

3.2 | F i n a n c i a l S t a t e m e n t CA Bishnu Kedia

Question 1

M/s Adhuna & Co. had a provision for bad debts of ₹13,000 against their book debts

on 1st April, 2015. During the year ended 31st March, 2022, ₹8,500 proved

irrecoverable and it was desired to maintain the provision for bad debts @5% on

Debtors which stood at ₹3,90,000 before writing off Bad Debts.

Prepare the provision for Bad Debt Account for the year ended March 31, 2022.

Ans:

Note:

Question 2

On 1st April, 2021 the balance of provision for bad and doubtful debts was ₹13,000.

The bad debts during the year 2021-22 were ₹9,500. The sundry debtors as on 31st

March, 2022 stood at ₹3,25,000 out of these debtors of ₹2,500 are bad and cannot be

realized. The provision for bad and doubtful debts is to be raised to 5% on sundry

debtors. You are required to:

(i) Pass necessary adjustment entries for bad debts and its provision on 31st March,

2022.

(ii) Prepare the necessary ledger accounts.

(iii) Show the relevant items in the profit and loss account and Balance Sheet.

Ans:

Note:

Question 3

A company maintains its provision for bad debts @ 5% and a provision for discount

on debtors @ 2%. You are given the following details: (in ‘000s)

Bad Debts 800 1,500

Discount Allowed 1,200 500

Sundry Debtors (before providing all Bad Debts and Discounts) 60,000 42,000

On 01.01.2021, Provision for bad debts and Provision of discount on debtors had

balance of ₹4,550 and ₹800 respectively.

Show Provision for Bad Debts and Provision for Discount on Debtors Account for the

year 2020 and 2021.

Ans:

Note:

3.3 | F i n a n c i a l S t a t e m e n t CA Bishnu Kedia

Question 4

On 31.12.2020, Sundry Debtors and Provision for Doubtful Debts are ₹50,000 and

₹5,000 respectively. During the year 2021, ₹3,000 are bad and written off on

30.9.2021, an amount of ₹400 was received on account of a debt which was written

off as bad last year on 31.12.2021, the debtors left was verified and it was found that

sundry debtors stood in the books were ₹40,000 out of which a customer Mr. X who

owed ₹800 was to be written off as bad.

Prepare Bad Debt A/c and Provision for Doubtful A/c assuming that some percentage

should be maintained for provision for Doubtful debt as it was on 31.12.2021.

Also show how the illustration appear in Profit & Loss A/c and Balance Sheet.

Ans:

Note:

Question 5

Following are the ledger balances presented by M/s. P. Sen as on 31st March 2022.

Particulars Amount (₹) Particulars Amount(₹)

Stock (1.4.2021) 10,000 Sales 3,00,000

Purchase 1,60,000 Return Inward 16,000

Carriage Inwards 10,000 Return Outward 10,000

Wages 30,000 Royalty on Production 6,000

Freight 8,000 Gas and Fuel 2,000

Additional Information:

(1) Stock on 31.3.2022: (i) Market Price ₹24,000; (ii) Cost Price ₹20,000;

(2) Stock valued ₹10,000 were destroyed by fire and insurance company admitted the

claim to the extent of ₹6,000.

(3) Goods purchased for ₹6,000 on 29th March, 2022, but still lying in-transit, not at

all recorded in the books.

(4) Goods taken for the proprietor for his own use for ₹3,000.

(5) Outstanding wages amounted to ₹4,000.

(6) Freight was paid in advance for ₹1,000.

Ans:

Note:

3.4 | F i n a n c i a l S t a t e m e n t CA Bishnu Kedia

Question 6

From the following particulars presented by Mr. Shankar for the year ended 31st

March 2022, prepare Profit and Loss Account after taking into consideration the given

details:

Gross Profit ₹1,00,000, Rent ₹22,000; Salaries, ₹10,000; Commission (Cr.) ₹12,000;

Insurance ₹8,000; Interest (Cr.) ₹6,000; Bad Debts ₹2,000; Provision for Bad Debts

(1.4.2021) ₹4,000; Sundry Debtors ₹40,000; Discount Received ₹2,000; Plant &

Machinery ₹80,000.

Adjustments:

(a) Outstanding salaries amounted to ₹4,000;

(b) Rent paid for 11 months;

(c) Interest due but not received amounted to ₹2,000

(d) Prepaid Insurance amounted to ₹2,000;

(e) Depreciate Plant and Machinery by 10% p.a.

(f) Further Bad Debts amounted to ₹2,000 and make a provision for Bad Debts @5%

on Sundry Debtors.

(g) Commissions received in advance amounted to ₹2,000.

Ans:

Note:

Question 7

X,Y and Z are three Partners sharing profit and Losses equally. Their capital as on

01.04.2021 were: X ₹80,000 ; Y ₹60,000 and Z ₹50,000.

They mutually agreed on the following points (as per partnership deed):

(a) Interest on capital to be allowed @ 5% P.a.

(b) X to be received a salary @ ₹ 500 p.m.

(c) Y to be received a commission @ 4% on net profit after charging such

commission.

(d) After charging all other items 10% of the net profit to be transferred General

Reserve.

Profit from Profit and Loss Account amounted to ₹ 66,720.

Prepare a Profit and Loss Appropriation Account for the year ended 31st March, 2022.

Ans:

Note:

3.5 | F i n a n c i a l S t a t e m e n t CA Bishnu Kedia

Question 8

From the following Trial Balance of M/s BJ & Sons, prepare the final accounts for the

year ended on 31st March 2022, and also the Balance Sheet as on that date.

Particulars Debit (₹) Credit (₹)

Stock as on 01.04.2021: Finished goods 2,00,000

Purchases and Sales 22,00,000 35,00,000

Bills Receivables 50,000

Returns 1,00,000 50,000

Carriage Inwards 50,000

Debtors and Creditors 2,00,000 4,00,000

Carriage Outwards 40,000

Discounts 5,000 5,000

Salaries and wages 2,20,000

Insurance 60,000

Rent 60,000

Wages and salaries 80,000

Bad debts 10,000

Furniture 4,00,000

BJ’s capital 5,00,000

BJ’s drawing 70,000

Loose tools 1,00,000

Printing & stationery 30,000

Advertising 50,000

Cash in hand 45,000

Cash at bank 2,00,000

Petty Cash 5,000

Machinery 3,00,000

Commission 10,000 30,000

Total 44,85,000 44,85,000

Adjustments:

(i) Finished goods stock: Stock on 31st March was valued at Cost price ₹4,20,000

and market price ₹400,000.

(ii) Depreciate furniture @ 10% p.a. and machinery @ 20% p.a. on reducing balance

method.

(iii) Rent of ₹5,000 was paid in advance.

(iv) Salaries & wages due but not paid ₹30,000.

(v) Make a provision for doubtful debts @ 5% on debtors.

(vi) Commission receivable ₹5,000.

Ans:

Note:

3.6 | F i n a n c i a l S t a t e m e n t CA Bishnu Kedia

Question 9

Mr. Arvind Kumar has a small business enterprise. He has given the trial balance as at

31st March 2022

Particulars Debit (₹) Credit (₹)

Mr. Arvind Kumar’s Capital 1,00,000

Machinery 36,000

Depreciation on machinery 4,000

Repairs to machinery 5,200

Wages 54,000

Salaries 21,000

Income tax of Mr. Arvind kumar 1,000

Cash in hand 4,000

Land & Building 1,49,000

Depreciation on building 5,000

Purchases 2,50,000

Purchase returns 3,000

Sales 4,98,000

CC Bank 7,600

Accrued Income 3,000

Salaries outstanding 4,000

Bills receivables 30,000

Provision for doubtful debts 10,000

Bills payable 16,000

Bad debts 2,000

Discount on purchases 7,080

Debtors 70,000

Creditors 62,520

Opening stock (01.04.2021) 74,000

Total 7,08,200 7,08,200

Additional information:

(1) Stock as on 31st March 2022 was valued at ₹60,000

(2) Write off further ₹6,000 as bad debt and maintain a provision of 5% on doubtful

debt.

(3) Goods costing ₹10,000 were sent on approval basis to a customer for ₹12,000 on

30th March, 2022. This was recorded as actual sales.

(4) ₹2,400 paid as rent for office was debited to Landlord’s A/c and was included in

debtors.

(5) General Manager is to be given commission at 10% of net profits after charging

3.7 | F i n a n c i a l S t a t e m e n t CA Bishnu Kedia

his commission.

(6) Works manager is to be given a commission at 12% of net profit before charging

General Manager’s commission and his own.

You are required to prepare final accounts in the books of Mr. Arvind kumar, and also

the Balance Sheet as on that date.

Ans:

Note:

Question 10

Mr. Abhay runs a small shop and deals in various goods. He has not been able to tally

his trial balance and has closed it by taking the difference to Suspense A/c. It is given

below.

Particulars (as on 31st March 2013) Debit (₹) Credit (₹)

Abhay’s capital 1,50,000

Drawings 75,000

Fixed assets 1,35,000

Opening stock (01.04.2021) 36,500

Purchases & returns 6,75,000 13,500

Sales & returns 34,000 8,50,000

Due from customer & to creditors 95,000 3,25,000

Expenses 45,750

Cash 3,000

Bank Deposits & Interest Earned 55,000 5,750

Suspense A/c 4,000

Advertising 2,00,000

Total 13,51,250 13,51,250

Mr. Abhay has requested you to help him in tallying his trial balance and also prepare

his final accounts. On investigation of his books you get the following information:

(i) Closing Stock on 31st March 2022 was ₹45,000 at cost and could sell over this

value.

(ii) Depreciation of ₹13,500 needs to be provided for the year.

(iii) A withdrawal slip indicated a cash withdrawal of ₹15,000 which was charged as

drawing. However, it was noticed that ₹11,000 was used for business purpose

only and was entered as expenses in cash book.

(iv) Goods worth ₹19,000 were purchased on 24th March 2022 and sold on 29th

March 2022 for ₹23,750. Sales were recorded correctly, but purchase invoice

3.8 | F i n a n c i a l S t a t e m e n t CA Bishnu Kedia

was missed out.

(v) Purchase returns of ₹1,500 were routed through sales return. Party’s A/c was

correctly posted.

(vi) Expenses include ₹3,750 related to the period after 31st March 2022.

(vii) Purchase book was over-cast by ₹1,000. Posting to suppliers’ A/c is correct.

(viii) Advertising will be useful for generating revenue for 5 years.

Ans:

Note:

Question 11

Mr. O maintains his accounts on Mercantile basis. The following Trial Balance has

been prepared from his books as at 31st March, 2022 after making necessary

adjustments for outstanding and accrued items as well as depreciation:

Trial Balance

as at 31st March, 2022

Particulars Dr.(₹) Cr.(₹)

Plant and Machinery 2,12,500

Sundry Creditors 2,64,000

Sales 6,50,000

Purchases 4,20,000

Salaries 40,000

Prepaid Insurance 370

Advance Rent 2,000

Outstanding Salary 6,000

Advance Salary 2,500

Electricity Charges 2,650

Furniture and Fixtures 72,000

Opening Stock (01.04.2021) 50,000

Outstanding Electricity Charges 450

Insurance 1,200

Rent 10,000

Miscellaneous Expenses 14,000

Cash in hand 3,000

Investments 80,000

Drawings 24,000

Dividend from Investments 8,000

Accrued Dividend from Investments 1,500

3.9 | F i n a n c i a l S t a t e m e n t CA Bishnu Kedia

Depreciation on Plant and Machinery 37,500

Depreciation on Furniture 8,000

Capital Account 2,11,970

Telephone Charges 6,000

Sundry Debtors 1,70,500

Stationery and Printing 1,200

Cash at Bank 65,000

Interest on Loan 8,000

Interest Due but not paid on loan 1,500

Loan Account 90,000

12,31,920 12,31,920

Additional Information:

(i) Salaries include ₹10,000 towards renovation of Proprietor’s residence.

(ii) Closing Stock amounted to ₹75,000.

Mr. O, however, request you to prepare a Trading and Profit & Loss Account for the

year ended 31st March, 2022 and a Balance Sheet as on that date following cash basis

of accounting.

Ans:

Note:

Question 12

The following Trial Balance has been prepared from the books of Mrs. Saxena as on

31st March, 2022 after making necessary adjustments for depreciation on Fixed

Assets, outstanding and accrued items and difference under Suspense Account.

Trial Balance as at 31st March, 2022

Particulars Dr.(₹) Particulars Cr.(₹)

Machineries 1,70,000 Sundry Creditors 82,000

Furniture 49,500 Capital Account 2,45,750

Sundry Debtors 38,000 Outstanding Expenses:

Drawings 28,000 Salaries 1,500

Travelling Expenses 6,500 Printing 600

Insurance 1,500 Audit Fees 1,000

Audit Fees 1,000 Bank Interest 1,200

Salaries 49,000 Discounts 1,800

Rent 5,000 Sales (Less Return) 6,80,000

Cash in hand 7,800

3.10 | F i n a n c i a l S t a t e m e n t CA Bishnu Kedia

Cash at Bank 18,500

Stock-in-trade (1-4-2021) 80,000

Prepaid Insurance 250

Miscellaneous Expenses 21,200

Discounts 1,200

Printing & Stationery 1,500

Purchase (Less Returns) 4,60,000

Depreciation:

Machineries 30,000

Furniture 5,500

Suspense Account 39,400

10,13,850 10,13,850

On the subsequent scrutiny following mistakes were noticed:

(i) A new machinery was purchase for ₹50,000 but the amount was wrongly posted

to Furniture Account as ₹5,000.

(ii) Cash received from Debtors ₹ 5,600 was omitted to be posted in the ledger.

(iii) Goods withdrawn by the proprietor for personal use but no entry was passed

₹5,000.

(iv) Sales included ₹30,000 as goods sold cash on behalf of Mr. Thakurlal who

allowed 15% commission on such sales for which effect is to be given.

You are further told that:-

(a) Closing stock on physical verification amounted to ₹47,500.

(b) Depreciation on Machineries and Furniture has been provided @ 15% and 10%,

respectively, on reducing balancing system.

Full year’s depreciation is provided on addition.

You are requested to prepare a Trading and Profit & Loss Account for the year ended

31st March 2022 and a Balance Sheet as on that date so as to represent a True and

Correct picture.

Ans:

Note:

3.11 | F i n a n c i a l S t a t e m e n t CA Bishnu Kedia

Question 13

The following Trail Balance has been extracted from the books of Mr. Agarwal as on

31.3.2022:

Trial Balance as on 31.3.2022

Particulars Dr.(₹) Particulars Cr.(₹)

Purchase 6,80,000 Sales 8,38,200

Sundry Debtors 96,000 Capital Account 1,97,000

Drawings 36,000 Sundry Creditors 1,14,000

Bad Debts 2,000 Outstanding Salary 2,500

Furniture & Fixtures 81,000 Sale of Old Papers 1,500

Office Equipments 54,000 Bank Overdraft (PP Bank) 60,000

Salaries 24,000

Advanced Salary 1,500

Carriage Inward 6,500

Miscellaneous Expenses 12,000

Travelling Expenses 6,500

Stationery & Printing 1,500

Rent 18,000

Electricity & Telephone 6,800

Cash In Hand 5,900

Cash at Bank (SBI) 53,000

Stock (1.4.2021) 50,000

Repairs 7,500

Motor Car 56,000

Depreciation:

Furniture 9,000

Office Equipment 6,000 15,000

12,13,200 12,13,200

Additional Information:

(i) Sales includes ₹60,000 towards goods for cash on account of a joint venture with

Mr. Reddy who incurred ₹800 as forwarding expenses. The joint venture earned a

profit of ₹15,000 to which Mr. Reddy is entitled to 60%

(ii) The motor car account represents an old motor car which was replaced on

1.4.2021 by a new motor car costing ₹1,20,000 with an additional cash payment

of ₹40,000 laying debited to Purchase Account.

(iii) PP Bank has allowed an overdraft limit against hypothecation of stocks keeping a

margin of 20%. The present balance is the maximum as permitted by the Bank.

(iv) Sundry Debtors include ₹4,000 as due from Mr. Trivedi and Sundry Creditors

3.12 | F i n a n c i a l S t a t e m e n t CA Bishnu Kedia

include ₹7,000 as payable to him.

(v) On 31.3.2022 outstanding rent amounted to ₹6,000 and you are informed that 50%

of the total rent is attributable towards Agarwal’s resident.

(vi) Depreciation to be provided on motor car @ 20% (excluding sold item).

Mr. Agarwal requests you to prepare a Trading and Profit & Loss Account for the

year ended 31.3.2022 and a Balance Sheet as on that date.

Ans:

Note:

Question 14

From the following particulars prepare a Final Accounts of M/s. X & Y for the year

ended 31st March 2022.

Particulars Amount (₹) Particulars Amount (₹)

Sales 8,20,000 Land 11,000

Opening Stock 3,00,000 Purchase 3,80,000

Loan (Dr.) 20,000 Interest (Cr.) 1,000

Wages 60,000 Salaries 40,000

Carriage Inwards 4,000 Carriage Outward 2,000

Returns inward 4,000 Returns Outwards 3,000

Furniture 10,000 Trade charges 8,000

Drawings Capital

-X 12,000 - X 24,000

-Y 10,000 - Y 16,000

Cash 3,000

Additional Information:

(i) Closing Stock amounted to ₹1,20,000;

(ii) Provide Interest on drawings (on an average 6 months) and interest on capital @

6% and 4% respectively.

(iii) Y is to get a salary of ₹400 p.m.

(iv) X is to get a commissions @ 2% on gross sales

(v) 50% of the profit is to be transferred to Reserve Fund.

(vi) Depreciations on furniture @ 10% p.a.

The partners share profit and loss equally.

Ans:

Note:

3.13 | F i n a n c i a l S t a t e m e n t CA Bishnu Kedia

Question 15

From the following balances extracted from the books of Mr. S on December 31,

2021, prepare a Trading and Profit and Loss Account for the year ended on that date

and also a Balance Sheet as on the same date:

Trial Balance as on 31.12.2021

Particulars Amount (₹) Particulars Amount (₹)

Salaries 18,000 Sales 2,43,000

Debtors 1,26,000 8% Loan from Mr. Kumar 60,000

(taken on 01.07.2021)

Stock on 01.01.2021 30,000 Provision for Bad Debts 8,000

Machinery 2,00,000 Bills Payable 11,000

Furniture 85,000 Outstanding Salaries 3,000

Bad Debts 4,000 Capital Account 3,30,000

Purchases 1,50,000 Creditors 90,000

Printing & Stationery 5,300

Postage & Telephone 3,200

Rent 4,500

Cash in Hand 2,500

Bank Balance 72,500

Insurance 4,800

Bills Receivable 15,000

General Expenses 9,200

Drawings 10,000

Interest on Loan 2,000

Wages 3,000

7,45,000 7,45,000

Additional Information:

a. Closing Stock (as on 31.12.2021): Cost Price ₹50,000; Market Value ₹40,000.

b. An old furniture which stood at ₹12,000 in the books on Jan 1, 2021 was disposed

of at ₹5,800 on June 30, 2021, in part exchange of a new furniture costing ₹10,400.

A net invoice of ₹4,600 was passed through the Purchase Day Book.

c. Sales include ₹36,000 hire-purchase sales. Hire-purchase sales prices are

determined after adding 25% on Hire-Purchase price. 30% of the installments have

not fallen due yet. Profit or loss on hire-purchase sales is to be shown in the Profit

and Loss Account.

d. Debtors include ₹7,500 due from Mr. M and Creditors include ₹6,000 due to him.

e. Insurance premium had been paid for the year ended December 31, 2021.

3.14 | F i n a n c i a l S t a t e m e n t CA Bishnu Kedia

f. Depreciate the fixed assets as follow: Machinery @ 15% p.a. and Furniture @ 10%

p.a.

g. Provide 5% for bad debts on debtors (excluding hire-purchase debtors).

Ans:

Note:

Question 16

Mrs. Joshi has presented you the following Trial Balance as on 31st December 2021:

Dr. Trial Balance as on 31.12.2021 Cr.

Particulars Amount (₹) Particulars Amount (₹)

Purchases 1,75,000 Sales 3,25,000

Interest 8,000 10% Loan from UBI 1,00,000

Debtors 1,04,000 Bills Payable 86,000

Suspense A/c 8,000 Capital 4,87,000

Rent 6,600 Sundry Creditors 1,02,500

Plant & Machinery 5,30,000 Apprenticeship Premium 2,000

Received

Furniture & Fixture 85,000 Purchase Return 1,500

Salaries 7,000

Wages 2,500

GST 6,000

Motor Car 70,000

Octroi 500

Insurance 10,000

Unexpired Insurance 2,300

Factory Shed 30,000

Bills Receivable 25,000

Patent 32,100

Sales Return 2,000

11,04,000 11,04,000

You are required to prepare a Trading and Profit & Loss account and a Balance Sheet

as on 31st Dec 2021 after considering the following adjustment:

1. A sale of ₹25,000 made for cash had been credited to Purchase A/c.

2. Private purchase amounting to ₹ 600 had been included in Purchase Day Book.

3. The loan account in the books of proprietor appeared as follows:

3.15 | F i n a n c i a l S t a t e m e n t CA Bishnu Kedia

Dr. 10% Loan from UBI Account Cr.

Date Particulars (₹) Date Particulars (₹)

31.12.21 To Balanced c/f 1,00,000 1.1.21 By Balance b/f 50,000

31.12.21 By Bank A/c 50,000

1,00,000 1,00,000

Interest paid includes ₹3,000 interest paid to UBI Bank.

4. During the year goods worth ₹1,00,000 were invoiced on ‘sale on approval basis’ at

cost plus 25%. Out of these, goods worth ₹20,000 accepted by the customers,

₹40,000 worth of goods were rejected and properly accounted for but no intimation

has been obtained for the balance of the goods and its period is yet to expire.

5. Debtors were shown after deduction of Provision for Doubtful Debt of ₹2,000. It

was decided that this debt was considered to be bad and should be written off and a

provision of ₹1,000 should be made which was considered doubtful.

6. Suspense account represents money advanced to sales manager who was sent to

Mumbai in August, 2021 for sales promotion. On returning to Kolkata submitted a

statement disclosing that ₹2,000 was incurred for travelling, ₹1,200 for legal

expenses and ₹1,800 for miscellaneous expenses. The balance lying with him is yet

to be refunded.

7. Business is carried on in a two-storied rented house. The ground floor, being 50 per

cent of the accommodation, is used for business. Mrs. Joshi lives with her family on

the first floor.

8. The Furniture account represents old furniture which was replaced on 1.1.2021 by a

new one, costing ₹1,20,000 with an additional cash payment of ₹80,000 lying

debited to purchases account. However, the assets were put to use on 1.4.2021.

9. Depreciation is to be charged on Furniture @ 10% p.a., Plant & Machinery @ 5%

p.a., Motor Car @ 5% p.a.

10. The General manager is entitled to commission based on a percentage of net profit

(such commission being charged to profit and loss account before ascertaining the

net profits), calculated in the following manner :

On the first ₹30,000 of net profit Nil

On the next ₹30,000 of net profit 10%

On the next ₹30,000 of net profit 20%

And on the balance of net profit 30%

11. Closing Stock was 31.12.2021 was 22,000.

Ans:

Note:

3.16 | F i n a n c i a l S t a t e m e n t CA Bishnu Kedia

You might also like

- Business StudiesDocument157 pagesBusiness StudiesPranay TapariaNo ratings yet

- ch04 PDFDocument4 pagesch04 PDFMosharraf HussainNo ratings yet

- Session 4 - Journal - ProblemsDocument23 pagesSession 4 - Journal - ProblemsanandakumarNo ratings yet

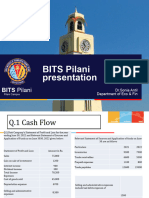

- Financial and Management Accounting: BITS PilaniDocument41 pagesFinancial and Management Accounting: BITS PilaniPunitNo ratings yet

- Mock Midterm Exam - Financial AccountingDocument3 pagesMock Midterm Exam - Financial Accountinglamvolamvo0912No ratings yet

- Session 5 - Ledger Format & Posting of TransactionsDocument33 pagesSession 5 - Ledger Format & Posting of Transactionsanandakumar100% (1)

- Sem1 MCQ FinancialaccountDocument14 pagesSem1 MCQ FinancialaccountHema LathaNo ratings yet

- L4 - Leder Posting and TBDocument30 pagesL4 - Leder Posting and TBPunitNo ratings yet

- Combined QUIZ PDF Fma PDFDocument90 pagesCombined QUIZ PDF Fma PDFsanjeev misraNo ratings yet

- Tutorial - FMA - Activity 4Document5 pagesTutorial - FMA - Activity 4Anonymous cdbGe8bFJoNo ratings yet

- Fma PaperDocument2 pagesFma Paperfishy18No ratings yet

- BITS MBA FMA Paper-1Document2 pagesBITS MBA FMA Paper-1Raja Mohan RaviNo ratings yet

- Topic-1: Course Objectives Learning Outcome StatementsDocument84 pagesTopic-1: Course Objectives Learning Outcome Statementsakalya eceNo ratings yet

- Financial Reporting Quality PPT - DONEDocument33 pagesFinancial Reporting Quality PPT - DONEpamilNo ratings yet

- Practice Session - 14 - MayDocument18 pagesPractice Session - 14 - MayprabhuNo ratings yet

- Debtors Journal of Olympia Sport and Trade For August 2020DJ 8Document7 pagesDebtors Journal of Olympia Sport and Trade For August 2020DJ 8thokoanebokang00No ratings yet

- # 2 Assignment On Financial and Managerial Accounting For MBA StudentsDocument7 pages# 2 Assignment On Financial and Managerial Accounting For MBA Studentsobsa alemayehuNo ratings yet

- Financial and Management Accounting: BITS PilaniDocument11 pagesFinancial and Management Accounting: BITS Pilanirani rinoNo ratings yet

- Chapter 02 - Basic Financial StatementsDocument139 pagesChapter 02 - Basic Financial StatementsElio BazNo ratings yet

- Session 3 - JournalDocument27 pagesSession 3 - JournalanandakumarNo ratings yet

- Absorption Costing & Marginal Costing PDFDocument33 pagesAbsorption Costing & Marginal Costing PDFNguyen Châu Anh100% (1)

- Ganesh Metal Industry Trial Balance, December 31, 2008 Account Debit (RS) Credit (RS)Document11 pagesGanesh Metal Industry Trial Balance, December 31, 2008 Account Debit (RS) Credit (RS)ayushsapkota907No ratings yet

- Tybaf Sem Vi Financial-Accounting-ViiDocument186 pagesTybaf Sem Vi Financial-Accounting-Viikalpesh.varankar12No ratings yet

- Accounting AnalysisDocument59 pagesAccounting AnalysisGEETI OBEROINo ratings yet

- Financial Accounting Question SetDocument24 pagesFinancial Accounting Question SetAlireza KafaeiNo ratings yet

- Chapter 7 - Accounting For ReceivablesDocument53 pagesChapter 7 - Accounting For ReceivablesJes ReelNo ratings yet

- Taxation of CompaniesDocument10 pagesTaxation of CompaniesnikhilramaneNo ratings yet

- F5 Variances TestDocument5 pagesF5 Variances Testv0524 vNo ratings yet

- Solutions IAS 1 For SEPT ATTEMPT FinalDocument25 pagesSolutions IAS 1 For SEPT ATTEMPT FinalShehrozSTNo ratings yet

- The Accounting Cycle: Accruals and Deferrals: Mcgraw-Hill/IrwinDocument40 pagesThe Accounting Cycle: Accruals and Deferrals: Mcgraw-Hill/IrwinjawadzaheerNo ratings yet

- LKAS 37 - StudentsDocument7 pagesLKAS 37 - StudentskawindraNo ratings yet

- Partnership Final AccountDocument1 pagePartnership Final Accountsujan Bhandari100% (1)

- COst SheetDocument52 pagesCOst SheetAshwini Harwale SonwaneNo ratings yet

- Bank Reconciliation StatementDocument12 pagesBank Reconciliation StatementMohammed Yazin100% (1)

- AFA2e Chapter03 PPTDocument50 pagesAFA2e Chapter03 PPTIzzy BNo ratings yet

- Chapter 7 SolutionsDocument8 pagesChapter 7 SolutionsAustin LeeNo ratings yet

- Question Bank 1Document5 pagesQuestion Bank 1lavarocks23100% (1)

- CA Foundation PDFDocument34 pagesCA Foundation PDFShyam ShelkeNo ratings yet

- 605 Chapter 4Document38 pages605 Chapter 4阿锭No ratings yet

- Test Bank For Intermediate Accounting 15th Edition Kieso, Weygandt, WarfieldDocument12 pagesTest Bank For Intermediate Accounting 15th Edition Kieso, Weygandt, Warfielda384600180No ratings yet

- Adjusting Entries & Questions PDFDocument18 pagesAdjusting Entries & Questions PDFshahroz QadriNo ratings yet

- Ca Inter Financial Management Icai Past Year Questions: Mr. Manik Arora & Ms. Aarzoo AroraDocument181 pagesCa Inter Financial Management Icai Past Year Questions: Mr. Manik Arora & Ms. Aarzoo AroraArun SapkotaNo ratings yet

- Solution To Trina Haldane - Question 4Document2 pagesSolution To Trina Haldane - Question 4Debbie Debz100% (2)

- Ratio Analysis Review QuestionsDocument5 pagesRatio Analysis Review QuestionsPASTORYNo ratings yet

- Ch.02 The Recording Process PDFDocument47 pagesCh.02 The Recording Process PDFSothcheyNo ratings yet

- Chapter 4Document24 pagesChapter 4Tanzeel HussainNo ratings yet

- Format of Trading Profit Loss Account Balance Sheet PDFDocument6 pagesFormat of Trading Profit Loss Account Balance Sheet PDFsonika7100% (1)

- 2010 June Financial Reporting L1Document90 pages2010 June Financial Reporting L1Dixie Cheelo0% (1)

- Q2 Partnership Final Accounts Online Questions q2Document3 pagesQ2 Partnership Final Accounts Online Questions q2Isha KatiyarNo ratings yet

- Introduction To Final AccountsDocument38 pagesIntroduction To Final AccountsCA Deepak Ehn88% (8)

- 13 Standard CostingDocument32 pages13 Standard CostingMusthari KhanNo ratings yet

- FSA Fiches MidtermsDocument15 pagesFSA Fiches Midtermsimad imadNo ratings yet

- 7 Adjustments To Final AccountsDocument11 pages7 Adjustments To Final AccountsBhavneet Sachdeva100% (1)

- Chapter 12Document45 pagesChapter 12gottwins05No ratings yet

- Branch Accounting PDFDocument18 pagesBranch Accounting PDFSivasruthi DhandapaniNo ratings yet

- Chapter 3 Single Entry and Incomplete RecordsDocument36 pagesChapter 3 Single Entry and Incomplete RecordsAzyyati Mohamad UtamaNo ratings yet

- How To Answer Cash Budget QuestionsDocument1 pageHow To Answer Cash Budget QuestionsDenisa M. Todea0% (1)

- Week 6 Tutorial SolutionsDocument13 pagesWeek 6 Tutorial SolutionsFarah PatelNo ratings yet

- BAC 223 Topic TwoDocument39 pagesBAC 223 Topic TwoGABRIEL KAMAU KUNG'UNo ratings yet

- ACCCOB1 - Quiz #1 - Tuesday - Set A - Answer KeyDocument4 pagesACCCOB1 - Quiz #1 - Tuesday - Set A - Answer KeyrabekogoNo ratings yet

- Financial Accounting Ii-2Document5 pagesFinancial Accounting Ii-2gautham rajeevanNo ratings yet

- 4.2 Risk Treatment ProcessDocument4 pages4.2 Risk Treatment ProcessRizky Hardiana de Toulouse-LautrecNo ratings yet

- Huraira Ehsan F17-0848 Bs Accounting and Finance 7 Semester Corporate Governance Sir Shiraz Ahmed 23/1/21Document9 pagesHuraira Ehsan F17-0848 Bs Accounting and Finance 7 Semester Corporate Governance Sir Shiraz Ahmed 23/1/21huraira ehsanNo ratings yet

- Pi (E) Day Payday!: Marketing Lead: Sam DomingoDocument4 pagesPi (E) Day Payday!: Marketing Lead: Sam DomingoYuan TugnaoNo ratings yet

- الامن المجتمعي مفهومه وعلاقته بالقطاعات الامنية الاخرى.Document20 pagesالامن المجتمعي مفهومه وعلاقته بالقطاعات الامنية الاخرى.Sabri El BeyaNo ratings yet

- Speaking - Unit 2Document11 pagesSpeaking - Unit 2Nadia GanjiNo ratings yet

- English Short Stories Random Pages Sample2Document22 pagesEnglish Short Stories Random Pages Sample2Àhmed R. Farrag50% (2)

- Unit 1Document14 pagesUnit 1மணிகண்டன் பிரியாNo ratings yet

- Civil Peace by Chinua AchebeDocument5 pagesCivil Peace by Chinua AchebeDaniel KohNo ratings yet

- Kudrat HCDDocument13 pagesKudrat HCDS M Tayzul IslamNo ratings yet

- Kinds of Spec. Pro.: Others: 1. Those Actions Under The Family Code 2. Those Related To ArbitrationDocument101 pagesKinds of Spec. Pro.: Others: 1. Those Actions Under The Family Code 2. Those Related To Arbitrationdnel13No ratings yet

- Factors Influencing The Contractor Performance in Water Supply Projects in RwandaDocument6 pagesFactors Influencing The Contractor Performance in Water Supply Projects in RwandaArega GenetieNo ratings yet

- Part 1.mp3: Speaker1Document9 pagesPart 1.mp3: Speaker1Anna Marie LaganzonNo ratings yet

- DGR REGULATION - Section 18 - Dangerous Goods by Air - Edition 2.0Document49 pagesDGR REGULATION - Section 18 - Dangerous Goods by Air - Edition 2.0kecildaimNo ratings yet

- MHN 16Document13 pagesMHN 16Vaishali SinghNo ratings yet

- Application For Probation With Motion To Post BailDocument3 pagesApplication For Probation With Motion To Post BailDax MonteclarNo ratings yet

- ProofDocument1 pageProofxhxbxbxbbx79No ratings yet

- Licensed Agents 2017.Document8 pagesLicensed Agents 2017.URAugandaNo ratings yet

- Ummu UmarahDocument3 pagesUmmu UmarahHazim ZakwanNo ratings yet

- Rosetta Stone of Women BehaviourDocument11 pagesRosetta Stone of Women Behaviourgift2umaNo ratings yet

- Agnew and Cashel v. St. Louis CountyDocument31 pagesAgnew and Cashel v. St. Louis CountyKelsi AndersonNo ratings yet

- Full-Year Results 2018: Press ConferenceDocument22 pagesFull-Year Results 2018: Press ConferenceDebasish SahooNo ratings yet

- Kinatac An Vs DecenaDocument12 pagesKinatac An Vs DecenaNoreenL.Natingor-TabanaoNo ratings yet

- Case StudyDocument7 pagesCase StudyCharmie Sta TeresaNo ratings yet

- People v. Sara 55 PHIL 939Document3 pagesPeople v. Sara 55 PHIL 939Anonymous100% (1)

- 265298examine This Report On Mobile Vehicle DetailersDocument3 pages265298examine This Report On Mobile Vehicle DetailersbranyauxvqNo ratings yet

- Colorado Homes & LifestylesDocument116 pagesColorado Homes & Lifestylessalman100% (2)

- Cyber Crime Effects To Businesses in Philippines: November 2016Document5 pagesCyber Crime Effects To Businesses in Philippines: November 2016DianaNo ratings yet

- RUral Areas Problem and OppertunityDocument6 pagesRUral Areas Problem and OppertunityDeva RanjanNo ratings yet

- Law On Obligations (MARK)Document10 pagesLaw On Obligations (MARK)Michael Olmedo NeneNo ratings yet