MCI Writeup

MCI Writeup

Uploaded by

Aijaz ShaikhCopyright:

Available Formats

MCI Writeup

MCI Writeup

Uploaded by

Aijaz ShaikhOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

MCI Writeup

MCI Writeup

Uploaded by

Aijaz ShaikhCopyright:

Available Formats

MCI Takeover battle: Verizon versus Qwest

MCI TAKEOVER BATTLE: VERIZON VERSUS QWEST

Name of the Student:

Name of the Course:

Name of the Course Instructor:

Date:

MCI Takeover battle: Verizon versus Qwest

MCI Takeover battle: Verizon versus Qwest

Introduction

This case profiles MCI’s merger debate between Verizon and Qwest in 2005. At this

time, many other companies are merging due to the industry consolidation, therefore forcing

MCI to keep up with its competition. MCI was acquired after a bidding war between WorldCom,

British Telecom and GTE, with the winning bid being a $37 billion offer from WorldCom. MCI-

WorldCom then acquired many other communication companies excluding Sprint due to a U.S.

Justice Department ruling. WorldCom operated throughout its filing of bankruptcy, resulting

with MCI being not only the surviving company, but one of the most extensive networks in the

world. After posting losses in 2004, MCI must undergo a strategic process in which to choose the

better bid, Verizon or Qwest, in order to stay on top of the industry.

Q-1 Evaluate the two offers in Exhibit 7. What explains the two structures? In each case, what is

the value to the MCI shareholders?

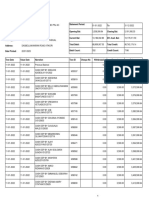

The Exhibit 7 shows the bid price offered by both Verizon and Qwest, along with the

stock prices of MCI, Verizon and Qwest. The standard deviation of each company and the

correlation and covariance of MCI’s stock price with each Verizon and Qwest is calculated in the

Exhibit 2.

The first bid offer made by Qwest was at the time when the stock price of Qwest was

$4.4 and stock price of MCI was $20.15. At that time the shareholders of MCI would have

suffered a loss of 2.2% (See Exhibit 2) of the current stock price at that time. Accepting the offer

might not be beneficial. After receiving the bid offer from Qwest the stock price of MCI

responded positively and increased to $21.03 from $20.15.

MCI Takeover battle: Verizon versus Qwest

MCI Takeover battle: Verizon versus Qwest

In the mid February the initial bid offered made by Verizon was $6.8 billion which was

accepted. In this situation, the shareholders of MCI would have gained 7% premium (See Exhibit

2) on the current share price of that time. Since the stock price of MCI at that time was $19.93

and the shareholders of MCI were getting a price of $21.28 from Verizon. It would add value to

their wealth. The impact of this offer on MCI’s stock price was also positive and increased to

$20.55 from $19.93.

At the same time Qwest increased its bid to $8.0 million, if MCI would have accepted the

bid, it would have substantially increased the value of the shareholders of MCI.

At 02/17/2005 Qwest announced that it will submit a new bid that affected the stock price

of MCI drastically. The stock price of MCI reacted positively to this announcement and

increased from $20.66 to $22.31.

At 24th February Qwest modified $8 billion bid to provide stock price protection and a faster cash

payout. Under this offer a bid price of $8 million would have added a value of $1.82 per share

(8% gains) to the shareholders of MCI ( See Exhibit 2). Accepting this offer would be beneficial

for the shareholders as this is the highest premium so far offered by each company.

After Carlos Slim declared both bids inadequate, on 17th March Qwest increased its offer to $8.4

billion which represented a total gain of 13% (see Exhibit 2).

On 28th March when Qwest imposed deadline for $8.4 billion the stock price of MCI shoots up to

$23.78 from 22.94 and on 29th March MCI considered Verizon’s revised bid of $7.6 billion. The

acceptance of this bid offer would not result in any premium the value of the shareholders will be

the same at that point.

MCI Takeover battle: Verizon versus Qwest

MCI Takeover battle: Verizon versus Qwest

Q-2 which offer should MCI accepts?

In Exhibit 1 using the FCF method the enterprise value of $5.02 billion (See Exhibit 1) of MCI

has been calculated in order to evaluate the offers of Verizon and Qwest. The enterprise value

calculated is based on the future expected revenues of MCI. The revenues of MCI are constantly

decreasing over the period of five years, thus; a negative growth rate has been used in order to

calculate the terminal value of MCI.

Assumptions made on determining the enterprise value are:

Market premium: Market premium is calculated by taking the average of three senior notes given

in the case.

Growth rate:The growth rate is calculated by the growth in the forecasted revenue which is in

negative.

Risk free rate: Risk free rate is given in the Table 1 i.e. U.S treasury bills of 10 years.

Cost of debt: Cost of debt is calculated by taking the average of three senior notes given in the

case.

Equity Beta: Equity beta of MCI is given in the Exhibit 8 of the case.

Terminal Value: Terminal value is based on the negative growth calculated and the assumption is

made that the company will continue to generate revenue for the foreseeable future.

Although the enterprise value calculated is just an estimate based on the assumptions. It will give

an idea to MCI what offer it should accept. According to the valuation MCI should not accept

MCI Takeover battle: Verizon versus Qwest

MCI Takeover battle: Verizon versus Qwest

anything offer lower than $5.02 billion. The initial bid offered by Qwest was in excess of the

MCI’s enterprise value. By looking at the figures only it was a feasible option for MCI to accept

the bid price as it was in excess of the enterprise value and the shareholders were gaining a

premium of $1.28 billion.

Later Verizon offered $6.8 billion which was also in excess of the enterprise value of MCI.

Accepting this offer would substantially benefit the shareholders of MCI. As the enterprise value

of MCI is $5.02 and Verizon is willing to pay $6.8 billion creating a premium of $1.78 billion.

According to the final bids offered of $7.6 billion and $8.4 billion by Verizon and Qwest

respectively. The right choice would be to accept Qwest offer, as it would increase the

shareholders value with a large margin than Verizon. And it will be more beneficial in short

term.

It seems as though MCI has four possible choices regarding the bidding war of Verizon and

Qwest: choose Verizon, choose Qwest, choose neither or choose both. By choosing either

company on their own, MCI would gain the monetary bid of that company, but then also have to

be able to support a much larger company. The value of MCI, if it merges with Qwest would be

$17.1 billion, which is a lot higher if MCI merges with Verizon i.e.$8.7 billion (See Exhibit 4).

but the Verizon CEO Ivan Seidenberg suggested Qwest’s estimates were unrealistic and did not

pass “a common sense test”. Since there are hesitations whether or not Qwest has the money to

back up their claims, it could be risky to take on a merger with them. However, a strong

company like Verizon seems like they would be able to hold up their side of the deal while

bringing positives to the newfound company. MCI can also choose that they are a strong enough

company without merger with others and choose to stay on their own and remain competitors

MCI Takeover battle: Verizon versus Qwest

MCI Takeover battle: Verizon versus Qwest

with Verizon and Qwest. This would be a good option if they felt stronger than the other

companies, but Verizon poses threats to the stability of MCI so this may not be their best option.

Finally, MCI could merge with both Verizon and Qwest, almost taking over the

telecommunications industry. this might would be the best option, as it would be a very big

change in a very short time and the overall company would have to make drastic changes. It

might end up hurting the company in the long run to invest so much in trying to please so many

new consumers. Therefore, the board of MCI, should choose to merge with Verizon. This strong

company has a lot to bring to the table, with loyal customers and a strong background. The

merger between Verizon and MCI would hopefully prove beneficial in the long run, changing

the way the telecommunications industry functioned.

Q-3) what are the strengths and weakness of Verizon, MCI and Quest? Where are the synergies

in the proposed combinations?

Both Verizon and Qwest have strengths, weaknesses, opportunities and threats which affect

MCI’s vision of these companies.

SWOT Analysis of Verizon

Strengths:

-Divestitures aimed at reducing debt and focusing on core business in 2002-2003

-Has an international branch, in accordance with domestic telecom, wireless and services

Weaknesses:

MCI Takeover battle: Verizon versus Qwest

MCI Takeover battle: Verizon versus Qwest

-Primarily serves U.S. markets, and is limited to 29 American states

Opportunities:

-Aware of the shift from analog to digital, wired to wireless, narrowband to broadband, and sees

this shifts as a way to expand and grow in the future

Threats:

-Experienced loss of 11 cell sites during terrorist attacks and must now rebuild

SWOT Analysis of Qwest

Strengths:

-Company altered plans after fraud charges to regain reputation

-Began work with Fiber Optics, a prospective field for the future of the industry

Weaknesses:

-CEO Nacchio leaves for high compensation but poor performance leading to fraud allegations

-Only facilitates 14 states in the American West and Northwest, mostly with wire lines

-The always changing technological needs are shifting from landlines to wireless, where Verizon

has seen about one in five people using their wireless phones as their primary forms of

communication. Qwest is still generating a strong majority of its revenue from their wireline

segment, and will therefore have to eventually undergo the process of shifting to wireless.

MCI Takeover battle: Verizon versus Qwest

MCI Takeover battle: Verizon versus Qwest

Opportunities:

-Understands industry is shifting to wireless, and importance of all services in one

Threats:

- Invested heavily in assets, anticipating growth, but is experiencing industry-wide decline

- Qwest has to invest heavily in the process of shifting to wireless. This might be a threat to

Qwest if it fails to raise the finance required for shifting process

SWOT analysis of MCI.

Strength:

- Diverse range of communication products and services in over 200 countries.

Weakness:

- MCI has not shifted to wireless technology thus facing losses.

Opportunity:

- The merger with Verizon or Qwest

Threat:

- Current threat to MCI would be the wrong selection for the acceptance of the bid price.

- Continue to make losses in the future.

MCI Takeover battle: Verizon versus Qwest

MCI Takeover battle: Verizon versus Qwest

The synergy proposed by Verizon would be generated by the wireless technology Verizon has

and MCI has access to over 200 countries.

Q-4 What approach would Verizon take to win the takeover contest? Qwest?

Knowing that Verizon is the more advantageous company, Qwest’s strategy was to outbid them

by over a million dollars. However, this in itself was not enough. Therefore, Qwest upped its bid

and made a presentation on how the synergies of Qwest and MCI would be beneficial. Verizon

then upped their bid slightly, but was still far lower than the bid by MCI. During this negotiation,

Verizon also offered a protection mechanism in which the value of stock would never be less

than $14.75. However, throughout this bidding war, it was questionable whether Qwest was

always being completely honest about their numbers. Some analysts even worried that they did

not have the cash to back up their offers. Therefore, Verizon’s honesty put them at a competitive

advantage over Qwest.

However, Verizon can offer a competitive bid price in relation with the price offered by Qwest.

Verizon has the advantage of being the world class company. Have a strong financial statement

and in the past Verizon has done many successful mergers and acquisitions. Verizon can use

these facts to influence MCI. Verizon can use the leverage ratios (calculated in Exhibit 5) to

show the stable position it has over Qwest. As the gearing level of Qwest is very much high than

Verizon and the interest coverage of Qwest is very poor but the interest coverage of Verizon is

3.84 times. The ratios calculated in Exhibit 5 shows that the position of Verizon is more stable

than Qwest.

MCI Takeover battle: Verizon versus Qwest

MCI Takeover battle: Verizon versus Qwest

Exhibit 1

$million

2005E 2006E 2007E 2008E 2009E 2010E

Revenues 18,000 16,000 15,000 14,500 14,200 14,100

Operating Expenses -15,900 -14,300 -13,500 -13,000 -12,800 -12,400

EBITDA 2,100 1,700 1,500 1,500 1,400 1,700

Depreciation Expense -2,100 -2,000 -1,900 -1,813 -1,775 -1,000

EBIT 0 -300 -400 -313 -375 700

EBIT*(1-35%) 0 -300 -400 -313 -375 455

Depreciation Expense 2,100 2,000 1,900 1,813 1,775 1,000

Capital Expenditures -1,000 -1,000 -1,000 -1,000 -1,000 -1,000

Increase in Net Working Capital -200 -100 -100 0 0 0

FCF 900 600 400 500 400 455

Terminal Value 3,571.34

FCF 900 600 400 500 400 4026

D.F 7.10%

Enterprise value $5,020.17

MCI Takeover battle: Verizon versus Qwest

MCI Takeover battle: Verizon versus Qwest

Exhibit 2

Bid Offered by Qwest Verizon Qwest Qwest Verizon

Date 2/3/2005 2/14/2005 2/24/2005 3/17/2005 3/29/2005

Number of MCI 319,600,000 319,600,000 319,600,000 319,600,000 319,600,000

shares

$ $ $ $ $

Stock price of MCI 20.15 19.93 23.21 23.30 23.78

Bid price/share of $ $ $ $ $

MCI 19.71 21.28 25.03 26.28 23.78

% gain/(loss) -2% 7% 8% 13% 0%

Exhibit 3

MCI Verizon Qwest

Standard Deviation 1.427683481 0.612921333 0.227208672

Correlation -0.298122026 -0.629597261

Covariance -0.254511184 -0.19924884

Exhibit 4

Value of MCI with Verizon $million

Enterprise value of MCI $5,020

Gross synergy $7,000

Cost of synergy -$3,300

Total Value $8,720

Value of MCI with Qwest $million

Enterprise value of MCI $5,020

Gross synergy $14,800

Cost of synergy -$2,700

Total Value $17,120

MCI Takeover battle: Verizon versus Qwest

MCI Takeover battle: Verizon versus Qwest

Exhibit 5

Verizon Qwest

leverage ratio 54% 27%

current ratio 0.98 0.84

Interest coverage -0.16 3.84

ROCE -13% 8%

ROE -22% 7%

MCI Takeover battle: Verizon versus Qwest

You might also like

- Blogging at Bzzagent Case AnalysisDocument6 pagesBlogging at Bzzagent Case AnalysisRavikanth VangalaNo ratings yet

- Particulars MSFT 3 Year 5 Year 10 Year 30 YearDocument2 pagesParticulars MSFT 3 Year 5 Year 10 Year 30 YearAsad BilalNo ratings yet

- CH4 InvDocument16 pagesCH4 InvPhước VũNo ratings yet

- 83592481 (1)Document3 pages83592481 (1)MedhaNo ratings yet

- West Teleservice: Case QuestionsDocument1 pageWest Teleservice: Case QuestionsAlejandro García AcostaNo ratings yet

- Case Study: United Technologies Corp. and Raytheon Company Deal 1. What Is The Specific Function of A. The MergerDocument15 pagesCase Study: United Technologies Corp. and Raytheon Company Deal 1. What Is The Specific Function of A. The MergerLaura Garcia100% (1)

- 109 20 Twitter LBODocument5 pages109 20 Twitter LBObellabell8821No ratings yet

- The MCI Takeover BattleDocument17 pagesThe MCI Takeover BattleLucas Tai100% (1)

- CP & NS Merger Case - GRP 1Document12 pagesCP & NS Merger Case - GRP 1Paul Ghanimeh100% (1)

- Assignment 1 - TombstonesDocument1 pageAssignment 1 - TombstonesDEVENDRA RATHORE0% (1)

- Tutorial 6 AnswersDocument5 pagesTutorial 6 AnswersMaria MazurinaNo ratings yet

- 02 Eaton Questions PDFDocument1 page02 Eaton Questions PDFSulaiman AminNo ratings yet

- Termination Case Study Presentation Group6Document10 pagesTermination Case Study Presentation Group6KrishnanandShenaiNo ratings yet

- Facebook Inc.: The Initial Public Offerings (A) : Ruskin Lisa Crystal WeiDocument32 pagesFacebook Inc.: The Initial Public Offerings (A) : Ruskin Lisa Crystal WeiThái Hoàng NguyênNo ratings yet

- This Study Resource WasDocument9 pagesThis Study Resource WasVishalNo ratings yet

- Case 11 Group 1 PDFDocument56 pagesCase 11 Group 1 PDFRumana ShornaNo ratings yet

- Eaton CorporationDocument1 pageEaton CorporationKym LatoyNo ratings yet

- Marriott CaseDocument1 pageMarriott CasejenniferNo ratings yet

- Sally Jameson CaseDocument2 pagesSally Jameson Casemaniaa545No ratings yet

- Pinkerton (A) - Assignment and Questions For ConsiderationDocument1 pagePinkerton (A) - Assignment and Questions For ConsiderationFarrah ZhaoNo ratings yet

- Mci Takeover Battle AnalysisDocument13 pagesMci Takeover Battle AnalysisAastha Swaroop50% (2)

- Ocean Carriers Executive SummaryDocument2 pagesOcean Carriers Executive SummaryAniket KaushikNo ratings yet

- Cgu MCIcaseDocument20 pagesCgu MCIcasekrishy19100% (2)

- FS Mo IiiDocument67 pagesFS Mo Iiiarul kumarNo ratings yet

- Sample ProblemsDocument9 pagesSample ProblemsDoshi VaibhavNo ratings yet

- Case Write Up Sample 2Document4 pagesCase Write Up Sample 2veda20No ratings yet

- Cougars+Deutsch HBS Case SolutionDocument16 pagesCougars+Deutsch HBS Case Solutionnicco.carduNo ratings yet

- BBB Case Write-UpDocument2 pagesBBB Case Write-UpNeal Karski100% (1)

- Marketing DossierDocument38 pagesMarketing DossierTigran WadiaNo ratings yet

- Sealed Air Corporation v1.0Document8 pagesSealed Air Corporation v1.0KshitishNo ratings yet

- Practice QuestionsDocument4 pagesPractice QuestionsAnyone SomeoneNo ratings yet

- Beta Management CompanyDocument8 pagesBeta Management Companymanishverma56470% (1)

- Iron Gate - InputDocument1 pageIron Gate - InputShshank0% (1)

- Sealed Air Corporation-V5 - AmwDocument8 pagesSealed Air Corporation-V5 - AmwChristopher WardNo ratings yet

- LP Laboratories CaseDocument4 pagesLP Laboratories CaseAkash GuptaNo ratings yet

- Written Analysis and Communication: PACADI FrameworkDocument6 pagesWritten Analysis and Communication: PACADI FrameworkSiddharth GoyalNo ratings yet

- Bed Bath Beyond (BBBY) Stock ReportDocument14 pagesBed Bath Beyond (BBBY) Stock Reportcollegeanalysts100% (2)

- Buffett CaseDocument15 pagesBuffett CaseElizabeth MillerNo ratings yet

- CFINDocument10 pagesCFINAnuj AgarwalNo ratings yet

- Questions USX RevisedDocument1 pageQuestions USX RevisedShyngys SuiindikNo ratings yet

- Adelphia QuestionsDocument1 pageAdelphia QuestionskiubiuNo ratings yet

- Marriott Case Analysis - FinalDocument7 pagesMarriott Case Analysis - FinalvasanthaNo ratings yet

- Case Study of Haidilao (HDL) International Holding Co. LimitedDocument7 pagesCase Study of Haidilao (HDL) International Holding Co. LimitedANH DINH NGOCNo ratings yet

- Super Project FinalDocument29 pagesSuper Project FinalSamuel ChuquistaNo ratings yet

- CH 032Document57 pagesCH 032Gandhi MardiNo ratings yet

- Launching of BMW Z3 RoadsterDocument15 pagesLaunching of BMW Z3 RoadsterPriyesh WankhedeNo ratings yet

- MIT Sloan School of ManagementDocument3 pagesMIT Sloan School of Managementebrahimnejad64No ratings yet

- CSTR Notes 1-5 (Gaurav Pansari)Document9 pagesCSTR Notes 1-5 (Gaurav Pansari)Jai KamdarNo ratings yet

- BP and Consolidation of Oil IndustryDocument2 pagesBP and Consolidation of Oil IndustryakankshaNo ratings yet

- Chapter 1Document27 pagesChapter 1Nicole JoanNo ratings yet

- Sealed Air Corp Case Write Up PDFDocument3 pagesSealed Air Corp Case Write Up PDFRamjiNo ratings yet

- Chapter 20Document93 pagesChapter 20Irina AlexandraNo ratings yet

- Yell Case Exhibits Growth RatesDocument12 pagesYell Case Exhibits Growth RatesJames MorinNo ratings yet

- Marriott CorporationDocument8 pagesMarriott CorporationtarunNo ratings yet

- Stone Container Corporation: Strategic Financial ManagementDocument3 pagesStone Container Corporation: Strategic Financial ManagementMalika BajpaiNo ratings yet

- FM-07 Valuations, Mergers Acquisitions Question PaperDocument4 pagesFM-07 Valuations, Mergers Acquisitions Question PaperSonu0% (1)

- LVMH - TiffanyDocument24 pagesLVMH - TiffanySagarika JindalNo ratings yet

- Case Study 3-2Document6 pagesCase Study 3-2tranquangtruong911No ratings yet

- Chapter 4Document4 pagesChapter 4tranlamhaphuong1405No ratings yet

- PDF Mastering Adjusting Entries Testbankdoc - CompressDocument18 pagesPDF Mastering Adjusting Entries Testbankdoc - CompressYvearyyNo ratings yet

- Valuation - NotesDocument41 pagesValuation - NotessreginatoNo ratings yet

- Final Exam Enhanced 1 1Document8 pagesFinal Exam Enhanced 1 1Villanueva Rosemarie100% (1)

- UntitledDocument485 pagesUntitledTowolawi AkeemNo ratings yet

- Aud 1&2 - CceDocument6 pagesAud 1&2 - Ccecherish melwinNo ratings yet

- Ias 1 Presentation of Financial Statements-2Document7 pagesIas 1 Presentation of Financial Statements-2Pia ChanNo ratings yet

- ABC Advance Accounting Inter 1Document4 pagesABC Advance Accounting Inter 1Chirag GadiaNo ratings yet

- Investment in AssociatesDocument17 pagesInvestment in AssociatesNobu NobuNo ratings yet

- Britannia Financial Model - SolnDocument23 pagesBritannia Financial Model - SolnsameerNo ratings yet

- Far670 Tutorial Basis of AnalysisDocument3 pagesFar670 Tutorial Basis of Analysis2020482736No ratings yet

- DEPRECIATIONDocument24 pagesDEPRECIATIONBhavikNo ratings yet

- Unit 5 FMCFDocument13 pagesUnit 5 FMCFPrince SinghNo ratings yet

- Accounting For Decision Makers - Final Exam Oct 2022Document12 pagesAccounting For Decision Makers - Final Exam Oct 2022Ahmed EhabNo ratings yet

- Coc Level 3 4TH RoundDocument15 pagesCoc Level 3 4TH Roundsolomon asfawNo ratings yet

- HiltonPlatt 11e TB Ch16Document97 pagesHiltonPlatt 11e TB Ch16Jay HanNo ratings yet

- Basics of Book Keeping and AccountingDocument4 pagesBasics of Book Keeping and AccountingNiya Maria NixonNo ratings yet

- Invoice Nr. 267-2023Document7 pagesInvoice Nr. 267-2023Md. Nazrul IslamNo ratings yet

- Cambridge O Level: ACCOUNTING 7707/21Document20 pagesCambridge O Level: ACCOUNTING 7707/21Fred SaneNo ratings yet

- Basic CommerceDocument5 pagesBasic CommerceRahul Gupta100% (1)

- XyzzzzzzzzzDocument13 pagesXyzzzzzzzzzAmish GangarNo ratings yet

- AutocopDocument96 pagesAutocopVinod RahejaNo ratings yet

- ACC 412 Specialised Accounting IDocument148 pagesACC 412 Specialised Accounting IStephen YigaNo ratings yet

- BO Declaration Forms CompanyDocument6 pagesBO Declaration Forms CompanyNarirwanenaramabuye JosephNo ratings yet

- Group AssignmentDocument4 pagesGroup Assignmentmichaelbarbosa0265No ratings yet

- Financial Statements-Icb-Assignment-3-Qp-2023-V1Document9 pagesFinancial Statements-Icb-Assignment-3-Qp-2023-V1maleisha kistenNo ratings yet

- Am Tool 27 v11.0Document17 pagesAm Tool 27 v11.0Sebastian MayrNo ratings yet

- Example of Workpaper FlowDocument17 pagesExample of Workpaper FlowDharmendra SinghNo ratings yet

- 9780 DatDocument4 pages9780 DatMASTER PERFECTNo ratings yet

- UntitledDocument6 pagesUntitledMuhammad AbdullahNo ratings yet

- BP Foi Full Book 2011 2015Document84 pagesBP Foi Full Book 2011 2015Manoj GuddatiNo ratings yet