Inventory Audit Work Program

Inventory Audit Work Program

Uploaded by

Adnan MohammedCopyright:

Available Formats

Inventory Audit Work Program

Inventory Audit Work Program

Uploaded by

Adnan MohammedCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Inventory Audit Work Program

Inventory Audit Work Program

Uploaded by

Adnan MohammedCopyright:

Available Formats

INVENTORY AUDIT WORK PROGRAM

Project Team (List Members):

Project Phase Date Comments

Planning

Fieldwork

Report Issuance

Time Project Work Step Initial Index

PRE-AUDIT

1. Review prior audit report and relevant press releases

NA

(acquisitions).

2. Obtain completed inventory internal control

questionnaire from the plant controller. Document

NA

any potential control weaknesses or unusual

practices and investigate upon arrival.

3. Obtain and document the following as of the audit

date:

a) Trial Balance

NA

b) Manufacturing Statement (YTD)

NA

c) Manufacturing Budget (YTD)

Verify

d) Date of Last Physical

NA

e) Cycle Counting Accuracy History

Verify

f) Inventory Turnover, Days Sales in

Inventory, Margin

Verify

g) Date and Scope of External Auditor's Most

Recent Visit

Verify

h) Detail of Excess and Obsolete Inventory

NA

i) Detail of Inventory Held on Consignment

Verify

j) Detail of Inventory Held at Subcontractor

and Outside Vendor

NA

k) Type of Inventory System

l) Size of Facility (Square Footage)

m) Primary products

Verify

n) Top Five Customers and Competitors

4. Ensure financial statement trial balance agrees with Verify with

the trial balance maintained by the facility. Obtain WH Keeper

explanations for any differences with the plant &

controller upon arrival. Accounting

5. Obtain and quantify in ACL the following reports as of

the audit date:

a) Inventory Aging Report Verify

b) Perpetual Inventory Listing Verify

c) All Open Work Orders NA

October 1, 2023 Internal Audit Activity Page 1 of 19

Time Project Work Step Initial Index

6. Reconcile perpetual inventory listing with the account

balances that appear on the G/L. Obtain and Verify with

document explanations for differences from the Accounting

controller upon arrival.

Verify if

there are

7. Obtain and document explanations from the

old/back

controller for all open work orders older than two

orders &

months.

duration of

each one

8. Describe procedures for developing current year

material, labor and overhead standards, and the date

of the last revision. If a standard system is not used,

NA

obtain and document an explanation from the

controller and/or corporate operations as to why a

standard system has not been implemented.

Verify if

9. Compare and document budgeted variances to

there is

actual variances for materials, labor and overhead.

comparison

Obtain and document explanations for significant (5%

of variances

+) variances from the controller and/or corporate

of stock to

operations.

budgeted

10. For facilities that do not employ a standard costing

system, recalculate labor and overhead allocations

and compare to the amount capitalized. Obtain and NA

document explanations for significant (10%+)

variances from the controller upon arrival.

11. Discuss conclusions/observations with the senior

associate. Obtain and document T&B senior

management concerns and ensure there are NA

adequate procedures in the program to address those

risks.

October 1, 2023 Internal Audit Activity Page 2 of 19

Time Project Work Step Initial Index

RECEIVING

1. Interview employees associated with the receiving

process in order to gain an understanding. Map this

process and include all applicable financial journal

entries.

2. Through inquiry and observation, ensure the

following controls are in place and operating

effectively and are included on the process map.

Identify all control gaps.

a) Goods are received at a designated

receiving bay

b) Receipts are checked for quantity and

quality

c) All goods received are based on a valid

purchase order (PO) number

d) PO is stated on delivery documents and is

verified for validity

e) The quantity of goods received is verified to

the packing slip and bill of lading

f) The receiver signs delivery documents

g) All receipts are recorded in a log and can

be cross referenced to the appropriate delivery

documents

h) The log is regularly reviewed

i) Receipts are accurately, promptly and

completely updated in the inventory system

j) Goods are safeguarded

k) Transfer of goods are documented

l) Items not meeting qualifications are kept

separate from other items

3. Process map procedures for vendor returns.

Through inquiry and observation, ensure that returns

are communicated to the purchasing department and

October 1, 2023 Internal Audit Activity Page 3 of 19

Time Project Work Step Initial Index

debit memos are prepared and forwarded to

accounts payable in a timely manner. In most

instances, this will require sampling returns during

the audit period.

4. Through inquiry and observation, ensure that

shipment discrepancy reports are pre-numbered and

reviewed by the appropriate purchasing and

accounting personnel to ensure that debit memos

have been taken.

PRODUCTION PROCESS/PHYSICAL SECURITY

1. Interview employees associated with the

production process. Map the production process and

include all applicable financial journal entries. Ensure

the following controls are present and are included in

the process map. Identify all control gaps.

a) Authorized persons approve goods

requisitions

b) goods requisitions coincide with the

approved sales plan

c) Disbursements from stockrooms are

allowed only upon receipt of properly authorized

requisition documents

d) Management approval is required for stock

issuance of amounts above the amount

necessary to support scheduled sales

requirements

e) Approved requisition documents and

inventory movement forms are promptly used to

update the inventory records

f) Pre-numbered requisition forms or

sequential logs are used to record issuance of

materials from stores and inventory movement

between locations

g) Warehouse/store is properly locked to

prevent unauthorized access and usage

h) Proper segregation of scrap and obsolete

inventory

October 1, 2023 Internal Audit Activity Page 4 of 19

Time Project Work Step Initial Index

PHYSICAL COUNTS

1. Obtain and review information supporting the most

recent wall-to-wall physical inventory. Ensure

quantities on hand were not known to counters prior

to the physical. Document compliance with corporate

policy.

2. Complete the physical inventory checklist.

Document control gaps, if any.

3. Document book-to-physical adjustments for the

past three years. Inquire as to whether or not the

adjustments were investigated prior to correcting

entries being made. Document your understanding of

this process. Determine when and if the adjustments

were capitalized or expensed and if they were

approved.

4. Evaluate propriety of reconciling items between the

perpetual inventory listings and the G/L account

balances. Examine supporting documentation for

each item individually greater than 2.5% of the

inventory account balance (or 50% of the items if

none individually exceed 2.5%, but the aggregate

exceeds 5%.)

5. Obtain, review and document policies and

procedures surrounding cycle counts. Observe two

cycle counts and document the following:

a) What was counted and how it was selected

b) Cycle counter is not aware of quantity on

hand prior to his count

c) Agree test counts to perpetual inventory

detail

d) Examine adjustment to perpetual inventory

detail/general ledger, if applicable

e) Document historical accuracy rates

6. Based solely on the work performed, document

observations regarding the physical security of

inventory.

7. Based on the date and results of the most recent wall-

to-wall physical count and the applicability of cycle

counts, consider performing the following:

a) Agree 10 inventory items per the perpetual

to the quantity on hand

October 1, 2023 Internal Audit Activity Page 5 of 19

Time Project Work Step Initial Index

b) Agree 10 inventory items on hand to the

perpetual

INVENTORY VALUATION

For facilities using a standard costing system, perform the

following:

1. Document procedures for developing current year

standards (raw material, labor and overhead) and the

date of the most recent development. Document

compliance with corporate policy.

2. On a sample basis (minimum of 30), test the

accuracy of the standards by performing the

following:

a) Examine recent invoices supporting raw

material component

b) Examine payroll-related information

supporting labor component, if applicable

c) Examine overhead estimate. Recalculate

based on available information

3. On a sample basis, examine the method and

accuracy of recording standard to actual variances.

Obtain explanations for standard to actual variances

greater than the budgeted amount as of audit date.

Examine entries to record variances and document

whether the variances were capitalized or expensed.

For facilities not using a standard costing system,

perform the following:

1. Document procedures for developing current year

labor and overhead amounts.

2. Examine (minimum of 30) recent invoices

supporting raw materials, and the raw material

component of WIP and FG. Document results by

quantifying unit cost variances and extrapolating to

population.

3. Recalculate labor and overhead calculations and

compare to amounts capitalized. Document

limitations in ability to recalculate.

October 1, 2023 Internal Audit Activity Page 6 of 19

Time Project Work Step Initial Index

INVENTORY RESERVES

1. Based on ACL reports, document inventory greater

than 180, 270 and 360 days.

2. Document method for estimating reserve for excess

and obsolete inventory. Document compliance with

corporate policy.

3. Obtain calculation of E&O estimate for most recent

quarter-end and agree to G/L. Agree significant

components to supporting documentation.

4. Document inconsistencies, if any, between the

calculation and aging analysis.

5. Ensure authorized persons adequately approve

provisions or write-offs. Review for evidence of

approval of inventory write-offs before they are

recorded.

October 1, 2023 Internal Audit Activity Page 7 of 19

Time Project Work Step Initial Index

CONSIGNMENT INVENTORY

1. Document policies and procedures for consigned

inventory. At a minimum, address the following items:

a) Existence of perpetual detail

b) Method of reporting, recording and verifying

changes

c) Method of accounting for scrap

d) Results of recent physical counts

2. Document compliance with corporate policy on

consigned inventories.

October 1, 2023 Internal Audit Activity Page 8 of 19

Time Project Work Step Initial Index

SCRAP

1. Document method for accounting for inventory scrap.

At a minimum, address the following:

a) Method used to quantify

b) Method used to cost

c) Method used to dispose

2. Through inquiry and observation, ensure that scrap

proceeds are collected from the scrap vendor

promptly after the collection of scrap materials.

3. Through inquiry and observation, ensure that approval

is granted before materials are sent to scrap.

4. Through inquiry and observation, ensure that

accounting and the warehouse verify the weight of

the scrap materials.

5. Through inquiry and observation, verify that scrap

vendors are selected through a bidding process.

October 1, 2023 Internal Audit Activity Page 9 of 19

Time Project Work Step Initial Index

SHIPPING AND RECEIVING (INCLUDING RETURNS)

1. For the most recent quarter-end, obtain the last and

first three shippers and receivers and agree pertinent

data to accounts receivable and inventory records

ensuring that transactions are recorded in the proper

period.

2. Explain the facility’s procedures for ensuring proper

cut-off.

October 1, 2023 Internal Audit Activity Page 10 of 19

Time Project Work Step Initial Index

GENERAL

1. Through inquiry and observation confirm that

management corrective action plans have been

implemented. If not, obtain explanation(s) and

consider the necessity of including in current year

audit report.

2. Complete best practices checklist.

3. Complete inventory diagnostic.

4.

5.

6.

October 1, 2023 Internal Audit Activity Page 11 of 19

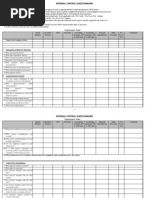

INVENTORYAUDIT WORK PROGRAM: SAMPLE 2

Project Team (List Members):

Project Timing Date Comments

Planning

Fieldwork

Report Issuance (Local)

Report Issuance (Worldwide)

Objectives

Evaluate controls in place over inventory functions, such as cycle counting, customer

returns, physical security, shipping and receiving.

Evaluate overall efficiency of the inventory management process.

Provide management team with cost effective suggestions to improve the general control

environment as well as to increase operating efficiency.

Time Project Work Step Initial Index

1. Review existing policies and procedures for the

inventory management functions, including: cycle

count procedures, handling of returned materials, the

scrap process, shipping and receiving, physical

security, training, and handling of slow moving,

excess and obsolete inventory.

2. Interview to understand the process.

Obtain an understanding of the overall inventory

management processes by interviewing key

personnel.

Perform an initial flowcharting of the process as

described by the personnel involved and

interviewed. Update the flowchart periodically as the

audit work progresses and the internal audit team’s

understanding grows.

Ensure that the finalized process flow diagram is

included in the audit report. This diagram should

include, at a minimum a.) Each major process step,

such as shipments arrive, shipments are counted,

quality control steps, bin report is generated, etc. b.)

Which departments are involved in the step, such

as inventory control, technology support,

purchasing, etc. c.) Reports being used/reviewed

October 1, 2023 Internal Audit Activity Page 12 of 19

Time Project Work Step Initial Index

d.) Manual internal control points e.) System-based

control points and f.) Internal control weaknesses.

3. Test for the following inventory process control points

and/or understand what alternative control(s) the

company has in place.

Blind (counter does not know system inventory

figure) cycle counts

Cycle count reconciliation

Write-off authorization

Shipment forms created outside of the warehouse

Exception reports reviewed daily

Receiving dept. counts all items received

Quality control (QC) inspection on all items received

Goods recounted after QC inspection

All goods have movement tracking sheets

Carriers sign manifest documents

4. Test for the following inventory physical control points

and/or understand what alternative control(s) the

company has in place.

Badge access is required

A security officer is in place in the warehouse and

the officer moves selected goods

A list of all personnel with access to the warehouse

is reviewed on a periodic basis to determine

whether these people should remain. The list is

adjusted as necessary.

Video cameras in the warehouse and security tapes

are reviewed on a scheduled basis

There are set receiving hours

October 1, 2023 Internal Audit Activity Page 13 of 19

Time Project Work Step Initial Index

There are locked cages for selected goods

5. Test for the following inventory system control points

and/or understand what alternative control(s) the

company has in place.

Bins/inventory accounts “blocked” during cycle

counts

Picking documents are created by system, not

manual

Shipping/receiving documents are scanned

Test system procedures for maintaining the

completeness of all information initially captured at

time of product receipt

Test reconciliation procedures to ensure

completeness/accuracy of the process as

product/materials receipts move from one location

to another

6. Ensure that scrap material is identified, tracked and

destroyed in a secure and controlled manner. All

destruction of scrap material should be witnessed.

7. Ensure that weekend and holiday access to the

warehouse is granted on an exception basis only, as

approved by the warehouse manager.

8. Ensure that a cross-training program exists for all

warehouse personnel. This should include, at a

minimum, re-training on any new policies and

procedures that result from the internal audit review.

9. Ensure that slow moving and obsolete inventory

reports are reviewed monthly. Consider the need for a

unique location to monitor slow moving and obsolete

items.

10. Ensure that a well-controlled management approval

process is in place to authorize any adjustment to

inventory balances in the system. The larger the

adjustment, the higher level the authorizing manager

should be, all the way up to the CFO.

October 1, 2023 Internal Audit Activity Page 14 of 19

Time Project Work Step Initial Index

11. Test that each shipment is counted and compared to

the packing slip prior to admission into inventory.

Discrepancies should be noted and tracked via a

discrepancy log.

12. Review management reports and also understand the

performance metrics being used to monitor the

inventory management process. Ensure that metrics

truly reflect the department’s/company’s goals.

13. In order to promote consistent practices, ensure that

the policies and procedures document is updated for

any process changes that resulted from the internal

audit review.

October 1, 2023 Internal Audit Activity Page 15 of 19

INVENTORY AUDIT WORK PROGRAM: SAMPLE 3

Project Team (List Members):

Project Phase Date Comments

Planning

Fieldwork

Report Issuance

Audit Objectives

Objective Comments Initial

1. Evaluate the processes

needed to procure, store and

manage inventories: raw

materials, work-in-progress

and finished goods.

2. Evaluate the effectiveness

and efficiency of current

inventory management

processes, which will include:

Forecasting requirements

to match marketplace

demands

Organizing the function

electronically

Ensuring accuracy of

inventories and related

recordkeeping activities

Optimizing supply base

Time Audit Step Initial Index

PLANNING & GENERAL

1. Identify key management sponsors and other

individuals who will be directly affected by the review

and send a formal notification memo approximately 2-

4 weeks prior to the beginning of fieldwork.

Communicate objectives, timing and expectations of

degree of assistance required of personnel.

2. Complete scoping and planning activities sufficient to

prepare a detailed work plan and time budget.

Complete work plan and submit for

manager/supervisory approval.

October 1, 2023 Internal Audit Activity Page 16 of 19

Time Audit Step Initial Index

3. Prepare time estimate and communicate expectations

to all team members.

4. Review and become well-acquainted with the

following:

Current procedures to monitor inventory

Organization charts

Background on current processes

5. Schedule and hold a final planning meeting prior to

the beginning of any significant fieldwork. Involve the

complete audit team. Discuss the detailed plan and all

relevant assignments, expectations, etc.

6. Set up and organize workpapers.

7. Provide manager with weekly status reports, including

summary of hours incurred, estimates to complete,

and budget versus actual status.

UNDERSTAND THE PROCESS

1. Through individual interviews or small group

meetings, develop an understanding of the key

processes and activities that relate to inventory

management. Develop process maps, if appropriate,

to document understanding of the processes and

activities.

Representation of individuals from the following

departments should be considered:

Purchasing

Warehousing

Distribution

Finance

Marketing/Support

Engineering

a. Focus attention on identifying and

documenting the key internal controls in

each area. Evaluate the type and quality

of each control.

b. Document any process performance

issues/problems that are identified.

2. Analyze current financial data relating to inventory,

including demand projections and physical/perpetual

inventory records.

3. Analyze company policies and assess compliance

with the policies for minimizing inventory levels,

reserves and write-offs.

4. Analyze methods used to calculate production and

inventory costs. Benchmark costing methods with any

October 1, 2023 Internal Audit Activity Page 17 of 19

Time Audit Step Initial Index

known best practices.

IDENTIFY PROCESS PERFORMANCE GAPS

1. Summarize and gauge the significant process

improvement opportunities identified.

2. Determine relevant key process measures and

controls to target for validation.

3. Discuss observations with management.

4. Test accuracy and reliability of relevant performance

measures and management information.

VALIDATE PROCESS MEASURES & CONTROLS

1. Test compliance with current policies and procedures.

2. Test accuracy and reliability of relevant performance

measures and management information.

ANALYZE ROOT CAUSES OF PROCESS

OPERATING AND CONTROL DEFICIENCIES

1. As required to develop specific action steps to

improve processes and controls, complete additional

analysis on specific issues. (Consult with

senior/manager for scope of issues and additional

analysis required.)

2. Define and refine solutions/recommendations for key

findings and issues. Draft formal written findings and

recommendations. Each finding should include: (1)

What should be, (2) what is, (3) why a difference

exists between (1) & (2), (4) business impact of

difference, and (5) recommended course of action to

correct deficiency.

3. Validate each finding, recommendation and course of

action with process owner or other appropriate

management.

REPORTING AND WRAP-UP

1. Draft final reports for manager review and approval.

2. Draft report should include the following sections:

Executive Summary

Objectives & Scope Statement

Background (in general and for each process)

Summary of Procedures Performed

Detailed Findings & Recommendations

(organized by area/process/significance)

Action Matrix

Follow-Up Procedures

Appendix: Process Maps

3. Review draft report in closing meeting with all

process owners. All findings and recommendations

should have been discussed prior to the closing

October 1, 2023 Internal Audit Activity Page 18 of 19

Time Audit Step Initial Index

meeting so that this meeting is only a formality.

4. Clear draft report with corporate controller and/or

other appropriate personnel.

5. Make final revisions and issue final report.

6. Distribute customer satisfaction survey forms.

7. Finalize working paper documentation related to all

work performed.

8. Prepare final time summary and staff evaluation

forms.

October 1, 2023 Internal Audit Activity Page 19 of 19

You might also like

- Payroll Internal Audit ProgramDocument2 pagesPayroll Internal Audit ProgramEric Gunthe100% (9)

- Physical Inventory Observation ChecklistDocument10 pagesPhysical Inventory Observation Checklistফয়সাল হোসেন50% (2)

- Business Plan On Event Management 1Document31 pagesBusiness Plan On Event Management 1Danish Ali100% (1)

- Audit Planning MemoDocument10 pagesAudit Planning MemoChyrra ALed ZuRc100% (4)

- Internal Audit ProgramDocument8 pagesInternal Audit ProgramKrishna Khandelwal100% (5)

- Final Accounts Payable Audit ProgramDocument5 pagesFinal Accounts Payable Audit Programjeff100% (3)

- Control Environment Audit Work ProgramDocument6 pagesControl Environment Audit Work ProgramLawrence MaretlwaNo ratings yet

- Sales and Promotion of Tvs Motor CompanyDocument46 pagesSales and Promotion of Tvs Motor Companyankita merchant88% (8)

- Milky Mist Risk & Control Matrix - Procure To Pay: COSO Principle Process Name Control Activity No. Coso ComponentDocument20 pagesMilky Mist Risk & Control Matrix - Procure To Pay: COSO Principle Process Name Control Activity No. Coso ComponentAswath S100% (1)

- Audit ProgrammesDocument63 pagesAudit ProgrammesSarah Hashem100% (1)

- Accruals Audit ProgramDocument4 pagesAccruals Audit Programvivek1119No ratings yet

- Internal Control Questionnaire For SalesDocument1 pageInternal Control Questionnaire For SalesJustine Ann VillegasNo ratings yet

- Illustrative Work-Paper Template For Testing ROMM and Performing WalkthroughsDocument35 pagesIllustrative Work-Paper Template For Testing ROMM and Performing Walkthroughsdroidant100% (1)

- Audit Programe - InventoryDocument3 pagesAudit Programe - InventoryAnnete Utomo Hutabarat100% (1)

- Auditing Fixed Assets and Capital Work in ProgressDocument23 pagesAuditing Fixed Assets and Capital Work in ProgressMM_AKSI87% (15)

- 10chap Audit Working PapersDocument10 pages10chap Audit Working PapersZahar Zahur Kaur Bhullar100% (1)

- ABC Company Audit Program - Receivables Department:: 1) Analytical Procedures-GeneralDocument7 pagesABC Company Audit Program - Receivables Department:: 1) Analytical Procedures-Generalvarghese200779% (14)

- The Operational Auditing Handbook: Auditing Business and IT ProcessesFrom EverandThe Operational Auditing Handbook: Auditing Business and IT ProcessesRating: 4.5 out of 5 stars4.5/5 (5)

- AU Locks Auditing Services: Audit Program Batangas Bestfeeds Multipurpose CooperativeDocument5 pagesAU Locks Auditing Services: Audit Program Batangas Bestfeeds Multipurpose CooperativeMirai KuriyamaNo ratings yet

- 02 Revenue Receipts Cycle Controls and Tests of ControlsDocument31 pages02 Revenue Receipts Cycle Controls and Tests of ControlsRonnelson PascualNo ratings yet

- Audit WorksheetDocument7 pagesAudit WorksheetEricXiaojinWangNo ratings yet

- Auditing Income Statement and Balance Sheet ItemsDocument27 pagesAuditing Income Statement and Balance Sheet ItemsNantha KumaranNo ratings yet

- AP 50 Accounts Payable and PurchasesDocument6 pagesAP 50 Accounts Payable and PurchasesSyarah AnlizaNo ratings yet

- AUDIT PROGRAM For Cash Disbursements 2Document5 pagesAUDIT PROGRAM For Cash Disbursements 2Yvonne Granada50% (2)

- Advances - Deposits - and - Prepayments - Audit - Program - TODDocument20 pagesAdvances - Deposits - and - Prepayments - Audit - Program - TODShohag RaihanNo ratings yet

- Audit Programme 1Document20 pagesAudit Programme 1Neelam Goel50% (2)

- Fixed Asset VeificationDocument12 pagesFixed Asset Veificationnarasi64No ratings yet

- Audit Program For Inventory Legal Company Name Client: Balance Sheet DateDocument3 pagesAudit Program For Inventory Legal Company Name Client: Balance Sheet DateHannah TudioNo ratings yet

- Working Papers - Top Tips PDFDocument3 pagesWorking Papers - Top Tips PDFYus Ceballos100% (2)

- Audit Program For Fixed Assets: Form AP 35Document9 pagesAudit Program For Fixed Assets: Form AP 35Adrianna LenaNo ratings yet

- General Internal Audit ModelDocument5 pagesGeneral Internal Audit ModelSoko A. KamaraNo ratings yet

- Ap Audit DocumentDocument7 pagesAp Audit DocumentAnna Tran100% (1)

- Purchasing Audit ProgramDocument3 pagesPurchasing Audit ProgramBernie LeBlanc100% (1)

- Accounts PayableExpense Accounting Audit Work ProgramDocument5 pagesAccounts PayableExpense Accounting Audit Work ProgrammohamedciaNo ratings yet

- Audit Program-Accrued ExpensesDocument10 pagesAudit Program-Accrued ExpensesPutu Adi NugrahaNo ratings yet

- Test of Controls and Substantive ProceduresDocument16 pagesTest of Controls and Substantive ProceduresAdeel Sajjad100% (5)

- Procurement Audit SampleDocument13 pagesProcurement Audit SampleCyrile Dianne Therese Ablir-BaliolaNo ratings yet

- Task 3 - Purchasing Process Walkthrough Documentation TemplateDocument4 pagesTask 3 - Purchasing Process Walkthrough Documentation TemplateKritika JainNo ratings yet

- E7 - TreasuryRCM TemplateDocument30 pagesE7 - TreasuryRCM Templatenazriya nasarNo ratings yet

- Internal Audit and Budget Department - Cash ReceiptsDocument13 pagesInternal Audit and Budget Department - Cash ReceiptsMarineth Monsanto100% (1)

- Audit Program Bank and CashDocument4 pagesAudit Program Bank and CashFakhruddin Young Executives75% (4)

- ICQ MatrixDocument8 pagesICQ Matrixapi-3828505No ratings yet

- Internal Audit CharterDocument7 pagesInternal Audit CharterSritrusta Sukaridhoto100% (1)

- Preparation Audit ProgramDocument8 pagesPreparation Audit ProgramJem Vadil100% (1)

- Audit ChecklistDocument44 pagesAudit Checklistwaittilldawn100% (2)

- Audit of Cash On Hand and in BankDocument2 pagesAudit of Cash On Hand and in Bankdidiaen100% (1)

- AC414 - Audit and Investigations II - Introduction To Audit EvidenceDocument32 pagesAC414 - Audit and Investigations II - Introduction To Audit EvidenceTsitsi AbigailNo ratings yet

- Accounts Receivable, Credit and Collections Audit Report - Sample 2Document29 pagesAccounts Receivable, Credit and Collections Audit Report - Sample 2Audit Department100% (3)

- Internal Audit ProgramDocument3 pagesInternal Audit ProgramTakogee100% (1)

- AssertionsDocument2 pagesAssertionsHaseeb KhanNo ratings yet

- Internal Control Self Assessment QuestionnaireDocument4 pagesInternal Control Self Assessment QuestionnaireHime Silhouette Gabriel100% (1)

- D4 Audit Working PaperDocument5 pagesD4 Audit Working PaperSyazliana KasimNo ratings yet

- AP 55 Accrued LiabilitiesDocument5 pagesAP 55 Accrued LiabilitiesMichelle SumayopNo ratings yet

- Module1 Internal Control Checklist en 0Document12 pagesModule1 Internal Control Checklist en 0Mohammad Abd Alrahim ShaarNo ratings yet

- Audit of Fixed Assets 1Document3 pagesAudit of Fixed Assets 1Leon MushiNo ratings yet

- Sample Audit ProceduresDocument44 pagesSample Audit ProceduresNetra Sharma100% (1)

- AC414 - Audit and Investigations II - Audit of Cash and Bank BalanceDocument20 pagesAC414 - Audit and Investigations II - Audit of Cash and Bank BalanceTsitsi AbigailNo ratings yet

- Audit Program For Fixed AssetDocument4 pagesAudit Program For Fixed AssetSandra Lang100% (1)

- Matrix Audit Evidence Vs AssertionsDocument8 pagesMatrix Audit Evidence Vs AssertionsHaris AdriansyahNo ratings yet

- Accounts Receivable Audit ProgramDocument3 pagesAccounts Receivable Audit Programaliraz101100% (2)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 4.5 out of 5 stars4.5/5 (2)

- Receiving Policy - Sample 2Document3 pagesReceiving Policy - Sample 2Adnan MohammedNo ratings yet

- Segregation of Duties Questionnaire - Financial ControlsDocument6 pagesSegregation of Duties Questionnaire - Financial ControlsAdnan MohammedNo ratings yet

- Enterprise Risk Management Audit Report Final - Sample 2Document16 pagesEnterprise Risk Management Audit Report Final - Sample 2Adnan MohammedNo ratings yet

- Segregation of Duties Review ReportDocument23 pagesSegregation of Duties Review ReportAdnan MohammedNo ratings yet

- Internal Audit Risk Assessment ReportDocument21 pagesInternal Audit Risk Assessment ReportAdnan MohammedNo ratings yet

- 5 - 13 (N) Accounts Payable, Trade - PrintingDocument8 pages5 - 13 (N) Accounts Payable, Trade - PrintingAdnan MohammedNo ratings yet

- IAD - Internal Audit Plan FY14Document7 pagesIAD - Internal Audit Plan FY14Adnan MohammedNo ratings yet

- A Case Study On Uber Pricing StrategyDocument12 pagesA Case Study On Uber Pricing StrategyDebasis Prusty100% (1)

- The Impact of FDI On E-Commerce Industry (Prajas Pradhan) 19CBBAD122 PDFDocument71 pagesThe Impact of FDI On E-Commerce Industry (Prajas Pradhan) 19CBBAD122 PDFMustaqim Khan BBA HNo ratings yet

- The Dow TheoryDocument2 pagesThe Dow TheoryaNo ratings yet

- Entrepreneurship Module 1 10Document10 pagesEntrepreneurship Module 1 10Demie Anne Alviz BerganteNo ratings yet

- SaffolaDocument2 pagesSaffolaAjitava NandiNo ratings yet

- Pike, StevenDocument27 pagesPike, StevenAndrea Morán GajateNo ratings yet

- Document Control PolicyDocument10 pagesDocument Control PolicyEast WestNo ratings yet

- Gebi Shuka FinalDocument70 pagesGebi Shuka FinalDerara UmetaNo ratings yet

- Facility Decisions: Network Design in A Supply ChainDocument35 pagesFacility Decisions: Network Design in A Supply Chainmushtaque61No ratings yet

- Economic Order Quantity EOQDocument8 pagesEconomic Order Quantity EOQAngelo CruzNo ratings yet

- Project ReportDocument22 pagesProject Reportseena15No ratings yet

- Business Policies & Strategic Management: SR - No Description Option1 Option2 Option3 Option4 ADocument19 pagesBusiness Policies & Strategic Management: SR - No Description Option1 Option2 Option3 Option4 AKrish KrishNo ratings yet

- Lesson 4 Accounting For Home OfficeDocument8 pagesLesson 4 Accounting For Home OfficeheyheyNo ratings yet

- Atlantic Marketing and Pricing CaseDocument8 pagesAtlantic Marketing and Pricing CaseRizki EkaNo ratings yet

- Chapter 10 ProblemsDocument21 pagesChapter 10 ProblemsJane Hzel Lopez MilitarNo ratings yet

- Infosys Consulting Campus JD - 2023Document11 pagesInfosys Consulting Campus JD - 2023Raghav RaghavendraNo ratings yet

- UCT SCM M8U3 NotesDocument9 pagesUCT SCM M8U3 Notesgaolebe lucasNo ratings yet

- Importance of Marketing in Fashion and Apparel Industry-MahidaDocument4 pagesImportance of Marketing in Fashion and Apparel Industry-Mahidasatex100% (1)

- New Product DevelopmentDocument3 pagesNew Product DevelopmentFaheemchaandNo ratings yet

- Economics in Modules 3rd Edition Krugman Solutions Manual DownloadDocument14 pagesEconomics in Modules 3rd Edition Krugman Solutions Manual DownloadLuisa Benedetti100% (24)

- Product Lifecycle ManagementDocument38 pagesProduct Lifecycle ManagementManjunatha50% (2)

- PrAE 304 Auditing and Assurance - MidtermsDocument6 pagesPrAE 304 Auditing and Assurance - MidtermsJeryl AlfantaNo ratings yet

- QuestionnaireDocument10 pagesQuestionnaireSantosh Arakeri100% (1)

- SM - 08Document49 pagesSM - 08Jithma RanawakeNo ratings yet

- Practice UncertainDocument1 pagePractice UncertainMaisongpol PolruthNo ratings yet

- Strategic Profit ModelDocument2 pagesStrategic Profit Modelth3hackerssquadNo ratings yet

- Larsen and TourboDocument4 pagesLarsen and TourboFortune BuildersNo ratings yet

- ALEJAGA FM Project Week 4Document5 pagesALEJAGA FM Project Week 4Andrea Monique AlejagaNo ratings yet