@ Real Estate Practice Exam

@ Real Estate Practice Exam

Uploaded by

Aleksandra LutosławskaCopyright:

Available Formats

@ Real Estate Practice Exam

@ Real Estate Practice Exam

Uploaded by

Aleksandra LutosławskaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

@ Real Estate Practice Exam

@ Real Estate Practice Exam

Uploaded by

Aleksandra LutosławskaCopyright:

Available Formats

Florida Real Estate Exam Applicants

100-Question Practice Exam.

We recommend that you print this 100-question practice exam. Take the exam, then

grade it using the answer key on the last page. You should strive for a minimum score

of 75% correct.

Be sure to review the real estate license law and the Rules of the FREC!

Go to http://www.realestate-school.com

License Law Section

1. Seller employed Broker to sell his property in Astoria Park. Broker subsequently

negotiated a contract whereby Seller and Buyer agreed to sell and buy the property in

Astoria Park. The contract was prepared and typed in Broker's office. As there were

numerous conditions and terms that had been agreed upon by Seller and Buyer, the

contract was quite long and involved. Since the amount of deposit obtained by Broker

from Buyer was equal to what his commission was going to be, in the middle of one of

the long paragraphs was the phrase "In the event the buyer defaults, the deposit shall be

retained by the broker as his compensation." At the time Broker presented the contract to

Seller and Buyer for their signatures, he made no mention of the phrase he inserted in the

contract, nor did he recommend that they read the contract. However, he did not in any

way try to influence them not to read it. Seller and Buyer signed the contract without

reading it. In the area, a 50/50 split of defaulted deposits is customary between sellers

and brokers. Buyer subsequently defaulted. Seller asked Broker for 50% of the deposit.

Broker refused and showed Seller the phrase he had inserted in the contract. What should

Broker do?

a. Share the deposit 50/50 with Buyer.

b. Give Seller 50% of the deposit.

c. Give Seller an amount equal to his expenses and keep the rest.

d. Observe the terms of the contract and keep the deposit.

Need more questions to review? Get

the Florida Exam Review Manual

http://www.realestate-school.com

© The Real Estate School, Inc. http://www.realestate-school.com ALL RIGHTS RESERVED 1

2. Possession of a current and valid license will be considered by a court

a. to have no effect.

b. as undeniable proof that the holder of that license may perform the services

of real estate.

c. as sufficient evidence to prove the license status unless stronger evidence to the

contrary is introduced.

d. as certification by the Commission that the license is in good standing.

3. A salesperson gets a signed contract from a buyer and mails it to the seller. The seller has

agreed to the terms and the escrow deposit is safely in the broker's escrow account. The

salesperson has a disagreement with his broker and quits. The broker refuses to pay a

commission because the salesperson was not in his employ when the contract was

actually received and signed. The salesperson should

a. notify the state.

b. sue the seller for his share.

c. sue the broker.

d. forget it. He is not entitled to the commission.

Need more questions to review? Get

the RealClass Exam CD

1001 Questions and Answers

http://www.realestate-school.com

4. A licensee who has passed the broker's state examination, but desires to continue to

operate under an owner-employer will be registered as a

a. broker.

b. salesperson.

c. broker-salesperson.

d. Realtor-Associate.

5. A hardware store owner, who is neither a real estate licensee nor a licensed or certified

appraiser, was appointed by the court to appraise another hardware store. The person can

a. be compensated for the appraisal.

b. not be compensated for the appraisal unless licensed or certified.

c. apply for a temporary license from the Commission.

d. appraise any hardware store in the state without a license.

6. In order to be a licensee member of the Florida Real Estate Commission, an individual

must have been licensed a minimum of

a. 1 year.

b. 2 years.

c. 4 years.

d. 5 years.

© The Real Estate School, Inc. http://www.realestate-school.com ALL RIGHTS RESERVED 2

7. Broker Bill has a listing contract to sell Janet's condominium. A prospective buyer offers

to pay $60,000, but refuses to give a binder deposit with the contract. Broker Bill should

a. refuse to submit the offer until accompanied by valuable consideration.

b. present the offer and suggest that the owner counteroffer for a binder.

c. present the offer only if the buyer promises to pay a binder if accepted.

d. present the offer only if it is close to the asking price.

8. A buyer gives a salesperson a binder check made out to him. The salesperson should

a. hold the check in the file until the broker returns and turn it over to him.

b. endorse the check and deposit it in the broker's business account.

c. endorse the check and give it to the broker within one business day.

d. put the check in his personal account, then write his personal check to the broker.

9. The F.R.E.C. is composed of

a. four brokers and three lay members.

b. five brokers and two lay members.

c. three brokers, two brokers or salespersons, and two lay members.

d. seven members.

10. Licensure may be suspended for what maximum period of time?

a. 1 year

b. 2 years

c. 5 years

d. 10 years

11. Broker Larry, Broker Linda, and Broker Susan form a partnership to buy a tract of land

and develop and sell the land. Salesperson Lee joins the partnership and profits will be

split equally among the four. Profits for the first year amount to $80,000. Which is

correct?

a. Profits may be divided three ways only. Salesperson Lee cannot be a partner.

b. Profits may be divided four ways.

c. Salesperson Lee may be a partner only if he has broker status.

d. a and c

Need more time hearing the

material? Get the Real Estate Exam

Review Audiocassettes

http://www.realestate-school.com

12. Which is not correct?

a. A licensee may be paid a commission only by his employer.

b. A licensee may not work for more than one employer.

c. A real estate licensee may not appraise a single family residence unless she has

been licensed as a state licensed or certified appraiser.

d. A licensee has no grace period for renewing a license, and may not operate while

the license is expired.

© The Real Estate School, Inc. http://www.realestate-school.com ALL RIGHTS RESERVED 3

13. The passage of rules require

a. the vote of all members of the Commission.

b. the full vote of the Commission and the Governor's signature.

c. the decision of the Chairman.

d. a quorum vote of the Commission.

14. Jane is a broker and accepts a deposit made out to her firm for $3,000. What is her legal

requirement?

a. She must place it in her personal account.

b. She must place it in her business account no later than the end of the next business

day.

c. She must place it in her trust account within three business days.

d. She must hold it until acceptance of the offer, then deposit it immediately.

15. Broker Jacqui decides to move her branch office from Fort Walton to Panama City. The

proper procedure is for Jacqui to

a. report the move to the Board of Realtors.

b. request that the Division transfer the license to the new location.

c. cancel the existing branch license and submit the request and a new fee for the

Panama City branch office.

d. wait until it is time to renew the branch office license.

Need more time with the material?

Get the Florida Exam Audio CD

http://www.realestate-school.com

16. A real estate salesperson is a person who

a. at times may perform any of the services ordinarily performed by a broker.

b. may perform some of the services ordinarily performed by a broker.

c. may not perform any service of real estate for the public for compensation in

Florida, unless employed by an owner-employer.

d. may perform any of the services ordinarily performed by a broker provided that the

service is under the supervision of the employing broker.

17. A salesperson chooses not to renew his license at the appropriate time. His license will be

a. involuntarily inactive.

b. canceled.

c. voluntarily inactive.

d. suspended.

18. The license period is currently

a. 1 year.

b. 2 years.

c. 3 years.

d. 4 years.

19. Which is exempt from licensing when performing real estate services?

© The Real Estate School, Inc. http://www.realestate-school.com ALL RIGHTS RESERVED 4

a. funeral directors

b. CPAs acting within the scope of their duties

c. partners receiving more than their pro-rata share of profits for selling services.

d. employees of a corporation who are paid on a transactional basis for selling

corporate property.

20. If an outdated and incorrect rental list is sold by a licensee, the licensee

a. is guilty of a misdemeanor of the first degree.

b. may be suspended or revoked.

c. must refund the full amount paid for the list if requested within 30 days.

d. all of the above

21. During the week, Janet works for Wonder Works Realty, Inc. as a salesperson. On

weekends, she holds open houses for Schultz Homes, and is paid a 2% commission

directly by Sam Schultz on any sales she helps procure. Which is correct?

a. This is a violation of FTC rule 21V-1.46 stating a salesperson may have only one

real estate employer.

b. She can work for both companies provided full disclosure is made and both parties

agree in writing.

c. She may do this provided the companies obtain a group license.

d. This is an illegal arrangement.

22. A salesperson properly licensed with a broker may

a. open his own branch office with permission from his broker.

b. manage a branch office.

c. not manage a branch office.

d. open his own office.

23. Who can receive compensation directly from an owner?

a. a broker

b. a salesperson, if licensed with a broker

c. a broker-salesperson, if licensed with a broker

d. all of the above

Need more questions to review? Get

the 800-Question Exam CD

http://www.realestate-school.com

24. Which is correct about a group license?

a. It is issued to salespersons who work for several employers.

b. A broker may have as many as she has offices.

c. It is issued to salespersons who work for several entities with a comm ownership.

d. It is issued to brokers for each branch office.

© The Real Estate School, Inc. http://www.realestate-school.com ALL RIGHTS RESERVED 5

25. Which of the following is a legal brokerage office?

I. permanent building with at least one office

II. sign at or about entrance with "Licensed Real Estate Broker" or REALTOR

III. names (but not license status) of all licensees of the firm in letters at least 1" high.

a. I only

b. I and II

c. I, II and III

d. I and III

26. Required brokerage relationship disclosures must be retained by the broker for:

a. five years.

b. three years.

c. two years.

d. one year.

27. Which of the following best describes the relationship of a broker and his principal?

a. caveat emptor

b. limited duties

c. fiduciary duties

d. confidentiality until the listing expires

28. A salesperson's license has expired. The salesperson is called by a buyer who wants to

see property. The salesperson shows the property, but does not write a contract until he

has renewed his license. The salesperson

a. is able to do this since the contract was not written during the time of inactivity.

b. is entitled to receive a commission.

c. has violated Chapter 475.

d. is able to discuss real estate with prospective buyers, but may not show or sell it.

29. A licensee fails to renew his license at renewal time, and desires to become active again

16 months later. What must he do?

a. Reinstate by filing a renewal request with a late fee.

b. Reinstate by taking 14 hours of continuing education and paying a late fee.

c. Reactivate by taking the reactivation instruction for a minimum 28 hours.

d. Take the salesperson's course and the state exam all over again.

30. John Harrison, a salesperson, leaves the employ of Gilbert Miller, a licensed real estate

broker. John wrote a sales contract prior to his termination, and the transaction closed

after he left Miller. The amount of the gross commission was $3,700, and John was on a

50/50 commission split. There is no office policy which covers this situation. John

demands his portion of the commission. What should Mr. Miller do?

a. Refer the matter to arbitration at the Board of Realtors.

b. Pay $1,850 to John.

c. Explain that the law allows him to pay only salespersons licensed with the firm at

the time of closing.

d. Deduct 25% of John's portion as administrative expense and pay John the balance.

© The Real Estate School, Inc. http://www.realestate-school.com ALL RIGHTS RESERVED 6

31. A Kentucky lawyer and a Florida broker joint venture to sell property in Florida for a

friend of the Kentucky lawyer. What can the Kentucky lawyer receive?

a. a commission provided he doesn't come to Florida

b. a referral fee if he doesn't come to Florida

c. a commission if he actually performs services in the transaction

d. no part of the real estate commission

32. A broker asks for advance fees and obtains $1,000 which he places into his operating

account. The broker buys a sign for $350, places advertising for $150, and submits office

rent bills which he accounts for as being used to directly market this piece of property.

The broker

a. is in violation of FS 475.

b. is in violation of FS 509.

c. has done nothing wrong.

d. has violated the code of ethics.

33. Hinson forms a limited partnership to develop and sell real property. Hinson will be the

general partner will do all the work. Bailey buys units as a limited partner and invests

$100,000. Hinson defrauds several purchasers who bring suit against the partnership and

get judgments for amounts in excess of $300,000. The partnership funds are wiped out.

Which is correct?

a. Hinson is liable for the same amount as Bailey.

b. Hinson is not liable because of the limited partnership status.

c. Hinson is liable for the unpaid judgments, Bailey is not.

d. Bailey is jointly and severally liable as a partner.

34. A Fort Walton Beach real estate broker is the property manager for several condos on the

beach which rent for $1,000 per month. He also manages several (which are rented) that

rent for $850 per month. The broker advertises beach front condos (which are

unavailable) at a price of $850, and has a good response rate. He is usually able to

explain the better quality of the $1,000 per month rentals and rents them quite fast. The

broker

a. has no problem. He actually manage units which rent for $850 per month.

b. has acted with bad faith, but is not guilty of a violation of Florida law.

c. has no problem if he can show all customers were satisfied.

d. is guilty of fraudulent and misleading advertising.

Need more questions to review? Get

the RealClass Exam CD

1001 Questions and Answers

http://www.realestate-school.com

© The Real Estate School, Inc. http://www.realestate-school.com ALL RIGHTS RESERVED 7

35. Jill sells commercial property exclusively. Which is correct about her brokerage

relationships?

a. She may have "no official brokerage relationship" status, may be a single agent or

may be a transaction broker.

b. Her broker may appoint her to be a designated sales representative for one party,

and another person in the firm to be a designated sales representative for the other

party in the transaction.

c. She must provide the Notice of Nonrepresentation at first contact with potential

buyers and sellers.

d. a and b.

36. Which of the following is most correct?

a. All salespersons work for brokers.

b. All brokers have salespersons.

c. All brokers are Realtors.

d. All Realtors must be members of NAR.

37. An example of institutional advertising would be

a. an ad about a private hospital for sale

b. an ad about the outstanding service offered by a real estate firm

c. an ad describing a duplex for sale in the northern part of the county

d. an ad describing a private academy for sale

38. Which of the notices shown below MUST be signed by a buyer or a seller.

a. Transaction Broker Notice.

b. Single Agent Notice.

c. Consent to Transition to Transaction Broker Notice.

d. Notice of Nonrepresentation.

39. John and Edward were brokers with their own firms. An economic downturn made them

decide to share office space. They did not put up signs which described that the public

was actually dealing with two separate firms. A BPR investigator made a routine office

inspection visit. The investigator would probably issue a citation stating that this

I. is an ostensible partnership.

II. is a general partnership.

III. is a violation.

a. I only

b. I and II

c. I, II, and III

d. I and III

40. A broker decides to go to work for an owner-developer, and will be compensated on a

salary plus commission basis. Which is correct?

a. She must be licensed as a salesperson.

b. She must be licensed as a broker.

c. She need not be licensed if she confines her sales activity to the one employer.

d. She must be registered as a broker-salesperson.

41. Which of the following situations requires disclosure of brokerage relationship to a

© The Real Estate School, Inc. http://www.realestate-school.com ALL RIGHTS RESERVED 8

customer?

I. sale of improved property with four units or fewer

II. leasing of property with four units or fewer unless the owner occupies one of the

units

III. sale of agricultural property with 10 acres or less

a. I only

b. I, II and III

c. I and III

d. I and II

42. Which brokerage relationship status requires that a broker disclose known facts that

materially affect the value of residential property?

a. any status requires the disclosure.

b. single agents

c. transaction brokers

d. licensees with no official brokerage relationship

43. A licensed salesperson of a brokerage corporation may

a. own stock in that corporation.

b. be an officer of that corporation.

c. be a director of that corporation.

d. none of the above.

44. Dexter Bonham is purchasing property through Lawrence Hafner, licensed real estate

broker. Hafner sold the same piece of property last year. Because Bonham is

experiencing financial difficulties, Hafner tells him that the title was insured last year,

and that he will go to the courthouse to determine if there have been any liens filed since

then. This would save the buyer nearly $500. Which is correct?

a. Bonham should write a letter of commendation to the local Board.

b. Hafner may not do this.

c. If no liens have, in fact, been filed, Hafner cannot be prosecuted.

d. Hafner may do this if he writes out a formal opinion of title and agrees to stand

responsible in case of later problems.

Need more questions to review? Get

the Florida Exam Manual

Questions and answers with rationale

http://www.realestate-school.com

45. A single agent broker who wishes to remain loyal to the principal

yet be involved in both sides of a transaction

a. may be a transaction broker for the other party.

b. may transition to dual agent with the written approval of both parties.

c. must work with the other party in a "no official brokerage relationship" role.

d. are unable to do so if working with the other party in a transaction.

© The Real Estate School, Inc. http://www.realestate-school.com ALL RIGHTS RESERVED 9

Principles and Practices Section

46. Permission to use another's property that may be withdrawn at will is

a. an easement appurtenant.

b. a license.

c. an encroachment.

d. a deed restriction.

47. An easement created when a person has been using a roadway without permission for

over 20 years is called an

a. easement by prescription.

b. easement in gross.

c. easement appurtenant.

d. easement by necessity.

48. All the following are methods of transferring legal title to real property except by

a. a will.

b. a patent.

c. a sales contract.

d. eminent domain.

49. Jim, Matt and Jack were co-owners of a parcel of real property. Matt died, and his

co-ownership passed, according to his will, to become part of his estate. The parties

owned the property as

a. tenants by the entireties.

b. tenants in common.

c. tenants at will.

d. joint tenants.

Need more questions to review? Get

the RealClass Exam CD

1001 Questions and Answers

http://www.realestate-school.com

50. Which of the following is immediately south of Township 2 South, Range 6 West?

a. Township 2 South, Range 7 West

b. Township 2 South, Range 5 West

c. Township 1 South, Range 6 West

d. Township 3 South, Range 6 West

© The Real Estate School, Inc. http://www.realestate-school.com ALL RIGHTS RESERVED 10

51. An owner wishes to have a survey made of a commercially-zoned parcel. It is 90 feet on

the front, 159 feet on the north side, 120 feet on the back and 180 feet on the south side.

It is not in a recorded subdivision. Which survey method would be most appropriate for

the parcel?

a. lot and block

b. rectangular

c. government survey

d. metes and bounds

52. Which of the following is not required on a contract?

a. offer and acceptance

b. both parties competent

c. legal object

d. execution and two witnesses

53. To be valid, a deed must be

a. signed and acknowledged.

b. signed and witnessed.

c. signed and recorded.

d. all of the above.

Need more time hearing the

material? Get the Real Estate Exam

Review Audiocassettes

http://www.realestate-school.com

54. Title to real property passes to the grantee when the deed is

a. recorded.

b. signed and witnessed.

c. delivered and accepted.

d. acknowledged.

55. Henry has a capital gain on the sale of his home of $197,000. He has owned the property

for two years. The sales price was $425,000. Costs of sale were $7,000, qualified fix-up

costs were $1,000 and moving costs were $2,000. How much must Henry pay in capital

gains taxes on this sale if his normal tax rate is 28%?

a. $ 39,400

b. $ 98,500

c. $197,000

d. $ 0

56. If an owner arrives before the foreclosure sale and pays the entire debt, court costs and

legal fees, and interest on the property, he is exercising his

a. right of stay of homestead foreclosure.

b. rights of estoppel.

c. right of redemption.

d. rights of certiori.

© The Real Estate School, Inc. http://www.realestate-school.com ALL RIGHTS RESERVED 11

57. A subdivision developer gives the county title to streets in a subdivision. The county

accepts the streets for maintenance. This transfer of title is known as

a. a patent deed.

b. dedication.

c. a public grant.

d. eminent domain.

58. Which of the following acts as an insurance agency?

a. FNMA

b. FHLMC

c. FHA

d. VA

59. Which happens to the monthly payments on a fixed payment mortgage?

a. Principal and interest portions of each payment remain the same.

b. Interest portion of each payment increases.

c. Interest portion of each payment decreases.

d. Principal is reduced and interest rates change annually.

60. The most common method used by the Federal Reserve Board to control the supply of

money is by

a. Urban Development Block Grants (UDAG).

b. affirmative action.

c. Tandem Plan.

d. Open Market Operations.

61. An example of functional obsolescence is which of the following?

a. increased traffic flow on the street in front of the house

b. community recycling plant next door

c. four bedroom, one bath house

d. leaking pipes

62. Investor Charles Greenacre is purchasing a building from the Acme Tool Company with

a 20-year net-net-net leaseback offering outstanding cash throwoff and good tax

treatment. The building was built to the seller's needs under strict specifications to the

seller's business. Greenacre should be most concerned with

a. the physical condition of the building.

b. the financial condition of the seller.

c. the chance of property appreciation.

d. the chance of increased maintenance costs.

63. An appraiser noted a 3 year-old air conditioning system which was operable. He assigned

$2,500 depreciation to the system. What type of depreciation is it?

a. incurable physical deterioration

b. curable physical deterioration

c. curable functional obsolescence

d. incurable functional obsolescence

© The Real Estate School, Inc. http://www.realestate-school.com ALL RIGHTS RESERVED 12

64. Which two expenses are deductible for income taxes that are not deducted in calculating

net operating income?

a. annual debt service and interest

b. annual debt service and depreciation

c. interest and depreciation

d. management and interest

65. If the capitalization rate increases, the value Need more time hearing the

a. increases proportionately. material? Get the Real Estate Exam

b. remains stable. Review Audio CD

c. increases non-proportionately. http://www.realestate-school.com

d. decreases.

66. Which is synonymous?

a. lender - mortgagor

b. seller - grantee

c. buyer - vendor

d. mortgagee - lender

67. Which is most closely related to the comparable sales approach?

a. reproduction cost

b. present value of the income stream

c. principle of substitution

d. level annuity capitalization rate

68. Plottage is

a. the plotting of a linear regression analysis curve on investment income.

b. plotting the direction of growth in a comprehensive plan.

c. an increase in value of individual parcels when joined with other parcels.

d. marking off cemetery lots.

69. Concerning the buyer's attitude and willingness to pay, the lender considers

a. credit rating.

b. assets.

c. income.

d. all of the above.

70. Which of the following forms of depreciation is usually found in external obsolescence?

a. intrinsic

b. inherent

c. incurable

d. curable

71. What is not available to the Federal Reserve System in controlling the money supply?

a. open market operations

b. adjusting the discount rate

c. changing the reserve requirement

d. changing depreciation rules

© The Real Estate School, Inc. http://www.realestate-school.com ALL RIGHTS RESERVED 13

72. Under the income approach, value equals

a. vacant land value plus depreciated building value.

b. rate times income.

c. rate divided by income.

d. income divided by rate.

73. Lien theory means that the mortgage

a. creates a lien on the property, with the mortgagee having title.

b. instrument conveys title to the mortgagee with mortgagor having a lien.

c. is a lien on the property, but property title is vested with the mortgagor.

d. is a lien on the property, but property title is vested with the mortgagee.

74 What is the final step after an appraiser has utilized all three approaches to value?

a. average each approach

b. use primarily the comparable sales approach

c. reconciliation

d. correlating

75. Which of the following expenses in not deducted from effective gross income in

calculating net operating income?

a. depreciation

b. utilities

c. advertising

d. management

76. John purchases a home, and the seller helps to finance the sale. The price is $100,000,

and John is to make a $10,000 cash down payment. The amount of the mortgage

payments would pay it off in thirty years, but the owner requires that it come due in

seven years. What type mortgage is this?

a. fully amortizing Need more questions?

b. term Get the RealClass Exam CD

c. partially amortizing http://www.realestate-school.com

d. adjustable rate

77. A seller tells a real estate licensee that he does not want his house shown to ethnic

buyers. The salesperson should say

a. “No problem. We probably won't have any buyers like that, anyway.”

b. “ will try my best to steer these buyers elsewhere.”

c. “I can't handle the sale of your property if you expect me to discriminate.”

d. “I’m going to call HUD and report you immediately.”

78. Jim Singletary wishes to construct an office building containing 24,000 square feet. The

zoning in the area requires 1 parking space for every 400 square feet of building area.

How many spaces will be necessary?

a. 60

b. 160

c. 200

d. 400

© The Real Estate School, Inc. http://www.realestate-school.com ALL RIGHTS RESERVED 14

79. Which is not correct?

I. Redlining is not a violation of state and federal laws.

II. “Blockbusting” is a description of the practice of scaring owners into selling

because of 'undesirable elements' moving into the neighborhood.

III. A salesperson has a direct fiduciary relationship with his seller under an exclusive

right of sale agreement.

a. I only

b. I and II

c. I, II, and III

d. I and III

80. John is a broker in Tallahassee, and meets for lunch with Martha, his most important

competitor. They agree that, effective January 1 of the following year, both companies

will begin charging 7.5% commissions on all residential properties. Which is correct?

a. This is legal if the sellers and buyers agree to pay.

b. This is a violation of FREC rules.

c. This is a violation of Regulation Z.

d. This is a violation of anti-trust laws.

81. A prospect enters Broker A's office and requests to be shown houses in neighborhoods

with certain racial characteristics. The broker advises the prospect that he will show him

houses without regard to the racial characteristics of the neighborhood. The prospect is

shown houses in certain minority neighborhoods and certain non-minority

neighborhoods. The prospect becomes interested in two of the houses, both of which are

in minority neighborhoods. If the broker had followed the prospect's initial instructions,

which of the following would be correct?

a. He would have violated federal laws but not the Florida real estate license law.

b. He violated Federal and State law and could have been suspended or revoked.

c. He would not have violated any laws; he must follow his principal's instructions.

d. He would not have violated any laws; he must follow his prospect's instructions.

82. Which is deducted from gross income to arrive at net operating income?

a. taxes

b. insurance

c. vacancy

d. debt service

83. A reasonably good balance between supply and demand of apartments is

a. 5% occupancy.

b. 90% vacancy.

c. 95% occupancy.

d. 87% occupancy.

84. The Fair Housing Act of 1968 (with amendments) prohibits discrimination

a. on the basis of age.

b. on the basis of a couple having children.

c. on the basis of behavioral characteristics.

d. all of the above

© The Real Estate School, Inc. http://www.realestate-school.com ALL RIGHTS RESERVED 15

85. A good faith estimate of settlement costs is required to be given to purchasers of a

residence when financing is secured at a federally insured savings and loan. This

requirement is found in

a. the "Little FTC" consumer protection act.

b. Regulation Z.

c. RESPA.

d. FHLBB consumer protection statutes.

86. Which is correct about Regulation Z?

a. It is published by the Federal National Mortgage Association.

b. It requires the disclosure of pertinent information such as down payment and

annual percentage rate if a "triggering" item such as interest rate is advertised.

c. It requires disclosure of estimate of settlement costs by the lender.

d. all of the above

87. Marilyn is applying for a loan to finance her new home in an area where there are

minorities. The loan officer tells her that she should try to find another location, since the

loan committee would prefer not to lend in that area. The lender may be involved in the

illegal practice called

a. blockbusting. Need more questions?

b. redlining. Get the 800-Question Exam CD

c. steering. http://www.realestate-school.com

d. failure to disclose under RESPa.

88. Which may be deducted for income tax purposes by a homeowner?

a. property taxes, insurance and interest

b. insurance, depreciation and taxes

c. depreciation, taxes and interest

d. taxes and interest

89. Usually, local planning commissions are composed of

a. lay members representing a cross section of the community.

b. professionals from each of the local planning authorities.

c. three county commissioners and two school board members.

d. local developers and representatives of utilities and banks.

Math Section

90. Fred has a long-term capital loss on the sale of his personal residence. He may deduct

a. a maximum of 28% of the loss.

b. a maximum of $3,000 each year until the loss has been deducted.

c. the entire loss.

d. none of the loss.

© The Real Estate School, Inc. http://www.realestate-school.com ALL RIGHTS RESERVED 16

91. A comparable property sold a year ago for $70,000 but would have sold for about eight

percent more today. The appraiser should:

a. adjust the subject price upward by $5,600.

b. adjust the subject price downward by $5,600.

c. adjust the comparable price upward by $5,600.

d. adjust the comparable price downward by $5,600

92. A small apartment property is estimated to have potential gross income of $ 25,000.

Vacancy and collection losses are expected to average 5 percent over the life of the

property. Operating expenses are expected to average about 30 percent of effective gross

income. An overall capitalization rate of 12 percent is derived from market transactions

of similar properties. What is the market value?

a. $208,333

b. $138,542

c. $197,917

d. $145,833

93. A 3-year insurance policy costing $1,164 is taken out November 1, 1995. The property

was sold on May 15, 1996, and the day of closing belongs to the buyer. If the buyer

assumes the policy, what the should the buyer pay the seller at closing, using the 30-day

month method?

a. $179.97

b. $955.99

c. $954.91

d. $977.97

94. An appraiser has been engaged to appraise a 4 bedroom home with a swimming pool.

Based on the appraiser's experience, a pool normally adds $14,000 value to a property,

and a bedroom is worth $9,000. She locates the following comparable sales:

5 bedroom home, no pool, sold for $125,000

4 bedroom home, no pool, sold for $116,000

3 bedroom home with pool, sold for $121,000

What is the value of the subject property?

a. $120,000

b. $125,000

c. $130,000

d. $135,000

95. A buyer purchases a 4-unit commercial building for $150,000 cash. Operating expenses

of the building total $30,000 annually. What must the buyer get in monthly rent from

each unit in order to achieve a 20% return?

a. $5,000

b. $2,500

c. $1,250

d. $ 125

© The Real Estate School, Inc. http://www.realestate-school.com ALL RIGHTS RESERVED 17

96. A building rents for $5 per square foot, and there is an index of 1.5. The following year

the index climbs to 1.8. The rent is tied to the index. What will the rent be per square

foot?

a. $5.68

b. $6.00

c. $8.00

d. $5.45

97. A comparable property, after adjustment, showed $40,000. The property sold two years

ago, and the adjustments indicated a 7% annual appreciation rate. Assuming the

appreciation was the only adjustment, how much was the total adjustment?

a. plus $5,063

b. plus $5,404

c. minus $5,063

d. plus $5,600

98. A home is 10 years old. It has a 50 year life, and a 100,000 reproduction cost. The

appraiser assigns physical deterioration of $26,000. Which is probably correct?

a. The home has been better maintained than others in the area

b. The home probably has a swimming pool, or is next to a convenience store.

c. The home has been poorly maintained.

d. The appraiser is wrong.

99. John takes out a 14% 30-year mortgage in the amount of $65,000. The loan constant is

.011849. What is the balance of the loan after the second payment?

a. $64,976.14

b. $64,988.14

c. $64,964.00

d. $1,516.52

100. A seller receives $18,000 proceeds from the sale of her home. The mortgage balance was

$32,000, she paid a commission of 7%, and her closing costs were 3%. What was the

sales price?

a. $55,555

b. $50,000

c. $55,000

d. $56,000

Need more questions?

Get the RealClass Exam CD

http://www.realestate-school.com

© The Real Estate School, Inc. http://www.realestate-school.com ALL RIGHTS RESERVED 18

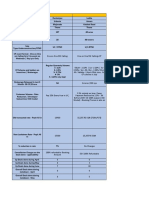

Florida Real Estate Exam

100-Question Practice Exam Answer Key

1b 21 d 41 c 61 c 81 b

2c 22 b 42 a 62 b 82 b

3c 23 a 43 a 63 a 83 c

4c 24 c 44 b 64 c 84 b

5a 25 a 45 c 65 d 85 c

6b 26 a 46 b 66 d 86 b

7b 27 c 47 a 67 c 87 b

8c 28 c 48 c 68 c 88 d

9d 29 c 49 b 69 a 89 a

10 d 30 b 50 d 70 c 90 d

11 b 31 d 51 d 71 d 91 c

12 c 32 a 52 d 72 d 92 b

13 d 33 c 53 b 73 c 93 c

14 c 34 d 54 c 74 c 94 c

15 c 35 d 55 d 75 a 95 c

16 d 36 d 56 c 76 c 96 b

17 a 37 b 57 b 77 c 97 a

18 b 38 c 58 c 78 a 98 c

19 b 39 d 59 c 79 d 99 a

20 d 40 d 60 d 80 d 100 a

Florida Real Estate Exam Manual

by George Gaines, David Coleman and Linda Crawford - Dearborn Real Estate Education

Includes over six hundred questions and answers WITH RATIONALE to help you pass the

Florida Real Estate Exam

Description

This is the very best exam review manual. Over 500 questions and answers. It reinforces the

information from thh pre-license real estate course. It is used by most private schools in their

exam prep courses. Prepares the student well for the state exam.

Order it now!

© The Real Estate School, Inc. http://www.realestate-school.com ALL RIGHTS RESERVED 19

You might also like

- Real Estate Exam Cheat SheetDocument6 pagesReal Estate Exam Cheat Sheetalvinraydj378% (9)

- California Real Estate PrinciplesDocument22 pagesCalifornia Real Estate PrinciplesWayne Chu100% (3)

- PrepAgent ExamPrep EbookDocument83 pagesPrepAgent ExamPrep EbookAvgvstine100% (1)

- 100 Question Real Estate Practice TestDocument21 pages100 Question Real Estate Practice Testwbowersox67% (3)

- PA Real Estate Exam Study SheetDocument42 pagesPA Real Estate Exam Study Sheetnic jNo ratings yet

- New York State Real Estate Exam Preparation and Success GuideFrom EverandNew York State Real Estate Exam Preparation and Success GuideNo ratings yet

- Illinois Real Estate License Exam Prep: All-in-One Review and Testing To Pass Illinois' PSI Real Estate ExamFrom EverandIllinois Real Estate License Exam Prep: All-in-One Review and Testing To Pass Illinois' PSI Real Estate ExamNo ratings yet

- Real Estate License Exam Calculation Workbook: 250 Calculations to Prepare for the Real Estate License Exam (2024 Edition)From EverandReal Estate License Exam Calculation Workbook: 250 Calculations to Prepare for the Real Estate License Exam (2024 Edition)Rating: 5 out of 5 stars5/5 (1)

- Real Estate Practice Test - 221120 - 214149Document53 pagesReal Estate Practice Test - 221120 - 214149Svetoslava Georgieva100% (3)

- Real Estate Appraisal FormulasDocument4 pagesReal Estate Appraisal FormulasMichelleOgatis83% (6)

- Mastering Real Estate MathDocument51 pagesMastering Real Estate MathHani100% (2)

- Florida Real Estate Post Licensing ExamDocument16 pagesFlorida Real Estate Post Licensing ExamJules100% (6)

- PSI Topic Exam QuestionsDocument10 pagesPSI Topic Exam QuestionsEPSONNo ratings yet

- CA Real Estate Exam Prep - Transfer of PropertyDocument5 pagesCA Real Estate Exam Prep - Transfer of PropertyThu-An Nguyen Thanh100% (1)

- Mini Cram 5 PDFDocument165 pagesMini Cram 5 PDFdatasuerNo ratings yet

- 100 Question Real Estate Practice TestDocument21 pages100 Question Real Estate Practice Testmanekenk100% (4)

- Texas Real Estate Sales Exam 4e PDFDocument287 pagesTexas Real Estate Sales Exam 4e PDFفهد محمد سليمان النمر100% (2)

- Annex2 - Practice Test For Broker'S Exam (100Q)Document5 pagesAnnex2 - Practice Test For Broker'S Exam (100Q)noullen100% (1)

- Exam For Real Estate in CaliforniaDocument230 pagesExam For Real Estate in Californiaharpay100% (9)

- Real Estate Buyers PackageDocument16 pagesReal Estate Buyers PackageTom Joseph75% (4)

- CliffsTestPrep California Real Estate Salesperson Exam 5 Practice TestsDocument211 pagesCliffsTestPrep California Real Estate Salesperson Exam 5 Practice TestsSanto Parsons100% (3)

- Answers To The Practice PA Real Estate Exam QuestionsDocument49 pagesAnswers To The Practice PA Real Estate Exam QuestionsAnonymous I5hdhuCxNo ratings yet

- Real EstateDocument53 pagesReal Estateitzmsmichelle100% (3)

- Real Estate MathDocument59 pagesReal Estate MathJephraimBaguyo67% (3)

- Florida Real Estate Sales Candidate BookletDocument18 pagesFlorida Real Estate Sales Candidate BookletAzul MezaNo ratings yet

- CA Real Estate Practice WorkbookDocument48 pagesCA Real Estate Practice WorkbookJason Chou100% (1)

- Real Estate Practice Exam 1 AnsweraDocument8 pagesReal Estate Practice Exam 1 Answeranatalie100% (2)

- 125 Real Estate Math Problems Solved SampleDocument7 pages125 Real Estate Math Problems Solved SampleShamsheer Ali Turk100% (5)

- LearningExpress Editors - Real Estate Sales ExamDocument232 pagesLearningExpress Editors - Real Estate Sales ExamRoger David Ellis100% (13)

- Real Estate Fundamentals Exam PracticeDocument6 pagesReal Estate Fundamentals Exam PracticeGene'sNo ratings yet

- Tarbell, Realtors - Practice Test #1Document28 pagesTarbell, Realtors - Practice Test #1minriversideNo ratings yet

- Real Estate Broker ExamDocument43 pagesReal Estate Broker ExamZoey Alexa100% (5)

- This Study Resource Was: Real Estate Final ExamDocument3 pagesThis Study Resource Was: Real Estate Final ExampNo ratings yet

- Real Estate QuestionsDocument12 pagesReal Estate QuestionsMike Marschall100% (1)

- Real Estate MathematicsDocument28 pagesReal Estate MathematicsHARSHIV MISTRY100% (1)

- Real Estate Exam Prep RE VocabularyDocument17 pagesReal Estate Exam Prep RE Vocabularydaniellemotta1985100% (1)

- Florida Real Estate ExamiantionDocument6 pagesFlorida Real Estate Examiantionjimmy_sam0010% (1)

- 15 Real Estate Math QuestionsDocument8 pages15 Real Estate Math QuestionsAnonymous 7WS1xXNo ratings yet

- California Real Estate Law PrinciplesDocument53 pagesCalifornia Real Estate Law Principlesminriverside100% (2)

- Real Estate Lecture - NotesDocument92 pagesReal Estate Lecture - NotesJunjie Tebrero100% (1)

- Real Estate Agent ChecklistDocument1 pageReal Estate Agent ChecklistKendall ElliottNo ratings yet

- Real Estate Brokers ExamDocument2 pagesReal Estate Brokers ExamangelgirlfabNo ratings yet

- Real Estate VocabularyDocument69 pagesReal Estate VocabularyCarlos Alberto Rojas100% (1)

- Real Estate Career GuideDocument34 pagesReal Estate Career GuideMaria Cristina Dongallo100% (1)

- New Real Estate Agent GuidebookDocument8 pagesNew Real Estate Agent Guidebooksalem100% (4)

- Real Estate in DepthDocument525 pagesReal Estate in Depthjokejokeonline100% (2)

- Apartment House Rags To RichesDocument22 pagesApartment House Rags To RichesBlvsrNo ratings yet

- Guide To Real Estate LawsDocument6 pagesGuide To Real Estate Lawshpark790% (1)

- Real Estate Broker Licensure ExaminationDocument47 pagesReal Estate Broker Licensure ExaminationErica Patricia Lao100% (13)

- Real Estate Salesperson License Quizlet TermsDocument30 pagesReal Estate Salesperson License Quizlet Termslindytindylindt100% (1)

- Real Estate Test 2 ReviewDocument19 pagesReal Estate Test 2 Reviewcarechung1900100% (1)

- Practice SetDocument39 pagesPractice SetDionico O. Payo Jr.No ratings yet

- Busines Plan Real Estate AgentDocument13 pagesBusines Plan Real Estate Agentopenid_JpMT3dV988% (8)

- 20 Tips - How To Top The Real Estate Brokers' Licensure ExamDocument7 pages20 Tips - How To Top The Real Estate Brokers' Licensure ExamhannaNo ratings yet

- Step-by-Step Procedure in Applying For The Real Estate Licensure ExamDocument7 pagesStep-by-Step Procedure in Applying For The Real Estate Licensure ExamBlanoRyanAzuraNo ratings yet

- BROKERAGE Quiz PDFDocument2 pagesBROKERAGE Quiz PDFMiggy Zurita100% (1)

- 2018 CALIFORNIA Real Estate License Exam Prep: A Complete Study Guide to Passing the Exam on the First Try, Questions & Answers with ExplanationsFrom Everand2018 CALIFORNIA Real Estate License Exam Prep: A Complete Study Guide to Passing the Exam on the First Try, Questions & Answers with ExplanationsNo ratings yet

- 2018 GEORGIA AMP Real Estate License Exam Prep: A Complete Study Guide to Passing the Exam on the First Try, Questions & Answers with ExplanationsFrom Everand2018 GEORGIA AMP Real Estate License Exam Prep: A Complete Study Guide to Passing the Exam on the First Try, Questions & Answers with ExplanationsNo ratings yet

- Investment in Equity SecuritiesDocument30 pagesInvestment in Equity SecuritiesJaybert DumaranNo ratings yet

- UPI (Updated)Document107 pagesUPI (Updated)Amit Singh100% (1)

- YCM Price List 16.08.2023Document2 pagesYCM Price List 16.08.2023pawansagar0530No ratings yet

- Financial Institution Other Than Bank ReportDocument10 pagesFinancial Institution Other Than Bank ReportVinod Kale72% (18)

- Forwards vs. FuturesDocument4 pagesForwards vs. FuturesSidharth ChoudharyNo ratings yet

- Lecture 4 2016 - RamzanDocument33 pagesLecture 4 2016 - RamzanQed VioNo ratings yet

- Assignment: Financial Management - 1Document8 pagesAssignment: Financial Management - 1Rahul SinghNo ratings yet

- Journal Entries 23.3.2024Document8 pagesJournal Entries 23.3.2024vihanjangid223No ratings yet

- Faculty - Business Management - 2020 - Session 1 - Degree - Fin552Document5 pagesFaculty - Business Management - 2020 - Session 1 - Degree - Fin552Mohd JufriNo ratings yet

- Quiz2 With AnswersDocument9 pagesQuiz2 With Answersprsa2017No ratings yet

- January 09, 2018Document6 pagesJanuary 09, 2018Monina JonesNo ratings yet

- IRDA Annual Report 2005Document228 pagesIRDA Annual Report 2005Yajur KapoorNo ratings yet

- Fair Value Accounting-Pros and ConsDocument9 pagesFair Value Accounting-Pros and ConsLuh ayuNo ratings yet

- Asistensi PE 2 - Pertemuan 6Document51 pagesAsistensi PE 2 - Pertemuan 6qonitahmutNo ratings yet

- Chukwuemeka Bright Ikechukwu - 9053580646 - 20240529181653Document18 pagesChukwuemeka Bright Ikechukwu - 9053580646 - 20240529181653ikechukwuchukwuemekabrightNo ratings yet

- JagoInvestor Book ReviewDocument33 pagesJagoInvestor Book ReviewDwarkesh PanchalNo ratings yet

- Caie Igcse Business Studies 0450 Formula Sheet 650c7e106352f31b2630655f 074Document3 pagesCaie Igcse Business Studies 0450 Formula Sheet 650c7e106352f31b2630655f 074rudra chauhanNo ratings yet

- 4-Sales - Invoice-Cash SaleDocument1 page4-Sales - Invoice-Cash Salenaamm7570% (1)

- Competition TracDocument12 pagesCompetition Tracdarshan shettyNo ratings yet

- KETAN PAREKH - The Mystery Man !!Document30 pagesKETAN PAREKH - The Mystery Man !!sangamch123No ratings yet

- Punjab and Sind Bank and Ors Vs Allied Beverages Cs100800COM455901Document8 pagesPunjab and Sind Bank and Ors Vs Allied Beverages Cs100800COM455901Advocate UtkarshNo ratings yet

- Multiple Choice CH 2Document5 pagesMultiple Choice CH 2gotax100% (3)

- PAYMENT OR PERFORMANCE Bsa 2aDocument57 pagesPAYMENT OR PERFORMANCE Bsa 2aEJ HipolitoNo ratings yet

- Balance StatementDocument2 pagesBalance Statementa1041599203No ratings yet

- Part - A Unit - 1 Accounting For - Not For Profit Organisations 1 Mark QuestionsDocument5 pagesPart - A Unit - 1 Accounting For - Not For Profit Organisations 1 Mark QuestionsDURAIMURUGAN MIS 17-18 MYP ACCOUNTS STAFFNo ratings yet

- Moving Augusta Forward IncDocument12 pagesMoving Augusta Forward IncSusan McCordNo ratings yet

- NISM Series X B-Investment Adviser Level 2 - New VersionDocument274 pagesNISM Series X B-Investment Adviser Level 2 - New VersionAlamgir HaqueNo ratings yet

- Full & Final SettlementDocument4 pagesFull & Final Settlementunique1alwaysNo ratings yet

- Indian Institute of Technology: Delhi Summary Sheet Non-Consumable StoresDocument2 pagesIndian Institute of Technology: Delhi Summary Sheet Non-Consumable StoresSumit SinghNo ratings yet

- Rashed Hossen. Final Project ReportDocument37 pagesRashed Hossen. Final Project ReportSadia PressNo ratings yet